Global Fertigation Monitoring Market Size, Share Analysis Report By Technology (Automated and Manual), By Analysis Technique (Soil Testing and Plant Tissue Testing), By Fertigation Devices (Dosing Unit Systems, Pressure Devices, and Hydraulic Systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171537

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

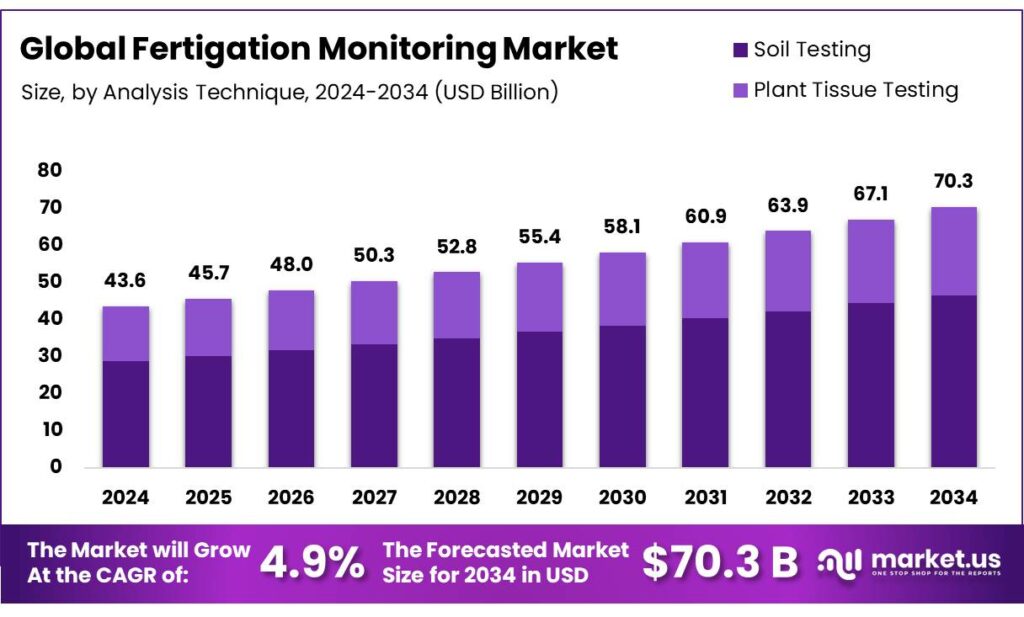

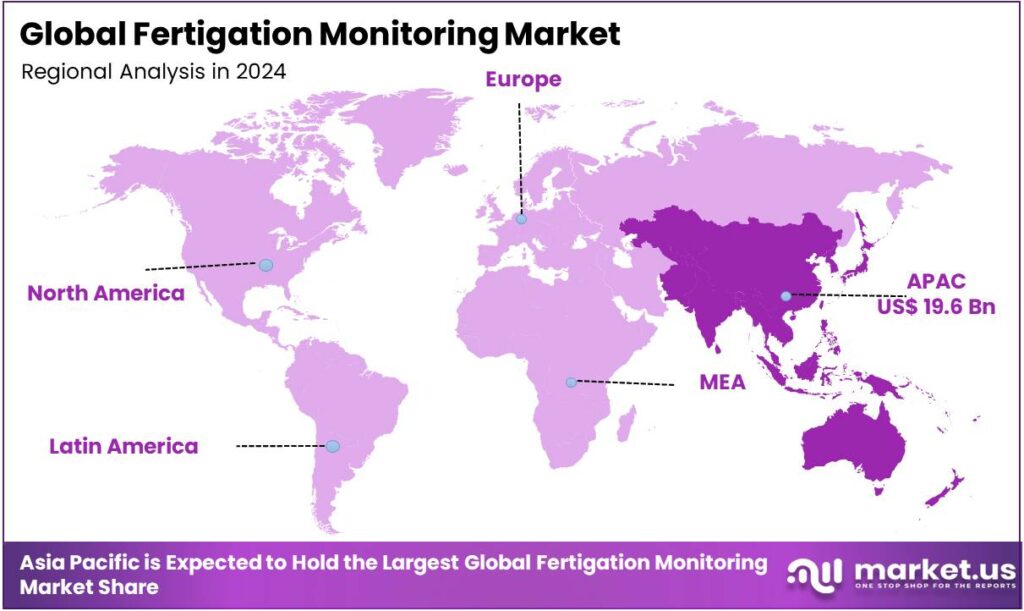

The Global Fertigation Monitoring Market size is expected to be worth around USD 70.3 Billion by 2034, from USD 43.6 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.9% share, holding USD 19.6 Billion in revenue.

Fertigation monitoring is the process of tracking and controlling the delivery of water and dissolved fertilizers, nutrients, to plants simultaneously through an irrigation system, to ensure precise, efficient, and customized feeding for optimal growth, reduced waste, and improved crop health. The fertigation monitoring market is evolving rapidly, driven by the increasing demand for efficient water and nutrient management in agriculture.

As water scarcity and high fertilizer costs become pressing concerns, fertigation systems, particularly automated ones, offer a solution by delivering precise amounts of water and nutrients directly to crops. This enhances resource efficiency, reduces environmental impact, and improves crop yields. Automated fertigation systems are preferred for their precision, scalability, and ability to reduce human error, while dosing units generate more revenue than pressure or hydraulic systems due to their high level of accuracy in nutrient application.

