Global Fruit Flavored Alcoholic Beverages Market Size, Share Analysis Report By Alcohol Type (Beers, Distilled Spirits, Wines, Cocktails, Others), By Packaging (Bottles, Cans, Others), By Distribution channel (Hyper/Supermarket, Specialty Store, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163180

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

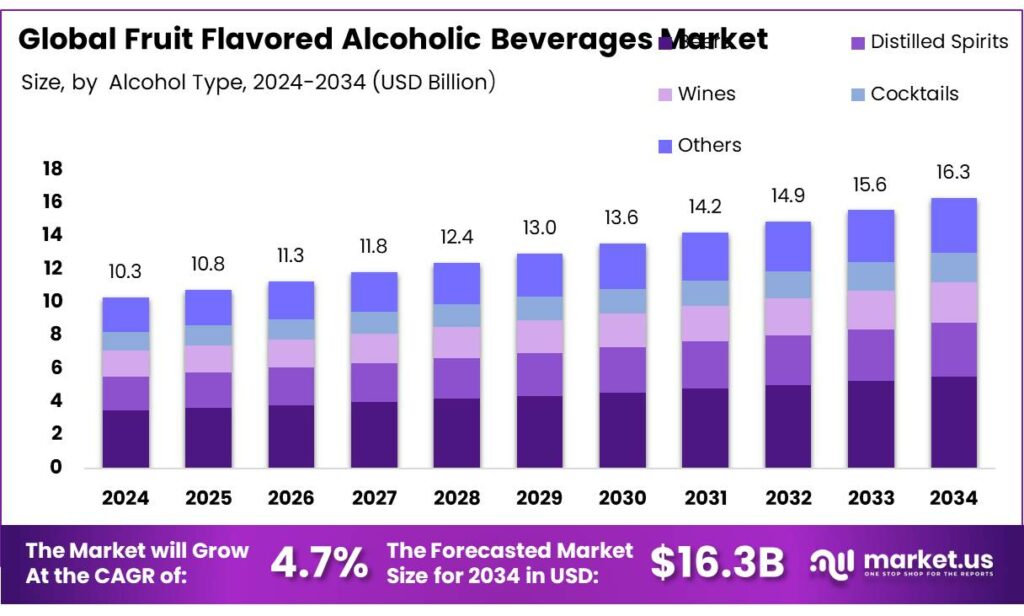

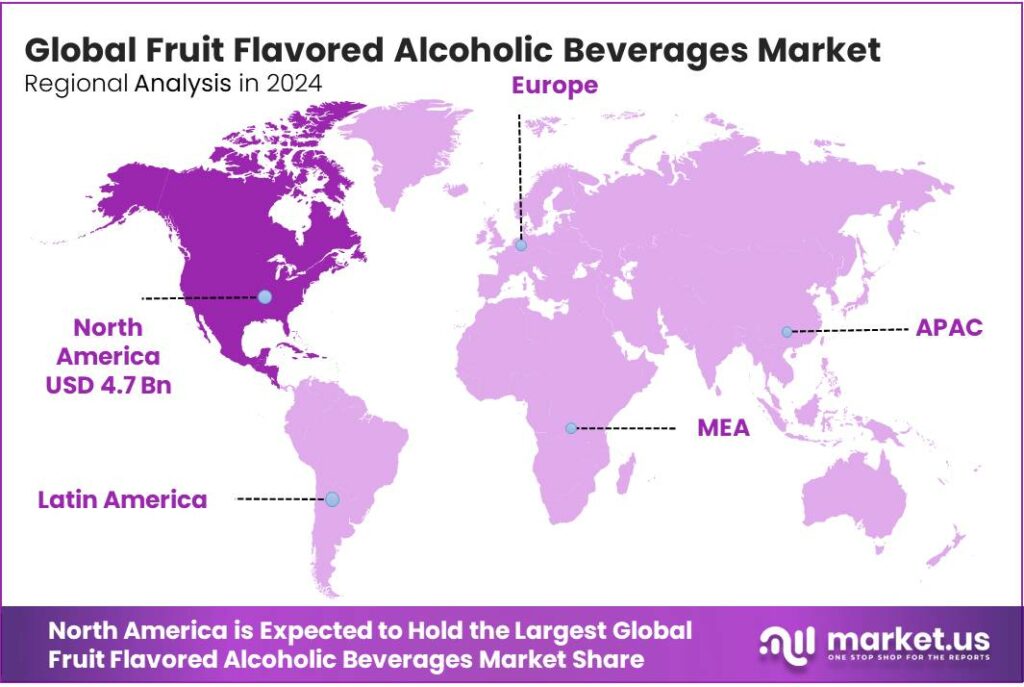

The Global Fruit Flavored Alcoholic Beverages Market size is expected to be worth around USD 16.3 Billion by 2034, from USD 10.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.9% share, holding USD 5.2 Billion in revenue.

Fruit-flavoured alcoholic beverages (FFABs) span ready-to-drink (RTD) spirits and malts, fruit ciders, flavoured wines, and infused beers. They play at the intersection of flavour innovation, convenience packaging, and regulatory scrutiny.

- The World Health Organization (WHO) estimates 2.6 million global deaths in 2019 were attributable to alcohol and reports average per-capita consumption of 8.2 L (men) vs 2.2 L (women) of pure alcohol, shaping policy and labeling trajectories that suppliers must track.

In India, the Food Safety and Standards Authority of India (FSSAI) codifies label statements for alcoholic beverages—e.g., declarations such as “Blended and Bottled by” and methods references—providing a harmonised framework for domestic and imported flavoured lines. In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) requires mandatory alcohol-content statements on flavoured malt beverages that contain alcohol from added flavours—directly impacting fruit-flavoured ales and seltzer-like extensions.

