Global Field Data Collection App Market Size, Share, Growth Analysis By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises), By Application (Inspections & Audits, Asset Management & Maintenance, Surveys & Research, Service & Delivery Management, Construction & Site Management, Agriculture & Environmental Monitoring, Others), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (Government & Public Sector, Agriculture, Energy & Utilities, Healthcare, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169138

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Technology

- AI Industry Adoption

- Emerging Trends

- US Market Size

- By Component

- By Deployment Mode

- By Application

- By Organization Size

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

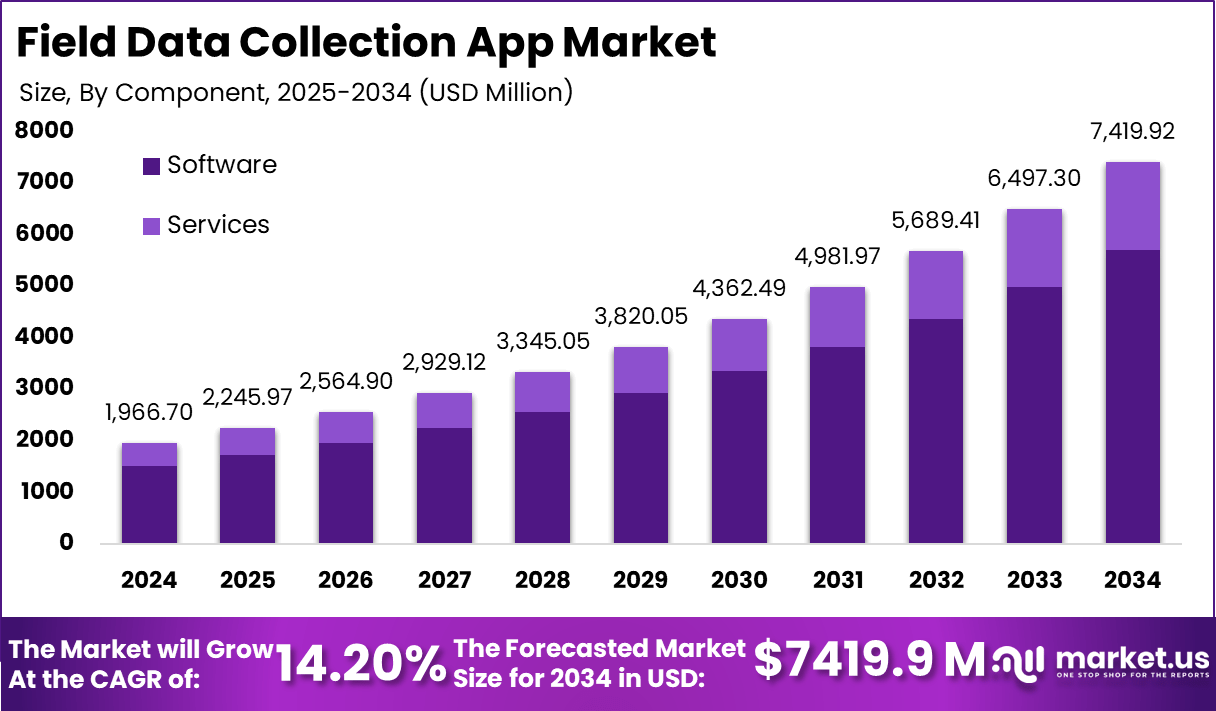

The global Field Data Collection App Market was valued at USD 1,966.7 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 14.20%, reaching an estimated value of USD 7,419.9 million by 2034.