Despite the advantages of the technology, it faces several hurdles in its adoption due to limited infrastructure in the rural areas, where most agricultural activities occur, and the high cost of the technology, which might deter consumers, particularly small and marginal farmers.

- In 2018, approximately 14.4 million hectares of the world’s soil were estimated to be using microirrigation systems, while in 2024, India alone had approximately 20 million hectares under micro-irrigation, presenting a considerable potential for the wider adoption of fertigation.

Key Takeaways

- The global fertigation monitoring market was valued at USD 43.6 billion in 2024.

- The global fertigation monitoring market is projected to grow at a CAGR of 4.9% and is estimated to reach USD 70.3 billion by 2034.

- Based on the technology, automated systems dominated the fertigation monitoring market, with a substantial market share of around 69.9%.

- On the basis of the analysis technique, soil testing, fertigation monitoring were at the forefront, comprising around 66.2% of the total market share.

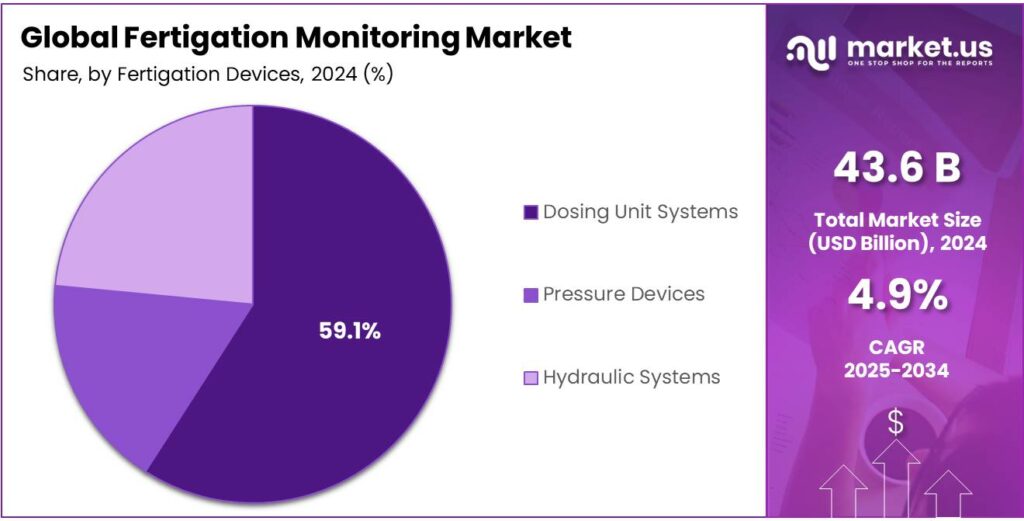

- Among the fertigation devices, dosing unit systems held a major share in the fertigation monitoring market, 59.1% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the fertigation monitoring market, accounting for around 44.9% of the total global consumption.

