Global Fluoropolymer Tubing Market Size, Share Analysis Report By Form Factor (Heat Shrink, Single Lumen, Co-Extruded, Multi Lumen, Tapered or Bump Tubing, Braided Tubing), By Material (PTFE, FEP, PFA, ETFE, PVDF, Others), By Application (Medical, Semiconductor, Energy, Oil and gas, Aerospace, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161712

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

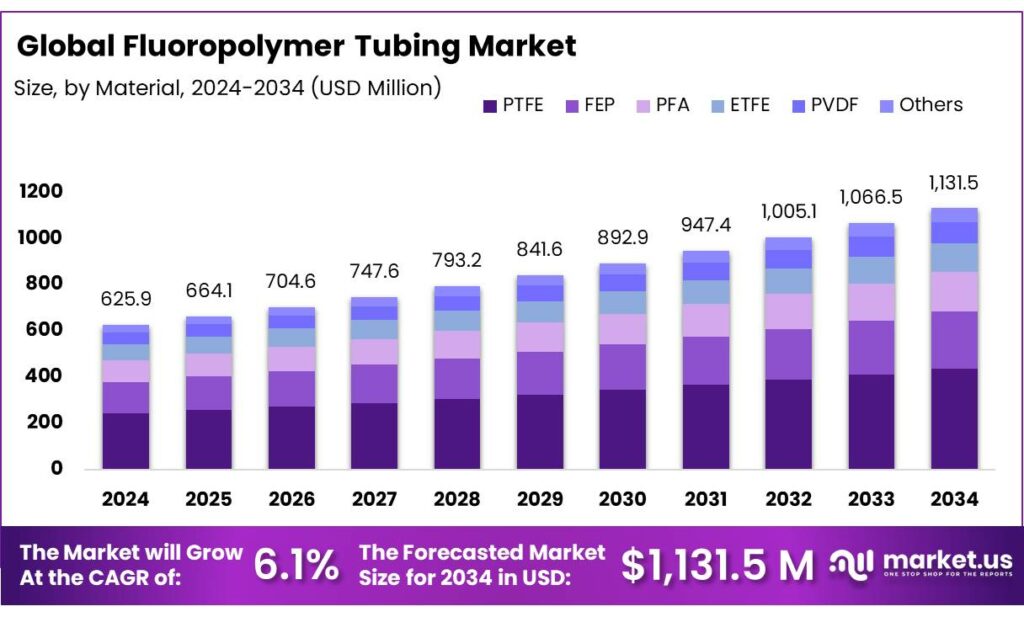

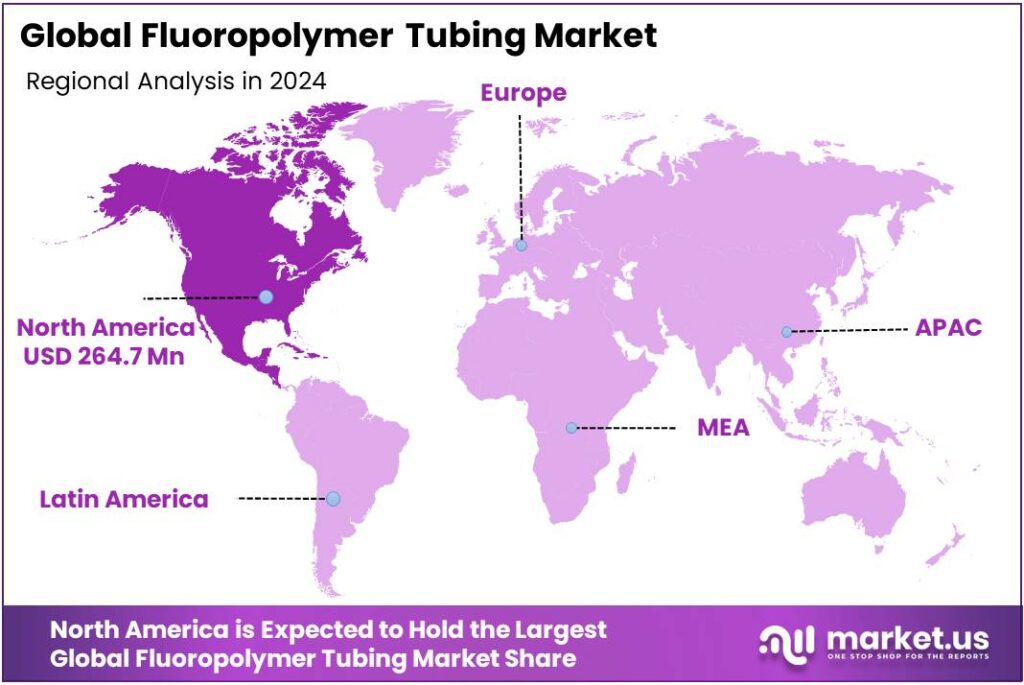

The Global Fluoropolymer Tubing Market size is expected to be worth around USD 1131.5 Million by 2034, from USD 625.9 Million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.30% share, holding USD 264.7 Million in revenue.

Fluoropolymer tubing—primarily PTFE, PFA, FEP, and PVDF—serves corrosive, high-purity, high-temperature, and cryogenic fluid paths across chemicals, semiconductors, life sciences, oil & gas, LNG, hydrogen, and renewables. Its non-wetting surfaces, broad chemical resistance, and cleanliness make it the default choice for aggressive acids/solvents, ultrapure water, and reactive gases; mechanically, it tolerates extremes from sub-zero LNG lines to hot, oxidizing chemistries in etch/clean steps.

- In 2025, global energy investment is set to reach USD 3.3 trillion, with USD 2.2 trillion flowing to renewables, grids, storage, low-emissions fuels, efficiency and electrification—twice the USD 1.1 trillion for fossil supply—supporting large volumes of chemically aggressive and ultrapure flow control where fluoropolymers dominate.

