Global Floating Floor Market Size, Share, Growth Analysis By System Type (Resilient Underlayment Floating Floors, Raised Floating Floors (Acoustic), Spring or Isolator Floating Floors, Other), By Material (Rubber & Elastomer, Foam Underlay, Mineral Wool Systems, Others), By End Use (Residential Multifamily, Commercial Offices, Hospitality, Studios & Specialty Rooms, Others), By Sales Channel (Flooring Contractors, Building Distributors, Direct Manufacturer Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175094

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

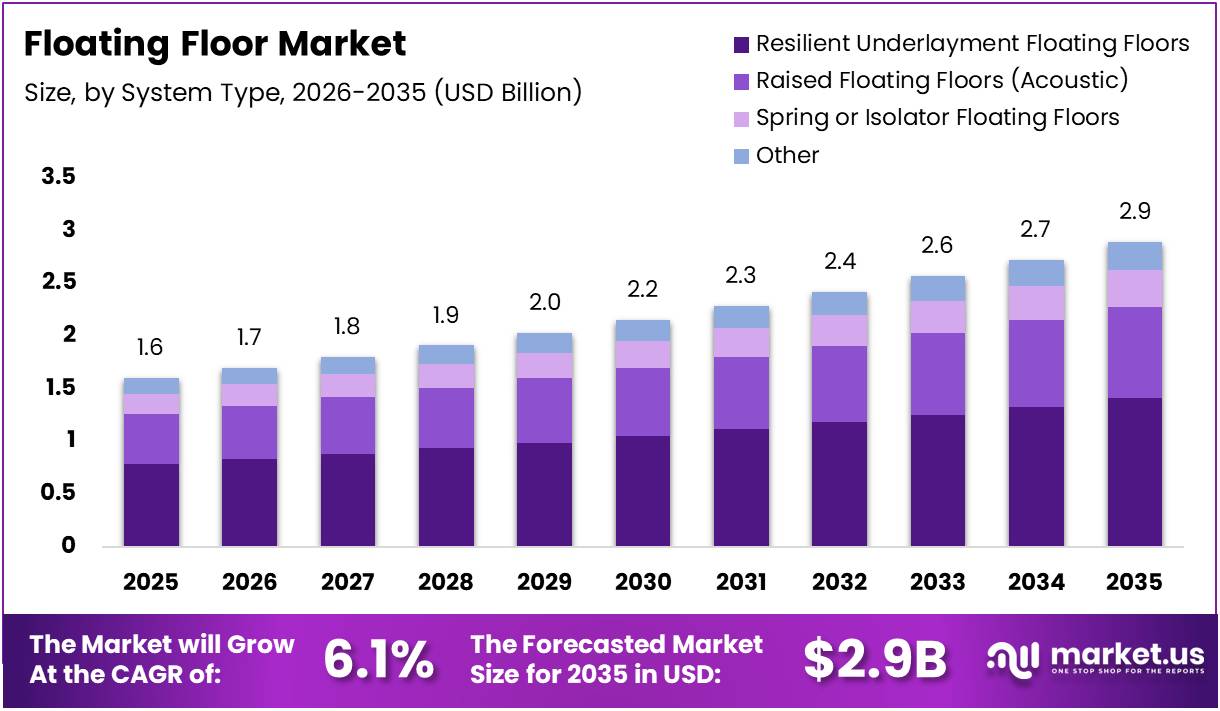

The Global Floating Floor Market size is expected to be worth around USD 2.9 Billion by 2035 from USD 1.6 Billion in 2025, growing at a CAGR of 6.1% during the forecast period 2026 to 2035.

The floating floor market encompasses flooring systems installed without direct attachment to the subfloor, utilizing underlayment materials for acoustic isolation and structural separation. These systems include resilient underlayment floors, raised acoustic floors, and spring-based isolator solutions. Moreover, they serve diverse applications across residential, commercial, hospitality, and specialty construction sectors.

