Global Eye-Safe Laser Range Finder Market Size, Share, Growth Analysis By Product Type (Handheld Laser Range Finders, Mounted Laser Range Finders), By Range (Short Range (up to 500 meters), Medium Range (500-5000 meters), Long Range (above 5000 meters)), By End-User (Military and Defense, Construction and Engineering, Sports and Recreation, Surveying and Mapping, Automotive, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165046

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

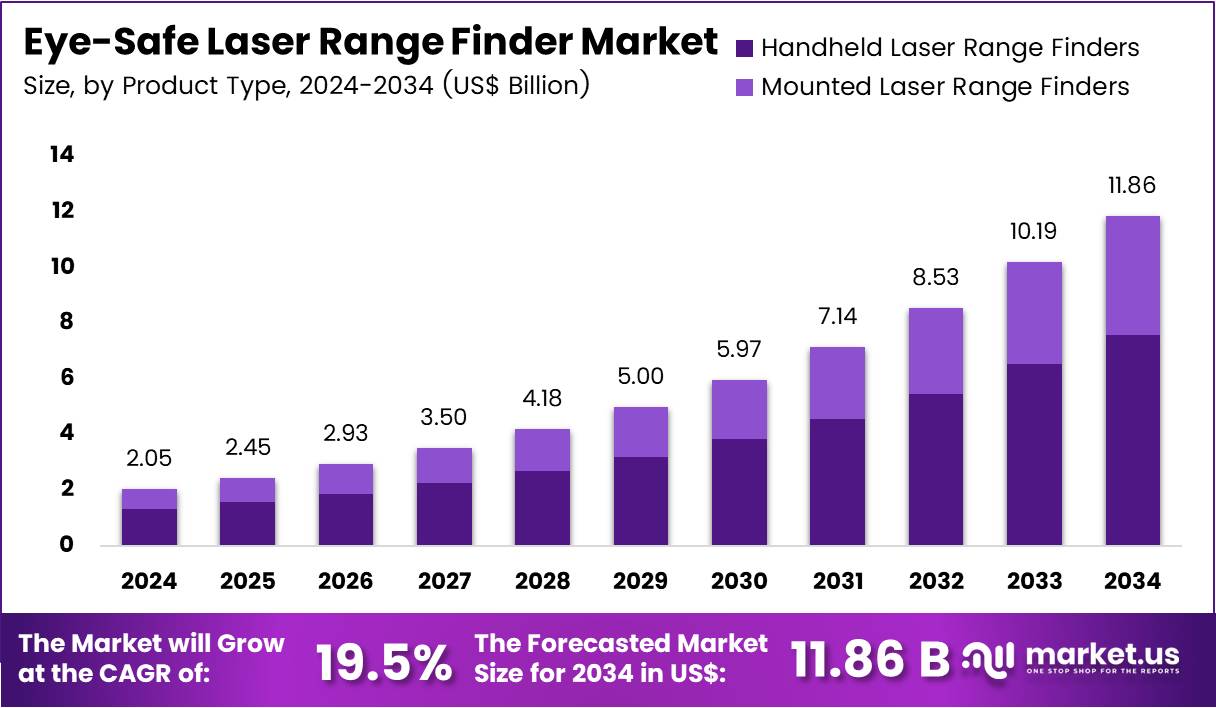

The Eye-Safe Laser Range Finder Market size is expected to be worth around US$ 11.85 billion by 2034 from US$ 2.05 billion in 2024, growing at a CAGR of 19.5% during the forecast period 2025 to 2034.

An eye-safe laser range finder is a distance measurement device that uses lasers operating at wavelengths above approximately 1.4 μm, ensuring light is absorbed by the eye’s cornea and lens to prevent retinal exposure. These devices are compliant with Class 1 human eye safety standards and are widely used in various industries for accurate, safe, and efficient distance measurement without posing risks to vision.

