Global Freight Transport Market Size, Share, Growth Analysis By Offering (Solution [Freight Transportation Cost Management, Freight Mobility Solution, Freight Security & Monitoring System, Fleet Tracking & Maintenance Solution, Freight Operational Management Solutions, Freight 3PL Solution], Services),By Mode Of Transport (Railways, Roadways, Seaways, Airways), By End-Use Industry (Automotive, Retail & E-commerce, Manufacturing & Industrial, Food & Beverage, Pharmaceuticals & Healthcare, Oil & Gas, Chemicals, Construction & Infrastructure, Technology & Electronics, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175557

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

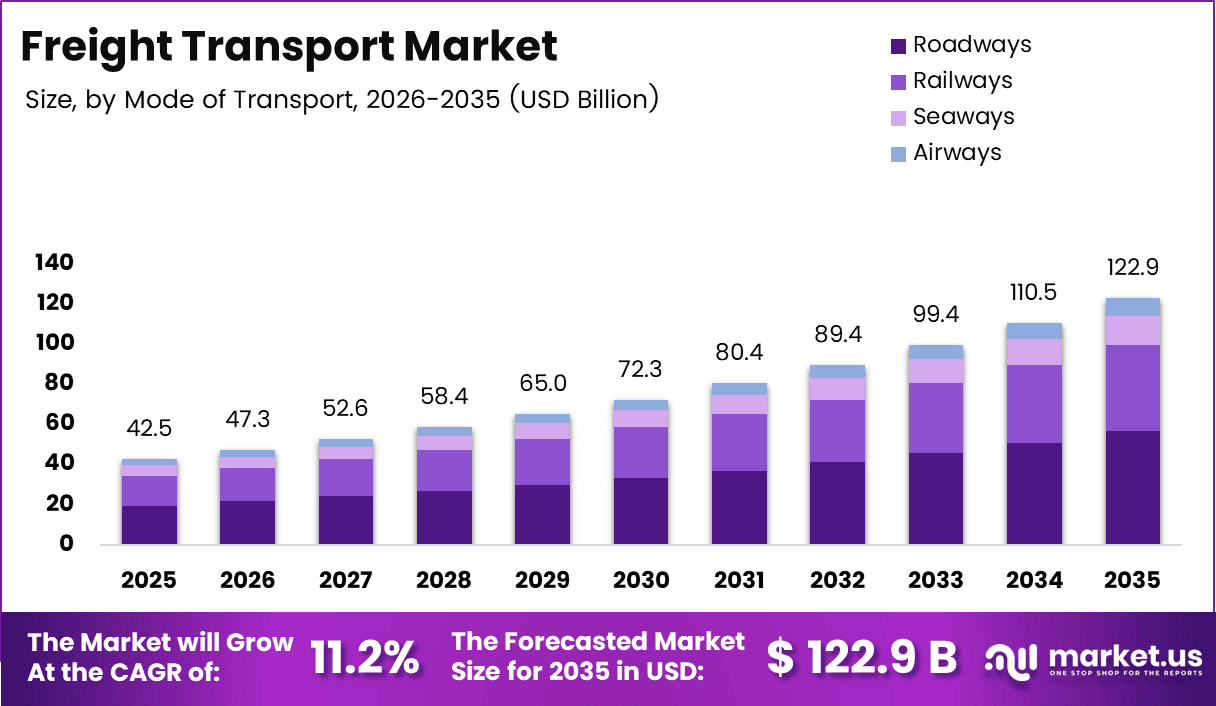

The Global Freight Transport Market size is expected to be worth around USD 122.9 billion by 2035, from USD 42.5 billion in 2025, growing at a CAGR of 11.2% during the forecast period from 2026 to 2035.

The Freight Transport Market fundamentally encompasses the systematic movement of goods and commodities across various transportation modes including road, rail, sea, and air. This essential industry serves as the backbone of global commerce, facilitating trade connections between manufacturers, distributors, and end consumers worldwide

through integrated logistics networks.

