Global Food Festival Insurance Market By Type (General Liability Insurance, Liquor Liability Insurance, Property Insurance, Event Cancellation Insurance, Others), By Coverage (Onsite Vendors, Organizers, Attendees, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Food Festival Organizers, Food Vendors, Venue Owners, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176139

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Driver Impact Analysis

- Restraint Impact Analysis

- Type Analysis

- Coverage Analysis

- Distribution Channel Analysis

- End-User Analysis

- Investment Opportunities

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

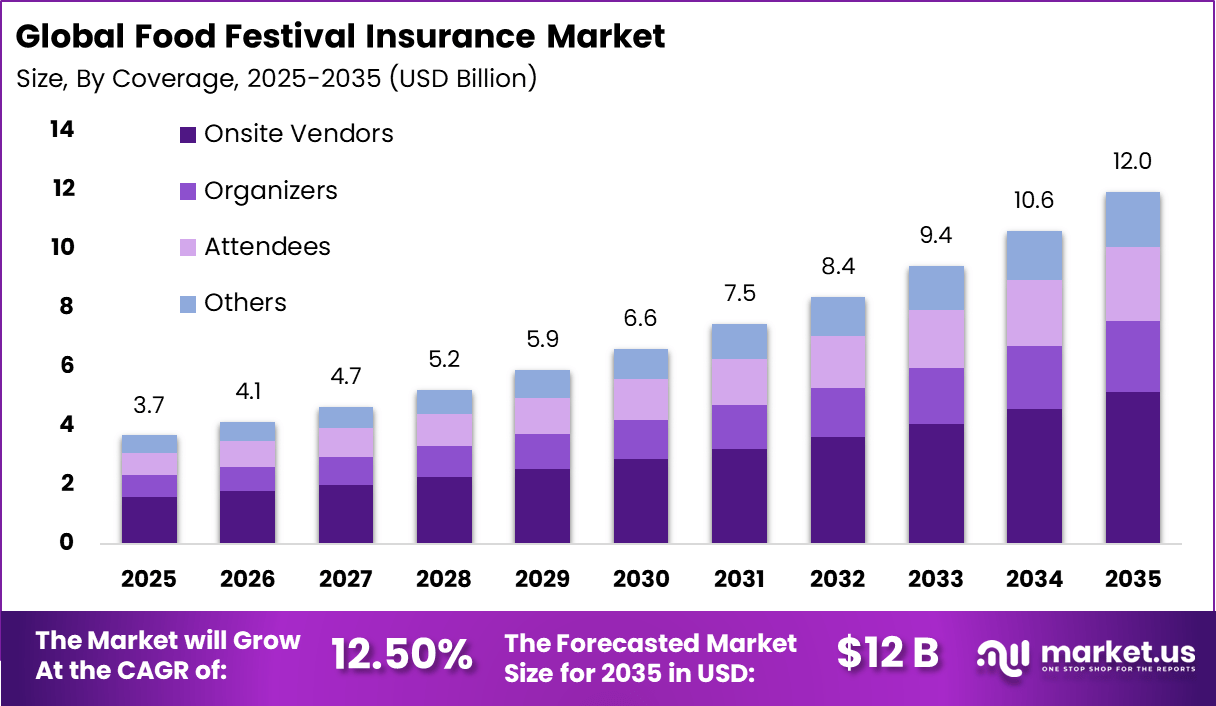

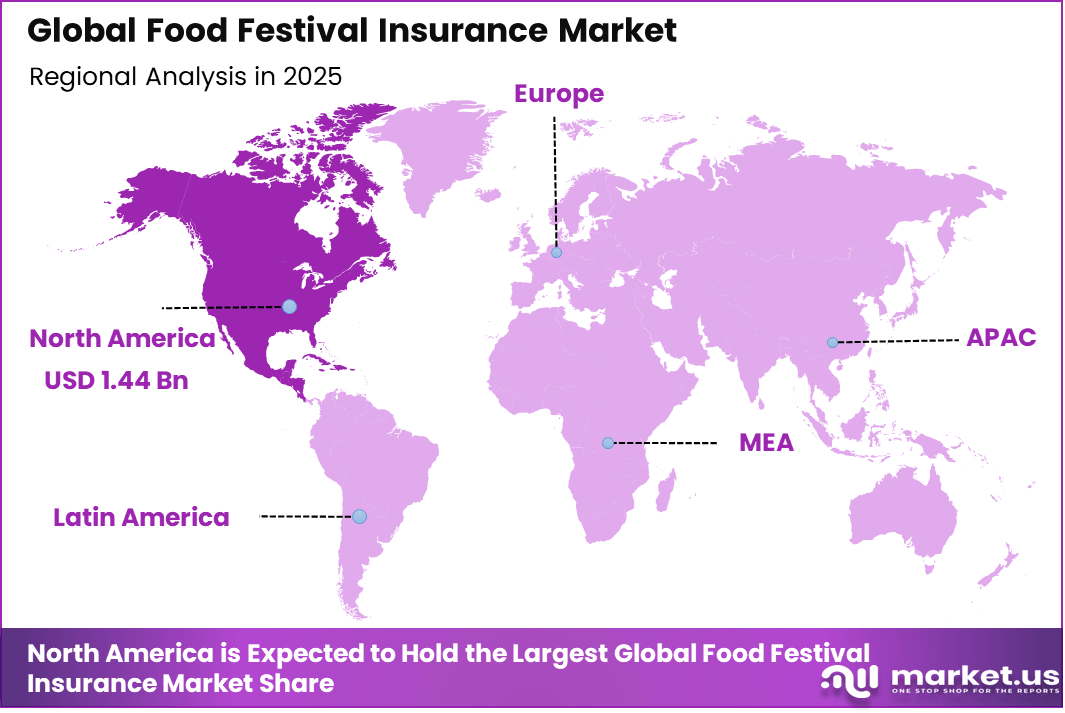

The Global Food Festival Insurance Market generated USD 3.7 billion in 2025 and is predicted to register growth from USD 4.1 billion in 2026 to about USD 12 billion by 2035, recording a CAGR of 12.50% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 39.3% share, holding USD 1.44 Billion revenue.

The Food Festival Insurance Market refers to specialized insurance coverage designed to protect organizers, vendors, sponsors, and venue owners involved in food focused public events. These policies address risks related to public liability, food safety incidents, property damage, event cancellation, and vendor operations. Food festivals typically involve large crowds, temporary structures, live cooking, and alcohol service, which together create a complex risk environment.

Food festival insurance is structured to cover both single day community events and large multi day festivals. Coverage often extends across organizers and participating food vendors operating under one event umbrella. Industry observations show that food festivals can attract thousands of attendees within short timeframes, significantly increasing exposure to injury and contamination risks. This concentration of risk sustains consistent demand for tailored insurance solutions.

One of the primary driving factors is the increasing number of food festivals hosted by cities, tourism boards, and private organizers. Culinary tourism and street food culture have expanded rapidly, leading to more frequent large scale events. As attendance grows, so does liability exposure. Insurance is used to manage these heightened public safety risks.

Demand for food festival insurance is growing among professional event organizers and municipalities. Many venues and local authorities require proof of insurance before issuing event permits. Internal event industry reviews indicate that more than 70% of public food events now require documented liability coverage. This requirement directly drives insurance adoption.

Top Market Takeaways

- By type, general liability insurance accounts for 40.7% of the market, providing essential coverage for bodily injury claims, property damage, and legal defense during food festivals.

- By coverage, onsite vendors represent 43.2% of the market, focusing on protections for food stalls, equipment breakdowns, and product liability in high-traffic event settings.

