Global Acetonitrile Market Size, Share, And Business Benefit By Product (Derivative, Solvent), By Application (Organic Synthesis, Analytical Applications, Extraction, Others), By End Use (Pharmaceutical, Agrochemicals, Electronics, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165587

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

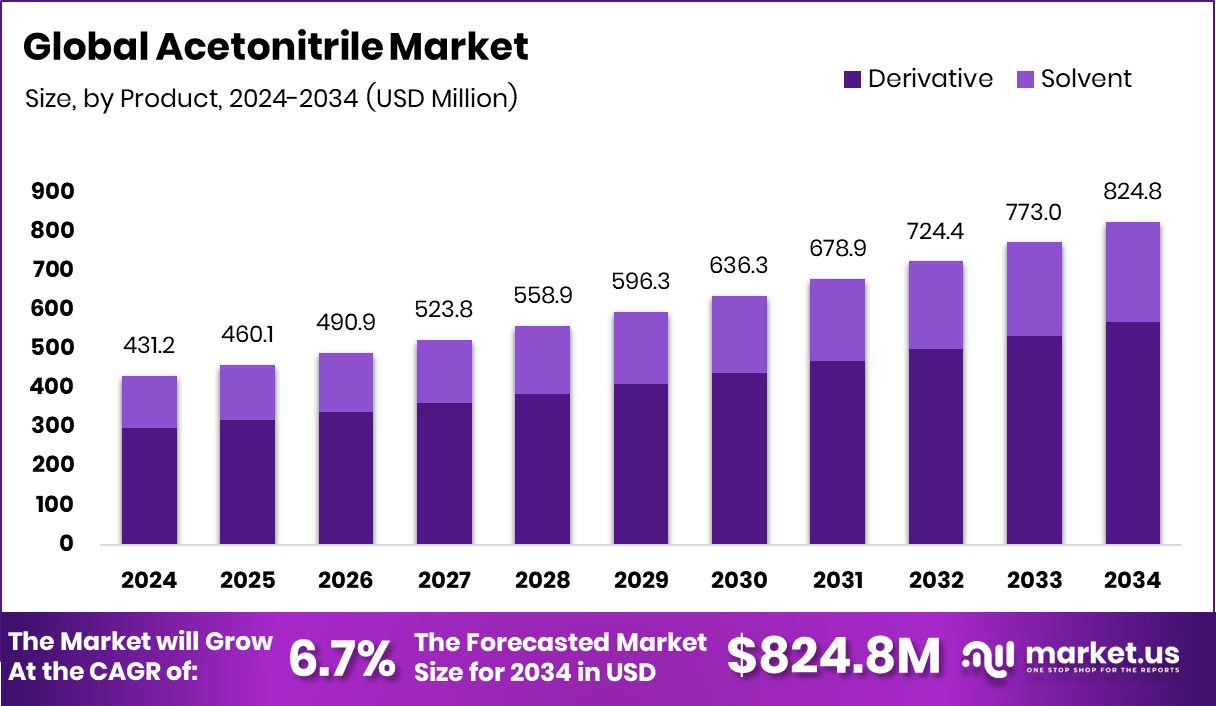

The Global Acetonitrile Market is expected to be worth around USD 824.8 million by 2034, up from USD 431.2 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. Asia Pacific maintains growth momentum, supported by its 38.20% share and USD 164.7 Mn.

Acetonitrile is a clear, highly polar organic solvent used widely in pharmaceuticals, agrochemicals, battery materials, and analytical testing. Its fast evaporation rate and ability to dissolve complex compounds make it essential for high-performance liquid chromatography and many modern synthesis processes. Because it is produced mainly as a by-product of acrylonitrile, its availability often depends on broader chemical production cycles.

The Acetonitrile market reflects this critical role, expanding steadily as drug manufacturing, biotech research, and precision analytics grow across major economies. Rising use in life-science labs, pesticide formulation, active-ingredient processing, and electrolyte solutions for advanced batteries continues to shape its global demand. Growth is also supported by stronger downstream industries, especially in regions with expanding pharmaceutical and agrochemical capacity.