This market segment addresses critical needs for quick installation, moisture resistance, and sound dampening in modern construction projects. Floating floor technology enables flexible design solutions while reducing labor costs and installation timeframes. Additionally, these systems accommodate building movement and thermal expansion without compromising structural integrity or aesthetic appeal.

Market growth stems from increasing renovation activities, commercial construction expansion, and consumer preference for DIY-friendly flooring solutions. However, the industry also benefits from technological advancements in underlayment materials and installation mechanisms. Consequently, manufacturers focus on developing sustainable, waterproof, and acoustically superior products to meet evolving market demands.

Government initiatives promoting sustainable building practices and energy-efficient construction drive market expansion across developed and emerging economies. Regulatory frameworks increasingly favor low-emission materials and recyclable flooring solutions. Therefore, industry players invest in eco-friendly product development to align with environmental standards and green building certifications.

The residential renovation sector represents a significant growth driver as homeowners seek cost-effective, aesthetically pleasing flooring upgrades. Commercial construction projects also increasingly adopt floating floor systems for their versatility and performance benefits. Additionally, institutional buildings prioritize acoustic solutions to enhance occupant comfort and productivity.

According to research, click-lock floating floor design has captured approximately 40% of the DIY flooring market in the United States. Furthermore, according to research, 63% of DIY homeowners prefer click-lock flooring due to its straightforward assembly process. Moreover, 70% of flooring professionals report that click-lock flooring reduces installation time by half compared to glue-lock methods.

Market dynamics reflect evolving consumer preferences toward tool-free installation systems and advanced underlayment technologies. Industry innovation focuses on enhancing durability, moisture resistance, and thermal insulation properties while maintaining competitive pricing structures. Consequently, the floating floor market demonstrates strong growth potential across multiple geographic regions and application segments through 2035.

Key Takeaways

- The Global Floating Floor Market is projected to reach USD 2.9 Billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035.