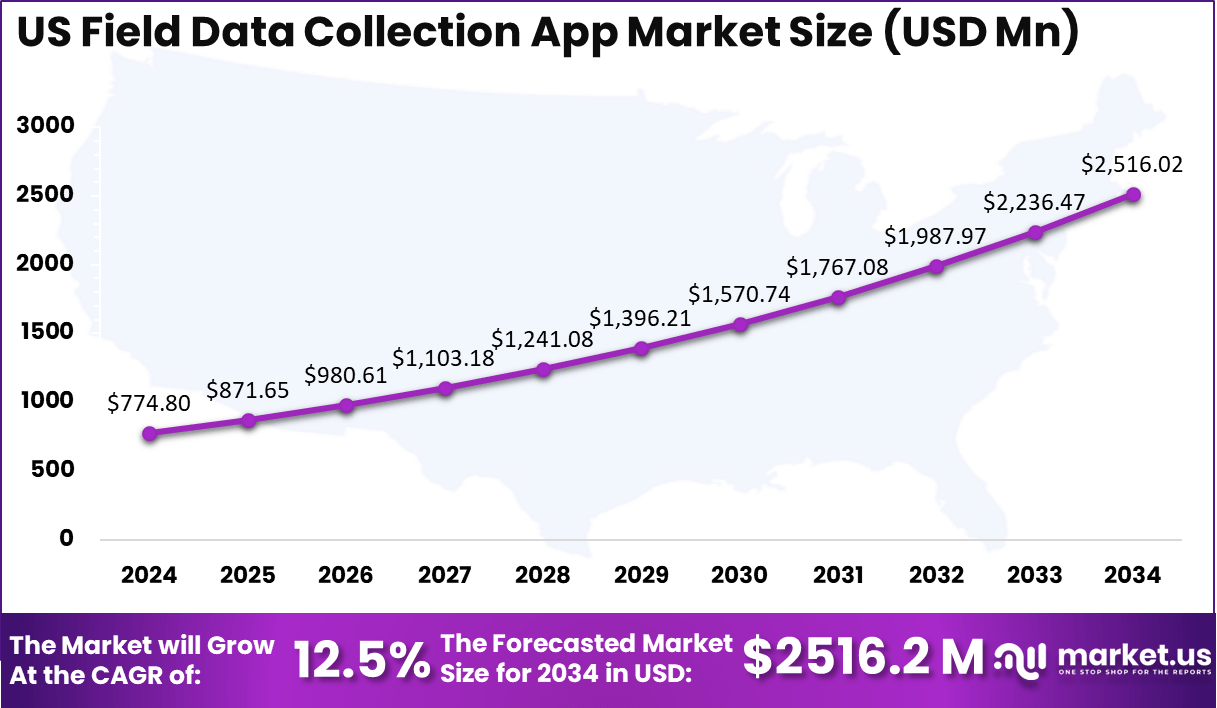

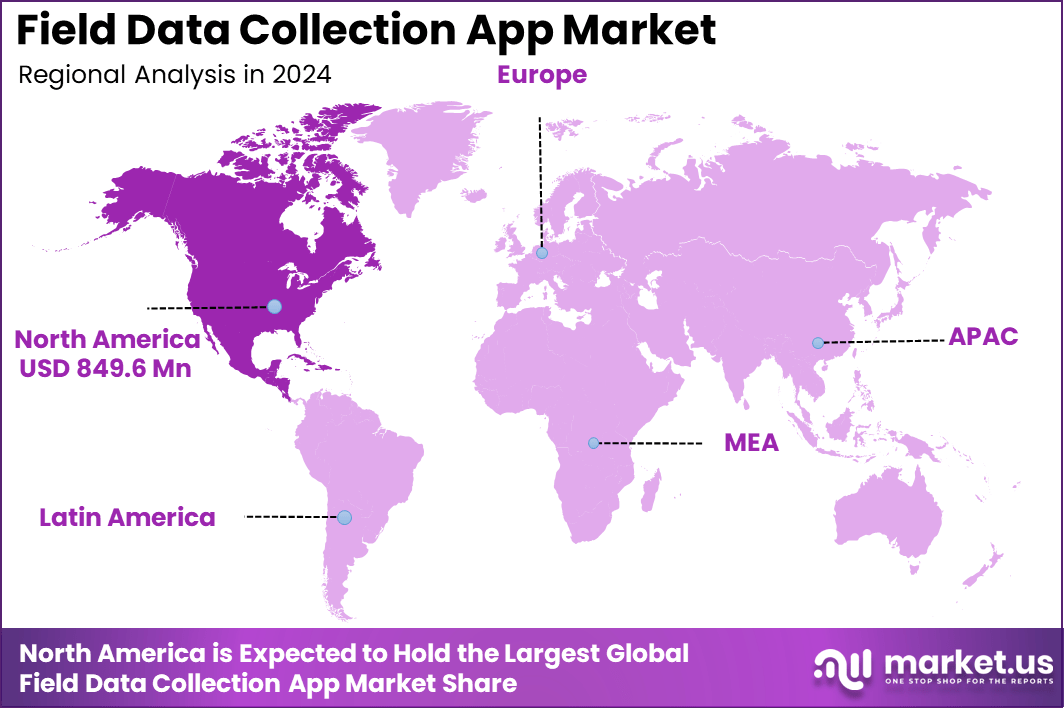

North America holds the largest market share, accounting for 43.2% of the global market, with an expected value of USD 849.6 million in 2024. In the United States, the market is valued at USD 774.8 million in 2024, with a steady growth trajectory, expected to reach USD 2,516.2 million by 2034, growing at a CAGR of 12.5%. This growth reflects the increasing demand for digital solutions that streamline field data collection processes, driving efficiency in various industries, including construction, healthcare, and retail.

The adoption of mobile and cloud-based technologies, along with advancements in data analytics, is expected to further propel market expansion, particularly in regions like North America, where companies are increasingly integrating digital tools for data collection and analysis. The market is poised to experience significant growth as organizations worldwide recognize the value of leveraging real-time data for operational improvements and decision-making.

The Field Data Collection App Market is witnessing rapid growth as businesses across various sectors increasingly recognize the value of real-time data capture and analysis. These applications allow field workers to efficiently collect, manage, and analyze data, improving decision-making, enhancing operational efficiency, and reducing human error.

Industries such as construction, agriculture, healthcare, logistics, and environmental monitoring are among the primary adopters of field data collection solutions, leveraging the technology to streamline workflows, ensure compliance, and boost productivity.

The rise of mobile and cloud-based technologies has further accelerated the adoption of these apps, enabling seamless integration with other enterprise systems and allowing users to access and update data from anywhere.

Moreover, the incorporation of advanced features like geospatial mapping, sensor integration, and machine learning algorithms is expanding the capabilities of field data collection apps, making them indispensable tools for organizations seeking to enhance their data-driven strategies.