Growth factors include the deeper adoption of specialty chemical processes and the steady shift toward high-purity solvents in drug discovery and crop-protection chemistry. Funding flows such as the Kotak fund betting $45 million on agrochemical firm Cropnosys and the $9.5 million raised by Scimplify highlight how capital is moving toward innovation in chemical and agri-inputs, indirectly strengthening acetonitrile consumption through better formulation work.

Demand is rising as laboratories, agrochemical formulators, and pharmaceutical producers push for consistent, high-purity solvents to support precision chemistry. India’s Agrim securing $17.3 million to ease farmer access to inputs shows how structured supply chains are expanding, which ultimately increases the need for high-grade solvents used in producing seeds, pesticides, and related intermediates.

Opportunities emerge from cleaner technologies, expanding synthesis routes, and sustainable crop-protection innovations. The €5 million secured by VitalFluid to advance sustainable AgTech reflects the push toward gentler, science-driven agricultural solutions, where acetonitrile continues to play a key role in research labs, testing centers, and next-generation chemical development workflows.

Key Takeaways

- The Global Acetonitrile Market is expected to be worth around USD 824.8 million by 2034, up from USD 431.2 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- Derivative products dominate the acetonitrile market with a strong 69.1% share globally.

- Organic synthesis holds a 44.2% share in the acetonitrile market due to its versatile solvent performance.

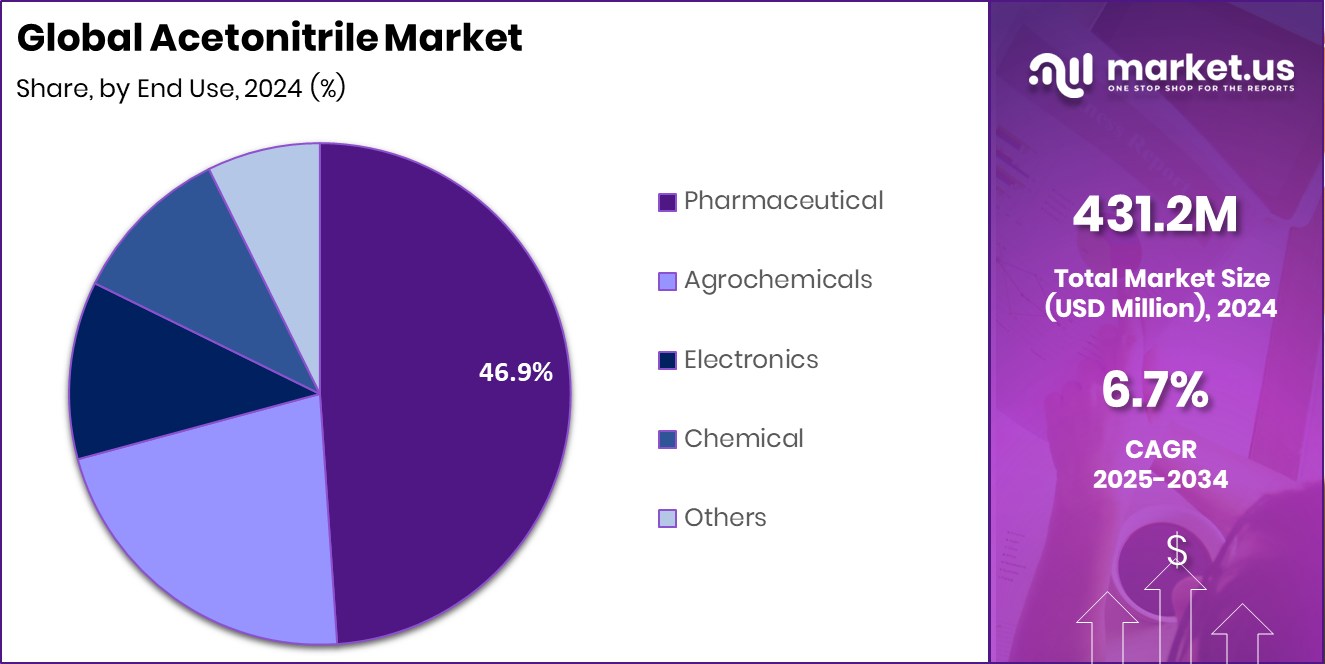

- Pharmaceutical applications lead the acetonitrile market with a strong 46.9% share worldwide.

