Global Fipronil Pyrazole Market Size, Share, And Business Benefits By Form (Gel, Particle, Liquid), By Crop Type (Rice, Corn, Soybeans, Wheat, Others), By Application (Pest Control, Animal Health, Human Health, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155825

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

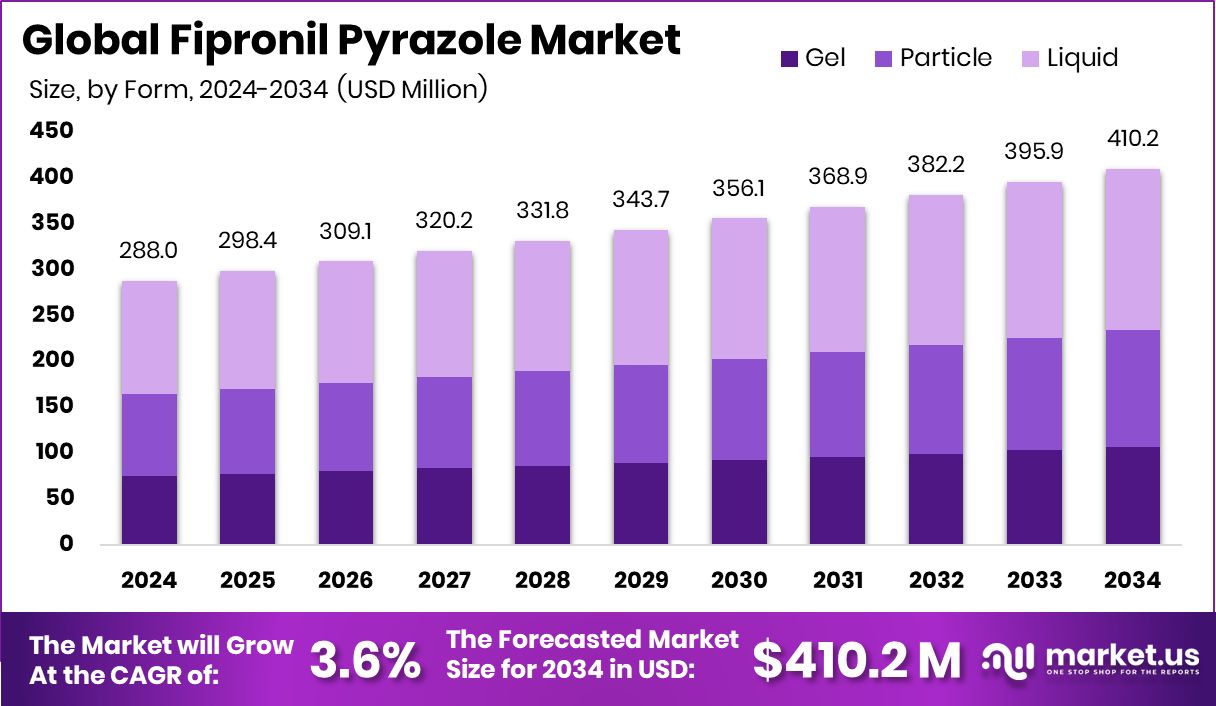

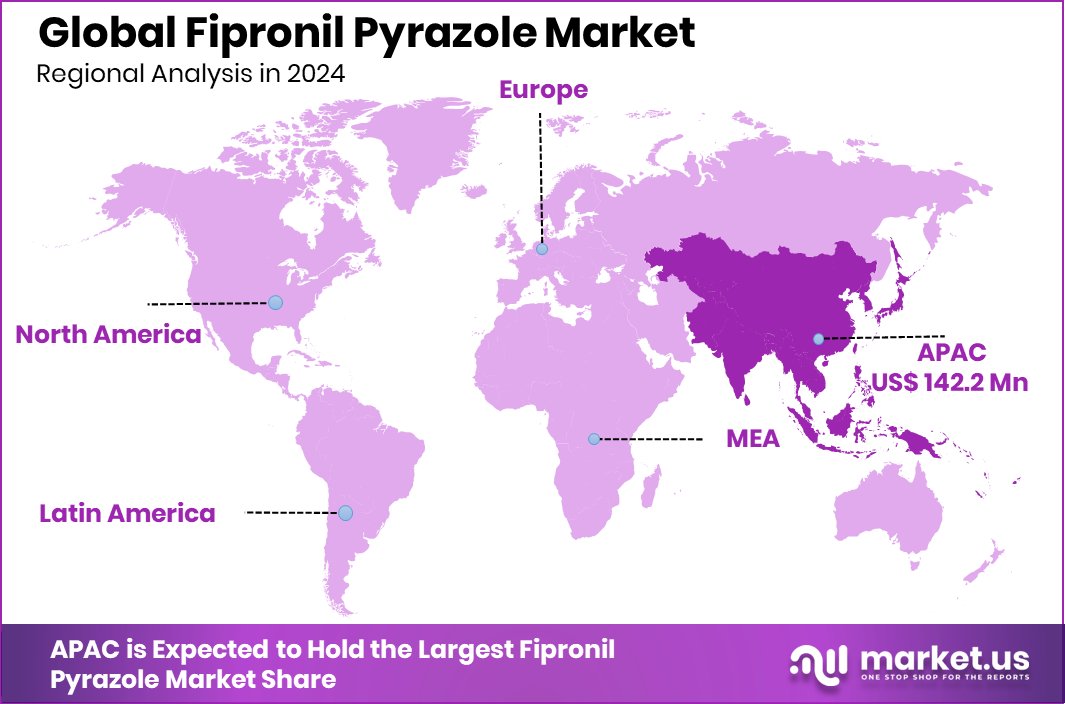

The Global Fipronil Pyrazole Market is expected to be worth around USD 410.2 million by 2034, up from USD 288.0 million in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034. Growing crop protection needs drive Asia-Pacific’s 49.4% share, worth USD 142.2 Mn.

Fipronil Pyrazole is a broad-spectrum insecticide that belongs to the chemical family of phenylpyrazoles. It is widely used in agriculture to control insects such as termites, ants, beetles, and other crop-damaging pests. Its mode of action works by interfering with the central nervous system of insects, causing paralysis and eventual death, while being less harmful to mammals and birds.

The Fipronil Pyrazole market refers to the global trade and usage of this insecticide across agriculture, animal health, and public health applications. Farmers rely on it to safeguard cereals, fruits, vegetables, and oilseeds, making it a key input in modern farming. Its demand is also supported by uses in seed treatment, soil management, and pest control products for livestock and households. According to an industry report, Meanwhile, FarmSense secured $2.2 million in funding to advance its smart pest control technology.

One of the main growth factors for this market is the rising need for higher agricultural productivity. With global food demand increasing, farmers are under pressure to reduce crop losses from pests, and Fipronil Pyrazole provides an effective solution. This push for efficiency directly drives its usage in large-scale farming. According to an industry report, the government has also provided a $22 million boost spread over three years to strengthen wildlife restoration efforts.

Demand is further strengthened by its versatility. Beyond crops, it is used in controlling ticks and fleas in animals, as well as termites and cockroaches in public health. This wide application makes it a preferred choice in both rural and urban markets, ensuring consistent consumption across regions. According to an industry report, A UCLA engineer has been awarded nearly $1 million in government support for agricultural research.

Key Takeaways

- The Global Fipronil Pyrazole Market is expected to be worth around USD 410.2 million by 2034, up from USD 288.0 million in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In 2024, the Fipronil Pyrazole Market saw liquid formulations dominate, capturing 43.7% market share.

- Rice crops accounted for 38.2% of the Fipronil Pyrazole Market, highlighting strong agricultural reliance globally.

