Global 2-shot Injection Molding Market Size, Share, And Enhanced Productivity By Material (Thermoplastics, Thermosets, Elastomers), By Machine Type (Horizontal, Vertical, Rotary), By Application (Automotive, Healthcare, Consumer Electronics, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 169509

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

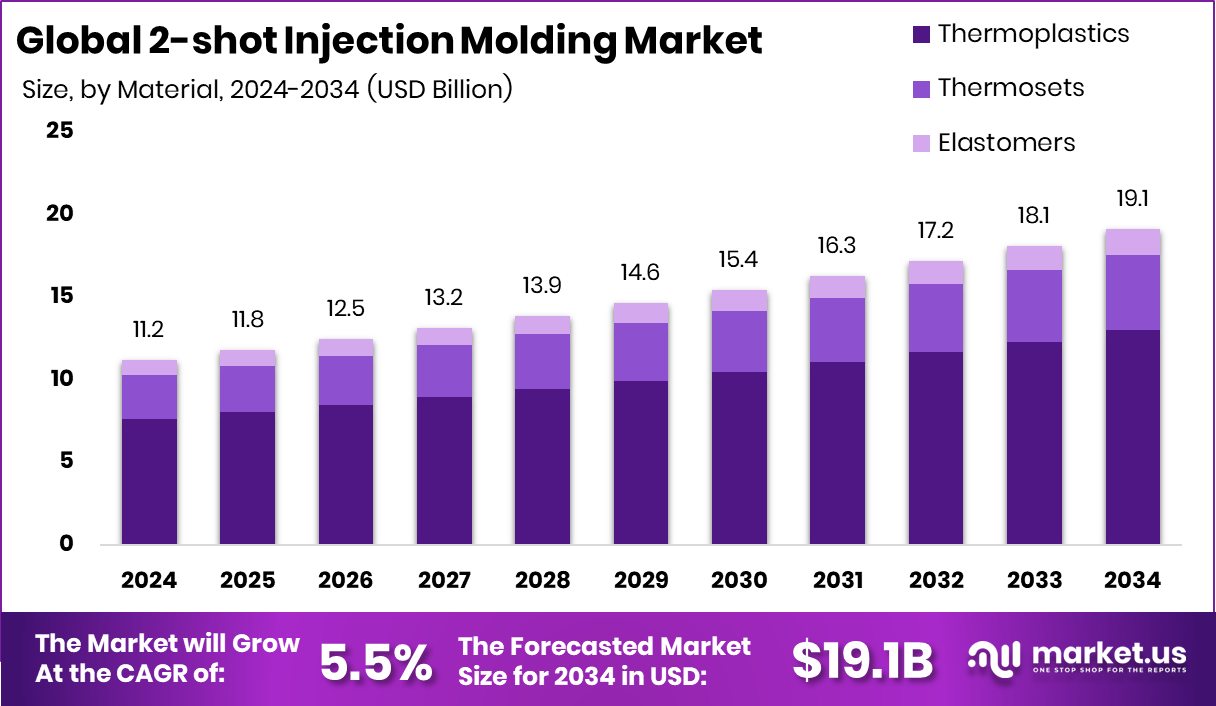

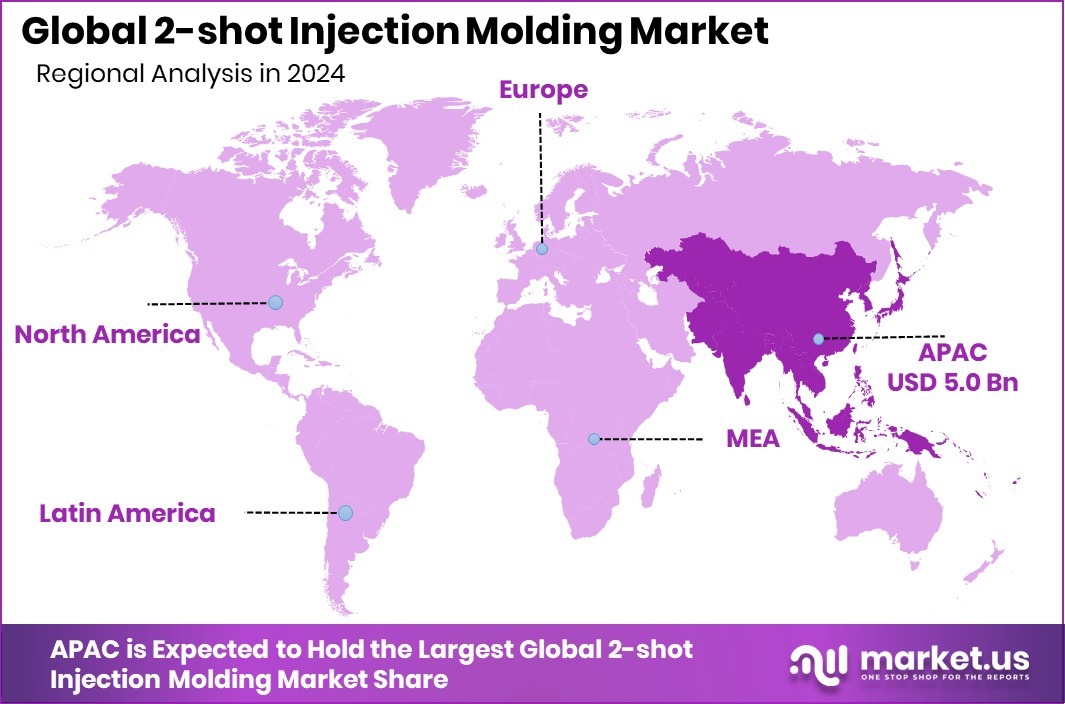

The Global 2-shot Injection Molding Market is expected to be worth around USD 19.1 billion by 2034, up from USD 11.2 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. North America dominates the 2-shot Injection Molding Market, accounting for 44.80% and USD 5.0 Bn.

2-shot injection molding is a manufacturing process where two different materials or colors are molded onto a single part in one continuous cycle. This method improves bonding, reduces assembly steps, and delivers finished components with better durability and visual appeal.

The 2-shot injection molding market refers to the demand for machinery, materials, and services that support this advanced molding process. It is closely linked to lightweight materials, complex part design, and the shift toward efficient, multi-material manufacturing across industries.

Growth factors include rising investments in advanced thermoplastics and composites. Funding momentum is strong, with €3.9 million raised by Lignin Industries to commercialize bio-based thermoplastics and $48 million in federal support for the Spokane Aerospace Materials Manufacturing Center Tech Hub.

Demand is driven by sustainability and performance needs. UBQ Materials secured $70 million for waste-based thermoplastic solutions, while Strohm attracted €15 million and an additional $30.86 million to expand thermoplastic composite pipe capabilities.

Opportunities are emerging from bio-based and composite materials. The push toward reducing fossil plastic use and scaling circular materials opens long-term scope for 2-shot molding in design-efficient, multi-material product development.

Key Takeaways

- The Global 2-shot Injection Molding Market is expected to be worth around USD 19.1 billion by 2034, up from USD 11.2 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- Thermoplastics lead the 2-shot injection molding market with a 67.9% share due to their flexibility and recyclability.