- The Asia Pacific Acetonitrile Market value stands firmly at USD 164.7 Mn.

By Product Analysis

The acetonitrile market sees the derivative segment dominating with a strong 69.1% share.

In 2024, Derivative held a dominant market position in the By Product segment of the Acetonitrile Market, with a 69.1% share. This strong lead reflects its wide acceptance across key processing needs where derivative forms support consistent performance and formulation stability. The segment’s high share indicates its firm integration into production workflows that rely on reliable solvent behavior.

Its position also shows how industries continue to prioritize derivative-based inputs for efficiency and process control. With such a commanding portion, the Derivative segment remains central to overall market movement and sets the tone for downstream demand patterns.

By Application Analysis

Acetonitrile Market growth is driven by organic synthesis applications, capturing a 44.2% share.

In 2024, Organic Synthesis held a dominant market position in the By Application segment of the Acetonitrile Market, with a 44.2% share. This reflects its crucial role in supporting reaction pathways that depend on stable and efficient solvent performance. The strong share shows how consistently Organic Synthesis applications rely on acetonitrile for precision, yield improvement, and reliable process behavior.

Its position also highlights the continued preference for a solvent that aligns well with complex synthesis requirements. With a 44.2% share, organic synthesis remains a core application area shaping usage patterns and guiding overall market direction.

By End Use Analysis

The acetonitrile market demand rises as the pharmaceutical end-use holds a 46.9% share.

In 2024, Pharmaceutical held a dominant market position in the By End Use segment of the Acetonitrile Market, with a 46.9% share. This strong share reflects the sector’s deep reliance on acetonitrile for critical operations such as ingredient processing, purification steps, and controlled synthesis work. The 46.9% portion also highlights the steady preference for a solvent that supports high-precision requirements common in pharmaceutical environments.

Its dominance shows how essential acetonitrile remains for maintaining consistency, efficiency, and quality across key production and analytical tasks. With this share, the Pharmaceutical segment continues to guide core demand dynamics and influence usage trends within the market.

Key Market Segments

By Product

- Derivative

- Solvent

By Application

- Organic Synthesis

- Analytical Applications

- Extraction

- Others

By End Use

- Pharmaceutical

- Agrochemicals

- Electronics

- Chemical

- Others

Driving Factors

Growing Use in High-Precision Chemical Processes

A major driving factor for acetonitrile is its rising use in high-precision chemical processes that require a clean, stable, and highly efficient solvent. Industries working on complex reactions increasingly prefer acetonitrile because it supports faster reaction rates and better control over purity. Its strong performance in chromatography, ingredient separation, and sensitive analytical work makes it a dependable choice for companies focusing on accuracy and consistency.

As more production systems move toward tighter quality standards, acetonitrile naturally becomes more important across labs, formulation units, and synthesis plants. This growing shift toward precision-driven chemistry keeps pushing the demand upward, reinforcing its role as a core solvent across multiple high-value applications.

Restraining Factors

Limited Availability Due to By-Product Dependence

A key restraining factor for acetonitrile is its limited and unpredictable availability, mainly because it is produced as a by-product rather than a primary chemical. This means its supply depends heavily on the production levels of other chemicals, especially acrylonitrile, rather than direct market demand for acetonitrile itself.

When upstream production slows down, the availability of acetonitrile also drops, creating supply gaps that affect buyers who rely on stable and continuous volumes. These fluctuations can lead to higher prices, delayed deliveries, and planning difficulties for users in pharmaceuticals, synthesis units, and testing laboratories. As industries grow more dependent on consistent solvent quality, this supply uncertainty becomes a significant challenge and continues to restrain smoother market expansion.