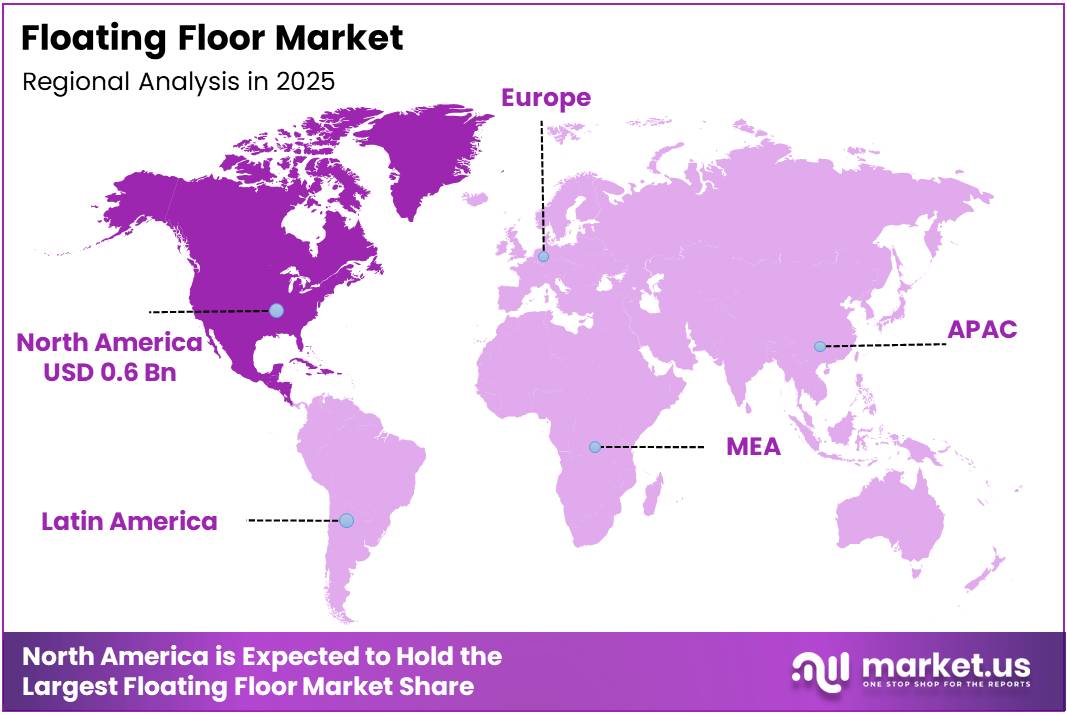

- North America dominates the market with a 39.20% share, valued at USD 0.6 Billion in 2025.

- Resilient Underlayment Floating Floors lead the System Type segment with a 48.8% market share.

- Rubber & Elastomer materials account for 39.3% of the market in the Material segment.

- Residential Multifamily applications dominate the End Use segment with 38.5% market share.

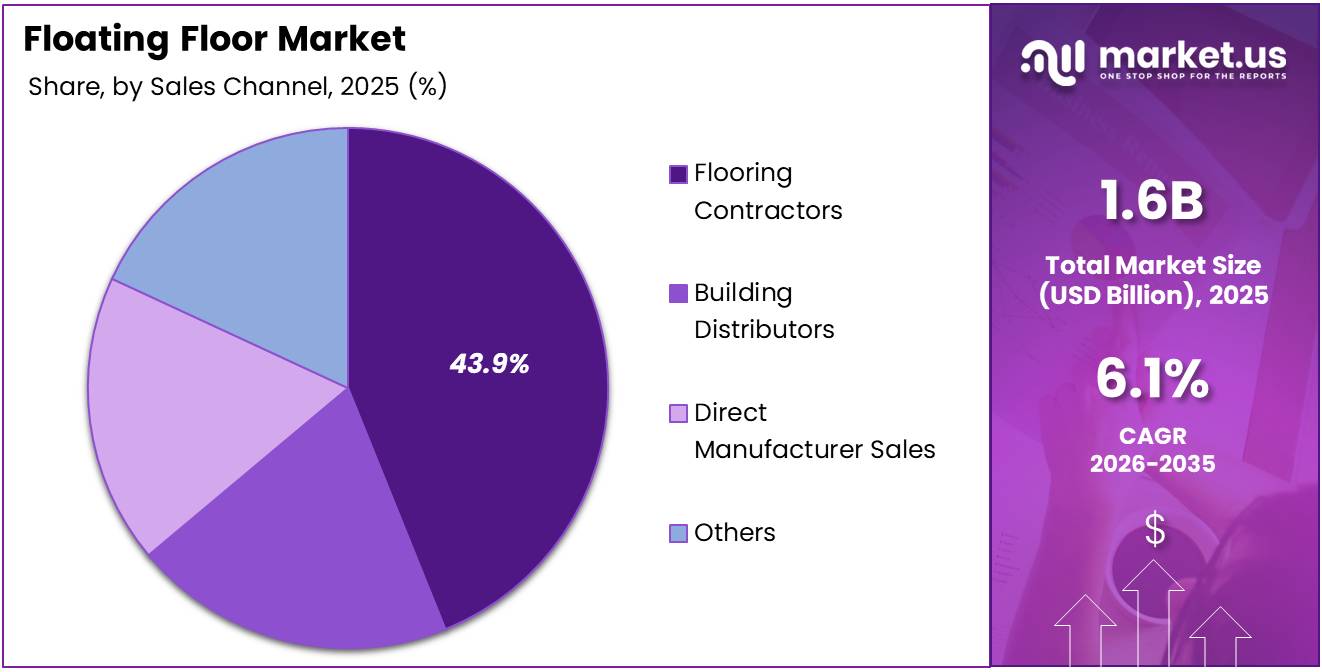

- Flooring Contractors represent 43.9% of the Sales Channel segment in 2025.