As businesses increasingly move towards digital transformation, field data collection apps have become a critical tool in industries that rely heavily on data-driven insights. The ongoing demand for mobile-first, paperless solutions that facilitate efficient field operations is expected to drive continued growth and innovation in the market, with future developments focused on further improving user experience and data analytics.

The field data collection app industry in 2025 is marked by significant developments in acquisitions, funding, and technological enhancements. Leading companies like Trimble Inc. have expanded their market presence through strategic acquisitions, focusing on integrating mobile data and geospatial tools to enhance field data accuracy and efficiency. Partnerships between app providers and IoT companies have increased, enabling devices to work offline with cloud-based syncing and advanced analytics, broadening app capabilities and user reach.

Funding activities have risen, including notable research grants like those from SurveyCTO to support fieldwork projects through platform access and equipment resources. There is also an upward trend in R&D investments and collaborations aimed at innovating scalable solutions capable of handling larger and more complex data sets. These efforts center on incorporating artificial intelligence, GIS technologies, and real-time data collection enhancements that improve data reliability and decision-making efficiency on the field.

The adoption of cloud infrastructure has accelerated, evidenced by significant increases in cloud spending in various regions, facilitating the deployment and scalability of these apps. Although specific product launch numbers and the count of mergers or acquisitions for 2025 are not detailed, the sector sees consistent yearly growth in transaction activities and funding rounds, driven by demand for automation, IoT integration, and digital transformation in data collection processes. Overall, these factors explain a dynamic and fast-evolving market landscape with increasing strategic collaborations and technological innovation.

Key Takeaways

- 2024 Market Value: USD 1,966.7 Million, Projected CAGR: 14.20%, 2034 Market Value: USD 7,419.9 Million.

- North America holds 43.2% of the global market share, with a 2024 market size of USD 849.6 Million.

- US Market Value in 2024: USD 774.8 Million, projected to reach USD 2,516.2 Million by 2034, with a CAGR of 12.5%.

- By Component, Software accounts for 76.8%.

