Epigenomics Market By Product (Reagents, Kits (Whole Genomic Amplification kit, RNA Sequencing Kit, Chip sequencing kit, Bisulfite Conversion kit, Others), Enzymes, Instruments and Services) By Application (Oncology and Non oncology) By Technology (DNA Methylation, MicroRNA Modification, Large non-coding RNA, Histone Methylation and Histone Acetylation), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155594

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

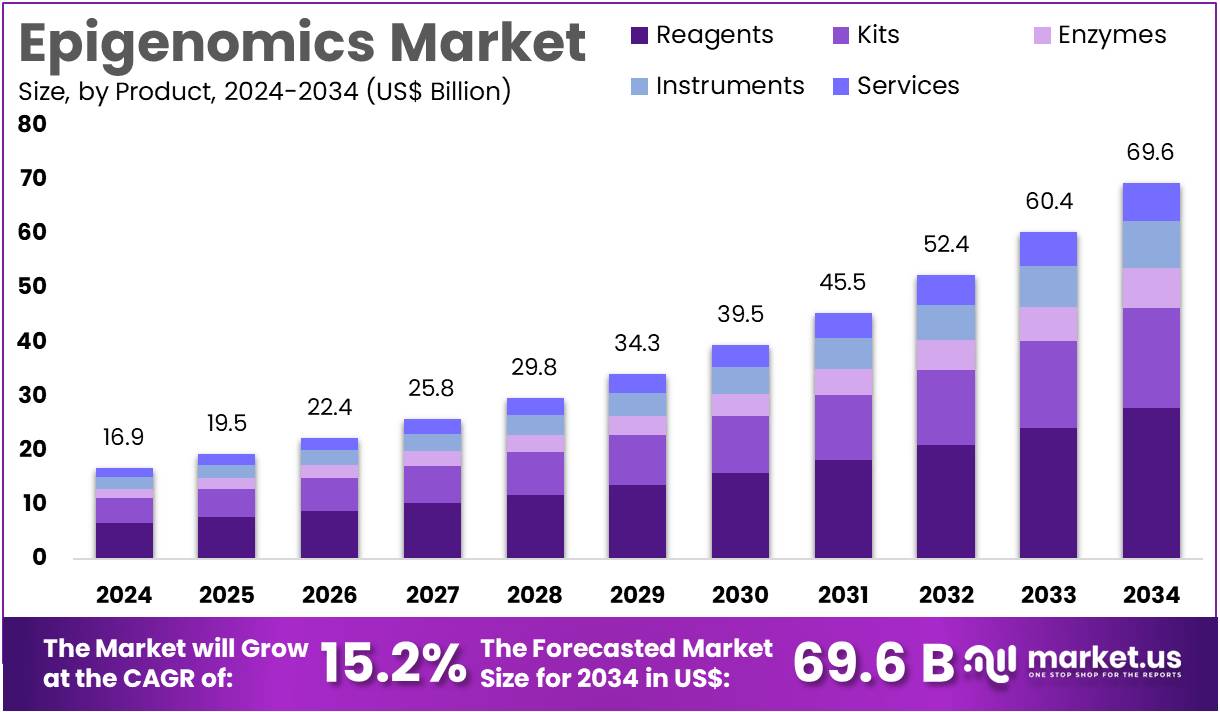

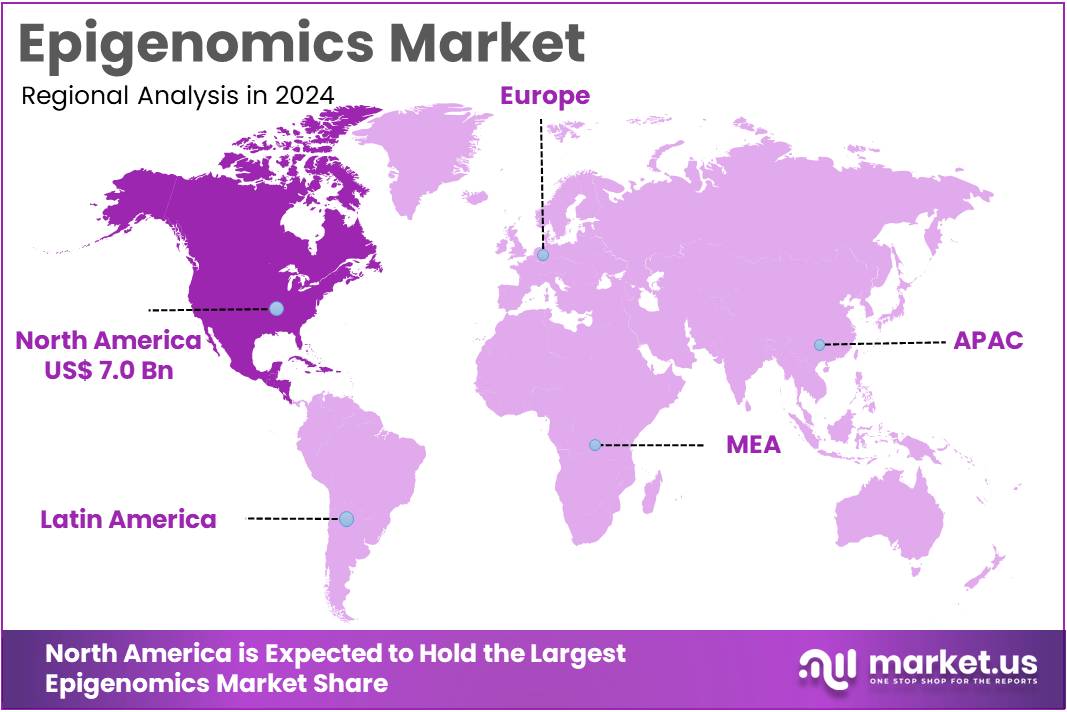

The Epigenomics Market Size is expected to be worth around US$ 69.6 billion by 2034 from US$ 16.9 billion in 2024, growing at a CAGR of 15.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.3% share and holds US$ 7 Billion market value for the year.

Rising awareness of epigenetics as a critical factor in human health and disease is a primary driver of the epigenomics market. Scientists now understand that environmental and lifestyle factors can alter gene expression without changing the underlying DNA sequence, profoundly impacting health outcomes. This knowledge is fueling a surge in research for applications in oncology, where epigenetic changes are known to drive cancer initiation and progression, and in neurodegenerative disorders. The market is capitalizing on this trend by developing advanced tools that enable researchers to map and analyze these complex epigenetic modifications, ultimately paving the way for more targeted diagnostics and therapies.

Growing technological sophistication and strategic product development are key trends shaping the epigenomics market. Companies are introducing new tools to enhance the precision and efficiency of epigenetic analysis. For instance, in March 2024, Thermo Fisher Scientific