Global Gene Therapy Market By Vector Type (Viral Vector(Retroviral, Adeno-associated) and Non – Viral(Oligonucleotides) Vector), By Gene Type (Antigen, Receptor, Growth Factors, Cytokine), By Delivery Method (Ex-Vivo & In Vivo Therapy), By Disease Indication (Ophthalmology, Neurology, Hematology) and Duchenne Muscular Dystrophy), By Distribution Channel (Hospitals, Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: March 2024

- Report ID: 22161

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Vector Analysis

- Application Analysis

- Delivery Method Analysis

- Route of Administration Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

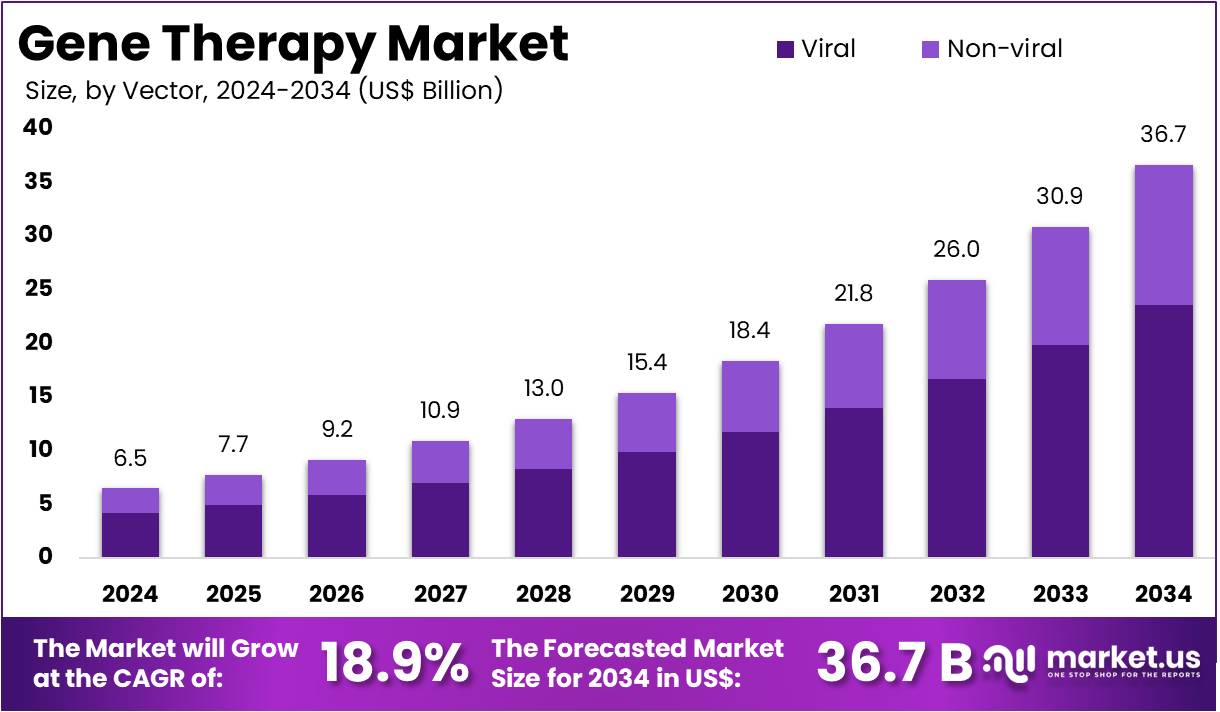

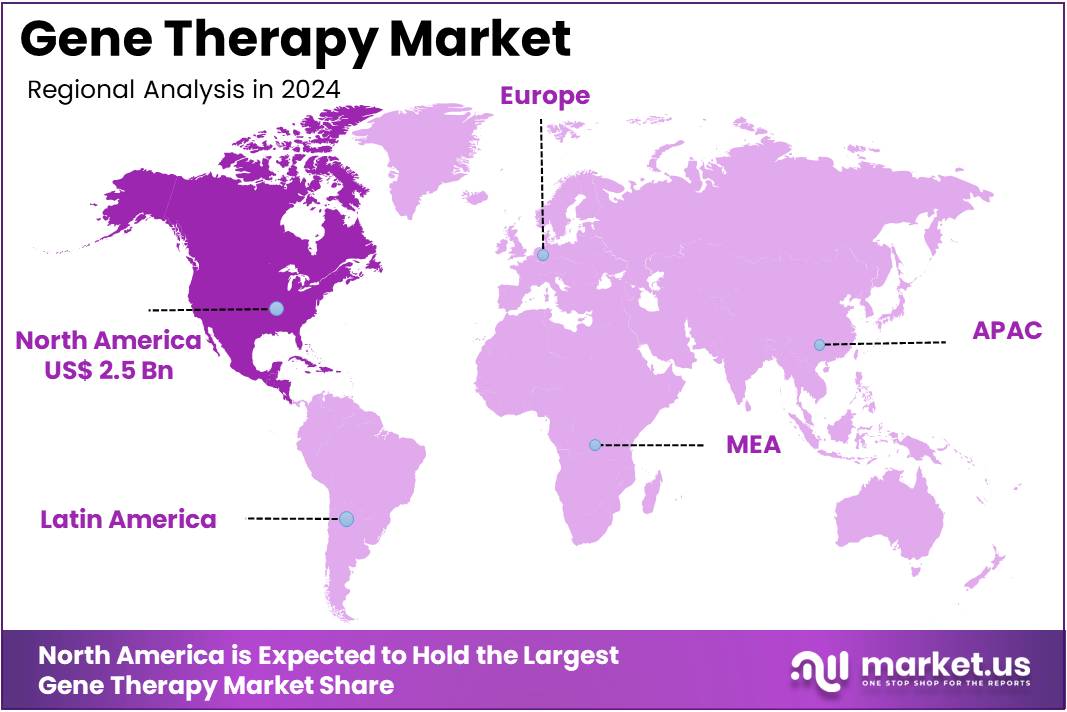

The Gene Therapy Market Size is expected to be worth around US$ 36.7 billion by 2034 from US$ 6.5 billion in 2024, growing at a CAGR of 18.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.9% share and holds US$ 2.5 Billion market value for the year.

Increasing recognition of one-time curative potential propels the Gene Therapy market, as healthcare systems shift investment from lifelong palliative care toward definitive genetic correction. Pharmaceutical leaders aggressively advance AAV, lentiviral, and adenoviral vectors that achieve durable transgene expression and functional rescue across diverse disease mechanisms. Clinicians now deploy approved gene therapies for inherited retinal dystrophies through subretinal delivery, spinal muscular atrophy via intrathecal administration, hemophilia B with liver-directed approaches, and sickle cell disease using ex-vivo hematopoietic editing.

Manufacturing scale-up emerges as a critical opportunity to eliminate supply constraints and reduce per-patient costs dramatically. Amgen directly tackled this bottleneck in December 2024 with a USD 1 billion investment in a second drug substance facility, substantially expanding bioprocessing capacity and accelerating commercial-scale production for multiple late-stage programs. This strategic infrastructure expansion solidifies the industrial backbone required for widespread patient access.

Growing clinical validation across non-rare indications accelerates the Gene Therapy market, as regulatory successes in larger patient populations attract substantial capital and partnership activity. Biotechnology firms prioritize intravesical, intratumoral, and intramuscular routes that enable localized high-dose delivery with minimized systemic exposure. These therapies now target Duchenne muscular dystrophy through exon-skipping vectors, beta-thalassemia via beta-globin restoration, leptin deficiency in congenital leptin disorders, and high-risk bladder cancer using oncolytic adenovirus platforms.

