Global 2,5-Furandicarboxylic Acid (FDCA) Market Size, Share, Growth Analysis By Type (0.99, 0.98), By Application (PET, Polyamides, Polycarbonates, Plasticizers, Polyester Polyols, Others), By End-User (Chemical, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169357

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

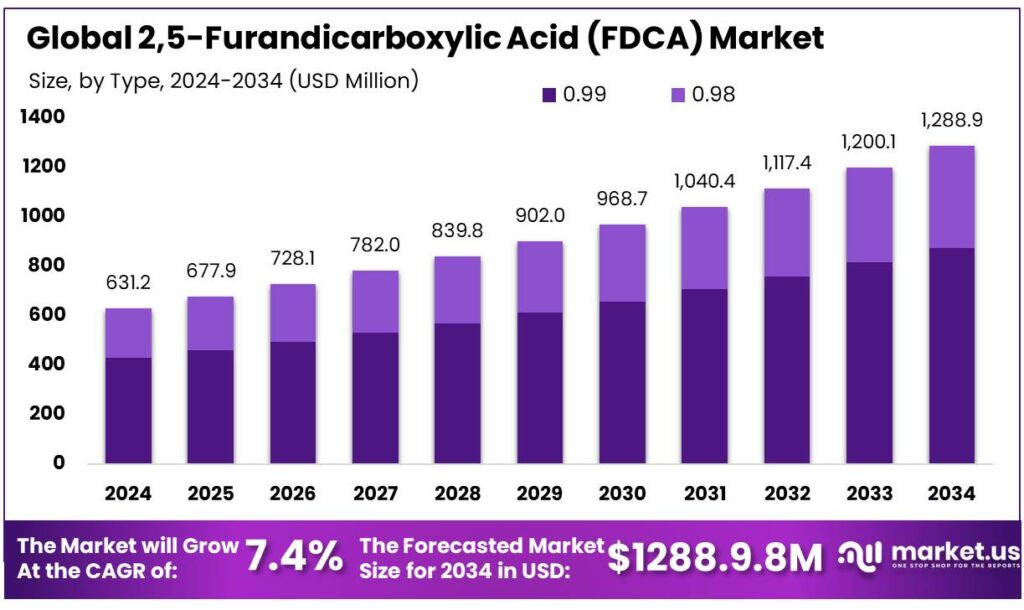

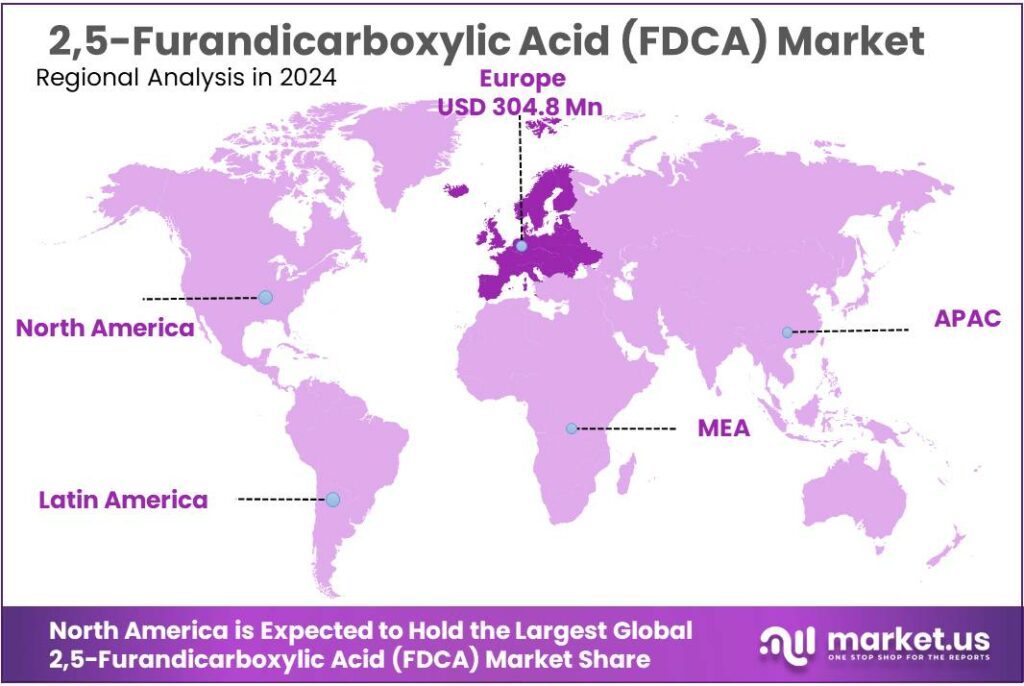

The Global 2,5-Furandicarboxylic Acid (FDCA) Market size is expected to be worth around USD 1288.9 Million by 2034, from USD 631.2 Million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 48.3% share, holding USD 304.8 Million revenue.

