Global Enterprise Video Market Report By Component (Solution, Services, By Deployment Mode (Cloud-Based, On-Premise), By Application (Corporate Communication, Training and Development, Marketing and Client Engagement, Other Applications), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail, Media and Entertainment, Education, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 126768

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Enterprise Video Market size is expected to be worth around USD 64.3 Billion by 2033, from USD 23.7 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

The Enterprise Video Market involves the creation, management, and distribution of video content within organizations. This market encompasses tools and platforms that enable businesses to use video for internal communication, training, marketing, and customer engagement. It includes video conferencing systems, live streaming, video-on-demand services, and content management solutions.

The rise in remote workplace services and the increasing importance of visual content for communication are major drivers of this market. Businesses use enterprise video to enhance collaboration, improve employee engagement, and deliver rich media content to customers and stakeholders.

The Enterprise Video market is experiencing sustained growth, driven by the increasing adoption of video conferencing as a critical tool for business communication. Video conferencing has become integral to modern workplaces, particularly in the context of hybrid and remote work environments.

As of early 2023, 77% of employees were accessing video conferences via laptops and desktop computers, while 34% utilized conference room equipment. This widespread use underscores the importance of video technology in maintaining business continuity and enhancing collaboration across dispersed teams.

However, despite its widespread adoption, video conferencing still faces challenges. Among the most significant issues are audio quality problems and the lack of personal connection, with 24.7% of users citing the latter as a major drawback. These challenges highlight the need for continuous improvement in video conferencing technology to ensure seamless communication and stronger engagement among participants.

Zoom remains the dominant platform in the enterprise video market, utilized by 80% of enterprises for activities such as marketing and sales. Other notable platforms include Team Viewer (74%), Google Hangouts Meet (73%), and Cisco Webex Meetings (63%). The preference for these platforms reflects their ability to meet the diverse needs of businesses, from large-scale meetings to more specialized functions like customer support and internal training.

Large enterprises, in particular, report a high level of daily video conferencing usage, with about 71% of respondents using it daily. This frequent use has proven beneficial, enhancing employee motivation and enabling better customer engagement. Additionally, 91% of business leaders have had positive experiences with hybrid meetings, underscoring the continued optimization of such meetings for flexible interaction in a hybrid workplace.

As businesses continue to navigate the evolving landscape of work, the Enterprise Video market is poised for further growth. The focus will likely remain on improving the quality of video conferencing experiences and integrating more advanced features to support the complex needs of modern enterprises. With ongoing innovation, the market is expected to play a pivotal role in shaping the future of business communication.

Key Takeaways

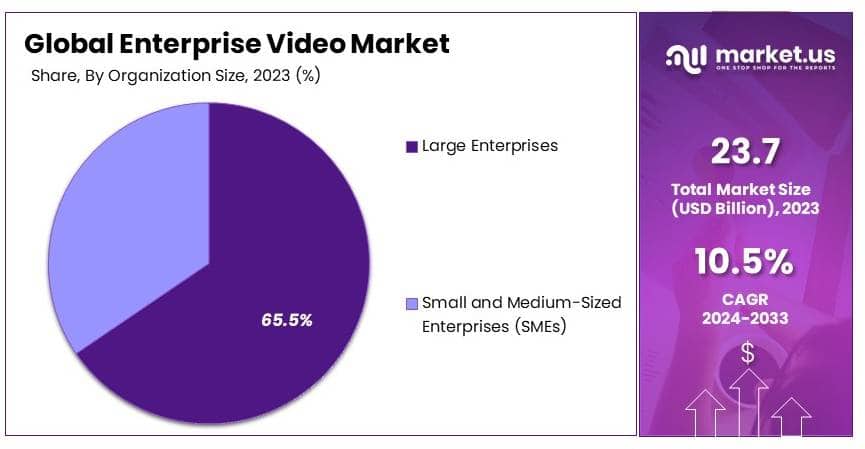

- The Enterprise Video Market was valued at USD 23.7 billion in 2023 and is expected to reach USD 64.3 billion by 2033, with a CAGR of 10.5%.

- In 2023, Solution dominated the component segment with 67.8% due to the increasing use of video conferencing and content management solutions.

- In 2023, Cloud-Based led the deployment mode segment with 63.1% as cloud solutions offer flexibility and ease of access for enterprises.

- In 2023, Corporate Communication dominated the application segment with 44.3%, driven by the need for effective communication tools in enterprises.

- In 2023, Large Enterprises led the organization size segment with 65.5%, reflecting the higher adoption of video solutions among large corporations.

