Fecal Pancreatic Elastase Testing Market By Product Type (ELISA Kits and Rapid Kits), By Application (Chronic Pancreatitis, Cystic Fibrosis, Type 1 Diabetes, and Others), By End-user (Hospitals, Specialty Clinics, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165088

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

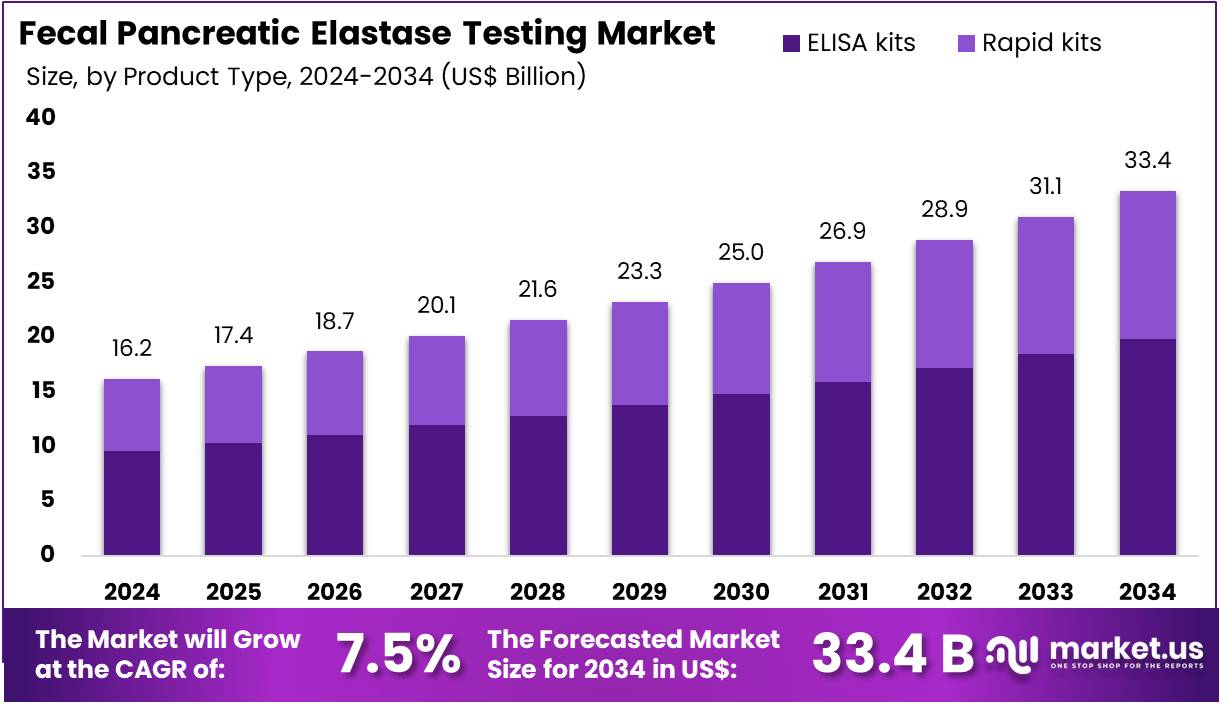

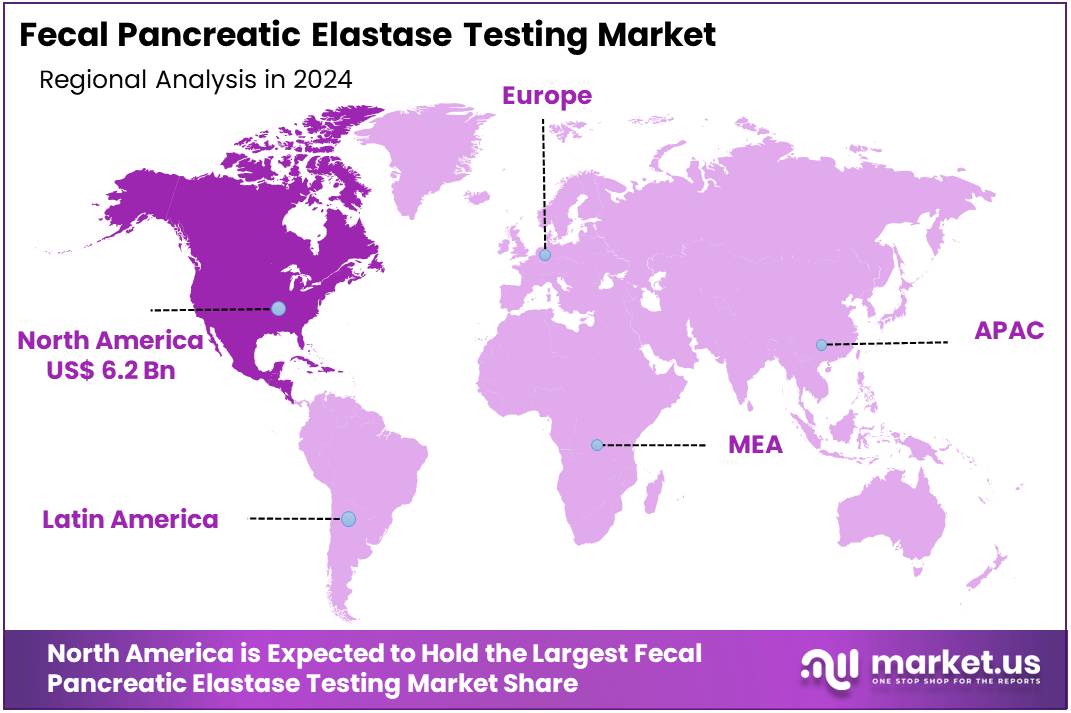

The Fecal Pancreatic Elastase Testing Market Size is expected to be worth around US$ 33.4 billion by 2034 from US$ 16.2 billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share and holds US$ 6.2 Billion market value for the year.

Increasing prevalence of malabsorption syndromes drives the Fecal Pancreatic Elastase Testing Market, as gastroenterologists rely on non-invasive markers for pancreatic exocrine function. Clinicians measure fecal elastase-1 levels to diagnose chronic pancreatitis in patients with persistent abdominal pain, avoiding endoscopic procedures. These tests support cystic fibrosis management by quantifying enzyme deficiency in pediatric and adult cases, guiding pancreatic enzyme replacement therapy.

Nutritionists apply serial elastase assays to monitor treatment response in small bowel bacterial overgrowth, optimizing digestive outcomes. In October 2022, ALPCO launched its Pancreatic Elastase Chemiluminescence immunoassay, offering wide-range detection of CELA3A isoforms with streamlined automation. This product enhances market growth by improving efficiency and reliability in routine clinical pancreatic assessments.

Growing endorsement by medical authorities creates opportunities in the Fecal Pancreatic Elastase Testing Market, as guidelines solidify its role in standard care protocols. Primary care physicians incorporate fecal elastase screening in unexplained weight loss evaluations, identifying exocrine pancreatic insufficiency early. These assays aid oncology by assessing pancreatic function in cancer survivors post-whipple surgery, preventing malnutrition.

Automated immunoassay platforms enable high-throughput processing in reference laboratories. In September 2023, the American Gastroenterological Association published guidelines designating fecal elastase testing as the primary tool for EPI diagnosis. This recommendation drives market expansion by establishing the assay as the gold standard for pancreatic insufficiency evaluation.

Rising automation in diagnostic workflows propels the Fecal Pancreatic Elastase Testing Market, as chemiluminescent platforms streamline sample analysis. Endocrinologists use elastase levels to differentiate type 3c diabetes from other forms, tailoring insulin management. These tests support bariatric surgery follow-ups by detecting post-procedural enzyme deficits, adjusting supplementation needs.