Understanding the freight transport landscape requires recognizing its critical role in enabling international trade flows. Maritime shipping dominates this ecosystem, as approximately 90% of global trade moves through ocean routes, establishing seas as primary conduits for commercial exchange. This maritime dominance underscores the industry’s heavy reliance on containerized shipping solutions for efficient cargo handling.

Container standardization has revolutionized freight efficiency remarkably. Standard containers measuring

20 or 40 feet in length and 8.5 feet in height enable systematic stacking on vessels, while high-cube variants reaching 9.5 feet provide enhanced cargo capacity. These dimensional standards facilitate seamless intermodal transfers, reducing handling costs and transit times significantly.Growth opportunities within this market remain substantial despite mounting environmental pressures. Road transport emerges as the fastest-expanding segment, driving demand for last-mile delivery solutions and regional distribution networks. However, this growth trajectory necessitates addressing sustainability concerns, as freight operations contribute approximately 8% of global greenhouse gas emissions, escalating to 11% when warehousing and port facilities are included.

Furthermore, road freight accounts for 65% of sector emissions and 80% of increased global diesel consumption, highlighting urgent decarbonization needs. Transportation equipment additionally generates

over 20% of worldwide black carbon emissions, representing a critical short-lived climate pollutant

requiring immediate mitigation strategies.Analyzing modal efficiency reveals significant disparities: air freight transports 303 billion tonne-kilometers while emitting 155 million tonnes of CO2, whereas rail achieves 10,842 billion tonne-kilometers with 170 million tonnes. Road freight carries 26,807 billion tonne-kilometers producing 2,230 million tonnes, while maritime and inland waterways handle 101,486 billion tonne-kilometers emitting 657 million tonnes

of CO2. These metrics indicate government regulations increasingly favor lower-emission alternatives, steering investment toward sustainable infrastructure and cleaner fuel technologies.Key Takeaways