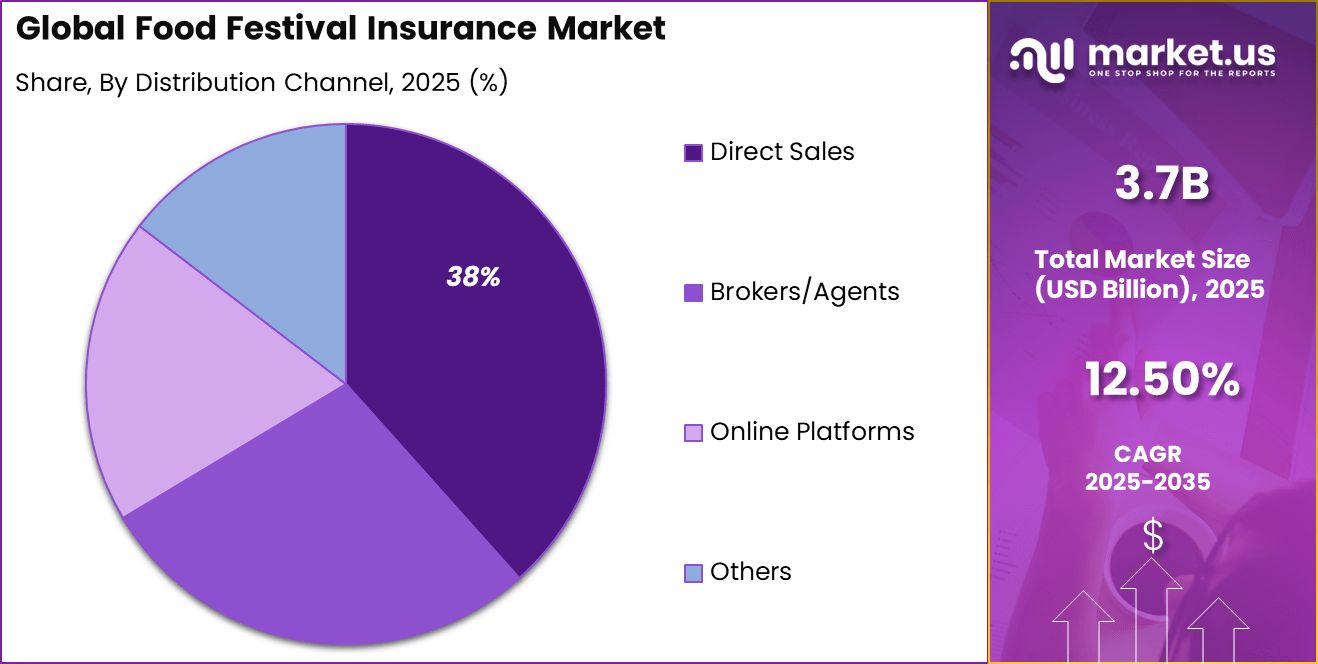

- By distribution channel, direct sales hold 38.4% share, enabling festival organizers to purchase tailored policies quickly through insurers’ online platforms or agents without intermediaries.

- By end-user, food festival organizers capture 45.6% of the market, driven by needs for comprehensive event cancellation, non-appearance, and public liability coverage.

