Global Fine Art Logistics Market Size, Share, Growth Analysis By Logistics Function (Transportation, Warehousing & Distribution), By End Users (Art Dealers and Galleries, Auction Houses, Museums, Art Fairs, Private Collectors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170679

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

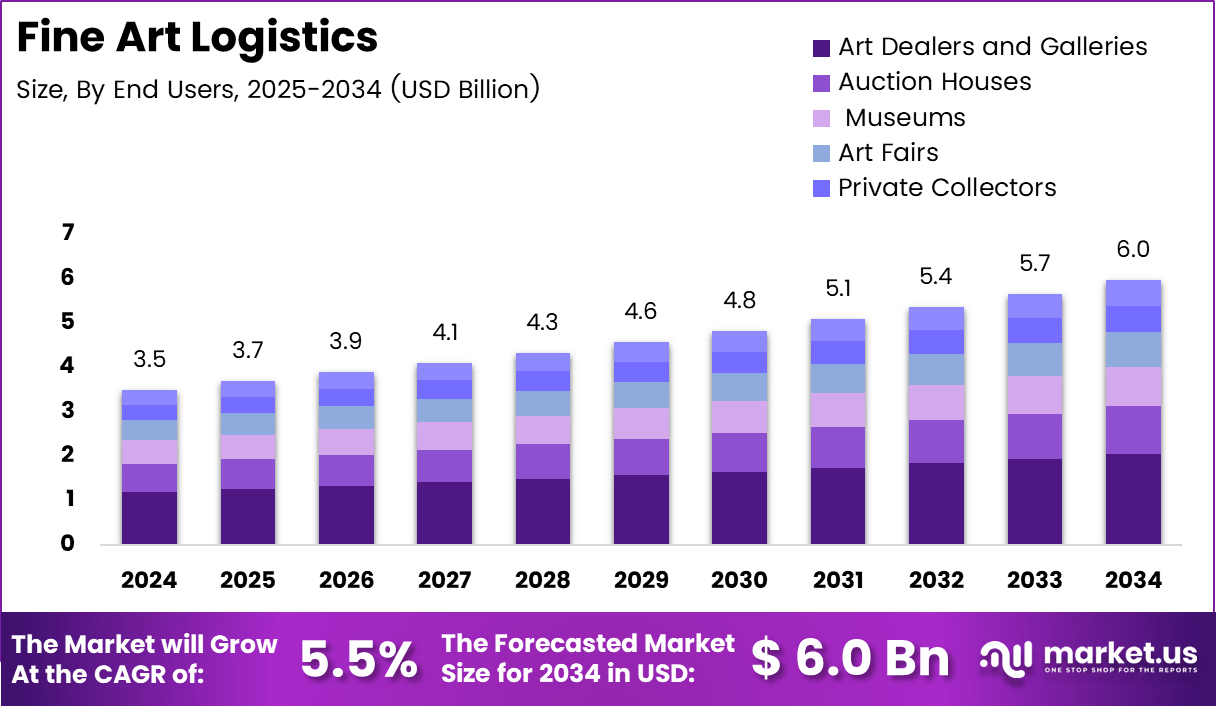

The Global Fine Art Logistics Market size is expected to be worth around USD 6.0 billion by 2034, from USD 3.5 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Fine Art Logistics Market refers to specialized services managing secure transportation, storage, handling, and installation of high value artworks. From an analyst viewpoint, this market operates at the intersection of logistics, conservation science, and risk management. Consequently, demand rises as artworks increasingly function as financial assets requiring controlled, compliant, and traceable logistics workflows.

From a growth perspective, fine art logistics is expanding alongside global art trade, exhibitions, and private collections. Moreover, rising cross border art movements increase reliance on professional logistics partners. Therefore, services such as climate controlled transport, condition reporting, and white glove handling are increasingly integrated into standard art transaction processes worldwide.

In terms of opportunity, secure storage infrastructure plays a critical role in value preservation. Modern facilities use welded steel frame modular strong rooms, delivering continuous security 24 hours a day, 7 days a week, 365 days a year. Consequently, bonded warehouses and freeports attract collectors, galleries, and institutions seeking long term storage solutions.

Government investment and regulation further shape market dynamics through customs controls, cultural heritage protection, and temporary import frameworks. Additionally, tax free zones and art freeports supported by public private partnerships facilitate international exhibitions. As a result, regulatory clarity and infrastructure funding are expected to strengthen cross border art logistics efficiency and compliance.