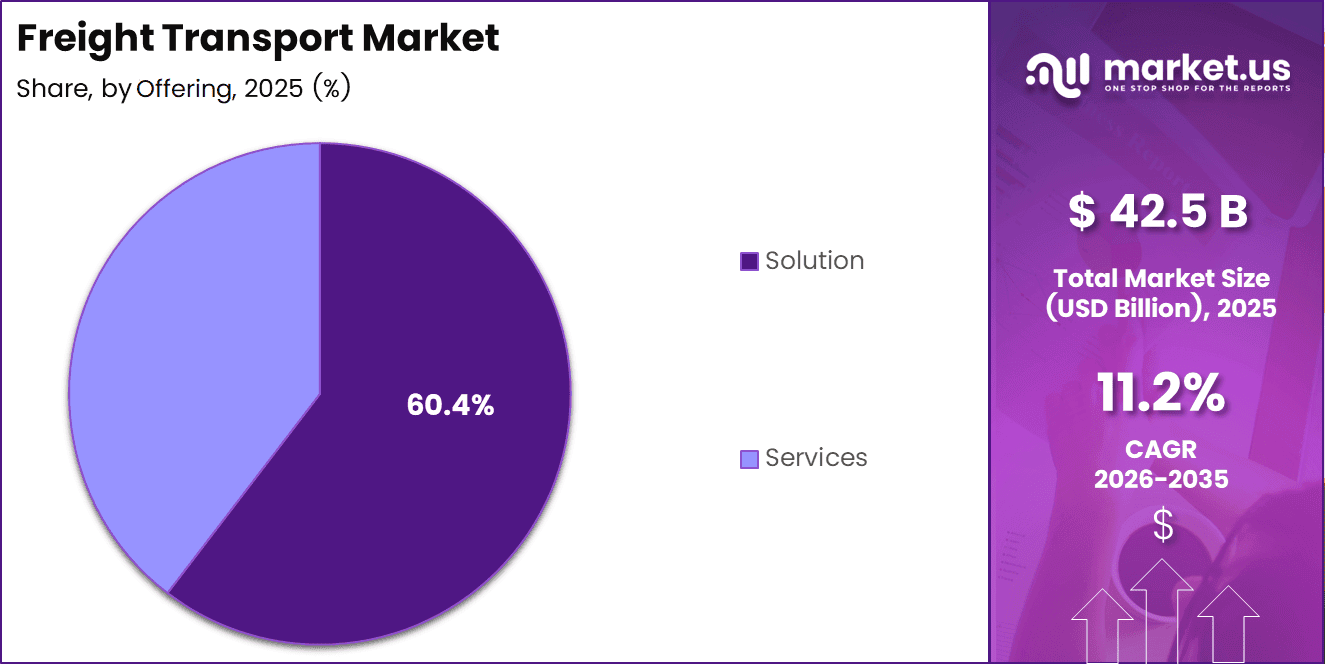

- The global freight transport market was valued at USD 42.5 billion in 2025 and is projected to grow at a CAGR of 11.2% through 2035.

- By solution, freight solutions dominated the market with a share of 60.4%, driven by digitalization and integrated freight management adoption.

- By mode of transport, roadways held the largest share at 45.9%, supported by extensive networks and strong last-mile delivery demand.

- By end-use industry, retail and e-commerce emerged as the leading segment with a market share of 20.5%, fueled by rising online shopping volumes.

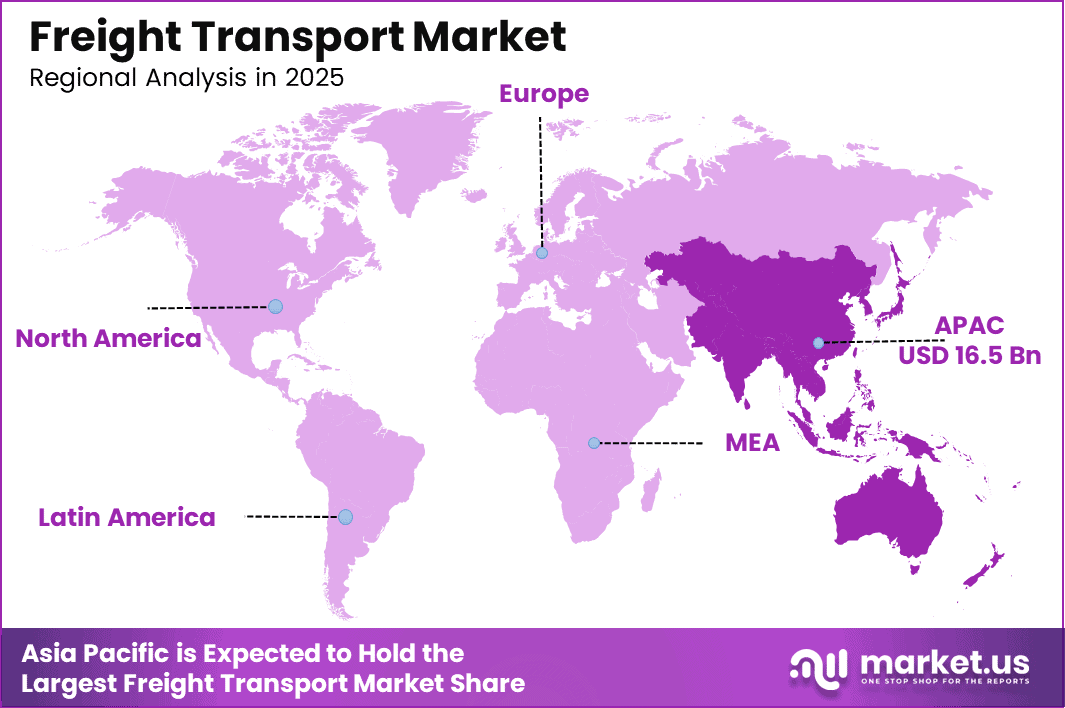

- Regionally, Asia Pacific dominated the freight transport market with a share of 38.9%, valued at USD 16.5 billion, supported by manufacturing growth and trade expansion.

Offering Analysis

Solution dominates with 60.4% due to rising digitalization, cost optimization needs, and integrated freight management adoption.

Freight Transportation Cost Management solutions help companies reduce operational expenses through route planning and fuel optimization. Moreover, these tools support better budgeting and margin control across complex freight networks.