Trends toward multiplex gastrointestinal panels integrate elastase with calprotectin, enhancing differential diagnosis. User-friendly reagent kits reduce technician training requirements in diverse laboratory settings. These advancements position the market for sustained growth through accessible, precise pancreatic function testing solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 16.2 billion, with a CAGR of 7.5%, and is expected to reach US$ 33.4 billion by the year 2034.

- The product type segment is divided into ELISA kits and rapid kits, with ELISA kits taking the lead in 2024 with a market share of 59.4%.

- Considering application, the market is divided into chronic pancreatitis, cystic fibrosis, type 1 diabetes, and others. Among these, chronic pancreatitis held a significant share of 47.2%.

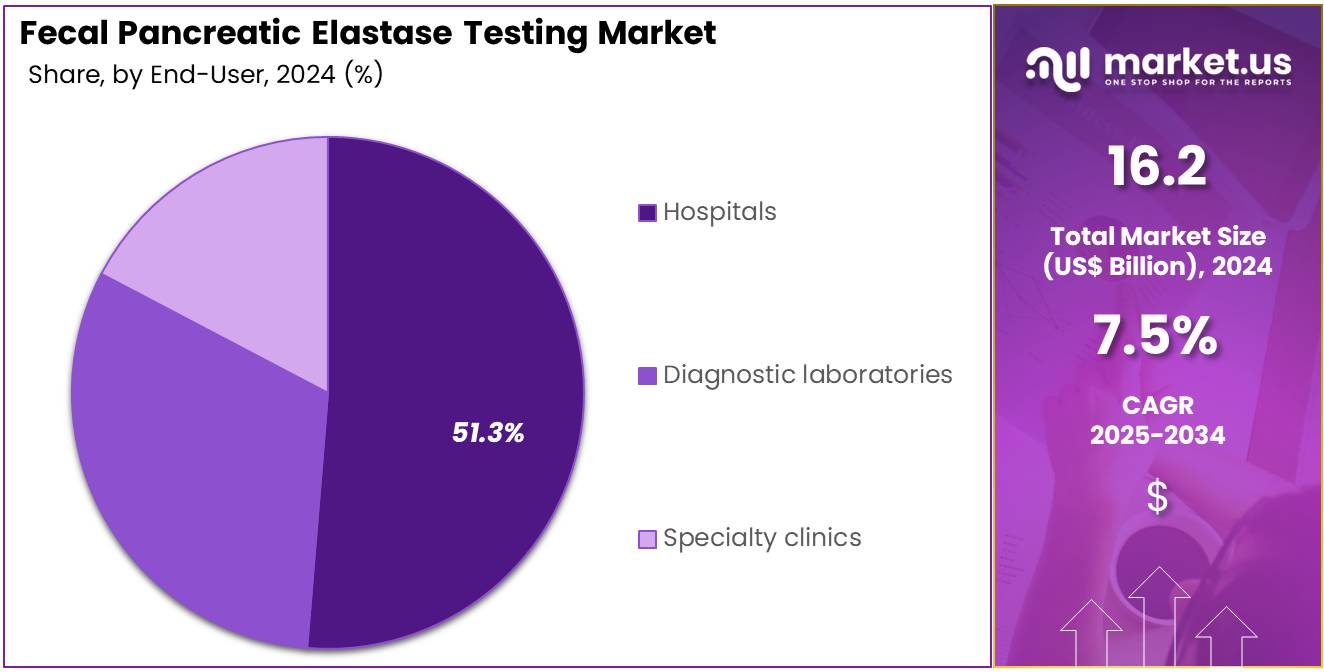

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, and diagnostic laboratories. The hospitals sector stands out as the dominant player, holding the largest revenue share of 51.3% in the market.

- North America led the market by securing a market share of 38.5% in 2024.

