Global 2-Propylheptanol Market By Purity (Up to 98% and Above 98%), By Applications (Plasticizers, Surfactants, Lubricants, Acrylates, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 158180

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

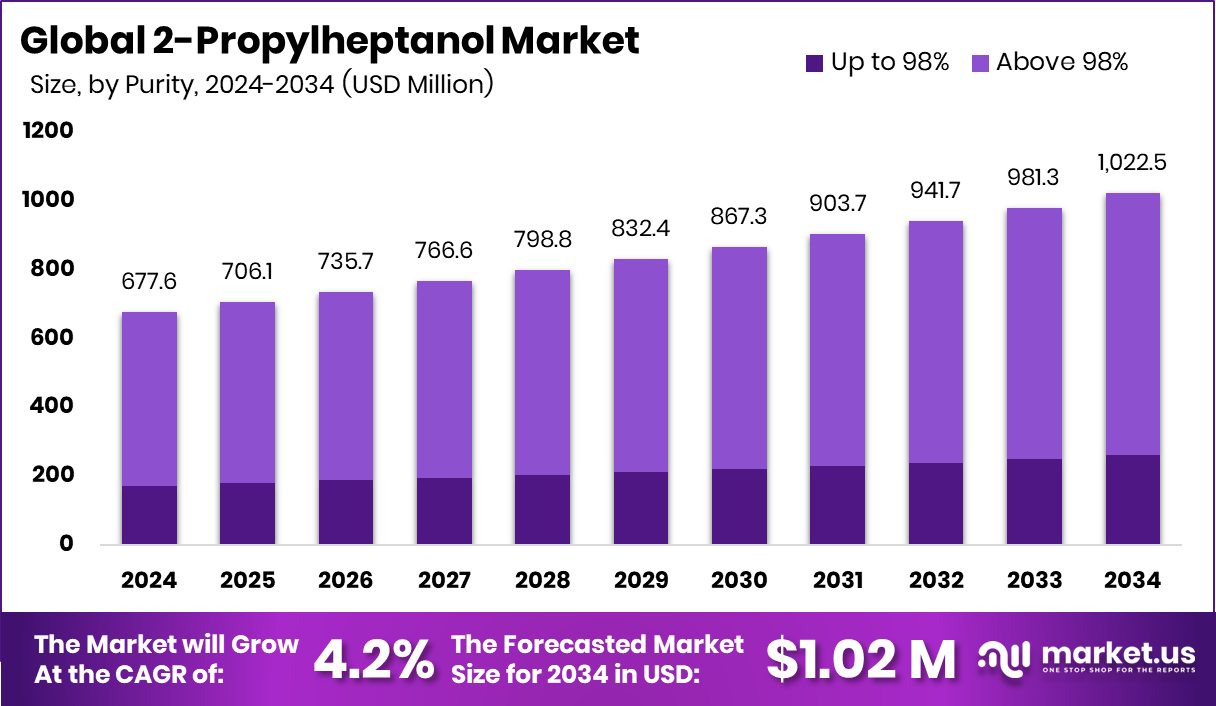

In 2024, the Global 2-Propylheptanol Market was valued at US$677.6 million, and between 2025 and 2034, this market is estimated to register a CAGR of 4.2%, reaching about US$1.02 million by 2034.

2-Propylheptanol is a C10 branched-chain alcohol, which has low volatility, good low-temperature performance, and versatility in various industrial uses. It is an oxo alcohol produced via the hydroformylation of C4 alkenes followed by hydrogenation. The major driver of the 2-propylheptanol market is its application in the manufacturing of plasticizers, such as di-(2-propylheptyl) phthalate, which impart flexibility to PVC products such as cable insulation and floor coverings.

In recent years, the chemical has also gained traction in the lubricant industry as an additive. It serves as a component in acrylates used in adhesives and in the fragrance and aroma industries. As it is relatively less volatile than other organic compounds, it is considered safer and has found its application in surface-active agents for cleaning and detergent products. Despite the advantages of 2-propylheptanol, the market may face challenges due to stricter regulations.

Key Takeaways

- The global 2-propylheptanol market was valued at US$677.6 million in 2024.

- The global 2-propylheptanol market is projected to grow at a CAGR of 4.2% and is estimated to reach US$1.02 million by 2034.

