Global Acetic Anhydride Market Size, Share Analysis Report By Form (Liquid, Solid), By End-use (Pharmaceutical, Chemical, Agrochemical, Textile, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152107

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

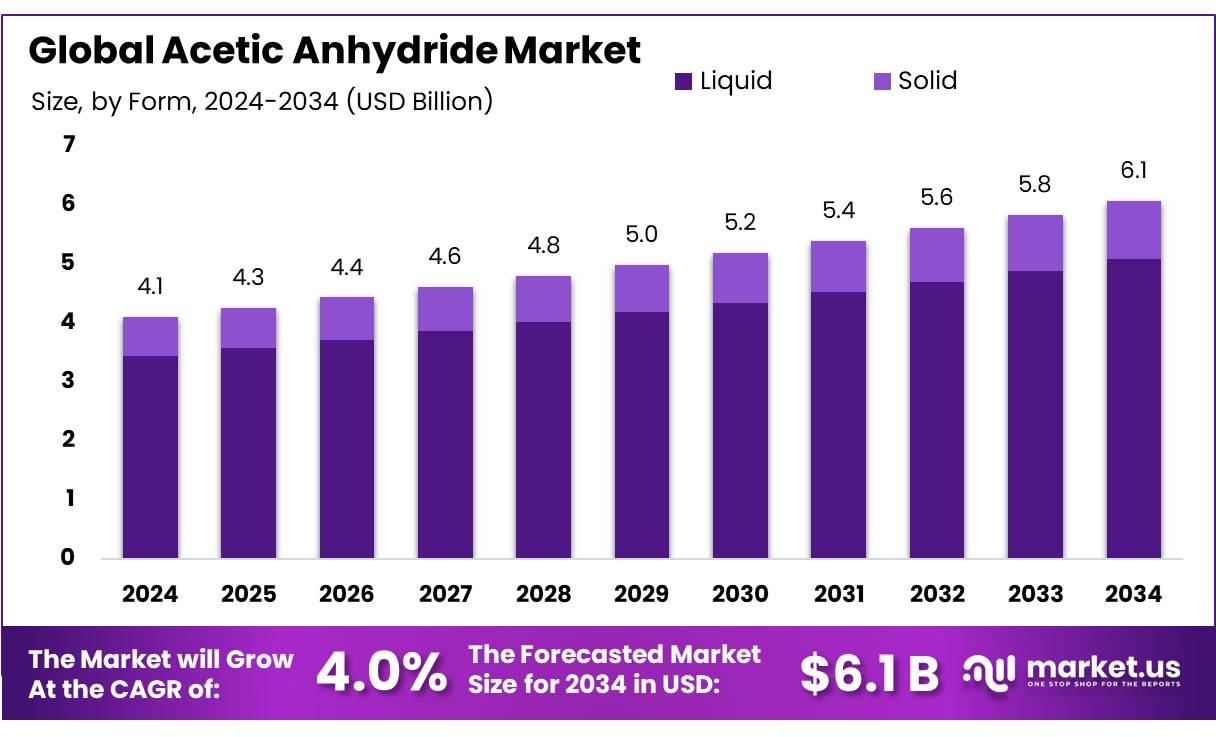

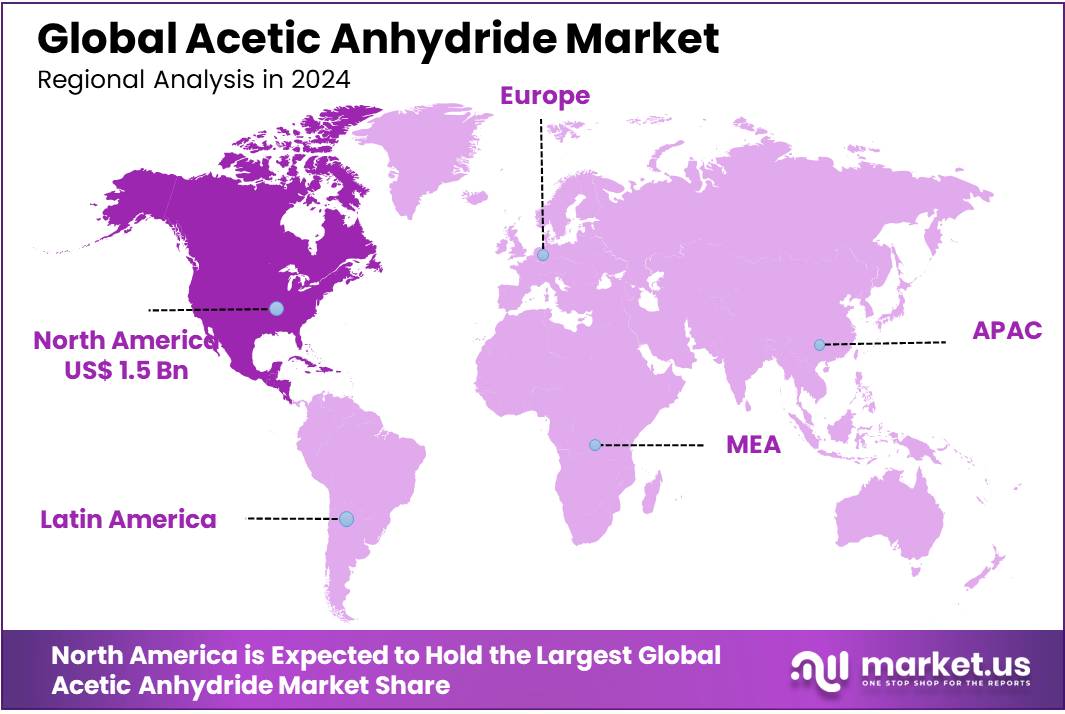

The Global Acetic Anhydride Market size is expected to be worth around USD 6.1 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 38.2% share, holding USD 1.5 billion revenue.

Acetic anhydride (AA) is an organic acid anhydride widely utilized as an intermediate in the production of cellulose acetate, pharmaceuticals, modified starches, agrochemicals and wood acetylation. It is produced industrially via carbonylation of methyl acetate or through ketene derived from acetic acid, using rhodium-iodide or lithium salts as catalysts.

In terms of trade, India exported acetic anhydride worth USD 40.6 million in 2023, with Belgium being the largest importer, accounting for approximately 82% of the exports. The country’s import of acetic anhydride in 2023 was valued at USD 17.4 million, primarily sourced from Saudi Arabia and China. This trade balance indicates India’s growing role as a significant player in the global acetic anhydride market.

Government initiatives such as the “Make in India” program have been instrumental in promoting domestic manufacturing and reducing reliance on imports. For instance, INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) have signed a Memorandum of Understanding to explore the construction of a 600-kilotonne-per-year acetic acid plant at GNFC’s site in Bharuch, Gujarat. This initiative aims to strengthen India’s domestic production capacity and align with the government’s objectives.

Acetic anhydride is listed as a precursor for illicit drug synthesis (heroin) and regulated under U.S. DEA List II and multiple national control regimes. In Canada, annual production was between 0.45–2.27 billion kg in 2011, while imports were in the range of 10,000–100,000 kg, showing limited domestic manufacturing capacity. Regulatory oversight is expected to remain tight, with export controls and precursor monitoring enforced globally.

Key Takeaways

- Acetic Anhydride Market size is expected to be worth around USD 6.1 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 4.0%.

- Liquid held a dominant market position in the acetic anhydride market, capturing more than an 83.8% share.

