Global Feed Additive Nosiheptide Premix Market Size, Share, And Industry Analysis Report By Concentration (4 percent, Between 4 to 12 percent), By Application (Livestock, Poultry), By Distribution Channel (Feed Manufacturers, Veterinary Pharmacies, Online Distributors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170512

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

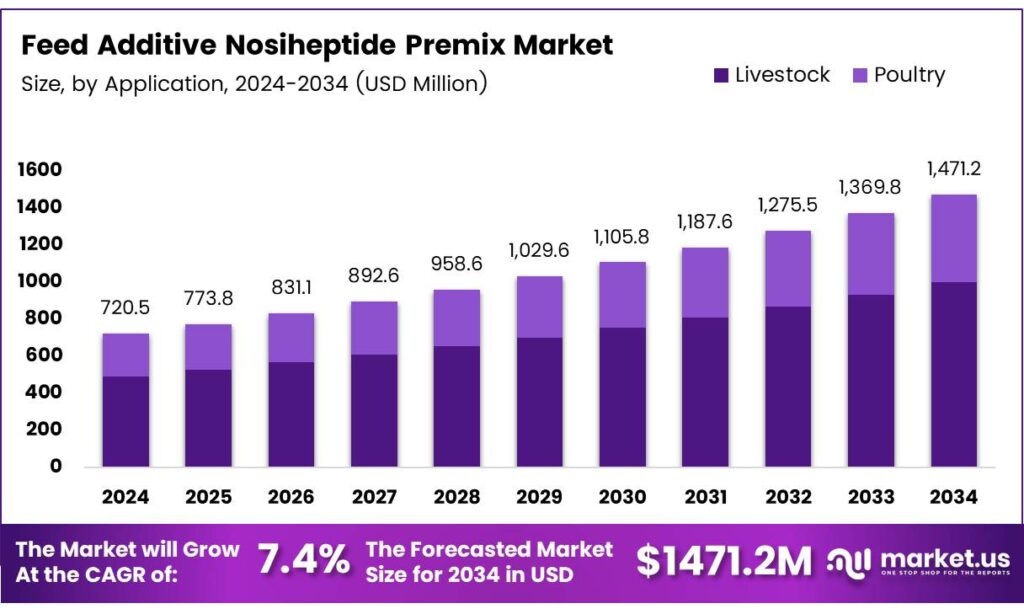

The Global Feed Additive Nosiheptide Premix Market size is expected to be worth around USD 1471.2 million by 2034, from USD 720.5 million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Feed Additive Nosiheptide Premix Market represents a specialized segment within medicated feed additives supporting efficient livestock and poultry production. It covers standardized premix formulations used in commercial feeds to enhance growth performance, stabilize gut health, and improve farm profitability, especially in intensive poultry and swine systems worldwide.

Feed Additive Nosiheptide Premix itself is a peptide-based antibacterial growth promoter designed for controlled inclusion in compound feed. Commonly, it supports weight gain while reducing digestive stress in young animals. Consequently, feed manufacturers value it for predictable performance, ease of blending, and compatibility with modern feed formulations. Regulatory alignment further strengthens market credibility. Residue thresholds and withdrawal compliance remain critical for medicated feeds.

- Nosiheptide premix is available in 1%, 2%, 0.25%, and 0.5% assays. Moreover, trials indicate feed efficiency improvements between 5% and 20%, supporting stronger conversion ratios and faster growth cycles in poultry and swine. Chickens fed 0–250 mg/kg for 8 weeks, and pigs fed 0–500 mg/kg for 90 days tissue residues below 0.025 mg/kg after 0–7 days withdrawal. Nosiheptide helps reduce diarrhea and piglet enteritis, improving survival rates.

The Market growth is mainly driven by rising global demand for affordable animal protein and improved feed efficiency. As production costs increase, farmers increasingly seek additives delivering measurable output gains. Therefore, nosiheptide premix demand grows alongside poultry integrator expansion, pig farming intensification, and structured feed manufacturing across the Asia-Pacific and emerging markets.

Key Takeaways

- The Global Feed Additive Nosiheptide Premix Market is projected to reach USD 1471.2 million by 2034, growing from USD 720.5 million in 2024 at a 7.4% CAGR.

- Between 4 to 12 percent concentration dominates the market with a share of 59.1%, driven by balanced efficacy and formulation flexibility.

- The Livestock application segment leads with a market share of 69.9%, supported by high feed consumption and large-scale farming.

