Global Food Cold Chain Market Size, Share Analysis Report By Type (Cold-chain Storage, Cold-chain Transport, Monitoring Components), By Temperature Range (Chilled (0–4 °C), Frozen (-18 °C), Deep-Frozen/Ultra-low (Less-than-40 °C)), By Technology (RFID and Real-time Monitoring, IoT-Enabled Telematics, Automated Storage and Retrieval Systems), By Transport Mode (Road – Reefer Trucks and Trailers, Sea – Reefer Containers, Rail – Refrigerated Railcars, Air Cargo, Others), By Application (Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169422

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

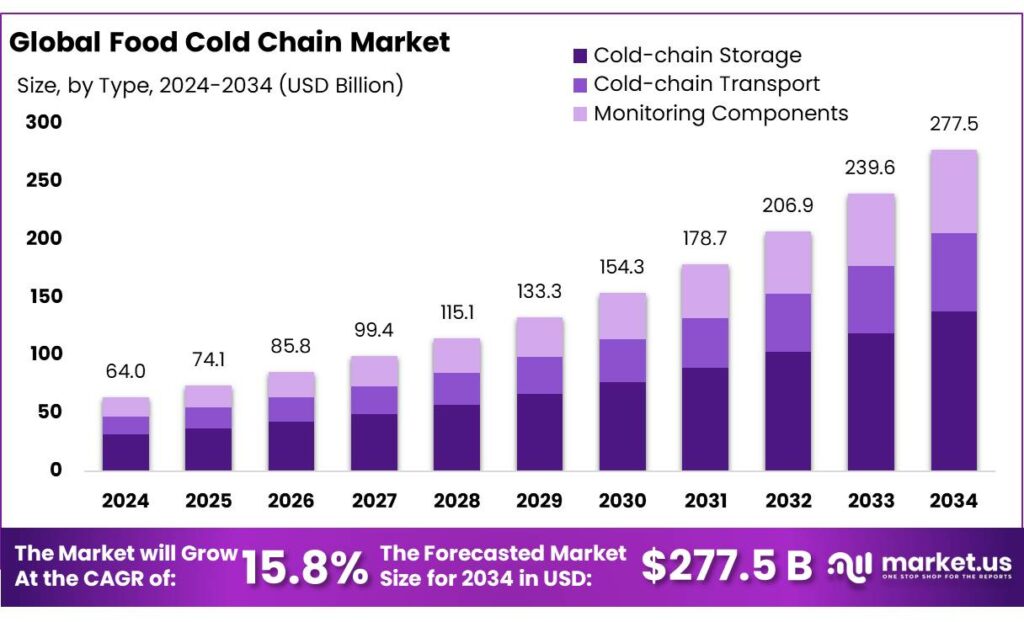

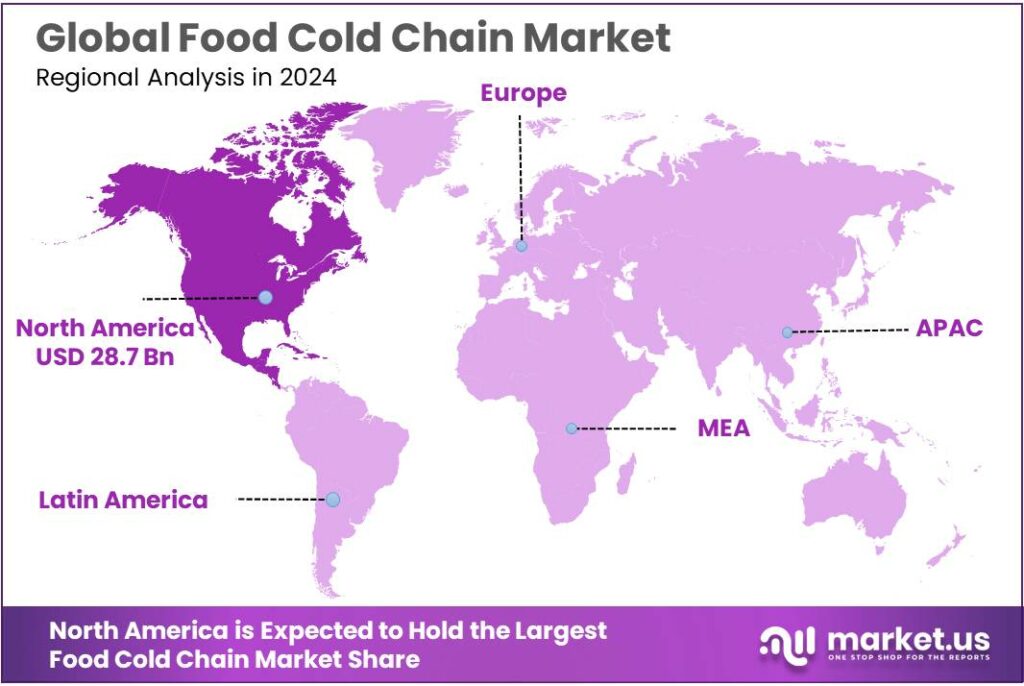

The Global Food Cold Chain Market size is expected to be worth around USD 277.5 Billion by 2034, from USD 64.0 Billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.90% share, holding USD 28.7 Billion revenue.

The food cold chain industry sits at the intersection of food security, energy systems and climate policy. Globally, weak or missing cold chains mean that about 13% of all food production is lost each year, equal to roughly 526 million tonnes of food that could feed around 950 million people. The UN estimates that 13.2% of food is lost between harvest and retail and a further 19% is wasted at household and food-service level. These figures frame the industrial role of cold chains: keeping temperature-sensitive products safe and marketable from farm to fork while reducing systemic waste.

From an energy perspective, the food cold chain is highly electricity-intensive. A recent technical review finds that cooling and freezing processes account for around 30% of electricity consumption in the food sector alone. At the same time, the International Energy Agency (IEA) notes that mandatory efficiency standards and labels already cover roughly 90% of global energy use for major end-uses such as space cooling and refrigeration. This combination of high demand but strong policy levers is defining the current industrial scenario: operators are under pressure to expand capacity while upgrading towards best-available, compliant equipment.

