Global Fruit Pomace Market Size, Share and Report Analysis By Source (Apple, Citrus, Banana, Berries, Grape, Mango, Others), By Foam (Powder, Pellets, Liquid/Paste), By Nature ( Conventional, Organic), By End Use (Animal Feed, Beverage Processing, Biofuel Production, Cosmetics And Personal Care, Dairy Products, Dietary Supplements, Edible Oils And Fats, Food Processing, Pectic Production, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176079

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

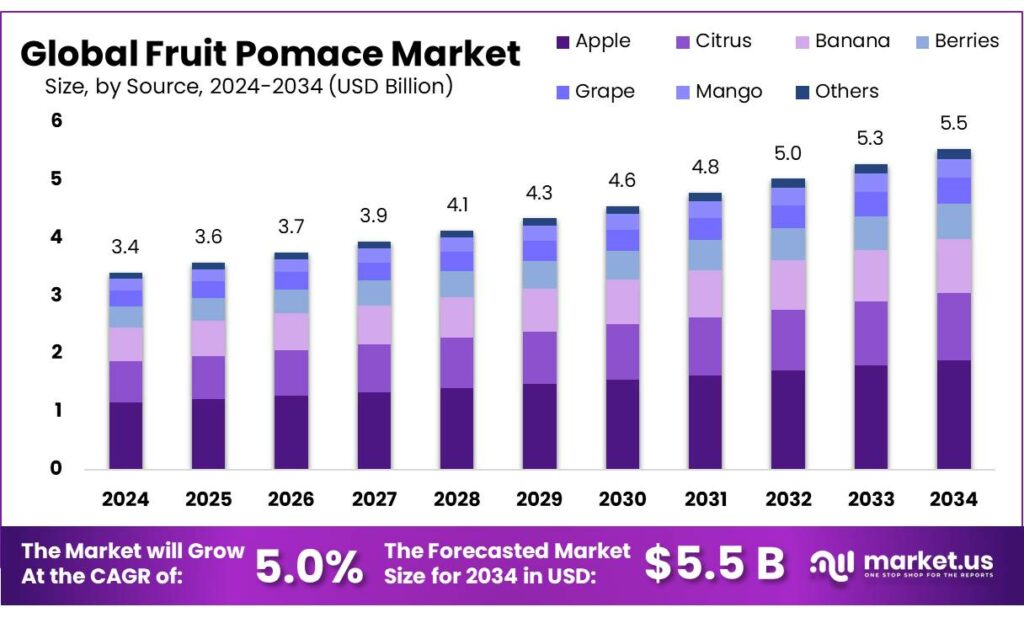

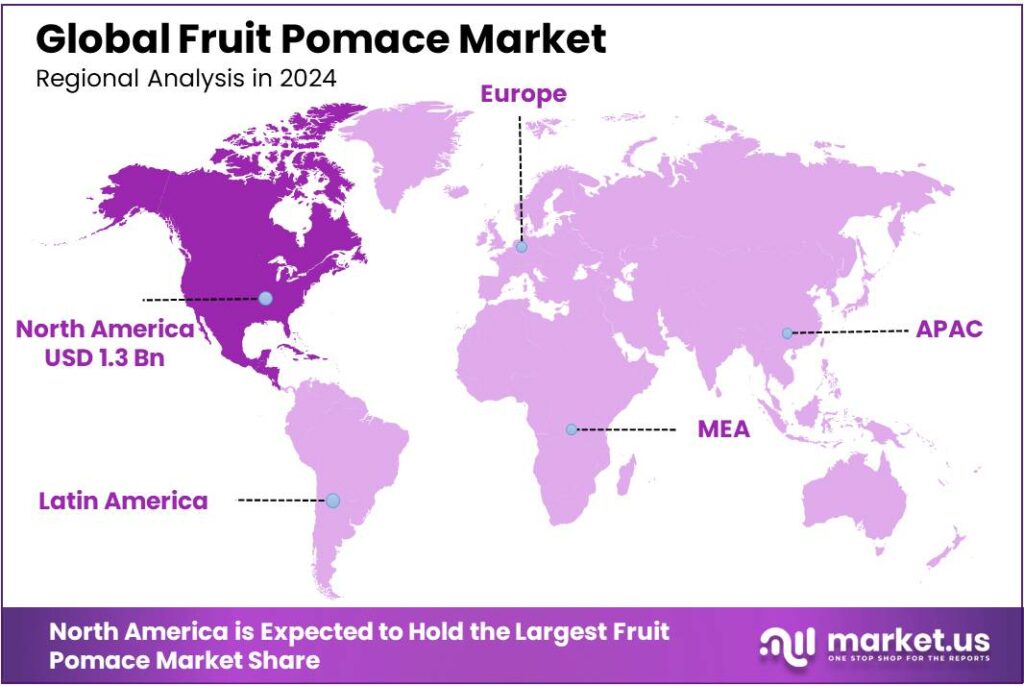

Global Fruit Pomace Market size is expected to be worth around USD 5.5 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.2% share, holding USD 1.3 Billion in revenue.

Fruit pomace is moving from being treated as “waste” to being managed as an industrial co-product. This shift is happening because food systems are under pressure to cut losses, lower disposal costs, and extract more value from the same fruit input. At a global level, the scale problem is clear: UNEP estimates 1.05 billion tonnes of food were wasted in 2022 across retail, food service, and households, including 631 million tonnes from households alone. FAO’s earlier benchmark also highlights that roughly one-third of food produced for people is lost or wasted—about 1.3 billion tonnes per year—which keeps waste reduction on policy and corporate agendas.

Industrially, pomace volumes rise with fruit processing throughput, and the yield of by-products is significant. In apple processing, multiple peer-reviewed sources describe apple pomace as roughly 25–30% of the original fruit mass after juice extraction. In citrus processing, peel waste alone can represent about 50% of wet fruit mass, and some reviews cite 50–70% of processed fruit weight depending on cultivar and process. On the supply side, ongoing commercial citrus activity underpins steady residue generation; for example, USDA’s citrus outlook forecasts global orange juice production at 1.4 million tons (65° brix) in 2024/25.