- Based on the purity, in 2024, 2-propylheptanol, which is more than 98% pure, led the market, encompassing about 74.6% share of the total global market.

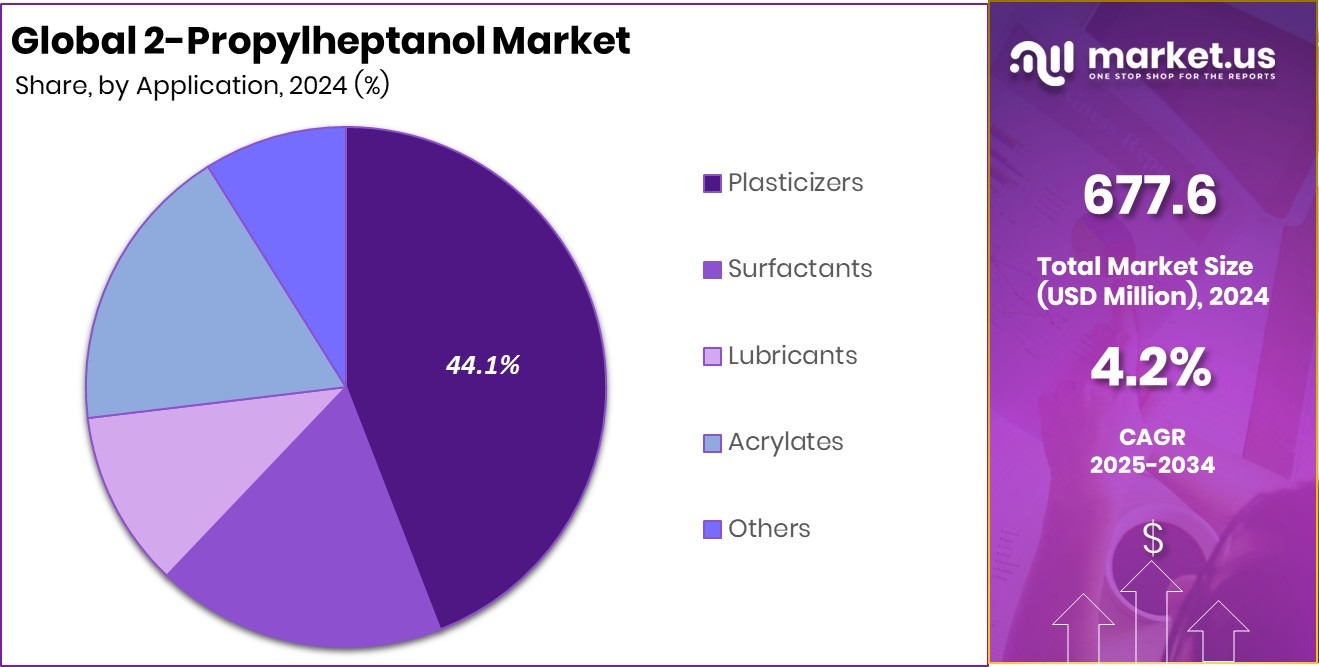

- Among the applications of 2-propylheptanol, the plasticizers manufacturing industry dominated the market in 2024, accounting for around 44% of the market share.