From a market sentiment standpoint, transaction optimism directly supports logistics demand. According to the Art Basel and UBS Art Market Report, 62% of dealers and 81% of second tier auction houses expected sales improvement in 2022. Consequently, higher sales confidence drives increased movement, storage, and exhibition related logistics activity.

Infrastructure expansion also reinforces market momentum. The Art Market Report notes the opening of at least 25 new auction businesses since 2020, nearly 30 new galleries in 2021, and major exhibition developments. For example, ART Tower launched by West Bund Group spans 93,000 square meters, intensifying logistics service requirements.

In the Western market, unprecedented supply absorption further strengthens logistics demand. According to industry reports, 87% of total supply found buyers, resulting in a 58% market share. Therefore, higher transaction volumes, frequent artwork circulation, and institutional expansion collectively position fine art logistics as a critical enabler of market liquidity and asset protection.

Key Takeaways

- The global Fine Art Logistics Market is projected to grow from USD 3.5 billion in 2024 to USD 6.0 billion by 2034, registering a 5.5% CAGR during 2025 to 2034.

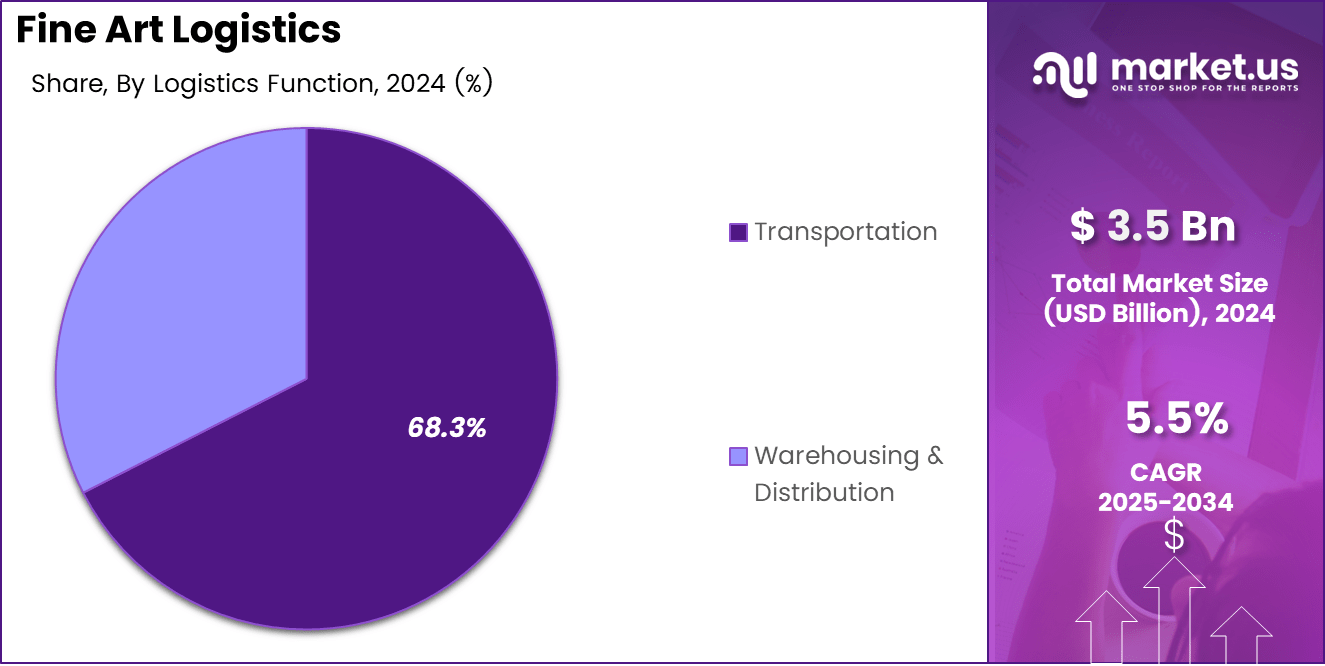

- By logistics function, Transportation dominates the market with a share of 68.3% in 2024, reflecting its critical role in secure and condition-controlled artwork movement.

- By end users, Art Dealers and Galleries lead the market with a share of 34.2% in 2024, driven by frequent exhibitions and cross-border art transactions.

- Regionally, North America holds the dominant position with a market share of 46.9%, accounting for USD 1.6 billion in 2024.