Product Type Analysis

ELISA kits account for 59.4% of the Fecal Pancreatic Elastase Testing market and are anticipated to remain dominant due to their superior sensitivity, reproducibility, and quantitative accuracy in detecting pancreatic insufficiency. The ability of ELISA to measure fecal elastase concentrations precisely enables early diagnosis of pancreatic disorders without the need for invasive procedures. Laboratories and hospitals prefer ELISA kits because of their standardized protocols and compatibility with automated analyzers.

The growing prevalence of exocrine pancreatic insufficiency (EPI) among patients with chronic pancreatitis and cystic fibrosis is fueling test adoption. Manufacturers are improving kit stability, reducing assay time, and enhancing colorimetric detection accuracy. Increasing availability of FDA- and CE-approved ELISA products strengthens trust among clinicians.

The expanding use of these kits in research for gastrointestinal biomarkers also supports steady market expansion. Rising global demand for cost-effective, scalable, and highly accurate stool-based diagnostics is projected to sustain ELISA’s leadership across both clinical and laboratory applications.

Application Analysis

Chronic pancreatitis accounts for 47.2% of the Fecal Pancreatic Elastase Testing market and is expected to remain the leading application due to the rising incidence of long-term pancreatic inflammation and exocrine dysfunction. Fecal elastase testing offers a non-invasive alternative for assessing pancreatic enzyme deficiency in these patients, improving early disease management and monitoring.

Increasing alcohol consumption, gallstones, and smoking-related pancreatic damage are contributing to the growing patient pool. Clinicians prefer fecal elastase testing over direct function tests because it provides reliable results without dietary restrictions or endoscopic procedures. The test’s capability to differentiate between mild and severe insufficiency supports its clinical importance.

Awareness campaigns about pancreatic health and diagnostic screening initiatives across Europe and Asia are boosting utilization. Pharmaceutical advancements in enzyme replacement therapy further drive diagnostic testing for therapy monitoring. As chronic pancreatitis remains a key risk factor for diabetes and pancreatic cancer, routine fecal elastase testing is anticipated to remain an essential diagnostic tool in long-term patient care.

End-User Analysis

Hospitals contribute 51.3% of the Fecal Pancreatic Elastase Testing market and are projected to maintain their dominant role due to the high volume of inpatient and outpatient diagnostic evaluations. The increasing prevalence of gastrointestinal disorders and pancreatic dysfunction has led hospitals to adopt ELISA-based stool testing for accurate enzyme analysis. Integrated laboratory facilities within hospitals ensure efficient sample collection, processing, and result interpretation.

Hospitals also act as referral centers for patients with complex pancreatic disorders requiring multidisciplinary assessment. Adoption of automated ELISA analyzers and digital reporting systems improves test turnaround times and diagnostic precision. Government funding for hospital-based diagnostic infrastructure and early disease detection programs strengthens their role in market expansion.

Hospitals often collaborate with diagnostic kit manufacturers for clinical validation and standardization of testing protocols. The growing awareness among gastroenterologists about the utility of fecal elastase testing in early disease identification further promotes its usage. As patient-centric diagnostics gain prominence, hospitals are anticipated to remain the cornerstone of fecal pancreatic elastase testing globally.

Key Market Segments

By Product Type

- ELISA Kits

- Rapid Kits

By Application

- Chronic Pancreatitis

- Cystic Fibrosis

- Type 1 Diabetes

- Others

By End-user

- Hospitals

- Specialty Clinics

- Diagnostics Laboratories

Drivers

Increasing Prevalence of Exocrine Pancreatic Insufficiency is Driving the Market

The growing occurrence of exocrine pancreatic insufficiency has significantly boosted the fecal pancreatic elastase testing market, since this non-invasive stool assay serves as a primary screening tool for assessing pancreatic enzyme output in patients with gastrointestinal symptoms.

Fecal pancreatic elastase testing quantifies elastase-1 levels to diagnose moderate to severe insufficiency, guiding enzyme replacement therapy to alleviate malabsorption and nutritional deficits. This driver is prominent in cohorts with chronic pancreatitis and cystic fibrosis, where routine monitoring prevents complications like steatorrhea and weight loss.