System Type Analysis

Resilient Underlayment Floating Floors dominate with 48.8% due to superior acoustic performance and ease of installation.

In 2025, Resilient Underlayment Floating Floors held a dominant market position in the By System Type segment of Floating Floor Market, with a 48.8% share. This segment leads due to exceptional sound dampening properties, moisture resistance, and compatibility with various finished flooring materials. Additionally, resilient underlayment systems provide thermal insulation while accommodating building movement and reducing impact noise transmission effectively.

Raised Floating Floors (Acoustic) serve specialized applications requiring elevated installation and enhanced acoustic isolation in commercial and institutional buildings. These systems create accessible plenums for mechanical systems while delivering superior sound control. Moreover, they accommodate irregular subfloors and provide flexibility for future modifications without extensive renovation work.

Spring or Isolator Floating Floors offer maximum vibration isolation for studios, performance venues, and precision equipment installations requiring stringent acoustic separation. These advanced systems utilize mechanical spring elements or elastomeric isolators. Consequently, they effectively decouple floor structures from building frameworks, preventing vibration transmission in sensitive environments.

Other system types include hybrid solutions combining multiple technologies and specialized applications for unique architectural requirements. These alternatives address niche market segments with specific performance criteria. Therefore, they complement mainstream systems while serving specialized construction and renovation projects.

Material Analysis

Rubber & Elastomer materials dominate with 39.3% due to exceptional durability and acoustic properties.

In 2025, Rubber & Elastomer held a dominant market position in the By Material segment of Floating Floor Market, with a 39.3% share. These materials provide outstanding resilience, impact absorption, and long-term performance across residential and commercial applications. Moreover, rubber-based underlayments resist moisture, mold, and compression while maintaining consistent acoustic isolation throughout their service life.

Foam Underlay materials offer lightweight, cost-effective solutions for residential installations where moderate acoustic performance suffices. These products provide thermal insulation and cushioning while simplifying handling and installation processes. Additionally, foam underlayments accommodate minor subfloor irregularities and deliver satisfactory performance for standard residential applications.

Mineral Wool Systems deliver superior fire resistance, acoustic isolation, and thermal insulation for commercial and institutional projects. These materials withstand high temperatures while maintaining structural integrity and sound dampening capabilities. Consequently, they meet stringent building codes and performance specifications in demanding construction environments.

Others encompass cork, recycled materials, and composite underlayment solutions addressing sustainability requirements and specialized performance criteria. These alternatives support green building initiatives while providing unique combinations of acoustic, thermal, and environmental benefits. Therefore, they serve eco-conscious market segments prioritizing renewable and low-impact construction materials.

End Use Analysis

Residential Multifamily applications dominate with 38.5% due to growing urbanization and apartment construction.

In 2025, Residential Multifamily held a dominant market position in the By End Use segment of Floating Floor Market, with a 38.5% share. Multifamily housing projects prioritize acoustic isolation between units to ensure resident comfort and regulatory compliance. Moreover, floating floor systems reduce construction costs and installation timeframes while meeting building codes for sound transmission control.

Commercial Offices increasingly adopt floating floor solutions to create flexible workspace layouts accommodating evolving business needs and technology infrastructure. These installations support modular furniture systems while providing acoustic privacy. Additionally, commercial applications benefit from quick installation processes minimizing business disruption during construction or renovation projects.

Hospitality venues utilize floating floors to enhance guest experience through superior acoustic comfort and aesthetic appeal across hotel rooms, restaurants, and event spaces. These systems reduce noise complaints while supporting diverse design requirements. Consequently, hospitality operators invest in quality underlayment solutions to differentiate their properties and improve guest satisfaction ratings.

Studios & Specialty Rooms require maximum acoustic isolation for recording studios, performance venues, home theaters, and precision equipment installations. These applications demand specialized floating floor systems delivering stringent vibration control. Others include healthcare, educational, and retail facilities requiring tailored acoustic and structural performance characteristics.