Key demand drivers are coming from three directions. First is regulation and public targets: the European Commission states that the revised Waste Framework Directive sets binding targets to reduce food waste by 10% in processing/manufacturing and 30% per capita in retail and consumption by 2030, pushing manufacturers to measure, prevent, and valorize residues like pomace. In the U.S., USDA and EPA have a national goal to cut food loss and waste by 50% by 2030, which supports investments in recovery, redistribution, and circular ingredient models.

From a material-flow viewpoint, the economics are attractive because pomace is not “small” in yield terms. Peer-reviewed sources commonly note that apple pomace can represent roughly 25–30% of the processed fruit mass, depending on process and product mix. Citrus streams can be even larger: published research reports peel waste ranges around 30–40% of fruit weight for lemons/limes and oranges/clementines, and up to 45–50% for pomelo.

Key Takeaways

- Fruit Pomace Market size is expected to be worth around USD 5.5 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 5.0%

- Apple held a dominant market position, capturing more than a 34.6% share.

- Powder held a dominant market position, capturing more than a 46.3% share.

- Organic held a dominant market position, capturing more than a 59.8% share.

- Animal Feed held a dominant market position, capturing more than a 52.1% share.

- North America dominates fruit pomace with 39.2% share, valued at 1.3 Bn, supported by strong processing and waste-cutting goals.

By Source Analysis

Apple Pomace Leads the Category with a Strong 34.6% Share

In 2024, Apple held a dominant market position, capturing more than a 34.6% share, mainly because apple juice and cider producers generate large and predictable volumes of pomace. Apple processing plants typically produce apple pomace amounting to 25–30% of the fruit’s weight, creating a steady industrial stream that is easy to collect and convert into fiber ingredients, polyphenol extracts, and fermentation substrates. This high recovery ratio, combined with strong juice consumption trends through 2024 and into 2025, keeps apples at the center of the fruit-pomace ecosystem. Apple pomace also gains preference because processors can dry, mill, or stabilize it with relatively lower cost compared to other fruits, making it suitable for bakery enrichment, clean-label fibers, and upcycled-ingredient positioning.