launched a new suite of epigenomics kits designed to improve data quality for research focused on DNA methylation and histone modification. These kits facilitate more accurate epigenetic research and a deeper understanding of gene regulation. Similarly, in February 2024, Illumina introduced AI-powered epigenomic analysis tools that leverage machine learning to accelerate the identification of biomarkers and therapeutic targets, offering researchers enhanced capabilities for more precise data analysis and faster breakthroughs.

Increasing investment from both public and private sectors is creating significant opportunities for market expansion. The National Institutes of Health (NIH) has been a consistent funder of epigenomics research, with a particular focus on understanding how environmental exposures and aging contribute to disease through epigenetic mechanisms. This public funding, combined with private venture capital, is supporting the development of novel diagnostic assays and therapeutic agents. This trend is especially evident in the field of personalized medicine, where epigenomics offers the potential to tailor treatments to a patient’s unique epigenetic profile. This robust investment ecosystem ensures that the market will continue to expand as research moves from basic science to clinical applications.

Key Takeaways

- In 2024, the market for Epigenomics generated a revenue of US$ 16.9 billion, with a CAGR of 15.2%, and is expected to reach US$ 69.6 billion by the year 2034.

- The product segment is divided into reagents, kits, enzymes, instruments and services, with reagents taking the lead in 2023 with a market share of 40.1%.

- Considering application, the market is divided into oncology and non oncology. Among these, oncology held a significant share of 57.2%.