Medical centers are incorporating the test into diagnostic algorithms for unexplained diarrhea, reducing reliance on more invasive procedures like secretin stimulation. The condition’s association with diabetes and post-surgical states further amplifies demand, integrating testing into multidisciplinary care pathways. Health initiatives emphasize its specificity, subsidizing lab access for early intervention in at-risk populations.

The Cystic Fibrosis Foundation reported approximately 40,000 adults and children living with cystic fibrosis in the United States in 2022, a condition where fecal pancreatic elastase testing is standard for evaluating exocrine function. This population metric illustrates the clinical imperative, as the test facilitates timely supplementation to maintain growth and vitality. Advancements in enzyme-linked immunosorbent assay kits improve turnaround, fitting urgent case reviews.

Economically, its deployment averts hospitalization costs, endorsing expansions in diagnostic offerings. Global consortia standardize cutoff thresholds, ensuring uniform interpretations across diverse healthcare contexts. This insufficiency prevalence not only elevates test volumes but also solidifies the assay’s integration in gastroenterology protocols. In essence, it propels refinements in automated formats, aligning evaluations with therapeutic necessities.

Restraints

Reimbursement Variability for Diagnostic Assays is Restraining the Market

Disparate reimbursement frameworks for fecal pancreatic elastase testing across insurers and regions continue to hinder market penetration, as coverage inconsistencies limit routine ordering by gastroenterologists. The test, despite its non-invasive appeal, often requires detailed medical necessity documentation, burdening providers with administrative delays in outpatient settings. This impediment particularly challenges rural facilities, where financial strains prioritize essential panels over specialized stool assays.

Policy differences in fee schedules across Medicare regions exacerbate the challenge, with local determinations imposing rigorous criteria for chronic condition monitoring. Developers face subsidized validation burdens, constraining investments in sensitivity improvements for mild cases. The consequence upholds underutilization, prolonging symptom persistence and escalating indirect healthcare expenses.

Initiatives for equitable coding evolve cautiously, limited by utilization evidence shortages. These reimbursement voids not only impede scalability but also perpetuate diagnostic disparities. Thus, they necessitate policy advocacy to fuse fiscal viability with clinical imperatives.

Opportunities

Expansion of Cystic Fibrosis Screening Programs is Creating Growth Opportunities

The steady expansion of cystic fibrosis newborn screening programs worldwide has created significant growth opportunities for the fecal pancreatic elastase testing market by establishing it as the preferred non-invasive method to assess pancreatic insufficiency immediately after CF diagnosis and throughout lifelong management. Clinical guidelines uniformly recommend fecal elastase-1 measurement to guide early initiation of pancreatic enzyme replacement therapy and to monitor pancreatic status over time.

The European Cystic Fibrosis Society Consensus Guidelines (published 2023) explicitly state that fecal pancreatic elastase should be performed annually in all pancreatic-sufficient CF patients and whenever there is concern about nutritional status or growth. This strong, evidence-based recommendation has been rapidly adopted into national CF care protocols across Europe, UK, Australia, Canada, and the United States, driving consistent repeat testing in accredited CF centers.

As a direct result, demand for monoclonal fecal elastase-1 immunoassays has become structurally embedded in routine CF care pathways, generating stable, high-volume orders independent of economic cycles. The inclusion of annual elastase monitoring in updated international standards ensures predictable long-term revenue growth for manufacturers supplying kits to pediatric and adult CF reference laboratories globally.

Impact of Macroeconomic / Geopolitical Factors

Increasing chronic pancreatitis cases and expanded gastroenterology screening programs encourage physicians to adopt fecal pancreatic elastase testing for non-invasive EPI evaluation, enabling timely enzyme replacement therapies that improve nutrient absorption and patient nutrition outcomes.

Elevated healthcare inflation from macroeconomic shifts, however, pressures insurers to tighten approvals for specialized stool assays, leading clinics to limit testing frequency and favor generic alternatives over validated kits during cost reviews.