Expansion into common urologic and oncologic malignancies creates unprecedented commercial opportunities beyond orphan designations. Ferring B.V. achieved this breakthrough in November 2024 with FDA approval of ADSTILADRIN, the first adenovirus-based gene therapy for non-muscle invasive bladder cancer, decisively proving viral vectors can succeed in solid tumor environments. This landmark approval instantly broadens the addressable market and validates non-systemic delivery for mainstream oncology.

Rising confidence in central nervous system penetration transforms the Gene Therapy market, as innovators overcome the blood-brain barrier through direct administration and next-generation capsids. Neurological specialists integrate gene replacement, silencing, and editing strategies that halt or reverse progressive neurodegeneration in previously intractable disorders.

Current applications include aromatic L-amino acid decarboxylase deficiency via putamen-targeted delivery, cerebral adrenoleukodystrophy through lentiviral HSC modification, and Canavan disease with oligodendrocyte-directed ASPA gene transfer. Direct brain administration opens entirely new opportunities for Parkinson’s, Alzheimer’s, and epilepsy pipelines that demand precise CNS targeting.

PTC Therapeutics demonstrated this feasibility in November 2024 by securing accelerated FDA approval for KEBILIDI, the first gene therapy administered directly into the human brain, instantly catalyzing investment into neuro-focused vector engineering. This regulatory milestone dramatically expands the therapeutic reach of gene therapy into the most protected organ system.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.5 billion, with a CAGR of 18.9%, and is expected to reach US$ 36.7 billion by the year 2034.

- The type segment is divided into gene silencing, gene augmentation, cell replacement, and others, with gene silencing taking the lead in 2023 with a market share of 41.8%.

- Considering vector, the market is divided into viral and non-viral. Among these, viral held a significant share of 64.3%.

- Furthermore, concerning the application segment, the market is segregated into oncology, neurology, hepatology, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 47.5% in the market.