By Foam Analysis

Powder Form Leads the Fruit Pomace Market with a Strong 46.3% Share

In 2024, Powder held a dominant market position, capturing more than a 46.3% share, mainly because it is the most stable, cost-efficient, and versatile form of fruit pomace used across food, nutraceutical, and feed industries. Powdered pomace is easy to store, transport, and blend, giving manufacturers a consistent ingredient that fits smoothly into bakery mixes, beverages, supplements, and natural fiber applications. Its longer shelf life compared to wet or semi-moist pomace also makes it the preferred option for large processors who need predictable inventory and minimal spoilage risk. Through 2024, demand was supported by the rise of clean-label formulations and the growing interest in upcycled ingredients that naturally boost fiber, antioxidants, and color.

By Nature Analysis

Organic Pomace Leads the Market with a Strong 59.8% Share

In 2024, Organic held a dominant market position, capturing more than a 59.8% share, driven by rising consumer preference for clean, chemical-free, and sustainably sourced ingredients. Organic fruit pomace has become a trusted source of natural fiber, antioxidants, and plant-based nutrients, making it popular across food, beverage, dietary supplements, and functional ingredient categories. As more consumers look for labels that signal purity and environmental responsibility, organic pomace benefits directly from this shift. Through 2024, the expansion of organic farming acreage and stricter residue-free standards further strengthened supply availability, allowing processors to maintain consistent quality across powdered and dried formats.

By End Use Analysis

Animal Feed Leads the Market with a Strong 52.1% Share

In 2024, Animal Feed held a dominant market position, capturing more than a 52.1% share, supported by consistent demand from livestock, poultry, and dairy producers who rely on fruit pomace as a cost-effective and nutrient-rich feed ingredient. Pomace offers natural fiber, residual sugars, and antioxidants that improve digestion and energy availability in animals, making it a practical supplement for feed formulators. Its abundant supply from juice and fruit-processing facilities throughout 2024 ensured steady availability, reinforcing its role as the most widely adopted end-use segment across the market.

Key Market Segments

By Source

- Apple

- Citrus

- Banana

- Berries

- Grape

- Mango

- Others

By Foam

- Powder

- Pellets

- Liquid/Paste

By Nature

- Conventional

- Organic

By End Use

- Animal Feed

- Beverage Processing

- Biofuel Production

- Cosmetics & Personal Care

- Dairy Products

- Dietary Supplements

- Edible Oils & Fats

- Food Processing

- Pectic Production

- Others

Emerging Trends

Upcycled certification is becoming mainstream, pulling fruit pomace into branded food products

A major latest trend in the Fruit Pomace market is the shift from “industrial by-product use” to consumer-facing, certified upcycled ingredients. Instead of pomace staying mostly in local animal feed channels, more food and beverage brands are using fruit pomace as a story-backed ingredient—fiber-rich, naturally sourced, and tied to waste reduction. This trend accelerated because buyers want proof, not just claims. Certification and measurable diversion data are now doing that job, making it easier for brands to justify pomace in mainstream products like snacks, baking mixes, and beverages.

In 2024, the Upcycled Food Association highlighted a clear jump in demand: Upcycled Certified™ product sales increased by 55%, rising from $42 million to $65 million since 2022. The same update pointed out how quickly certain categories are moving, noting that Upcycled Certified™ snack products saw 443% sales growth over the past two years. For fruit pomace suppliers, this matters because snack formats are one of the easiest places to use pomace powders and fibers without disrupting production.

The policy environment is reinforcing the same direction, which is why this trend is not fading after one “green” season. In the EU, the 2025 amendment of the Waste Framework Directive introduced binding targets to reduce food waste by 10% in processing and manufacturing and by 30% per capita at retail and consumption by 2030. In the U.S., EPA notes the national goal aims to reduce food waste by 50% by 2030. When targets become formal, large processors and brands tend to prefer solutions that can be tracked and reported.

