Global AC Stabilized Power Supply Market Size, Share, And Enhanced Productivity By Type (Single Phase, Three Phase), By Power Rating (Up to 10 kVA, 10-50 kVA, Above 50 kVA), By Application (Industrial, Commercial, Residential), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170388

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

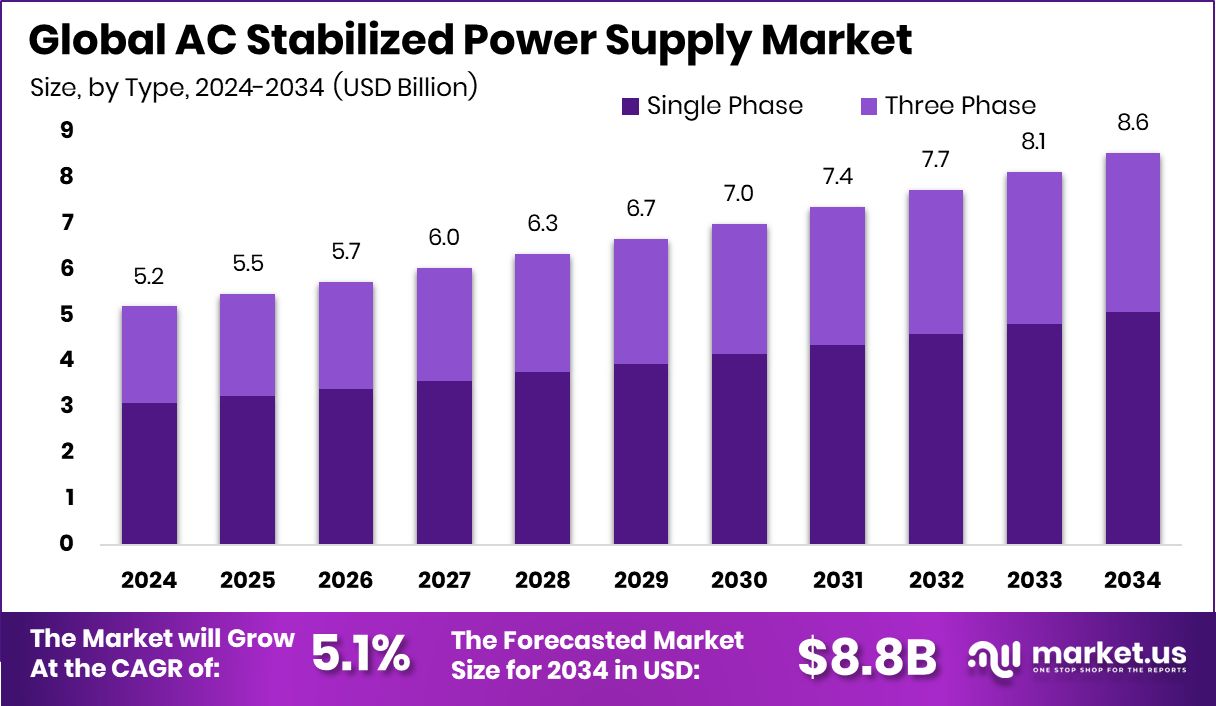

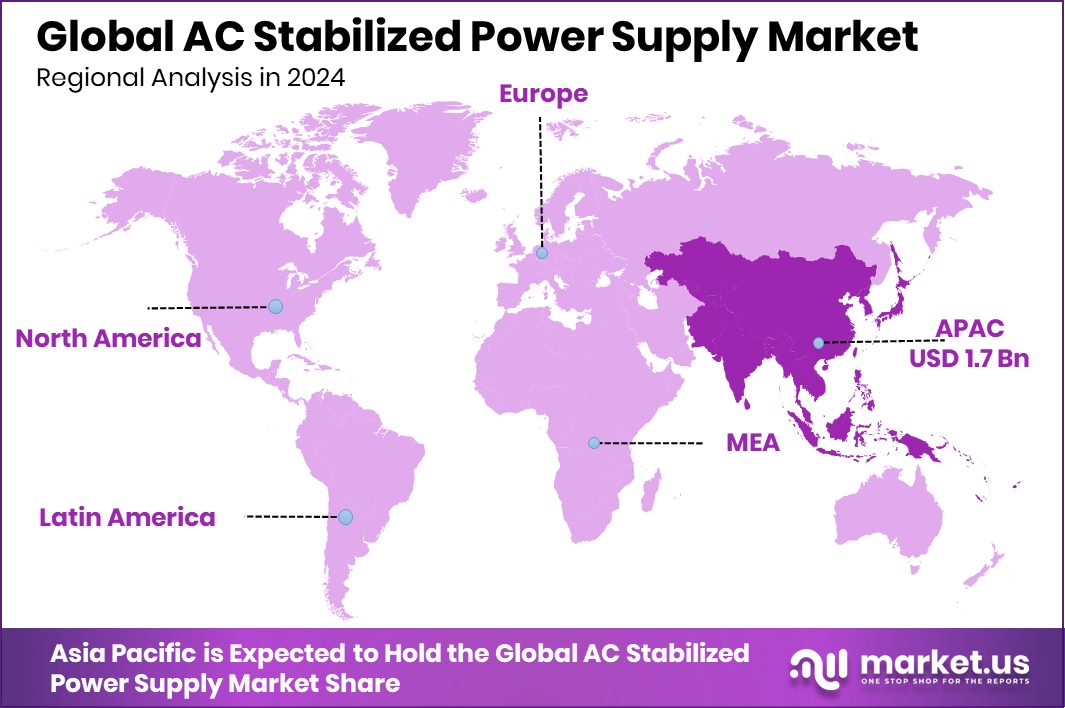

The Global AC Stabilized Power Supply Market is expected to be worth around USD 8.6 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. Asia Pacific leadership as AC Stabilized Market reached 32.80% valued at USD 1.7 Bn.

An AC Stabilized Power Supply is an electrical device designed to deliver a constant and safe output voltage, even when the incoming power fluctuates. It protects electrical equipment from damage caused by voltage swings, surges, and drops, ensuring smooth operation and longer equipment life. These systems are commonly used where grid power is unstable and voltage variation is frequent.

The AC Stabilized Power Supply Market refers to the ecosystem of products and solutions developed to maintain voltage stability across residential, commercial, and industrial settings. The market exists because power fluctuations remain a persistent issue in many regions, especially where aging grids, rapid electrification, and uneven power distribution are common. Stable power has become a basic operational need rather than a technical add-on.