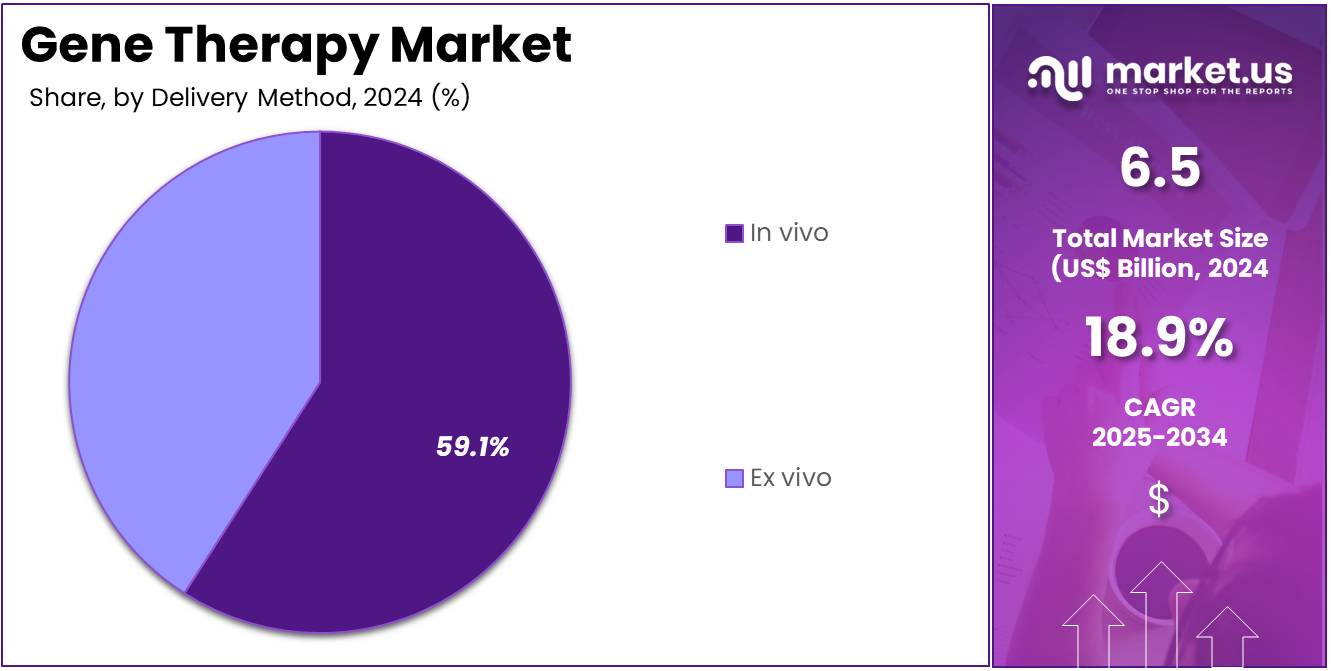

- The delivery method segment is segregated into in vivo and ex vivo, with the in vivo segment leading the market, holding a revenue share of 59.1%.

- Considering route of administration, the market is divided into intravenous, intramuscular, and other. Among these, intravenous held a significant share of 52.4%.

- North America led the market by securing a market share of 37.9% in 2023.

Type Analysis

Gene silencing accounts for 41.8% of the Gene Therapy market and is projected to dominate due to its precision in suppressing harmful genetic mutations that drive disease progression. This approach is anticipated to witness rapid adoption across oncology, neurology, and rare genetic disorders as RNA interference (RNAi) and antisense oligonucleotide (ASO) technologies advance.

Companies are increasingly developing gene silencing therapies that offer long-lasting expression control with reduced off-target effects. Regulatory approvals for siRNA-based drugs, such as patisiran and givosiran, have validated the therapeutic promise of gene silencing platforms. The growing number of partnerships between biotech firms and research institutions is accelerating innovation in silencing vectors and delivery systems.

Additionally, gene silencing provides reversible modulation, offering safety advantages over permanent gene editing techniques. Expanding clinical pipelines targeting neurodegenerative and metabolic conditions reinforce its market leadership. As precision medicine expands, gene silencing is expected to remain a cornerstone of targeted genetic intervention.

Vector Analysis

Viral vectors dominate with 64.3% of the Gene Therapy market and are expected to maintain their lead due to their superior transfection efficiency and durable gene expression. Adeno-associated viruses (AAV), lentiviruses, and retroviruses are extensively utilized for delivering therapeutic genes into host cells. Advancements in vector design have improved safety, reduced immunogenicity, and enabled tissue-specific targeting.

Viral vectors are integral to approved gene therapies such as Zolgensma, Luxturna, and Hemgenix, setting strong commercial precedents. Pharmaceutical collaborations and acquisitions are further driving large-scale viral vector manufacturing capabilities. The expansion of GMP-compliant production facilities is addressing supply bottlenecks for clinical and commercial programs.

Continuous improvements in capsid engineering and vector optimization are expanding their applicability beyond rare diseases to common chronic conditions. With sustained R&D investment and regulatory confidence, viral vectors are anticipated to remain the gold standard for gene delivery across therapeutic domains.

Application Analysis

Oncology accounts for 47.5% of the Gene Therapy market and is anticipated to dominate as cancer treatment increasingly incorporates gene-modifying technologies. Gene therapy enables targeted correction of oncogenic mutations, enhancement of immune responses, and improved drug sensitivity.

The rapid adoption of gene-modified cell therapies, including CAR-T and TCR-T, reflects oncology’s strong integration with genetic engineering. Ongoing clinical trials are expanding gene therapy’s role in solid tumors such as glioblastoma, melanoma, and lung cancer. The rise in personalized oncology programs leveraging tumor sequencing has intensified demand for customized gene constructs.

Pharmaceutical companies are investing heavily in combination therapies integrating gene therapy with checkpoint inhibitors and targeted drugs. Regulatory bodies are supporting fast-track approvals for novel oncologic gene therapies, accelerating patient access. As cancer incidence continues rising globally, oncology is projected to remain the primary revenue driver for gene therapy innovation and commercialization.