Drivers

Food-waste reduction targets are pushing fruit pomace from “waste” into a usable raw material

One major driving factor for fruit pomace is the growing pressure—through policy, cost, and sustainability goals—to cut food waste and keep by-products in the value chain. In practical terms, fruit pomace becomes a “ready-to-use” stream the moment juice, puree, or concentrate is produced, so processors can reduce disposal costs and generate additional income if they stabilize and sell it for animal feed, fiber powders, or extraction inputs.

- This matters because the global food system is still losing an enormous amount of edible material: FAO has estimated that roughly one-third of food produced for human consumption is lost or wasted, equal to about 1.3 billion tonnes per year.

The urgency is reinforced by more recent measurement work. UNEP’s Food Waste Index reports that in 2022 the world wasted about 1.05 billion tonnes of food across retail, food service, and households, which is around 19% of food available to consumers. The same report highlights the household component at 631 million tonnes and an average of 79 kg per capita per year. While these figures are not “pomace-only,” they raise the accountability bar across the entire supply chain and increase scrutiny on industrial by-products too.

Government targets are now translating this pressure into clear operational expectations. In the United States, USDA and EPA set a national goal to reduce food loss and waste by 50% by 2030. In the European Union, the revised Waste Framework Directive introduces binding targets to reduce food waste by 10% in processing and manufacturing and by 30% per capita at retail and consumption by 2030.

Restraints

High moisture and fast spoilage make fruit pomace expensive to store and move

One major restraining factor for the Fruit Pomace market is high moisture content, which makes pomace heavy, unstable, and quick to spoil unless it is processed immediately. In real operations, fruit pomace is not a dry “ingredient” at the point of generation—it is a wet mass that often needs rapid handling, drying, or chilling. For example, technical literature notes that apple pomace typically contains 70–85% moisture, which means companies are essentially transporting and storing water along with solids. This raises costs per tonne and creates a narrow window to prevent odor, microbial growth, and quality loss.

This moisture-driven instability also limits how far pomace can travel economically. When moisture stays high, processors either need to use it locally or invest in stabilization—most commonly drying, ensiling, or controlled fermentation. Even academic processing references describe fresh apple pomace as “highly perishable” because moisture can sit around 66.4–78.2%, and while refrigeration/freezing can extend storage, the energy and space requirements are often not practical for most plants at scale. In other words, the restraint is not that pomace has no value; it is that the value is hard to capture before the material degrades.

In 2024, this problem was felt most strongly by mid-sized juice processors and seasonal fruit clusters. Pomace generation is concentrated around harvest and peak processing weeks, so the volume spike can overwhelm local demand and drying capacity. If drying equipment is undersized, processors face a tough choice: accept lower prices in nearby feed channels, pay for disposal, or risk quality deterioration that makes the material unsuitable for higher-value food or nutraceutical uses. A 2025 ScienceDirect review similarly points out that storing apple pomace is challenging due to high moisture—reported at about 700 g/kg—because high water content creates conditions that favor rapid deterioration.

Opportunity

Upcycled, “certified” ingredients are creating a clear sales path for fruit pomace

A major growth opportunity for fruit pomace is the fast rise of upcycled food ingredients—where brands intentionally use by-products and market them as a sustainability and nutrition win. In 2024, this idea moved from “nice story” to measurable commercial traction. The Upcycled Certified™ program reported that Upcycled Certified™ product sales increased by 55%, rising from $42M to $65M since 2022.

The opportunity becomes stronger when looking at scale signals from certification adoption. A January 2025 industry update stated that in 2024, 105 companies were certified and there were 568 products certified—described as a 17% increase over the prior year. The same update also claimed those certified companies combined to divert approximately 1.2 million tons of food waste, framed as the equivalent of 248 million bags of groceries.