Energy dynamics increasingly influence plant economics and sustainability positioning in breweries, wineries, and spirits bottling. The International Energy Agency (IEA) reports the industrial sector accounted for 37% of global energy use in 2022, underscoring the cost exposure of beverage processors to electricity and heat.

The IEA also notes electricity’s share of final energy use reached ~20% in 2023—a trend that favours electrification of thermal steps and integration of heat-pump technologies in beverage facilities. At the same time, energy-transition capex is accelerating: global energy investment is set to exceed USD 3 trillion in 2024, with USD 2 trillion in clean energy. This shifts corporate power-sourcing options that FFAB producers can leverage for cost and emissions resilience.

Category demand is pulled by flavour exploration, moderated ABV, and convenience. However, governments’ public-health priorities shape commercial tactics. WHO reports 56% of adults abstained from alcohol in the prior 12 months (2019), and many countries maintain national alcohol policies—factors that channel FFAB growth into compliant, lower-risk propositions.

Key Takeaways

- Fruit Flavored Alcoholic Beverages Market size is expected to be worth around USD 16.3 Billion by 2034, from USD 10.3 Billion in 2024, growing at a CAGR of 4.7%.

- Beers held a dominant market position, capturing more than a 33.8% share in the fruit-flavored alcoholic beverages segment.

- Bottles held a dominant market position, capturing more than a 67.3% share in the fruit-flavored alcoholic beverages market.

