Global Enterprise Search Market Size, Share Report By Component (Solutions, Services), By Search Type (Keyword-Based Search, Conversational/NLP Search, Multimedia (Image/Video/Audio) Search, Multilingual and Cross-lingual Search), By Deployment Mode (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Industry Vertical (BFSI, Healthcare and Life Sciences, Government and Public Sector, Retail and E-commerce, Media and Entertainment, Travel and Hospitality, Manufacturing and Automotive, Others (Energy, Education, Legal, etc.), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169562

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Enterprise Search Statisitcs

- Role of Generative AI

- Investment and Business Benefits

- U.S. Enterprise Search Market Size

- Component Analysis

- Search Type Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

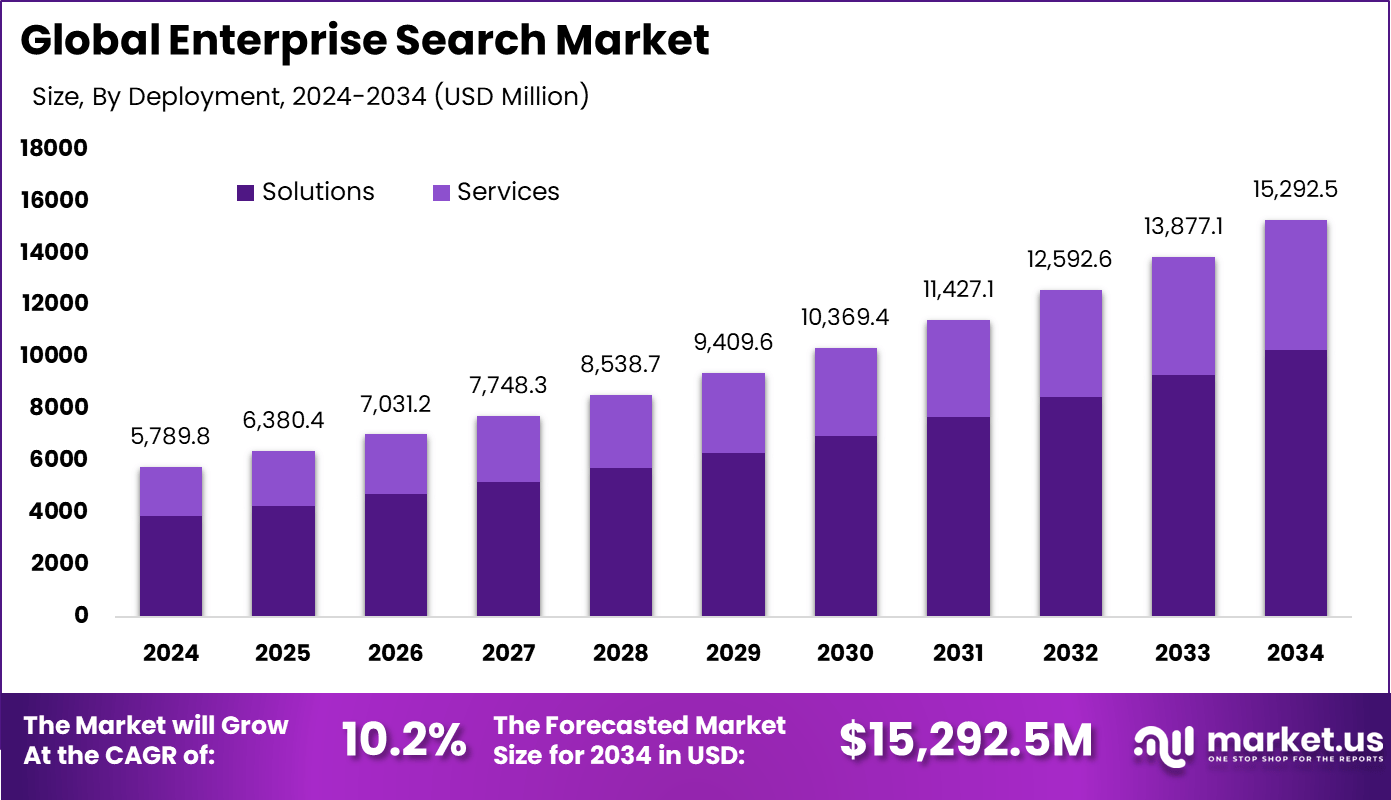

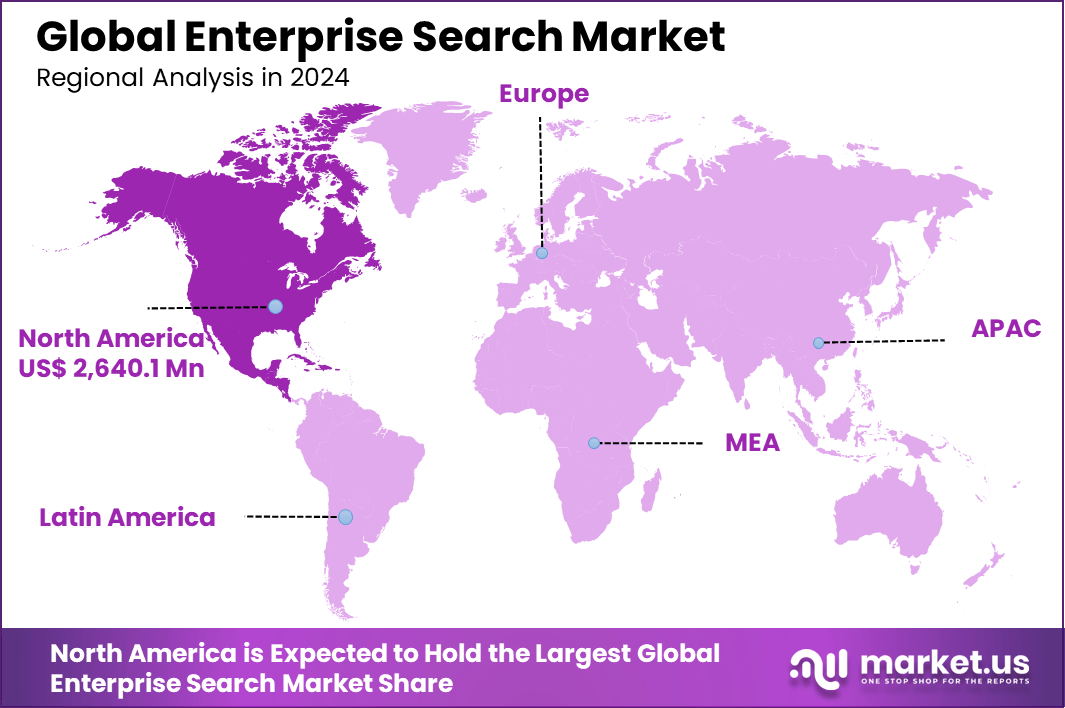

The Global Enterprise Search Market size is expected to be worth around USD 15,292.5 million by 2034, from USD 5,789.8 million in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 45.6% share, holding USD 2,640.1 million in revenue.

The enterprise search market has expanded as organisations manage rising volumes of structured and unstructured data across digital systems. Growth reflects the need to locate business information quickly across documents, emails, databases, cloud platforms and internal applications. Enterprise search platforms enable employees to access relevant information from multiple data sources through a single search interface, improving knowledge visibility across the organisation.

The growth of the market can be attributed to rapid data growth, increasing cloud adoption and rising dependence on digital collaboration tools. Organisations face productivity loss when information remains siloed across departments and systems. The push toward data driven decision making and faster access to operational intelligence further strengthens demand for advanced enterprise search capabilities.