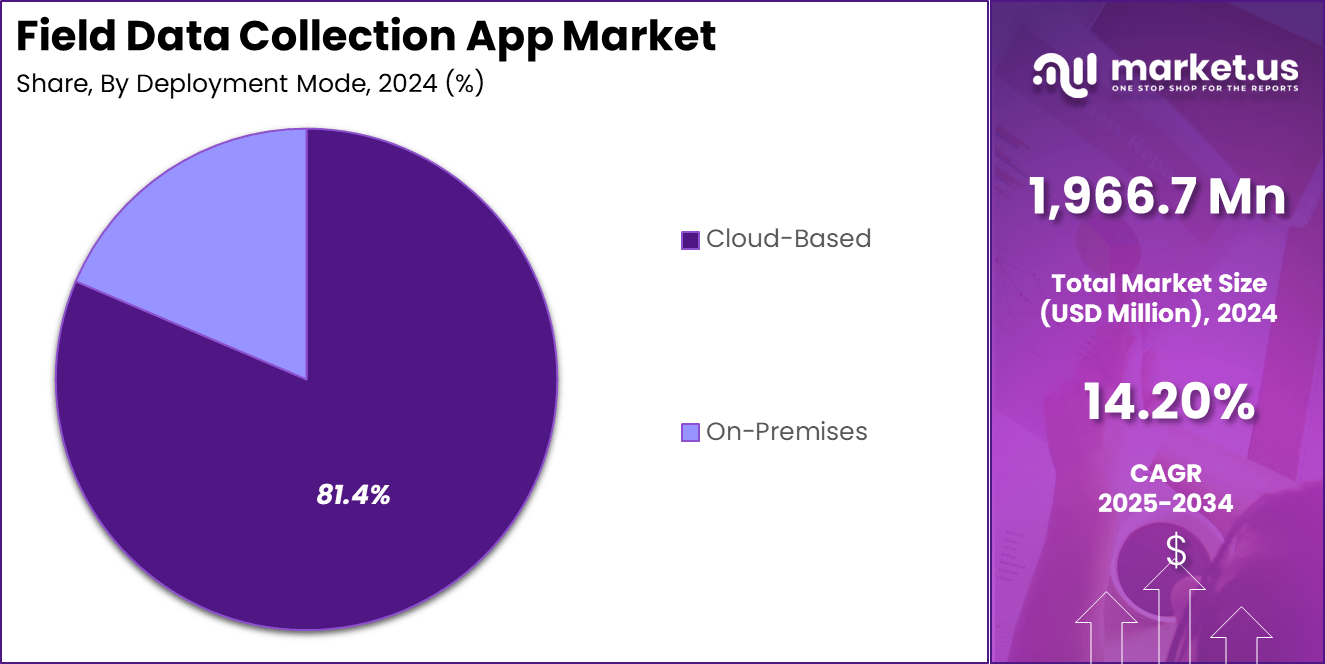

- By Deployment Mode, Cloud-based solutions represent 81.4%.

- By Application, Inspections & Audits comprise 32.5%.

- By Organization Size, Large Enterprises represent 63.2%.

- By End-User, Construction makes up 30.3%.

Role of Technology

Technology plays a pivotal role in transforming industries by enabling greater efficiency, innovation, and scalability. In sectors like healthcare, manufacturing, retail, and logistics, technology has become the backbone of operations, driving automation, data analytics, and enhanced decision-making. The integration of digital tools such as cloud computing, artificial intelligence (AI), machine learning, and Internet of Things (IoT) has revolutionized how businesses operate, providing real-time insights and streamlining processes.

In field data collection, for example, mobile apps equipped with AI and GPS are enhancing data accuracy and reducing errors, allowing field workers to gather and analyze data instantly. This reduces dependency on manual processes and ensures more informed, timely decisions. Furthermore, cloud-based platforms have made it easier for businesses to store, access, and share data across multiple locations, fostering collaboration and scalability.

The role of technology is also crucial in enabling remote work and virtual communication, expanding access to global talent and markets. As businesses continue to adopt these advanced technologies, they can respond to market demands more quickly, create innovative products and services, and achieve operational excellence. In the coming years, the role of technology will continue to evolve, shaping the future of industries and driving economic growth.

AI Industry Adoption

The adoption of artificial intelligence (AI) across industries is accelerating rapidly as companies leverage its capabilities to drive efficiency, innovation, and competitiveness. Recent data indicates that 72 % of companies globally now use AI in at least one business function, reflecting the broad acceptance of AI-enabled tools and processes.