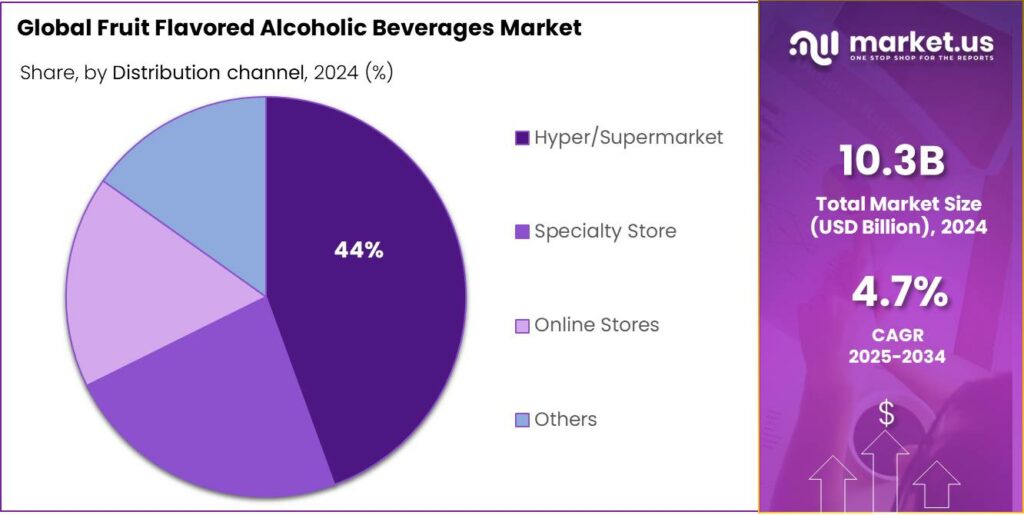

- Hyper/Supermarkets held a dominant market position, capturing more than a 44.2% share in the fruit-flavored alcoholic beverages market.

- North American region, the fruit-flavored alcoholic beverages market is notably robust, with the region holding approximately 45.80% of global market share and achieving a regional valuation of USD 4.7 billion.

By Alcohol Type Analysis

Beers lead the market with 33.8% share in 2024 driven by strong global consumption trends

In 2024, Beers held a dominant market position, capturing more than a 33.8% share in the fruit-flavored alcoholic beverages segment. The demand was largely driven by the increasing popularity of fruit-infused lagers and ales among young consumers seeking lighter and refreshing alternatives to traditional brews. Major breweries expanded their product portfolios with tropical and citrus-based flavors such as mango, lime, and passionfruit, appealing to changing taste preferences and seasonal demand. The introduction of low-calorie and low-alcohol variants further strengthened market penetration, aligning with the global shift toward balanced drinking habits.

In 2025, the segment is projected to sustain its leadership as breweries continue to innovate with hybrid formulations that combine craft beer quality and natural fruit essences. The expansion of flavored beer lines across North America, Europe, and Asia-Pacific has been supported by premium packaging and broader retail availability, particularly in cans and smaller bottles suited for single-serve consumption. Increasing investments in microbreweries and collaborations with fruit growers have also enhanced product differentiation, ensuring consistent flavor authenticity and freshness.

By Packaging Analysis

Bottles dominate the market with 67.3% share in 2024 owing to their premium appeal and consumer trust

In 2024, Bottles held a dominant market position, capturing more than a 67.3% share in the fruit-flavored alcoholic beverages market. The dominance of bottled packaging was primarily supported by its long-standing association with quality, brand identity, and consumer preference for premium presentation. Glass bottles, in particular, remained the preferred choice among producers due to their ability to preserve flavor integrity, carbonation, and freshness of fruit-based alcohol blends. Established brands continued to rely on bottled formats to maintain brand recognition and communicate authenticity, especially in retail and on-premise channels.

In 2025, the bottled segment is expected to maintain its leadership as manufacturers introduce lightweight and recyclable glass alternatives to reduce logistics costs and environmental impact. The segment’s growth will also be reinforced by the expanding craft and premium beverage sector, where bottles are viewed as symbols of quality and exclusivity. Furthermore, consumer buying behavior in emerging markets continues to favor bottled beverages, especially for gifting and celebratory occasions.

By Distribution Channel Analysis

Hyper/Supermarkets dominate with 44.2% share in 2024 due to strong product visibility and consumer convenience

In 2024, Hyper/Supermarkets held a dominant market position, capturing more than a 44.2% share in the fruit-flavored alcoholic beverages market. This leadership was driven by their extensive shelf space, wide product variety, and ability to offer competitive pricing. Consumers preferred these retail formats for their convenience, easy access to multiple brands, and frequent promotional discounts on alcoholic beverages. The presence of well-organized product displays and chilled sections further encouraged impulse purchases, especially for fruit-flavored beers, ciders, and ready-to-drink cocktails. The ability to compare flavors and packaging options in a single visit also contributed to higher sales volumes across urban and suburban regions.