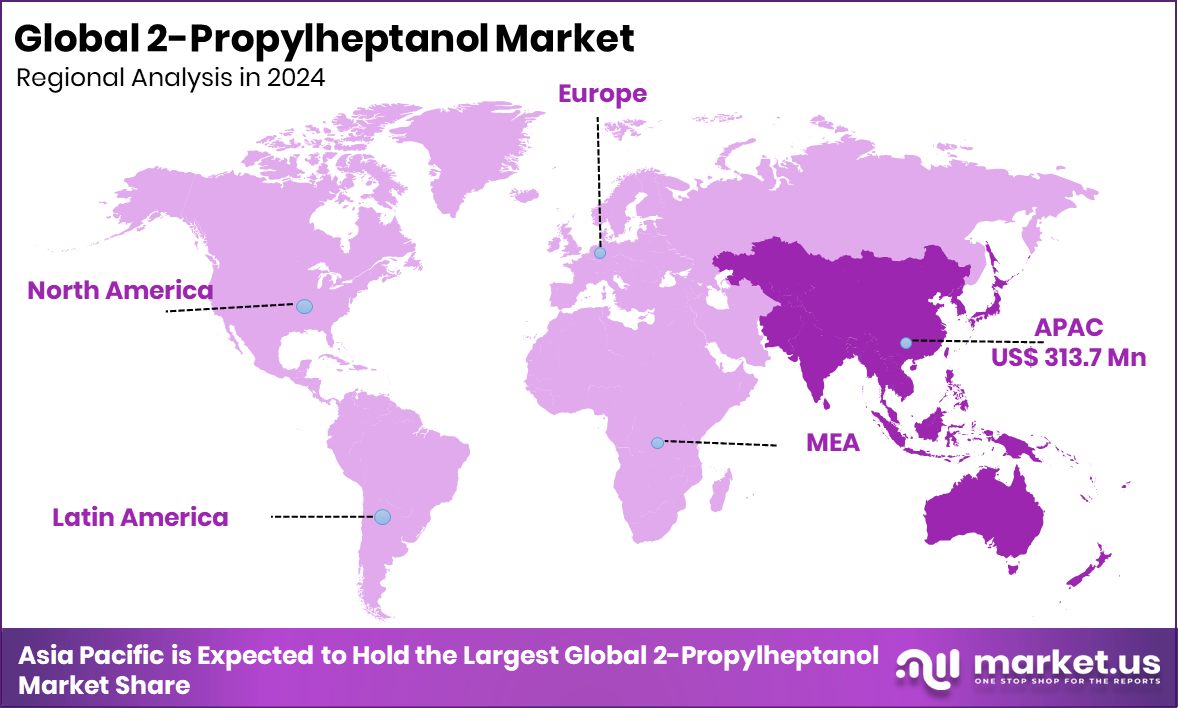

- Asia Pacific was the largest market for 2-propylheptanol in 2024, with approximately 46.3% of the total market share.

Purity Analysis

2-Propylheptanol, which is More Than 98% Pure, dominated the Market in 2024 due to Its Chemical Properties.

Based on the purity of the 2-propylheptanol, the market is divided into up to 98% and above 98%. 2-propylheptanol, which is more than 98% pure, dominated the market in 2024 with a market share of 74.6%. The dominance is characterized by its higher performance and consistency. High-purity 2-propylheptanol ensures better chemical stability and consistent reactivity in downstream applications. It is critical in the production of plasticizers, where small impurities can affect product quality, processing characteristics, and end-use performance.

Additionally, lower purity grades may contain impurities that can lead to unwanted side chain reactions during synthesis, reducing yield and efficiency. High-purity grades minimize these risks, making them preferable for large-scale industrial production. Moreover, several industries, such as automotive, construction, and consumer goods, require materials that meet strict quality and regulatory standards.

Application Analysis

In 2024, the Plasticizers Industry Dominated the 2-Propylheptanol Market.

On the basis of applications of the 2-propylheptanol, the market is segmented into plasticizers, surfactants, lubricants, acrylates, and others. In 2024, its application in the plasticizer industry dominated the market with 44.1% of the total market share. As a C10 alcohol, 2-propylheptanol produces high-molecular-weight plasticizers that are essential for high-performance PVC applications. It provides desirable properties such as flexibility, thermal stability, and low volatility, which are critical in plasticizers that are added to polymers to improve softness and flexibility.

Additionally, 2-propylheptanol offers better plasticizing efficiency, migration resistance, and low-temperature flexibility, making it more valuable for durable plastic goods. Furthermore, the plasticizer market is larger and more established than other sectors, with annual consumption reaching approximately 12 million tons globally. Manufacturers allocate more 2-propylheptanol for plasticizer production due to higher volumes and consistent demand.

Key Market Segments

By Product Type

- Up to 98%

- Above 98%

By Application

- Plasticizers

- Surfactants

- Lubricants

- Acrylates

- Others

Drivers

The Global Plasticizer Sector, along with Increasing Demand from the Solvents Sector, Drives the Market.

The 2-propylheptanol market is significantly influenced by the expanding global plasticizer industry, as well as the increasing demand for solvents across various sectors. 2-Propylheptanol is a key intermediate in the production of esters used as plasticizers, particularly in the manufacture of flexible PVC products such as cables, flooring, and wall coverings. The construction and automotive industries, which heavily rely on flexible plastics, are major consumers of these materials.