Growth Opportunity

Rising Demand from Evolving Specialty Chemistry Applications

A key growth opportunity for acetonitrile comes from its expanding use in new and evolving specialty chemistry applications that require high-purity solvents. As research labs, formulation units, and advanced synthesis teams shift toward more complex reaction pathways, they increasingly need solvents that offer clean performance, fast evaporation, and strong solvency power.

Acetonitrile fits these needs well, making it a preferred choice for next-generation analytical work, precision separation, and controlled synthesis environments. This opens doors for greater adoption in innovative chemical processes, new ingredient development, and emerging high-value applications. As industries push toward better efficiency and more reliable outcomes, acetonitrile stands to benefit from this ongoing transition toward advanced specialty chemistry.

Latest Trends

Increasing Shift Toward High-Purity Solvent Requirements

A leading trend in the acetonitrile market is the growing shift toward high-purity solvent requirements, driven by the rising complexity of chemical and analytical work. Laboratories, pharmaceutical units, and formulation teams now focus on cleaner reaction conditions, tighter impurity control, and more consistent solvent behavior. This pushes demand for grades that support sensitive synthesis steps, advanced chromatographic analysis, and precision ingredient development.

The trend is also shaped by the adoption of modern testing systems that rely on solvents offering stable performance across a wide range of operating conditions. As industries upgrade their quality standards and move toward more demanding workflows, the preference for high-purity acetonitrile continues to strengthen, shaping both product choices and overall market direction.

Regional Analysis

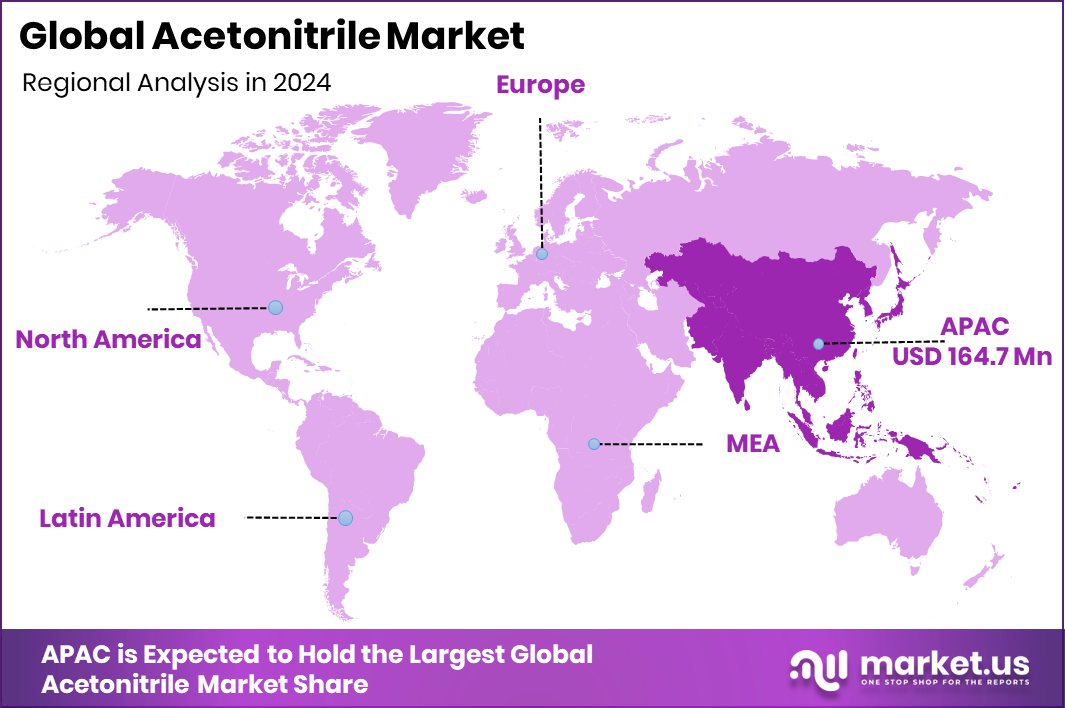

Asia Pacific leads the Acetonitrile Market with a strong 38.20% share.

