Global Garden And Orchard Tractors Market Size, Share, And Industry Analysis Report By Drive Type (Two-Wheel Drive (2WD), Four-Wheel Drive (4WD), All-Wheel Drive (AWD)), By Tractor Type (Orchard Tractor, Garden Tractor), By Engine (Diesel Engines, Gasoline Engines, Electric Engines, Hybrid Engines), By Power Output (Below 20 HP, 20–40 HP, 41–60 HP, Above 60 HP), By Application (Farming, Plantation Management, Landscaping, Garden Maintenance, Orchard Operations), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174059

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

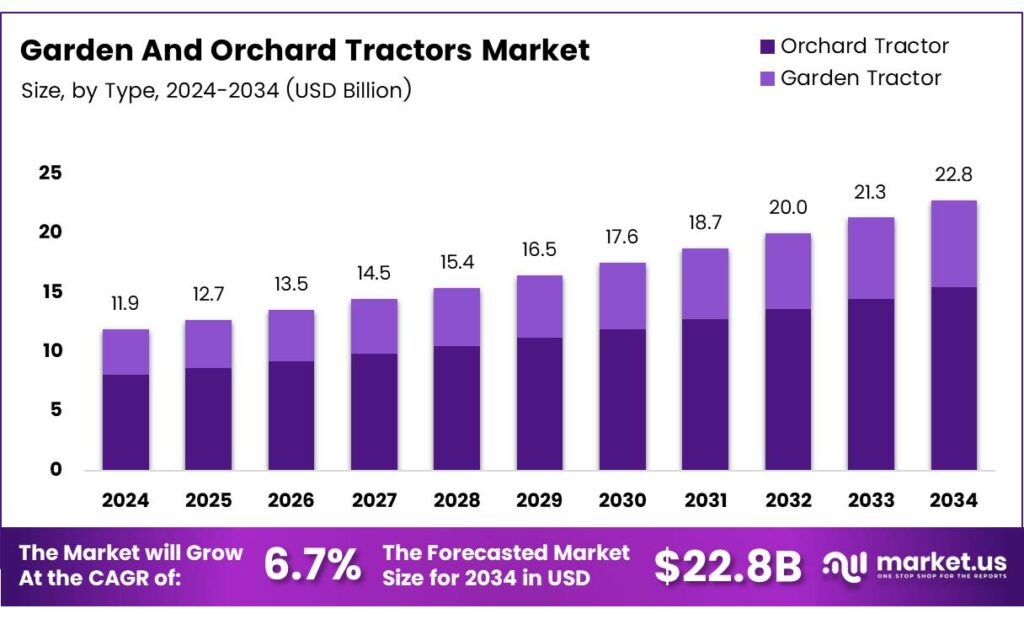

The Global Garden and Orchard Tractors Market size is expected to be worth around USD 22.8 billion by 2034, from USD 11.9 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

The Garden and Orchard Tractors Market covers compact, narrow, and utility tractors designed for orchards, vineyards, plantations, and landscaped farms. These machines focus on maneuverability, fuel efficiency, and precision operations. As landholdings fragment and horticulture expands, demand steadily shifts toward tractors that balance productivity, affordability, and low maintenance requirements.

Growth is supported by rising fruit cultivation, commercial gardening, and orchard modernization. Governments increasingly promote mechanization to address labor shortages and improve farm incomes. Consequently, garden and orchard tractors benefit from supportive subsidy programs, easier credit access, and localized manufacturing incentives, strengthening long-term market stability and adoption.

- Two-wheel drive tractors continue to serve cost-sensitive users operating on simple terrains and light orchard workloads. Typically operating within the 15–68 HP range, these models offer affordable ownership, lower maintenance needs, and practical performance for small farmers and horticulture-focused enterprises seeking reliable mechanization without high capital investment.

In contrast, four-wheel drive tractors address heavier workloads and challenging field conditions, commonly ranging from 20–73.5 HP. Their enhanced traction and stability support operations on uneven land, wet soils, and sloped orchards, while low-speed peak torque at 1,200–2,200 RPM ensures steady pulling power, improved fuel efficiency, and reduced mechanical stress during demanding tasks.

Operational efficiency remains central to buyer decisions. Garden and orchard tractors are engineered for narrow row spacing, low canopy clearance, and repeated field passes. Therefore, farmers prioritize durability, ease of servicing, and compatibility with orchard implements. These factors collectively enhance return on investment, supporting transactional intent among small and mid-sized agricultural operators.