The market for Enterprise Search is driven by the explosion of unstructured data across emails, documents, and databases that overwhelms traditional tools. Workers lose hours hunting for info, so firms turn to advanced search platforms for quick access. This boosts daily output and sharpens decisions in fast-paced sectors like finance and health. Cloud shifts and remote work add fuel as teams need unified views of scattered sources. AI layers make results smarter, pulling the market forward steadily.

The demand for enterprise search grows from a constant influx of digital content. Employees waste over two and a half hours daily just searching for information, time that could be spent on productive tasks. As data multiplies across company systems, finding relevant details becomes a challenge for many workers. Enterprise search tools meet this demand by instantly delivering precise information to users. It reduces the effort needed to find answers and supports smoother workflows, helping teams stay productive and focused on meaningful tasks.

For instance, in December 2025, Google positioned Gemini Enterprise as the core operating layer for workplace AI, enabling multimodal search across images, audio, and natural language to transform how teams access internal knowledge. Banks can now tailor results by employee roles while healthcare pros handle complex medical terms seamlessly.

Key Takeaway

- Solutions dominated with a 67.3% share in 2024, showing that enterprises prefer complete search platforms over standalone tools.

- Keyword-based search accounted for 46.4%, indicating that traditional search methods remain widely used for structured enterprise data.

- Cloud deployment led with 68.7%, reflecting strong demand for scalable, remote-access enterprise search infrastructure.

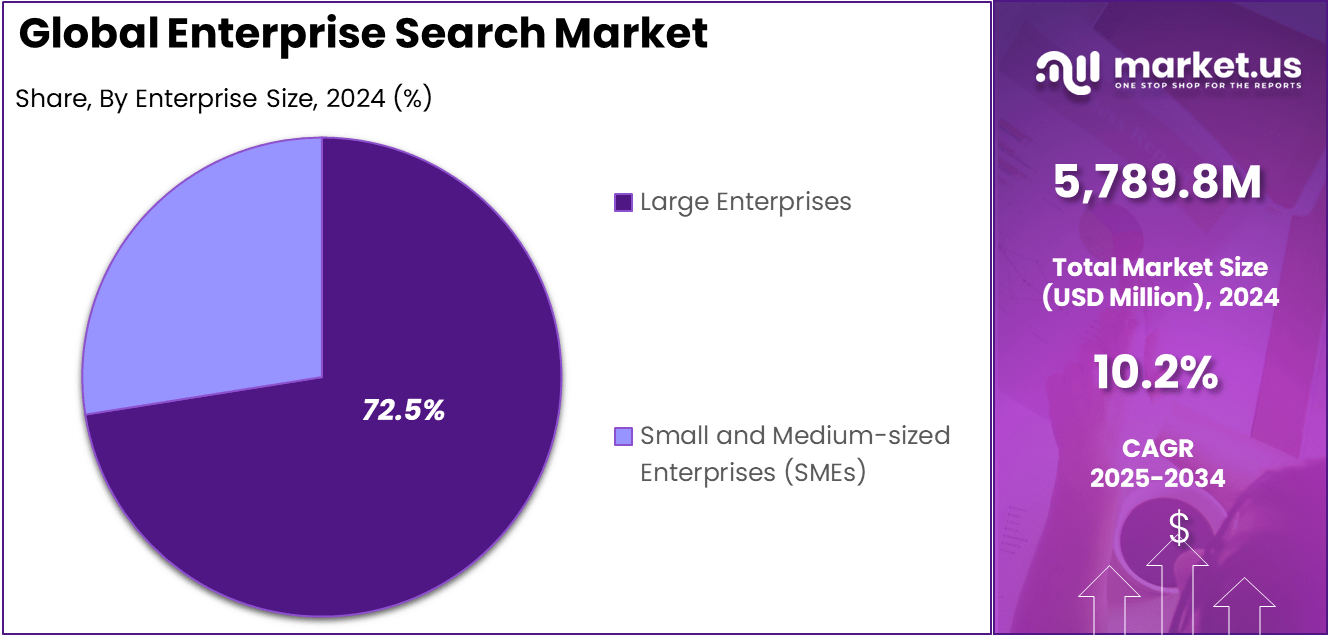

- Large enterprises represented 72.5%, confirming that high-volume data environments drive most enterprise search investments.