Delivery Method Analysis

In vivo delivery holds 59.1% of the Gene Therapy market and is expected to dominate due to its direct and efficient approach for delivering therapeutic genes into patient tissues. This method eliminates complex ex vivo manipulation, enabling streamlined treatment administration. The increasing adoption of adeno-associated viral vectors for in vivo delivery in diseases such as spinal muscular atrophy and hemophilia reinforces its clinical success.

Advancements in tissue-targeted capsids and promoter optimization enhance precision and reduce immune responses. In vivo delivery is anticipated to grow rapidly with the introduction of CRISPR-based editing tools that enable systemic and localized correction of genetic defects. Its scalability supports broad population treatments, unlike patient-specific ex vivo models. Additionally, government funding and partnerships with academic research institutions are promoting in vivo vector innovation. As manufacturing technologies evolve, in vivo delivery is projected to remain the preferred approach for next-generation genetic therapeutics.

Route of Administration Analysis

Intravenous administration represents 52.4% of the Gene Therapy market and is anticipated to lead due to its efficiency in achieving systemic gene delivery and therapeutic distribution. This route ensures rapid vector circulation, enabling access to target tissues such as the liver, muscles, and central nervous system. Intravenous delivery supports a wide range of applications, including hemophilia, Duchenne muscular dystrophy, and cancer gene therapy.

Pharmaceutical developers are optimizing dosage protocols and vector formulations to enhance transduction efficiency while minimizing immunogenic responses. The use of nanoparticle carriers and engineered viral vectors is improving safety and biodistribution profiles. Hospitals and clinical centers are increasingly standardizing intravenous protocols to ensure treatment precision and patient safety. Expanding FDA and EMA approvals for intravenously delivered gene therapies are further boosting market confidence. As vector delivery becomes more sophisticated and manufacturing costs decline, intravenous administration is expected to remain the cornerstone of clinical gene therapy deployment.

Key Market Segments

By Type

- Gene silencing

- Gene augmentation

- Cell replacement

- Others

By Vector

- Viral

- Non-Viral

By Application

- Oncology

- Neurology

- Hepatology

- Others

By Delivery Method

- In Vivo

- Ex Vivo

By Route of Administration

- Intravenous

- Intramuscular

- Other

Drivers

Increasing Clinical Validation of Curative Potential is Driving the Market

The accumulating evidence from successful gene therapy approvals demonstrating long-term curative effects continues to propel the gene therapy market forward, establishing these treatments as viable alternatives to lifelong symptomatic management. Regulatory endorsements validate extensive clinical data, showcasing sustained transgene expression and disease modification in previously intractable conditions. This validation attracts substantial investments from pharmaceutical companies, accelerating pipeline advancements across multiple modalities.

Healthcare providers increasingly incorporate approved therapies into standard protocols, enhancing patient access through specialized centers. Positive real-world outcomes further reinforce clinician confidence, driving referral patterns and treatment adoption. Pharmaceutical firms leverage these successes to pursue label expansions, broadening eligible patient populations. Collaborative efforts between academia and industry refine vector designs, improving safety profiles and efficacy endpoints.

Patient registries capture longitudinal data, providing additional support for reimbursement negotiations. The momentum sustains innovation, positioning gene therapy as a cornerstone of precision medicine. In July 2024, Pfizer’s BEQVEZ (marketed as DURVEQTIX in Europe) gained European Commission approval for adult hemophilia B treatment, together with its April 2024 FDA approval, making BEQVEZ one of the first single-dose gene therapies for hemophilia and demonstrating the commercial viability of durable, curative treatments in hematology.