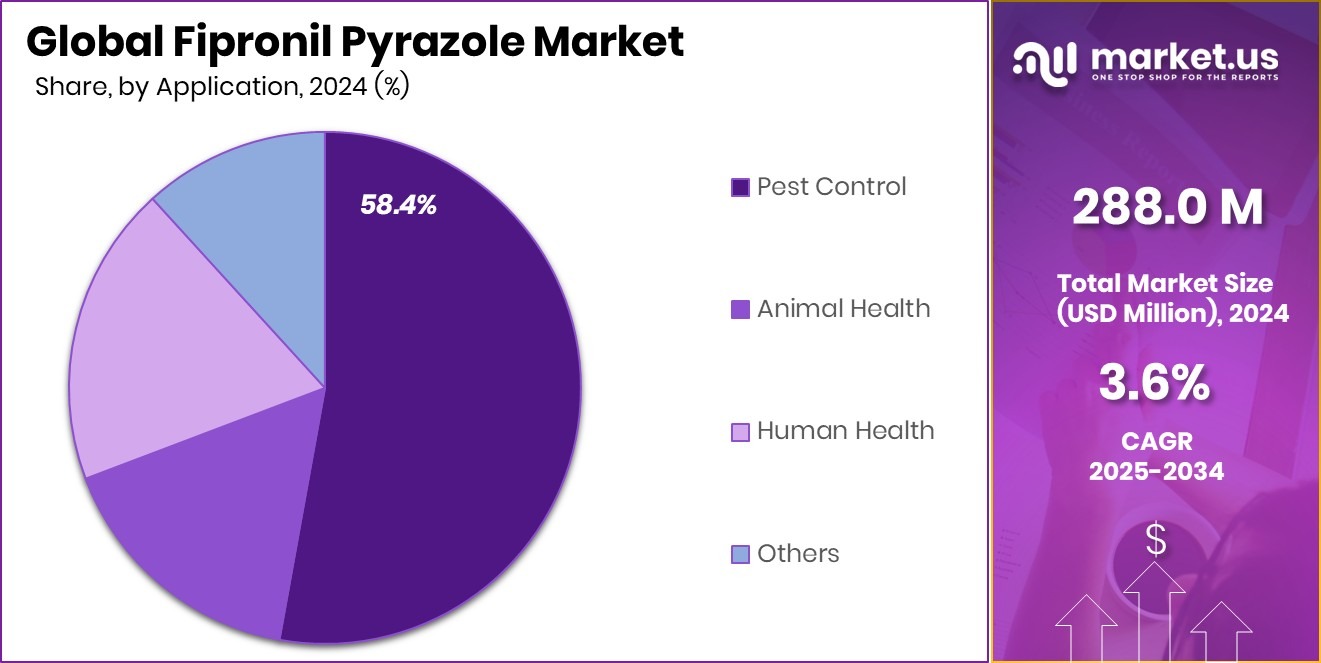

- Pest control applications led the Fipronil Pyrazole Market with a 58.4% share, reflecting its broad insecticidal effectiveness.

- The Asia-Pacific market reached USD 142.2 Mn, highlighting strong regional demand.

By Form Analysis

The Fipronil Pyrazole Market in liquid form holds 43.7% dominance.

In 2024, Liquid held a dominant market position in the By Form segment of the Fipronil Pyrazole Market, with a 43.7% share. The liquid form is widely preferred because of its ease of application, fast absorption, and better coverage on crops compared to other formulations. Farmers often choose liquid formulations, as they can be sprayed directly, ensuring uniform distribution and higher effectiveness against a broad range of pests. This advantage helps in reducing crop losses and improving yield, which is critical at a time when demand for food production is steadily rising.

The dominance of the liquid form is also linked to its adaptability in different agricultural practices. It is suitable for use in foliar sprays, soil treatments, and seed coating, making it versatile across multiple crop types such as cereals, vegetables, and fruits. Moreover, the convenience of storage and mixing further adds to its preference among farmers.

Another factor supporting its strong market share is the growing adoption of mechanized farming, where liquid insecticides are easier to integrate with modern spraying equipment. This compatibility ensures efficiency in large-scale farming, particularly in regions with high agricultural output. With these benefits, the liquid segment continues to lead the market, shaping overall growth trends.

By Crop Type Analysis

Rice cultivation drives the Fipronil Pyrazole Market with a strong 38.2% share.

In 2024, Rice held a dominant market position in the By Crop Type segment of the Fipronil Pyrazole Market, with a 38.2% share. Rice cultivation is highly vulnerable to insect infestations such as stem borers, leaf folders, planthoppers, and other pests that can cause significant yield losses.