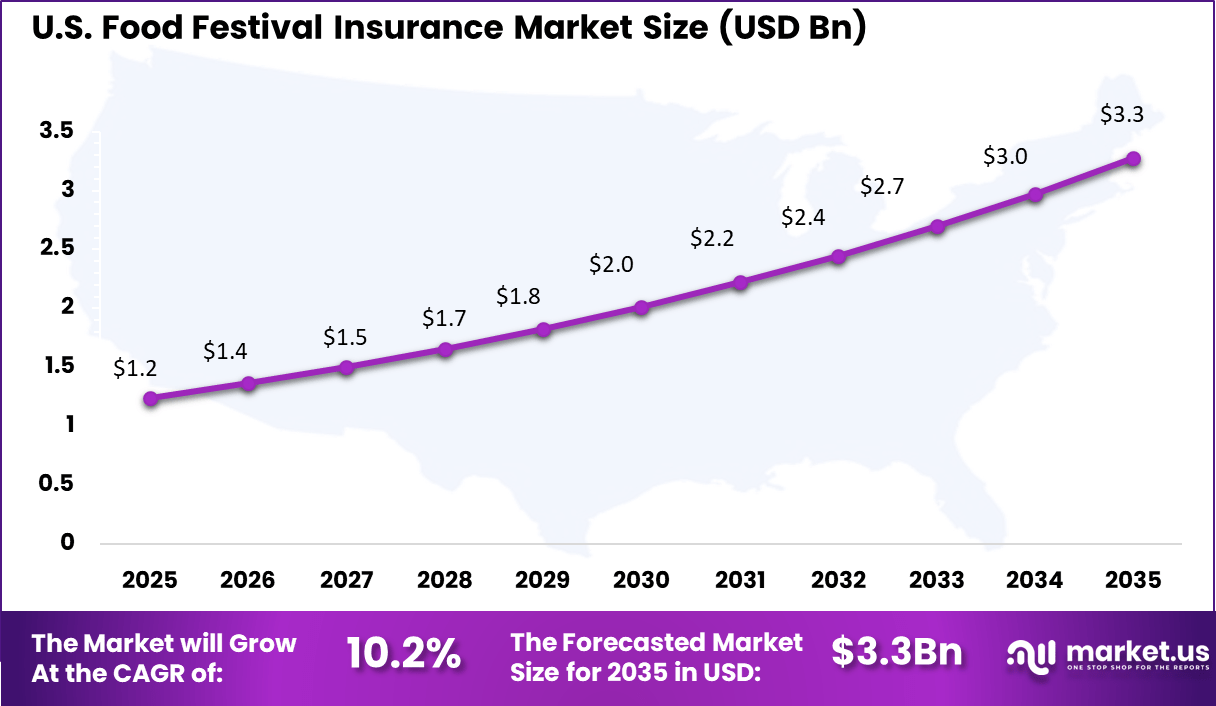

- By region, North America leads with 39.3% of the global market, where the U.S. is valued at USD 1.24 billion with a projected CAGR of 10.2%, supported by rising event frequencies and regulatory mandates for public gatherings.

Key Insights Summary

Adoption Rates

- Around 86.2% of food vendors at organized festivals are required to present valid insurance coverage as part of permit or contract conditions.

- Adoption among event organizers remains very high and contributes nearly 45.7% of total growth within festival specific insurance segments.

- Approximately 25% of gig workers, including temporary festival staff, do not actively consider insurance when accepting secondary work, indicating a coverage gap.

- Despite strong compliance at large scale events, nearly 40% of small food business owners reported lacking business insurance in 2025, mainly due to rising operating expenses.

Usage and Claims Statistics

- About 28% of insurance claims occur during transit or event setup, primarily linked to auto or trailer related incidents.

- On site liability claims account for 18% of cases involving third party damage, while equipment failure and food spoilage each represent 13% of total claims.

- The average claim payout stands at USD 4,632, indicating meaningful financial protection for small vendors when incidents occur.

- In the US, the highest concentration of claims is reported in California, Texas, and Florida, reflecting higher festival activity levels in these states.

Driver Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising number of large-scale food festivals and public events +3.4% North America, Europe Short to medium term Increased awareness of liability, crowd safety, and event disruption risks +2.9% North America, Europe Short term Stricter regulatory and permitting requirements for public events +2.4% North America, Europe Medium term Higher participation from sponsors and commercial vendors +2.1% Global Medium term Growing exposure to weather-related cancellations and delays +1.7% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High premium costs for small and independent event organizers -2.3% Emerging Markets Short to medium term Limited insurance awareness among informal or community festivals -1.9% Asia Pacific, Latin America Medium term Complexity of multi-coverage event insurance policies -1.6% Global Medium term Budget sensitivity during periods of economic uncertainty -1.4% Global Medium term Inconsistent enforcement of insurance requirements -1.1% Emerging Markets Long term Type Analysis

General liability insurance held a dominant share of 40.7%, reflecting its role as the core coverage type for food festivals. This dominance is driven by the broad protection it provides against bodily injury, property damage, and third-party claims. Most venues and city authorities explicitly require general liability coverage as part of event licensing agreements.

The nature of food festivals involves direct interaction between vendors and the public, which significantly raises the probability of slip-and-fall incidents and accidental injuries. Industry claim records show that crowd movement, temporary seating, and shared dining spaces contribute to frequent minor injury claims.

General liability insurance addresses these risks through standardized coverage terms that are widely understood by regulators and venue owners. Its clarity and acceptance support its continued dominance within the market.

Coverage Analysis

Coverage focused on onsite vendors accounted for 43.2%, highlighting the central risk posed by food preparation and direct sales activities. Onsite vendors are responsible for cooking, storage, and serving, which directly links them to food safety incidents.

Insurance policies increasingly extend coverage to include individual vendors under a master event policy. This approach reduces administrative burden while ensuring consistent risk management standards. Foodborne illness claims represent one of the most financially damaging risks at food festivals.