Technology Analysis

Automated Fertigation Monitoring Systems Held a Major Share in the Market.

The fertigation monitoring market is segmented based on technology into automated and manual. The automated fertigation monitoring systems dominated the market, comprising around 69.9% of the market share, due to their ability to significantly enhance efficiency, precision, and scalability. These systems allow for real-time monitoring and adjustments, reducing human error and ensuring optimal nutrient and water delivery based on precise data inputs such as soil moisture, pH levels, and weather conditions. Automation minimizes labor costs and time, allowing farmers to focus on other aspects of farm management.

Moreover, automated systems can operate continuously and remotely, making them especially valuable in large-scale or remote agricultural operations. By providing consistent and tailored fertigation schedules, these systems improve crop yields and resource utilization while reducing waste. Furthermore, the ability of these systems to automatically collect and analyze data for continuous optimization makes them more sustainable, aligning with the growing demand for precision farming solutions.

Analysis Technique Analysis

Soil Testing Technique is a Prominent Segment in the Fertigation Monitoring Market.

The fertigation monitoring market is segmented based on the analysis technique into soil testing and plant tissue testing. The soil testing technique dominated the fertigation monitoring market, comprising around 66.2% of the market share, due to its broader applicability, cost-effectiveness, and ease of implementation. Soil tests provide a comprehensive analysis of the nutrient availability in the soil, helping farmers determine the precise amounts of water and fertilizers required for optimal crop growth. This technique is beneficial for a wide range of crops and is less labor-intensive than plant tissue testing, which requires more frequent sampling and specialized analysis.

Additionally, soil testing can be conducted before planting and at various growth stages, giving a more holistic view of soil health. In contrast, plant tissue testing is more focused on assessing the nutritional status of crops after they grow, which makes it a more reactive technique. Consequently, soil testing offers a proactive and economical approach to nutrient management, making it the preferred method for most agricultural operations.

Fertigation Devices Analysis

The Dosing Unit Systems were Utilized Most in the Fertigation Monitoring Market.

Based on the fertigation devices, the market is divided into dosing unit systems, pressure devices, and hydraulic systems. The dosing unit systems dominated the market, with a market share of 59.1%, due to their higher precision, versatility, and direct impact on nutrient and water efficiency.

Dosing units enable precise control over the amount of fertilizers and chemicals delivered to crops, which is essential for optimizing crop yields while minimizing waste. Unlike pressure devices or hydraulic systems, which primarily manage water flow and pressure, dosing units allow for more accurate nutrient application, reducing the risk of over- or under-fertilization.

This precision improves resource efficiency and supports sustainable farming practices, which are increasingly in demand. Additionally, dosing units can be easily integrated with modern automation and IoT technologies, offering real-time monitoring and adjustments.

Key Market Segments

By Technology

- Automated

- Manual

By Analysis Technique

- Soil Testing

- Plant Tissue Testing

By Fertigation Devices

- Dosing Unit Systems

- Pressure Devices

- Hydraulic Systems

Drivers

Water Scarcity Drives the Fertigation Monitoring Market.

Water scarcity is a significant driver of the fertigation monitoring market, as agricultural practices increasingly depend on efficient water and nutrient management. The global water demand has grown exponentially, with agriculture accounting for approximately 70% of water consumption worldwide. In regions such as the Middle East, North Africa, and parts of Asia, where water availability is limited, the adoption of fertigation systems has become crucial. Fertigation, which combines irrigation with nutrient delivery, allows for precise water and fertilizer application, reducing wastage and enhancing crop yields.

