Global Enterprise Flash Storage Market Size, Share and Analysis Report By Type (All-Flash Array, Hybrid Flash Array), By End-user Industry (IT & Telecom, Automotive, BFSI, Healthcare, Defense, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177440

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Type Analysis

- By End User Industry Analysis

- Regional Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

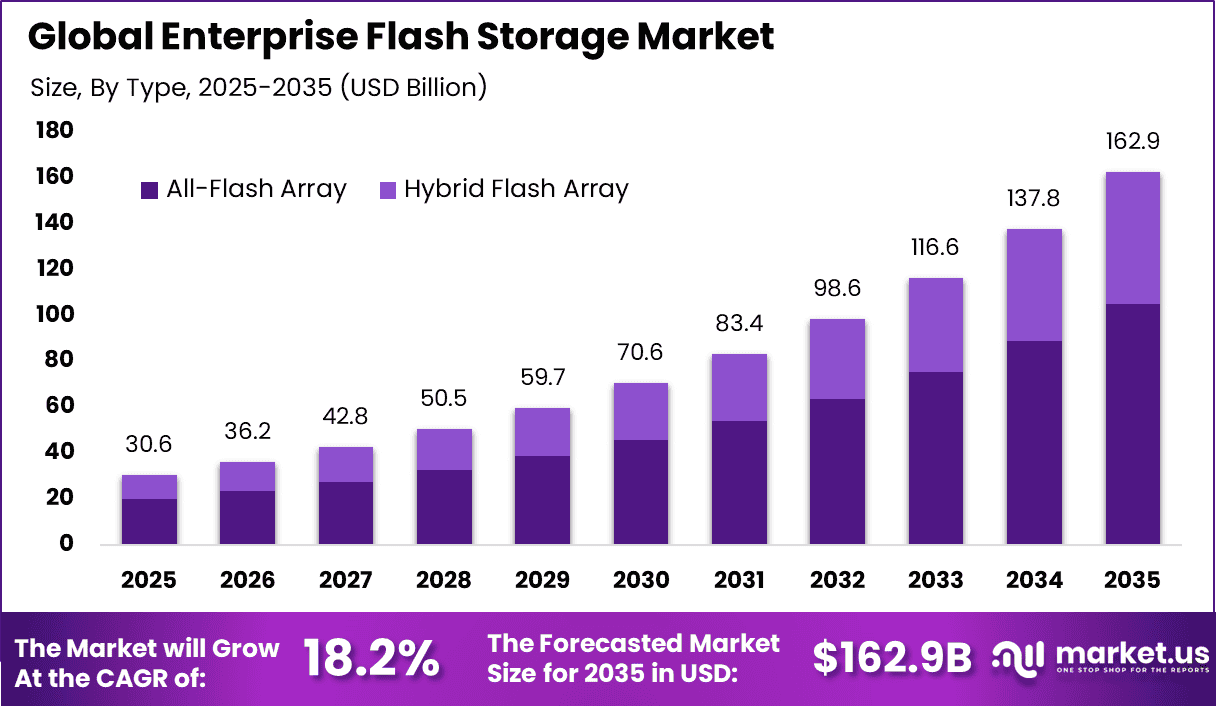

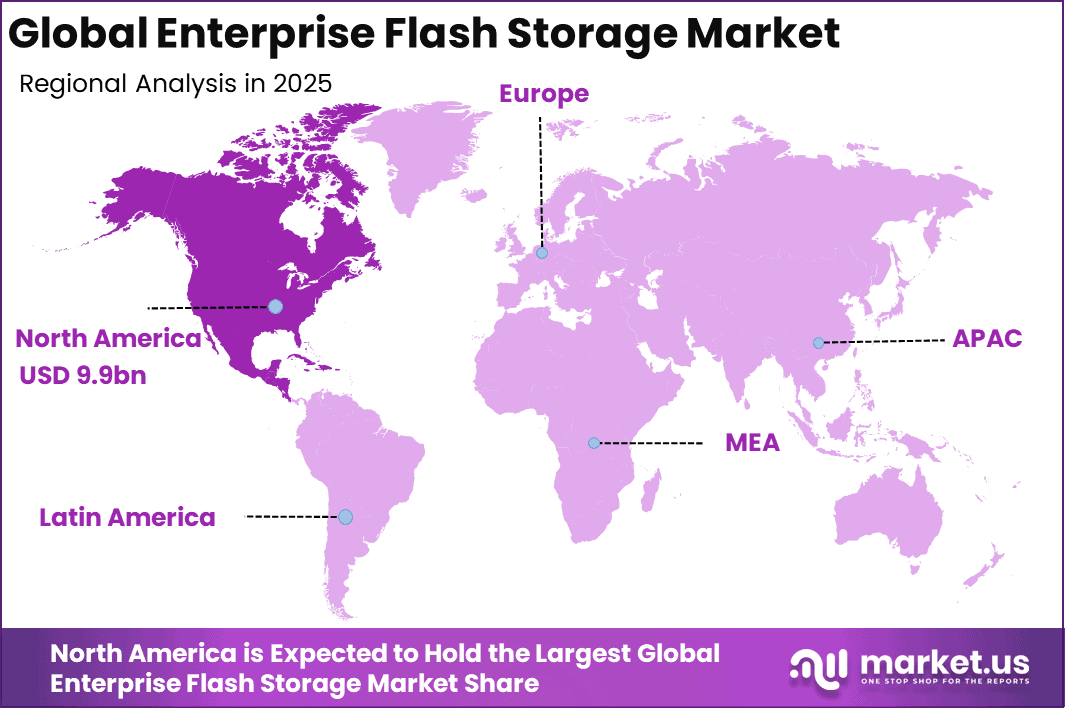

The Global Enterprise Flash Storage Market size is expected to be worth around USD 162.9 Billion By 2035, from USD 30.6 billion in 2025, growing at a CAGR of 18.2% during the forecast period from 2026 to 2035. North America held a dominant Market position, capturing more than a 32.5% share, holding USD 9.9 Billion revenue.

The Enterprise Flash Storage Market refers to high performance storage systems that use flash memory to store and manage critical enterprise data. These systems are deployed in data centers, cloud environments, and mission critical enterprise applications where speed, reliability, and scalability are essential. Flash storage replaces or complements traditional hard disk based systems by delivering faster data access and lower latency.

Enterprise flash storage is widely used to support databases, virtualization, analytics, and real time business applications. Organizations increasingly depend on always on digital systems, where slow storage directly impacts productivity and customer experience. Industry analysis shows that flash based systems can reduce application response times by more than 70% compared to disk based storage. This performance advantage has positioned flash storage as a strategic infrastructure investment.

One of the primary drivers of the market is the growing demand for high performance data processing. Enterprises run workloads that require rapid read and write speeds, such as analytics and transaction processing. Traditional storage systems struggle to meet these demands. Flash storage enables consistent performance under heavy workloads.

Demand for enterprise flash storage is strong among large organizations with data intensive operations. Industries such as finance, healthcare, and retail rely on fast data access for daily operations. Internal IT studies indicate that storage related delays can reduce application productivity by over 25%. This performance risk drives continued investment in flash based solutions.

Top Market Takeaways

- By type, all flash arrays led the Enterprise Flash Storage Market with a 64.5% share, supported by demand for high speed data access and low latency performance.