Eye-Safe Laser Range Finder Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 774.6 1,009.8 1,436.6 1,716.7 2,051.5 19.5% The Eye-Safe Laser Range Finder Market is growing rapidly, driven by demand across defense, automotive, and recreational sectors. These devices, operating at eye-safe wavelengths (above 1.4 μm), are essential in defense for safe targeting and reconnaissance, and in automotive advanced driver assistance systems (ADAS) for collision avoidance.

Additionally, they’re popular in recreational activities like hunting and golfing. North America and Europe lead the market due to high defense spending and stringent safety standards, while Asia-Pacific is expanding through defense modernization and increased automotive adoption. Technological advances are further supporting this growth by enhancing range finder accuracy and accessibility.

The Eye-Safe Laser Range Finder Market is witnessing notable growth driven by advancements in laser technology and the demand for safe distance measurement tools across industries. Eye-safe laser range finders, typically operating at wavelengths around 1550 nm, minimize the risk of retinal damage and are thus, compliant with safety standards for human eyes. This feature makes them particularly valuable in applications across defense, aerospace, automotive, construction, and recreational activities.

In the defense and aerospace sectors, eye-safe laser range finders are used extensively for applications such as reconnaissance, target acquisition, and surveillance. These range finders support real-time data collection and measurement for targeting and navigation without risking eye damage to users or bystanders.

With military budgets expanding globally—particularly in regions like the United States, China, and several European countries—investment in advanced laser systems has accelerated. Eye-safe lasers, particularly at wavelengths that avoid eye hazards, are prioritized in procurement for both training and field operations, adding to the product’s adoption.

The recreational sector, including activities such as hunting, golfing, and outdoor sports, has increasingly adopted eye-safe laser range finders. These devices enable safe and reliable distance measurement for users, addressing a rising demand for advanced tools in sports and adventure activities. The growing popularity of hunting and outdoor sports, particularly in North America and Europe, has spurred steady market growth for eye-safe laser range finders. In golf, for example, distance-measuring tools have become standard for both amateur and professional players, driving adoption further in this category.

Additionally, technological advancements in laser optics and precision engineering are making eye-safe laser range finders more affordable and accessible, further fueling market growth. The move toward miniaturized, lightweight, and energy-efficient designs has made these range finders suitable for a wider range of applications, including portable devices in consumer electronics.

North America dominated the eye-safe laser range finder market due to robust defense spending, a high rate of adoption in automotive and recreational sectors, and strict safety regulations. Meanwhile, Asia-Pacific is emerging as a promising market, driven by the rise of defense modernization programs, expanding automotive manufacturing, and a growing interest in adventure sports. For example, China and India are both investing heavily in autonomous vehicle technology and defense systems, which are expected to bolster demand for eye-safe laser solutions in the region.

Key Takeaways

- The global Eye-Safe Laser Range Finder market was valued at USD 2.05 billion in 2024 and is anticipated to register substantial growth of USD 11.85 billion by 2034, with 19.5% CAGR.

- Based on Product Type, the market is bifurcated into Handheld Laser Range Finders and Mounted Laser Range Finders, with Handheld Laser Range Finders taking the lead in 2024 with 64.0% market share.