2,5-Furandicarboxylic acid (FDCA) is a bio-based diacid made from sugars such as fructose and lignocellulosic biomass. It is the key monomer for polyethylene furanoate (PEF), a 100% bio-based polyester positioned as a direct replacement for fossil-based polyethylene terephthalate (PET) in bottles, films, and fibers. As the energy system struggles to decarbonise, global energy-related CO₂ emissions still reached 37.4 billion tonnes in 2023, underscoring the need to cut emissions embodied in plastics and packaging.

Plastics alone generated around 2.24 gigatonnes of greenhouse-gas emissions in 2019, roughly 5% of the global total and similar to 600 coal-fired power plants, with emissions potentially rising to 6.78 gigatonnes by 2050 if unchecked. FDCA sits at the heart of industrial strategies to break this trend by replacing fossil aromatics with sugar-derived furanics. Avantium’s flagship FDCA plant in Delfzijl, for example, is designed for about 5 kilotons per year of FDCA capacity, marking the first commercial-scale asset for this platform molecule.

Today FDCA still represents a small slice of global bioplastics, but the surrounding ecosystem is scaling fast. European Bioplastics expects global bioplastics production capacity to rise from about 2.47 million tonnes in 2024 to roughly 5.73 million tonnes by 2029. Within this growth, PEF and other FDCA-based polymers are positioned as premium materials where performance and sustainability justify higher prices, particularly in beverage, food, and specialty packaging.

FDCA’s industrial appeal rests on performance as well as carbon footprint. PEF made from FDCA is reported to be about 31-times less permeable to CO₂ than PET and offers substantially better oxygen barrier properties. Other studies show PEF delivering up to 10-times better oxygen barrier and roughly 16–20-times better CO₂ barrier than PET in bottle applications. Life-cycle assessments indicate that bio-based PEF bottles can cut greenhouse-gas emissions by about 50–74% versus PET bottles of similar size. With PET production exceeding 50 megatons per year worldwide, even a modest substitution by FDCA-based PEF has meaningful climate leverage.

Policy and regulatory dynamics strongly support FDCA adoption. Under the EU’s proposed Packaging and Packaging Waste Regulation, member states must cut packaging waste by 5% by 2030, 10% by 2035, and 15% by 2040, with all packaging required to be recyclable by 2030. The updated EU Bioeconomy Strategy further signals targets and criteria for bio-based plastics by 2027, offering regulatory clarity for FDCA and PEF investments.

Key Takeaways

- 2,5-Furandicarboxylic Acid (FDCA) Market size is expected to be worth around USD 1288.9 Million by 2034, from USD 631.2 Million in 2024, growing at a CAGR of 7.4%.

- 0.99 held a dominant market position, capturing more than a 67.9% share.

- PET held a dominant market position, capturing more than a 42.7% share.

- Chemical held a dominant market position, capturing more than a 61.4% share.

- Europe held a dominant position in the global 2,5-Furandicarboxylic Acid (FDCA) market, accounting for 48.30% of total revenue, equivalent to USD 304.8 million.

By Type Analysis

0.99 FDCA grade leads with a 67.9% share, driven by its high purity and rising industrial demand

In 2024, 0.99 held a dominant market position, capturing more than a 67.9% share, as demand for high-purity FDCA increased across packaging, resins, and bio-based polymer applications. The growth of this segment was supported by its suitability for producing PEF, where consistent quality and performance standards were required. In 2025, the 0.99 grade continued to gain traction as adoption in sustainable plastics and specialty chemicals increased, and the segment’s expansion was attributed to rising investment in bio-based materials. The preference for this purity level strengthened as manufacturers prioritized stable molecular properties and improved process efficiency.

By Application Analysis

PET dominates with a 42.7% share as the primary application for FDCA, driven by compatibility with polyester production

In 2024, PET held a dominant market position, capturing more than a 42.7% share, as demand for bio-based polyester precursors was elevated by packaging and textile industries seeking sustainable alternatives. The segment was supported by established polyester manufacturing infrastructure, which allowed FDCA-derived monomers to be integrated with limited process changes, and by rising interest in bottles and films where barrier properties and recyclability were prioritized. In 2025, PET remained the largest application segment as product developers and converters increased pilot-scale adoption of FDCA-based routes, and the segment’s strength was attributed to supply-chain familiarity, ease of polymer substitution, and growing regulatory and consumer preference for lower-carbon materials.