- The BFSI sector held 18.2%, supported by heavy reliance on fast document retrieval, compliance search, and risk analysis.

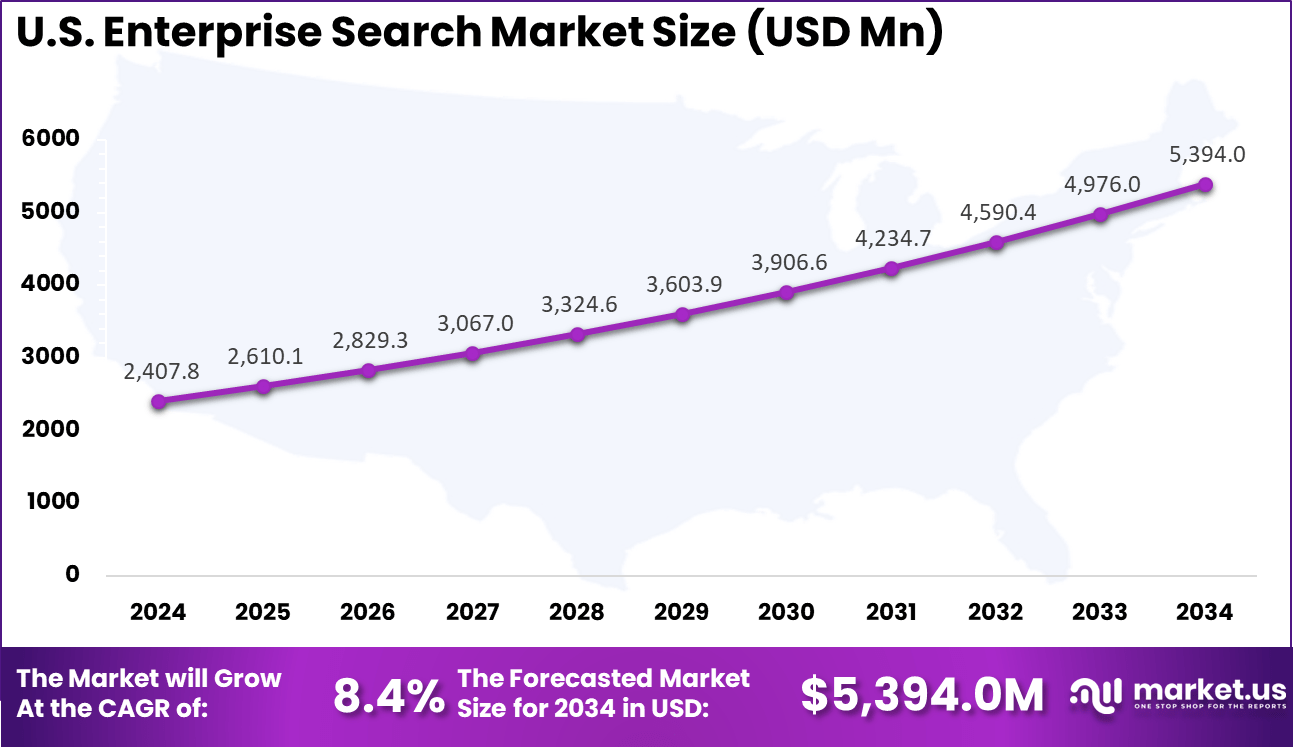

- The U.S. enterprise search market reached USD 2,407.8 million in 2024 with a steady 8.4% CAGR, showing consistent demand across industries.

- North America captured 45.6%, driven by early enterprise AI adoption, cloud maturity, and strong digital workplace transformation.