Driving forces are both food-system and energy-system related. UNEP reports that around 14% of food intended for human consumption is lost before reaching consumers, with poor cold chain infrastructure identified as a major contributor; aligning developing-country cold chains with developed ones could save about 144 million tonnes of food annually. In parallel, the IEA highlights that space cooling is now the fastest-growing source of energy demand in buildings, rising by almost 4% per year to 2035 under current policies, largely in emerging economies.

- Energy-linked government initiatives are reshaping how new cold chain capacity is built, especially in agrarian economies. In India, for example, estimates suggest that nearly 40% of horticultural produce is wasted due to inadequate cold storage, driving interest in distributed, solar-powered cold rooms near farms. Broader clean-energy schemes, such as India’s PM-KUSUM programme targeting 34,800 MW of new solar capacity with central support of ₹ 34,422 crore, including 1.4 million solar pumps, indirectly support cold chain growth by stabilizing rural power supply.

Key Takeaways

- Food Cold Chain Market size is expected to be worth around USD 277.5 Billion by 2034, from USD 64.0 Billion in 2024, growing at a CAGR of 15.8%.

- Cold-chain Storage held a dominant market position, capturing more than a 49.8% share.

- Chilled (0–4 °C) held a dominant market position, capturing more than a 44.3% share.

- RFID and Real-time Monitoring held a dominant market position, capturing more than a 34.9% share.

- Road – Reefer Trucks and Trailers held a dominant market position, capturing more than a 53.6% share.