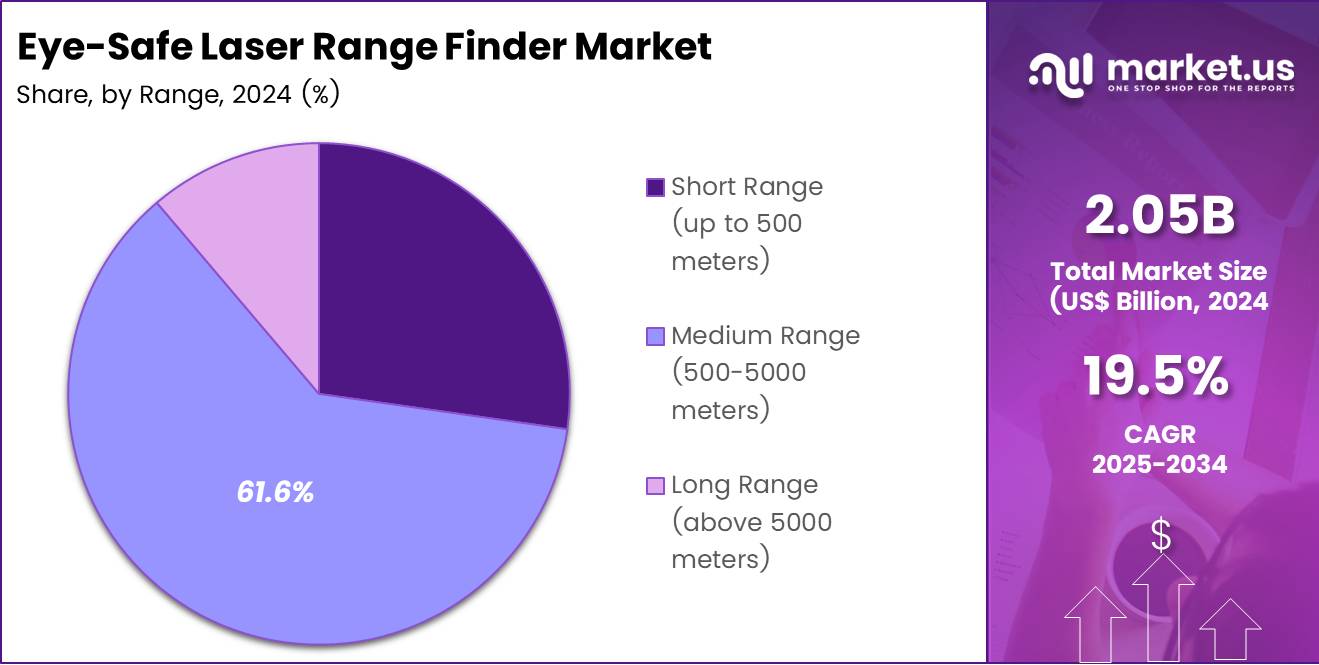

- Based on Range, the market is divided into Short Range (up to 500 meters), Medium Range (500-5000 meters), and Long Range (above 5000 meters), with Medium Range (500-5000 meters) leading with dominant market share of 61.6%.

- By End-User, the market is classified into Military and Defense, Construction and Engineering, Sports and Recreation, Surveying and Mapping, Automotive, and Others, with Military and Defense leading the market share with 43.9% in 2024.

- North America maintained its leading position in the global market with a share of over 39.4% of the total revenue.

By Product Type

The Handheld Laser Range Finder (LRF) segment emerged as the dominant segment in the global Laser Range Finder market, securing a market share of 63.6% and generating revenues of approximately US$ 1.09 billion. This segment is anticipated to grow at an impressive CAGR of 19.7% from 2024 to 2034, driven by increasing demand across diverse industries and rapid technological advancements.

The growth of the Handheld LRF segment is attributed to its portability, versatility, and affordability, making it an indispensable tool in various fields. These devices are widely adopted in construction and engineering, where accurate measurements are critical for infrastructure projects, and in sports and recreation, particularly in activities like hunting, golfing, and hiking.

The demand is further bolstered by features such as angle compensation, ballistic calculation, bluetooth connectivity, and improved measurement accuracy. In addition to traditional applications, the integration of advanced technologies such as thermal imaging, GPS, and real-time data transfer has expanded the use cases for handheld LRFs.

Multi-functional devices like the HikMicro Gryphon series combine laser rangefinding with thermal imaging, catering to security, wildlife observation, and other specialized needs.

Eye-Safe Laser Range Finder Market, Product Type, 2020-2024 (US$ Million)

Product Type 2020 2021 2022 2023 2024 CAGR Handheld Laser Range Finders 491.54 642.11 915.37 1,096.14 1,312.57 19.7% Mounted Laser Range Finders 283.07 367.70 521.20 620.56 738.88 19.1% Total 774.61 1,009.80 1,436.57 1,716.70 2,051.45 19.5% By Range

The Medium Range Laser Range Finder segment dominated the market with 61.6% market share. These devices are widely used in applications where measurements over short distances are critical, including construction, sports, agriculture, and recreational activities. Their affordability, compact size, and user-friendly nature have made them popular across diverse user groups ranging from professionals to hobbyists. In construction and engineering, short-range LRFs are indispensable for tasks like interior measurement, equipment alignment, and site planning.

