Global Enterprise Business Analytics Software Market Size, Share, Industry Analysis Report By Component (Software/Platform, Services: Professional Services, Managed Services), By Deployment Mode (On-Premise, Cloud-Based), By Application (Financial Analytics, Risk & Compliance Analytics, Supply Chain & Operation Analytics, Marketing & Sales Analytics, Human Resource Analytics, Others), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Technology (Predictive Analytics, Prescriptive Analytics, Descriptive Analytics, Diagnostic Analytics), By End User (BFSI, Retail, Healthcare, Manufacturing, IT and Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Dec. 2025

- Report ID: 167758

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- General Adoption Rates

- U.S Market Size

- By Component

- By Deployment Mode

- By Application

- By Organization Size

- By Technology

- By End-User

- Increasing Adoption Technologies

- Investment and Business Benefits

- Key Market Segments

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Future Outlook and Opportunities

- Report Scope

Report Overview

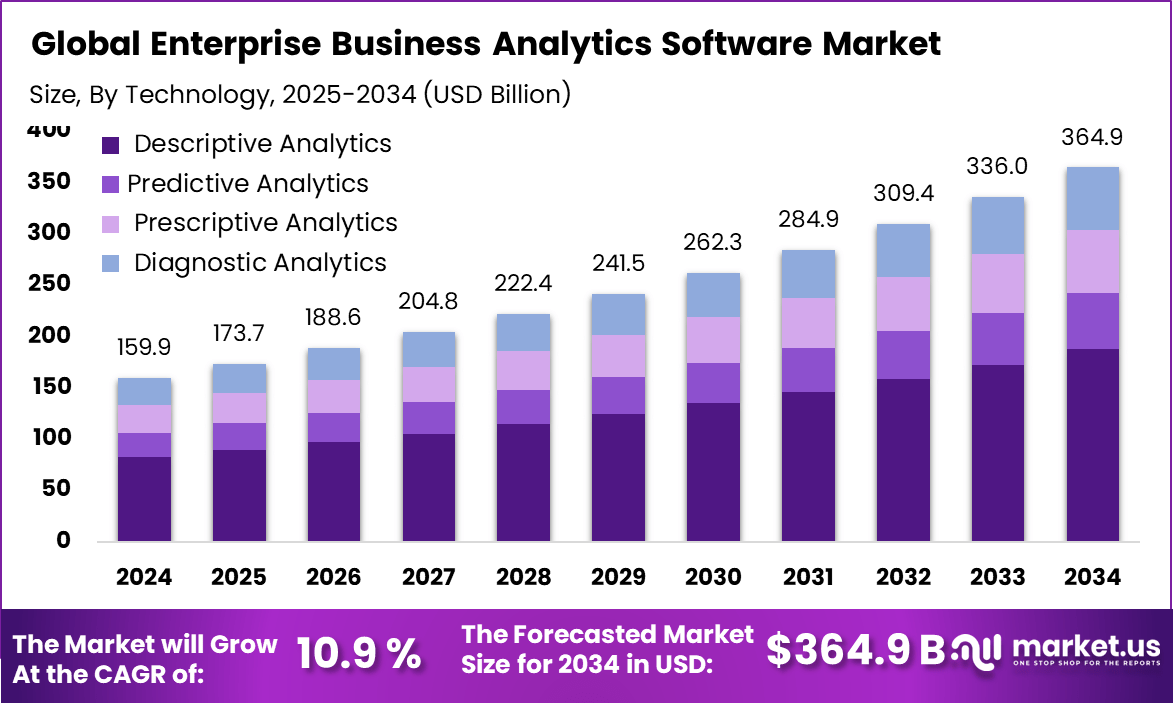

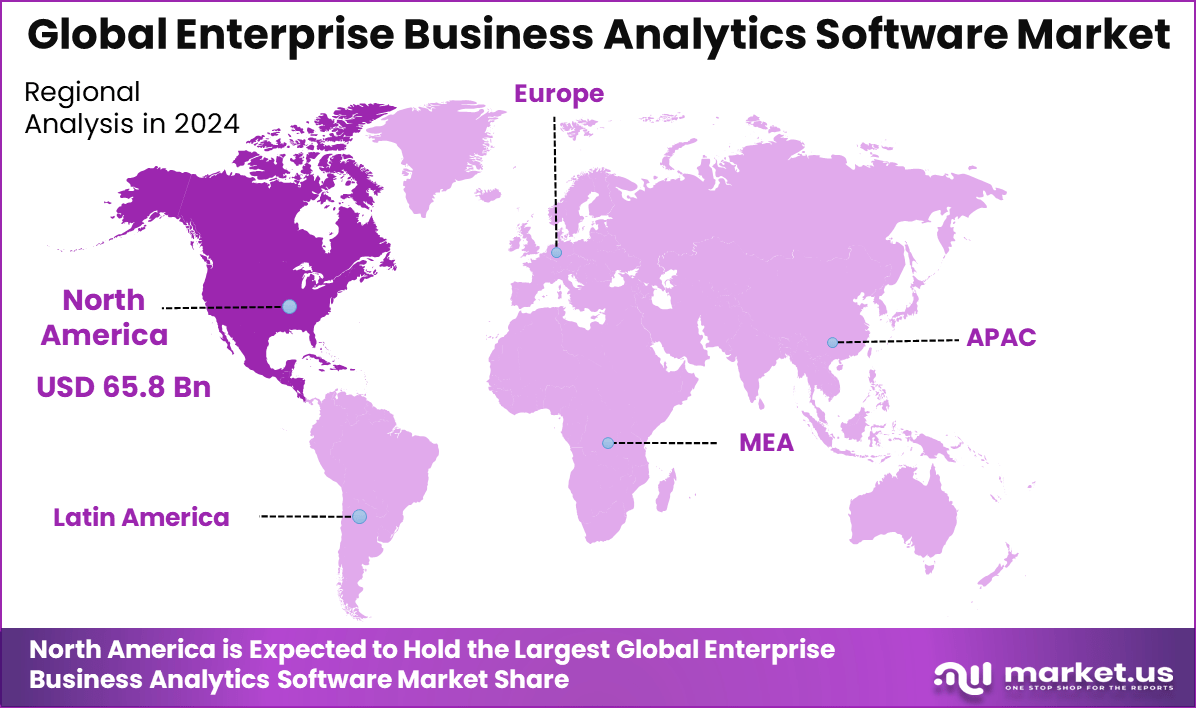

The Global Enterprise Business Analytics Software Market generated USD 159.9 Billion in 2024 and is predicted to register growth to about USD 364.9 Billion by 2034, recording a CAGR of 10.90% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 41.2% share, holding USD 65.8 Billion revenue.

The enterprise business analytics software market refers to solutions that help organizations collect, process, and analyze data from various sources to generate insights that improve strategic decision making. These tools include dashboards, reporting platforms, predictive analytics engines, data visualization interfaces, and integrated data warehouses.