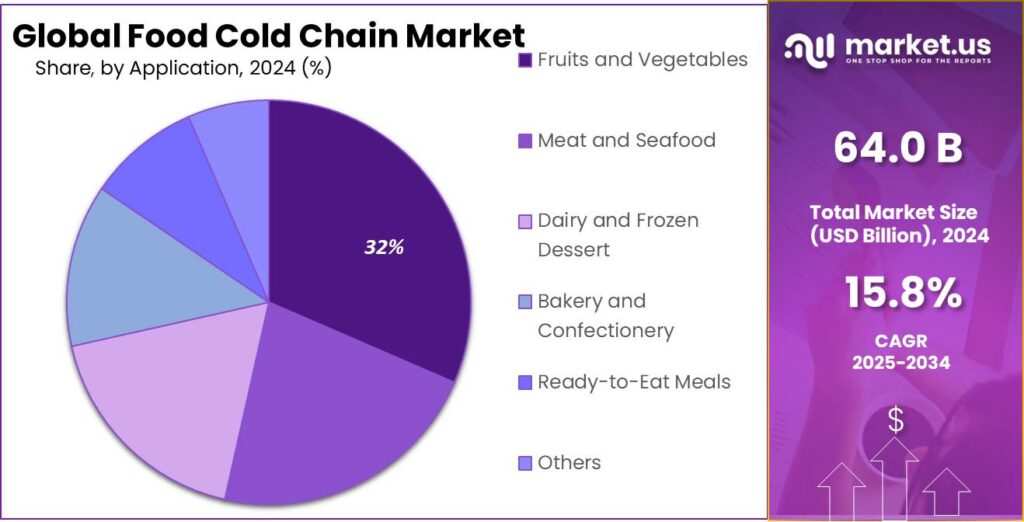

- Fruits and Vegetables held a dominant market position, capturing more than a 31.5% share.

- North America held a dominant position in the global food cold chain market, accounting for 44.90% of revenue USD 28.7 billion.

By Type Analysis

Cold-chain storage leads with a 49.8% share as the backbone of food preservation and distribution.

In 2024, Cold-chain Storage held a dominant market position, capturing more than a 49.8% share. The segment’s leadership can be attributed to expanding refrigerated warehousing capacity, stricter food-safety regulations and rising demand for temperature-controlled logistics across retail and foodservice channels. Investment in multi-temperature facilities and last-mile refrigerated vehicles was prioritised to reduce spoilage and extend shelf life, while consolidation of 3PL providers improved utilisation rates and operational reliability. Procurement decisions were influenced by total cost-of-ownership considerations, with operators favouring scalable storage that supports fresh, frozen and chilled SKUs.

By Temperature Range Analysis

Chilled (0–4 °C) leads with a 44.3% share due to its role in preserving freshness for perishables.

In 2024, Chilled (0–4 °C) held a dominant market position, capturing more than a 44.3% share. The segment was supported by growing demand for fresh dairy, ready-to-eat meals, fresh meat and produce that require tight temperature control to retain texture and safety. Investment in multi-chamber chilled facilities and temperature-monitored transport was intensified to reduce spoilage and meet regulatory traceability requirements. Retail and foodservice buyers preferred chilled inventory to balance shelf life with product quality, which improved turnover and reduced waste.

By Technology Analysis

RFID and real-time monitoring lead with a 34.9% share due to improved traceability and loss reduction.

In 2024, RFID and Real-time Monitoring held a dominant market position, capturing more than a 34.9% share. The segment was driven by the need for continuous temperature and location visibility across refrigerated storage and transport, which reduced spoilage and supported regulatory traceability; automated alerts and cloud-linked dashboards were adopted to enable faster corrective action and to optimise route planning. Investment in sensor networks and tag-based inventory control was justified by measurable reductions in waste and improved shelf-life management at retail and distribution nodes.

By Transport Mode Analysis

Road — Reefer trucks and trailers lead with a 53.6% share thanks to route flexibility and capacity.

In 2024, Road – Reefer Trucks and Trailers held a dominant market position, capturing more than a 53.6% share. The segment was supported by its ability to provide door-to-door service, flexible routing and multi-temperature configurations that met the varied needs of fresh, chilled and frozen cargoes. Investment in modern reefers improved fuel efficiency and temperature control, which reduced spoilage and lowered operating costs per pallet; this made road transport the preferred mode for short- and medium-distance moves and for last-mile deliveries.

By Application Analysis

Fruits and Vegetables lead the market with a strong 31.5% share due to rising demand for fresh produce.

In 2024, Fruits and Vegetables held a dominant market position, capturing more than a 31.5% share as demand for fresh, minimally processed produce continued to rise across both developed and emerging markets. The growth of this segment was supported by expanding retail networks, higher consumption of nutrient-rich foods, and the need to reduce post-harvest losses through reliable temperature-controlled handling. Investments in pre-cooling units, pack-house infrastructure, and improved reefer transport strengthened supply continuity and reduced wastage.