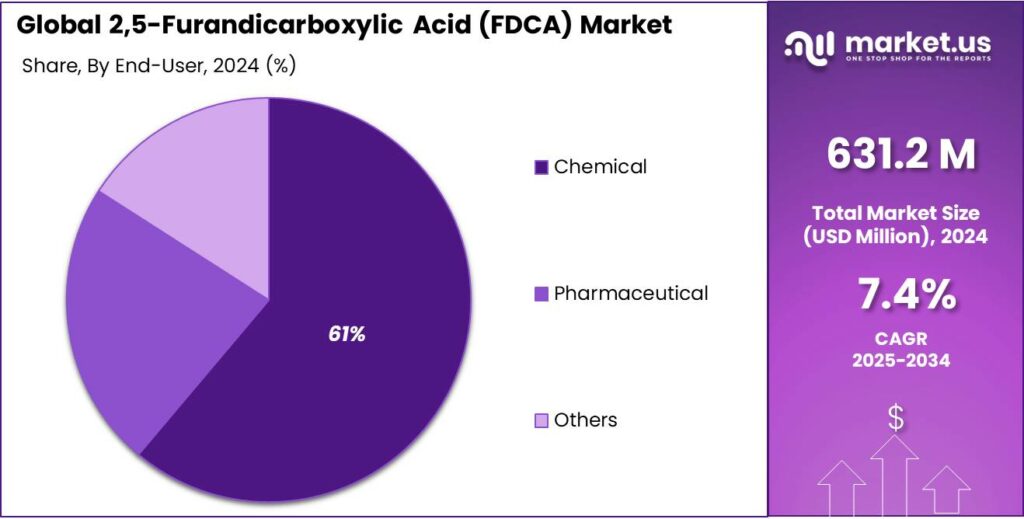

By End-User Analysis

Chemical leads with a 61.4% share as the primary end-use for FDCA, driven by broad industrial demand

In 2024, Chemical held a dominant market position, capturing more than a 61.4% share. The segment was supported by widespread use of FDCA as an intermediate in specialty chemicals, resins and additives, where its performance and bio-based origin were valued by formulators. Manufacturing processes were adapted with limited disruption to incorporate FDCA-based routes, and end-users preferred the consistency and purity that the chemical applications required. In 2025, the chemical end-use continued to account for the largest share as pilot scaling and adoption in formulation science advanced, reinforcing the role of the chemical sector as the primary demand center for FDCA.

Key Market Segments

By Type

- 0.99

- 0.98

By Application

- PET

- Polyamides

- Polycarbonates

- Plasticizers

- Polyester Polyols

- Others

By End-User

- Chemical

- Pharmaceutical

- Others

Emerging Trends

Brand and policy convergence around FDCA-based food packaging

A clear latest trend around 2,5-Furandicarboxylic Acid (FDCA) is that it is moving from lab curiosity to the centre of collaborative projects between food and drink brands, packaging suppliers and policymakers. Instead of being framed only as a “green polymer,” FDCA is now linked to very concrete food-system goals: less waste, lower emissions and truly circular packaging.

The starting point is the food-waste problem. The UNEP Food Waste Index Report 2024 estimates that in 2022 the world wasted about 1.05 billion tonnes of food at retail, food service and household level, equal to roughly 19% of all food available to consumers. The European Commission, echoing this work, highlights the same 1.05 billion tonnes and 19% share, stressing that 60% of waste comes from households and 28% from food services. For retailers and brand owners, these numbers make packaging performance a strategic issue, not just a cost line.

In parallel, packaging itself is being reshaped by regulation. The EU’s new Packaging and Packaging Waste Regulation (PPWR), adopted in 2024, commits Member States to cut packaging waste per capita by 5% by 2030, 10% by 2035 and 15% by 2040, compared with a 2018 baseline. The legal summary on EUR-Lex makes clear that producers will carry full life-cycle responsibility, including collection, sorting and recycling of their packaging. This drives interest in FDCA-based PEF, which is designed to be recyclable and can use less material for the same performance.

Industry structure is shifting with this pressure. European Bioplastics reports that global bioplastics production capacity reached about 2.47 million tonnes in 2024, and that packaging is the biggest outlet, taking 45% of that volume – roughly 1.12 million tonnes dedicated to packaging applications. Their medium-term outlook shows total bioplastics capacity potentially rising to around 5.73 million tonnes by 2029, with packaging remaining the lead segment.