Freight Mobility Solutions enhance shipment movement visibility and coordination. As a result, logistics providers improve delivery speed, asset utilization, and customer satisfaction across domestic and cross-border freight operations.

Freight Security & Monitoring Systems focus on cargo safety and theft prevention. Consequently, real-time tracking, alerts, and compliance tools reduce losses and strengthen shipper confidence.

Fleet Tracking & Maintenance Solutions improve vehicle uptime and operational efficiency. Therefore, predictive maintenance and tracking capabilities lower breakdown risks and support long-term fleet performance.

Freight Operational Management Solutions streamline workflows, documentation, and carrier coordination. Thus, businesses achieve smoother freight execution and better control over daily logistics activities.

Freight 3PL Solutions support outsourcing of logistics operations. In turn, shippers gain flexibility, scalability, and access to expert freight handling services.

Services provide consulting, integration, and support functions. These services ensure successful implementation, system optimization, and long-term performance improvements.

Mode of Transport Analysis

Roadways dominate with 45.9% due to flexibility, extensive networks, and strong last-mile delivery demand.

Railways support long-distance bulk freight with cost efficiency. Moreover, rail transport offers lower emissions and improved reliability for heavy industrial shipments.

Roadways enable fast, flexible, and door-to-door freight movement. Therefore, they remain essential for regional distribution and last-mile logistics operations.

Seaways handle large cargo volumes efficiently across international routes. Consequently, maritime transport remains vital for global trade and containerized freight.

Airways serve time-sensitive and high-value shipments. As a result, air freight supports urgent deliveries despite higher transportation costs.

By End-Use Industry Analysis

Retail & E-commerce dominates with 20.5% driven by rising online shopping and fast delivery expectations.

Automotive freight supports just-in-time manufacturing and spare parts distribution. Therefore, efficient transport minimizes production delays and inventory costs.

Retail & E-commerce demand fast, reliable, and scalable freight services. Consequently, logistics providers focus on speed, accuracy, and last-mile efficiency.

Manufacturing & Industrial sectors rely on steady raw material and equipment transport. As a result, freight reliability directly impacts production continuity.

Food & Beverage freight prioritizes freshness and compliance. Hence, temperature-controlled logistics play a critical role.

Pharmaceuticals & Healthcare require secure and compliant transport. Thus, traceability and quality assurance remain essential.

Oil & Gas freight supports heavy equipment and material movement. Therefore, specialized logistics solutions are necessary.

Chemicals transportation demands safety and regulatory adherence. As a result, controlled handling is crucial.

Construction & Infrastructure rely on bulk material transport. Hence, timely delivery supports project schedules.

Technology & Electronics require careful handling of high-value goods. Consequently, secure logistics solutions are preferred.

Agriculture freight enables farm-to-market connectivity. Thus, efficient transport reduces spoilage and losses.

Others include diverse industries with customized freight needs. Therefore, flexible transport solutions remain important.

Key Market Segments

By Offering

- Solution

- Freight Transportation Cost Management

- Freight Mobility Solution

- Freight Security & Monitoring System

- Fleet Tracking & Maintenance Solution

- Freight Operational Management Solutions

- Freight 3PL Solution

- Services

By Road Of Transport

- Railways

- Roadways

- Seaways

- Airways

By End-Use Industry

- Automotive

- Retail & E-commerce

- Manufacturing & Industrial

- Food & Beverage

- Pharmaceuticals & Healthcare

- Oil & Gas

- Chemicals

- Construction & Infrastructure

- Technology & Electronics

- Agriculture

- Others

Drivers

Increasing Global E-commerce Demand Driving Last-Mile Delivery Volumes

The freight transport market is strongly driven by the rapid growth of global e-commerce. As more consumers prefer online shopping, the need for fast and reliable delivery services has increased. This directly raises demand for freight transport, especially for last-mile delivery operations in urban and semi-urban areas. From an analyst’s view, logistics providers are expanding fleets and delivery networks to handle higher parcel volumes efficiently.

Another major driver is the expansion of international trade routes and shipping networks. Growing cross-border trade has increased the movement of raw materials and finished goods across regions. Freight transport plays a key role in supporting global supply chains and ensuring timely delivery.

