Global 4-Chloro-3-Methylphenol (CAS 59-50-7) Market Size, Share, And Enhanced Productivity By Grade (Technical Grade, Pharmaceutical Grade, Cosmetic Grade), By Form (Powder Form, Liquid Form, Crystalline Form), By Application (Antiseptic and Disinfectant Formulations, Personal Care and Cosmetic Products, Pharmaceutical Formulations, Others), By End-Use (Chemical Industry, Pharmaceutical Industry, Cosmetics and Personal Care Industry, Cleaning and Hygiene Products Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169719

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

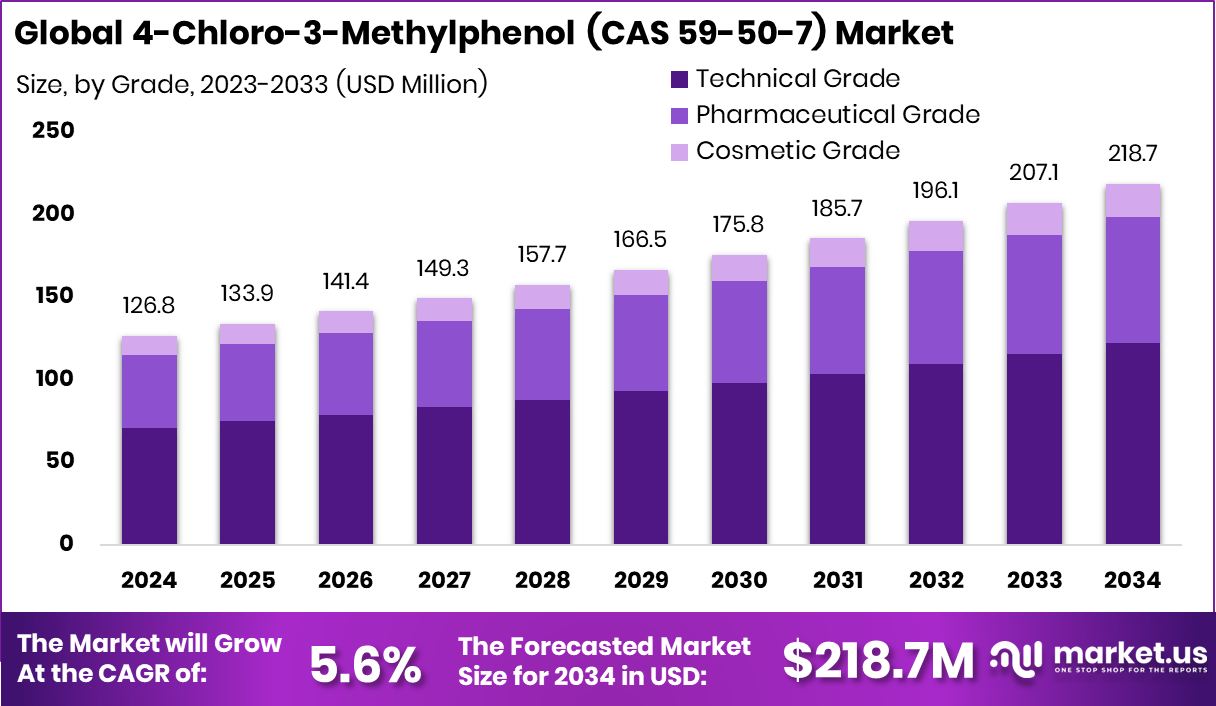

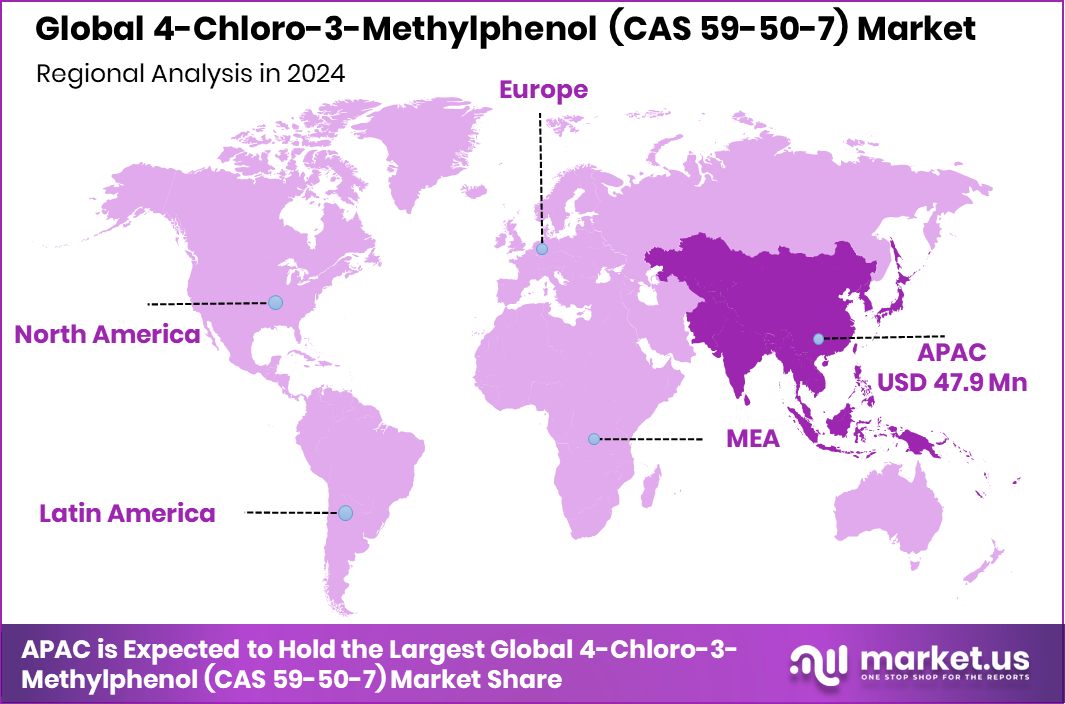

The Global 4-Chloro-3-Methylphenol (CAS 59-50-7) Market is expected to be worth around USD 218.7 million by 2034, up from USD 126.8 million in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. Asia Pacific accounted for 37.8% of the market size, generating USD 47.9 Mn overall.

4-Chloro-3-Methylphenol (CAS 59-50-7) is a chlorinated phenolic compound known for its strong antimicrobial and preservative properties. It is mainly used to control bacteria and fungi in disinfectants, personal care formulations, lubricants, and certain industrial sanitation applications.

The 4-Chloro-3-Methylphenol market refers to the commercial production and use of this chemical across hygiene, cosmetics, pharmaceuticals, and industrial cleaning segments. Demand is linked to rising hygiene standards, stricter microbial control practices, and growing consumption of formulated disinfectant products.

Growth factors include innovation in antimicrobial technologies, supported by funding such as a $1 million NSF grant awarded to a UCF alumna for developing microbe-killing residual disinfectants, and $15 million raised by Kinnos to expand disinfectant solutions, reinforcing downstream demand.

Demand is fueled by personal care and cosmetics growth. Companies like Renee Cosmetics raised $30 million and later secured ₹100 crore in Series B funding to expand product lines, reflecting rising consumption of preservative-based cosmetic formulations.

Opportunities emerge from premium cosmetics and lifestyle spending, highlighted by cases like a $2.4 million theft in China to fund cosmetic procedures and luxury living, which indirectly signals expanding beauty markets needing effective antimicrobial ingredients.

Key Takeaways

- The Global 4-Chloro-3-Methylphenol (CAS 59-50-7) Market is expected to be worth around USD 218.7 million by 2034, up from USD 126.8 million in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Technical grade holds a 55.8% share due to cost efficiency and suitability for large-scale antimicrobial manufacturing applications.

