Global Fiber Batteries Market Size, Share and Report Analysis By Form Factor (Cylindrical Batteries, Pouch Batteries, Prismatic Batteries, Laminated Batteries), By Battery Technology (Lithium-Ion Batteries, Solid-State Batteries, Polymer Batteries, Alkaline Batteries), By Application (Consumer Electronics, Automotive, Energy Storage Systems, Medical Devices, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178207

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

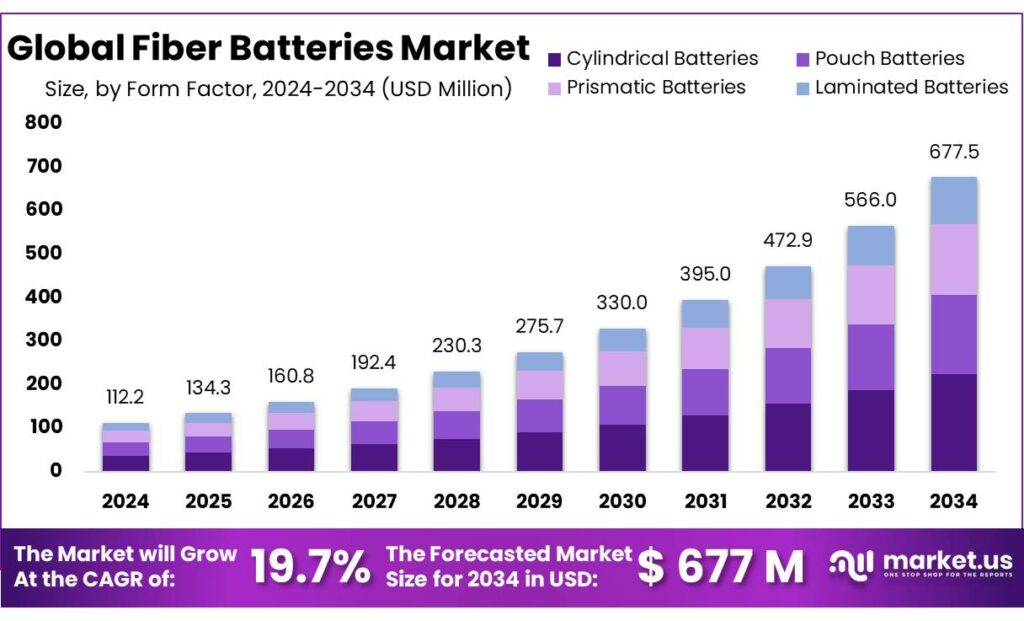

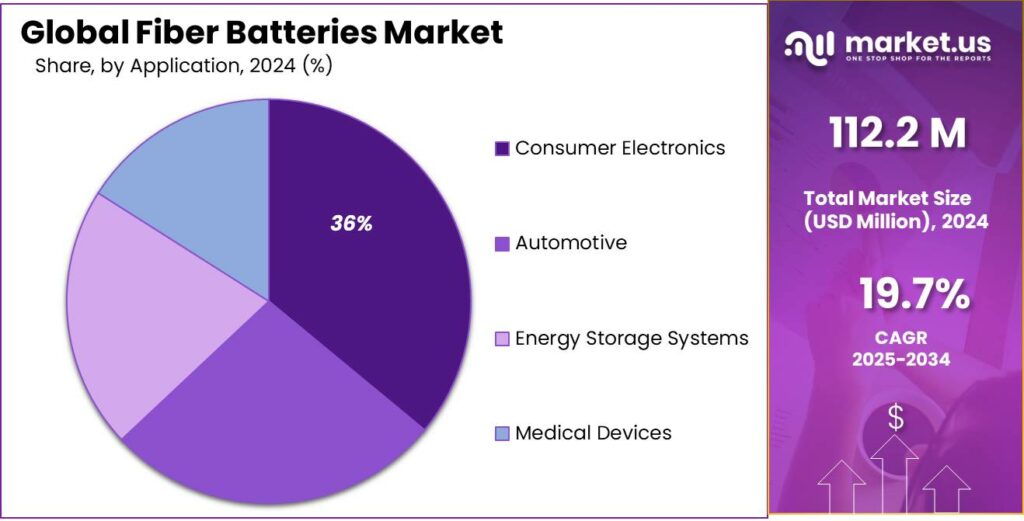

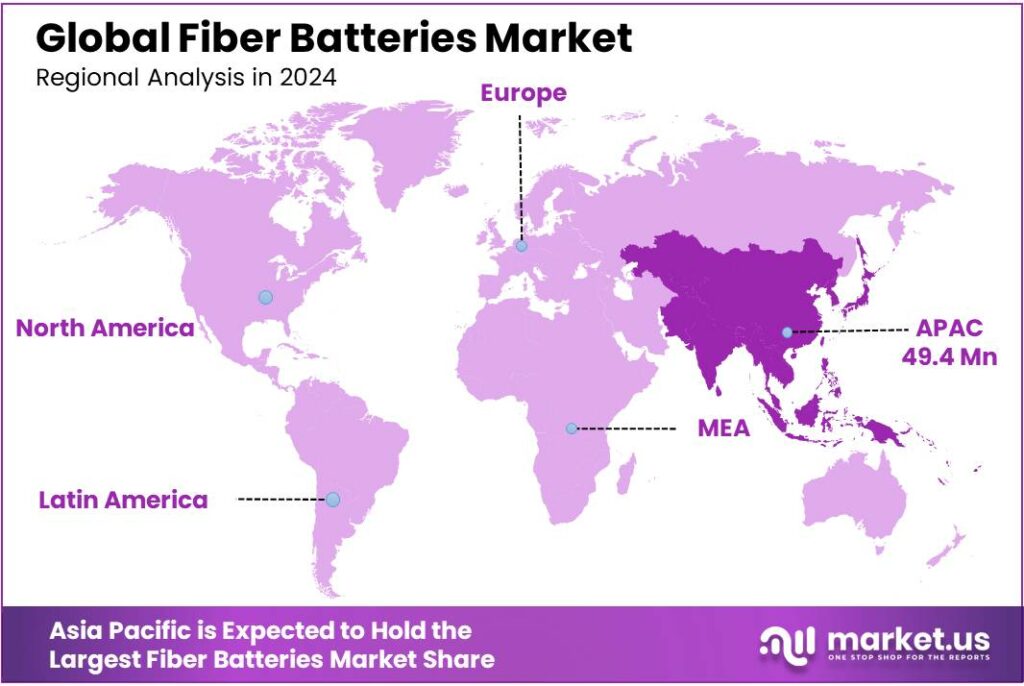

The Global Fiber Batteries Market is expected to be worth around USD 677.5 Million by 2034, up from USD 112.2 Million in 2024, and is projected to grow at a CAGR of 19.7% from 2025 to 2034. Asia Pacific accounted for 44.1%, reaching USD 49.4 Mn.

Fiber battery composites combine load-bearing composite parts with electrochemical storage, so a panel or beam can carry mechanical loads and store energy at the same time. Industrial interest is rising because conventional designs “double count” mass: separate casings, frames, and battery packs add weight and volume.