Industries such as manufacturing, healthcare, finance, retail, logistics, automotive, and energy have emerged as major adopters, underscoring AI’s versatility and relevance across diverse sectors. In manufacturing, around 93 % of industry leaders report moderate to extensive use of AI — from quality inspection to predictive maintenance, robotics, and automation — helping reduce costs and improve output quality.

In healthcare, AI is transforming diagnostics, patient monitoring, and treatment planning, enabling faster analysis of complex clinical data, improving accuracy, and personalizing care. Financial services and banking continue to benefit from AI for fraud detection, risk assessment, automation of back offices, and customer engagement analytics.

Moreover, AI adoption is not limited to large enterprises. Even small and medium‑sized businesses, especially in service and retail sectors, are adopting AI to gain a competitive edge through automation, analytics, and enhanced customer interactions. As firms increasingly integrate AI tools and machine learning systems, they gain improved decision-making capacity, operational scalability, enhanced productivity, and opportunities for innovation across functions.

Emerging Trends

- The increasing integration of AI, ML, IoT, edge computing, and cloud computing is enabling data‑collection systems to evolve into real‑time, intelligent platforms offering automated analytics and predictive insights.

- There is a visible shift from centralized cloud‑based processing toward edge computing and distributed architectures, enabling lower latency, improved responsiveness, and better data privacy — especially important for field and IoT data collection.

- Multi‑modal data collection — combining sensor data, geospatial mapping, audio/video, IoT telemetry, and ML-derived analytics — is growing, making field data apps more versatile across industries.

- Low‑code/no‑code and no‑code development frameworks are emerging, lowering the barrier for organizations to deploy custom data‑collection and analytics apps without deep technical expertise.

- Data analytics is shifting toward augmented analytics — platforms that automate data cleaning, pattern detection, and insight generation — reducing dependency on data‑science specialists and enabling faster decision‑making.

- The convergence of AI and IoT (AIoT) is creating intelligent data‑collection networks that can detect patterns in real time, enable predictive maintenance, remote monitoring, and dynamic reporting — adding strategic value for enterprises.

- Growing global emphasis on data privacy, security, and regulatory compliance is influencing the design of data collection and storage systems — prompting adoption of secure architectures, encryption, and responsible data management.

- Demand for cross‑industry, scalable field data collection solutions is rising, as sectors like agriculture, construction, logistics, utilities, and environmental monitoring increasingly rely on real‑time data and analytics-driven workflows.

US Market Size

The US market for field data collection apps is valued at USD 774.8 million in 2024 and is projected to grow significantly, reaching USD 2,516.2 million by 2034. This represents a compound annual growth rate (CAGR) of 12.5%, highlighting the growing demand for real-time data collection and analytics solutions across various industries. The increasing adoption of mobile applications and cloud-based platforms is driving this growth, enabling businesses to collect, process, and analyze data efficiently and accurately.

Industries such as construction, agriculture, healthcare, and logistics are key contributors to the growth of the field data collection market in the US. These sectors are increasingly recognizing the importance of leveraging data to improve operational efficiency, ensure compliance, and make informed decisions. The integration of advanced technologies like AI, IoT, and machine learning into field data collection apps is further enhancing their capabilities, allowing for predictive maintenance, automation, and real-time decision-making.

As organizations in the US continue to adopt digital solutions to optimize their field operations, the market for field data collection apps is expected to expand at a strong pace. With the continued focus on data-driven insights, the US market is poised for substantial growth over the next decade.

By Component

The component‑wise breakdown of the Field Data Collection App market indicates that software represents 76.8% of the market, while the remaining share is attributable to services. This high share of software reflects several underlying dynamics. Software solutions, especially cloud‑based and subscription‑based models, enable rapid deployment, scalability, and frequent updates, making them appealing for organisations seeking agile data‑collection tools.

The prevalence of software further suggests that vendors have prioritised building feature‑rich and modular applications that can support functions like data capture, geospatial mapping, analytics, and reporting without requiring heavy custom services or on‑site infrastructure. On the other hand, the services portion covers deployment support, integration, customization, training, and maintenance, which remain important for clients with complex workflows or regulatory requirements.