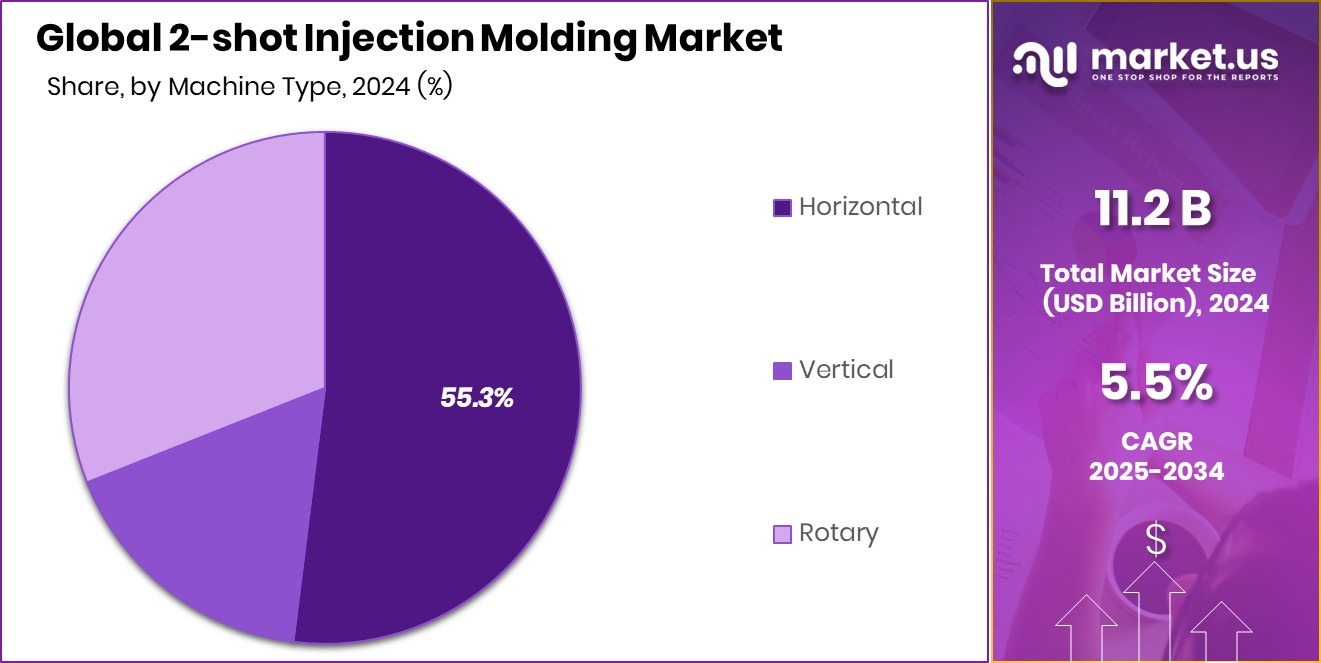

- Horizontal machines dominate the 2-shot injection molding market, holding a 55.3% share for production efficiency.

- Automotive leads the 2-shot injection molding market with a 38.5% application share worldwide.

- In North America, the 2-shot Injection Molding Market reached USD 5.0 Bn, holding 44.80%.

By Material Analysis

Thermoplastics hold a 67.9% share in the 2-shot injection molding market due to flexibility.

In 2024, Thermoplastics held a dominant market position in By Material segment of the 2-shot Injection Molding Market, with a 67.9% share. This leadership reflects the strong processing flexibility and repeatability that thermoplastics offer in two-shot molding operations.

Manufacturers prefer thermoplastics due to their ability to bond efficiently in multi-material cycles while maintaining dimensional stability and surface quality. The material supports complex geometries and dual-function parts without secondary assembly, improving production efficiency. Its compatibility with automated molding systems further strengthens adoption across high-volume manufacturing environments.

Thermoplastics also allow easier recycling and reprocessing during molding, reducing material loss. In 2-shot injection molding, consistent melt flow and predictable cooling behavior enable stable cycle times, making thermoplastics a reliable choice. As product designs increasingly require soft-touch surfaces, rigid structures, or layered performance, thermoplastics continue to anchor material selection within this segment.

By Machine Type Analysis

Horizontal machines account for a 55.3% share in the 2-shot injection molding market globally.

In 2024, Horizontal held a dominant market position in the By Machine Type segment of the 2-shot Injection Molding Market, with a 55.3% share. This dominance is linked to the machine’s stable clamping structure and flexibility in handling complex two-material molds.

Horizontal machines support precise alignment between shots, which is essential for consistency and strong material bonding. Their layout allows easier mold changes and smoother automation integration, supporting continuous production cycles. Manufacturers rely on horizontal configurations for better control over injection pressure and cooling balance during multi-shot operations.

The design also enables efficient material flow and accurate shot transfer without compromising part quality. As demand grows for multi-material components with tight tolerances, horizontal machines remain the preferred choice within this segment due to their operational reliability and proven performance.