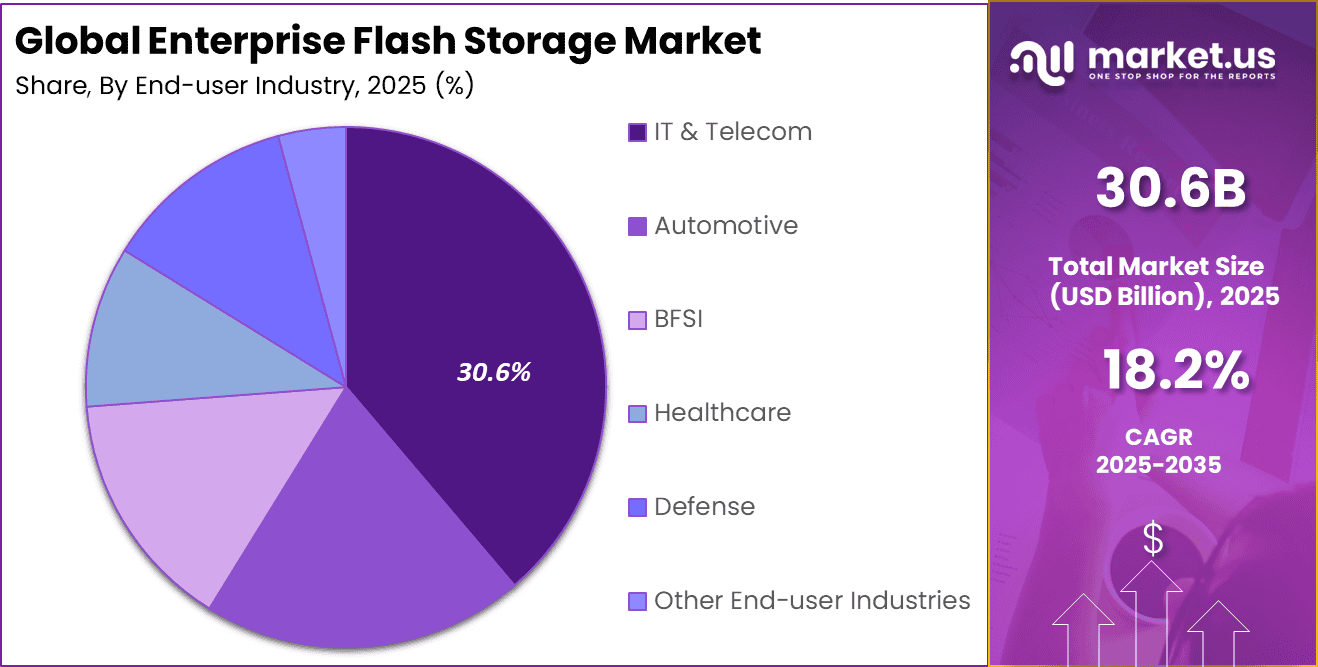

- By end user industry, IT and telecom accounted for 38.8% of total adoption, driven by rising data traffic and cloud infrastructure expansion.

- Regionally, North America held a 32.5% share of the market, reflecting advanced data center investments.

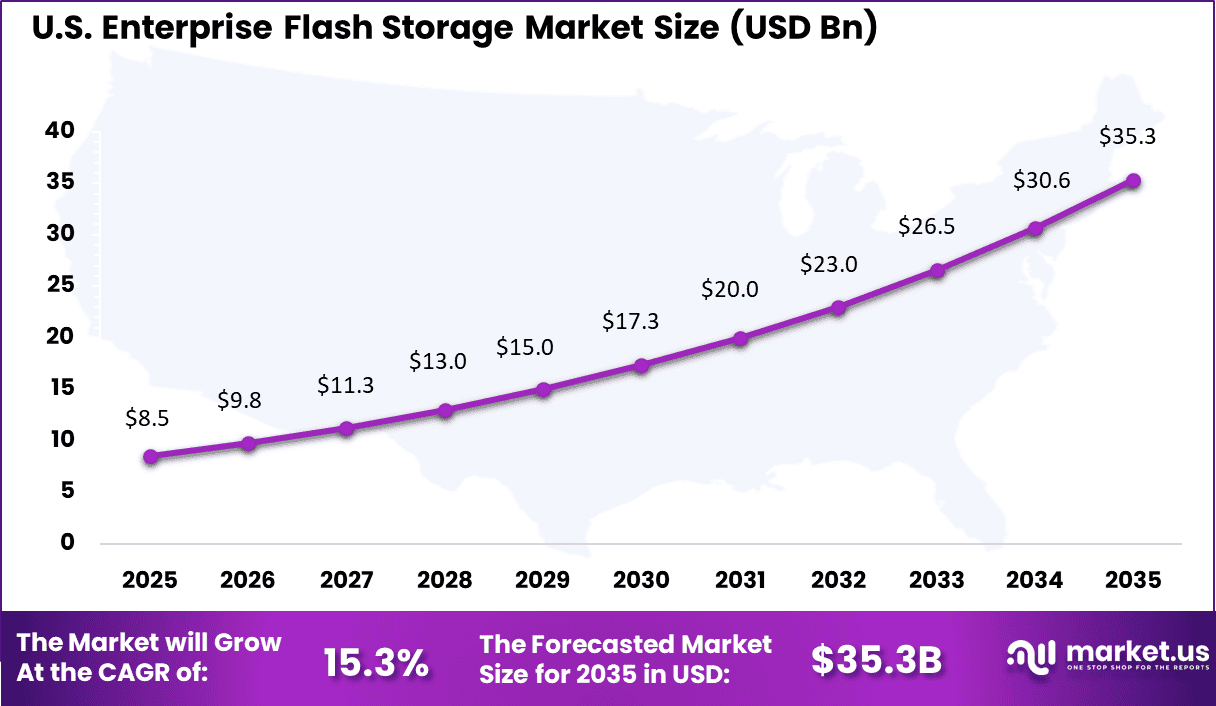

- In the US, the Enterprise Flash Storage Market reached USD 8.56 billion and recorded a CAGR of 15.3%, supported by growth in enterprise workloads and digital transformation initiatives.