Enterprises deploy these systems to understand customer behaviour, monitor performance across functions, optimize operations, and identify growth opportunities. Analytics software has evolved from simple reporting tools to advanced platforms that support real-time insights, artificial intelligence integration, and automated data processing, reflecting the increasing importance of data in business strategy.

This market plays a crucial role in enabling organizations to transform raw data into actionable intelligence. Analytics solutions help teams uncover patterns in sales, supply chain performance, customer engagement, and financial operations. Insights derived from data support resource allocation, cost control, and risk management. In competitive industries, analytics tools enable early detection of emerging trends and support rapid response to market shifts.

Growth is driven by increasing data volumes, digital transformation initiatives, and the need for real-time insight into business performance. As enterprise systems generate more structured and unstructured data, analytics software becomes essential for efficient interpretation. Cloud adoption has facilitated scalable analytics deployments that reduce reliance on on premise infrastructure. Advances in artificial intelligence and machine learning have enhanced predictive capabilities within analytics platforms.

Key Takeaways

- Software platforms dominate this market segment with a share of 64.7%.

- Cloud-based deployment leads with a substantial 70.5% share, driven by the flexibility, scalability, and cost-effectiveness it offers organizations.

- Marketing and sales analytics hold a 25.9% share, reflecting the critical need for enterprises to understand customer behavior and optimize revenue generation efforts.