Industrial activity is being reshaped by record renewable additions and gas system reconfiguration. In 2024, the world added 585 GW of renewable power, pushing total renewables to 4,448 GW; solar led the surge, and these projects expand balance-of-plant tubing demand for electrolytes, heat-transfer fluids, and water treatment lines that require fluoropolymers’ purity and corrosion resistance.

The U.S. Department of Energy’s H2Hubs program anchors multi-state hydrogen production and offtake networks; individual hubs have moved into Phase 1 with initial disbursements, including $22 million for the Gulf Coast hub of a total federal cost-share up to $1.2 billion, $22.2 million for the Midwest (MachH2) hub of up to $1 billion, and $30 million for the Appalachian hub of up to $925 million—all of which cascade into procurement of corrosion-resistant, permeation-minimizing tubing and fittings.

Key Takeaways

- Fluoropolymer Tubing Market size is expected to be worth around USD 1131.5 Million by 2034, from USD 625.9 Million in 2024, growing at a CAGR of 6.1%.

- Single Lumen held a dominant market position, capturing more than a 42.8% share.

- PTFE (Polytetrafluoroethylene) held a dominant market position, capturing more than a 38.6% share of the global fluoropolymer tubing market.

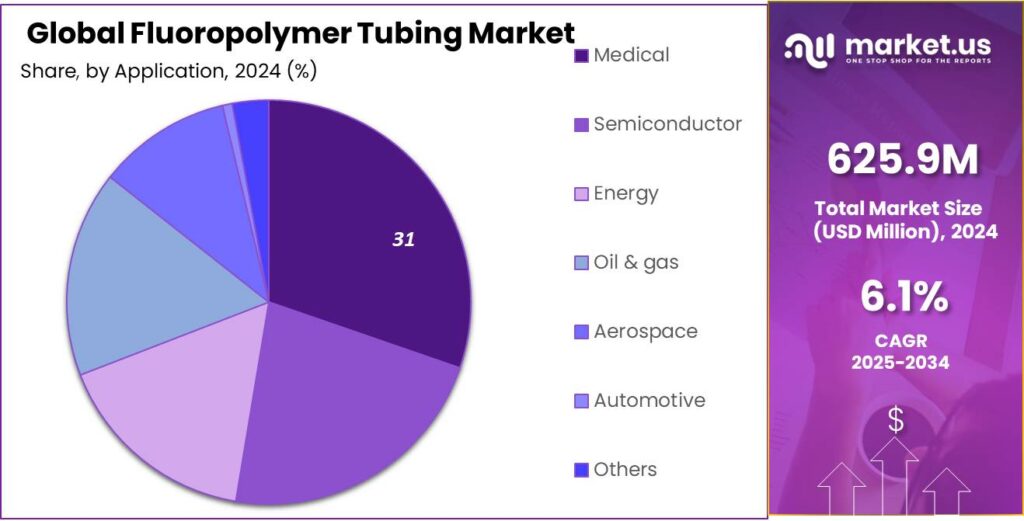

- Medical segment held a dominant market position, capturing more than a 31.2% share of the global fluoropolymer tubing market.