However, given the dominance of software, the market is trending toward standardised, off‑the‑shelf platforms that minimise the need for bespoke services. As enterprises increasingly prefer cloud‑based, user-friendly software with minimal setup overhead, the relative role of services is decreasing, emphasizing software as the critical growth engine in the field of the data collection app market.

By Deployment Mode

The deployment‑mode breakdown of the field data collection app market shows that cloud‑based solutions account for 81.4% while the remainder relies on on‑premises deployment. The dominance of cloud-based deployment reflects multiple advantages for enterprises. Cloud solutions offer flexibility and scalability: organizations can easily adjust capacity based on real‑time needs without heavy upfront investments in hardware and infrastructure.

Cloud hosting also allows rapid deployment, enabling applications to be up and running within hours or days rather than weeks or months. Cloud providers manage maintenance, updates, backup, and disaster recovery, reducing the burden on in‑house IT teams and lowering the total cost of ownership. Remote accessibility is another key benefit; users can access apps from any location with internet connectivity, supporting mobile field operations and multi‑site coordination.

By contrast, on‑premises deployment gives full control over data, infrastructure, and security, and may suit organizations with strict compliance or latency requirements. However, on‑premises requires substantial capital expenditure, dedicated IT staff for maintenance, and limited scalability. As businesses increasingly prefer agility, cost‑efficiency, and rapid rollout of field data tools, cloud deployment emerges as the preferred mode for most new field data collection applications.

By Application

The application‑wise distribution of the field data collection app market highlights that inspections and audits account for 32.5% of total usage, underscoring the fundamental role of these apps in quality control, compliance, and safety across many industries. Inspections & audits enable field teams to digitize checklists, capture photos/GPS data, and generate standardized reports swiftly, eliminating paper‑based errors and improving reliability.

Asset management & maintenance represents the next critical segment, where apps help track the condition, location, history, and maintenance schedules of physical assets, infrastructure, machinery, or utilities. This use case helps organizations reduce downtime, ensure regulatory compliance, and optimize lifecycle costs.

Surveys & research leverage field data apps for collecting structured feedback, environmental data, or market intelligence; these enable faster deployment of surveys, real‑time data capture, and higher accuracy compared to manual methods. Service & delivery management benefits from streamlined assignment of work orders, real‑time updates from field personnel, and better coordination between office and field.

Construction & site management uses apps for site audits, safety inspections, progress tracking, and documentation; agriculture & environmental monitoring leverages them for soil, crop, environment data, pest tracking, and ecological assessments; others include utilities, public works, asset survey,s and compliance monitoring.

By Organization Size

Large enterprises represent 63.2% of the market by organization size, reflecting their dominant role in the adoption of field data collection apps. This high share suggests that organizations with larger operations and more complex workflows are more likely to invest in comprehensive digital data‑collection and management platforms.

Large enterprises often have the resources to deploy extensive software suites, manage licensing costs, and integrate these applications with enterprise‑level systems such as ERP, asset management, and compliance tracking. This scale enables them to benefit from improved efficiency, centralized data management, and consistent reporting across multiple sites or regions.

In contrast, small and medium enterprises (SMEs), though increasingly adopting cloud-based and mobile solutions, generally face constraints in IT capacity, budget, and infrastructure, which may limit their ability to implement full‑scale field data systems.

Cloud‑based tools and modular solutions lower barriers for SMEs, yet large enterprises continue to lead adoption due to their capacity for investment, infrastructure readiness, and need for standardized data workflows across complex operations. As digital transformation continues, large enterprises remain the primary driver of demand for field data collection applications.

By End-User

The end‑user breakdown of the field data collection app market shows that Construction accounts for 30.3% of total use. This indicates that construction firms represent a major portion of demand for field data tools. Construction companies adopt these apps to digitize site reporting, progress tracking, safety inspections, compliance, and resource management, enabling real‑time data capture from the field and faster decision‑making.

Other sectors, such as Government & Public Sector, use field data apps for infrastructure inspections, environmental monitoring, surveys, and public works oversight. Agriculture uses these tools for crop monitoring, farm management, yield optimization, and environmental data collection, often integrating sensor data and geolocation to support precision farming. Energy & Utilities leverage field data apps for maintenance, asset inspection, fault detection, and regulatory compliance of utility networks.