Enterprise Search Statisitcs

User Productivity and Challenges

- The average employee wastes about 3.2 hours per week searching for information, which equals more than 166 hours per year per worker.

- Poor search systems cause a 45% productivity loss across organizations due to repeated searches and content recreation.

- A company with 1,000 employees can lose over USD 5 million per year in salary costs because of inefficient enterprise search.

- Internal enterprise search shows only a 10% first-attempt success rate, compared to about 95% first-page accuracy for public web search engines.

- Only 27% of organizations currently use a dedicated enterprise search tool, showing a wide adoption gap and strong market potential.

Technological and Industry Trends

- Conversational search powered by AI, ML, and NLP is growing at over 21% CAGR, showing rapid shift toward intelligent search experiences.

- Cloud platforms held about 66% share in 2024, driven by lower infrastructure cost and better deployment flexibility.

- Large enterprises control over 70% of the market, as they manage the highest data volumes and complex workflows.

- BFSI and Healthcare remain major end-user sectors, while Healthcare and Life Sciences are the fastest-growing verticals in enterprise search adoption.

Role of Generative AI

Generative AI changes enterprise search by turning plain questions into clear answers from many data sources. It relies on large language models to grasp user intent and deliver natural responses. This method cuts through lists of links to provide direct insights. Teams save time on research tasks. About 80% of businesses aim to roll out these AI tools soon. The approach builds trust with accurate results across documents.

This AI adds fresh content creation to search through retrieval methods. It handles tough queries by pulling from databases and files with high precision. Adoption hit 78% in enterprises last year. Workers now use it for daily decisions. The tech fits well in varied work settings. It boosts output without extra effort. Overall, it makes data access simple and fast.

Investment and Business Benefits

Investment in enterprise search focuses on combining search with advanced AI for deeper insights beyond just finding documents. Security is a big area attracting attention, as companies want to protect sensitive information while enabling quick access for authorized users. Cloud-based enterprise search solutions are especially attractive for organizations looking to scale easily without high upfront costs.

These investments show confidence in enterprise search platforms adapting to future business needs and regulatory challenges. There are growing opportunities for solutions that blend search speed with strong compliance and data governance. Businesses benefit from enterprise search by increasing productivity and reducing errors linked to poor data access. This technology prevents duplicated work and helps new employees start faster, saving training time and costs.

Enterprise search turns scattered information into a collective knowledge base that everyone in the company can tap into. This shared access supports better decision-making and eliminates bottlenecks caused by slow or incomplete data retrieval. Overall, enterprise search tools improve operational efficiency and help companies maximize the value of their data resources.

U.S. Enterprise Search Market Size

The market for Enterprise Search within the U.S. is growing tremendously and is currently valued at USD 2,407.8 million, the market has a projected CAGR of 8.4%. The market is growing due to the increasing data volumes and the need for efficient information retrieval across industries. Organizations are adopting advanced search technologies to improve employee productivity, customer service, and regulatory compliance.

The shift towards cloud-based deployments and AI-powered search solutions enables faster, more accurate results. Additionally, large enterprises with complex data ecosystems fuel demand, especially in data-sensitive sectors like BFSI.

For instance, in May 2025, Glean announced a collaboration with Dell Technologies to bring its Work AI platform, featuring enterprise search and AI agents, to on-premises environments for the first time. This move targets U.S.-based enterprises in regulated sectors like healthcare and finance, allowing secure deployment on Dell’s AI Factory infrastructure within private data centers.

In 2024, North America held a dominant market position in the Global Enterprise Search Market, capturing more than a 45.6% share, holding USD 2,640.1 million in revenue. This dominance is due to its advanced technological infrastructure and early adoption of digital transformation initiatives.