Geopolitical conflicts, such as Ukraine border closures, disrupt enzyme stabilizer imports from Eastern European processors, compelling distributors to secure premium air freight that extends lead times and strains inventory during diagnostic backlogs. Yet, these challenges promote domestic biotech partnerships, developing compact, user-friendly elastase readers that integrate with lab workflows and minimize overseas exposure.

Latest Trends

Development of Smartphone-Integrated LAMP Assays is a Recent Trend

The integration of mobile technology with isothermal amplification has exemplified a transformative progression in 2024, enabling user-operated detection of pathogens via colorimetric readouts on smartphone cameras.

Smartphone-linked LAMP platforms, employing lateral flow strips, provide visual endpoints for nucleic acid amplification, supporting non-lab environments in resource-constrained areas. This trend signifies a maturation toward democratized diagnostics, accommodating multiplex targets like SARS-CoV-2 and influenza in single reactions.

Regulatory validations affirm its simplicity, accelerating endorsements for community surveillance. This mobility aligns with digital health objectives, associating results to apps for remote result sharing. The approach resolves equipment dependencies, favoring setups resilient to ambient variations. A JAMA Network Open study in 2022 demonstrated a smartphone-based LAMP assay’s suitability for SARS-CoV-2 and influenza detection without specialized gear, with validations extending into 2024 field trials.

These demonstrations underscore viability, as implementations match molecular standards. Forecasters anticipate guideline incorporations, elevating its role in frontline protocols. Progressive appraisals reveal discordance declines, refining operational efficiencies. The prospect envisions AI-assisted interpretations, envisioning predictive outbreak alerts. This mobile-centric evolution not only heightens diagnostic accessibility but also coordinates with decentralized surveillance mandates.

Regional Analysis

North America is leading the Fecal Pancreatic Elastase Testing Market

In 2024, North America is estimated to have held a 38.5% share of the global fecal pancreatic elastase testing market, driven primarily by the region’s high prevalence of chronic pancreatitis and diabetes. Research indicates that exocrine pancreatic insufficiency (EPI) is significantly associated with diabetes, with prevalence rates ranging from 14% to 77.5% among Type 1 diabetes patients and 16.8% to 49.2% among those with Type 2 diabetes, reflecting a median of 33% and 29%, respectively. Additionally, acute pancreatitis remains a major contributor to gastrointestinal hospitalizations across the US, further intensifying the demand for accurate pancreatic function testing.

The region benefits from advanced healthcare infrastructure, broad insurance coverage, and access to Pancreatic Enzyme Replacement Therapy (PERT), all of which support early diagnosis and disease management. Continuous R&D initiatives aimed at refining diagnostic precision, coupled with rising awareness among clinicians and patients about the subtle onset and complications of EPI, are expected to reinforce North America’s leadership in both diagnostic and therapeutic segments of the fecal pancreatic elastase testing landscape.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies in Asia Pacific anticipate the fecal pancreatic elastase testing sector to expand during the forecast period, as public health efforts target PEI screening in chronic pancreatitis patients amid rising diabetes rates in urban centers. Officials in China and India fund ELISA kits, equipping primary labs to quantify elastase in malnourished diabetic cohorts from agrarian regions.

Diagnostic providers collaborate with regional institutes to standardize turbidimetric methods, estimating accurate profiling of insufficiency in tropical pancreatitis variants. Oversight bodies in Japan and South Korea subsidize automated platforms, positioning community facilities to monitor exocrine function without specialized centers. Administrative systems project linking assay data to digital health records, accelerating enzyme therapy for cystic fibrosis complications in migrant groups.