The effectiveness of Fipronil Pyrazole in controlling these pests has made it a preferred choice for rice farmers across major producing regions. Its ability to provide long-lasting protection and reduce repeated applications contributes to higher productivity, which is vital for meeting the global demand for rice as a staple food.

The segment’s strength also comes from the extensive use of rice as a primary dietary component in Asia, Africa, and parts of Latin America. Farmers in these regions rely heavily on efficient crop protection solutions, and the proven performance of Fipronil Pyrazole in rice farming has ensured its consistent adoption.

By Application Analysis

Pest control applications lead the Fipronil Pyrazole Market, capturing a 58.4% share.

In 2024, Pest Control held a dominant market position in the By Application segment of the Fipronil Pyrazole Market, with a 58.4% share. The segment’s leadership is driven by the widespread use of fipronil pyrazole in managing termites, ants, cockroaches, and other household and structural pests that pose risks to both health and property.

Its strong efficacy, even in small concentrations, has made it one of the most reliable choices for pest control operators and households seeking long-term solutions. The ability of Fipronil Pyrazole to disrupt the central nervous system of insects ensures effective elimination, which explains its heavy reliance in this segment.

The prominence of pest control is also linked to increasing urbanization and rising awareness about hygiene and public health. With urban centers expanding, the demand for effective pest control solutions has grown significantly, as infestations can lead to food contamination, structural damage, and disease transmission. Fipronil Pyrazole, known for its residual effect and versatility in liquid and bait formulations, meets these requirements effectively.

Its adoption in pest control continues to rise due to its adaptability for both residential and commercial settings. The ability to deliver consistent results has cemented its dominance, ensuring the segment maintains its leading position in the overall market.

Key Market Segments

By Form

- Gel

- Particle

- Liquid

By Crop Type

- Rice

- Corn

- Soybeans

- Wheat

- Others

By Application

- Pest Control

- Animal Health

- Human Health

- Others

Driving Factors

Rising Global Food Demand Boosts Insecticide Adoption

One of the biggest driving factors for the Fipronil Pyrazole Market is the rising global demand for food production. As the world population grows, farmers face pressure to produce more crops on limited farmland. Pests such as stem borers, termites, beetles, and leaf folders cause major yield losses, making effective crop protection vital.

Fipronil Pyrazole has become a trusted solution because it controls a wide range of insects with long-lasting effectiveness. Its use allows farmers to safeguard staple crops like rice, wheat, and maize, which are essential for food security. With increasing pressure to reduce crop losses and improve productivity, the adoption of Fipronil Pyrazole continues to grow, making it a key factor driving the market forward.

Restraining Factors

Environmental Concerns and Regulatory Restrictions Limit Growth

A major restraining factor for the Fipronil Pyrazole Market is the growing concern over its environmental impact and strict government regulations. While the chemical is highly effective against pests, studies have shown that excessive or improper use can harm non-target species, including bees and aquatic life. This has led to stricter usage guidelines and, in some regions, partial restrictions or bans.

Farmers and pest control operators often face limitations on dosage, frequency, and approved crops, which directly affect their market reach. Moreover, rising awareness among consumers about food safety and residues has increased pressure on policymakers to enforce tighter controls. These factors create barriers for wider adoption and pose challenges to the long-term expansion of the market.

Growth Opportunity

Development of Eco-Friendly Formulations Creates New Opportunities

A key growth opportunity for the Fipronil Pyrazole Market lies in the development of eco-friendly and safer formulations. Farmers and consumers are becoming more conscious about sustainability, food safety, and the long-term impact of chemicals on soil and water. This shift is encouraging manufacturers to explore innovative blends of Fipronil Pyrazole that minimize environmental risks while maintaining strong pest control performance.

Advanced delivery methods, such as controlled-release liquids and seed coatings, can improve efficiency while reducing excessive use. Such innovations would not only meet stricter regulatory standards but also align with global trends toward sustainable agriculture. By focusing on safer, targeted, and residue-free solutions, the market can capture new demand and secure long-term growth potential.

Latest Trends

Increasing Use in Integrated Pest Management Practices

One of the latest trends in the Fipronil Pyrazole Market is its growing use within Integrated Pest Management (IPM) systems. Farmers and pest control operators are moving away from heavy dependence on a single chemical and are instead combining different biological, cultural, and chemical methods to control pests more effectively.