Government direction adds another layer of momentum through 2025, because food-waste reduction targets push companies to show real actions, not just promises. In the U.S., EPA and USDA’s national goal aims to reduce food waste by 50% by 2030, which keeps waste-reduction investments on the agenda for manufacturers and retailers. In the EU, the 2025 amendment of the Waste Framework Directive introduced binding targets to reduce food waste by 10% in processing and manufacturing and by 30% per capita at retail and consumption by 2030.

Regional Insights

North America dominates fruit pomace with 39.2% share, valued at 1.3 Bn, supported by strong processing and waste-cutting goals.

North America leads the Fruit Pomace market because the region has a mature juice, cider, and fruit-processing ecosystem that produces steady pomace streams and has practical end-use demand, especially in animal feed and ingredient upcycling. With a 39.2% share and market value of 1.3 Bn, North America benefits from established collection networks near processing plants, making it easier to move pomace into drying, milling, and feed channels rather than treating it as disposal.

- A useful indicator of the region’s processing-linked activity is U.S. trade performance in fruit and vegetable juice products: USDA data shows U.S. fruit & vegetable juices export value of $988.43 million in 2024, reflecting ongoing large-scale throughput that typically generates by-products like pomace.

Policy pressure also supports the region’s utilization trend. In the U.S., EPA and USDA have a national goal to reduce food loss and waste by 50% by 2030, which pushes processors to adopt measurable, operational solutions—such as stabilizing pomace for resale rather than paying for disposal.

Europe is strengthening as a fast-moving region because regulation is turning waste reduction into a compliance target. The EU’s binding 2030 targets require 10% reduction in food waste in processing/manufacturing and 30% per-capita reduction at retail and consumption, encouraging more structured by-product valorization programs.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hydrofarm is a U.S. hydroponics and controlled-environment agriculture supplier. In FY2024, the company reported net sales of $190 million. Its Q4 2024 net sales were $37.3 million. The business supports cultivation inputs, which can indirectly influence demand for plant-based by-products used in circular agri-systems.

Public corporate information for this exact entity is not reliably verifiable from trusted filings in open sources. What can be stated numerically, based on the product category it implies, is the typical cyclopentanone identifier set: CAS 120-92-3, molecular weight 84.12, and common industrial purity listings at ≥99% (GC) for standard synthesis grades. This suggests a likely role as a specialty solvent/intermediate supplier.

GREENLIFE CHEM-SYNTHESIS PRIVATE LIMITED, incorporated on 12-12-1995. As of 21-06-2024, it lists authorized share capital ₹50,000,000 and paid-up capital ₹44,478,000. This provides a clearer numeric company profile than “Greenlife Cyclopentanone” as a standalone name, and indicates an operating chemical entity with formal registration.

Top Key Players Outlook

- Citrosuco

- AGRANA Beteiligungs-AG

- Louis Dreyfus Company

- Kerry Group plc

- Cargill, Incorporated

- ADM

- SunOpta

- Tate & Lyle

- Symrise

- Olam Group

Recent Industry Developments

In 2024, Hydrofarm Holdings Group, Inc reported net sales of $190 million, with roughly three-quarters of its revenue coming from consumables such as grow media and nutrients that support year-round cultivation.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 5.5 Bn CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Apple, Citrus, Banana, Berries, Grape, Mango, Others), By Foam (Powder, Pellets, Liquid/Paste), By Nature ( Conventional, Organic), By End Use (Animal Feed, Beverage Processing, Biofuel Production, Cosmetics And Personal Care, Dairy Products, Dietary Supplements, Edible Oils And Fats, Food Processing, Pectic Production, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Citrosuco, AGRANA Beteiligungs-AG, Louis Dreyfus Company, Kerry Group plc, Cargill, Incorporated, ADM, SunOpta, Tate & Lyle, Symrise, Olam Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Citrosuco

- AGRANA Beteiligungs-AG

- Louis Dreyfus Company

- Kerry Group plc

- Cargill, Incorporated

- ADM

- SunOpta

- Tate & Lyle

- Symrise

- Olam Group