In the Healthcare field, data collection supports remote patient surveys, epidemiological data gathering, mobile health outreach in remote areas, and public health monitoring. Other end‑users include logistics, environmental monitoring, public works, and service providers that require on‑site data gathering, monitoring, or audits. The wide diversity of end‑users demonstrates the versatility and broad applicability of field data collection apps across multiple sectors.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Inspections & Audits

- Asset Management & Maintenance

- Surveys & Research

- Service & Delivery Management

- Construction & Site Management

- Agriculture & Environmental Monitoring

- Others

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- Government & Public Sector

- Agriculture

- Energy & Utilities

- Healthcare

- Construction

- Others

Regional Analysis

The regional analysis for North America reflects a dominant position for the field data collection app market in that region. North America accounts for 43.2 % of the global market share, with a 2024 size of USD 849.6 million. The region’s strong performance is underpinned by advanced digital infrastructure, widespread enterprise adoption of cloud‑based and data‑management tools, and a high degree of regulatory and operational standardisation that encourages modern data practices.

The prevalence of cloud computing and digital transformation across sectors supports the rapid deployment and scalability of field data solutions, reinforcing North America’s leading role. The high level of technology adoption across enterprises in North America supports complex, large‑scale deployments, making it an attractive market for vendors.

Mature industries such as construction, utilities, public infrastructure, environment monitoring, and healthcare in the region benefit from regulatory compliance, robust IT readiness, and the availability of a skilled workforce, contributing to stable demand.

North America’s dominance also stems from greater willingness among firms to invest in software platforms, analytics capabilities, and mobile/cloud‑enabled field operations. As global adoption increases, North America is projected to continue as a leading market region due to these structural advantages and ongoing investments in digital infrastructure.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The increasing emphasis on digital transformation and automation in both public and private sectors is driving the adoption of field data collection apps. The ability to replace paper‑based methods with mobile forms reduces manual errors, accelerates data capture, and streamlines workflows — enhancing operational efficiency.

The ubiquity of smartphones and tablets, along with reliable mobile connectivity, supports the use of these apps in remote or field environments. Mobile data collection enables real‑time data submission, even offline, which ensures timely decision‑making and reduces delays associated with traditional methods.

Industries such as construction, utilities, agriculture, and environmental monitoring increasingly rely on digital field data to improve resource allocation, compliance tracking, and service delivery. Integration of features such as GPS location, photo capture, and offline functionality enhances the utility and reliability of the apps. The flexibility, scalability, and lower cost of cloud‑based deployment further encourage organisations, large enterprises, as well as SMEs, to adopt field data solutions.

Restraint Factors

Concerns around data privacy, security, and regulatory compliance act as important restraints. Sensitive information collected in the field and transmitted via mobile or cloud channels can be vulnerable to breaches, prompting hesitation among some organisations. Infrastructure challenges also restrict adoption, in areas with poor network connectivity, mobile devices may not be able to sync data reliably or operate in real time.

Dependence on trained personnel and staff readiness presents another barrier; lack of adequate training or unfamiliarity with new digital tools can lead to resistance. For smaller organisations or in resource‑constrained environments, costs related to device procurement, deployment, and integration with existing systems may be prohibitive. Legacy systems and internal inertia within organisations with traditional workflows further slow down the transition to digital field data collection, especially where on‑premises or paper‑based systems have long been entrenched.

Growth Opportunities

There is a substantial opportunity for adoption across underpenetrated regions, especially in emerging markets with growing infrastructure, agriculture, utilities, and public sector activities. Organisations in such regions often still rely on manual or paper‑based methods; shifting them to mobile and cloud‑based field data collection can yield efficiency gains and cost savings. The integration of advanced technologies such as AI, machine learning, IoT, and sensor‑based data collection opens avenues for predictive analytics, asset‑tracking, remote monitoring, and proactive maintenance.

Expansion into sectors such as utilities, healthcare, environmental monitoring, and logistics presents further growth potential. Modular, subscription‑based models and cloud‑hosted solutions lower barriers for SMEs and enable scalable deployment even for smaller operations. As regulatory frameworks tighten and demand for compliance grows, field data collection apps can serve as compliance and audit tools, enhancing their value proposition.