The region benefits from mature IT ecosystems and a concentration of leading tech enterprises investing heavily in AI-driven and cloud-based search solutions. Additionally, strong demand from data-intensive sectors like BFSI and healthcare supports sustained market growth. This combination of innovation, infrastructure, and sector demand positions North America as the global leader in enterprise search solutions.

For instance, in November 2025, SearchBlox released SearchAI 11.2, enhancing enterprise AI search with generative AI for improved knowledge discovery and governance. This upgrade allows users to approve AI-generated metadata and maintain on-brand responses via a master prompt, supporting seamless search across multiple data sources and over 40 document types.

Component Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 67.3% share of the Global Enterprise Search Market. These solutions offer companies the ability to quickly deploy indexing and retrieval functions without starting from scratch, addressing common data search needs effectively. This makes solutions particularly appealing for businesses aiming for standard operations without deep customization.

While services support customization and integration, solutions remain dominant due to their ease of adoption and ability to meet broad industry requirements. Companies often find that these solutions provide the necessary balance between functionality and cost, allowing for effective enterprise search deployments without extensive development time.

For Instance, in December 2025, Google rolled out AI Mode enhancements in its search platform, focusing on solutions for enterprise data retrieval. These updates allow quick indexing of internal documents with Gemini models. Companies now handle complex queries faster across teams. This strengthens solutions’ lead in ready-to-deploy tools.

Search Type Analysis

In 2024, the Keyword-Based Search segment held a dominant market position, capturing a 46.4% share of the Global Enterprise Search Market. This traditional method works well in structured data environments where exact term matching is crucial. Users find keyword search straightforward, enabling quick result retrieval, especially in daily operational tasks.

Despite emerging semantic and AI-driven search methods, keyword-based search persists because of its proven reliability and speed. It remains the prevalent choice in many enterprises that prioritize straightforward search experiences without the complexity of more advanced technologies.

For instance, in July 2025, Microsoft released Microsoft 365 Copilot Search in general availability. It combines keyword precision with AI context for workplace queries. Employees find emails and files through simple terms reliably. This keeps keyword-based methods central in daily use.

Deployment Mode Analysis

In 2024, The Cloud segment held a dominant market position, capturing a 68.7% share of the Global Enterprise Search Market. This is largely driven by the cloud’s flexibility, allowing organizations to easily scale their search infrastructure without the high upfront costs of physical hardware. Remote and globally dispersed teams benefit from cloud access.

Though on-premise setups remain relevant in sectors with strict data privacy rules, the agility and cost efficiency of cloud deployment have encouraged widespread adoption. Cloud platforms also enable faster implementation and regular updates, supporting evolving business needs.

For Instance, in November 2025, Elastic advanced its cloud-native search with generative AI production tools. Enterprises deploy vectorized data foundations easily in the cloud. Reranking models enhances result quality without on-site hardware. Cloud flexibility powers this deployment trend.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 72.5% share of the Global Enterprise Search Market. These companies often manage vast amounts of data and require advanced search capabilities to support multiple departments and global operations. Hence, they invest significantly in comprehensive enterprise search tools.

Smaller organizations tend to have simpler requirements and thus lower adoption rates. However, the complexity of data and operational scale in large enterprises necessitates more robust search systems, which explains their dominant share in the market.

For Instance, in November 2025, Oracle integrated advanced search into its cloud apps for large firms. The update handles massive datasets across global operations. Big enterprises streamline compliance and productivity searches. This fits their scale-driven needs perfectly.

Industry Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing an 18.2% share of the Global Enterprise Search Market. Banks, financial institutions, and insurers require enterprise search for regulatory compliance, fraud detection, and customer service efficiency.

Due to stringent industry regulations and high transaction volumes, BFSI firms prioritize advanced search technologies to manage their critical data. This focus on data accuracy and availability helps BFSI maintain a leading position in enterprise search adoption.

For Instance, in November 2025, ServiceNow enhanced its platform with AI agents for financial services. Insurers access records quickly for risk assessments. Workflow search improves customer service response times. This boosts BFSI’s reliance on precise data tools.