Key Takeaways

- The Global Garden and Orchard Tractors Market is projected to reach USD 22.8 billion by 2034, growing from USD 11.9 billion in 2024 at a 6.7% CAGR.

- Two-Wheel Drive (2WD) tractors dominate the market by type, accounting for a 49.3% share due to affordability and ease of use.

- Orchard Tractors leads the tractor category segment with a dominant 61.8% market share, driven by crop-specific design advantages.

- Diesel engines remain the preferred engine type, holding a 47.2% share supported by strong torque and durability.

- The 20–40 HP power output segment dominates with a 41.9% share, balancing maneuverability and workload capacity.

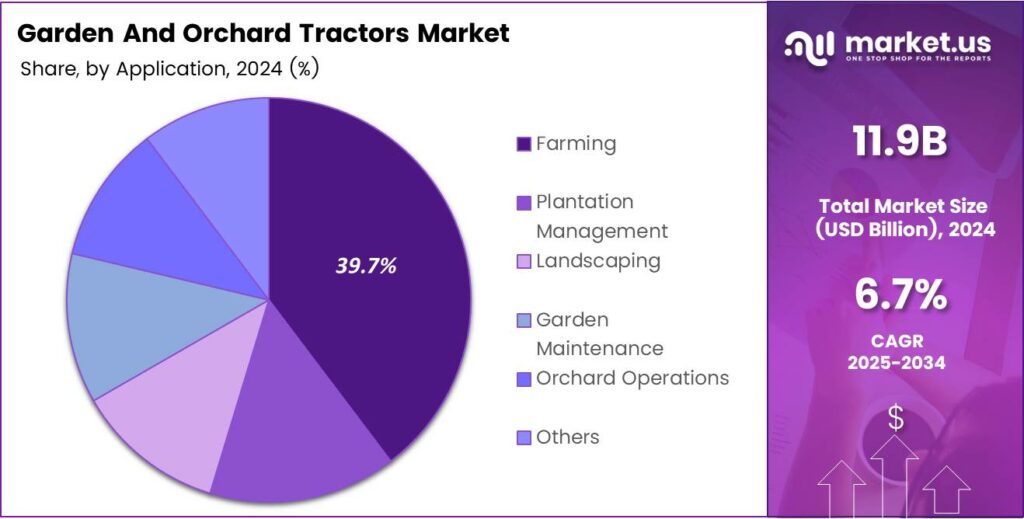

- Farming is the leading application segment, contributing 39.7% of total market demand.

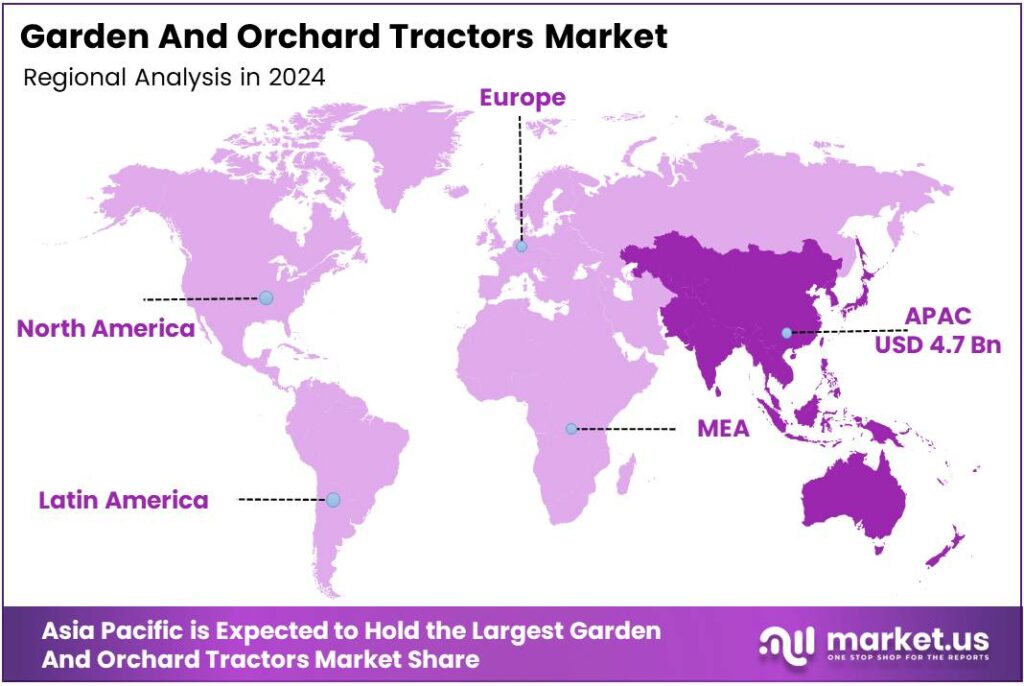

- Asia Pacific is the dominant regional market with a 39.5% share, valued at USD 4.7 billion in 2024.