Fipronil Pyrazole is finding a stronger role in these programs because of its targeted action and long residual effect, which reduces the need for frequent spraying. By using it as part of an IPM approach, farmers can cut overall chemical load, lower costs, and improve environmental safety. This trend reflects the market’s shift toward smarter, more sustainable practices that balance productivity with ecological responsibility.

Regional Analysis

In 2024, the Asia-Pacific held a 49.4% share of the Fipronil Pyrazole Market.

The Fipronil Pyrazole Market shows a varied regional landscape, with Asia-Pacific emerging as the clear leader in 2024. Asia-Pacific accounted for 49.4% of the market, valued at USD 142.2 million, supported by its large-scale rice and cereal cultivation, which faces high pest infestation levels. Countries such as China, India, and Vietnam rely heavily on crop protection chemicals to safeguard yields, making the region the central hub for demand.

The dominance of Asia-Pacific is further driven by rising food consumption, expanding agricultural practices, and government support for improving productivity. In contrast, North America and Europe reflect steady adoption, largely influenced by advanced farming practices, regulatory frameworks, and the need for sustainable pest management solutions. Meanwhile, Latin America has been showing gradual growth, supported by large agricultural economies like Brazil and Argentina, where pest pressure remains a key challenge.

The Middle East & Africa market, although smaller, is expanding as nations invest in food security initiatives and modern farming techniques. Overall, Asia-Pacific stands as the dominating region, accounting for nearly half of the global market, underlining its crucial role in shaping the growth trajectory of Fipronil Pyrazole across all major agricultural economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albaugh LLC has positioned itself as a significant player by focusing on off-patent crop protection products. Its strategy of providing cost-effective solutions has enabled it to build a strong presence in markets where affordability drives adoption, particularly among farmers in emerging regions. By offering Fipronil-based products that balance performance with competitive pricing, Albaugh has strengthened its role as a reliable supplier.

BASF SE, on the other hand, remains a global innovation leader in crop protection, leveraging its advanced research capabilities. The company’s involvement in developing safer, efficient formulations of Fipronil has positioned it strongly in both developed and developing markets. BASF’s continued focus on sustainability and regulatory compliance ensures its long-term relevance, even as global scrutiny on chemical pesticides grows.

Bayer AG and Bayer CropScience AG, operating under an integrated framework, have sustained their dominance by combining strong R&D capabilities with wide distribution networks. Bayer’s brand strength and global reach allow it to maintain trust among farmers, while CropScience plays a pivotal role in delivering targeted agricultural solutions. Their focus on protecting staple crops such as rice, maize, and wheat directly aligns with rising global food demand.

Top Key Players in the Market

- Albaugh LLC

- BASF SE

- Bayer AG

- Bayer CropScience AG

- Gharda Chemicals Limited

- HPM Chemicals

- Parijat Industries (India) Pvt. Ltd.

- Peptech Biosciences Ltd.

- Sumitomo Chemical Company Limited

Recent Developments

- In March 2025, Albaugh Brazil introduced Sultan®, a new insecticide based on the active ingredient etiprole. This product is specifically formulated to protect soybean crops in Brazil, offering a concentrated, high-value alternative for farmers dealing with pest challenges in this key agricultural market.

Report Scope

Report Features Description Market Value (2024) USD 288.0 Million Forecast Revenue (2034) USD 410.2 Million CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Gel, Particle, Liquid), By Crop Type (Rice, Corn, Soybeans, Wheat, Others), By Application (Pest Control, Animal Health, Human Health, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albaugh LLC, BASF SE, Bayer AG, Bayer CropScience AG, Gharda Chemicals Limited, HPM Chemicals, Parijat Industries (India) Pvt. Ltd., Peptech Biosciences Ltd., Sumitomo Chemical Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fipronil Pyrazole MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Fipronil Pyrazole MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Albaugh LLC

- BASF SE

- Bayer AG

- Bayer CropScience AG

- Gharda Chemicals Limited

- HPM Chemicals

- Parijat Industries (India) Pvt. Ltd.

- Peptech Biosciences Ltd.

- Sumitomo Chemical Company Limited