By Logistics Function Analysis

Transportation dominates the Fine Art Logistics Market with 68.3%, supported by the critical need for secure, time-sensitive, and condition-controlled movement of high-value artworks.

Transportation held a dominant market position in the By Logistics Function Analysis segment of Fine Art Logistics Market, with a 68.3% share. This dominance is driven by rising cross-border art trade, frequent participation in international art fairs, and growing demand for climate-controlled vehicles. Consequently, logistics providers prioritize secure handling, real-time tracking, and specialized packaging solutions.

Warehousing & Distribution held a supporting position in the By Logistics Function Analysis segment of Fine Art Logistics Market. This segment focuses on secure storage, inventory management, and controlled access facilities. Moreover, demand is reinforced by private collectors and institutions seeking long-term preservation, bonded storage options, and value-added services such as cataloging and insurance coordination.

By End Users Analysis

Art Dealers and Galleries lead the Fine Art Logistics Market with 34.2%, reflecting their continuous involvement in exhibitions, sales, and international artwork movements.

Art Dealers and Galleries held a dominant market position in the By End Users Analysis segment of Fine Art Logistics Market, with a 34.2% share. Their dominance stems from frequent artwork rotation, global buyer access, and participation in exhibitions. As a result, consistent demand exists for transport, short-term storage, and customs clearance services.

Auction Houses represented a significant end-user segment within the By End Users Analysis of Fine Art Logistics Market. These entities require precise scheduling, secure pre-auction storage, and fast post-sale delivery. Additionally, high transaction values increase reliance on insured transportation and specialized handling to protect artworks during peak auction periods.

Museums remained an important end-user segment in the By End Users Analysis of Fine Art Logistics Market. Museums depend on logistics providers for loaned exhibitions, conservation-safe transport, and long-term storage. Moreover, public and private museum collaborations continue to support steady logistics demand across domestic and international routes.

Art Fairs contributed steadily to the By End Users Analysis of Fine Art Logistics Market. These events require rapid setup, dismantling, and synchronized delivery schedules. Consequently, logistics providers offer temporary storage, on-site handling, and reverse logistics solutions to support multiple exhibitors within strict timelines.

Private Collectors formed a growing end-user segment in the By End Users Analysis of Fine Art Logistics Market. Increasing wealth concentration and interest in art as an investment encourage demand for discreet transportation and secure storage. Furthermore, collectors value customized services emphasizing confidentiality and asset protection.

Others, including corporate buyers and cultural institutions, represented a smaller yet stable segment in the By End Users Analysis of Fine Art Logistics Market. This group relies on professional logistics for artwork relocation, office displays, and cultural projects. Gradually, awareness of professional art handling standards supports consistent service adoption.

Key Market Segments

By Logistics Function

- Transportation

- Warehousing & Distribution

By End Users

- Art Dealers and Galleries

- Auction Houses

- Museums

- Art Fairs

- Private Collectors

- Others

Drivers

Expansion of Global Art Trade Drives Fine Art Logistics Market Growth

The expansion of global art trade is a key driver for the fine art logistics market. Increasing cross-border gallery representation allows artists and dealers to reach international buyers more easily. As a result, artworks move more frequently between countries for exhibitions, sales, and collaborations. This trend steadily increases demand for professional logistics services.

Rising participation in international art fairs further supports market growth. These events require timely and secure transportation of artworks across borders. Consequently, logistics providers play a critical role in ensuring artworks arrive safely, on schedule, and in compliance with handling standards.

Another important driver is the growing need for climate-controlled and conservation-grade transportation. High-value artworks are sensitive to temperature, humidity, and vibration. Therefore, collectors and institutions increasingly rely on specialized transport solutions to preserve artwork condition.

Additionally, growth in private art collections and institutional investments strengthens demand. High-net-worth individuals, family offices, and museums continue acquiring artworks and organizing traveling exhibitions. This activity consistently supports the need for expert fine art logistics services.

Restraints

Complex Regulatory Requirements Restrain Fine Art Logistics Market Growth

Complex customs clearance processes remain a major restraint for the fine art logistics market. Artworks crossing international borders must comply with varying import, export, and cultural property regulations. These procedures often delay shipments and increase administrative workload for logistics providers.

Cultural property laws add further challenges. Certain artworks require special permits or face export restrictions. As a result, logistics planning becomes more time-consuming and requires legal expertise, limiting operational flexibility.