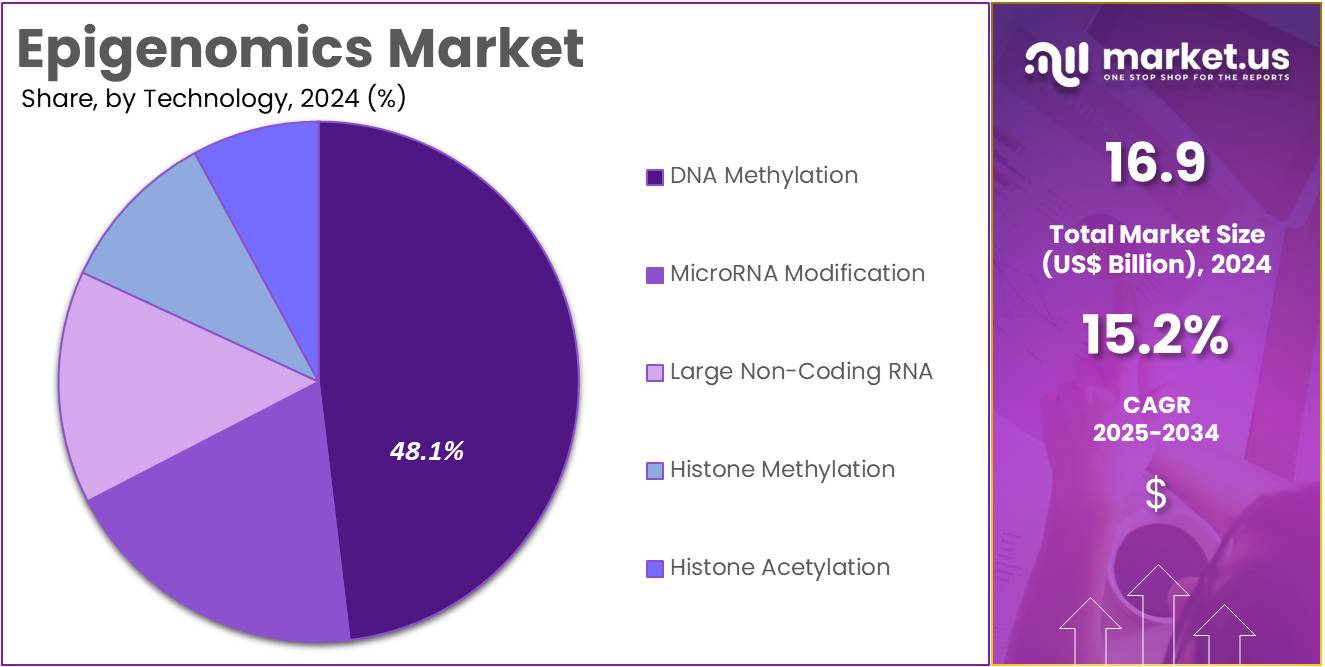

- Furthermore, concerning the technology segment, the market is segregated into DNA methylation, microRNA modification, large non-coding RNA, histone methylation and histone acetylation. The DNA methylation sector stands out as the dominant player, holding the largest revenue share of 48.1% in the Epigenomics market.

- North America led the market by securing a market share of 41.3% in 2023.

Product Analysis

Reagents hold the largest share of 40.1% in the epigenomics market, and this growth is expected to continue as they are essential for conducting various epigenetic analyses. Reagents play a critical role in DNA modification studies, enabling researchers to perform methylation, acetylation, and other epigenetic processes. As the focus on epigenetics in both research and clinical diagnostics increases, the demand for high-quality reagents is projected to rise. Advances in reagent formulations, particularly those that improve efficiency, sensitivity, and specificity, are likely to contribute to this growth.

The rising emphasis on personalized medicine and the increasing number of studies exploring the role of epigenetic factors in diseases, particularly cancer, are expected to drive further adoption of reagents. As researchers and healthcare providers demand more precise tools for understanding genetic and epigenetic factors, reagents will remain integral to the field of epigenomics.

Application Analysis

Oncology represents 57.2% of the application segment in the epigenomics market. This growth is expected to continue as epigenetic research plays a key role in understanding cancer biology, particularly in areas like tumorigenesis, metastasis, and drug resistance. The ability to identify epigenetic markers for early cancer detection and prognosis is fueling demand for epigenomic technologies in oncology.