Restraints

High Treatment Costs and Reimbursement Challenges are Restraining the Market

The extraordinarily high pricing of approved gene therapies, often exceeding USD 1–3 million per patient, combined with inconsistent or delayed reimbursement decisions, continues to severely restrict widespread clinical adoption and market expansion. Payers frequently require extensive real-world evidence of long-term durability before granting broad coverage, creating prolonged access barriers even for FDA/EMA-approved products. This uncertainty forces treatment centers to navigate complex patient assistance programs or risk financial losses, limiting administration to only a small fraction of eligible individuals.

In many countries, national health technology assessment bodies have either rejected or heavily restricted funding for certain gene therapies due to budget impact concerns. Manufacturers face intense pressure to implement outcomes-based risk-sharing agreements, adding operational complexity and revenue unpredictability. The combination of upfront manufacturing costs, specialized infusion requirements, and mandatory long-term follow-up further escalates the total cost of care. These economic hurdles disproportionately affect pediatric and rare disease populations in lower-resource settings, perpetuating global inequities. Until more predictable and sustainable pricing-reimbursement models emerge, high costs will continue to cap patient numbers and slow market penetration despite proven clinical efficacy.

Opportunities

Expanding Therapeutic Scope Beyond Common Indications is Creating Growth Opportunities

The progressive extension of gene therapy applications into rare and ultra-rare neurological disorders presents substantial growth opportunities for the market, addressing high unmet needs in pediatric and neuro-metabolic conditions. Approvals in these niches validate ex-vivo autologous approaches, encouraging developers to target similar genetic mechanisms. This expansion diversifies portfolios beyond ophthalmology and hematology, mitigating risks associated with concentrated indications.

Specialized manufacturing facilities adapt to hematopoietic stem cell processing, supporting scalable production for low-prevalence diseases. Orphan drug designations facilitate accelerated reviews and market exclusivity, enhancing economic incentives. Partnerships with patient foundations expedite trial recruitment and awareness campaigns. Reimbursement frameworks evolve to accommodate high-cost interventions justified by lifelong benefits.

Global regulatory harmonization eases multinational launches, expanding geographic reach. These opportunities foster sustained R&D commitments, transforming niche approvals into broader platform technologies. In March 2024, Orchard Therapeutics, now a Kyowa Kirin subsidiary, earned FDA approval for LENMELDY (OTL-200) to treat early-onset metachromatic leukodystrophy in children, strengthening confidence in ex-vivo autologous gene therapies for pediatric indications and setting a precedent for similar neuro-metabolic applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic uncertainty and tighter capital markets slow funding rounds for early-stage gene therapy companies, pushing some developers to pause or downsize expensive pivotal trials. Strong demand from aging populations and rising prevalence of genetic disorders, however, keep premium pricing intact and attract strategic corporate investments that fill the gap left by cautious venture funds.

Geopolitical fragmentation and export controls on advanced biotech equipment disrupt established manufacturing partnerships, forcing companies to rebuild supply chains at higher cost and longer timelines. These same pressures drive aggressive onshoring and new regional alliances that ultimately strengthen intellectual property protection and speed up regulatory alignment.

Forward-thinking players respond by fast-tracking U.S.-based GMP facilities and securing domestic partnerships that qualify for tariff exemptions. While short-term friction remains undeniable, these challenges sharpen competitive edges and accelerate the shift toward scalable, cost-efficient platforms.

Latest Trends

Focus on Optimizing Manufacturing and Delivery Technologies is a Recent Trend

The intensified emphasis on advancing manufacturing processes and vector delivery systems emerged as a prominent trend in 2024, aimed at overcoming scalability challenges and improving therapeutic precision in gene therapy development. Companies prioritize next-generation adeno-associated virus capsids to enhance tissue tropism and reduce immunogenicity risks. Acquisitions target proprietary platforms that enable higher potency at lower doses, streamlining clinical translation.