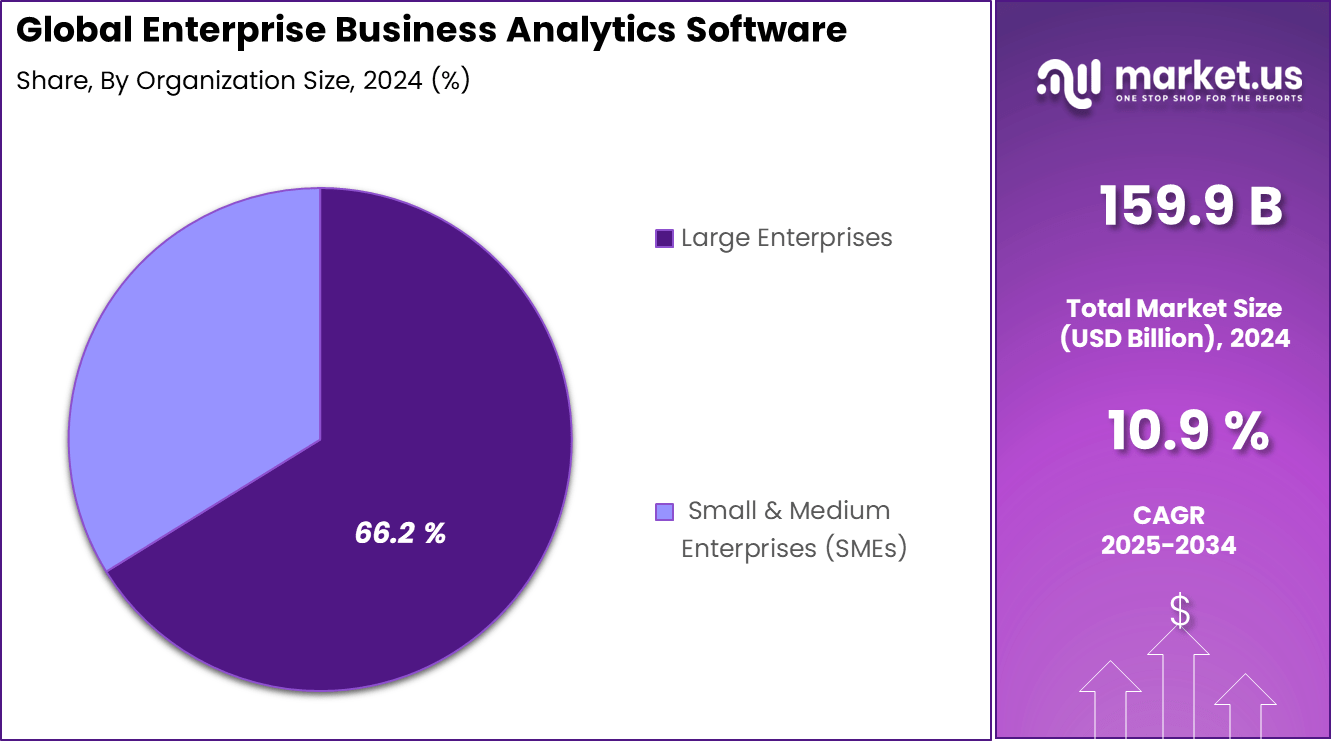

- Large enterprises account for 66.2%, representing the majority of the business analytics market.

- Descriptive analytics is the leading technology with a 51.4% share, focusing on summarizing historical data to understand past performance and trends.

- The Banking, Financial Services, and Insurance (BFSI) segment leads with 26.4%, highlighting its strong dependency on analytics for risk management, fraud detection, customer segmentation, and regulatory compliance.

- By region, North America holds 41.2% of the enterprise business analytics software market, solidifying its position as the largest and most mature market globally.