Key Market Segments

By Type

- Cold-chain Storage

- Cold-chain Transport

- Monitoring Components

By Temperature Range

- Chilled (0–4 °C)

- Frozen (-18 °C)

- Deep-Frozen/Ultra-low (<-40 °C)

By Technology

- RFID and Real-time Monitoring

- IoT-Enabled Telematics

- Automated Storage and Retrieval Systems

By Transport Mode

- Road – Reefer Trucks and Trailers

- Sea – Reefer Containers

- Rail – Refrigerated Railcars

- Air Cargo

- Others

By Application

- Fruits and Vegetables

- Meat and Seafood

- Dairy and Frozen Dessert

- Bakery and Confectionery

- Ready-to-Eat Meals

- Others

Emerging Trends

Shift Towards Sustainable, Low-Emission Cold Chains

One of the most important and hopeful recent trends in the food cold chain is the growing move toward sustainable, low-emission cooling systems — meaning cold chains that do not just preserve food, but do so in ways that are kinder to the planet and to communities. This shift reflects mounting global concern about climate change, food loss, energy use and greenhouse gas emissions; at the same time, it points to more resilient and inclusive food systems for the future.

According to a joint report by United Nations Environment Programme (UNEP) and Food and Agriculture Organization of the United Nations (FAO), food cold chains currently contribute roughly 4% of global greenhouse gas emissions — a combination of emissions from refrigeration technologies and emissions tied to waste when food spoils due to lack of cooling. Meanwhile, recent research published in 2024 estimated that total greenhouse-gas emissions from agrifood system cold chains reached 1.32 gigatonnes CO₂-equivalent in 2022 — more than double the levels from 2000.

Governments and institutions are responding. There is rising interest in adopting what the UNEP + FAO report calls a “system-level approach” — combining efficient refrigeration hardware, renewable power, better insulation, and policies that support clean cold chains. In some countries, national cold-chain development programmes now explicitly include guidelines for energy-efficient cooling, lower-GWP refrigerants, and sustainable cold-storage infrastructure. For example, these policy pushes draw on frameworks such as the Kigali Amendment under the Montreal Protocol — which aims to phase down high-global-warming-potential refrigerants.

The human side of this shift matters deeply. In developing countries — where cold-chain access has been historically weak — sustainable cold chains mean more than just lower emissions. They can help small farmers and rural communities gain fairer access to markets, reduce post-harvest food loss, and improve food security and nutrition. According to the UNEP–FAO report, if cold-chain coverage in developing regions rose to levels common in richer countries, those regions could collectively save around 144 million tonnes of food annually. That food could feed millions, reduce hunger, and improve incomes across rural communities.

Drivers

Reducing Food Loss and Waste as the Main Driver of Food Cold Chain Growth

Behind every new warehouse, reefer truck or pack-house investment in the food cold chain is a simple reality: the world throws away far too much food. The Food and Agriculture Organization (FAO) estimates that 13.2% of food is lost between harvest and retail stages in the supply chain. UNEP adds that a further 19% of food is wasted at retail, food-service and household level. When companies and governments look at these numbers, they see not just waste, but a very clear business case for stronger, more reliable cold chains.

For policy makers, food loss has become a front-line food security issue. UN analyses suggest that around 14% of global food production is lost before it even reaches markets, worth roughly USD 400 billion each year. At the same time, UNEP notes that food loss and waste together account for 8–10% of global greenhouse gas emissions. This dual pressure – feeding people better while cutting emissions – is pushing ministries of agriculture, energy and environment to treat cold chains as critical infrastructure, not just optional logistics.

Energy and climate agencies are reinforcing the same message. A joint FAO–UNEP report on sustainable food cold chains highlights that lack of effective refrigeration is a major contributor to food loss and that developing countries could save 144 million tonnes of food every year if they built cold chain infrastructure to levels seen in developed markets. For farmers, that means less produce rotting before sale; for cold chain companies, it signals a huge demand pipeline for pre-cooling units, cold rooms, reefer vehicles and frozen storage.

For businesses along the chain, the driver is very practical: every percentage point of loss avoided can translate into higher margins and more stable supply. FAO and UNEP point out that the world already produces enough food to feed everyone, but poor handling and weak cold chains mean hundreds of millions still face hunger. Retailers use cold rooms and chilled distribution to keep shelves stocked with fresh products longer.