Automation in bioreactors and analytical testing accelerates batch release, addressing supply constraints for commercial products. Cryopreservation advancements ensure product stability during global distribution. Integration of machine learning optimizes capsid evolution, expediting discovery timelines. This trend reflects competitive differentiation in a crowded pipeline, focusing on in-vivo efficiency. Strategic consolidations bolster internal capabilities, reducing reliance on external contract manufacturers.

Regulatory feedback loops incorporate these innovations into guidance documents. In November 2024, Novartis AG’s USD 1.1 billion acquisition of Kate Therapeutics advanced its control over next-generation AAV engineering through the DELIVER capsid platform, increasing vector potency and selectivity to enhance delivery efficiency and durability—key differentiators fueling R&D competitiveness in in-vivo gene therapy.

Regional Analysis

North America is leading the Gene Therapy Market

The Gene Therapy market in North America captured 37.9% of the global share in 2024, propelled by streamlined regulatory pathways that expedited product commercialization for rare genetic disorders. Pharmaceutical giants like Novartis and Spark Therapeutics expanded manufacturing capacities, enabling faster delivery of adeno-associated virus-based vectors for retinal and neuromuscular diseases.

Federal grants from the Advanced Research Projects Agency for Health surged, allocating resources to next-generation CRISPR-Cas9 editing platforms for sickle cell anemia and beta-thalassemia. Academic-medical center alliances, such as those at the University of Pennsylvania, accelerated preclinical validations, translating discoveries into phase III successes. Investor enthusiasm manifested in over $2 billion in dedicated funding rounds, prioritizing scalable delivery systems to mitigate immunogenicity risks.

Enhanced reimbursement policies from Medicare facilitated broader patient access, particularly for pediatric oncology applications. Cross-industry consortia developed standardized quality controls, reducing batch failures and boosting confidence among clinicians. The surge in orphan drug designations incentivized niche innovations, addressing unmet needs in metabolic syndromes. Export-oriented hubs in Boston and San Francisco emerged as innovation epicenters, influencing global standards. The U.S. Food and Drug Administration approved a total of 19 gene therapies as of June 2024, with 17 of these occurring between 2022 and mid-2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts project the regenerative medicine landscape in Asia Pacific to expand significantly during the forecast period, fueled by strategic national investments in biotechnology infrastructure. China intensifies support through its National Key R&D Program, fostering viral vector production for hemophilia treatments and attracting foreign direct investment. Japan bolsters its AMED funding initiatives, advancing non-viral delivery methods for Parkinson’s disease interventions.

India leverages its Biotechnology Industry Research Assistance Council to scale up lentiviral platforms, targeting hemoglobinopathies prevalent in the population. South Korea’s Korea Health Industry Development Institute channels resources into ex vivo editing for immunodeficiencies, building domestic expertise. Governments establish dedicated regulatory frameworks, such as Singapore’s Health Sciences Authority expedited reviews, to shorten approval timelines.

Bio-incubators in Hyderabad and Busan nurture startups, integrating AI for trial design optimization. Regional harmonization efforts under ASEAN frameworks promote data sharing, enhancing multi-site studies. Medical hubs like Bangkok draw inbound patients for cost-effective procedures, stimulating service exports. The Alliance for Regenerative Medicine reported 319 ongoing clinical trials for gene therapies in the Asia Pacific region as of the third quarter of 2023.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Dominant enterprises in the genetic editing therapeutics sphere fuel progression by cultivating exclusive licensing pacts with vector engineering specialists to refine adeno-associated virus serotypes, which sharpen targeting precision for central nervous system indications and curtail off-target effects. They funnel dedicated funding into modular, AI-optimized process development labs that expedite upstream fermentation and downstream purification, enabling seamless transitions from preclinical batches to commercial volumes.