Growth factors are strongly linked to rising electricity demand, grid expansion, and the push toward energy resilience. Large public investments in power infrastructure highlight this trend.

- African Development Bank approved over USD 68 million to protect Bamako’s power supply, directly addressing outages and voltage instability.

- Global partners pledged USD 50 billion to expand electricity access across Africa, signaling long-term demand for voltage protection solutions.

Demand is increasing as industries, digital systems, and public services depend on uninterrupted power. The UK-HyRES hydrogen research hub funded 10 new projects, while UK universities received £3 million, both relying on stable electrical environments. Similarly, Nigeria secured a €21 million energy fund with Germany to improve power reliability.

Opportunities are expanding with technology-driven electricity use. Singapore-based Amperesand raised USD 80 million, while Cell-En secured ¥150 million for power generation innovation. Additionally, meeting AI-driven electricity needs will require USD 2 trillion in new revenue, reinforcing the long-term role of stabilized power systems.

Key Takeaways

- The Global AC Stabilized Power Supply Market is expected to be worth around USD 8.6 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- Single Phase dominates the AC Stabilized Power Supply Market with 59.3% share due to usage.

- 10-50 kVA leads the AC Stabilized Power Supply Market with 44.2% driven by capacity demand.

- Industrial applications hold 49.1% in the AC Stabilized Power Supply Market, supporting operational reliability needs.