- North America emerged as the dominant regional market for fluoropolymer tubing, accounting for 42.30% of global demand USD 264.7 million.

By Form Factor Analysis

Single Lumen leads with 42.8% share in 2024 owing to widespread usage in standard applications

In 2024, Single Lumen held a dominant market position, capturing more than a 42.8% share of the fluoropolymer tubing market by form factor. Such dominance was driven by its simplicity, lower cost versus multi-lumen or co-extruded variants, and suitability for many chemical transport and general fluid handling applications where only one internal passage is needed.

The Single Lumen segment continued to command a strong share, slightly adjusting but remaining well above the 40% threshold in most regions. Its share was estimated at roughly 43-45% in 2025 in global assessments, reflecting steady preference among end-users for reliability, ease of installation, and lower maintenance in many industrial settings.

By Material Analysis

PTFE dominates with 38.6% share in 2024 owing to its unmatched chemical resistance and versatility

In 2024, PTFE (Polytetrafluoroethylene) held a dominant market position, capturing more than a 38.6% share of the global fluoropolymer tubing market by material. Its leadership was attributed to its exceptional chemical resistance, low friction coefficient, and wide temperature stability, making it the most widely used material across chemical processing, medical, and semiconductor industries. The material’s ability to withstand aggressive acids, solvents, and high temperatures up to 260°C positioned it as the preferred choice for critical fluid transfer applications.

Demand for PTFE-based tubing rose steadily as industries moved toward higher purity and longer service life components. The material’s inertness and biocompatibility further boosted its adoption in pharmaceutical manufacturing and medical device production, where contamination control remains essential. Industrial users also favored PTFE for its reliability under high-pressure and high-temperature conditions, particularly in energy and analytical instrumentation sectors.

By Application Analysis

Medical segment leads with 31.2% share in 2024 driven by rising healthcare innovation and device demand

In 2024, the medical segment held a dominant market position, capturing more than a 31.2% share of the global fluoropolymer tubing market by application. The growth was largely driven by the increasing use of fluoropolymer tubing in catheters, surgical instruments, diagnostic devices, and fluid delivery systems. The material’s biocompatibility, flexibility, and resistance to chemical degradation have made it a preferred choice in critical medical applications where safety, precision, and reliability are essential.

The global healthcare industry’s continued expansion, along with rising investments in advanced medical technologies, supported this strong market position. In 2024, demand for minimally invasive procedures and high-performance medical devices surged, prompting manufacturers to rely heavily on PTFE and FEP tubing for applications requiring high purity and inertness. Hospitals and device makers also favored fluoropolymer tubing for its smooth internal surface that reduces contamination risk and ensures precise fluid control, particularly in intravenous and diagnostic systems.

Key Market Segments

By Form Factor

- Heat Shrink

- Single Lumen

- Co-Extruded

- Multi Lumen

- Tapered or Bump Tubing

- Braided Tubing

By Material

- PTFE

- FEP

- PFA

- ETFE

- PVDF

- Others

By Application

- Medical

- Semiconductor

- Energy

- Oil & gas

- Aerospace

- Automotive

- Others

Emerging Trends

Audit-ready, low-migration food-contact lines using fluoropolymer tubing

Food and beverage plants are moving fast toward “audit-ready” fluid paths—lines that can prove purity, traceability, and low migration at any time. Fluoropolymer tubing (PTFE, FEP, PFA) is at the center of this shift because it brings very low extractables, broad chemical resistance for CIP/SIP, and stable performance across temperature cycles. The pressure to upgrade is not just technical; it is driven by public-health expectations and enforcement.

- The World Health Organization estimates 600 million people fall ill from unsafe food every year and 420,000 die, with an economic toll of US$110 billion in low- and middle-income countries. Those losses keep hygiene and contamination control at the top of every plant manager’s agenda—and create demand for higher-integrity tubing in sampling, dosing, and clean-in-place loops.

Regulatory frameworks are reinforcing the same direction. In the European Union, plastic materials and articles that contact food must meet migration limits under Regulation (EU) No 10/2011, which sets out substance lists, testing conditions, and documentation duties for compliance.