Advances in DNA methylation and histone modification studies are expected to provide new insights into cancer progression and potential therapeutic targets. The increasing focus on personalized cancer treatments and the identification of epigenetic biomarkers for targeted therapies is likely to drive the market for epigenomics tools in oncology. Additionally, as new cancer therapies and clinical trials increasingly rely on epigenetic data for patient stratification, the market for oncology-related epigenomic products is projected to grow significantly.

Technology Analysis

DNA methylation holds 48.1% of the technology segment in the epigenomics market. This segment’s growth is expected to be driven by the crucial role that DNA methylation plays in gene expression regulation and its significant implications in various diseases, particularly cancer. DNA methylation analysis is widely used for detecting genetic modifications that contribute to disease progression, and it has become a key tool in both clinical diagnostics and research.

The growing interest in understanding how environmental and lifestyle factors influence gene expression through methylation is expected to contribute to the expansion of this segment. Furthermore, as technologies for analyzing DNA methylation continue to improve in terms of accuracy, affordability, and speed, more researchers and clinicians are expected to adopt these methods. The increasing use of DNA methylation for early detection of cancers, as well as its application in personalized medicine, is anticipated to drive the growth of this technology in the epigenomics market.

Key Market Segments

By Product

- Reagents

- Kits

- Whole Genomic Amplification kit

- RNA Sequencing Kit

- Chip sequencing kit

- Bisulfite Conversion kit

- Others

- Enzymes

- Instruments

- Services

By Application

- Oncology

- Non oncology

By Technology

- DNA Methylation

- MicroRNA Modification

- Large non-coding RNA

- Histone Methylation

- Histone Acetylation

Drivers

The rising prevalence of chronic diseases is driving the market

The epigenomics market is experiencing significant growth due to the increasing burden of chronic diseases and the growing recognition of the role epigenetics plays in their development and progression. Epigenetic modifications, such as DNA methylation and histone acetylation, are now understood to be critical in the pathogenesis of conditions like cancer, diabetes, and neurodegenerative disorders. According to the Centers for Disease Control and Prevention (CDC), in 2023, 76.4% of American adults had at least one of twelve selected chronic conditions. This high prevalence fuels a persistent demand for advanced diagnostic and therapeutic tools that can target the epigenetic mechanisms of these diseases.

Furthermore, the number of scientific studies focused on the epigenetic basis of diseases is rapidly increasing, with a growing number of cancer-related epigenetics research papers and clinical trials being registered annually. The ability to detect these epigenetic changes, often through minimally invasive methods like liquid biopsies, allows for earlier diagnosis and more personalized treatment plans. This scientific and clinical shift reinforces the value of epigenomic technologies and solidifies their role in the future of disease management.

Restraints

The high cost of research and complex data analysis are restraining the market

A significant restraint on the epigenomics market is the high cost associated with both research projects and the specialized equipment and services required to conduct them. The expense of reagents, advanced sequencing platforms, and the specialized personnel needed to operate them creates a substantial financial barrier, particularly for smaller research institutions and emerging biotechnology companies. A single comprehensive epigenomic sequencing project can cost tens of thousands of dollars, making large-scale population studies prohibitively expensive for many. This is compounded by the complexity of the data generated.

Epigenomic datasets are massive, often containing hundreds of millions of data points per sample, which necessitates sophisticated bioinformatics tools and a high level of computational power for analysis. A 2024 analysis of sequencing costs and data management highlighted that the cost of bioinformatics and data storage now represents a significant portion of the total project budget, with the price of sequencing itself continuing to decline. The need for highly skilled bioinformaticians to interpret this data and translate it into meaningful clinical insights remains a bottleneck, creating a shortage of qualified professionals and adding to the overall cost and complexity.

Opportunities

Continuous technological innovations in sequencing and bioinformatics are creating growth opportunities

The epigenomics market is presented with significant opportunities due to continuous technological innovations that are dramatically improving the speed, accuracy, and affordability of sequencing and data analysis. The development of advanced next-generation sequencing (NGS) platforms has been a primary catalyst. For example, in October 2024, Illumina introduced its MiSeq™ i100 Series, a benchtop sequencing system designed to offer greater simplicity and speed, with run times as fast as four hours and a significant reduction in packaging waste. This makes high-quality sequencing more accessible to a wider range of laboratories, democratizing the technology.