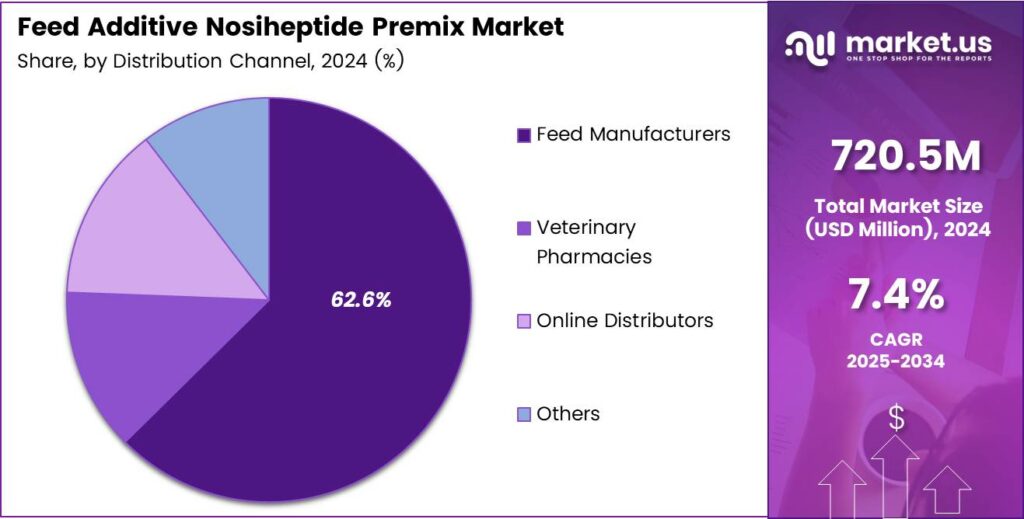

- Feed Manufacturers are the largest distribution channel, accounting for 62.6% of total market demand due to integrated supply chains.

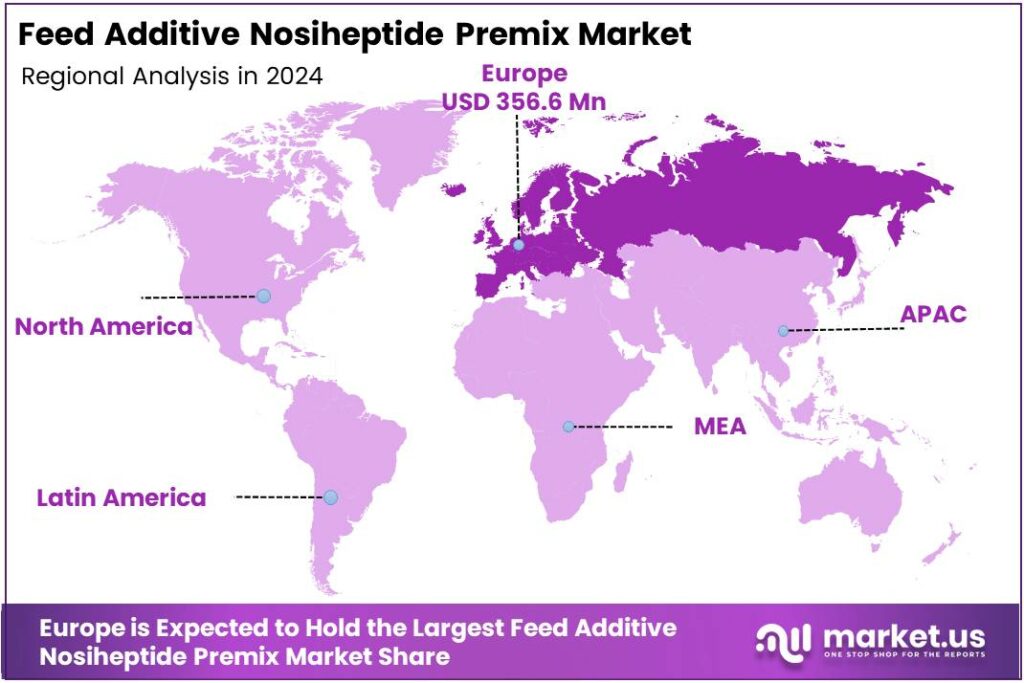

- Europe dominates regional demand with a market share of 49.5%, valued at USD 356.6 million in 2024.

By Concentration Analysis

Between 4 to 12 percent dominate, with 59.1% due to balanced efficacy and formulation flexibility.

In 2024, between 4 to 12 percent held a dominant market position in the By Concentration Analysis segment of the Feed Additive Nosiheptide Premix Market, with a 59.1% share. This concentration range is preferred because it offers consistent growth promotion while remaining easy to blend into compound feed.

Between 4 to 12 percent support controlled dosage and stable performance across different livestock systems. As a result, feed formulators rely on this range to maintain feed efficiency, reduce wastage, and ensure uniform distribution during large-scale feed manufacturing operations.

The 4 percent concentration serves specific feeding programs where lower inclusion rates are required. Although its share is smaller, it remains relevant for targeted applications, especially in operations focused on cost sensitivity and gradual performance improvement without altering existing feed formulations.