Moreover, the demand for 2-propylheptanol in solvent applications is growing due to its favorable properties, such as low volatility, good solvency, and chemical stability. For instance, it is used in coatings, adhesives, and cleaning agents, where performance and environmental safety are critical.

With increasing regulatory pressure to replace more hazardous substances with safer alternatives, the use of alcohol-based solvents like 2-propylheptanol is becoming more attractive. This dual demand from both plasticizer and solvent applications is creating a strong and sustained push for 2-propylheptanol production globally.

Restraints

Regulatory and Environmental Scrutiny Might Hamper the Growth of the 2-Propylheptanol Market.

Regulatory and environmental scrutiny present a significant challenge to the growth of the 2-propylheptanol market, as global authorities increasingly tighten standards on chemical production, emissions, and end-use safety. Although plasticizers made from 2-propylheptanol are considered relatively safer and it is less volatile, their own production process involves petrochemical derivatives and energy-intensive methods that can raise concerns regarding carbon emissions and environmental impact.

For instance, the synthesis of oxo-alcohols such as 2-propylheptanol typically requires high-pressure hydrogenation and the use of catalysts, which may be subject to stricter oversight under evolving climate and safety regulations. In addition, disposal and degradation of end-products made with this product can contribute to environmental pollution if not properly managed.

Regulatory bodies such as the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) are increasingly focused on the entire life cycle of chemical substances, which could result in tighter restrictions or additional compliance costs that may hinder the broader adoption of 2-propylheptanol.

Opportunity

Utilizing 2-Propylheptanol in the Surfactant and Adhesive Industries Creates Opportunities in the Market.

2-Propylheptanol is gaining increasing attention for its valuable applications in the surfactant and adhesive industries, creating new opportunities for market expansion. In the surfactant industry, it is used as a key intermediate in the production of non-ionic surfactants, which are widely utilized in detergents, personal care products, and industrial cleaners due to their excellent emulsifying and dispersing properties.

For instance, non-ionic surfactants derived from 2-propylheptanol are preferred in household laundry detergents for their effectiveness in hard water conditions. In the adhesive industry, it is used in the synthesis of resins that enhance the flexibility, adhesion strength, and durability of adhesive formulations.

Its branched structure contributes to low volatility and good performance under thermal stress, making it suitable for pressure-sensitive adhesives used in packaging, automotive, and construction. These diverse applications underscore the growing relevance of 2-propylheptanol as industries prioritize performance-enhancing chemical components tailored for specific, high-demand uses.

Trends

Application of 2-Propylheptanol in Lubricants.

There is an ongoing trend of using 2-propylheptanol in the lubricant industry as a lubricant additive. It is a critical raw material for synthesizing esters that are used in high-performance lubricants, such as those found in automotive and industrial applications. It offers excellent lubricating properties, especially in high-pressure and high-temperature applications.

Reducing friction and wear between moving parts helps to prolong the lifespan and efficiency of mechanical equipment, such as engines, gears, and bearings. In addition to its lubricating properties, 2-propylheptanol also acts as a viscosity modifier, improving the flow and consistency of lubricants. The rise in demand for advanced, high-performance lubricants for fuel-efficient vehicles and industrial automation has created a significant market for 2-propylheptanol.

Increased automation and the rising global vehicle population are boosting the need for synthetic lubricants that can improve performance and durability. Its compatibility with various chemical formulations makes it a preferred choice in the development of high-performance and reliable lubrication solutions.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the 2-Propylheptanol Market.

Geopolitical tensions significantly impact the 2-propylheptanol market by disrupting global supply chains, increasing raw material costs, and creating uncertainty in trade policies. 2-Propylheptanol is commercially produced primarily through the oxo process, where C4 alkenes, which are petrochemicals, are reacted with carbon monoxide and hydrogen.As the petrochemical industry is highly susceptible to geopolitical tensions, these tensions can significantly affect the 2-propylheptanol market by disrupting its supply chain. For instance, conflicts such as the Russia-Ukraine war have strained the global energy supply, especially affecting the cost and availability of petrochemical feedstock. Due to the conflict, natural gas prices in Europe surged by over 300% due to disrupted pipelines, directly influencing the chemical manufacturing sector.