Key Insights Summary

- Flash based systems, including all flash and hybrid configurations, now represent nearly 80% of total enterprise storage sales, reflecting strong market transition from legacy disk systems.

- All flash arrays held a dominant position with a 69.23% share in 2024, supported by demand for higher performance and faster data processing.

- NVMe based storage solutions captured 48.14% of the market in 2024, driven by ultra low latency and improved throughput capabilities.

- Despite performance advantages, flash media remains approximately 4x to 6x more expensive per gigabyte compared to traditional hard disk drives, influencing purchasing strategies.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rapid growth of data-intensive workloads and analytics +4.6% Global Short to medium term Increasing adoption of cloud computing and hybrid IT infrastructure +3.9% North America, Europe Medium term Rising demand for low-latency storage in AI and machine learning +3.4% North America, Asia Pacific Medium term Expansion of high-performance enterprise applications +3.1% Global Medium term Migration from HDD-based systems to all-flash arrays +3.2% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High upfront capital expenditure compared to traditional storage -3.5% Emerging Markets Short to medium term Supply chain dependency on NAND flash components -3.0% Global Medium term Rapid technology obsolescence and pricing pressure -2.6% Global Medium term Complexity in large-scale data migration projects -2.2% North America, Europe Medium term Power consumption and sustainability concerns in data centers -1.8% Europe Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Enterprise storage hardware manufacturers Very High Medium Global Strong infrastructure-driven demand Cloud service providers High Medium North America, Europe Data center expansion Semiconductor and NAND manufacturers High Medium Asia Pacific Component-driven growth Private equity firms Medium Medium North America, Europe Consolidation of storage vendors Venture capital investors Medium High North America Focus on software-defined storage innovation Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline NVMe and NVMe-over-Fabrics architecture +4.8% Ultra-low latency performance Global Short to medium term All-flash arrays with software-defined storage +4.1% Scalable enterprise storage Global Medium term AI-optimized storage acceleration +3.5% High-performance data processing North America Medium term Cloud-native storage integration +3.0% Hybrid cloud flexibility Global Medium to long term Data compression and deduplication technologies +2.4% Cost efficiency and optimization Global Long term By Type Analysis

By type, all flash array systems accounted for 64.5% of adoption. These systems use only flash memory and are designed for high throughput and low latency workloads. Enterprises prefer all flash arrays for mission critical applications where performance consistency is essential. This segment has become the dominant architecture in enterprise storage environments.

All flash arrays simplify storage management. They reduce complexity by eliminating tiering between disk and flash. This improves operational efficiency and reduces downtime risk. IT teams benefit from easier provisioning and predictable performance.

Performance driven workloads continue to support this segment. Databases, virtual desktops, and transactional systems rely heavily on fast storage access. As these workloads expand, all flash arrays remain the preferred choice. Their dominance reflects enterprise focus on speed and reliability.

By End User Industry Analysis

By end user industry, IT and telecom accounted for 38.8% of demand. This sector manages large scale networks, data centers, and cloud platforms. High availability and low latency are critical requirements. Flash storage supports these needs effectively.

Telecom operators process massive volumes of network data in real time. Flash storage improves service quality by reducing processing delays. It also supports edge computing and 5G related workloads. These factors have increased adoption across the sector.

IT service providers rely on flash storage to deliver performance guarantees. Service level agreements depend on consistent system response. Flash based systems help meet these expectations. As digital services expand, IT and telecom remain leading users.

Regional Analysis

North America accounted for 32.5% of market adoption, supported by advanced enterprise IT infrastructure. The region has a high concentration of data centers and cloud service deployments. Enterprises in this region prioritize performance and resilience. This has driven early adoption of flash storage technologies.

The United States is the largest contributor, with spending reaching USD 8.56 Bn and a CAGR of 15.3%. Enterprises continue to modernize storage environments to support analytics and cloud workloads. Investment in digital infrastructure remains strong.

Ongoing innovation reinforces regional leadership. Adoption of automation and software defined storage has increased flash utilization. As data volumes grow, enterprise flash storage remains a foundational technology in North America.

Emerging Trends Analysis

An emerging trend in the enterprise flash storage market is the integration of storage class memory and persistent memory technologies. These approaches blur the line between traditional storage and system memory, enabling even faster data access and improved workload performance. Adoption of hybrid memory-storage architectures is gaining interest.

Another trend is the incorporation of intelligent data services directly within storage platforms. Features such as inline compression, deduplication, and automated tiering optimise capacity and performance. These capabilities improve cost efficiency and streamline data management.