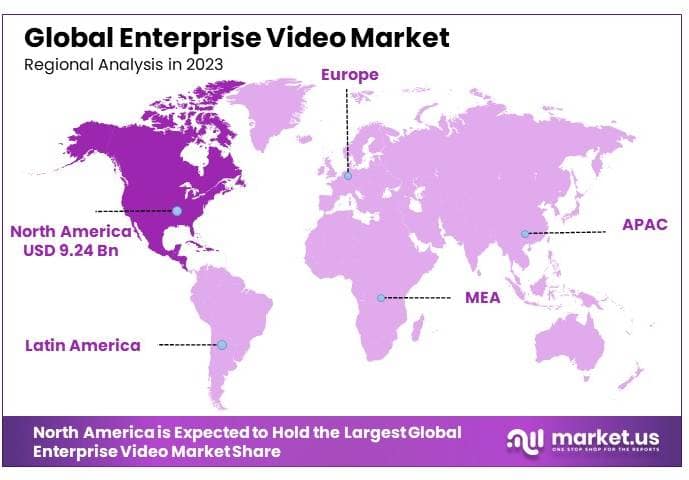

- In 2023, North America dominated the market with 39.0%, valued at USD 9.24 billion, reflecting the strong presence of leading technology companies.

Component Analysis

Solution dominates with 67.8% due to its integral role in facilitating comprehensive video functionalities.

In the Enterprise Video Market, the Solution segment emerges as the most significant, capturing 67.8% of the market. This segment’s dominance is driven by the escalating demand for advanced video solutions across various industries, aimed at enhancing communication and operational efficiencies.

Key components under this segment include Video Conferencing Solutions, Video Content Management Solutions, Webcasting and Streaming Solutions, among others, with Video Conferencing Solutions standing out due to the growing need for remote collaboration tools.

Video Conferencing Solutions have become essential in today’s global business environment, enabling real-time communication and collaboration across different geographical locations. This technology has been pivotal in supporting the continuity of business operations, especially in the face of increasing remote work trends and global outsourcing practices.

The other solutions, like Video Content Management and Webcasting, also play crucial roles by allowing enterprises to efficiently manage and distribute video content. These tools are vital for training, corporate communications, and marketing, facilitating a streamlined flow of information within and outside the organization.

Services, comprising Professional and Managed Services, complement these solutions by providing necessary support, customization, and maintenance, ensuring systems are optimized and aligned with business goals.

Deployment Mode Analysis

Cloud-Based dominates with 63.1% due to its scalability and flexibility.

The Cloud-Based deployment mode holds the largest share in the Enterprise Video Market at 63.1%. This model’s popularity is attributed to its scalability, flexibility, and cost-effectiveness, which are crucial for businesses expanding their digital infrastructure. Cloud-based solutions allow organizations to deploy video solutions quickly and efficiently without the significant upfront costs associated with on-premise setups.

The ability to scale services to match fluctuating demand and the ease of integrating with other cloud services make the cloud-based model particularly attractive. This deployment mode also offers enhanced accessibility, enabling employees to access video tools from anywhere, which is increasingly important in a mobile-centric business world.

On-Premise deployment, while offering greater control over security and data, involves higher initial investments and maintenance costs, making it less appealing for businesses seeking agility and lower capital expenditures.

Application Analysis

Corporate Communication dominates with 44.3% due to its crucial role in internal and external business operations.

Corporate Communication is the leading application within the Enterprise Video Market, accounting for 44.3% of the segment. This dominance is fueled by the increasing necessity for robust communication channels that can support the dynamic needs of modern enterprises, facilitating both internal employee interactions and external stakeholder engagement.

Effective corporate communication is essential for maintaining operational coherence across diverse business units and geographical boundaries. Enterprise video solutions support a wide range of communication needs, from executive announcements to employee training, ensuring consistent messaging and enhanced collaborative efforts.

Other applications such as Training and Development and Marketing and Client Engagement also significantly contribute to the market. These applications leverage video solutions to create interactive and engaging content, critical for effective training programs and marketing initiatives that can attract and retain customers.

Organization Size Analysis

Large Enterprises dominate with 65.5% due to their extensive resource base and broader operational scopes.

Large Enterprises constitute the primary market for Enterprise Video solutions, holding a 65.5% share. This segment’s dominance is largely due to the extensive resources and broader operational scopes of large organizations, which necessitate robust video communication tools to connect dispersed teams and streamline processes.