Drivers

Rising demand for sustainable food and beverage packaging

A major driving force behind 2,5-Furandicarboxylic Acid (FDCA) is the push for packaging that keeps food fresh for longer while cutting plastic and carbon footprints. Food systems are under pressure: FAO and UNEP estimate that about 14% of global food, worth roughly USD 400 billion a year, is lost before retail, and a further 17% is wasted at retail and consumer level.

A newer UNEP Food Waste Index update shows that in 2022 around 19% of the world’s food – about 1.05 billion tonnes – was wasted, while 783 million people still faced chronic hunger. This waste is responsible for roughly 8–10% of global greenhouse-gas emissions. For food brands and retailers, these numbers turn shelf-life, spoilage and packaging performance into board-level topics, not just technical details. FDCA-based polyethylene furanoate (PEF) directly addresses this by offering much stronger barrier properties than conventional PET.

Industry data from Avantium and partner studies show that PEF bottles can provide about 10-times better oxygen barrier and 16–19-times better CO₂ barrier than PET, depending on the test system. Better barriers help keep drinks fizzy, flavours stable and oxygen-sensitive foods fresher for longer, which directly supports retailers trying to cut write-offs in chilled cabinets and ambient shelves. Inline Plastics, for example, highlights that PEF packaging “extends shelf life” by blocking gases and moisture more effectively than PET.

Governments are tightening rules on packaging. The EU’s Packaging and Packaging Waste Regulation requires all packaging on the market to be recyclable in an economically viable way by 2030. It also sets binding waste-reduction targets of 5% by 2030, 10% by 2035 and 15% by 2040 compared with 2018 levels. For beverage packaging specifically, draft EU rules aim for at least 10% of retail beverage packaging to be reusable by 2030 and 40% by 2040. These measures reward lighter, high-performance, bio-based materials like PEF that are designed for recycling from the outset.

Restraints

High production cost and feedstock constraints limit wider adoption

One major restraining factor for 2,5-Furandicarboxylic Acid (FDCA) is the high cost and limited availability of sustainable feedstock compared with fossil-based alternatives. FDCA is mainly produced from sugars derived from corn, sugar beet, or other biomass. At the global level, FAO reports that food-grade sugar production reached about 182 million tonnes in 2023, while demand from food and beverages remained the priority consumer of these crops. When bio-based chemicals compete with food uses for the same agricultural inputs, prices become volatile and supply security weakens.

This issue is closely linked to energy and input costs. Fertilizer production alone accounts for nearly 2% of total global energy consumption and generates about 2.6 gigatonnes of CO₂ emissions annually. Rising natural gas prices directly affect fertilizer prices, which then push up sugar and starch costs. For FDCA producers, this means feedstock expenses fluctuate with energy markets rather than staying stable like petrochemical aromatics, making long-term pricing difficult for converters and brand owners.

Food-industry voices also raise concerns about cost pass-through. The World Food Programme reports that global food price volatility remained high in 2022–2023, with staple food prices at times exceeding 30% above pre-pandemic averages in many regions. When packaging costs increase due to premium bio-based materials, food producers operating on thin margins struggle to absorb them. As a result, many brands hesitate to shift fully to FDCA-based packaging unless price parity with PET is closer.

Governments are supporting bio-based materials, but timelines remain long. The EU’s Circular Bio-based Europe Joint Undertaking has committed over EUR 2 billion for bio-based innovation between 2021 and 2027. yet only a portion is directed toward scaling FDCA specifically. In the short term, this funding helps technology development but does not immediately solve cost and feedstock constraints at industrial volumes.

Opportunity

Uniting food-waste reduction and circular packaging with FDCA

A big growth opportunity for 2,5-Furandicarboxylic Acid (FDCA) lies in projects that cut food loss and packaging waste at the same time. Global food systems are under real pressure. FAO and UNEP estimate that around 14% of food is lost after harvest and along the supply chain, while another 17% is wasted at retail, in food service and in homes, adding up to huge social and climate costs.

These losses matter for climate goals too. FAO notes that food loss and waste account for roughly 8–10% of global greenhouse-gas emissions. At the same time, packaging is a major source of waste. UNEP’s Global Waste Management Outlook 2024 reports that plastic packaging represents about 50% of total plastic waste in municipal streams.

Demand from the food industry is already shifting toward such materials. European Bioplastics reports that global bioplastics capacity was about 2.47 million tonnes in 2024, and around 45% of that volume—roughly 1.12 million tonnes—was destined for packaging, making it the largest application segment. The same association expects total bioplastics capacity to rise to about 5.73 million tonnes by 2029. FDCA-based PEF is well placed to capture a meaningful share of that additional packaging volume, especially in premium drinks, dairy, and fresh food.