- Recent lab demonstrations show why the concept is credible: one reported carbon-fiber structural battery composite delivered ~30 Wh/kg and maintained performance for ~1,000 cycles. Materials literature also highlights the mechanical side of the equation—carbon fibres used as battery electrodes can reach ~290 GPa Young’s modulus and ~3.1 GPa tensile strength, while glass-fibre separators are cited around ~76 GPa modulus and ~1.7 GPa tensile strength, supporting the “structural” role when integrated with an electrolyte matrix.

Demand momentum is anchored in transport and logistics electrification. Global electric car sales exceeded 17 million in 2024, taking EVs to more than 20% of new car sales—an adoption curve that directly increases requirements for safer, lighter, and more thermally managed battery packs where composites can replace heavier metals in non-cell components.

On the battery side, EV-battery demand reached more than 750 GWh in 2023, and the broader lithium-ion battery market exceeded USD 150 billion in 2025, reinforcing why fiber-based composite solutions are gaining attention for durability, thermal performance, and manufacturability at scale.

Policy and funding are accelerating commercialization. India’s Ministry of Heavy Industries is executing the PLI “National Programme on Advanced Chemistry Cell (ACC) Battery Storage” with an outlay of ₹18,100 crore to establish 50 GWh of domestic ACC manufacturing capacity, improving local sourcing opportunities for composite housings, fiber mats, and related intermediates.