The scale of operations in large enterprises often requires sophisticated video conferencing systems and content management solutions that can support large volumes of simultaneous users and complex data integrations. These organizations prioritize high-quality, reliable video solutions to ensure seamless communication across all levels of the enterprise.

Small and Medium-Sized Enterprises (SMEs), while also adopting video solutions, typically have different requirements and constraints, focusing more on cost-effective and scalable solutions that can grow with their business.

Industry Vertical Analysis

IT & Telecommunications dominates with 23.6% due to the high dependency on advanced communication technologies.

In the Industry Verticals of the Enterprise Video Market, IT & Telecommunications leads with a 23.6% share, underscoring the sector’s reliance on cutting-edge communication technologies. This industry’s need for constant innovation and rapid information dissemination makes enterprise video solutions indispensable for daily operations.

The integration of video in IT and telecommunications helps facilitate effective collaboration, swift problem resolution, and ongoing training—all essential for maintaining competitive edges in fast-paced technological landscapes.

Other verticals like BFSI, Healthcare, Retail, and Education also integrate video solutions for various purposes, including customer service, remote patient care, employee training, and virtual learning, highlighting the broad applicability and importance of enterprise video across different sectors.

Key Market Segments

By Component

- Solution

- Video Conferencing Solutions

- Video Content Management Solutions

- Webcasting and Streaming Solutions

- Other Solutions

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Application

- Corporate Communication

- Training and Development

- Marketing and Client Engagement

- Other Applications

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail

- Media and Entertainment

- Education

- Other Industry Verticals

Driver

Remote Work and Digital Transformation Drive Market Growth

The growing trend of remote work, accelerated by the COVID-19 pandemic, is a major driver of the enterprise video market. As businesses increasingly adopt remote and hybrid work models, the demand for reliable video communication tools has surged. Companies require robust video conferencing solutions to maintain collaboration and productivity among geographically dispersed teams.

Additionally, the broader trend of digital transformation across industries is fueling the need for enterprise video solutions. Businesses are increasingly integrating video into their operations for training, customer engagement, and internal communications. This shift is driven by the need for more dynamic and interactive content that can engage both employees and customers effectively.

Moreover, advancements in video technology, such as higher resolution and AI-driven analytics, are enhancing the appeal of enterprise video solutions. These technologies enable better user experiences and provide valuable insights through features like automatic transcription and analytics as a service. Companies are adopting these advanced solutions to gain a competitive edge in their communications and marketing strategies.

Restraint

High Costs and Security Concerns Restrain Market Growth

High costs and security concerns are significant factors restraining the growth of the enterprise video market. Implementing advanced video solutions often requires substantial investment in infrastructure, software, and ongoing maintenance, which can be a deterrent for small and medium-sized enterprises.

Additionally, security concerns surrounding the storage and transmission of video content present another major restraint. As enterprise video platforms handle sensitive and proprietary information, businesses are increasingly concerned about potential data breaches and unauthorized access. The need for robust security measures adds to the overall cost and complexity of deploying these solutions, further slowing adoption.

Moreover, the challenge of integrating enterprise video systems with existing IT infrastructure can be a significant barrier. The complexity of ensuring seamless integration without disrupting ongoing operations can lead to delays in implementation and increased costs.

Opportunity

Integration with AI and Personalized Content Provides Opportunities for Market Growth

The integration of artificial intelligence (AI) into enterprise video platforms presents significant opportunities for market players. AI enhances video solutions by enabling features such as automated video editing, personalized content recommendations, and advanced analytics. Companies that leverage AI to improve their video offerings can attract more customers by providing smarter and more efficient video tools.

Additionally, the growing demand for personalized content in marketing and communications creates new opportunities. Businesses are increasingly using video to deliver tailored messages to specific audiences. This trend is particularly evident in sectors like e-commerce platforms, where personalized video content can enhance customer engagement and drive sales. Companies that can develop video solutions tailored to these needs are well-positioned to capitalize on this opportunity.

Moreover, the expanding use of video in e-learning and online education offers a growing market. Educational institutions and businesses alike are using video to deliver training and educational content. This trend is expected to continue as online learning becomes more prevalent, creating opportunities for providers of enterprise video solutions.

Challenge

Integration Complexities and User Adoption Challenges Market Growth

Integration complexities and user adoption issues are key challenges facing the growth of the enterprise video market. Integrating enterprise video solutions with existing IT infrastructure and other business applications can be a daunting task. This often requires significant time and resources, particularly when dealing with legacy systems, leading to delays in implementation and increased costs.