Consumer attitudes support this shift rather than blocking it. University-backed research on bio-based bottles, including PEF, shows very strong acceptance: one study found that 96.8% of participants preferred bio-based bottles over fossil-based PET, and were willing to pay more for them. A separate Avantium-supported project reported that shoppers were willing to pay up to 40% more for drinks in PEF bottles when they clearly signalled environmental benefits.

Regional Insights

Europe maintains a leading position in the global FDCA market with a 48.30% share valued at USD 304.8 million

In 2024, Europe held a dominant position in the global 2,5-Furandicarboxylic Acid (FDCA) market, accounting for 48.30% of total revenue, equivalent to USD 304.8 million. The region’s leadership was supported by strong policy commitments toward bio-based chemicals, stringent carbon-reduction targets, and early industrial adoption of next-generation sustainable polymers.

The transition toward renewable intermediates accelerated the use of FDCA in packaging, resins, and high-performance materials, as regulatory frameworks such as the EU Green Deal and circular-economy directives encouraged substitution of petroleum-derived feedstocks. In 2024, the demand for FDCA in Europe was strengthened further by expanding PEF research programs, where consistent purity requirements and barrier enhancements were prioritized by converters and brand owners.

The region’s industrial ecosystem, which includes advanced chemical clusters in Germany, the Netherlands, France, and Belgium, created favorable conditions for scaling bio-based monomers and intermediates. Investments in feedstock diversification, catalytic pathway optimization, and sustainable polymer engineering ensured that domestic manufacturers could maintain competitive supply reliability. Rising consumer preference for recyclable and renewable packaging materials reinforced demand momentum, particularly in food and beverage applications where improved performance characteristics were valued.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AstaTech is described as a contract research and fine-chemicals provider that combines custom chemistry services with a broad catalogue of building blocks. Founded in the late 1990s, the company expanded R&D and production footprints with facilities in the United States and China, enabling support for drug discovery, pilot synthesis and scaled manufacturing. Its offerings were positioned to meet both discovery scientists and commercial formulators with cost-effective intermediates and catalog items used in specialty chemical and pharmaceutical workflows.

Corbion is characterised as a leading supplier of fermentation-derived and biobased ingredients, with core strengths in lactic acid, biopolymers and specialty emulsifiers. The company’s technology platforms and production footprint were reported to support applications across food, pharmaceuticals, personal care and bioplastics, enabling formulation and preservation solutions with sustainability credentials. Corbion’s market position and financial disclosures were cited to reflect scale and capability in commercialising bio-derived intermediates relevant to the evolving FDCA and biopolymer landscape.

Top Key Players Outlook

- Alfa Aesar GmbH & Co KG

- Asta Tech Inc.

- Avantium

- Carbone Scientific

- Corbion NV

- Novamont SpA

- BASF

Recent Industry Developments

In 2024, AstaTech provided practical support to FDCA and related furan-chemistry projects by offering catalogue items and small-scale synthesis services: the company’s public catalogue listed ~200,000 compounds with ~50,000 held in stock in the U.S., and facilities comprising ~15,000 sq ft including kilo labs capable of synthesis up to 10 kg scale—capabilities that enabled pilot synthesis, reference-standard supply and analytical support for FDCA research and early process development.

In 2024 Avantium advanced its FDCA commercialisation: the company raised €64.4 million net capital (Feb 2024) and recorded €58.6 million in capital expenditure during the year as resources were focused on bringing the FDCA flagship plant into operation.

In 2024, Carbone Scientific supported FDCA-focused research and small-scale sourcing by offering a broad catalogue of specialty and fine-chemical intermediates; the supplier listed >50,000 catalogue items with >6,000 products held in stock, enabling immediate access to reference materials and small-batch reagents for polymer and furan-chemistry projects.

Report Scope

Report Features Description Market Value (2024) USD 631.2 Mn Forecast Revenue (2034) USD 1288.9 Mn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (0.99, 0.98), By Application (PET, Polyamides, Polycarbonates, Plasticizers, Polyester Polyols, Others), By End-User (Chemical, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Aesar GmbH & Co KG, Asta Tech Inc., Avantium, Carbone Scientific, Corbion NV, Novamont SpA, BASF Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2,5-Furandicarboxylic Acid (FDCA) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

2,5-Furandicarboxylic Acid (FDCA) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Aesar GmbH & Co KG

- Asta Tech Inc.

- Avantium

- Carbone Scientific

- Corbion NV

- Novamont SpA

- BASF