- In the United States, DOE programs show direct support across the chain, including $1.82 billion awarded to 14 projects for battery materials processing/manufacturing and recycling-linked approaches, plus a Vehicle Technologies Office batteries funding notice of $43 million to advance battery R&D and manufacturing innovations.

In Europe, the EU Batteries Regulation (EU) 2023/1542 entered into force on 17 August 2023, tightening sustainability and circularity expectations that tend to favor lightweighting, design-for-disassembly, and materials traceability—areas where composite supply chains are investing in documentation and recycling pathways.

Key Takeaways

- Fiber Batteries Market is expected to be worth around USD 677.5 Million by 2034, up from USD 112.2 Million in 2024, and is projected to grow at a CAGR of 19.7%.

- Cylindrical Batteries held a dominant market position, capturing more than a 33.8% share.

- Lithium-Ion Batteries held a dominant market position, capturing more than a 48.5% share.

- Consumer Electronics held a dominant market position, capturing more than a 36.8% share.

- Asia Pacific dominates fiber batteries with 44.1% share, reaching 49.4 Mn on strong electrification momentum.

By Form Factor Analysis

Cylindrical Batteries lead with 33.8% share driven by structural strength and scalable design

In 2024, Cylindrical Batteries held a dominant market position, capturing more than a 33.8% share. This strong position in the fiber batteries market is largely linked to their mechanical stability and ease of integration into composite structures. Cylindrical formats naturally offer better stress distribution, which makes them suitable for fiber-based battery designs where structural integrity and energy storage are combined in one system. Manufacturers in 2024 preferred cylindrical cells for pilot-scale production because they are already widely used in electric mobility and industrial tools, allowing easier adaptation into fiber composite frameworks.

By Battery Technology Analysis

Lithium-Ion Batteries dominate with 48.5% share driven by proven performance and energy efficiency

In 2024, Lithium-Ion Batteries held a dominant market position, capturing more than a 48.5% share. Their leadership in the fiber batteries market is mainly supported by their high energy density, stable cycling performance, and wide commercial acceptance. In 2024, manufacturers continued to rely on lithium-ion chemistry for structural and fiber-based battery solutions because it offers a balanced mix of power output and lightweight design. This makes it well suited for applications where batteries are integrated into composite materials, such as electric vehicles, aerospace components, and advanced mobility systems.

By Application Analysis

Consumer Electronics leads with 36.8% share supported by demand for slim and lightweight devices

In 2024, Consumer Electronics held a dominant market position, capturing more than a 36.8% share. The strong performance of this segment in the fiber batteries market is mainly driven by the rising need for compact, lightweight, and flexible power solutions. In 2024, device manufacturers focused on reducing product weight and thickness while maintaining strong battery life, which supported the use of fiber-based battery technologies. These batteries can be integrated into structural components of devices such as smartphones, wearables, laptops, and smart accessories, helping optimize internal space.

Key Market Segments

By Form Factor

- Cylindrical Batteries

- Pouch Batteries

- Prismatic Batteries

- Laminated Batteries

By Battery Technology

- Lithium-Ion Batteries

- Solid-State Batteries

- Polymer Batteries

- Alkaline Batteries

By Application

- Consumer Electronics

- Automotive

- Energy Storage Systems

- Medical Devices

- Others

Emerging Trends

Structural battery composites move from lab prototypes toward design-ready parts

One of the clearest latest trends in fiber batteries is the shift from “proof-of-concept cells” to structural battery composites that engineers can realistically design around—materials that store energy while also acting like a stiff, load-bearing component. In 2024 and 2025, the conversation started changing from can it work? to can it survive real loads, last long enough, and be manufactured in repeatable shapes? That matters because fiber batteries only become commercially interesting when they can replace a real part instead of adding another layer of complexity.

A good example of this maturity step is recent peer-reviewed work showing an all-carbon-fiber structural battery composite with ~30 Wh/kg energy density, elastic modulus above 76 GPa, and cyclic stability up to 1,000 cycles—numbers that signal improving balance between mechanical performance and usable energy storage.

In 2024, this “design-ready” direction showed up in how researchers and developers prioritized mechanical stiffness, stable cycling, and practical separators/electrolytes rather than chasing energy density alone. In 2025, the same trend strengthened as industry audiences began treating structural battery composites as a serious pathway for lightweight electrification—especially where weight and space drive operating costs. The World Economic Forum even highlighted structural battery composites as an emerging technology theme in its 2025 report, reflecting wider cross-industry attention beyond materials labs.