For example, Bushnell’s Elite 1 Mile CONX, designed for precision shooting and long-range hunting, integrates Bluetooth connectivity for real-time ballistic data, making it a preferred choice for military and sports users alike.

Similarly, Leupold RX-2800 TBR/W offers a maximum range of 2,800 meters and is equipped with True Ballistic Range technology, catering to advanced targeting needs.

Moreover, devices such as Bosch GLM 50 C, which integrates Bluetooth for data transfer to mobile apps, highlight the segment’s emphasis on connectivity and ease of use.

Eye-Safe Laser Range Finder Market, Range, 2020-2024 (US$ Million)

Range 2020 2021 2022 2023 2024 CAGR Short Range (up to 500 meters) 209.99 274.10 390.45 467.16 559.04 19.7% Medium Range (500-5000 meters) 480.96 625.61 888.01 1,059.02 1,262.68 19.2% Long Range (above 5000 meters) 83.65 110.09 158.10 190.51 229.73 20.5% Total 774.61 1,009.80 1,436.57 1,716.70 2,051.45 19.5%

By End-User Analysis

Military and Defense is the dominating segment in 2024 with 43.9% market share. Eye-safe laser range finders (ELRFs) are integral tools for military and defense applications, offering precise distance measurement while ensuring operator safety. Operating primarily in the infrared spectrum (typically above 1400 nm), these devices significantly reduce the risk of eye injury compared to traditional lasers, making them indispensable in modern warfare.

ELRFs are widely used in target acquisition, surveillance, reconnaissance, and fire control. For instance, in sniper operations, ELRFs enable accurate distance calculation, facilitating precise adjustments to bullet trajectories based on range, wind speed, and elevation. Similarly, in artillery strikes, ELRFs aid in calculating firing solutions, reducing collateral damage and improving mission success rates.

For instance, during the Iraq War, U.S. Army snipers relied on the AN/PED-1 Lightweight Laser Designator Rangefinder (LLDR) to improve targeting precision.

Defense forces also utilize ELRFs for mapping enemy positions during reconnaissance missions. For example, drones equipped with ELRFs can relay real-time distance data to command centers, enhancing situational awareness and enabling better strategic planning. Additionally, naval vessels use ELRFs for range-finding during navigation and combat operations, ensuring accurate targeting in maritime environments.

The growth of the market is underscored by the increasing adoption of laser-based technologies, driven by advancements in miniaturization, durability, and multifunctionality.

Eye-Safe Laser Range Finder Market, End-User, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 CAGR Military and Defense 330.99 434.46 622.31 748.47 900.97 20.4% Construction and Engineering 157.12 204.52 290.53 346.77 413.62 19.3% Sports and Recreation 115.74 149.70 211.29 250.61 296.82 18.4% Surveying and Mapping 76.62 99.41 140.73 167.46 199.10 18.9% Automotive 49.72 65.00 92.73 111.07 133.14 19.9% Others 44.43 56.72 78.98 92.31 107.80 16.3% Total 774.61 1,009.80 1,436.57 1,716.70 2,051.45 19.5% Key Market Segments

By Product Type

- Handheld Laser Range Finders

- Mounted Laser Range Finders

By Range

- Short Range (up to 500 meters)

- Medium Range (500-5000 meters)

- Long Range (above 5000 meters)

By End-User

- Military and Defense

- Construction and Engineering

- Sports and Recreation

- Surveying and Mapping

- Automotive

- Others

Drivers

Increased Defense Spending

Increased defense spending worldwide is a significant driver of the Eye-Safe Laser Range Finder (LRF) market, as military and defense sectors are among the primary users of these devices. Eye-safe LRFs utilize laser wavelengths that are safe for human eyes, which is crucial for applications involving personnel safety and training. As defense budgets expand globally, especially in countries such as the United States, China, India, and various European nations, there is a growing demand for advanced range-finding technology to support mission-critical applications.