- For instance, according to the International Fertilizer Association, microirrigation-based fertigation offers up to 90% water use efficiency.

A quarter of the world’s population across 17 countries, including in India, the Middle East, and North Africa, is living in regions of extremely high water stress. By 2050, that number is predicted to rise to 52% of the world’s projected 9.7 billion population. Using fertigation in microirrigation systems, vast areas of arid and semi-arid land and other marginal soils can be used to grow produce, which could help feed the 25% of the world’s population currently living in regions of extremely high water stress. Furthermore, such systems help optimize crop growth in water-scarce environments by ensuring that water is used sustainably, minimizing runoff and leaching, and improving overall soil health.

Restraints

High Initial Investment Might Hinder the Growth of the Fertigation Monitoring Market.

Despite the growing adoption of fertigation monitoring systems, high initial investment costs and infrastructure gaps in rural areas pose significant barriers to their widespread implementation. The setup of advanced fertigation systems often requires substantial upfront expenditure for equipment, sensors, automated controllers, and installation, which can be prohibitive for small-scale farmers. For instance, in rural regions of India and Southeast Asia, where farming is often less capital-intensive, the high cost of adoption has hindered the transition to modern agricultural technologies. Additionally, poor infrastructure, such as limited access to technical support, further complicates the deployment of these systems in remote areas.

- According to a study by the International Energy Agency (IEA), 730 million individuals worldwide lacked access to electricity in 2024, which directly affects the functionality of smart fertigation technologies. While fertigation monitoring systems offer significant potential for increasing agricultural efficiency, the financial and infrastructural challenges remain significant hurdles to their widespread adoption in certain regions.

Opportunity

Demand to Reduce Fertilizer Utilization Creates Opportunities in the Fertigation Monitoring Market.

Rising fertilizer costs and growing environmental concerns have created significant opportunities in the fertigation monitoring market, as the agricultural industry seeks more cost-effective and sustainable solutions. Fertilizer prices have surged dramatically in the past decade, with costs rising by over 50% in some regions due to global supply chain disruptions and increased raw material prices. The farmers are turning to fertigation systems, which allow for more precise and controlled application of fertilizers, thereby reducing waste. For instance, fertigation is observed to reduce fertilizer use by up to 25%, resulting in cost savings while ensuring crops receive optimal nutrients.

Similarly, according to the International Fertilizer Association, fertigation can result in high crop yields and up to 90% nutrient use efficiency. Moreover, the environmental impact of excessive fertilizer application, such as nutrient runoff leading to water pollution, is a growing concern. Fertigation systems help mitigate these issues by delivering nutrients directly to plant roots, reducing runoff, and minimizing soil and water contamination. This efficient nutrient management aligns with sustainability, benefiting the economy and the environment.

Trends

Shift Towards Integration of the Smart Technology.

The integration of smart technology into fertigation monitoring systems is an emerging trend reshaping the agricultural landscape. With the rise of Internet of Things (IoT) devices, artificial intelligence (AI), and data analytics, farmers are increasingly adopting automated and connected fertigation systems. For instance, smart sensors can monitor soil moisture levels, nutrient concentrations, and weather conditions in real time, allowing for precise adjustments to irrigation and fertilization schedules.

- According to the U.S. Environmental Protection Agency (EPA), smart irrigation controllers can reduce outdoor water use by 20% to 50%. In addition, AI-driven predictive analytics enable farmers to make data-backed decisions that optimize crop yields and minimize input costs.

In regions such as Europe and North America, the use of smart fertigation systems has gained traction, with farmers leveraging these technologies to enhance resource use efficiency and reduce environmental impact. This shift towards smart technology is improving agricultural productivity and supporting sustainability objectives globally.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Fertigation Monitoring market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions are significantly impacting the fertigation monitoring market, influencing the supply chain dynamics and the cost structures of essential agricultural inputs. For instance, the ongoing conflict in Eastern Europe has disrupted global fertilizer supply chains, particularly affecting the availability of key raw materials such as nitrogen and phosphorus. Due to the conflict, fertilizer prices saw sharp increases, prompting farmers worldwide to seek more efficient and cost-effective solutions such as fertigation.