By Type Analysis

Two-Wheel Drive (2WD) dominates with 49.3% due to its affordability and ease of operation.

In 2024, Two-Wheel Drive (2WD) held a dominant market position in the By Type Analysis segment of the Garden and Orchard Tractors Market, with a 49.3% share. Moreover, farmers prefer 2WD models for light-duty orchard activities. Consequently, lower purchase costs and simpler maintenance strongly support adoption across small and medium holdings.

Four-Wheel Drive (4WD) tractors follow as a reliable alternative for tougher field conditions. Additionally, these tractors improve traction on uneven land and wet soil surfaces. As a result, growers managing sloped orchards and mixed plantations increasingly rely on 4WD units for stability and consistent output.

All-Wheel Drive (AWD) tractors serve niche users seeking balanced power distribution. Although adoption remains limited, AWD systems enhance maneuverability in confined orchard rows. Therefore, premium orchard operators gradually consider AWD tractors for specialized tasks requiring precision, safety, and smoother torque delivery.

By Tractor Category Analysis

Orchard Tractor dominates with 61.8% driven by crop-specific design advantages.

In 2024, Orchard Tractor held a dominant market position in the By Type Analysis segment of the Garden and Orchard Tractors Market, with a 61.8% share. Notably, compact frames and narrow widths support efficient movement between tree rows. Therefore, orchard-focused farms widely adopt these tractors for spraying and harvesting.

Garden Tractors play an important supporting role across residential and institutional landscapes. Additionally, these tractors simplify lawn care, soil preparation, and routine maintenance. Municipalities and commercial gardens prefer garden tractors for controlled environments with moderate operational demands.

Orchard tractors integrate better ground clearance and crop-protection features. Consequently, reduced plant damage and higher productivity reinforce their strong position. Meanwhile, garden tractors continue expanding within landscaping-focused applications.

By Engine Analysis

Diesel Engines dominate with 47.2% due to torque efficiency and durability.

In 2024, Diesel Engines held a dominant market position in the By Engine Analysis segment of the Garden and Orchard Tractors Market, with a 47.2% share. Importantly, diesel engines deliver strong low-speed torque. Consequently, they ensure fuel efficiency and reliable pulling power for orchard implements.

Gasoline Engines remain relevant for lighter garden applications. Moreover, lower upfront costs and quieter operation appeal to small-scale users. Therefore, gasoline-powered tractors suit short-duration tasks where heavy torque requirements remain limited.

Electric Engines are gradually gaining attention due to emission concerns. Although adoption is early-stage, electric models reduce noise and operating costs. Hence, sustainability-focused gardens increasingly explore electric alternatives for enclosed or urban environments.

By Power Output Analysis

20–40 HP dominates with 41.9% due to versatile workload handling.

In 2024, 20–40 HP held a dominant market position in the By Power Output Analysis segment of the Garden and Orchard Tractors Market, with a 41.9% share. Notably, this range balances power and maneuverability. Therefore, it suits most orchard spraying, towing, and cultivation tasks.

Below 20 HP addresses light-duty garden operations. Additionally, compact size supports easy handling in confined spaces. Residential gardens and nurseries commonly adopt this power range. 41–60 HP tractors support heavier orchard workloads. Consequently, they manage advanced attachments and denser soil conditions.

Above 60 HP tractors remain limited to large estates requiring higher pulling capacity. Power selection aligns with land size, implement usage, and soil resistance. Hence, mid-range horsepower continues dominating adoption patterns.

By Application Analysis

Farming dominates with 39.7% driven by mechanization demand.

In 2024, Farming held a dominant market position in the By Application Analysis segment of the Garden and Orchard Tractors Market, with a 39.7% share. Primarily, tractors support land preparation, spraying, and hauling. Consequently, mechanization improves productivity and reduces manual labor dependency.

Plantation Management relies on tractors for consistent crop upkeep. Additionally, tractors enhance efficiency in pruning and nutrient application. Therefore, plantations increasingly integrate specialized orchard tractors into daily operations. Landscaping and Garden Maintenance applications emphasize aesthetics and precision.