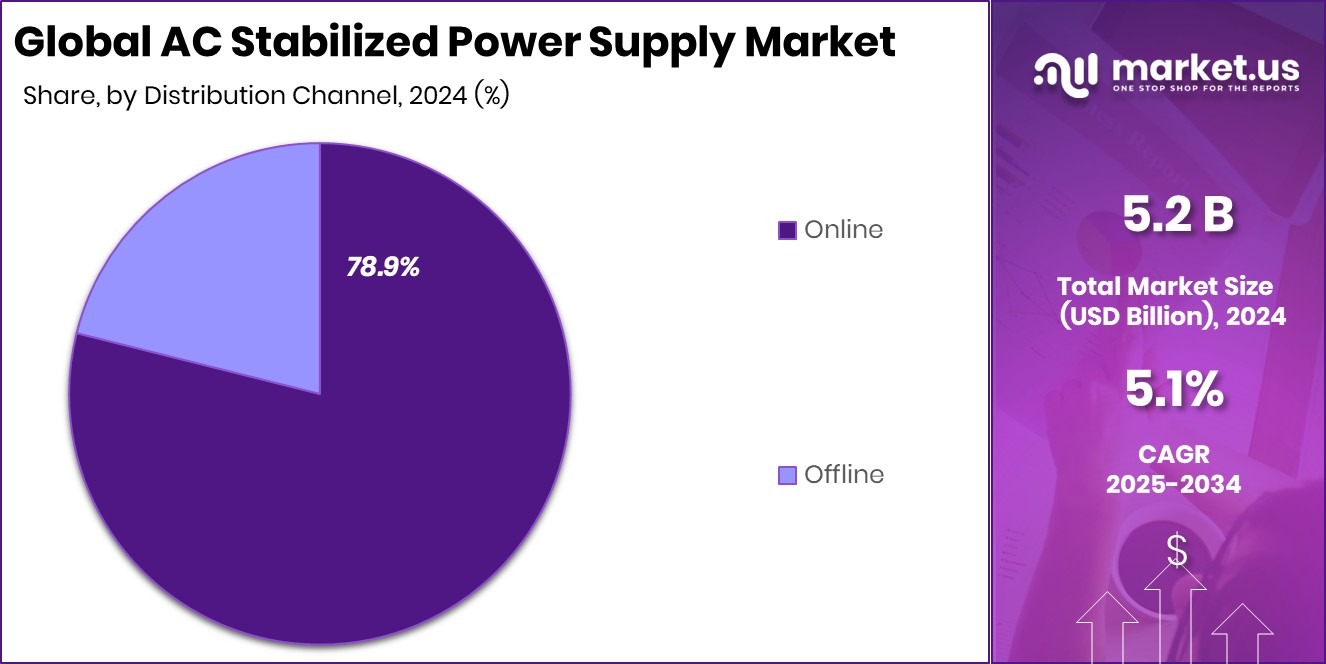

- Offline channels account for 78.9% of the AC Stabilized Power Supply Market’s global sales worldwide.

- Asia Pacific region recorded an AC-stabilized contribution of 32.80%, worth USD 1.7 Bn.

By Type Analysis

Single phase dominates the AC Stabilized Power Supply Market with a 59.3% share.

In 2024, Single Phase held a dominant market position in By Type segment of AC Stabilized Power Supply market, with a 59.3% share. This leadership reflects its wide adoption across environments where consistent voltage regulation is essential for protecting sensitive electrical equipment. Single-phase systems remain a practical choice due to their compatibility with commonly used electrical infrastructure and ease of integration into existing setups.

The strong share of this segment is also supported by its operational simplicity and reliable performance under fluctuating input conditions. Users favor single-phase stabilized power supplies for their stable output, compact design, and dependable voltage correction. These factors collectively reinforce the segment’s sustained dominance and make it a preferred configuration within the overall AC stabilized power supply landscape.

By Power Rating Analysis

Power between 10-50 kVA leads AC Stabilized Power Supply Market at 44.2%.

In 2024, 10–50 kVA held a dominant market position in the By Power Rating segment of AC Stabilized Power Supply market, with a 44.2% share. This power range has emerged as a balanced solution for applications that require moderate to high load handling without excessive system complexity. Its dominance highlights steady demand for power stabilization that supports continuous and reliable operations.

The segment benefits from its ability to manage voltage fluctuations effectively while maintaining energy efficiency and operational stability. Equipment within the 10–50 kVA range is widely selected for its scalability and consistent performance across demanding use conditions. As a result, this power rating continues to anchor market demand and remains central to overall segment growth dynamics.

By Application Analysis

Industrial applications drive AC Stabilized Power Supply Market demand, accounting for 49.1%.

In 2024, Industrial held a dominant market position in By Application segment of AC Stabilized Power Supply market, with a 49.1% share. This dominance underscores the critical role of voltage stabilization in industrial operations where machinery uptime and power quality directly affect productivity. Industrial users rely heavily on stabilized power to safeguard equipment from voltage variations.

The segment’s strong position is driven by the need for continuous, stable power across production processes and operational systems. AC stabilized power supplies support consistent performance, reduce equipment stress, and help maintain operational continuity. These functional advantages continue to reinforce the industrial segment’s leading share and its importance within the overall market structure.