Sales Channel Analysis

Flooring Contractors dominate with 43.9% due to professional expertise and project management capabilities.

In 2025, Flooring Contractors held a dominant market position in the By Sales Channel segment of Floating Floor Market, with a 43.9% share. Professional contractors provide technical expertise, warranty support, and quality assurance essential for commercial and complex residential installations. Moreover, contractors maintain relationships with material suppliers and offer comprehensive solutions including subfloor preparation and finishing services.

Building Distributors serve construction companies and contractors through wholesale channels offering competitive pricing, inventory management, and logistics support for large-scale projects. These distributors maintain extensive product portfolios across multiple manufacturers. Additionally, they provide technical consultation and specification assistance to construction professionals navigating product selections.

Direct Manufacturer Sales enable large commercial customers and institutional buyers to negotiate volume pricing while accessing technical support and customization options directly from producers. This channel supports major construction projects requiring specific performance guarantees. Consequently, manufacturers leverage direct relationships to introduce innovative products and gather market feedback.

Others include retail home improvement centers, online marketplaces, and specialty flooring stores catering to DIY consumers and small renovation projects. These channels democratize access to floating floor products. Therefore, they expand market reach while supporting consumer education and product awareness initiatives.

Key Market Segments

By System Type

- Resilient Underlayment Floating Floors

- Raised Floating Floors (Acoustic)

- Spring or Isolator Floating Floors

- Other

By Material

- Rubber & Elastomer

- Foam Underlay

- Mineral Wool Systems

- Others

By End Use

- Residential Multifamily

- Commercial Offices

- Hospitality

- Studios & Specialty Rooms

- Others

By Sales Channel

- Flooring Contractors

- Building Distributors

- Direct Manufacturer Sales

- Others

Drivers

Rising Demand for Quick-Install Flooring Solutions in Residential Renovation Projects Drives Market Growth

Homeowners increasingly prioritize renovation projects that minimize disruption and reduce installation timeframes without compromising quality or aesthetics. Floating floor systems address these requirements through tool-free click-lock mechanisms and simplified preparation processes. Moreover, DIY-friendly installation reduces labor costs while enabling personalized home improvement projects that enhance property values and living comfort.

Commercial renovation projects similarly benefit from quick-install floating floor solutions that allow business continuity during construction activities. Contractors achieve faster project completion while maintaining quality standards and meeting client deadlines. Additionally, reduced installation complexity lowers skilled labor requirements, improving project economics and expanding market accessibility across diverse customer segments.

Technological advancements in locking mechanisms and underlayment materials further accelerate installation processes while enhancing performance characteristics. Manufacturers develop innovative products addressing moisture concerns, acoustic requirements, and durability expectations. Consequently, the market experiences sustained growth as product innovations align with consumer preferences for convenient, cost-effective flooring solutions across residential and commercial applications.

Restraints

Performance Limitations in Heavy Industrial and High Load-Bearing Applications Limit Market Adoption

Floating floor systems demonstrate structural limitations when subjected to extreme weight loads, heavy machinery, or high-impact industrial applications. These constraints restrict adoption in manufacturing facilities, warehouses, and specialized industrial environments requiring permanent, load-bearing flooring solutions. Moreover, floating installations may experience movement or damage under concentrated loads, necessitating alternative flooring technologies for heavy-duty applications.

Acoustic performance challenges emerge in multi-story buildings and high-density residential complexes where sound transmission between units exceeds acceptable standards. Despite underlayment improvements, floating floors sometimes fail to achieve stringent acoustic isolation requirements. Additionally, improper installation techniques or inadequate underlayment selection exacerbate noise transmission issues, generating resident complaints and regulatory compliance concerns.

Economic considerations also influence market restraints as premium floating floor systems command higher initial costs compared to conventional flooring alternatives. Budget-conscious consumers and developers may opt for traditional installation methods despite long-term benefits. Consequently, price sensitivity in certain market segments limits penetration rates, particularly in emerging economies where cost considerations dominate purchasing decisions over performance advantages.