Growth Factors Analysis

One of the key growth factors for the enterprise flash storage market is the proliferation of data-driven applications. Real time analytics, machine learning, and transactional systems all demand rapid storage performance. Flash solutions provide the backbone for these workloads.

Another growth factor is the global shift toward cloud and hybrid IT environments. Enterprise storage strategies increasingly involve cloud integration for scalability and disaster recovery. Flash storage aligns with cloud performance expectations and supports hybrid deployment models that enhance agility.

Opportunity Analysis

A significant opportunity in the enterprise flash storage market lies in hybrid storage architectures. Combining flash storage with traditional disk systems allows organizations to balance performance and cost. Tiered storage strategies can place high performance workloads on flash media while retaining lower priority data on less expensive storage. This balanced approach supports broader adoption.

Another opportunity is the expansion of flash storage within edge and distributed computing environments. As enterprises deploy data processing closer to sources such as manufacturing sites, retail environments, and IoT networks, demand for high performance local storage increases. Flash based solutions align with these distributed needs.

Challenge Analysis

A key challenge for the enterprise flash storage market is managing data lifecycle and tiering policies effectively. Without intelligent lifecycle management, data may remain in high cost flash storage longer than necessary, reducing cost efficiency. Organizations must implement robust policies to balance performance and storage economics.

Another challenge involves ensuring long term durability and endurance. While flash memory performance is high, write endurance is finite. Enterprise systems must incorporate wear leveling and redundancy mechanisms to ensure sustained reliability over time. Addressing these technical considerations is essential for enterprise confidence.

Competitive Analysis

Leading enterprise infrastructure providers such as Dell Technologies, Hewlett Packard Enterprise, and IBM dominate the enterprise flash storage market through integrated all-flash arrays and hybrid systems. NetApp and Pure Storage focus on high-performance and software-defined architectures. These vendors emphasize low latency, high throughput, and energy efficiency.

Semiconductor and NAND flash manufacturers such as Samsung Electronics, Western Digital, Kioxia, and Micron Technology form the technology backbone of enterprise flash systems. Intel supports performance optimization through advanced controllers and interfaces. These companies invest heavily in higher-density and faster flash technologies. Adoption is supported by declining cost per gigabyte and rising data center modernization.

Global IT and infrastructure providers such as Hitachi Vantara, Lenovo, Huawei, and Inspur expand flash deployment across enterprise and cloud environments. These players focus on scalable architectures and integration with cloud platforms. Other vendors enhance regional presence and competitive pricing. This landscape supports continued growth of enterprise flash storage across hyperscale and corporate data centers.

Top Key Players in the Market

- Dell Technologies

- Pure Storage

- NetApp

- Hewlett Packard Enterprise (HPE)

- IBM

- Samsung Electronics

- Western Digital

- Kioxia

- Micron Technology

- Intel

- Hitachi Vantara

- Inspur

- Lenovo

- Huawei

- Others

Recent Developments

- In August 2025, Kioxia showcased its latest flash memory and SSD innovations at Future of Memory and Storage (FMS). The company introduced the industry’s first 245.76 TB NVMe SSD and announced development of 1 TB TLC products for next generation NAND flash. These advancements are aimed at delivering scalable and energy efficient storage infrastructure to support growing AI workloads.

- In October 2025, NetApp launched AFX disaggregated all-flash arrays with ONTAP, scaling storage/compute independently and adding AI Data Engine for preprocessing LLM/agent data alongside Ransomware Resilience Service.

Key Market Segments

By Type

- All-Flash Array

- Hybrid Flash Array

By End-user Industry

- IT & Telecom

- Automotive

- BFSI

- Healthcare

- Defense

- Other End-user Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 30.6 Bn Forecast Revenue (2035) USD 162.9 Bn CAGR(2026-2035) 18.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (All-Flash Array, Hybrid Flash Array), By End-user Industry (IT & Telecom, Automotive, BFSI, Healthcare, Defense, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell Technologies, Pure Storage, NetApp, Hewlett Packard Enterprise (HPE), IBM, Samsung Electronics, Western Digital, Kioxia, Micron Technology, Intel, Hitachi Vantara, Inspur, Lenovo, Huawei, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Flash Storage MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise Flash Storage MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Dell Technologies

- Pure Storage

- NetApp

- Hewlett Packard Enterprise (HPE)

- IBM

- Samsung Electronics

- Western Digital

- Kioxia

- Micron Technology

- Intel

- Hitachi Vantara

- Inspur

- Lenovo

- Huawei

- Others