According to Peter G. Peterson Foundation, U.S. defense spending rose by $55 billion between 2022 and 2023. Furthermore, India’s defense budget for FY 2024-25 has been raised to ₹6.21 lakh crore (US$ 75 billion), up from ₹5.94 lakh crore in the previous year, with the goal of strengthening military capabilities and infrastructure. In comparison, China’s defense budget is $231.36 billion, reflecting a 7.2% increase.

The adoption of Eye-Safe Laser Range Finders in military operations has increased as modern warfare strategies emphasize precision, safety, and enhanced operational efficiency. LRFs are essential in target acquisition, surveillance, and reconnaissance operations, offering soldiers the ability to accurately measure distances to potential targets while minimizing the risk of accidental eye injury. This accuracy allows for precise coordination and improved effectiveness of weapons systems, ultimately enhancing battlefield performance.

In October 2024, Elbit Systems Ltd., an Israeli defense technology company, has secured a significant US$ 200 million contract from the Israeli Ministry of Defence (IMOD) to provide high-power laser technology for Israel’s “Iron Beam” air defense system.

Restraints

Availability of Alternative Measurement Technology

The availability of alternative measurement technologies poses a restraint on the growth of the Eye-Safe Laser Range Finder (LRF) market. Although Eye-Safe LRFs are widely valued for their precision and safety, alternative technologies like ultrasonic sensors, radar, and GPS-based measurement systems offer competitive solutions, especially in applications where laser range finders may not be as effective.

Ultrasonic sensors, for example, are commonly used in industrial and automotive applications for distance measurement and obstacle detection. These sensors operate by emitting sound waves and calculating the time it takes for the waves to reflect back, making them useful in situations where environmental factors like dust, fog, or rain can interfere with laser functionality. Ultrasonic technology also tends to be more cost-effective, which can appeal to budget-conscious industries and markets.

Radar technology is another alternative that is particularly effective in long-range applications. In military and defense scenarios, radar systems are often used in tandem with other technologies to provide more robust and interference-resistant measurements. Unlike LRFs, radar can function over longer distances and perform reliably in diverse weather conditions, which may make it preferable in certain strategic applications.

GPS-based measurement systems have also made strides, especially with advancements in satellite technology, enabling more precise location and distance measurements. While GPS is less accurate over short distances compared to LRFs, it is widely used in navigation and geospatial applications, particularly for outdoor use where a continuous line of sight is not always required.

Growth Factors

Growing Use in Autonomous Vehicles

The adoption of eye-safe laser range finders (LRFs) in autonomous vehicles is a significant growth area, driven by the need for precise and reliable navigation, obstacle detection, and pedestrian safety. LRFs, especially those using 1550 nm lasers, are eye-safe and prevent potential harm to pedestrians, cyclists, and other road users while still providing high-resolution distance measurements crucial for vehicle navigation.

In April 2024, Lumispot Tech’s developed “Baize Series” new laser rangefinder module. By using a 1535nm erbium glass laser wavelength, it delivers a ranging accuracy of up to 0.5 meters.

In January 2023, at CES 2023, Innovusion unveiled its long-range Falcon LiDAR, which won the 2023 CES Innovation Award for its exceptional design and engineering. This LiDAR is engineered to enhance autonomous driving systems by offering high-resolution, long-range sensing capabilities.

In autonomous vehicles, eye-safe LRFs function as key components of LiDAR (Light Detection and Ranging) systems. LiDAR creates a 3D map of the surrounding environment by emitting laser pulses and measuring the reflected signals. Eye-safe LRFs provide the required range without posing risks to nearby individuals.

In urban areas, where vehicles share space with pedestrians, eye-safe LiDAR is essential. Companies like Waymo and Tesla have implemented LiDAR technologies to increase the safety and functionality of their autonomous systems, although Tesla has also integrated alternative sensing technologies.