By Application Analysis

Livestock dominates with 69.9% due to higher consumption volumes and commercial farming scale.

In 2024, Livestock held a dominant market position in the By Application Analysis segment of the Feed Additive Nosiheptide Premix Market, with a 69.9% share. This dominance is linked to large herd sizes and the need for consistent weight gain and feed efficiency.

Livestock producers increasingly use nosiheptide premix to improve growth performance and optimize feed conversion. Consequently, commercial cattle and swine operations drive steady demand, supported by structured feeding programs and standardized additive inclusion.

The Poultry segment continues to show stable adoption, driven by intensive farming systems and short production cycles. Although its share is lower, poultry producers value nosiheptide premix for maintaining uniform flock growth and supporting predictable output levels.

By Distribution Channel Analysis

Feed Manufacturers dominate with 62.6% due to bulk procurement and integrated supply chains.

In 2024, Feed Manufacturers held a dominant market position in the By Distribution Channel Analysis segment of the Feed Additive Nosiheptide Premix Market, with a 62.6% share. Their dominance comes from large-scale purchasing and direct incorporation into compound feeds.

Feed manufacturers benefit from consistent supply contracts and quality control advantages. They act as the primary channel, ensuring standardized dosing and widespread market reach across livestock and poultry producers. Veterinary Pharmacies play an important role in smaller operations, offering direct access and advisory support.

Meanwhile, Online Distributors are gradually gaining attention due to convenience and wider geographic accessibility. The Others category includes local traders and cooperatives supporting rural demand. Although fragmented, these channels remain essential for reaching underserved farming regions.

Key Market Segments

By Concentration

- 4 percent

- Between 4 to 12 percent

By Application

- Livestock

- Poultry

By Distribution Channel

- Feed Manufacturers

- Veterinary Pharmacies

- Online Distributors

- Others

Emerging Trends

Shift Toward Precision Nutrition in Animal Feed

A major trending factor in the Feed Additive Nosiheptide Premix Market is the move toward precision nutrition. Farmers are increasingly focusing on exact nutrient and additive requirements to maximize animal performance while minimizing waste. This trend supports controlled and targeted use of premixes.

The rising role of feed manufacturers in advisory services. Many suppliers now guide farmers on feed optimization, which improves the adoption of specialized additives like nosiheptide premix. Digital tools and farm data are also helping fine-tune feeding strategies.

There is a visible trend toward balanced growth solutions rather than aggressive weight gain. Producers want stable, healthy growth cycles to reduce disease risks. From an analyst standpoint, these trends favor feed additives that deliver consistent results within modern feeding programs.

Drivers

Rising Focus on Livestock Productivity and Feed Efficiency

The Feed Additive Nosiheptide Premix Market is mainly driven by the growing need to improve livestock productivity in a cost-effective way. Farmers and commercial producers are under pressure to produce more meat and poultry using limited feed resources. Nosiheptide premix helps improve feed efficiency, allowing animals to gain weight faster with less feed intake.

- Nosiheptide premix is valued for its role in maintaining gut health, which directly supports consistent animal performance. FAO-led study projects that, if current practices continue, global antibiotic use in livestock could rise by nearly 30% by 2040, reaching approximately 143,481 tons, compared with the 2019 baseline of around 110,777 tons.

Rising global demand for animal protein is pushing producers to adopt performance-enhancing feed solutions. Urbanization, income growth, and changing food habits are increasing meat consumption, indirectly boosting demand for feed additives. These structural demand factors make nosiheptide premix a practical choice for producers focused on efficiency and profitability.

Restraints

Regulatory Pressure on Antibiotic Use Limits Adoption

One of the key restraints in the Feed Additive Nosiheptide Premix Market is increasing regulatory scrutiny on antibiotic-based feed additives. Many countries are tightening rules around the use of antibiotics in animal feed due to concerns over antimicrobial resistance. This creates uncertainty for manufacturers and users of nosiheptide premix.

The growing preference for antibiotic-free and organic animal products. Consumers are becoming more aware of how animals are raised, pushing producers to reduce or eliminate antibiotic additives. This shift can limit demand, especially in premium meat and export-oriented markets.

Cost sensitivity among small and medium farmers also acts as a barrier. While nosiheptide premix improves performance, its price compared to alternative feed solutions can restrict adoption in price-driven markets. From an analyst perspective, these restraints highlight the need for clear usage guidelines, education, and compliant formulations to sustain market presence.

Growth Factors

Expansion of Organized Animal Farming Creates New Demand

Strong growth opportunities exist as organized livestock and poultry farming continues to expand globally. Large commercial farms prefer standardized feed formulations that deliver predictable results, creating space for consistent additives like nosiheptide premix.