Public health records in North America indicate that temporary food events face higher compliance scrutiny due to limited infrastructure and high turnover. Insurance coverage for onsite vendors helps address medical costs, legal defense, and settlement expenses arising from such incidents. This has made vendor-focused coverage a priority for both organizers and insurers.

Distribution Channel Analysis

Direct sales represented 38.4%, reflecting strong reliance on direct engagement between event organizers and insurers or licensed agents. Food festivals often operate on tight timelines, making rapid policy issuance essential. Direct sales channels enable faster customization, clearer communication, and quicker proof-of-insurance delivery. These advantages are particularly important for short-term and seasonal events.

Event organizers typically require guidance on coverage limits, exclusions, and compliance requirements. Direct sales allow insurers to assess event-specific risks such as attendance volume, alcohol service, and cooking methods. This risk-based underwriting improves policy accuracy and reduces claim disputes. As a result, direct sales remain the preferred channel for complex or high-attendance festivals.

End-User Analysis

Food festival organizers accounted for 45.6%, underscoring their central role as policyholders and risk coordinators. Organizers carry primary responsibility for attendee safety, vendor compliance, and venue obligations. Insurance policies are typically issued in their name, with extensions covering vendors and partners. This structure places organizers at the core of insurance decision-making.

Organizers face multidimensional risk exposure, including cancellation losses, liability claims, and reputational damage. Insurance adoption is increasingly viewed as a governance requirement rather than a legal formality. Internal risk planning now integrates insurance coverage with emergency response and vendor management protocols. This integration has strengthened organizer-led demand.

As festivals scale in size and geographic reach, organizers manage multiple stakeholders, including sponsors and municipalities. Insurance coverage supports contractual obligations by naming these stakeholders as additional insureds. This reduces friction during event approvals and partnership negotiations. The growing complexity of event operations reinforces organizer dominance as the primary end user.

Investment Opportunities

Investment opportunities in the food festival insurance market are supported by the steady rise in large scale public food events across urban and semi urban regions. Event organizers are showing higher willingness to purchase tailored insurance coverage due to stricter safety rules and higher financial risk exposure.

This creates strong demand for customized policies covering food safety incidents, weather disruption, vendor liability, and crowd related risks. Insurers investing in flexible policy design, digital underwriting, and short term event coverage models are well positioned to capture consistent seasonal demand.

Investment Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialized event insurance providers High Medium North America, Europe Stable and predictable premium growth Large commercial insurers Medium Low to Medium Global Portfolio diversification opportunity Digital insurance platforms High Medium North America Growth through online distribution Private equity firms Medium Medium North America, Europe Attractive for niche consolidation Venture capital investors Medium High North America Focus on technology-enabled underwriting Emerging Trends Analysis

An emerging trend in the food festival insurance market is increased focus on food safety technology integration. Festival organisers are adopting digital hygiene tracking, temperature monitoring, and food handling verification tools. Insurers are aligning coverage incentives with adoption of these preventative technologies. This technology driven risk reduction supports improved underwriting outcomes.

Another trend is demand for cancellation and postponement coverage that accommodates public health risks such as disease outbreaks and regulatory shutdowns. COVID-related disruptions highlighted the need for flexible event protection. Coverage that responds to public health directives is gaining relevance.

Growth Factors Analysis

One of the key growth factors for the food festival insurance market is sustained consumer interest in experiential dining and cultural events. Food festivals attract diverse audiences and tourism dollars. Their popularity supports continued event proliferation, which in turn drives demand for risk management solutions.

Another growth factor is rising commercial participation by vendors, sponsors, and brand partners. As more businesses leverage food festivals for marketing and product exposure, contractual obligations and financial stakes increase. Insurance becomes a standard requirement to protect multi party interests.

Key Market Segments

By Type

- General Liability Insurance

- Liquor Liability Insurance

- Property Insurance

- Event Cancellation Insurance

- Others

By Coverage

- Onsite Vendors

- Organizers

- Attendees

- Others

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Platforms

- Others

By End-User

- Food Festival Organizers

- Food Vendors

- Venue Owners

- Others

Regional Analysis

North America accounted for 39.3% share, supported by a high concentration of food festivals, cultural events, and large scale public gatherings across the region. Event organizers and vendors have increasingly relied on food festival insurance to manage risks related to public liability, food safety, property damage, and event cancellation.