By Application Analysis

Automotive applications represent a 38.5% share of the 2-shot injection molding market demand.

In 2024, Automotive held a dominant market position in By Machine Type segment of the 2-shot Injection Molding Market, with a 38.5% share. This leadership is driven by the automotive sector’s need for multi-material parts that combine strength, flexibility, and visual appeal in a single component.

Two-shot molding supports the production of interior and exterior parts that require tight tolerances and durable bonding between materials. Automotive production environments favor this process for its ability to reduce assembly steps while improving part consistency. The process also supports lightweight component design, which aligns with efficiency and performance goals.

High repeatability and design precision make two-shot molding well-suited for automotive applications, allowing manufacturers to meet strict quality standards while maintaining production speed and design flexibility.

Key Market Segments

By Material

- Thermoplastics

- Thermosets

- Elastomers

By Machine Type

- Horizontal

- Vertical

- Rotary

By Application

- Automotive

- Healthcare

- Consumer Electronics

- Packaging

- Others

Driving Factors

Rising Demand for Multi-Material, High-Precision Components

The strongest driving factor for the 2-shot injection molding market is the growing demand for parts that combine multiple materials in one finished product. Manufacturers are under pressure to deliver components that are strong, flexible, visually appealing, and durable, all at the same time. Two-shot molding makes this possible without adding extra assembly steps.

It allows different materials to bond tightly during one production cycle, reducing errors and production time. This process also improves product consistency, which is important in high-volume manufacturing.

As industries focus on better product performance and cleaner designs, the need for precise, multi-material parts continues to increase. Two-shot injection molding supports these needs by offering efficiency, repeatability, and design freedom, making it a preferred production method for modern manufacturing requirements.

Restraining Factors

High Initial Setup and Tooling Cost Barriers

One major restraining factor for the 2-shot injection molding market is the high initial investment required to start production. The process needs specialized machines and complex molds that are more expensive than standard single-shot setups.

Designing and manufacturing two-shot molds takes more time and technical skill, which increases upfront costs. Small and mid-sized manufacturers often hesitate to adopt this process due to budget limits. In addition, changing or repairing these molds can be costly and slow.

Skilled operators are also required to manage material compatibility and process timing. These cost and complexity challenges can delay adoption, especially for low-volume production, limiting wider market growth despite the clear long-term benefits of 2-shot injection molding.

Growth Opportunity

Expansion of Advanced Manufacturing and Local Production

A strong growth opportunity for the 2-shot injection molding market lies in expanding advanced manufacturing capacity and local production across fast-growing economies. Companies are placing more focus on setting up integrated manufacturing units that can handle complex, multi-material components in one process. This shift supports faster production, lower logistics costs, and better quality control. Large capital commitments are encouraging this transition.

Reliance Industries may invest around Rs 14,000 crore in subsidiaries, signaling strong confidence in advanced materials, plastics, and downstream manufacturing ecosystems. Such investments improve access to high-performance thermoplastics and modern processing technologies.

As local suppliers adopt advanced molding methods, 2-shot injection molding can scale faster, supporting demand for efficient, high-quality components while strengthening domestic manufacturing value chains.

Latest Trends

Innovation Focus on Process Precision and Materials

A key latest trend in the 2-shot injection molding market is the growing focus on process precision and advanced material behavior. Manufacturers are working to improve bonding accuracy, cycle timing, and material flow to achieve cleaner finishes and stronger multi-material joints. This trend is supported by increased research activity aimed at improving molding efficiency and material compatibility.

Academic and technical institutions are playing an active role in this shift. A Houston professor earned a competitive NSF award with a nearly $700,000 grant, highlighting strong research attention toward advanced manufacturing and materials science.

Such research helps refine molding techniques and supports innovation in tooling design and process control. As these learnings move from labs to factories, 2-shot injection molding continues to evolve toward higher precision, lower waste, and better performance outcomes.

Regional Analysis

North America leads the 2-shot Injection Molding Market with 44.80% share, USD 5.0 Bn.