Emerging markets where meat consumption is rising rapidly. As these regions modernize their farming practices, demand for proven growth-supporting feed additives is expected to increase. Feed manufacturers can integrate nosiheptide premix into customized premix blends for different animal categories.

There is also scope for product innovation, such as optimized dosage formulations and combination premixes. These solutions can help improve acceptance while addressing regulatory and performance needs. From an analyst’s view, aligning product development with farm-level efficiency goals will unlock long-term growth opportunities.

Regional Analysis

Europe Dominates the Feed Additive Nosiheptide Premix Market with a Market Share of 49.5%, Valued at USD 356.6 Million

Europe leads the Feed Additive Nosiheptide Premix Market due to its well-regulated livestock industry and strong focus on feed efficiency and animal health. In 2024, the region accounted for 49.5% of global demand, translating to a market value of USD 356.6 million, supported by advanced compound feed production systems. Strict feed quality standards and widespread adoption of performance-enhancing premixes in poultry and swine farming continue to reinforce Europe’s dominant position.

North America represents a mature and technology-driven market, supported by large-scale commercial livestock operations and high awareness of feed optimization. The region shows steady demand for nosiheptide premixes, particularly in poultry and cattle farming, where feed efficiency and controlled weight gain are key priorities. Consistent feed safety regulations further support stable market growth across the region.

The U.S. plays a central role within North America, driven by intensive poultry and swine production systems. Feed manufacturers increasingly integrate nosiheptide premixes to improve feed conversion ratios and maintain uniform animal growth. Strong integration between feed producers and livestock farms supports sustained consumption across commercial operations.

Asia Pacific is emerging as a high-growth region due to the rapid expansion of industrial livestock farming and rising protein consumption. Increasing adoption of medicated and functional feed premixes is improving animal productivity across poultry and pig farms. Growing investments in modern feed mills and improved veterinary practices are accelerating market penetration in developing economies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Chattha Group is typically viewed as a volume-focused participant that competes through dependable supply, practical pricing, and relationships with regional feed buyers. From an analyst lens, its strength is execution—keeping product moving consistently—while the main watch-out is how well it sustains margin and quality consistency when raw-material costs swing.

For FENGCHEN GROUP CO., LTD., the market role is often tied to export-oriented trade capabilities and broad sourcing, which can help buyers secure nosiheptide premix across changing procurement cycles. The key differentiator is responsiveness and logistics coordination, but long-term competitiveness depends on transparency in documentation, stable specifications, and the ability to support repeat orders without variability.

In the case of Zhejiang Esigma Animal Health, the positioning tends to be more technical, leaning on application know-how and compliance readiness for customers that want predictable performance in commercial feed programs. Analysts usually track how the company strengthens downstream support—usage guidance, formulation fit, and customer education—because these services can defend pricing and reduce churn.

ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD. is often assessed for its manufacturing depth and process control, which matters in a market where buyers expect consistent assay and mixing behavior. The upside is scalability and operational discipline; the main evaluation point is how it maintains quality systems and regulatory alignment as demand expands across livestock and poultry value chains.

Top Key Players in the Market

- Chattha Group

- FENGCHEN GROUP CO., LTD.

- Zhejiang Esigma Animal Health

- ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD.

- Zhejiang University Sunny Nutrition Technology

- Others

Recent Developments

- In 2025, FENGCHEN participated in the China Chengdu International Pharmaceutical Exhibition, highlighting its veterinary premix offerings amid a challenging export environment for APIs. The company made a prominent appearance at CPHI & PMEC China, showcasing its pharmaceutical and veterinary API/premix products, which include feed additives.

- In 2025, the company’s Nosiheptide Premix product for use in layer hens with a zero-day egg withdrawal period. This expands its application beyond traditional swine and broiler uses, enhancing its market potential for poultry egg production. The approval highlights Nosiheptide’s low residue profile and efficacy against gram-positive bacteria like Clostridium perfringens.

Report Scope

Report Features Description Market Value (2024) USD 720.5 Million Forecast Revenue (2034) USD 1471.2 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Concentration (4 percent, Between 4 to 12 percent), By Application (Livestock, Poultry), By Distribution Channel (Feed Manufacturers, Veterinary Pharmacies, Online Distributors, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Chattha Group, FENGCHEN GROUP CO., LTD., Zhejiang Esigma Animal Health, ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD., Zhejiang University Sunny Nutrition Technology, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Feed Additive Nosiheptide Premix MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Feed Additive Nosiheptide Premix MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chattha Group

- FENGCHEN GROUP CO., LTD.

- Zhejiang Esigma Animal Health

- ZHEJIANG ESIGMA BIOTECHNOLOGY CO., LTD.

- Zhejiang University Sunny Nutrition Technology

- Others