By Distribution Channel Analysis

Offline channels strongly dominate the AC Stabilized Power Supply Market distribution with 78.9%.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the AC Stabilized Power Supply market, with a 78.9% share. This dominance reflects customer preference for direct purchasing channels that offer product verification, technical consultation, and immediate availability. Offline channels remain a trusted route for acquiring power stabilization equipment.

The segment benefits from established distributor networks and in-person support that aids buyers in selecting appropriate solutions. Physical channels also enable better after-sales interaction and service coordination, strengthening buyer confidence. As a result, offline distribution continues to command a substantial share, maintaining its role as the primary route to market for AC stabilized power supply solutions.

Key Market Segments

By Type

- Single Phase

- Three Phase

By Power Rating

- Up to 10 kVA

- 10-50 kVA

- Above 50 kVA

By Application

- Industrial

- Commercial

- Residential

By Distribution Channel

- Online

- Offline

Driving Factors

Expanding Grid Investments Drive Voltage Stability Demand

Rising public investment in electricity generation and grid expansion is a major driving factor for the AC Stabilized Power Supply Market. As governments push to improve access and reliability, voltage fluctuations become more common during grid upgrades and load additions. Stabilized power supplies are increasingly required to protect equipment and ensure consistent electricity delivery, especially in regions with weak or transitioning grids. The focus on renewable integration and cross-border interconnections further increases the need for voltage control solutions to manage irregular power flows and prevent equipment damage.

- Nigeria secured USD 950 million in funding to boost renewable electricity supply, aiming to improve power access for 86 million citizens currently without electricity, directly increasing demand for voltage stabilization solutions across new and upgraded networks.

- Uganda and South Sudan received USD 153.66 million in financing for an electricity interconnection project, highlighting the need for stabilized power systems to manage cross-border power exchange safely.

Additional momentum comes from a USD 500 million government initiative to jumpstart power supply and a USD 104 million approval by the African Development Bank to improve electricity reliability in eastern Ethiopia, reinforcing sustained market growth.

Restraining Factors

High Infrastructure Costs Limit Adoption Pace

One key restraining factor for the AC Stabilized Power Supply Market is the rising cost pressure across power infrastructure projects. Utilities and grid operators often prioritize core generation and transmission assets, leaving limited budgets for voltage stabilization systems. Even when power quality issues exist, spending is directed toward transformers, lines, or solar capacity first, delaying investments in stabilized power solutions. This budget imbalance slows adoption, especially in regions facing financial stress within electricity distribution companies.

- A ₹43 Cr power transformer order triggered a 4% stock jump, showing how capital is absorbed by core equipment purchases rather than auxiliary stabilization systems.

- The Meghalaya solar mission, worth Rs 100 crore, focuses on renewable expansion, where funding is largely allocated to generation assets, reducing near-term focus on voltage control infrastructure.

Financial strain further restricts adoption, as PNG Power, owing USD 1.5 billion, including dues to an Australian-backed fund, highlights how utility debt limits investment capacity for power stabilization upgrades.

Growth Opportunity

Digital Infrastructure Expansion Creates Stable Power Demand

A major growth opportunity for the AC Stabilized Power Supply Market is the rapid expansion of digital and infrastructure projects that demand consistent, high-quality electricity. Technology hubs, data-driven businesses, and large construction programs rely on stable voltage to protect sensitive systems and avoid downtime. As these projects scale, the need for reliable power conditioning becomes essential rather than optional, opening steady opportunities for stabilized power solutions.

- Delhi NCR tech funding reached USD 2.4 billion in 2025, with late-stage funding rising 77% to USD 1.6 billion, increasing demand for dependable power systems across offices, data centers, and innovation hubs.

- Texas approved USD 150 million for Borderland Expressway Phase 3 in Northeast El Paso, driving construction activity that requires stable power for equipment and control systems.

Additionally, OKX’s USD 100 million vision fund for its X Layer strategy highlights growing digital platforms that depend heavily on uninterrupted and stabilized power environments.

Latest Trends

Industrial Decarbonisation Accelerates Demand for Power Stability

A key latest trend in the AC Stabilized Power Supply Market is the shift toward cleaner, smarter industrial operations that require stable and high-quality electricity. As industries adopt low-carbon heating, advanced manufacturing, and energy-efficient processes, voltage stability becomes critical to protect sensitive equipment and automation systems. Power stabilization is increasingly viewed as a supporting layer for decarbonisation and industrial modernization rather than a standalone electrical add-on.