Moreover, ensuring compatibility across various devices and platforms adds another layer of complexity. Businesses must ensure that their video solutions work seamlessly on different operating systems, devices, and networks, which can be challenging and resource-intensive.

Additionally, user adoption remains a critical challenge. While enterprise video solutions offer numerous benefits, getting employees and stakeholders to fully embrace these tools can be difficult. Resistance to change, a lack of familiarity with new technologies, and insufficient training can result in low usage rates, reducing the overall effectiveness of the investment.

Growth Factors

- Enhanced Video Content Analysis: AI algorithms enable detailed analysis of video content, such as identifying key themes, objects, and speech patterns. This capability helps enterprises to better understand and organize their video libraries, making content more accessible and valuable.

- Improved Video Search Capabilities: AI-powered search tools allow users to quickly find specific content within large video collections by analyzing metadata, spoken words, and visual elements. This improvement in search efficiency is vital for enterprises managing extensive video assets.

- Personalized Content Delivery: AI can tailor video content to individual viewers based on their preferences and behavior. This personalization enhances user engagement and ensures that employees receive relevant information, which is critical for effective internal communication.

- Automated Video Editing: AI-driven tools can automate time-consuming video editing tasks, such as trimming, captioning, and scene detection. This automation not only saves time but also ensures consistency and quality in enterprise video production.

- Enhanced Security and Compliance: AI helps monitor and secure enterprise video content by detecting unauthorized access and ensuring compliance with data protection regulations. This is particularly important for organizations handling sensitive or proprietary information.

- Advanced Video Analytics: AI enables the extraction of actionable insights from video content, such as viewer engagement, sentiment analysis, and performance metrics. These analytics help enterprises make informed decisions about their video strategies and content effectiveness.

Emerging Trends

- Cloud-Based Video Solutions: The adoption of cloud-based video platforms is a major trend, offering scalability, flexibility, and easier access to video content. This shift allows enterprises to manage and distribute video more efficiently across global teams.

- Interactive Video Content: There is a growing trend toward creating interactive video content, such as quizzes, polls, and clickable links within videos. This engagement-focused approach enhances viewer participation and improves learning outcomes in corporate training and communication.

- Integration with Collaboration Tools: The integration of video with collaboration tools like Slack, Microsoft Teams, and Zoom is becoming increasingly common. This trend enhances real-time communication and enables seamless sharing and discussion of video content within enterprise teams.

- AI-Powered Video Transcription and Translation: AI-driven transcription and translation services are gaining popularity in the enterprise video market. These tools automatically convert speech to text and translate content into multiple languages, making videos more accessible to global audiences.

- Rise of Video-Based Learning: Video-based learning is emerging as a key trend, with enterprises increasingly using videos for training, onboarding, and skill development. This method is proving effective in delivering consistent, scalable education across organizations.

- Virtual and Augmented Reality Integration: The integration of virtual and augmented reality (VR/AR) with enterprise video is a growing trend. These technologies offer immersive video experiences, which are particularly useful for training simulations, product demonstrations, and virtual meetings.

Regional Analysis

North America Dominates with 39.0% Market Share in the Enterprise Video Market

North America commands a 39.0% share with a valuation of USD 9.24 Bn of the enterprise video market, largely due to widespread corporate adoption of video for training, marketing, and communication. The presence of major technology companies and the early adoption of cloud-based solutions significantly contribute to this dominance.

The region benefits from a highly developed IT infrastructure and a culture that embraces technological innovations in enterprise solutions. These factors facilitate the extensive use of video content in business operations and corporate communications across diverse industries.

North America is expected to continue its leadership in the enterprise video market as companies further integrate video into their core business processes. Ongoing technological advancements and the increasing importance of remote work will likely enhance market growth and innovation in this region.

Other Regions:

- Europe: Europe holds a strong position in the enterprise video market, supported by robust data protection regulations that encourage secure video solutions and a focus on enhancing communication across multinational corporations.

- Asia Pacific: Asia Pacific’s enterprise video market is rapidly expanding, driven by economic growth, technological adoption, and the increasing need for effective communication and training solutions in large and growing enterprises.

- Middle East & Africa: The Middle East and Africa are witnessing growth in the enterprise video market, spurred by digital transformation initiatives and investments in enhancing communication infrastructure in both public and private sectors.

- Latin America: Latin America shows promising growth in the enterprise video market as businesses in the region increasingly adopt video tools for communication and training to overcome geographical barriers and enhance operational efficiencies.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Enterprise Video Market is expanding rapidly, driven by the need for efficient communication and collaboration tools. The top three companies shaping this market are Cisco Systems, Inc., Microsoft Corporation, and Zoom Video Communications, Inc..