Visionary directors orchestrate milestone-driven consortia with regulatory agencies to navigate expedited review pathways, such as RMAT designations, which compress approval timelines for orphan drug candidates in hemophilia and muscular dystrophy. Organizations methodically integrate bioinformatics platforms to mine genomic datasets, identifying novel disease-modifying targets that diversify their oncology-focused CRISPR portfolios beyond base editing. They champion patient advocacy coalitions to streamline trial recruitment via decentralized protocols, harnessing telemedicine for endpoint monitoring in geographically dispersed cohorts. This cohesive playbook not only amplifies valuation multiples through phased derisking but also entrenches market leadership in an ecosystem ripe for consolidation.

CRISPR Therapeutics AG, established in 2013 as a trailblazer in harnessing CRISPR/Cas9 for curative interventions, bases its operations from Zug, Switzerland, while channeling R&D through its Cambridge, Massachusetts hub to pioneer gene-based solutions for debilitating conditions. The entity partners strategically with Vertex Pharmaceuticals to advance ex vivo therapies, including those targeting blood disorders via autologous stem cell modifications that restore normal protein function.

CRISPR Therapeutics bolsters its arsenal with in vivo editing modalities leveraging proprietary nanoparticle carriers, addressing liver and eye diseases through direct genomic corrections. The company upholds a commitment to rigorous safety profiling and scalable manufacturing, positioning itself as a vanguard in translating foundational discoveries into accessible treatments for rare and prevalent ailments alike.

Top Key Players in the Gene Therapy Market

- Taxus Cardium Pharmaceuticals Group Inc.

- Sibinono GeneTech Co. Ltd

- Shanghai Sunway Biotech Co. Ltd

- Gensight Biologics S.A.

- Epeius Biotechnologies Corp.

- Dimension Therapeutics Inc.

- Bristol-Myers Squibb Company

- BioMarin Pharmaceuticals Inc.

- Applied Genetic Technologies Corporation

- American Gene Technologies

Recent Developments

- In November 2024: Sarepta Therapeutics’ collaboration with Arrowhead Pharmaceuticals to license rare-disease programs for muscle, CNS, and pulmonary disorders accelerated diversification within the genetic-medicine portfolio. By pairing Sarepta’s development expertise with Arrowhead’s RNA-based technologies, the partnership reinforced innovation across multiple gene-targeted modalities.

- In January 2024: Ginkgo Bioworks’ collaboration with Biogen to optimize AAV productivity advanced manufacturing efficiency for large-scale gene therapy production. By integrating synthetic-biology tools into vector development, the alliance aimed to lower costs and accelerate the transition from preclinical to commercial supply.

- In January 2024: Novartis signed a capsid-license and collaboration agreement with Voyager Therapeutics to develop gene therapies for Huntington’s disease and spinal muscular atrophy. This deal enhanced Novartis’s long-term innovation pipeline and demonstrated how precision vector design remains a crucial growth engine within the evolving gene therapy landscape.

Report Scope

Report Features Description Market Value (2024) US$ 6.5 billion Forecast Revenue (2034) US$ 36.7 billion CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Gene Silencing, Gene Augmentation, Cell Replacement, and Others), By Vector (Viral and Non-Viral), By Application (Oncology, Neurology, Hepatology, and Others), By Delivery Method (In Vivo and Ex Vivo), By Route of Administration (Intravenous, Intramuscular, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Taxus Cardium Pharmaceuticals Group Inc., Sibinono GeneTech Co. Ltd, Shanghai Sunway Biotech Co. Ltd, Gensight Biologics S.A., Epeius Biotechnologies Corp., Dimension Therapeutics Inc., Bristol-Myers Squibb Company, BioMarin Pharmaceuticals Inc., Applied Genetic Technologies Corporation, American Gene Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Taxus Cardium Pharmaceuticals Group Inc.

- Sibinono GeneTech Co. Ltd

- Shanghai Sunway Biotech Co. Ltd

- Gensight Biologics S.A.

- Epeius Biotechnologies Corp.

- Dimension Therapeutics Inc.

- Bristol-Myers Squibb Company

- BioMarin Pharmaceuticals Inc.

- Applied Genetic Technologies Corporation

- American Gene Technologies