This trend connects closely to food and beverage logistics, where electrification is accelerating and payload efficiency is a daily concern. Walmart’s operations illustrate the scale of the system that ultimately benefits from lighter, more integrated energy storage: the company reported fiscal year 2025 revenue of $681.0 billion. For large grocery and omni-channel networks, improvements that save weight or free up space can translate into more reliable routes, more capacity per trip, and better total cost control. On the beverage side, PepsiCo reported full-year 2024 net revenue of $91,854 million, underscoring the size of distribution activity that depends on trucks, warehouses, and frequent deliveries.

Drivers

Electrification of food supply chains is a major driver for fiber batteries

One major driving factor for fiber batteries is the fast electrification of food supply chains, especially grocery delivery, beverage distribution, and temperature-controlled logistics where every kilogram and every cubic inch of space matters. Food companies and retailers are pushing electric vans and trucks into daily operations to cut fuel costs, reduce emissions exposure, and meet customer expectations for faster delivery windows.

That shift creates a practical problem: electric vehicles and mobile cold-chain equipment need more energy without adding more weight. Fiber batteries directly answer that challenge by allowing energy storage to be built into structural parts—so the vehicle body, rack systems, or protective panels can do double duty instead of carrying separate, heavy housings.

The scale of fleet electrification in food-linked operations shows why lightweight, space-saving energy solutions are gaining attention. Walmart, which runs one of the world’s largest grocery delivery networks, has deployed around 2,000 electric vehicles for last-mile deliveries from stores, highlighting how quickly electrified delivery is becoming “business as usual” in food retail logistics.

- Government initiatives reinforce this same demand signal by funding battery improvements that also benefit structural and composite-integrated designs. In the United States, the Department of Energy announced $43 million (FY2024) to advance battery research, development, and deployment in areas such as manufacturing, safety, and supply chains—work that supports the kinds of materials and design advances needed for next-generation battery integration.

Restraints

High production complexity and cost barriers limit large-scale adoption

One major restraining factor for fiber batteries is the high production complexity and overall cost compared to conventional battery systems. Fiber batteries combine structural materials such as carbon fiber with electrochemical components, which makes the design and manufacturing process more complicated than assembling a standard battery pack. The integration of load-bearing materials with energy storage layers requires precision engineering, advanced curing processes, and strict quality control.

In 2024, many manufacturers exploring structural or fiber-based battery solutions remained at pilot or limited production stages because scaling such technology demands new tooling, specialized expertise, and long validation cycles. This creates hesitation among industries that operate on tight cost margins, including food and beverage logistics.

- The food sector provides a clear example of why cost sensitivity matters. Companies in grocery retail and beverage distribution operate fleets where return on investment is carefully calculated. Walmart, for example, reported total revenue of US$648.1 billion in fiscal year 2024, reflecting the scale at which it manages cost efficiency across supply chains.

Government initiatives support battery innovation, but they also highlight the financial intensity of advanced battery development. The U.S. Department of Energy announced US$43 million in 2024 to advance battery manufacturing and technology research, underlining how much public funding is needed to accelerate next-generation systems.

Opportunity

Cold-chain electrification creates a big opening for fiber batteries in food logistics

A major growth opportunity for fiber batteries is the rapid electrification of the food cold chain—delivery vans, insulated box bodies, refrigerated containers, and the mobile cooling equipment used to move groceries, dairy, meat, and beverages safely from factories to stores and homes. In this part of the supply chain, operators fight two constant constraints: payload and space. Refrigeration hardware already consumes room and adds weight, and electric power systems add even more mass.

The scale of food distribution makes this opportunity hard to ignore. Walmart, one of the world’s largest grocery retailers, reported fiscal 2025 revenue of $681.0 billion, reflecting the massive volume of product that must be moved through stores and delivery networks. With operations at that size, even small improvements in vehicle efficiency and uptime become meaningful, especially in last-mile grocery where vehicles make frequent stops and refrigeration loads cycle constantly.

Beverage and snack distribution offers another clear runway. PepsiCo reported 2024 net revenue of $91,854 million, highlighting the scale of production and movement required to keep shelves stocked across convenience, retail, and foodservice channels. For companies that ship high volumes every day, the economics of electrified transport depend on how far a vehicle can go, how much it can carry, and how reliably it can run.