The Food and Agriculture Organization reports agrifood systems used 12.5 million tonnes of plastic products in plant and animal production in 2019, plus 37.3 million tonnes in food packaging. While most of that volume is commodity plastics, the headline numbers underline how pervasive polymers are in the food chain—and how many critical points exist where plants can swap to higher-performance, certified materials for low-migration service.

Drivers

Food Safety & Compliance in Processing Lines

One of the major driving forces behind the growth of fluoropolymer tubing is the ever‐increasing demand for safe, clean, and regulatory-compliant fluid transfer in the food and beverage industry. When food, drink, or ingredient slurries must be moved, measured, cleaned, or sampled, the tubing must not leach unwanted chemicals, must resist aggressive cleaning agents, and must maintain purity over many cycles.

From a governmental or institutional side, food safety regulations and standards act as catalysts. Many countries have food contact material regulations that mandate or strongly recommend the use of inert materials. In the EU, for instance, food contact plastic regulations (Regulation (EU) 10/2011 and subsequent updates) require testing of migration and require certification for materials used in contact with food. Although fluoropolymers are more expensive, their superior chemical stability often makes them acceptable in the strictest compliance regimes.

Another nudge comes from the broader concern over plastics in the food and agricultural systems. The FAO estimates that in 2019, 12.5 million tonnes of plastic products were used in plant and animal production globally (including items like films, containers, irrigation/tubing) and 37.3 million tonnes in food packaging. While much of that is commodity plastic, the aggregate attention to plastics in agrifood chains pushes regulators and food companies to evaluate material safety and lifecycle impacts more closely. When food firms undergo audits for microplastic, plastic migration, or contamination risk, they gravitate toward more robust, inert, low-degradation materials—in effect favoring fluoropolymers in critical segments.

Restraints

Regulatory Pressure over PFAS & Food-Contact Safety

One of the biggest obstacles limiting the wider adoption of fluoropolymer tubing is the growing regulatory scrutiny over PFAS (per- and polyfluoroalkyl substances) in food contact materials. Because many fluoropolymers are classed under PFAS or related chemistries, any tightening of laws or bans affecting PFAS use in packaging, coatings, or contact surfaces may chill demand or raise compliance costs for tubing used in food, beverage, or ingredient transfer systems.

For example, the U.S. Food and Drug Administration reports that in their Total Diet Study (TDS), no PFAS were detected in over 97% of the fresh and processed foods tested in the general food supply. That statistic reflects how sensitive regulators and consumers are to trace contamination. Even though the detected PFAS in foods are often from environmental sources rather than deliberate use, the ultra-low detection expectations put pressure on any material that might leach fluorinated compounds.

In addition, many U.S. states are passing laws that ban “intentionally added PFAS” in food packaging. As of late 2023, states such as California ban food packaging containing PFAS exceeding 100 parts per million (ppm) or any intentionally added PFAS. All this creates a compliance burden—not just for packaging, but for any equipment materials in contact with food that may be secondarily regulated or scrutinized.

Further complicating matters, scientific knowledge gaps persist: a peer-reviewed review noted that 68 PFAS have been detected in migrates or extracts of food contact materials, many of which are not yet listed in industry or regulatory inventories. Because of unknowns, regulators may adopt precautionary or blanket bans rather than substance-by-substance rules, further threatening fluoropolymer use.

Opportunity

Expansion into Sustainable Food Processing & Hygiene Lines

One of the strongest growth opportunities for fluoropolymer tubing lies in its use within sustainable food processing systems and hygiene-critical lines, especially as food safety, clean labeling, and contamination control become non-negotiable. As food producers push toward “cleaner” ingredients, minimal processing, and stricter traceability, the components that touch food streams—like tubing for sampling, CIP (clean-in-place) loops, ingredient dosing, and filtration purge paths—must deliver ultra-low leachability, chemical inertness, and ease of sterilization.

To put scale around this, consider how large the food value chain is. The FAO reports that in 2019, 12.5 million tonnes of plastics were used annually in plant and animal production (e.g. mulch films, irrigation tubing, packaging, other uses) and 37.3 million tonnes in food packaging. This magnitude underscores how pervasive polymer use is in food systems—and therefore how much opportunity there is to substitute higher-performance, food-grade fluoropolymers in critical, sensitive spots where purity matters.