Compact tractors help maintain lawns, parks, and estates. Orchard Operations further strengthens demand through harvesting and inter-row cultivation tasks. Other applications contribute marginally but support market diversification. Application diversity sustains steady demand across farming, horticulture, and managed landscapes.

Key Market Segments

By Drive Type

- Two-Wheel Drive (2WD)

- Four-Wheel Drive (4WD)

- All-Wheel Drive (AWD)

By Tractor Type

- Orchard Tractor

- Garden Tractor

By Engine

- Diesel Engines

- Gasoline Engines

- Electric Engines

- Hybrid Engines

By Power Output

- Below 20 HP

- 20–40 HP

- 41–60 HP

- Above 60 HP

By Application

- Farming

- Plantation Management

- Landscaping

- Garden Maintenance

- Orchard Operations

- Others

Emerging Trends

Adoption of Compact and Multi-Function Tractors Shapes Trends

Compact size and multi-function capability are key trending factors in the garden and orchard tractors market. Buyers increasingly prefer tractors that can perform multiple tasks using interchangeable attachments. Demand is growing for models designed for narrow rows and uneven terrain.

- John Deere publicly set a goal of reaching 1.5 million connected machines by 2026, showing how quickly telematics and digital tools are becoming standard, not premium add-ons. The official scheme summary explains a common funding pattern where the Government of India shares 60% of costs and states contribute 40% (with special provisions for some regions).

Digital features like basic sensors and maintenance alerts are slowly entering this segment. Electric and hybrid concepts are also being explored for small-scale applications. Overall, trends focus on flexibility, comfort, and sustainability to meet evolving user needs.

Drivers

Rising Mechanization in Small Farms Drives Market Growth

Growing mechanization across small farms, orchards, and gardens is a major driver for the garden and orchard tractors market. Farmers are shifting from manual tools to compact tractors to save time and labor. These tractors help with spraying, mowing, hauling, and soil preparation in tight spaces.

- Rising labor shortages and increasing wage costs further push farmers toward mechanized solutions. Compact tractors also improve work accuracy and reduce physical strain, making them attractive for aging farm owners. APEDA (using India’s official horticulture estimates) lists FY24 fruit production at 112.98 million metric tonnes from 7.13 million hectares, and vegetable production at 207.21 million metric tonnes from 11.23 million hectares.

Government support for farm mechanization and rural productivity also plays a supporting role. Easy financing options and better availability through local dealers make these tractors more accessible. As orchard farming and landscaping activities expand near urban areas, demand continues to grow steadily. The need for efficiency, speed, and cost control strongly supports market growth.

Restraints

High Initial Cost Limits Adoption Across Regions

High upfront cost remains a key restraint for the garden and orchard tractors market. Small farmers and individual gardeners often find it difficult to afford new tractors. Even compact models require a significant investment compared to traditional tools. Maintenance, fuel, and spare parts add to the total ownership cost over time.

- EPA explains that Tier 4 requires advanced emission-control technologies to meet the standards, which adds engineering and component costs for equipment makers. Industry summaries of these rules commonly describe Tier 4 as targeting about a 90% reduction in particulate matter and NOx versus earlier tiers, which shows the scale of change manufacturers had to deliver.

Land fragmentation in certain regions reduces the practical need for mechanized equipment. In addition, fluctuating farm incomes and weather-related risks make farmers cautious about large investments. These factors together slow down adoption, especially among very small-scale operators.

Growth Factors

Expansion of Horticulture and Landscaping Creates New Opportunities

The expansion of horticulture, landscaping, and specialty crop farming creates strong growth opportunities for the garden and orchard tractors market. Rising demand for fruits, nuts, and ornamental plants increases orchard development worldwide. Urban landscaping, golf courses, and commercial gardens also require compact and versatile tractors.

Growth in greenhouse farming and plantation crops supports demand for narrow and low-height tractor models. Technological improvements, such as fuel-efficient engines and easy-attach implements, attract new users. Rental and leasing services open access for farmers who cannot afford ownership.

Export-oriented fruit farming further encourages investment in productivity tools. Government programs promoting high-value crops also support mechanization. These trends together create long-term opportunities for manufacturers and service providers.

Regional Analysis

Asia Pacific Dominates the Garden and Orchard Tractors Market with a Market Share of 39.5%, Valued at USD 4.7 billion

Asia Pacific remains the dominating region in the Garden and Orchard Tractors Market, holding a strong 39.5% share and reaching a value of USD 4.7 billion. The region benefits from extensive agricultural activity, high orchard density, and growing mechanization across small and medium farms. Rising adoption of compact and mid-horsepower tractors supports productivity in orchards and plantations.