Furthermore, the cost of sequencing continues to fall, with some reports in 2024 indicating that the cost to sequence a human genome is now around US$600. This dramatic reduction in cost allows researchers to conduct larger and more extensive studies, accelerating the discovery of new epigenetic biomarkers. Innovations in bioinformatics, including the integration of AI and machine learning, are also making the analysis of complex data more efficient and accurate, transforming it from a bottleneck into a powerful tool for discovery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces are shaping the operational landscape for manufacturers and suppliers in the epigenomics sector. Rising global inflation has driven up the cost of critical raw materials, specialized enzymes, and high-purity chemicals essential for both reagents and sequencing platforms used in advanced research. Data from the US Bureau of Labor Statistics (BLS) showed a 0.9% increase in the Producer Price Index for “Chemicals and Allied Products Wholesaling” in February 2024, signaling the rising expenses encountered by distributors and manufacturers.

Simultaneously, geopolitical instability in key manufacturing regions has led to disruptions in the global supply chain for these specialized chemicals. According to a 2024 bio-pharma supply chain report, ongoing conflicts and trade tensions have resulted in a 2.9% increase in supply chain costs for the year, largely driven by rising raw material and freight costs. To navigate these challenges, the industry is focusing on improving operational efficiency and diversifying suppliers. Companies with robust supply chains and the ability to absorb or mitigate cost increases are better positioned to sustain stability and profitability, demonstrating that flexibility and strategic planning are key to long-term success.

Current US tariff policies are adding complexity to the supply chain dynamics. New duties on imported laboratory equipment and chemical reagents from key trading partners have raised the landed cost of these products. A 2025 analysis of US tariffs revealed that some imported diagnostic reagents and laboratory supplies now face duties as high as 25% or more, depending on their classification and origin. These tariff increases are passed along the supply chain, putting pressure on distributor margins and ultimately raising prices for research institutions and laboratories. This could reduce the profitability of research and development projects, potentially slowing innovation.

However, these tariffs are also giving a competitive edge to US-based manufacturers, who are exempt from these import duties. As a result, many research institutions are turning to domestic suppliers to secure a more stable supply chain and predictable pricing. This shift towards domestic production is encouraging companies to invest in local manufacturing capabilities, allowing them to bypass tariff-related costs and strengthen their position in the market, thus ensuring a more favorable long-term outlook.

Latest Trends

Expansion of liquid biopsy and non-invasive testing is a recent trend

A significant trend observed in 2024 and 2025 is the expansion of liquid biopsy and other non-invasive testing methods into the epigenomics field, particularly for early disease detection and monitoring. These tests analyze epigenetic markers such as circulating tumor DNA (ctDNA) from a simple blood draw, offering a less invasive alternative to traditional tissue biopsies. The US Food and Drug Administration (FDA) has actively supported this trend, with several liquid biopsy platforms receiving approval for their use as companion diagnostics in recent years.

For instance, in November 2024, the FDA approved FoundationOne Liquid CDx to be used as a companion diagnostic for a new therapy in patients with a specific type of non–small cell lung cancer, validating its clinical utility. This move towards non-invasive diagnostics improves the patient experience and allows for more frequent monitoring of disease progression and treatment response. As a result, the development of new non-invasive tests is a major area of focus for research and development. The ability to detect epigenetic changes from liquid biopsies offers a promising avenue for personalized medicine, enabling clinicians to tailor treatments to a patient’s specific epigenetic profile in real-time.

Regional Analysis

North America is leading the Epigenomics Market

The epigenomics market in North America held a commanding 41.3% share of the global market in 2024, a testament to the region’s strong commitment to scientific research and its advanced healthcare infrastructure. This growth is a direct result of substantial government and private funding in life sciences, particularly in areas like oncology and personalized medicine.