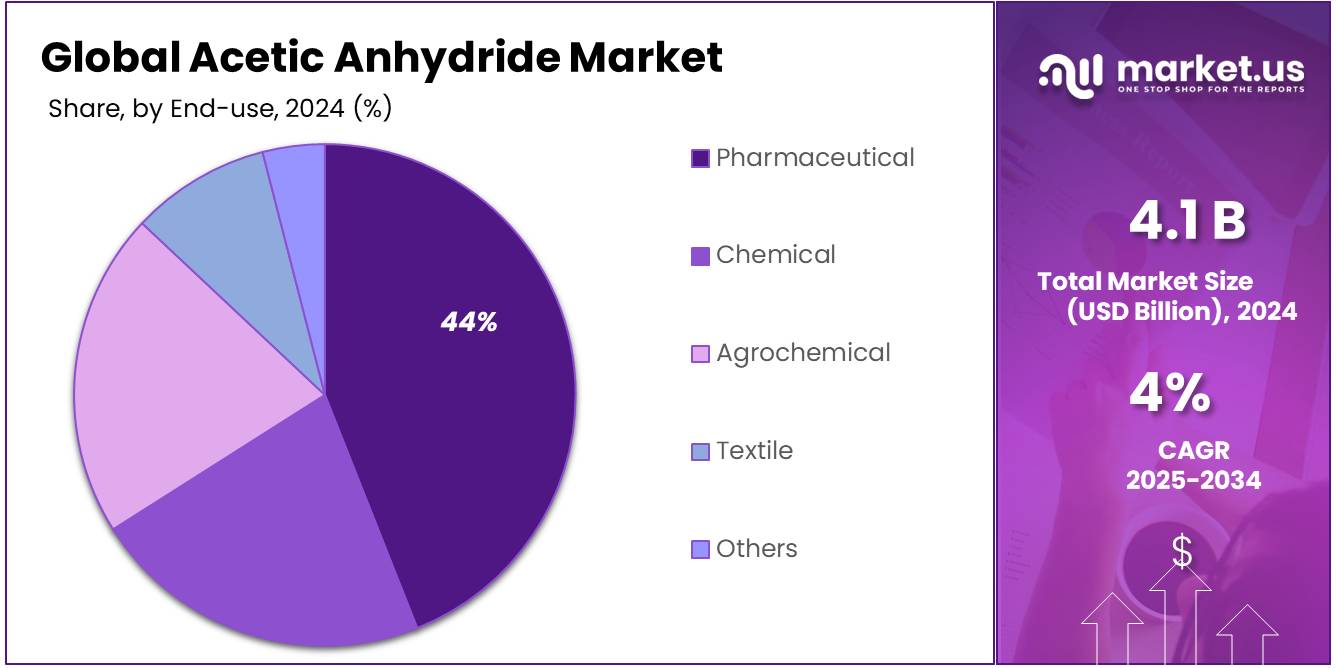

- Pharmaceutical held a dominant market position in the global acetic anhydride market, capturing more than a 44.9% share.

- North American acetic anhydride market is projected to dominate the global market, holding a significant share of approximately 38.2% and reaching a value of USD 1.5 billion.

By Form Analysis

Liquid Acetic Anhydride dominates with 83.8% market share in 2024 due to its high industrial adaptability and ease of handling.

In 2024, Liquid held a dominant market position in the acetic anhydride market, capturing more than an 83.8% share. This significant lead is largely due to the liquid form’s high compatibility with various industrial processes, particularly in the production of cellulose acetate, pharmaceuticals, and chemical intermediates. Liquid acetic anhydride is favored for its ease of storage, transport, and direct usage in large-scale chemical reactions without the need for conversion or further processing. Industries dealing with dyes, fragrances, and agrochemicals rely heavily on liquid acetic anhydride for consistent quality and efficient blending.

Its ability to be stored in bulk tanks and transported via tankers makes it a preferred option for manufacturers seeking streamlined logistics and cost-efficiency. By 2025, the dominance of the liquid form is expected to remain strong, supported by steady demand from Asia-Pacific and North American regions, where pharmaceutical and cellulose-based manufacturing activities are expanding rapidly. The widespread use and functional benefits of liquid acetic anhydride are anticipated to sustain its commanding market share well into the forecast period.

By End-use Analysis

Pharmaceutical sector leads with 44.9% share in 2024, driven by rising drug formulation demand.

In 2024, Pharmaceutical held a dominant market position in the global acetic anhydride market, capturing more than a 44.9% share. This strong lead is largely attributed to the compound’s vital role in producing active pharmaceutical ingredients (APIs) such as acetylsalicylic acid (aspirin), paracetamol, and various antibiotics.

The pharmaceutical industry heavily relies on acetic anhydride for acetylation reactions, which are essential in modifying chemical structures to increase drug effectiveness and stability. With the growing global population and rising healthcare needs, demand for common over-the-counter and prescription drugs has increased steadily, especially across emerging economies.

Additionally, the trend of expanding generic drug manufacturing—particularly in countries like India and Brazil—has further contributed to the increased consumption of acetic anhydride. In 2025, this upward trajectory is expected to continue, as pharmaceutical companies ramp up production capacities and invest in new drug formulations. The reliability and versatility of acetic anhydride as a key reagent keep it in high demand within pharmaceutical synthesis, ensuring that this end-use segment maintains its leading market share over the forecast period.