Cisco Systems, Inc. is a market leader with its robust video conferencing and collaboration solutions. Cisco’s Webex platform is widely adopted by enterprises globally, offering high-quality video, security, and seamless integration with other business tools. Its strong market presence and continuous innovation keep Cisco at the forefront of the industry.

Microsoft Corporation plays a pivotal role with its Microsoft Teams platform. Integrated with the broader Microsoft 365 suite, Teams offers a comprehensive solution for video meetings, collaboration, and document sharing. Microsoft’s extensive customer base and strong ecosystem significantly enhance its market influence.

Zoom Video Communications, Inc. has rapidly become a major player, particularly in the wake of the global shift to remote work. Known for its user-friendly interface and reliable performance, Zoom has seen widespread adoption across businesses of all sizes. Its focus on scalability and customer satisfaction positions Zoom as a key competitor in the market.

These companies are driving the growth and innovation in the Enterprise Video Market. Their strategic positioning, technological advancements, and market influence are central to shaping the future of enterprise communication and collaboration.

Top Key Players in the Market

- Cisco Systems, Inc.

- Microsoft Corp.

- IBM Corporation

- Adobe Inc.

- Zoom Video Communications, Inc.

- Google LLC

- Avaya Inc.

- Huawei Technologies Co., Ltd.

- Accenture plc

- Zoho Corporation

- Brightcove, Inc.

- Kaltura

- Other Key Players

Recent Developments

- August 2024: At Cisco Live 2024, Cisco announced a series of AI-powered innovations aimed at enhancing enterprise networking, security, and observability solutions. The launch of new AI-enriched platforms is expected to improve digital resilience, with a $1 billion AI investment fund focusing on secure, reliable AI solutions for customers globally.

- June 2023: IBM expanded its partnership with Adobe, introducing a generative AI-powered content supply chain solution. This initiative is designed to assist large enterprises in automating and accelerating their creative processes, integrating Adobe Firefly and Sensei GenAI to optimize marketing workflows.

Report Scope

Report Features Description Market Value (2023) USD 23.7 Billion Forecast Revenue (2033) USD 64.3 Billion CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution: Video Conferencing Solutions, Video Content Management Solutions, Webcasting and Streaming Solutions, Other Solutions; Services: Professional Services, Managed Services), By Deployment Mode (Cloud-Based, On-Premise), By Application (Corporate Communication, Training and Development, Marketing and Client Engagement, Other Applications), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail, Media and Entertainment, Education, Other Industry Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Adobe Inc., Zoom Video Communications, Inc., Google LLC, Avaya Inc., Huawei Technologies Co., Ltd., Accenture plc, Zoho Corporation, Brightcove, Inc., Kaltura, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Enterprise Video ?The Enterprise Video encompasses video communication and content management solutions used by organizations for corporate communication, training, marketing, and client engagement. This market includes video conferencing, webcasting, and streaming services.

How big is the Enterprise Video Market?The Enterprise Video Market was valued at USD 23.7 billion and is expected to reach USD 64.3 billion, growing at a CAGR of 10.5% during the forecast period.

What are the key factors driving the growth of the Enterprise Video Market?Growth is driven by the increasing demand for remote communication tools, the rise of video-based training and marketing, and the widespread adoption of cloud-based video solutions.

What are the current trends and advancements in the Enterprise Video Market?Trends include the integration of AI for video content analysis, the rise of hybrid work models requiring robust video communication tools, and the increasing importance of video content management systems for large enterprises.

What are the major challenges and opportunities in the Enterprise Video Market?Challenges include data security concerns, high initial costs, and the need for high-bandwidth internet connections. Opportunities lie in the growing use of video in corporate training, marketing, and the adoption of video solutions by SMEs.

Who are the leading players in the Enterprise Video Market?Key players include Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Adobe Inc., Zoom Video Communications, Inc., Google LLC, Avaya Inc., Huawei Technologies Co., Ltd., Accenture plc, Zoho Corporation, Brightcove, Inc., Kaltura, and others.

-

-

- Cisco Systems, Inc.

- Microsoft Corporation

- IBM Corporation

- Adobe Inc.

- Zoom Video Communications, Inc.

- Google LLC

- Avaya Inc.

- Huawei Technologies Co., Ltd.

- Accenture plc

- Zoho Corporation

- Brightcove, Inc.

- Kaltura

- Other Key Players