Similarly, in regions such as the Middle East and North Africa, where geopolitical instability often exacerbates water scarcity, fertigation technologies are increasingly viewed as essential for maximizing crop yields with minimal water usage. Furthermore, due to supply chain disruptions as trade barriers took effect, countries such as India and China have accelerated the development and adoption of domestic fertigation technologies.

These geopolitical shifts are ultimately reshaping the way agricultural sectors across the globe approach resource management, fostering increased interest in fertigation monitoring systems as a strategic solution for sustainable farming.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Fertigation Monitoring Market.

In 2024, the Asia Pacific dominated the global fertigation monitoring market, holding about 44.9% of the total global consumption. The region holds the largest share of the global fertigation monitoring market, driven by its vast agricultural sector and growing concerns about water scarcity and resource optimization.

- According to a report by the Food and Agriculture Organization of the United Nations (FAO), Asia is the region with the largest agricultural land area of around 2.08 billion hectares, one-third of which is in China. Similarly, in most countries of the region, such as India, the agricultural sector is the top contributor to the GDP. These vast amount of agricultural activities creates opportunities in the region. Countries such as India, China, and Australia are leading the adoption of fertigation technologies.

For instance, China, with its large-scale farming operations, has seen a rise in fertigation systems to maximize crop yields while minimizing water and fertilizer wastage. With favorable government policies, technological advancements, and increasing awareness about sustainable farming, the Asia Pacific region continues to dominate the fertigation monitoring market, shaping its growth trajectory.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the fertigation monitoring market employ several strategies to enhance their market reach and expand their market share. The companies focus on product innovation, where firms develop advanced, user-friendly systems incorporating IoT, AI, and data analytics to improve efficiency and precision in fertigation. Additionally, companies focus on partnerships with local distributors and agricultural cooperatives to reach rural and underserved regions, ensuring broader access to their products.

Moreover, many major companies put emphasis on expanding into emerging markets with high agricultural potential, particularly in Asia and Africa, which allows them to tap into growing demand for sustainable farming solutions. Furthermore, these companies collaborate with other R&D companies for product enhancement, such as Netafim’s collaboration with Phytech to integrate Phytech’s mobile AI platform into their fertigation monitoring system.

The Major Players in The Industry

- Soilmoisture Equipment Corp.

- LaMotte Company

- Advantech Manufacturing, Inc.

- Humboldt Mfg. Co.

- Jain Irrigation System

- Netafim

- Irritec

- Novedades Agricolas

- Harvel

- Other Key Players

Key Development

- In March 2025, Lauritz Knudsen Electrical and Automation (formerly L&T Switchgear) launched the SMARTCOMM irrigation management system, which enables remote farm monitoring and resource optimization for activities such as fertigation.

- In November 2024, Netafim USA, the precision agriculture business of Orbia Advance Corporation’s S.A.B. de C.V., announced the launch of GrowSphere, an intuitive, all-in-one digital farming tool that manages irrigation and fertigation.

Report Scope

Report Features Description Market Value (2024) USD 43.6 Bn Forecast Revenue (2034) USD 70.3 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Automated and Manual), By Analysis Technique (Soil Testing and Plant Tissue Testing), By Fertigation Devices (Dosing Unit Systems, Pressure Devices, and Hydraulic Systems) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Soilmoisture Equipment Corp., LaMotte Company, Advantech Manufacturing, Inc., Humboldt Mfg. Co., Jain Irrigation System, Netafim, Irritec, Novedades Agricolas, Harvel, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Fertigation Monitoring MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Fertigation Monitoring MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Soilmoisture Equipment Corp.

- LaMotte Company

- Advantech Manufacturing, Inc.

- Humboldt Mfg. Co.

- Jain Irrigation System

- Netafim

- Irritec

- Novedades Agricolas

- Harvel

- Other Key Players