In 2025, the hyper/supermarket channel is expected to maintain its dominance as global retail chains continue to expand their beverage sections and collaborate with producers for exclusive product launches. Seasonal promotions, in-store tastings, and loyalty-based offers are projected to attract a growing base of younger consumers seeking variety and freshness in alcoholic beverages. Additionally, improved cold-chain logistics and retail digitization are likely to enhance inventory management and product availability, strengthening the role of this channel in total market revenue.

Key Market Segments

By Alcohol Type

- Beers

- Distilled Spirits

- Wines

- Cocktails

- Others

By Packaging

- Bottles

- Cans

- Others

By Distribution channel

- Hyper/Supermarket

- Specialty Store

- Online Stores

- Others

Emerging Trends

Transparent e-labels and moderated ABV steer fruit-forward launches

Moderated-ABV innovation aligns with evolving health expectations. The World Health Organization reported 2.6 million deaths attributable to alcohol in 2019 (4.7% of all deaths), strengthening public-health pressure for clearer labels and responsible marketing. As policies nudge toward informed choice, fruit-forward SKUs that show calories, sugars, and ABV in a scan-friendly way fit the spirit of these measures while retaining flavour appeal.

Supply conditions reinforce the trend. The International Organisation of Vine and Wine (OIV) notes global wine consumption fell to 221 million hectolitres in 2023, the lowest since 1996, while weather impacts helped drive 2023 wine production down to ~237 million hectolitres, the smallest in over 60 years. With classic wine under pressure, producers are experimenting with seasonal fruit infusions, spritzed formats, and compliant low-ABV variants that present freshness and simplicity—often supported by e-labels to signal quality and authenticity.

Agricultural scale makes this flavour-first, transparent approach practical. FAO reports fruit and vegetable output reached 2.1 billion tonnes in 2023, ensuring steady availability of juices, purées, and peels for infusions and fermentations. Harnessing this raw-material base, FFAB makers can standardize fruit provenance and batch analytics on e-labels, turning traceability into a brand asset.

Regulatory clarity is also tightening in the United States. The Alcohol and Tobacco Tax and Trade Bureau (TTB) makes an ABV statement mandatory for malt beverages whenever any alcohol comes from added flavours or other added non-beverage ingredients—common in fruit-flavoured malt seltzers and shandies. This pushes brands to declare strength precisely and to reformulate when needed to remain within style and jurisdictional limits.

Drivers

Growing Appeal of Unique Flavour Experiences

One major driving factor for the rise of fruit-flavoured alcoholic beverages lies in the evolving taste preferences of younger consumers who crave flavour variety and convenience. For example, in the U.S., a survey found that 42.9% of Gen Z drinkers say they choose canned cocktails or ready-to-drink (RTD) alcoholic beverages, which often include fruit flavours. This shift doesn’t just reflect a genetic preference — it signals a broader change in how the 18-to-34 demographic approaches alcohol: less about tradition and more about experience, portability and novelty.

The data shows that for the 21-to-29 age bracket, 8% said RTD cocktails were the type they consumed most often – a modest share but meaningful in a large category. What this suggests is that flavour innovation and format convenience are not niche trends but growing consumer behaviours. Another data point: a study of RTD consumption in Britain found that over 60% of respondents drink RTDs at least once a week. These figures illustrate that fruit-flavoured alcoholic drinks are appealing because they meet younger consumers where they are: social, mobile, and flavour-driven.

This trend is reinforced by the fact that among RTD consumers, unique flavours matter. In a U.S. convenience-store survey, 32% of respondents said they drank RTDs in casual social gatherings. Moreover, a substantial share of consumers—over half in some studies—indicated they seek out unique or novel flavour profiles over brand or alcohol strength. For fruit-flavoured alcoholic beverages, this means flavours like tropical fruit, berry blends, citrus infusions and experimental combinations become key levers for attracting attention. Innovation in this space drives differentiation and repeat purchase, especially among millennials and Gen Z who favour exploration.