North America shows stable demand for garden and orchard tractors, supported by advanced farming practices and high equipment replacement rates. The region benefits from strong adoption of mechanized solutions in orchards, vineyards, and landscaping applications. Focus on operational efficiency and labor reduction continues to drive consistent market performance. Technological upgrades also contribute to sustained regional growth.

Europe represents a mature yet steady market, driven by specialized orchard farming and compact landholdings. Demand is supported by precision agriculture practices and stringent efficiency standards. Farmers increasingly prefer versatile tractors for multi-season usage in vineyards and orchards. Replacement demand remains a key contributor to regional market stability.

The Middle East and Africa region reflects gradual growth due to expanding horticulture and plantation activities. Mechanization adoption is rising as farmers seek improved yields and efficient land use. Government-supported agricultural development programs indirectly support equipment uptake. However, market penetration remains moderate compared to developed regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deere and Company remains a benchmark brand in garden and orchard tractors in 2024, helped by broad dealer coverage and a portfolio that spans compact utility and specialty orchard use-cases. Its strength is packaging tractors with compatible implements and service plans, which supports higher uptime for professional growers and landscapers. The company’s market posture leans premium, targeting customers who prioritize durability, resale value, and streamlined after-sales support.

CNH Global NV competes through a multi-segment approach that fits mixed farming and horticulture customers who want one platform for several tasks. In 2024, its focus is typically on productivity features—operator comfort, hydraulics, and attachment flexibility—paired with financing and parts availability to reduce ownership friction. The brand strategy is to stay competitive across price bands while still offering specialized configurations for orchard rows and tight turning needs.

Mahindra Tractors is positioned strongly for cost-conscious buyers in 2024, especially where the total cost of ownership and service accessibility drive purchase decisions. Its appeal comes from practical horsepower options, simpler maintenance, and models that fit smaller orchards, plantations, and municipal landscaping contracts. This value-led approach helps it defend its share in regions where mechanization is rising, but budgets remain tight.

AGCO Tractor brings a portfolio mindset in 2024, aligning tractor performance with specific orchard and estate requirements rather than a one-size-fits-all offer. Its differentiation often centers on operator efficiency, drivetrain choices, and support programs aimed at professional users. AGCO’s competitive edge is the ability to scale from compact work to heavier-duty orchard operations while maintaining consistent service and parts ecosystems.

Top Key Players in the Market

- Deere and Company

- CNH Global NV

- Mahindra Tractors

- AGCO Tractor

- Farmtrac Tractor Europe

- Kubota Tractor Corp.

- McCormick Tractors

- Case IH

- Deutz-Fahr

- Claas Tractor

Recent Developments

- In 2025, Deere and Company will focus on advancing autonomy and electrification in its specialty tractor lineup, particularly for orchard applications. Introduction of the 5ML autonomous orchard tractor series, featuring second-generation autonomy with enhanced camera arrays and LIDAR for faster, more accurate operation in high-value crops like almonds.

- In 2025, CNH Industrial, through its New Holland and Case IH brands, will emphasize autonomy and expanded tractor offerings for specialty applications. Launch of the New Holland R4 autonomous orchard tractor, developed with GPS, LIDAR, and cameras for vineyards and orchards, addressing labor shortages in narrow-row environments.

Report Scope

Report Features Description Market Value (2024) USD 11.9 Billion Forecast Revenue (2034) USD 22.8 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drive Type (Two-Wheel Drive (2WD), Four-Wheel Drive (4WD), All-Wheel Drive (AWD)), By Tractor Type (Orchard Tractor, Garden Tractor), By Engine (Diesel Engines, Gasoline Engines, Electric Engines, Hybrid Engines), By Power Output (Below 20 HP, 20–40 HP, 41–60 HP, Above 60 HP), By Application (Farming, Plantation Management, Landscaping, Garden Maintenance, Orchard Operations, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Deere and Company, CNH Global NV, Mahindra Tractors, AGCO Tractor, Farmtrac Tractor Europe, Kubota Tractor Corp., McCormick Tractors, Case IH, Deutz-Fahr, Claas Tractor Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Garden and Orchard Tractors MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Garden and Orchard Tractors MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Deere and Company

- CNH Global NV

- Mahindra Tractors

- AGCO Tractor

- Farmtrac Tractor Europe

- Kubota Tractor Corp.

- McCormick Tractors

- Case IH

- Deutz-Fahr

- Claas Tractor