Asia Pacific remains the dominant region in the Acetonitrile Market, holding 38.20% share valued at USD 164.7 Mn, reflecting its strong position in consumption and processing activities. This leadership highlights the region’s deeper use of acetonitrile across key applications that rely on steady solvent performance.

North America continues to participate actively in the market through steady adoption across its industrial and laboratory systems, though without the scale seen in the Asia Pacific. Europe follows with consistent usage driven by its structured chemical processes and established research environments.

The Middle East & Africa region engages in selective demand supported by developing industrial needs, while Latin America maintains a moderate presence shaped by gradual growth in solvent-dependent applications.

Across all regions, Asia Pacific’s clear lead at 38.20% and USD 164.7 Mn sets the tone for overall market behavior, with its strong base influencing supply alignment, consumption patterns, and broader demand flow within the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alkyl Amines Chemicals Limited remains influential through its broader expertise in amine-based chemicals, giving it a solid platform to support solvent-linked value chains. Its disciplined manufacturing approach and focus on reliability continue to shape how it positions itself within downstream users that depend on a consistent solvent supply.

Asahi Kasei Corporation brings long-standing chemical know-how and process discipline, enabling it to operate efficiently in segments requiring stable production performance. Its diversified chemical background supports a structured outlook in the acetonitrile space, aligning with industries that prioritize quality and predictable behavior in synthesis and analytical work.

Avantor Performance Materials LLC, known for serving laboratory and high-purity needs, plays an important role by targeting users who rely on consistency, controlled specifications, and dependable supply for critical procedures. Its capabilities align well with sectors demanding precision and clean solvent performance.

Top Key Players in the Market

- Alkyl Amines Chemicals Limited

- Asahi Kasei Corporation

- Avantor Performance Materials LLC

- Formosa Plastic Corporation

- Henan GP Chemicals Co.,Ltd

- Honeywell International Inc

- Imperial Chemical Corporation

- INEOS

- Jindal Speciality Chemical

- Nantong Acetic Acid Chemical Co., Ltd.

Recent Developments

- In November 2025, Asahi Kasei entered into a licence agreement with EAS Batteries for its acetonitrile-containing electrolyte technology, enabling global OEMs and battery manufacturers to access this innovation.

- In April 2024, INEOS Nitriles announced the first commercial sales of INVIREO™, its new bio-based acetonitrile used in making and purifying many medicines, including insulin and vaccines. The product is made through a certified mass-balance route and is reported to cut the carbon footprint by about 90% compared with regular acetonitrile, while keeping the same performance. This move fits INEOS’s strategy as the world’s largest producer of acrylonitrile and acetonitrile and strengthens its position with pharmaceutical customers looking for greener solvents.

Report Scope

Report Features Description Market Value (2024) USD 431.2 Million Forecast Revenue (2034) USD 824.8 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Derivative, Solvent), By Application (Organic Synthesis, Analytical Applications, Extraction, Others), By End Use (Pharmaceutical, Agrochemicals, Electronics, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alkyl Amines Chemicals Limited, Asahi Kasei Corporation, Avantor Performance Materials LLC, Formosa Plastic Corporation, Henan GP Chemicals Co., Ltd, Honeywell International Inc., Imperial Chemical Corporation, INEOS, Jindal Speciality Chemicals, Nantong Acetic Acid Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alkyl Amines Chemicals Limited

- Asahi Kasei Corporation

- Avantor Performance Materials LLC

- Formosa Plastic Corporation

- Henan GP Chemicals Co.,Ltd

- Honeywell International Inc

- Imperial Chemical Corporation

- INEOS

- Jindal Speciality Chemical

- Nantong Acetic Acid Chemical Co., Ltd.