Impact of Macroeconomic / Geopolitical Factors

Economic-slowdown pressures in major economies are constraining defence and infrastructure budgets, thereby limiting procurement of advanced eye-safe range-finding systems in segments such as fixed installations and large vehicle platforms. At the same time, rising inflation and supply-chain cost escalation—especially in raw optical components or semiconductors—are putting upward pressure on unit costs, squeezing margins for manufacturers.

On the geopolitical side, heightened tensions and military modernisation efforts across regions (notably Asia-Pacific and the Middle East) are boosting demand for eye-safe solutions, particularly those compatible with unmanned aerial systems, reconnaissance platforms and advanced targeting. This is reflected in growing defence budgets and accelerated procurement cycles.

Export-control regimes (e.g., technology transfer restrictions, sanctions) are pushing manufacturers to localise production or source alternate supply-chains, which adds complexity and cost but also opens up near-term opportunities for regional manufacturing hubs.

Emerging Trends

Emerging Applications in Drones and UAVs

The integration of eye-safe laser range finders in drones and UAVs (Unmanned Aerial Vehicles) represents a significant trend in the global market. As industries such as agriculture, construction, and defense adopt drones for diverse tasks, the demand for precise and safe distance-measuring tools within these platforms has surged. Eye-safe laser range finders, which typically operate at wavelengths safe for human eyes, are becoming essential components for drone applications that require high-precision measurement and mapping.

In agriculture, for instance, drones equipped with laser range finders are used for terrain mapping, crop monitoring, and irrigation planning. This trend is driven by the increased investment in precision agriculture. Eye-safe range finders in this sector enhance safety during close-proximity operations and enable accurate measurements over large areas, improving resource management and crop yields.

For instance, according to statistics, U.S. precision farming market represented about 24% of the global precision farming. In the U.S., larger farms are expanding their use of precision agriculture and successfully addressing technology barriers to implement these practices. However, adoption among small farms—comprising over 85% of all U.S. farms—remains minimal.

Regional Analysis

North America is leading the Eye-Safe Laser Range Finder Market

North America dominated the global eye-safe laser range finder market, driven by a combination of robust defense spending, advanced technological infrastructure, and high demand across various sectors. The United States, in particular, plays a central role in shaping this market, with significant investments in both military and civilian applications of eye-safe laser range finders

In the defense sector, the U.S. military’s focus on cutting-edge technologies is a key factor in the dominance of the region. The U.S. Department of Defense (DoD) allocates substantial budgets to modernizing defense systems, including the integration of eye-safe laser range finders for target acquisition, reconnaissance, and navigation.

The U.S. military’s emphasis on ensuring the safety of personnel in combat and training environments has further fueled the demand for eye-safe technology. In fact, contracts with defense contractors such as L3Harris Technologies and Safran underscore the increasing adoption of these advanced systems.

According to the Stockholm International Peace Research Institute, U.S. military spending reached $801 billion in 2021.

Additionally, North America’s automotive sector contributes significantly to the market. With the rapid development of autonomous vehicles and advanced driver assistance systems (ADAS), eye-safe laser range finders are critical for safety features such as collision avoidance and object detection. Major automotive manufacturers in the region are adopting these technologies to enhance vehicle safety, creating strong demand for such systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Eye-Safe Laser Range Finder Company Insights

Key players in the Eye-Safe Laser Range Finder market includes EVPÚ Defense, Hensoldt, L3Harris Technologies, Inc., ASELSAN, YUGOIMPORT, Raythink Technology Co., Ltd., ERDI, Beijing Radifeel Technology Co., Ltd., WOORIRO, Chengdu JRT Meter Technology Co., Ltd, 3E EOS, and Other key players.