Growth Factors

Increasing Use of Floating Flooring Systems in Modular and Prefabricated Construction Accelerates Market Expansion

Modular construction methodologies increasingly incorporate floating floor systems due to compatibility with factory-assembled building components and rapid on-site installation requirements. These applications benefit from standardized underlayment solutions and simplified installation processes. Moreover, prefabricated construction timelines align with floating floor advantages, reducing overall project duration while maintaining quality control and performance standards.

Technological advancements in waterproof, scratch-resistant, and durable materials expand floating floor applications across moisture-prone environments and high-traffic commercial spaces. Manufacturers develop enhanced polymer formulations and protective coatings addressing performance concerns. Additionally, improved wear resistance and stain protection extend product lifecycles, reducing replacement costs and enhancing long-term value propositions for commercial and residential customers.

Rising demand for floating floors in renovation and remodeling of existing buildings creates sustained market opportunities as aging infrastructure requires modernization. Property owners prioritize non-invasive installation methods preserving existing structural elements while upgrading interior finishes. Consequently, floating floor systems emerge as preferred solutions for retrofit projects, historic building preservation, and value-enhancement initiatives across residential and commercial real estate sectors.

Emerging Trends

Growing Popularity of Click-Lock and Tool-Free Floating Floor Installation Systems Reshapes Market Landscape

Click-lock technology revolutionizes floating floor installation by eliminating adhesive requirements and specialized tools while enabling secure, gapless connections between flooring panels. This innovation empowers DIY consumers and reduces professional installation costs. Moreover, tool-free systems accelerate project completion and minimize installation errors, expanding market accessibility across diverse skill levels and customer segments seeking convenient home improvement solutions.

Increasing integration of advanced acoustic and thermal underlay solutions addresses performance expectations in energy-efficient and noise-sensitive construction projects. Manufacturers combine multiple functional layers delivering sound dampening, thermal insulation, and moisture protection within single-product solutions. Additionally, these integrated underlayments simplify material selection and installation processes while meeting stringent building codes and green construction standards.

Rising focus on sustainable, low-emission, and recyclable flooring materials reflects growing environmental consciousness among consumers, regulators, and construction professionals. Industry leaders develop bio-based underlayments, recycled content products, and fully recyclable flooring systems minimizing environmental impact. Consequently, sustainability initiatives drive product innovation and differentiate brands in competitive markets where eco-friendly credentials influence purchasing decisions and corporate responsibility commitments.

Regional Analysis

North America Dominates the Floating Floor Market with a Market Share of 39.20%, Valued at USD 0.6 Billion

North America leads the global floating floor market with a 39.20% share, valued at USD 0.6 Billion, driven by robust residential renovation activity and commercial construction growth. The region benefits from high DIY culture adoption, advanced product availability, and stringent acoustic building codes. Moreover, technological innovation and sustainability initiatives strengthen market position across United States and Canadian construction sectors.

Europe Floating Floor Market Trends

Europe demonstrates strong market growth supported by renovation activities in mature housing stock and stringent environmental regulations promoting sustainable construction materials. The region emphasizes acoustic performance standards in multifamily residential buildings. Additionally, European manufacturers lead innovation in recyclable materials and low-emission products, aligning with green building certifications and circular economy principles.

Asia Pacific Floating Floor Market Trends

Asia Pacific experiences rapid market expansion driven by urbanization, rising construction activity, and growing middle-class housing demand across China, India, and Southeast Asian nations. The region benefits from increasing awareness of acoustic comfort and quick-install flooring solutions. Moreover, expanding manufacturing capabilities and competitive pricing support market penetration across diverse economic segments and construction applications.

Latin America Floating Floor Market Trends

Latin America shows emerging market potential with growing residential construction and commercial development projects in Brazil, Mexico, and regional urban centers. Economic development and rising living standards drive demand for modern flooring solutions. Additionally, increasing adoption of international construction standards and product awareness support market growth despite economic volatility and regional infrastructure challenges.