The adoption of advanced logistics and supply chain management technologies is also supporting market growth. Digital tools improve tracking, route planning, and inventory control, helping companies reduce delays and costs.

Additionally, rising investment in cold chain and specialized freight solutions is boosting demand. Industries such as food, pharmaceuticals, and chemicals require temperature-controlled transport, increasing the need for advanced freight services.

Restraints

Increasing Global E-commerce Demand Driving Last-Mile Delivery Volumes

The freight transport market faces restraints mainly due to fuel price volatility. Fluctuating fuel costs directly affect operational expenses for transport companies. From an analyst perspective, sudden price increases reduce profit margins and make cost planning difficult. Smaller operators are more vulnerable, as they have limited ability to absorb rising fuel expenses or pass costs to customers.

Another key restraint is the presence of stringent environmental regulations and emission compliance requirements. Governments across regions are enforcing strict emission norms to reduce pollution. While these rules support sustainability, they increase compliance costs for freight operators.

Companies must invest in cleaner vehicles, upgraded engines, and emission control technologies. This raises capital expenditure and maintenance costs. For developing markets, adapting to these regulations can slow fleet expansion.

Overall, fuel cost uncertainty and regulatory pressure create operational challenges. These factors may limit short-term growth, especially for companies with older fleets and limited financial flexibility.

Growth Factors

Increasing Global E-commerce Demand Driving Last-Mile Delivery Volumes

The freight transport market offers strong growth opportunities due to the development of autonomous and electric freight vehicles. These technologies can reduce fuel dependency, lower emissions, and improve long-term operating efficiency. Analysts see electric trucks as a key solution for urban and short-haul transport.

Integration of IoT and AI for real-time fleet monitoring is another major opportunity. Smart systems help track vehicle performance, cargo condition, and delivery timelines. This improves decision-making, reduces downtime, and enhances customer service.

Expansion in emerging markets with rising industrialization also creates growth potential. As manufacturing and trade activities increase, demand for reliable freight transport services grows steadily.

Furthermore, investment in sustainable and low-emission transport infrastructure supports future market expansion. Green logistics initiatives attract government support and long-term contracts from environmentally focused businesses.

Emerging Trends

Increasing Global E-commerce Demand Driving Last-Mile Delivery Volumes

One of the key trends in the freight transport market is the surge in digital freight platforms connecting shippers and carriers. These platforms improve transparency, pricing efficiency, and load matching. Analysts note that digitalization is reducing manual processes and improving market access.

There is also a growing preference for multimodal transport solutions. Companies increasingly combine road, rail, sea, and air transport to optimize costs and delivery time. This trend supports flexible and resilient supply chains.

Increased use of data analytics to optimize routes and reduce costs is another major trend. Data-driven planning helps reduce fuel usage, delivery delays, and operational risks.

Lastly, rising demand for temperature-controlled and pharmaceutical logistics is shaping market trends. Growth in healthcare and biotech sectors is increasing the need for specialized freight transport services.

Regional Analysis

Asia Pacific Dominates the Freight Transport Market with a Market Share of 38.9%, Valued at USD 16.5 Billion

Asia Pacific leads the global freight transport market, driven by strong manufacturing activity, expanding e-commerce, and large-scale infrastructure development. The region accounted for a dominant share of 38.9%, with the market valued at USD 16.5 billion. Rapid urbanization, rising trade volumes, and growing cross-border logistics within countries such as China and India continue to support steady freight demand.

North America Freight Transport Market Trends

North America represents a mature and well-structured freight transport market supported by advanced logistics networks. Strong demand from retail, automotive, and industrial sectors drives consistent freight movement across road, rail, and intermodal transport. High adoption of digital logistics platforms further improves operational efficiency and service reliability.

Europe Freight Transport Market Trends

Europe’s freight transport market is shaped by strong intra-regional trade and well-developed transport infrastructure. The region emphasizes sustainable freight solutions, with increasing use of rail and low-emission vehicles. Regulatory focus on carbon reduction is influencing logistics strategies and long-term investment decisions.