Flavour-led innovation also pairs with the convenience of RTD formats. Younger consumers marry the need for portability, shareability, and multiple occasions — outdoor gatherings, virtual events, quick at-home pours. Studies show that RTDs are consumed more frequently at home and in informal settings, aligning with the consumption behaviours of younger adults. In short, flavour and format combine to create a product that fits both lifestyle and taste-preference shifts.

Restraints

Stringent Public Health Regulations and Consumer Backlash

One significant restraining factor for the fruit-flavoured alcoholic beverages category is the increasingly strict public health regulations combined with growing consumer awareness of alcohol-related risks. Globally, alcohol use remains heavily regulated because of its recognised health impacts.

- In fact, according to the World Health Organization (WHO), in 2019 roughly 52% of men and 35% of women aged 15 + had consumed alcohol in the past 12 months; average annual per-capita consumption was 8.2 litres for men and 2.2 litres for women of pure alcohol.

This regulatory environment affects fruit-flavoured alcoholic beverages (FFABs) because flavour additions, packaging innovation, and lower alcohol formats often trigger extra monitoring, labelling obligations and duty categories. For example, governments increasingly demand clear statements about alcohol by volume (ABV), ingredient disclosure, and health warnings on packaging. These rules raise the cost burden for producers of fruit-forward products—especially smaller or newer entrants who may rely on flavour innovation and novelty as differentiators.

Additionally, public health policy and consumer sentiment are shifting in ways that may dampen growth for FFABs. The Pan-American Health Organization (PAHO) reports that in the Americas, 29% of the adult population are lifetime abstainers, 54% are current drinkers, and heavy episodic use remains high at 21.3% of those aged over 15. These numbers reflect a significant segment of the population either choosing not to drink or drinking with caution, which limits the addressable market for novel alcoholic beverage formats like fruit-flavoured RTDs.

Regulators in many countries are introducing stricter rules specifically around sweetness, flavourings, youth-target marketing and portion size. For instance, in the EU, new wine and aromatised wine labelling regulations effective December 2023 require detailed ingredient and nutritional information, which extends pressure to associated flavoured alcoholic categories. These measures raise cost, complexity and time to market for FFAB innovations. On the consumer side, growing health-consciousness is evident: in the United States, a recent Gallup poll found 53% of adults believe that moderate drinking is bad for one’s health, up from 45% a few years prior.

Opportunity

Upcycling fruit surplus into transparent, lower-ABV innovation

A powerful growth opportunity for fruit-flavoured alcoholic beverages (FFABs) is to turn abundant—and often under-used—fruit streams into transparent, lower-ABV products that meet stricter labelling rules and health-minded tastes. The supply base is deep: the Food and Agriculture Organization (FAO) reports world fruit production reached 952 million tonnes in 2023, while combined fruit-and-vegetable output reached 2.1 billion tonnes—ample raw material for fermented bases, infusions, and natural flavour systems.

This supply scale intersects with a big efficiency gap that FFABs can help close. FAO and the UN Environment Programme estimate that around 14% of food is lost post-harvest before retail, and a further 17% is wasted at retail and in households. Redirecting even a fraction of cosmetically imperfect fruit or surplus puree into compliant alcoholic formats creates value, reduces waste, and supports local grower incomes. FAO also pegs the value of post-harvest losses at roughly USD 400 billion per year, underscoring the economic headroom for upcycling.

Policy is moving in a direction that rewards clarity and quality—an advantage for well-made fruit-forward SKUs. In the European Union, new labelling rules for wine and aromatised-wine products took effect on 8 December 2023, requiring ingredient and nutrition disclosure. Producers who lean into transparent recipes, QR-based details, and portion-controlled formats can convert scrutiny into trust, and extend these practices to adjacent FFAB lines.

Health awareness is another nudge toward moderated ABV and clear information—both natural fits for FFABs built on real fruit. The World Health Organization notes that in 2019 average recorded per-capita consumption was 8.2 litres for men vs 2.2 litres for women, a profile that supports interest in portion-controlled, lower-strength drinks with full disclosure on pack or via e-labels. Brands that pair authentic fruit inputs with crisp ABV labelling and sugar transparency can meet policy goals and consumer expectations at once.