North America remains the dominating region in the 2-shot Injection Molding Market, holding a 44.80% share valued at USD 5.0 Bn. This leadership is driven by early adoption of advanced manufacturing processes and strong demand for multi-material components. The region shows high penetration of precision molding technologies, supporting consistent quality and large-scale production requirements.

Europe represents a mature and stable market for 2-shot injection molding, supported by structured manufacturing frameworks and steady demand for high-performance molded components. The region emphasizes process efficiency, durability, and compliance-driven production, which aligns well with two-shot molding capabilities across industrial applications.

Asia Pacific continues to gain momentum as manufacturing capacities expand and production technologies advance. The region benefits from rising industrial output and increasing focus on value-added plastic components, encouraging wider use of multi-material molding processes in regional manufacturing hubs.

The Middle East & Africa market is developing gradually, with adoption driven by expanding industrial infrastructure and growing interest in advanced plastics processing. Two-shot injection molding is increasingly viewed as a method to improve component durability and reduce assembly dependency.

Latin America shows emerging adoption, supported by the gradual modernization of manufacturing facilities and rising interest in efficiency-driven molding techniques.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arburg GmbH + Co KG continues to play a critical role in advancing the global 2-shot injection molding landscape through its strong focus on precision machinery and process control. In 2024, the company’s strength lies in its ability to deliver flexible molding systems that support multi-material part production with high repeatability. Its engineering-driven approach helps manufacturers improve production efficiency and reduce assembly complexity, making it well aligned with growing multi-shot molding requirements.

Bemis Manufacturing Company brings long-standing manufacturing expertise into the 2-shot injection molding market, particularly through its experience in molded consumer and industrial components. In 2024, the company’s emphasis on durable, functional product design supports the wider application of two-material molding. Bemis benefits from in-house processing know-how that allows better integration of multiple materials while maintaining consistent product quality and performance standards.

Biomedical Polymers Inc. contributes niche expertise by focusing on high-performance polymer applications that demand precision and material compatibility. In 2024, the company’s capabilities align well with advanced 2-shot molding needs where controlled bonding and material behavior are essential. Its polymer-focused development approach supports innovation in specialized molding applications, strengthening its position within the evolving multi-material molding ecosystem.

Top Key Players in the Market

- Arburg GmbH + Co KG

- Bemis Manufacturing Company

- Biomedical Polymers Inc

- CM International Industries Corporation

- ENGEL Holding GmbH

- Girard Rubber Corporation

- Haitian International Holdings Limited

- Husky Injection Molding Systems Ltd.

- KraussMaffei Group GmbH

- Milacron LLC

Recent Developments

- In September 2025, Arburg also unveiled the vertical ALLROUNDER 475 V, notable for its compact footprint, energy-efficient servo-hydraulics (up to 60% lower energy consumption), and flexible automation options. This machine supports insert encapsulation and complex molding tasks in a small space.

- In March 2025, ENGEL expanded its manufacturing footprint in the Americas by opening a new production facility in Querétaro, Mexico. This facility aims to produce multiple machine series, including all-electric and hydraulic machines, and will support better regional supply and faster delivery for customers in the Americas.

Report Scope

Report Features Description Market Value (2024) USD 11.2 Billion Forecast Revenue (2034) USD 19.1 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Thermoplastics, Thermosets, Elastomers), By Machine Type (Horizontal, Vertical, Rotary), By Application (Automotive, Healthcare, Consumer Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arburg GmbH + Co KG, Bemis Manufacturing Company, Biomedical Polymers Inc, CM International Industries Corporation, ENGEL Holding GmbH, Girard Rubber Corporation, Haitian International Holdings Limited, Husky Injection Molding Systems Ltd., KraussMaffei Group GmbH, Milacron LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-shot Injection Molding MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

2-shot Injection Molding MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arburg GmbH + Co KG

- Bemis Manufacturing Company

- Biomedical Polymers Inc

- CM International Industries Corporation

- ENGEL Holding GmbH

- Girard Rubber Corporation

- Haitian International Holdings Limited

- Husky Injection Molding Systems Ltd.

- KraussMaffei Group GmbH

- Milacron LLC