Middle East & Africa Floating Floor Market Trends

Middle East and Africa demonstrate selective market growth concentrated in GCC nations and South African urban markets with active construction sectors. The region prioritizes luxury residential projects and commercial developments incorporating advanced building technologies. Moreover, extreme climate conditions drive demand for moisture-resistant and thermally efficient flooring solutions supporting sustainable construction initiatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Getzner Werkstoffe maintains a leading position in the floating floor market through specialized vibration isolation solutions serving construction, transportation, and industrial applications. The company leverages advanced polymer technology and engineering expertise to develop high-performance underlayment systems. Moreover, Getzner’s focus on acoustic excellence and sustainable materials strengthens its competitive position across European and global markets, supporting diverse construction projects requiring stringent noise control standards.

Kinetics Noise Control specializes in architectural acoustic solutions including floating floor systems for commercial, institutional, and residential applications demanding superior sound isolation. The company offers comprehensive product portfolios combining resilient underlayments with engineered isolation systems. Additionally, Kinetics provides technical consultation and custom design services, differentiating its market approach through expertise-driven customer relationships and performance-guaranteed solutions across North American construction sectors.

REGUPOL delivers innovative rubber-based underlayment solutions emphasizing sustainability through recycled content utilization and circular economy principles. The company serves sports facilities, commercial buildings, and residential projects with versatile product lines addressing acoustic, shock absorption, and durability requirements. Furthermore, REGUPOL’s commitment to environmental stewardship and product quality establishes strong brand recognition across European markets and international construction applications.

Mason Industries provides comprehensive vibration isolation and seismic protection solutions including floating floor systems for mechanical equipment, healthcare facilities, and precision manufacturing environments. The company combines engineering expertise with customized product development addressing complex isolation challenges. Consequently, Mason Industries maintains significant market presence through technical innovation, application-specific solutions, and strong relationships with consulting engineers and commercial contractors throughout North America.

Key Players

- Getzner Werkstoffe

- Kinetics Noise Control

- REGUPOL

- Mason Industries

- GERB Schwingungsisolierung

- Trelleborg

- Saint-Gobain

- Knauf

Recent Developments

- December 2025 – Classen launched PP Floors, a fully recyclable and health-conscious alternative to traditional vinyl floating floors, utilizing polypropylene instead of PVC. This innovation addresses growing consumer demand for sustainable flooring solutions while eliminating concerns about harmful emissions and chemical additives associated with conventional vinyl products.

- August 2025 – Avery Dennison Corporation announced signing a definitive agreement to acquire the U.S.-based flooring adhesives business of Meridian Adhesives Group for a purchase price of USD 390 million. This strategic acquisition strengthens Avery Dennison’s position in specialty adhesives markets and expands capabilities serving the flooring industry with advanced bonding solutions.

Report Scope

Report Features Description Market Value (2025) USD 1.6 Billion Forecast Revenue (2035) USD 2.9 Billion CAGR (2026-2035) 6.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Resilient Underlayment Floating Floors, Raised Floating Floors (Acoustic), Spring or Isolator Floating Floors, Other), By Material (Rubber & Elastomer, Foam Underlay, Mineral Wool Systems, Others), By End Use (Residential Multifamily, Commercial Offices, Hospitality, Studios & Specialty Rooms, Others), By Sales Channel (Flooring Contractors, Building Distributors, Direct Manufacturer Sales, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Getzner Werkstoffe, Kinetics Noise Control, REGUPOL, Mason Industries, GERB Schwingungsisolierung, Trelleborg, Saint-Gobain, Knauf Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Getzner Werkstoffe

- Kinetics Noise Control

- REGUPOL

- Mason Industries

- GERB Schwingungsisolierung

- Trelleborg

- Saint-Gobain

- Knauf