- Government action strengthens the commercial case by funding the kind of battery manufacturing, safety, and materials innovation that structural and composite-integrated designs depend on. In the U.S., the Department of Energy announced $43 million in FY2024 batteries funding to advance R&D, safety, manufacturing approaches, and supply chain improvements.

Regional Insights

Asia Pacific dominates fiber batteries with 44.1% share, reaching 49.4 Mn on strong electrification momentum

Asia Pacific is the dominating region in the Fiber Batteries market, accounting for 44.1% and 49.4 Mn (as provided). This leadership is closely tied to the region’s deep battery and advanced materials ecosystem, where scale manufacturing, rapid electrification, and dense electronics supply chains sit in the same geography. In 2024, Asia Pacific stayed ahead because the largest EV and battery production base is concentrated here—China alone produced 12.4 million electric cars in 2024, representing more than 70% of global electric car production, which keeps demand high for lighter, stronger, and more integrated energy-storage formats such as fiber-based/structural battery concepts.

From a demand standpoint, Asia Pacific’s pull is also visible in sales. The IEA notes that global electric car sales exceeded 17 million in 2024, and China sold over 11 million electric cars, with electric cars reaching almost half of all car sales in China that year. This matters for fiber batteries because automakers and component suppliers in the region are actively pursuing lightweighting and packaging efficiency—exactly where composite-integrated batteries can reduce total system mass and open design space. On the supply side, the IEA highlights how the battery industry has scaled rapidly, with global manufacturing capacity reaching 3 TWh in 2024—a capacity base where Asia (led by China, Japan, and South Korea) plays a central role in cell output and materials processing, supporting faster iteration and commercialization cycles.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hydrofarm is a public supplier to controlled-environment agriculture (hydroponics/indoor growing). It traces its operating roots to 1977 and lists its principal executive office at 1510 Main Street, Shoemakersville, PA 19555 (USA). Financially, it reported FY2024 net sales of $190.3 million, down from $226.6 million in FY2023, reflecting a softer retail/wholesale environment but continued restructuring.

The Aquaponic Source is a privately held aquaponics supplier and system designer serving home, school, and commercial users. It is based in Wheat Ridge, Colorado (5151 Ward Rd, CO 80033) and lists a direct line (+1 303-720-6604), supporting local service and training-led sales. The current owners (JD and Tawnya Sawyer) purchased the business in 2015, and the firm continues to position itself around custom system design and support rather than mass manufacturing.

Top Key Players Outlook

- A123 Systems

- Ahlstrom

- Amprius Technologies

- Braille Battery

- Celgard

- EEMB Battery

- Ensurge Micropower ASA

- Form Energy

- KULR Technology Group

- Luna Innovations

Recent Industry Developments

In FY2024, Hydrofarm reported net sales of $190.3 million (vs $226.6 million in FY2023), with gross profit margin of 16.9% and a net loss of $66.7 million, showing a tough demand cycle but continued operations in a power-hungry end market.

In 2025, Practical Cyclopentanone (Pty) Ltd the firm partnered with a regional utility to pilot a 250 kWh grid support unit using iron–chromium electrolyte concepts, reflecting early moves into battery storage applications that could intersect with lightweight fiber battery research and composite energy storage ideas.

Report Scope

Report Features Description Market Value (2024) USD 112.2 Mn Forecast Revenue (2034) USD 677.5 Mn CAGR (2025-2034) 19.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form Factor (Cylindrical Batteries, Pouch Batteries, Prismatic Batteries, Laminated Batteries), By Battery Technology (Lithium-Ion Batteries, Solid-State Batteries, Polymer Batteries, Alkaline Batteries), By Application (Consumer Electronics, Automotive, Energy Storage Systems, Medical Devices, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A123 Systems, Ahlstrom, Amprius Technologies, Braille Battery, Celgard, EEMB Battery, Ensurge Micropower ASA, Form Energy, KULR Technology Group, Luna Innovations Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A123 Systems

- Ahlstrom

- Amprius Technologies

- Braille Battery

- Celgard

- EEMB Battery

- Ensurge Micropower ASA

- Form Energy

- KULR Technology Group

- Luna Innovations