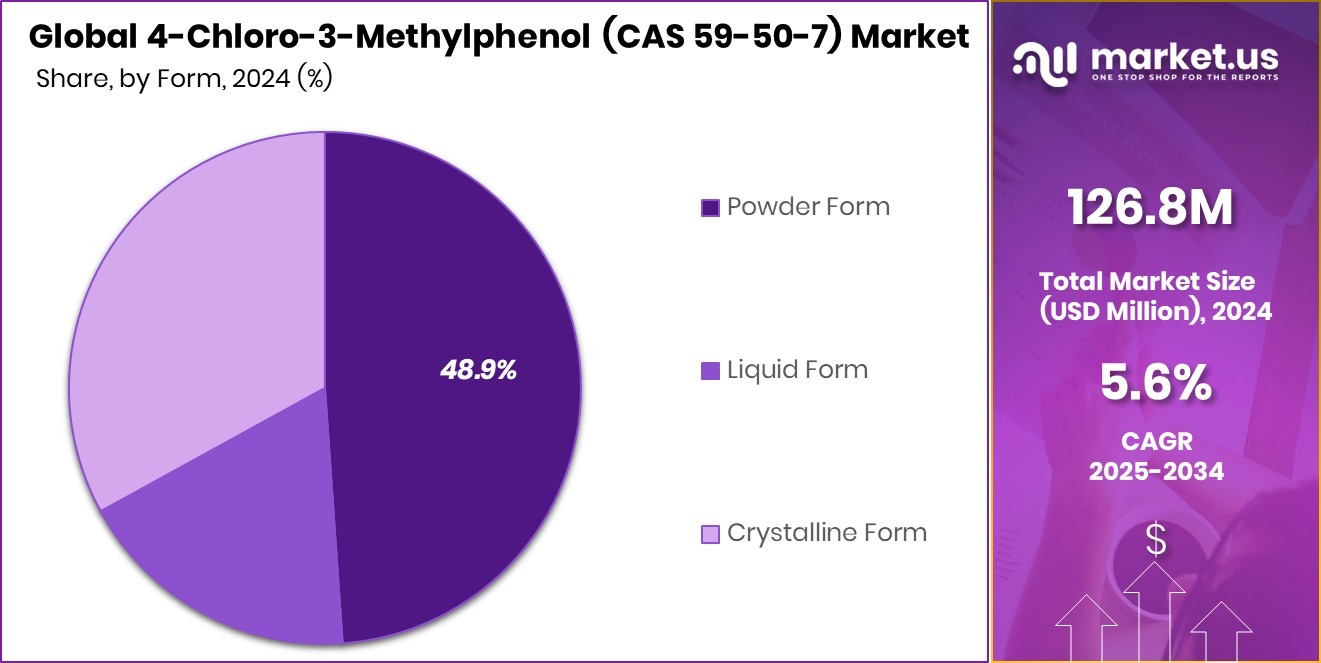

- Powder form accounts for a 48.9% share and is preferred for stable storage, easy handling, and formulation flexibility.

- Antiseptic and disinfectant formulations dominate with a 44.7% share, driven by rising hygiene and sanitation needs.

- The chemical industry contributes a 38.1% share, supported by consistent demand for phenolic intermediates.

- Asia Pacific demand remains strong, holding 37.8% share and reaching USD 47.9 Mn.

By Grade Analysis

In the 4-Chloro-3-Methylphenol market, Technical Grade dominates with a 55.8% share globally across industrial applications.

In 2024, Technical Grade held a dominant market position in By Grade segment of the 4-Chloro-3-Methylphenol (CAS 59-50-7) Market, with a 55.8% share. This dominance is mainly linked to its wide suitability for industrial and institutional applications where cost efficiency and functional performance matter more than ultra-high purity.

Technical-grade material is commonly preferred in disinfectant formulations, industrial sanitizers, and antimicrobial preparations used in non-personal care settings. Its stable chemical profile supports consistent antimicrobial activity, which is critical for large-scale cleaning and hygiene operations.

Additionally, ease of handling, broader formulation tolerance, and reliable supply availability strengthen its adoption across manufacturing and maintenance sectors. These advantages collectively allowed technical grade to maintain a strong and sustained presence in the market throughout 2024.

By Form Analysis

Powder form leads the 4-Chloro-3-Methylphenol market, holding 48.9% usage share worldwide across formulations.

In 2024, Powder Form held a dominant market position in the By Form segment of 4-Chloro-3-Methylphenol (CAS 59-50-7) Market, with a 48.9% share. This strong position is supported by its ease of storage, longer shelf life, and high stability during transportation compared to other physical formats.

Powder form allows accurate dosing and uniform blending during formulation, which is especially important for antimicrobial and disinfectant applications. Its lower moisture sensitivity reduces degradation risk, making it suitable for bulk handling and extended use in industrial environments.

Manufacturers also favor the powder form due to simpler packaging requirements and reduced leakage risks. These functional and logistical advantages contributed to its widespread preference and sustained dominance in the market throughout 2024.

By Application Analysis

Antiseptic disinfectant applications drive 44.7% of the 4-Chloro-3-Methylphenol market demand globally across industries.

In 2024, Antiseptic and Disinfectant Formulations held a dominant market position in the By Application segment of 4-Chloro-3-Methylphenol (CAS 59-50-7) Market, with a 44.7% share. This dominance is driven by the compound’s proven effectiveness in controlling a broad range of bacteria and fungi, making it a reliable ingredient in hygiene-focused formulations.

Its stability under varying conditions supports consistent antimicrobial performance in both institutional and household use. Widespread emphasis on cleanliness standards in healthcare facilities, public spaces, and industrial environments further strengthened adoption.

The ability to maintain residual antimicrobial activity after application also enhances its value in disinfectant solutions. These practical advantages allowed antiseptic and disinfectant formulations to secure a leading position in overall application demand during 2024.