Meanwhile, in the U.S., the food and beverage production sector is a heavyweight economic engine. In 2023, it contributed US$534.3 billion to GDP (roughly 2.2% of the total) and supported nearly 3.5 million jobs across agriculture, processing, distribution, and more. That confirms that food and beverage operations are massive, continuous, and capital-intensive—they have incentive to invest in reliability, safety, and durability rather than always chase the lowest upfront cost.

Regional Insights

North America leads with 42.30% share (USD 264.7 million) as the primary regional market for fluoropolymer tubing

In 2024, North America emerged as the dominant regional market for fluoropolymer tubing, accounting for 42.30% of global demand USD 264.7 million. This position was supported by a concentrated base of high-technology end users, including medical device manufacturers, semiconductor fabs, and specialty chemical processors, where fluoropolymer tubing was required for high-purity fluid handling, chemical resistance, and regulatory compliance.

Regulatory and quality-assurance frameworks in North America were observed to favour certified materials and traceable suppliers, increasing demand for premium, medical-grade and semiconductor-grade tubing. Over 2024–2025, growth rates in the region were expected to track or slightly exceed global averages, supported by near-term ramp-ups in cleanroom capacity and replacement of legacy metallic lines in corrosive service.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Saint-Gobain is a global leader in performance plastics and fluoropolymer tubing. The company produces PTFE, FEP, and PFA tubing for demanding industries including semiconductor, medical, chemical processing, and food & beverage. It offers precision fluid & gas transfer solutions with regulatory compliance, wide temperature resistance (up to ~260 °C), chemical inertness and non-leaching behaviour. Saint-Gobain’s extensive global manufacturing footprin t enables localized supply and shorter lead times. Its Versilon™ and Tygon® lines are well known for hygiene, purity and custom sizing.

Parker Hannifin through its Parflex and TexLoc divisions offers a broad suite of fluoropolymer tubing including PTFE, FEP, PFA and PVDF. Its tubing is used in fluid & material handling, instrumentation, chemical transfer, food & beverage, and industrial protection. Parker’s tubing lines are built for high temperature (~ 260 °C), non-stick surface, corrosion resistance, non-wetting and non-leaching characteristics. Parker also provides regulatory compliant tubing. It offers a wide range of sizes, configurations, and strong distribution in North America and internationally.

Adtech is a UK-based specialist in high-performance fluoroplastic engineering, producing PTFE, PFA, FEP & PVDF tubing. The company is privately held which gives agility in R&D and custom product development. It offers bespoke fabrications, large diameter heat shrink sleeving, lined fluoroplastic components and tailored tubing solutions for medical, food & drink, UVC sterilisation and other technical industries. Certifications such as ISO 9001 are held; its strength lies in custom specification, product development and ability to respond quickly to unique customer application requirements.

Top Key Players Outlook

- Saint-Gobain

- Zeus Company LLC

- Optinova

- Parker Hannifin

- TE Connectivity

- Adtech Polymer Engineering Ltd.

- AMETEK

- Swagelok Company

- Tef-Cap Industries

- Teleflex Incorporated

Recent Industry Developments

In 2024 Saint-Gobain, reported sales of €46.6 billion, with a record operating margin of 11.4% and free cash flow of €4.0 billion.

In 2024 Zeus Company LLC, was acquired by EQT Private Equity, valuing Zeus at approximately $3.4 billion.

Report Scope

Report Features Description Market Value (2024) USD 625.9 Mn Forecast Revenue (2034) USD 1131.5 Mn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form Factor (Heat Shrink, Single Lumen, Co-Extruded, Multi Lumen, Tapered or Bump Tubing, Braided Tubing), By Material (PTFE, FEP, PFA, ETFE, PVDF, Others), By Application (Medical, Semiconductor, Energy, Oil and gas, Aerospace, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Saint-Gobain, Zeus Company LLC, Optinova, Parker Hannifin, TE Connectivity, Adtech Polymer Engineering Ltd., AMETEK, Swagelok Company, Tef-Cap Industries, Teleflex Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fluoropolymer Tubing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Fluoropolymer Tubing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Saint-Gobain

- Zeus Company LLC

- Optinova

- Parker Hannifin

- TE Connectivity

- Adtech Polymer Engineering Ltd.

- AMETEK

- Swagelok Company

- Tef-Cap Industries

- Teleflex Incorporated