Middle East and Africa Freight Transport Market Trends

The Middle East and Africa region is witnessing gradual growth due to rising trade activities and infrastructure investments. Expansion of ports, logistics hubs, and cross-border corridors is improving freight connectivity. Growth is also supported by increasing demand from energy, construction, and consumer goods sectors.

Latin America Freight Transport Market Trends

Latin America shows moderate growth in freight transport, supported by improving road networks and regional trade agreements. Agricultural exports and mining activities generate steady freight demand. However, ongoing investments in logistics infrastructure are expected to enhance transport efficiency and regional connectivity over time.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Freight Transport Company Insights

In 2025, the global freight transport market continues to be shaped by major logistics powerhouses that drive innovation, efficiency, and resilience in an increasingly complex supply chain environment. At the forefront, DHL Supply Chain & Global Forwarding remains a dominant force, leveraging its expansive global network and advanced digital solutions to meet the evolving needs of multinational clients, particularly in e-commerce and cross-border transportation.

Another key player, Kuehne + Nagel International AG maintains its leadership through a strong focus on customer-centric services and strategic investments in technology, enabling seamless integration across air, sea, and road freight operations to support end-to-end supply chain visibility. Meanwhile, DB Schenker is reinforcing its competitive position with robust sustainability initiatives and innovative logistics solutions that cater to sectors such as automotive and industrial manufacturing, bolstering its reputation for operational excellence.

DSV Global Transport and Logistics continues to expand its footprint through targeted acquisitions and capacity enhancements, ensuring scalable and flexible freight solutions that adapt to fluctuating market demands while optimizing cost efficiencies. Together, these four companies exemplify the critical trends in the freight transport market, from digital transformation and sustainability to strategic network expansion.

As competition intensifies, their strategies set benchmarks for service quality and operational agility, influencing how supply chains are designed and executed worldwide. Their performance in 2025 will be crucial in determining how effectively the industry can navigate geopolitical uncertainties, regulatory changes, and the ongoing push toward greener logistics.

Top Key Players in the Market

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel International AG

- DB Schenker

- DSV Global Transport and Logistics

- C.H. Robinson Worldwide

- Expeditors International of Washington

- Sinotrans Limited

- GEODIS

- CEVA Logistics

- UPS Supply Chain Solutions

- Nippon Express

- Yusen Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

- Toll Group

- Other Key Players

Recent Developments

- In September 2025, CMA CGM announced the acquisition of Freightliner UK Intermodal Logistics, strengthening its rail freight capabilities and expanding intermodal logistics operations across the United Kingdom.

- In February 2025, SG Holdings announced the acquisition of shares in Morrison Express to enhance its global supply chain reach and expand integrated logistics service offerings worldwide.

Report Scope

Report Features Description Market Value (2025) USD 42.5 billion Forecast Revenue (2035) USD 122.9 billion CAGR (2026-2035) 11.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offring (Solution [Freight Transportation Cost Management, Freight Mobility Solution, Freight Security & Monitoring System, Fleet Tracking & Maintenance Solution, Freight Operational Management Solutions, Freight 3PL Solution],Services), By Mode of Transport (Railways, Roadways, Seaways, Airways), By End-Use Industry (Automotive, Retail & E-commerce, Manufacturing & Industrial, Food & Beverage, Pharmaceuticals & Healthcare, Oil & Gas, Chemicals, Construction & Infrastructure, Technology & Electronics, Agriculture, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DHL Supply Chain & Global Forwarding, Kuehne + Nagel International AG, DB Schenker, DSV Global Transport and Logistics, C.H. Robinson Worldwide, Expeditors International of Washington, Sinotrans Limited, GEODIS, CEVA Logistics, UPS Supply Chain Solutions, Nippon Express, Yusen Logistics, Agility Logistics, Hellmann Worldwide Logistics, Toll Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel International AG

- DB Schenker

- DSV Global Transport and Logistics

- C.H. Robinson Worldwide

- Expeditors International of Washington

- Sinotrans Limited

- GEODIS

- CEVA Logistics

- UPS Supply Chain Solutions

- Nippon Express

- Yusen Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

- Toll Group

- Other Key Players