EVPÚ Defence: Offers modular eye-safe laser rangefinders with measurement spans from 50 m up to 32 km, accuracy between 0.5-1.5 m, and rugged sealed design suited for mobile and stationary electro-optical systems. Hensoldt: Provides “LDM” and “ELRF”-series eye-safe laser rangefinders featuring solid-state OPO-shifted lasers, compact robust builds, and integration on land, air and maritime platforms for precision targeting. L3Harris Technologies, Inc.: Markets Class 1 eye-safe long-range systems such as DP-ELRF III with up to 30 km range, and miniaturised models like the 10 km MLRF for compact platforms, aimed at advanced fire-control applications.

Top Key Players in the Market

- EVPÚ Defense

- Hensoldt

- L3Harris Technologies, Inc.

- ASELSAN

- YUGOIMPORT

- Raythink Technology Co., Ltd.

- ERDI

- Beijing Radifeel Technology Co., Ltd.

- WOORIRO

- Chengdu JRT Meter Technology Co., Ltd

- 3E EOS

- Other key players

Key Opinion Leaders

Name & Title Country Expert Quote Dr. Pavel Kostka, Defense Optoelectronics Specialist Czech Republic “EVPÚ Defence has achieved a remarkable balance between rugged military-grade durability and precision optics. Their modular eye-safe rangefinders perform exceptionally in harsh field conditions, supporting surveillance and targeting systems without compromising operator safety.” Prof. Emilia Wagner, Military Systems Researcher Germany “Hensoldt’s eye-safe rangefinding technology exemplifies German engineering excellence. The company’s ELRF series combines superior wavelength management with compact design, offering unmatched accuracy and rapid target acquisition across land and air defense systems.” Col. James Carter (Ret.), Defense Technology Consultant United States “L3Harris continues to push boundaries in rangefinding innovation with its diode-pumped, long-range eye-safe laser systems. Their integration into next-generation fire-control solutions enhances situational awareness and targeting precision for modern tactical forces.” Recent Developments

- In November, 2024, BAE Systems collaborated with German military systems specialist ESG Elektroniksystem- and Logistik-GmbH, part of the HENSOLDT Group, to explore ways to combine their technology and experience across the European defense market.

- In May 2024, EVPÚ Defence announced its significant involvement in the Czech CV90 infantry fighting vehicle programme, supplying its advanced CMS-1 commander sights. This collaboration with BAE Systems Hagglunds marks a critical development in the partnership between the two defense firms. The CMS-1 system, designed for both wheeled and tracked armored vehicles, features multi-sensor electro-optical capabilities that enhance battlefield command and control.

- In January 2023, L3Harris Technologies Inc. provide shipboard sights for the fire control necessary for U.S. Navy surface warships to hit enemy ships and aircraft with naval gun fire under terms of an $8.9 million order announced. The MK 20 EOSS has digital stabilization with fiber-optic gyros, a separate eye-safe laser rangefinder with diode-pumped laser, enhanced built-in test, and improved sensor-to-sensor boresight alignment.

Report Scope

Report Features Description Market Value (2024) USD 2.05 billion Forecast Revenue (2034) USD 11.85 billion CAGR (2025-2034) 19.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Handheld Laser Range Finders, Mounted Laser Range Finders), By Range (Short Range (up to 500 meters), Medium Range (500-5000 meters), Long Range (above 5000 meters)), By End-User (Military and Defense, Construction and Engineering, Sports and Recreation, Surveying and Mapping, Automotive, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape EVPÚ Defense, Hensoldt, L3Harris Technologies, Inc., ASELSAN, YUGOIMPORT, Raythink Technology Co., Ltd., ERDI, Beijing Radifeel Technology Co., Ltd., WOORIRO, Chengdu JRT Meter Technology Co., Ltd, 3E EOS, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Eye-Safe Laser Range Finder MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Eye-Safe Laser Range Finder MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- EVPÚ Defense

- Hensoldt

- L3Harris Technologies, Inc.

- ASELSAN

- YUGOIMPORT

- Raythink Technology Co., Ltd.

- ERDI

- Beijing Radifeel Technology Co., Ltd.

- WOORIRO

- Chengdu JRT Meter Technology Co., Ltd

- 3E EOS

- Other key players