Restraints

High Energy Costs and Capital Intensity Remain a Key Barrier to Food Cold Chain Expansion

One of the biggest restraints holding back the food cold chain, especially in developing and emerging economies, is the high cost of energy and infrastructure. Cold storage, freezing, and refrigerated transport all depend on reliable electricity, yet power supply remains expensive or unstable in many food-producing regions. According to the International Energy Agency (IEA), cooling-related electricity demand worldwide has more than tripled since 1990, and refrigeration and air conditioning together now account for close to 20% of global electricity use. For food cold chain operators, this translates directly into high operating costs that are difficult to pass on to farmers or consumers.

This energy burden is even more visible at the farm and aggregate level. The Food and Agriculture Organization (FAO) notes that in many low- and middle-income countries, electricity costs can represent 25–40% of total operating expenses for a cold storage facility. When power tariffs rise or supply becomes erratic, cold rooms are either underused or shut down entirely. As a result, farmers continue to sell quickly at lower prices, while cold chain assets remain financially risky investments.

The capital cost of building cold chain infrastructure also remains a major hurdle. FAO data show that post-harvest food losses in fruits and vegetables can reach 30–50% in the absence of adequate cooling. Ironically, the upfront cost needed to prevent these losses—such as pack-houses, pre-cooling units and controlled-atmosphere stores—often exceeds the financial capacity of farmer groups and local cooperatives. Commercial banks frequently view cold chain projects as high risk due to irregular cash flows and seasonal demand, limiting access to affordable credit.

Governments are trying to ease this restraint, but progress is uneven. In India, for example, the Ministry of New and Renewable Energy promotes solar-powered cold storage under broader farm and clean energy schemes, yet adoption remains limited compared to need. Official studies have long suggested that nearly 40% of fresh produce losses in the country are linked to gaps in cold chain infrastructure. Even with subsidies, upfront costs and maintenance challenges still discourage many first-time users.

Opportunity

Sustainable Cold Chains to Feed a Larger, Warmer World

One of the biggest growth opportunities for the food cold chain sits at the crossroads of food security and climate action. The Food and Agriculture Organization (FAO) estimates that about 14% of the world’s food is lost between harvest and retail, equal to roughly USD 400 billion in value every year. A joint FAO–UNEP assessment adds that a lack of effective refrigeration leads to the loss of around 526 million tonnes of food, roughly 12% of global production, and that better food cold chains in developing countries could save about 144 million tonnes annually. Turning this waste into sellable, nutritious food is a clear growth story for cold chain logistics, equipment makers and energy providers.

Demographics reinforce this opportunity. The United Nations projects that the global population will climb to about 9.8 billion people by 2050. FAO’s long-term outlook suggests that feeding a world of roughly 9.1 billion in 2050 would require raising overall food production by about 70% compared with 2005/07 levels. Analysts at the World Resources Institute further highlight that the world must close a significant “food gap” by 2050 for nearly 10 billion people, as rising incomes push diets towards more perishable, animal-based foods.

Energy trends create a second wave of opportunity. The International Energy Agency (IEA) finds that cooling is now the fastest-growing use of energy in buildings and warns that, without better efficiency, electricity demand for space cooling could more than triple by 2050. In 2022, space cooling delivered the largest increase in energy use among building end-uses, growing by over 3% in a single year. This rising demand is driving strong policy interest in high-efficiency compressors, natural refrigerants, thermal storage and demand-responsive cold warehouses.

Government and multilateral initiatives are already setting the tone. The FAO-backed “Food is Never Waste” coalition uses FAO data showing that around 14% of food, worth about USD 400 billion, is lost before retail as a rallying point for investment in loss-reducing infrastructure such as cold storage and refrigerated transport. Many countries are designing National Cooling Action Plans and implementing the Kigali Amendment to phase down high-GWP refrigerants, pushing the market towards modern, efficient systems. Development banks and climate funds are also experimenting with concessional finance for solar-powered rural cold rooms and efficient urban cold hubs, directly linking project finance to national climate and food-security goals.

Regional Insights

North America leads with a 44.90% share, valued at USD 28.7 billion in 2024

In 2024, North America held a dominant position in the global food cold chain market, accounting for 44.90% of revenue (USD 28.7 billion). This leadership was supported by high per-capita cold-chain spend, advanced refrigerated infrastructure, and stringent food-safety regulation that together increased demand for temperature-controlled warehousing, refrigerated transport and monitoring technologies.