Emerging Trends

One important trend in the enterprise search market is the increasing use of AI techniques to improve accuracy and relevance of search results. Organizations generate large amounts of unstructured information such as emails, documents, chat logs, and multimedia files. AI helps classify this information, understand context, and return results that match the user’s intent more closely.

As workplaces rely more on digital collaboration, the need for intelligent search tools that reduce time spent locating information continues to grow. Another trend is the movement toward unified search across multiple platforms.

Employees often work with many applications, including cloud storage, communication tools, project systems, and internal databases. Unified search allows them to find information from all these sources through a single search interface. This approach reduces confusion, improves consistency, and helps users access information quickly without switching between applications.

Growth Factors

Growth in the enterprise search market is supported by the rising volume of data created by organizations of all sizes. As digital workflows expand, employees produce large collections of documents and files across departments. Without strong search tools, workers spend more time locating information, which reduces productivity.

Enterprise search platforms help overcome this challenge by organizing data and returning results quickly, which increases interest from businesses seeking efficiency. Another growth factor is the need for better decision support.

Managers and analysts often depend on timely insights from internal data. By improving information retrieval, enterprise search systems help organizations respond faster to operational issues, customer needs, and market changes. This ability to turn internal information into practical insight encourages firms to invest in more advanced search tools.

Key Market Segments

By Component

- Solutions

- Cognitive Search Platforms

- Federated Search Engines

- Insight Engines

- Services

- Professional Services

- Managed Services

By Search Type

- Keyword-Based Search

- Conversational/NLP Search

- Multimedia (Image/Video/Audio) Search

- Multilingual and Cross-lingual Search

By Deployment Mode

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- Healthcare and Life Sciences

- Government and Public Sector

- Retail and E-commerce

- Media and Entertainment

- Travel and Hospitality

- Manufacturing and Automotive

- Others (Energy, Education, Legal, etc.)

Region

- North America

- Asia Pacific

- Latin America

- Middle East & Africa

Drivers

A major driver in the enterprise search market is the rising volume of digital information stored across organizations. Employees now work with documents, emails, databases, communication platforms, cloud folders, and internal applications. Finding accurate information quickly becomes difficult when data is scattered. Enterprise search systems help organize and retrieve this information in a single place, improving daily workflow and reducing time spent locating files.

Another driver is the need for better decision making. When teams can retrieve relevant information quickly, they can respond faster to customer requests, review internal knowledge, and complete tasks without repeated delays. Organizations in sectors such as finance, healthcare, retail, and public administration rely heavily on accurate information.

For instance, in April 2025, the Google Cloud Next event highlighted Agentspace upgrades. This tool scales enterprise search across huge data pools. It taps Google models for fast info pulls from scattered sources. Workers get secure access rights in Chrome workflows. Data overload drives firms to such seamless tools.

Restraint

A key restraint is the challenge of integrating search systems across different platforms and data sources. Many organizations use a mix of older systems, cloud tools, and locally stored files. Bringing all of these into one search layer requires technical effort and careful configuration. Differences in file formats, security settings, and access rights add to the difficulty. This complexity may discourage some organizations from adopting enterprise search solutions.

Another restraint concerns data privacy and security. Enterprise search tools must index and display information without allowing unauthorized access. If the system is not configured correctly, sensitive information may be exposed to users who should not see it. Organizations with strict compliance rules may hesitate to adopt search tools unless strong access controls and audit features are in place.

Opportunities

There is strong opportunity in supporting remote and hybrid work models. As employees work across multiple locations and devices, they need a reliable method to access the same information from anywhere. Enterprise search systems that offer user friendly interfaces and secure access from different environments can help organizations modernize their information flow and support distributed teams.