Regional Insights

North America leads with 45.80% share and USD 4.7 billion in 2024, driven by strong RTD and flavored beer demand.

In the North American region, the fruit-flavored alcoholic beverages market is notably robust, with the region holding approximately 45.80% of global market share and achieving a regional valuation of USD 4.7 billion in the base year. This dominance underlines the region’s mature consumption culture, widespread availability of flavored alcoholic formats and advanced retail infrastructure. Consumer adoption in the United States and Canada has been supported by shifting preferences toward convenient, flavour-rich alcoholic offerings and a growing interest in novelty and premiumisation.

The success of the North American segment can be attributed to several factors: high disposable incomes, strong brand presence of major beverage companies, and a well-established network of hypermarkets, supermarkets and convenience channels that facilitate rapid market penetration. Product innovation in fruit-flavoured malt beverages, ready-to-drink cocktails and flavored beers has been particularly evident in the region, creating a fertile environment for growth and experimentation. The consumer base, especially among younger adults, has embraced these formats as accessible, flavourful alternatives to traditional alcohol categories.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arbor Mist Winery continued to dominate the fruit-flavored wine segment in 2024 with a wide range of sweet and semi-sweet wines infused with natural fruit flavors like strawberry, peach, and mango. Its approachable pricing and strong presence in retail stores across the U.S. supported consistent market demand. The brand’s success stemmed from appealing to casual wine drinkers seeking flavor variety and convenience. Arbor Mist’s easy-drinking style and broad accessibility made it a major driver in flavored wine consumption.

E & J Gallo Winery remained a leading force in 2024, capitalizing on consumer demand for fruit-infused wines and cocktails. The company’s diverse product line included flavored wines, spritzers, and canned RTD beverages under brands such as Barefoot and Apothic. Its investment in sustainable winemaking and innovative flavor profiles positioned it ahead in the flavored alcoholic beverage segment. Strong global distribution and marketing initiatives reinforced E & J Gallo’s image as a pioneer in the flavored wine category.

Anheuser-Busch held a commanding presence in 2024 through its extensive range of fruit-flavored beers and hard seltzers. The company’s innovation in tropical and citrus-based flavors under brands like Bud Light Seltzer and Michelob Ultra propelled strong consumer engagement across North America. Its vast distribution channels, premium packaging, and focus on low-sugar formulations aligned with evolving health-conscious trends. By integrating sustainability and brand innovation, Anheuser-Busch successfully maintained leadership in the flavored alcoholic beverages landscape.

Top Key Players Outlook

- Accolade Wines

- Molson Coors Brewing

- Arbor Mist Winery

- E & J Gallo Winery

- Anheuser-Busch

- Brown-Forman

- Carlsberg

- Bacardi

- Beam Suntory

- Pernod Ricard

Recent Industry Developments

In 2024 Anheuser Busch InBev, recorded total revenue of USD 59.77 billion, up 2.7% over 2023, although volumes fell by 1.4%—showing that growth is increasingly value-led rather than volume-led.

In 2025 Accolade Wines, completed a merger and rebranded as Vinarchy, creating a specialist global wine company with more than AUD 1.5 billion (≈USD 1 billion) in annual net sales and 1,600 employees.

Report Scope

Report Features Description Market Value (2024) USD 10.3 Bn Forecast Revenue (2034) USD 16.3 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Alcohol Type (Beers, Distilled Spirits, Wines, Cocktails, Others), By Packaging (Bottles, Cans, Others), By Distribution channel (Hyper/Supermarket, Specialty Store, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Accolade Wines, Molson Coors Brewing, Arbor Mist Winery, E & J Gallo Winery, Anheuser-Busch, Brown-Forman, Carlsberg, Bacardi, Beam Suntory, Pernod Ricard Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fruit Flavored Alcoholic Beverages MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Fruit Flavored Alcoholic Beverages MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accolade Wines

- Molson Coors Brewing

- Arbor Mist Winery

- E & J Gallo Winery

- Anheuser-Busch

- Brown-Forman

- Carlsberg

- Bacardi

- Beam Suntory

- Pernod Ricard