- Türkiye Industrial Development Bank secured €250M climate funding from German KfW, supporting industrial upgrades that increase demand for stable power systems.

- The Commission allocated €1 billion for the first pilot auction for industrial heat decarbonisation, reinforcing the need for reliable voltage control in new clean-energy processes.

Additional momentum comes from Tsuyo Manufacturing raising INR 40 crore, Möbius Industries securing USD 3.8 million pre-seed funding, and Arizona announcing USD 5 million for advanced manufacturing training, all signaling rising adoption of stabilized power in modern industrial environments.

Regional Analysis

Asia Pacific AC Stabilized Market held a 32.80% share valued at USD 1.7 Bn.

The regional analysis of the AC Stabilized Power Supply Market highlights Asia Pacific as the dominating region, accounting for 32.80% of the market and valued at USD 1.7 Bn, reflecting its strong concentration of manufacturing activity, expanding electrical infrastructure, and high dependence on voltage-sensitive equipment. The region’s dominance is supported by widespread usage of stabilized power systems across industrial facilities, commercial buildings, and essential utility networks, where voltage fluctuation remains a persistent challenge. North America represents a mature regional market characterized by stable demand patterns and consistent replacement cycles, supported by well-established power standards and a strong installed base of electrical equipment.

Europe follows closely, driven by structured grid systems and a continued focus on maintaining power quality across industrial and commercial environments. The Middle East & Africa region shows steady adoption due to uneven grid stability and growing reliance on protective power solutions in operational settings.

Latin America also contributes to overall market presence, supported by gradual infrastructure upgrades and increasing awareness of voltage regulation needs. Collectively, these regions shape a balanced global market structure, with Asia Pacific clearly leading in value and market share based on the provided data.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schneider Electric continued to demonstrate strong strategic positioning in the global AC Stabilized Power Supply Market in 2024 through its long-standing focus on power quality, energy efficiency, and system reliability. The company’s portfolio aligns well with customer demand for stable voltage management across industrial and commercial environments. Its emphasis on integrated electrical solutions allows Schneider Electric to address power protection as part of broader energy management frameworks, strengthening customer stickiness and long-term adoption.

Siemens AG maintained a solid presence in the AC stabilized power supply landscape by leveraging its deep expertise in electrical engineering and automation systems. The company’s strength lies in delivering highly reliable power conditioning solutions that integrate smoothly with complex electrical infrastructures. Siemens’ reputation for engineering precision and operational durability supports its role as a preferred supplier in applications where power stability is critical to continuous operations.

ABB Ltd remained a key participant in 2024, supported by its strong capabilities in power electronics and grid technologies. ABB’s AC stabilized power supply offerings are valued for their robustness and performance consistency under fluctuating voltage conditions. The company’s ability to combine advanced electrical design with scalable deployment reinforces its competitive standing and positions it well to meet evolving power stability requirements across diverse end-use environments.

Top Key Players in the Market

- Schneider Electric

- Siemens AG

- ABB Ltd

- Eaton Corporation

- Emerson Electric Co.

- Toshiba Corporation

- Delta Electronics, Inc.

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Legrand

Recent Developments

- In September 2025, ABB announced it will invest US$110 million in the United States to grow manufacturing and R&D for advanced electrification products, helping improve energy efficiency and uptime.

- In July 2025, Schneider Electric agreed to acquire the remaining 35% stake in Schneider Electric India Private Limited (SEIPL) from Temasek, making SEIPL a wholly owned unit. This strengthens Schneider’s presence in India, enhancing decision-making and capacity growth in a key market for power management and electrical solutions.

- In March 2025, Siemens finalized the purchase of Altair Engineering Inc., a major provider of simulation, data science, high-performance computing, and AI software. This acquisition expands Siemens’ industrial software portfolio and enhances its digital twin and AI-powered engineering tools that help global customers design and optimize products faster.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Phase, Three Phase), By Power Rating (Up to 10 kVA, 10-50 kVA, Above 50 kVA), By Application (Industrial, Commercial, Residential), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schneider Electric, Siemens AG, ABB Ltd, Eaton Corporation, Emerson Electric Co., Toshiba Corporation, Delta Electronics, Inc., Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Legrand Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AC Stabilized Power Supply MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

AC Stabilized Power Supply MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric

- Siemens AG

- ABB Ltd

- Eaton Corporation

- Emerson Electric Co.

- Toshiba Corporation

- Delta Electronics, Inc.

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Legrand