Trending Factors

The shift toward mobile- and cloud-first operations continues to accelerate the adoption of field data collection apps. Demand is rising for offline-capable apps that function in remote or connectivity‑constrained areas. Growing use of IoT and sensor networks is enabling more sophisticated data capture, combining GPS, image, and environmental sensor data, and more.

There is increasing focus on analytics and reporting capabilities; organisations prefer apps that provide real‑time dashboards, data visualization, and integration with ERP or asset‑management systems. Environmental sustainability and paperless initiatives support the trend toward digital field data capture. Remote work and decentralised operations, in construction, utilities, agriculture, and service industries, are also contributing to heightened demand for mobile field data tools.

Competitive Analysis

The competitive landscape of the field data collection app market is marked by a mix of established vendors and emerging niche players competing across software features, deployment flexibility, and industry specialization. Key incumbents include Fulcrum, GoCanvas, ProntoForms, Zebra Technologies, Trimble Inc., ArcGIS Survey123 (by Esri), KoBoToolbox, SurveyCTO, Formstack, and Device Magi,c among others, as major competitors.

Competitive differentiation emerges around factors such as ease of form creation and customization, offline data capture capabilities, geospatial mapping and GPS integration, analytics dashboards, cloud vs on‑premises deployment, and vertical focus (e.g., construction, utilities, environment, public sector).

Vendors offering strong offline support and mobile‑friendly UI appeal to users in remote or connectivity‑limited locations. Solutions with extensive integration capabilities (e.g,. with GIS platforms, asset‑management systems, ERP) tend to attract large enterprises and regulated industries needing compliance and reporting.

In addition to feature competition, pricing models (subscription vs enterprise license vs pay‑per‑user), scalability, and vendor support services play a key role. Newer niche players often compete by targeting underserved segments such as SMEs, NGOs, or field surveys in emerging markets, offering lightweight and cost‑efficient alternatives. Buyers, therefore, select providers based on a balance between robustness, flexibility, total cost of ownership, and alignment with industry‑specific workflows.

Top Key Players in the Market

- Fulcrum

- GoCanvas

- ProntoForms

- Zebra Technologies

- Trimble Inc.

- Esri

- Magpi

- Form.com

- Device Magic

- SurveyCTO

- Open Data Kit (ODK)

- KoBoToolbox

- Resco.net

- Jotform

- FastField Forms

- Others

Recent Developments

- November 20, 2025: The ArcGIS Survey123 released a major update introducing an AI‑powered assistant for survey creation, nested groups for complex form structuring, and beta support for text and audio‑analysis data capture, features designed to speed up form design and improve data‑capture accuracy.

- June 2025: Zerion Software Inc. launched FieldApps.ai, an AI‑centric platform aimed at automating field data collection and workflow processes. The platform emphasizes “smart” data capture and processing to boost productivity and reduce manual input across mobile field operations.

- July 2025: ArcGIS Survey123 released enhancements to its web‑designer and mobile interfaces, improving usability, survey layout control, and overall stability for field teams, facilitating easier adoption among new and existing users.

Report Scope

Report Features Description Market Value (2024) USD 1,966.7 Million Forecast Revenue (2034) USD 7419.9 Million CAGR(2025-2034) 14.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises), By Application (Inspections & Audits, Asset Management & Maintenance, Surveys & Research, Service & Delivery Management, Construction & Site Management, Agriculture & Environmental Monitoring, Others), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (Government & Public Sector, Agriculture, Energy & Utilities, Healthcare, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fulcrum, GoCanvas, ProntoForms, Zebra Technologies, Trimble Inc., Esri, Magpi, Form.com, Device Magic, SurveyCTO, Open Data Kit (ODK), KoBoToolbox, Resco.net, Jotform, FastField Forms, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Field Data Collection App MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Field Data Collection App MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fulcrum

- GoCanvas

- ProntoForms

- Zebra Technologies

- Trimble Inc.

- Esri

- Magpi

- Form.com

- Device Magic

- SurveyCTO

- Open Data Kit (ODK)

- KoBoToolbox

- Resco.net

- Jotform

- FastField Forms

- Others