By End-Use Analysis

The chemical industry accounts for 38.1% of end-use demand in the 4-chloro-3-methylphenol market worldwide applications.

In 2024, the chemical industry held a dominant market position in the By End-Use segment of 4-Chloro-3-Methylphenol (CAS 59-50-7) Market, with a 38.1% share. This dominance reflects the compound’s broad usability as an intermediate and functional additive within chemical manufacturing processes.

Its antimicrobial and preservative properties support the production of disinfectants, specialty formulations, and treatment agents used across multiple downstream applications. Consistent demand from routine production cycles and the need for reliable contamination control reinforced its role within chemical operations.

The material’s compatibility with established processing systems also simplified adoption without major formulation changes. These practical aspects enabled the chemical industry to remain the leading end-use segment, maintaining a stable and significant share of total market consumption in 2024.

Key Market Segments

By Grade

- Technical Grade

- Pharmaceutical Grade

- Cosmetic Grade

By Form

- Powder Form

- Liquid Form

- Crystalline Form

By Application

- Antiseptic and Disinfectant Formulations

- Personal Care and Cosmetic Products

- Pharmaceutical Formulations

- Others

By End-Use

- Chemical Industry

- Pharmaceutical Industry

- Cosmetics and Personal Care Industry

- Cleaning and Hygiene Products Industry

- Others

Driving Factors

Rising Hygiene and Skincare Product Demand Drives Market

One of the main driving factors for the 4-Chloro-3-Methylphenol market is the growing demand for hygiene, skincare, and personal protection products. Consumers are becoming more aware of skin safety, cleanliness, and protection from harmful microbes in daily-use products. This shift is pushing formulators to use effective antimicrobial ingredients that can control bacteria and fungi without affecting product stability.

4-Chloro-3-Methylphenol fits this need well, as it supports longer shelf life and reliable performance in skincare formulations. Funding activity also shows this trend clearly. ClayCo Cosmetics received $2 million from Unilever Ventures, highlighting rising investment in skincare brands that focus on product safety and skin-friendly formulations. As more beauty and skincare companies scale production, the need for proven antimicrobial ingredients continues to strengthen market growth.

Restraining Factors

Strict Safety Regulations Limit Broader Market Adoption

One major restraining factor for the 4-Chloro-3-Methylphenol market is the presence of strict safety and usage regulations, especially in skincare and personal care products. Regulatory authorities closely monitor phenolic compounds due to possible skin sensitivity and long-term exposure concerns. This often leads to usage limits, additional testing requirements, and longer approval timelines for manufacturers.

As a result, formulators may reduce concentration levels or delay product launches, which can slow overall market growth. Even growing brands face these challenges. WishCare raised Rs 20 crore from Unilever Ventures, yet such companies still need to invest heavily in compliance, testing, and reformulation to meet regulatory guidelines. These added costs and process complexities restrict faster adoption, particularly among small and mid-scale producers targeting mass-market hygiene and skincare segments.

Growth Opportunity

Expanding Natural Skincare Formulations Creates New Opportunities

A major growth opportunity for the 4-Chloro-3-Methylphenol market lies in the rapid expansion of modern skincare formulations that balance safety, performance, and longer shelf life.

As skincare brands launch new creams, lotions, and cleansers, there is a rising need for antimicrobial ingredients that can protect products from bacterial contamination during storage and use.

4-Chloro-3-Methylphenol supports this demand by offering reliable preservation while maintaining formulation stability. Investment activity further highlights this opportunity. Lotus Herbals has set up a $50 million fund to invest in startups, signaling strong momentum in the skincare and wellness space.

As new startups develop advanced and blended formulations, demand for effective antimicrobial compounds is expected to rise, opening steady growth avenues across personal care product development.

Latest Trends

Sustainable Skincare Innovation Shapes Advanced Antimicrobial Usage

A key latest trend in the 4-Chloro-3-Methylphenol market is its careful integration into sustainable and environmentally conscious skincare formulations. Brands are increasingly working to balance antimicrobial protection with lower environmental impact, focusing on responsible ingredient selection and optimized usage levels. This trend reflects a shift toward products that deliver hygiene benefits while aligning with eco-friendly brand values.

4-Chloro-3-Methylphenol is being used more precisely to maintain product safety without excess formulation load. Funding developments underline this direction. BYBI secured £1.9 million in funding to expand its carbon-negative skincare line, showing strong industry movement toward sustainability-driven personal care. As clean and climate-focused skincare gains traction, demand for efficient antimicrobial compounds that support stability is expected to continue growing.

Regional Analysis

Asia Pacific leads the 4-Chloro-3-Methylphenol market with 37.8% share at USD 47.9 Mn.