Another opportunity comes from applying search tools to industry specific needs. Sectors such as legal services, healthcare, manufacturing, and research generate large volumes of specialized information. Enterprise search platforms that include domain focused filters, classification tools, or document understanding capabilities can attract customers who require precise information retrieval for their daily operations.

Challenges

A major challenge involves maintaining accuracy and relevance in search results. If search tools provide outdated or incomplete information, employees may lose trust in the system and return to manual searching. Ensuring accurate results requires regular updates, good indexing methods, and strong internal data organization. Keeping all sources aligned remains a continuing challenge for both providers and users.

Another challenge is training and adoption inside organizations. Even the best search platform cannot deliver full value if employees do not use it effectively. Some workers may prefer older habits such as browsing folders manually. Organizations must invest time in training and encourage consistent use of the system in order to gain the full benefits of enterprise search.

Key Players Analysis

One of the leading players in May 2025, IBM partnered with Salesforce to embed Watson AI directly into Salesforce’s enterprise search features, boosting search accuracy and user experience across customer data platforms. This collaboration targets enterprise clients needing smarter information retrieval from vast datasets, combining IBM’s AI strengths with Salesforce’s CRM ecosystem. It’s a clear play to capture more market share in AI-augmented search amid growing hybrid work demands.

Top Key Players in the Market

- Google LLC (Alphabet Inc.)

- Amazon Web Services, Inc.

- Microsoft Corporation)

- IBM Corporation

- Elastic N.V.

- SAP SE

- OpenText Corporation

- Oracle Corporation

- Coveo Solutions Inc.

- Algolia SAS

- Sinequa SAS

- Lucidworks, Inc.

- Mindbreeze GmbH

- Yext, Inc. (Yext Site Search)

- SearchBlox Software, Inc.

- BA Insight Inc.

- Glean Technologies, Inc.

- ServiceNow, Inc.

- Dell Technologies Inc.

- Others

Recent Developments

- In July 2025, Lucidworks Fusion’s Neural Hybrid Search won Enterprise AI Search Solution of the Year at AI Breakthrough Awards, praised for solving trust gaps in AI retrieval and enabling non-technical users to deploy site-wide intelligent search.

- In November 2025, Microsoft Corporation rolled out Copilot Search upgrades in Microsoft 365, blending semantic indexing with natural language queries for seamless content across productivity suites. It marks a clear shift from basic search to intelligent enterprise knowledge retrieval.

Report Scope

Report Features Description Market Value (2024) USD 5,789.8 Mn Forecast Revenue (2034) USD 15,292.5 Mn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Search Type (Keyword-Based Search, Conversational/NLP Search, Multimedia (Image/Video/Audio) Search, Multilingual and Cross-lingual Search), By Deployment Mode (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Industry Vertical (BFSI, Healthcare and Life Sciences, Government and Public Sector, Retail and E-commerce, Media and Entertainment, Travel and Hospitality, Manufacturing and Automotive, Others (Energy, Education, Legal, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC (Alphabet Inc.), Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation, Elastic N.V., SAP SE, OpenText Corporation, Oracle Corporation, Coveo Solutions Inc., Algolia SA, Sinequa SAS, Lucidworks, Inc., Mindbreeze GmbH, Yext, Inc. (Yext Site Search), SearchBlox Software, Inc., BA Insight Inc., Glean Technologies, Inc., ServiceNow, Inc., Dell Technologies Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Google LLC (Alphabet Inc.)

- Amazon Web Services, Inc.

- Microsoft Corporation)

- IBM Corporation

- Elastic N.V.

- SAP SE

- OpenText Corporation

- Oracle Corporation

- Coveo Solutions Inc.

- Algolia SAS

- Sinequa SAS

- Lucidworks, Inc.

- Mindbreeze GmbH

- Yext, Inc. (Yext Site Search)

- SearchBlox Software, Inc.

- BA Insight Inc.

- Glean Technologies, Inc.

- ServiceNow, Inc.

- Dell Technologies Inc.

- Others