Key Market Segments

By Form

- Liquid

- Solid

By End-use

- Pharmaceutical

- Chemical

- Agrochemical

- Textile

- Others

Emerging Trends

Growing Adoption of Acetic Anhydride in Plant-Based Food Processing

One of the emerging trends in the acetic anhydride market is its growing adoption in plant-based food processing. As consumers increasingly shift towards plant-based diets, the food industry is responding by developing innovative alternatives to traditional animal-based products. Acetic anhydride plays an essential role in this transformation by acting as a key ingredient in the production of food preservatives, flavorings, and additives that are integral to plant-based foods.

According to the Food and Agriculture Organization (FAO). This growth is driven by rising awareness of the health benefits associated with plant-based diets and a growing demand for sustainable food choices. As more plant-based products enter the market, such as dairy-free cheeses, plant-based meats, and beverages, acetic anhydride is becoming a vital component in maintaining product stability, taste, and shelf life.

Government initiatives are also supporting this trend. In the United States, the Department of Agriculture (USDA) has introduced several programs to promote plant-based food production, providing funding and resources for innovation in the sector. These programs encourage the development of healthier, plant-based alternatives, which, in turn, increases the demand for acetic anhydride in food processing.

Drivers

Growing Demand for Acetic Anhydride in the Food Industry

In recent years, the increasing demand for acetic anhydride in the food industry has been a major driving factor behind its growth. Acetic anhydride is commonly used in the production of food additives and preservatives, including acetic acid, which is vital in the food processing industry. With global food production expanding, the need for preservatives and additives has grown significantly.

For instance, according to the Food and Agriculture Organization (FAO), global food production has been rising steadily, with a 1.5% annual increase in global food production, which naturally fuels the demand for acetic acid and related products like acetic anhydride.

The demand for acetic anhydride in food packaging has also surged. Food packaging materials that prevent spoilage and extend shelf life require acetic anhydride as a key ingredient. This is particularly true in the case of processed foods and beverages, where preserving freshness and quality is essential. As the global population grows and urbanization increases, the consumption of processed foods continues to rise, pushing the demand for these chemicals.

Additionally, various governments have initiated programs to enhance the safety and quality of food products, which indirectly support the use of acetic anhydride. For example, in 2023, the U.S. Food and Drug Administration (FDA) reaffirmed the safety of acetic acid in food production, further driving its demand in food-related applications. This regulatory endorsement strengthens consumer confidence, which is crucial for market growth.

Restraints

Regulatory Challenges and Safety Concerns

One of the major restraining factors for the growth of acetic anhydride in the food industry is the increasing regulatory scrutiny and safety concerns surrounding its use. Acetic anhydride is classified as a hazardous chemical due to its reactive and corrosive nature, which poses risks to both human health and the environment if mishandled. This has led to stricter government regulations and safety standards for its production and use, which can impact its widespread adoption in various industries.

For example, in the European Union, regulations on chemicals such as acetic anhydride have become more stringent with the implementation of the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework. According to the European Chemicals Agency (ECHA), manufacturers are required to ensure that all chemical substances used in food production, including acetic anhydride, meet rigorous safety standards. This can lead to increased compliance costs and may limit the ability of small-scale manufacturers to access or utilize this chemical in food processing.

Similarly, in the United States, the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) impose strict guidelines on the handling, storage, and transportation of acetic anhydride. Any breach of these regulations can result in fines or temporary bans on its use, which creates a challenging environment for businesses involved in food manufacturing and processing. Furthermore, in the food industry, consumers and advocacy groups are becoming more aware of the safety and toxicity concerns related to certain chemicals, which could drive demand for safer alternatives to acetic anhydride.

Opportunity

Rising Demand for Bio-based and Sustainable Products

A significant growth opportunity for acetic anhydride lies in the increasing demand for bio-based and sustainable products. With growing consumer awareness and regulatory pressure to reduce environmental footprints, industries are shifting towards more sustainable and eco-friendly production methods. This is creating an opportunity for acetic anhydride producers to innovate and offer bio-based alternatives, which can appeal to both environmentally conscious consumers and businesses seeking to meet sustainability goals.

In the food industry, the use of sustainable packaging materials is one area where acetic anhydride can play a key role. Biodegradable packaging made from renewable sources, such as plant-based plastics, requires chemicals like acetic anhydride in the production process. According to the Food and Agriculture Organization (FAO), the global market for biodegradable packaging is expected to grow by 9.1% annually from 2024 to 2034, driven by consumer demand for sustainable products. As companies in the food and beverage sector seek greener packaging solutions, acetic anhydride could see increased demand in this area.