Limited availability of skilled art handlers also restrains market expansion. Fine art logistics depends on professionals trained in conservation-safe handling. However, such expertise is not widely available, especially in emerging markets.

High operational costs present another restraint. Specialized packaging, secure vehicles, insurance, and trained staff significantly increase service costs. These factors can limit adoption among smaller galleries and collectors.

Growth Factors

Expansion of Online Art Sales Creates Growth Opportunities

The expansion of online art sales platforms creates strong growth opportunities for the fine art logistics market. Digital auctions and online galleries increase artwork movement directly to buyers. This trend raises demand for reliable last-mile delivery services designed for delicate artworks.

Rising demand for bonded storage and freeport facilities also supports market opportunity. Collectors and dealers seek secure storage in major art hubs to defer taxes and manage collections efficiently. Consequently, logistics providers offering these services gain a competitive advantage.

Emerging art markets present additional growth potential. Regions such as Asia Pacific, the Middle East, and Latin America are witnessing increased art investment. Growing local galleries and fairs drive demand for professional logistics support.

Moreover, international interest in regional artists encourages cross-border shipments. This ongoing expansion broadens the global footprint of fine art logistics services.

Emerging Trends

Adoption of Advanced Handling Practices Shapes Market Trends

Real-time environmental monitoring is a key trend in the fine art logistics market. Sensors track temperature, humidity, and shock during transport and storage. This improves transparency and reassures clients about artwork safety.

Bespoke crating solutions are increasingly used to match specific artwork materials and formats. Customized crates reduce movement and environmental exposure, improving protection for fragile and high-value pieces.

Sustainability practices are also gaining attention. Logistics providers are adopting reusable crates and eco-friendly packaging to reduce environmental impact while maintaining protection standards.

Additionally, clients prefer end-to-end logistics providers. Companies offering handling, storage, transport, and installation simplify coordination and reduce risk. This integrated service model continues to shape market expectations.

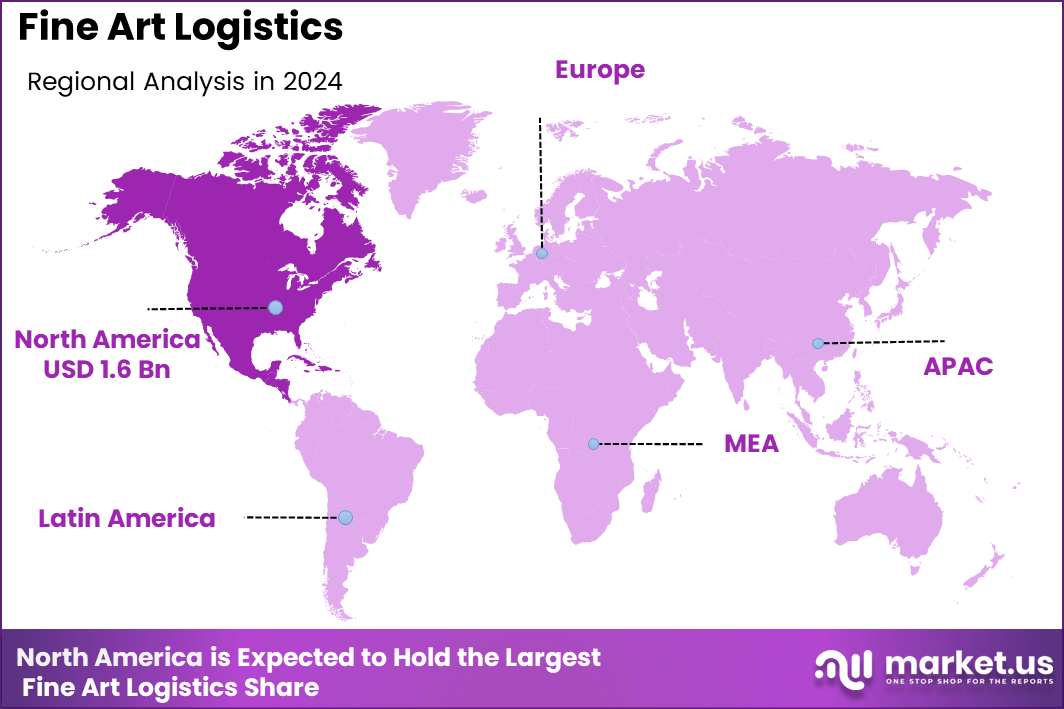

Regional Analysis

North America Dominates the Fine Art Logistics Market with a Market Share of 46.9%, Valued at USD 1.6 Billion

North America held the dominant position in the Fine Art Logistics Market, accounting for 46.9% of the market and reaching a value of USD 1.6 billion. This dominance is supported by a well-established art ecosystem, high concentration of private collectors, and frequent international art movements. Strong institutional demand from museums and auction activities further sustains consistent logistics requirements.