Asia Pacific dominates the global market with a 37.8% share, valued at USD 47.9 Mn, supported by strong manufacturing activity, expanding chemical production bases, and rising consumption of disinfectants and hygiene-related formulations. Rapid urbanization and growing awareness around cleanliness across industrial and institutional users continue to strengthen regional demand, making the Asia Pacific the leading contributor to the overall market value.

North America represents a mature market where demand is primarily sustained by consistent usage in industrial chemicals and regulated hygiene applications. Stable consumption patterns and established production infrastructure support steady market participation, although growth remains more controlled compared to emerging regions.

Europe follows a similar trend, with demand shaped by strict regulatory oversight and a strong focus on product compliance and formulation safety. Usage remains concentrated in industrial and professional sectors where controlled antimicrobial performance is required.

The Middle East & Africa market is developing gradually, driven by infrastructure expansion, sanitation needs, and growing industrial activities in selected economies. Adoption remains moderate but shows steady progress.

Latin America reflects emerging demand, supported by industrial growth and increasing hygiene awareness, contributing modestly to the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Lanxess AG maintained a strong presence in the 4-Chloro-3-Methylphenol market through its deep expertise in specialty chemicals and antimicrobial solutions. The company’s established chemical manufacturing capabilities and focus on high-performance intermediates position it well to serve industrial and hygiene-related applications. Its emphasis on quality control and regulatory compliance supports consistent demand across mature markets where reliability and safety are critical purchasing factors.

Santa Cruz Biotechnology, Inc. plays a more niche, but important role in the market, largely supporting research, laboratory, and specialty synthesis needs. In 2024, its strength lay in supplying precise chemical compounds for scientific and pharmaceutical research, where purity, documentation, and consistency are essential. This focus allows the company to cater to customers requiring smaller volumes with high specification standards, reinforcing its relevance in specialized end-use segments.

TCI Chemicals (India) Pvt. Ltd. continued to strengthen its footprint by leveraging a broad product catalog and strong distribution capabilities. Its role in the market is supported by accessibility, dependable supply, and responsiveness to academic and industrial demand. The company’s presence in India also supports regional availability, making it a key supplier for customers seeking efficient sourcing and consistent product performance in 2024.

Top Key Players in the Market

- Lanxess AG

- Santa Cruz Biotechnology, Inc.

- TCI Chemicals (India) Pvt. Ltd.

- Central Drug House (P) Ltd.

- Loba Chemie Pvt. Ltd.

- Apollo Scientific Ltd.

- Chem-Impex International, Inc.

- Spectrum Chemical Manufacturing Corp.

- MP Biomedicals, LLC

- Fisher Scientific UK Ltd.

Recent Developments

- In April 2025, LANXESS completed the sale of its Urethane Systems business to UBE Corporation. This divestment marks the company’s shift toward concentrating on its core specialty chemicals and consumer protection segments.

- In 2025, Fisher Scientific UK continues to list 4-Chloro-3-Methylphenol, 99+% (CAS 59-50-7) under its Thermo Scientific Chemicals catalog, indicating an ongoing supply of this high-purity chemical for laboratory and research-grade use.

Report Scope

Report Features Description Market Value (2024) USD 126.8 Million Forecast Revenue (2034) USD 218.7 Million CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical Grade, Pharmaceutical Grade, Cosmetic Grade), By Form (Powder Form, Liquid Form, Crystalline Form), By Application (Antiseptic and Disinfectant Formulations, Personal Care and Cosmetic Products, Pharmaceutical Formulations, Others), By End-Use (Chemical Industry, Pharmaceutical Industry, Cosmetics and Personal Care Industry, Cleaning and Hygiene Products Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lanxess AG, Santa Cruz Biotechnology, Inc., TCI Chemicals (India) Pvt. Ltd., Central Drug House (P) Ltd., Loba Chemie Pvt. Ltd., Apollo Scientific Ltd., Chem-Impex International, Inc., Spectrum Chemical Manufacturing Corp., MP Biomedicals, LLC, Fisher Scientific UK Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  4-Chloro-3-Methylphenol (CAS 59-50-7) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

4-Chloro-3-Methylphenol (CAS 59-50-7) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lanxess AG

- Santa Cruz Biotechnology, Inc.

- TCI Chemicals (India) Pvt. Ltd.

- Central Drug House (P) Ltd.

- Loba Chemie Pvt. Ltd.

- Apollo Scientific Ltd.

- Chem-Impex International, Inc.

- Spectrum Chemical Manufacturing Corp.

- MP Biomedicals, LLC

- Fisher Scientific UK Ltd.