Additionally, governments are encouraging the adoption of bio-based and environmentally friendly chemicals. For example, in the European Union, the Green Deal aims to make Europe the first climate-neutral continent by 2050. As part of this initiative, there is a significant push towards supporting the use of renewable and sustainable chemicals in various industries, including food processing and packaging. This trend is expected to drive the demand for acetic anhydride as a key ingredient in the production of bio-based products.

Regional Insights

North America dominates with 38.2% share and USD 1.5 billion market value in 2024

The North American acetic anhydride market is projected to dominate the global market, holding a significant share of approximately 38.2% and reaching a value of USD 1.5 billion by 2024. This dominance can be attributed to the region’s strong presence in key industries such as chemicals, pharmaceuticals, and food processing, which are major consumers of acetic anhydride. The region’s robust industrial infrastructure and advanced manufacturing capabilities further contribute to this growth, ensuring a steady demand for acetic anhydride across various sectors.

In the food industry, North America is witnessing a rising demand for preservatives, flavorings, and packaging solutions, driving the need for acetic anhydride. With a growing preference for processed and packaged foods, especially in the U.S. and Canada, the market for acetic anhydride is expected to continue expanding. Moreover, the ongoing trend towards bio-based and sustainable products in the region, supported by various government policies such as the U.S. Green Deal, is fueling further growth for chemicals like acetic anhydride.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Anhui Huamao Chemical is a prominent Chinese chemical manufacturer specializing in acetic anhydride production. The company is known for its extensive experience in producing and supplying high-quality acetic anhydride, catering to various industries such as chemicals, pharmaceuticals, and food processing. Their strategic positioning in China allows them to meet growing regional demand while maintaining competitive pricing. The company is also focused on enhancing its product offerings and expanding its production capacity to support increasing market needs.

BASF is a global leader in the chemical industry, offering a broad range of products, including acetic anhydride. The company has a strong presence across multiple regions, with advanced production facilities in North America, Europe, and Asia. BASF’s acetic anhydride is widely used in the production of various chemicals, coatings, and food additives. Their focus on innovation, sustainability, and high-quality products positions them as a key player in the acetic anhydride market, contributing significantly to industry advancements.

Celanese Corporation is a leading global technology and specialty materials company, offering a wide array of chemical solutions, including acetic anhydride. With operations in over 30 countries, Celanese’s acetic anhydride is used in a variety of applications, including the manufacturing of pharmaceuticals, plastics, and food ingredients. The company’s commitment to innovation and environmental sustainability has solidified its role as a major player in the global acetic anhydride market, addressing both customer needs and regulatory demands.

Top Key Players Outlook

- Anhui Huamao Chemical

- BASF

- Celanese Corporation

- China National Petroleum Corporation

- Hindustan Organic Chemicals

- Daicel Corporation

- DuPont

- Eastman Chemical

- Ercros

- Huntsman

- INEOS

- Jubilant Ingrevia Ltd.

- Luna Chemical Industries Pvt. Ltd.

- LyondellBasell

- SABIC

- Shandong Huijin Chemical

Recent Industry Developments

In 2024 Anhui Huamao Chemical, the company reported a revenue of approximately $200 million, reflecting its strong position in the industry. Huamao Chemical’s acetic anhydride production capacity stands at around 100,000 metric tons per year, catering to various sectors including pharmaceuticals, textiles, and food processing.

In 2024, Hindustan Organic Chemicals Limited acetic anhydride production capacity was approximately 25,000 metric tons per annum, contributing to India’s overall installed capacity of 223,430 metric tons as reported in 2017.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By End-use (Pharmaceutical, Chemical, Agrochemical, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Huamao Chemical, BASF, Celanese Corporation, China National Petroleum Corporation, Hindustan Organic Chemicals, Daicel Corporation, DuPont, Eastman Chemical, Ercros, Huntsman, INEOS, Jubilant Ingrevia Ltd., Luna Chemical Industries Pvt. Ltd., LyondellBasell, SABIC, Shandong Huijin Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Huamao Chemical

- BASF

- Celanese Corporation

- China National Petroleum Corporation

- Hindustan Organic Chemicals

- Daicel Corporation

- DuPont

- Eastman Chemical

- Ercros

- Huntsman

- INEOS

- Jubilant Ingrevia Ltd.

- Luna Chemical Industries Pvt. Ltd.

- LyondellBasell

- SABIC

- Shandong Huijin Chemical