Similarly, ongoing trade disputes between major economies such as the United States and China have led to tariffs on chemical imports and exports, making raw materials more expensive and harder to source. Furthermore, as China-Taiwan tensions build up, several companies are forced to diversify the manufacturing bases for 2-propylheptanol.

Regional Analysis

Asia Pacific was the Largest Market of 2-Propylheptanol in 2024.

Asia Pacific held the major share of the global 2-propylheptanol market, valued at around US$313.7 million. The region emerged as the precursor in the global 2-propylheptanol market, commanding an estimated 46.3% of total revenue share. The dominance of the market is attributed to the rapid industrialization and urbanization in the region.

Countries such as China, India, Vietnam, and Indonesia are undergoing fast-paced industrial development. This growth fuels demand for plastics, construction materials, and automotive products, all of which use plasticizers derived from 2-propylheptanol.

Additionally, as the population in the region is growing, infrastructure and residential construction projects are surging, driving the demand for flexible PVC, essential in pipes, window frames, and insulation materials.

Furthermore, the Asia Pacific is a major hub for car production and sales, with roughly 54 million units produced each year. As this number grows, the 2-propylheptanol market is expected to grow due to demand for dashboards, door panels, and seat coverings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The key players in the 2-propylheptanol market are Evonik Industries, BASF SE, Ningbo Inno Pharmchem, Petronas Chemicals, and Shandong Hanshen Chemical Technology.

Evonik Industries is a leading producer of high-molecular-weight plasticizers, with a large European capacity for 2-propylheptanol and other plasticizer alcohols such as isononanol. The company is actively involved in developing sustainable plasticizers and promoting their safe and durable use.

BASF SE is the world’s leading chemical company, providing innovative solutions to customers in nearly all sectors. The company is focused on expanding its production capacity and developing innovative and sustainable products related to 2-propylheptanol and its downstream applications.

Ningbo Inno Pharmchem is a Chinese high-tech company specializing in the research, development, production, and sales of pharmaceutical intermediates and fine chemicals, serving global pharmaceutical, healthcare, pesticide, and other industries. The company is known to have adopted a virtual R&D and manufacturing approach, integrating resources with independent R&D and production capabilities.

Top Key Players in the Market

- Evonik Industries AG

- Johnson Matthey

- BASF SE

- Ningbo Inno Pharmchem Co., Ltd.

- PETRONAS Chemicals Group Berhad

- Shandong Hanshen Chemical Technology Co., Ltd.

- Shandong Bonroy Chemical Co., Ltd

- Ningbo Inno Pharmchem Co.,Ltd.

- Kenya Chemical

- Zhengzhou Alfa Chemical Co.,Ltd

- Chemical Bull Pvt. Ltd.

- Other Key Players

Recent Developments

- In September 2022, Johnson Matthey and Dow announced that Anqing Shuguang Petrochemical Oxo licensed LP Oxo Technology to produce approximately 200 kta 2-ethylhexanol and 25 kta iso-butyraldehyde.

Report Scope

Report Features Description Market Value (2024) USD 677.6 Million Forecast Revenue (2034) USD 1.02 Million CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 98%, Above 98%), By Applications (Plasticizers, Surfactants, Lubricants, Acrylates, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, BASF SE, Ningbo Inno Pharmchem Co., Ltd., PETRONAS Chemicals Group Berhad, Shandong Hanshen Chemical Technology Co., Ltd., Zhengzhou Alpha Chemical Co., Ltd., Shandong Bonroy Chemical Co., Ltd., Ningbo Inno Pharmchem Co.,Ltd., Kenya Chemical, Zhengzhou Alfa Chemical Co.,Ltd., Chemical Bull Pvt. Ltd. & Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Propylheptanol MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

2-Propylheptanol MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- Johnson Matthey

- BASF SE

- Ningbo Inno Pharmchem Co., Ltd.

- PETRONAS Chemicals Group Berhad

- Shandong Hanshen Chemical Technology Co., Ltd.

- Shandong Bonroy Chemical Co., Ltd

- Ningbo Inno Pharmchem Co.,Ltd.

- Kenya Chemical

- Zhengzhou Alfa Chemical Co.,Ltd

- Chemical Bull Pvt. Ltd.

- Other Key Players