Demand has been driven by stricter venue requirements, higher insurance awareness, and rising costs associated with accidents and legal claims. The region’s well developed event management ecosystem has reinforced steady adoption of specialized insurance coverage.

The U.S. market reached USD 1.24 Bn and is projected to grow at a 10.2% CAGR, reflecting sustained growth in food based events and outdoor festivals. Adoption has been driven by increasing regulatory scrutiny, higher consumer safety expectations, and greater involvement of multiple stakeholders such as vendors, sponsors, and municipalities. Food festival insurance has helped U.S. organizers protect against claims related to foodborne illness, crowd incidents, and weather related disruptions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large global insurers such as Allianz SE, AXA XL, and Zurich Insurance Group hold strong positions in the food festival insurance market. Their coverage typically includes event cancellation, public liability, property damage, and product liability. Chubb Limited and Hiscox Ltd support mid-sized and large-scale festivals. These insurers benefit from strong underwriting expertise and global event portfolios. Demand is driven by rising attendance levels and stricter safety regulations.

Specialty and event-focused providers such as Markel Corporation, Tokio Marine HCC, and Great American Insurance Group emphasize tailored policies for food vendors and temporary venues. Event Insurance Services Ltd, CoverMyEvent, and EventCover focus on simplified, short-term coverage. These players address vendor liability, equipment breakdown, and weather-related risks. Adoption is supported by permit requirements and sponsor expectations.

Brokerage and advisory firms such as Marsh & McLennan Companies and Aon plc play a key role in structuring insurance programs. Travelers Companies, Inc., Liberty Mutual Insurance, Aviva plc, Intact Insurance, Beazley Group, OneBeacon Insurance Group, and Ansvar Insurance expand regional access. Other insurers enhance customization and competitive intensity across the market.

Top Key Players in the Market

- Allianz SE

- AXA XL

- Marsh & McLennan Companies

- Aon plc

- Zurich Insurance Group

- Hiscox Ltd

- Chubb Limited

- Event Insurance Services Ltd

- Intact Insurance

- Markel Corporation

- Tokio Marine HCC

- Travelers Companies, Inc.

- Liberty Mutual Insurance

- Aviva plc

- Beazley Group

- Great American Insurance Group

- OneBeacon Insurance Group

- CoverMyEvent

- EventCover

- Ansvar Insurance

- Others

Recent Developments

- February, 2025 – Allianz Commercial teamed up with SRC Special Risk Consortium to boost entertainment and event insurance across Germany, Austria, Switzerland, and Italy, targeting film and live events with tailored coverage.

- February, 2025 – Marsh McLennan snapped up McGriff Insurance Services for $7.75 billion, strengthening its brokerage muscle in specialty lines like special event insurance.

Report Scope

Report Features Description Market Value (2025) USD 3.7 Billion Forecast Revenue (2035) USD 12 Billion CAGR(2025-2035) 12.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (General Liability Insurance, Liquor Liability Insurance, Property Insurance, Event Cancellation Insurance, Others), By Coverage (Onsite Vendors, Organizers, Attendees, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Food Festival Organizers, Food Vendors, Venue Owners, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA XL, Marsh & McLennan Companies, Aon plc, Zurich Insurance Group, Hiscox Ltd, Chubb Limited, Event Insurance Services Ltd, Intact Insurance, Markel Corporation, Tokio Marine HCC, Travelers Companies, Inc., Liberty Mutual Insurance, Aviva plc, Beazley Group, Great American Insurance Group, OneBeacon Insurance Group, CoverMyEvent, EventCover, Ansvar Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Festival Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Food Festival Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- AXA XL

- Marsh & McLennan Companies

- Aon plc

- Zurich Insurance Group

- Hiscox Ltd

- Chubb Limited

- Event Insurance Services Ltd

- Intact Insurance

- Markel Corporation

- Tokio Marine HCC

- Travelers Companies, Inc.

- Liberty Mutual Insurance

- Aviva plc

- Beazley Group

- Great American Insurance Group

- OneBeacon Insurance Group

- CoverMyEvent

- EventCover

- Ansvar Insurance

- Others