Europe Fine Art Logistics Market Trends

Europe represents a mature and stable regional market driven by cross-border art movement within the region. The presence of historic museums, cultural institutions, and international exhibitions supports continuous demand for specialized transportation and storage services. Regulatory complexity across countries also reinforces the need for professional logistics expertise.

Asia Pacific Fine Art Logistics Market Trends

Asia Pacific is experiencing steady growth due to rising art investments and expanding private collections. Increasing participation in global art fairs and growth of regional galleries are driving demand for secure transport and bonded storage. Improved logistics infrastructure in major cities supports greater market adoption.

Middle East and Africa Fine Art Logistics Market Trends

The Middle East and Africa region shows gradual expansion supported by cultural investments and new museum developments. Growing interest in international exhibitions and private collections is increasing the need for conservation-grade logistics. Demand remains concentrated in key cultural and financial hubs.

Latin America Fine Art Logistics Market Trends

Latin America reflects emerging opportunities driven by rising regional art events and growing collector interest. Increased participation in international art exchanges encourages cross-border shipments. As awareness of professional art handling grows, demand for specialized logistics services continues to develop steadily.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Fine Art Logistics Company Insights

In 2024, the global Fine Art Logistics market continues to evolve with a focus on specialized handling, secure transport, and tailored client services. Yamato Transport has strengthened its position by leveraging its extensive Asia-Pacific network and commitment to precision in temperature and humidity control, setting high standards for the safe movement of artworks. Its emphasis on integrating digital tracking enhances transparency and builds confidence among high-value clients.

Gander & White remains a key player renowned for its bespoke logistics solutions that cater specifically to galleries, museums, and private collectors. The company’s deep expertise in customs clearance and risk-mitigation strategies allows it to manage complex cross-border shipments effectively, supporting major exhibitions and high-profile art sales with tailored consultation throughout the delivery process.

Sinotrans has leveraged its expansive global footprint to offer competitive solutions in fine art logistics, particularly through combined sea, air, and land transport services. Its investment in secure packaging technologies and infrastructure reflects a broader industry trend toward end-to-end accountability, ensuring artworks are protected from origin to destination while optimizing transit costs for international clients.

Helu-Trans differentiates itself through a strong emphasis on personalized service and flexibility, catering to niche market segments requiring highly customized handling protocols. By focusing on client collaboration and innovation in transport solutions, it has carved out a reputation for reliability in delivering delicate and high-value pieces, particularly in emerging markets where demand for fine art logistics is growing.

Top Key Players in the Market

- Yamato Transport

- Gander & White

- Sinotrans

- Helu-Trans

- Hasenkamp

- DSV

- Masterpiece International

- U.S. Art

- DHL

- Andre Chenue

Recent Developments

- In Aug 2024, DHL Global Forwarding decided to divest its Norwegian fine art business to MTAB, refocusing its specialized logistics portfolio. The divested unit provides highly tailored fine art logistics services, including transportation, packaging, storage, installation, and conservation through a global partner network.

- In Jul 31, 2025, The Fine Art Group announced the expansion of its Art Investment and Finance divisions with the appointment of Li Jun Xian as Senior Director, Art Investment in New York. The appointment strengthens the firm’s asset backed financing capabilities, supported by Xian’s 20+ years of experience from roles at Goldman Sachs and Emigrant Bank Fine Art Finance.

Report Scope

Report Features Description Market Value (2024) USD 3.5 billion Forecast Revenue (2034) USD 6.0 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Logistics Function (Transportation, Warehousing & Distribution), By End Users (Art Dealers and Galleries, Auction Houses, Museums, Art Fairs, Private Collectors, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Yamato Transport, Gander & White, Sinotrans, Helu-Trans, Hasenkamp, DSV, Masterpiece International, U.S. Art, DHL, Andre Chenue Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yamato Transport

- Gander & White

- Sinotrans

- Helu-Trans

- Hasenkamp

- DSV

- Masterpiece International

- U.S. Art

- DHL

- Andre Chenue