For instance, the National Cancer Institute (NCI), a part of the National Institutes of Health (NIH), has actively supported epigenetics research, recognizing its potential to revolutionize cancer diagnosis and treatment. The market also benefits from a high prevalence of chronic diseases, creating a significant demand for advanced diagnostic and therapeutic solutions. According to a 2022 NIH-funded study, understanding the link between epigenetic changes and racial and economic disparities could help address inequities in premature mortality, highlighting the importance of this research in public health initiatives.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific epigenomics market is anticipated to experience the fastest growth during the forecast period. This is largely due to the region’s rapidly developing healthcare infrastructure, increasing government and private investment in genomics and biopharmaceuticals, and a large population with a growing burden of chronic diseases. For instance, countries like China are making substantial investments in healthcare and biotechnology. According to an FDI World Dental Federation report, the density of dentists in China was 4.5 per 10,000 population in 2021, and this number is continuously growing, indicating an expanding professional base to serve patient needs.

Moreover, governments across the region are implementing favorable policies and funding initiatives to support scientific research. For example, some government-funded projects in India, such as the SERB-CRG, have provided significant grants for research into various scientific fields, including those related to life sciences, during the 2022-2024 period. This focus on local innovation and capacity building, combined with a rising awareness of personalized medicine, is positioning Asia Pacific as a critical engine of growth in the global epigenomics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Growth strategies for key players in the epigenomics market center on a multi-pronged approach. Companies aggressively invest in research and development to advance new technologies, specifically focusing on innovations that reduce sequencing costs and improve data throughput. They also employ strategic collaborations and acquisitions to expand their product portfolios and access new markets, often partnering with academic institutions and biopharmaceutical firms. Furthermore, these players emphasize new product launches and continuous improvement of their existing platforms to maintain a competitive edge and meet the evolving needs of their customer base in clinical diagnostics and drug development.

Illumina, Inc., a global leader in genomics, provides integrated systems for analyzing genetic variation and biological function. Their core business revolves around developing, manufacturing, and marketing DNA sequencing and array-based technologies. The company’s diverse product and service offerings cater to academic research, clinical diagnostics, and the pharmaceutical industry, helping to pioneer advances in oncology, genetic diseases, and reproductive health. Illumina is renowned for its Next-Generation Sequencing (NGS) platforms, which have become a dominant force in the market.

Recent Developments

- In February 2022: Zenith Epigenetics Ltd., in collaboration with the National Cancer Institute (NCI), reported the first patient to receive a dose of ZEN-3694, a BET inhibitor, alongside OPDIVO and YERVOY, two PD-1 immune checkpoint inhibitors from Bristol Myers Squibb. This study, focused on solid tumor cancer, marks a significant advancement in the epigenomics market, as it demonstrates the potential of combining epigenetic therapies with immune checkpoint inhibitors to enhance cancer treatment effectiveness.

- In February 2022: Dovetail Genomics and Element Biosciences, Inc., creators of an innovative DNA sequencing platform, partnered to demonstrate Dovetail’s proximity ligation-based next-generation sequencing (NGS) library prep solutions on Element’s AVITI System. This collaboration offers new opportunities in the epigenomics market, enabling more precise and efficient sequencing techniques that could accelerate the discovery of novel epigenetic biomarkers and therapeutic targets, driving innovation in genomic research and personalized medicine.

Top Key Players in the Epigenomics Market

- Zymo Research

- Thermo Fisher Scientific

- QIAGEN

- PerkinElmer

- Pacific Biosciences

- New England Biolabs

- Merck KGaA

- Illumina

- Bio-Rad Laboratories

- Agilent Technologies

- Active Motif

- Abcam

Report Scope

Report Features Description Market Value (2024) US$ 16.9 billion Forecast Revenue (2034) US$ 69.6 billion CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Reagents, Kits (Whole Genomic Amplification kit, RNA Sequencing Kit, Chip sequencing kit, Bisulfite Conversion kit, Others), Enzymes, Instruments and Services) By Application (Oncology and Non oncology) By Technology (DNA Methylation, MicroRNA Modification, Large non-coding RNA, Histone Methylation and Histone Acetylation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zymo Research, Thermo Fisher Scientific, QIAGEN, PerkinElmer, Pacific Biosciences, New England Biolabs, Merck KGaA, Illumina, Bio-Rad Laboratories, Agilent Technologies, Active Motif, Abcam. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zymo Research

- Thermo Fisher Scientific

- QIAGEN

- PerkinElmer

- Pacific Biosciences

- New England Biolabs

- Merck KGaA

- Illumina

- Bio-Rad Laboratories

- Agilent Technologies

- Active Motif

- Abcam