Regional gastroenterologists develop multiplex formats, coordinating with WHO initiatives to track PEI trends in post-bariatric surgery patients. These measures establish a scalable basis for exocrine diagnostic access. The National Institute of Diabetes and Digestive and Kidney Diseases noted in 2023 that fecal elastase-1 serves as a primary screening tool for pancreatic insufficiency, with ongoing clinical trials extending into 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading organizations in the pancreatic function diagnostics sector advance their portfolios by introducing automated ELISA kits that deliver rapid, quantitative results from stool samples, streamlining workflows for gastroenterologists in busy clinics. They establish strategic collaborations with regional health networks to integrate tests into routine EPI screening protocols, enhancing early detection rates amid rising chronic pancreatitis cases. Enterprises channel investments into point-of-care adaptations with digital connectivity, enabling remote result access and reducing lab dependencies for underserved populations.

Executives pursue acquisitions of specialized reagent developers to refine assay sensitivity, incorporating monoclonal antibodies for superior specificity against interfering substances. They deepen market penetration in Asia-Pacific and Latin America, forging distribution pacts with local labs to align with national digestive health initiatives and secure tender opportunities. Moreover, they deploy bundled training programs with outcome analytics, fortifying clinician adoption and generating recurring revenue through maintenance subscriptions.

ScheBo Biotech AG, founded in 1988 and headquartered in Giessen, Germany, specializes in innovative in vitro diagnostics for gastrointestinal disorders, pioneering monoclonal antibody-based tests for accurate pancreatic enzyme evaluation worldwide. The company engineers its ScheBo Pancreatic Elastase 1 Test, a gold-standard immunoassay that quantifies elastase levels in feces to diagnose exocrine insufficiency with high reliability.

ScheBo Biotech directs focused R&D toward user-friendly formats, including rapid cassette versions for outpatient use, serving over 50 countries through a network of certified distributors. CEO Dr. Thomas ScheBo leads a compact team emphasizing regulatory compliance and evidence-based advancements in stool diagnostics. The firm partners with clinical societies to validate protocols, supporting global efforts in pancreatic health management. ScheBo Biotech upholds its niche leadership by combining analytical excellence with practical innovations to empower precise disease interventions.

Top Key Players in the Fecal Pancreatic Elastase Testing Market

- Verisana Laboratories

- ScheBo Biotech AG

- R-Biopharm AG

- Invivo Healthcare

- Immundiagnostik AG

- DRG Instruments GMBH

- DiaSorin

- CerTest Biotec S.L.

- BÜHLMANN Laboratories AG

- American Laboratory Products Company, Ltd

Recent Developments

- In May 2025: CerTest Biotec S.L. validated its Pancreatic Elastase Turbilatex® Combo assay for use on the Roche Cobas c501 analyzer. This integration expands automated stool-based diagnostics by enabling high-precision, quantitative detection of pancreatic elastase. The compatibility with a major clinical chemistry platform supports laboratory standardization and increases adoption of fecal elastase testing across hospital networks.

- In August 2023: Alpha Laboratories introduced a faster method for diagnosing exocrine pancreatic insufficiency using the BÜHLMANN fPELA® assay with the CALEX extraction device. The ability to process both fPELA and fCAL tests on the same instrument enhances operational efficiency and diagnostic accuracy, driving demand for rapid, multi-parameter stool analysis in gastroenterology diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 16.2 billion Forecast Revenue (2034) US$ 33.4 billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (ELISA Kits and Rapid Kits), By Application (Chronic Pancreatitis, Cystic Fibrosis, Type 1 Diabetes, and Others), By End-user (Hospitals, Specialty Clinics, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Verisana Laboratories, ScheBo Biotech AG, R-Biopharm AG, Invivo Healthcare, Immundiagnostik AG, DRG Instruments GMBH, DiaSorin, CerTest Biotec S.L., BÜHLMANN Laboratories AG, American Laboratory Products Company, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fecal Pancreatic Elastase Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Fecal Pancreatic Elastase Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Verisana Laboratories

- ScheBo Biotech AG

- R-Biopharm AG

- Invivo Healthcare

- Immundiagnostik AG

- DRG Instruments GMBH

- DiaSorin

- CerTest Biotec S.L.

- BÜHLMANN Laboratories AG

- American Laboratory Products Company, Ltd