Investment in modern cold storage capacity and automation was indicated by rising utilisation rates and higher capital expenditure among logistics operators in 2024, which reduced spoilage and improved inventory velocity. In addition, the region’s strong food-processing industry created sustained inflows of chilled and frozen SKUs that benefited reefer fleets and contract logistics providers. By 2025, demand was expected to remain robust as investment in energy-efficient refrigeration systems and real-time monitoring continued, and as retailers increased assortment of chilled ready-to-eat and frozen fresh products.

Key performance metrics in 2024 included elevated warehouse throughput, shortening lead times for refrigerated freight, and measurable reductions in shrink when RFID and IoT monitoring were deployed; these operational gains were reflected in higher revenue per pallet for cold-chain operators. North America’s dominant share was therefore attributed to scale, regulatory drivers, and technology adoption, which collectively reinforced the region’s position as the primary market for food cold-chain services and solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hydrofarm is a large manufacturer and distributor of components for controlled-environment agriculture (CEA), offering lighting, climate control, growing media and nutrients used by commercial growers and logistics operators handling perishable produce. The company supplies branded and private-label products through wholesale and retail channels and reported full-year 2024 disclosures describing its scale and restructuring initiatives. Its product breadth and distribution reach make it a key supplier for firms that require standardised indoor-growing inputs integrated with cold-chain handling strategies.

The Aquaponic Source is a family-run US business that designs, supplies and supports aquaponic and hydroponic systems for residential, educational and commercial growers. In practice, the company provides turnkey system kits, technical training and spare parts, and advises on water quality, filtration and crop planning to help users scale production reliably. Its role in controlled-environment food production positions it as a practical supplier to operators exploring closed-loop, low-water-value chains and localised cold-chain needs for fresh produce.

Practical Cyclopentanone (Pty) Ltd is referenced in trade and supplier listings as a specialist distributor of cyclopentanone-class solvents and intermediates for fragrance, agrochemical and specialty-chemical uses. Firms of this type typically provide technical data sheets, small-batch supply and logistics support for customers requiring high-purity ketones in formulation and synthesis. Their market role is to bridge bench-scale chemistry and industrial users, enabling pilot runs and replenishment doses that feed into downstream processing and controlled-temperature handling where solvent quality matters.

Top Key Players Outlook

- Americold Logistics LLC

- Burris Logistics, Inc.

- Lineage Logistics, LLC

- Nordic Logistics

- Preferred Freezer

- Wabash National

- Cold Chain Technologies, Inc.

- Cryopak Industries Inc.

Recent Industry Developments

In 2024, Hydrofarm reported net sales of approximately $226.6 million, reflecting demand for lighting, climate control and growing systems adapted to localised supply models, and the business finished the year with about 286 employees (Dec 31, 2024) after ongoing restructuring to improve margins.

In 2024, The Aquaponic Source supplied turnkey aquaponic kits, training and technical support that enabled growers, schools and small businesses to produce fresh vegetables and fish locally, thereby reducing dependence on long refrigerated supply chains and lowering cold-chain costs; the company reported an estimated revenue of $1.2 million (2024) and operated with about 8 employees (2024) from its Wheat Ridge, Colorado base, reflecting a small, specialist operator focused on education and decentralised production.

Report Scope

Report Features Description Market Value (2024) USD 64.0 Bn Forecast Revenue (2034) USD 277.5 Bn CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cold-chain Storage, Cold-chain Transport, Monitoring Components), By Temperature Range (Chilled (0–4 °C), Frozen (-18 °C), Deep-Frozen/Ultra-low (Less-than-40 °C)), By Technology (RFID and Real-time Monitoring, IoT-Enabled Telematics, Automated Storage and Retrieval Systems), By Transport Mode (Road – Reefer Trucks and Trailers, Sea – Reefer Containers, Rail – Refrigerated Railcars, Air Cargo, Others), By Application (Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Americold Logistics LLC, Burris Logistics, Inc., Lineage Logistics, LLC, Nordic Logistics, Preferred Freezer, Wabash National, Cold Chain Technologies, Inc., Cryopak Industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Americold Logistics LLC

- Burris Logistics, Inc.

- Lineage Logistics, LLC

- Nordic Logistics

- Preferred Freezer

- Wabash National

- Cold Chain Technologies, Inc.

- Cryopak Industries Inc.