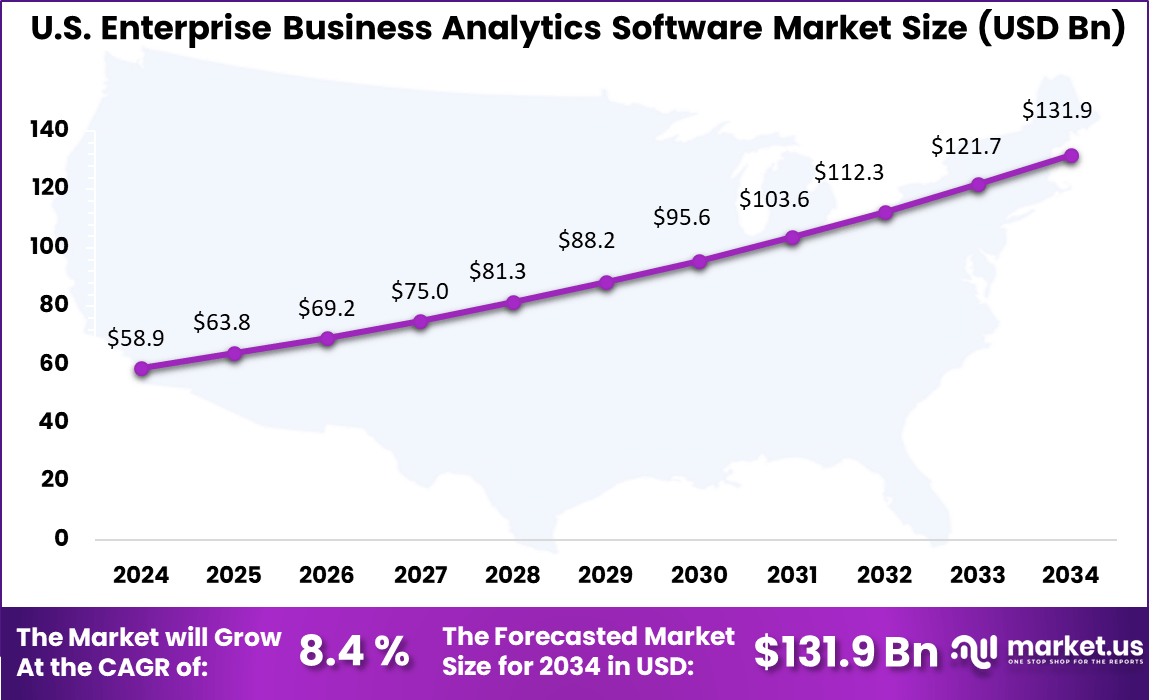

- The United States market is a dominant force within North America, with revenue reaching USD 58.9 billion and an adoption growth rate of 8.4%.

General Adoption Rates

- Around 82% of organizations now use business and data analytics across operations.

- Nearly 80% of companies have embedded big data analytics into core decision-making processes.

- AI-powered analytics adoption reached 88% in late 2025, rising sharply from 78% in 2024.

- Although 67% of employees have access to BI tools, only 8% use advanced analytics daily, showing a usage gap.

- BFSI leads with 91% adoption, mainly for fraud detection and risk management.

- Healthcare follows at 89%, using analytics for patient outcomes and operational efficiency.

- Retail and e-commerce report about 70% adoption, with 92% of leading e-commerce firms using AI-based personalization.

- Manufacturing stands at 58%, focused on predictive maintenance and supply chain planning.

- Nearly 90% of analytics workloads are expected to run on cloud platforms by the end of 2025.

- More than 75% of businesses are moving toward self-service analytics for non-technical users.

- 86% of organizations use two or more BI tools, while 25% rely on ten or more platforms.

- 44% of users still depend on descriptive analytics, but prescriptive analytics is growing fastest.

- Only 24% of executives are certified in data literacy.

- Just 32% feel confident making decisions based on data.

- About 67% of leaders do not fully trust their data.

- 58% cite integration with legacy systems as a major barrier.

- The U.S. faces a shortage of nearly 250,000 data scientists by 2025.

U.S Market Size

The United States market is a dominant force within North America, with revenue reaching USD 58.9 billion and an adoption growth rate of 8.4%. The US leads because of federal government initiatives promoting data modernization and AI integration, alongside accelerated cloud adoption in private and public sectors. Organizations here increasingly demand scalable cloud-native platforms with advanced predictive and descriptive analytics capabilities.

US companies, especially in BFSI, healthcare, and manufacturing, invest heavily in business analytics software to optimize processes and improve customer experiences. AI-powered analytics, governance frameworks, and self-service BI tools are widely embraced, empowering users across enterprise levels to generate insights and drive data-led strategies effectively.

North America holds 41.2% of the enterprise business analytics software market, solidifying its position as the largest and most mature market globally. This dominance is underpinned by advanced IT infrastructure, widespread technology adoption, and significant investments in analytics and cloud solutions. Companies here prioritize data-driven strategies and integrate analytics with emerging technologies like AI, IoT, and machine learning.

North American enterprises benefit from a strong ecosystem of technology vendors and skilled professionals, facilitating rapid innovation in analytics software. The region’s focus on real-time insights, automation, and customer-centric analytics drives continuous market growth, with BFSI, healthcare, and retail sectors being prominent users of business analytics.

By Component

Software and platform solutions lead with 64.7%, showing that enterprises rely mainly on dedicated analytics platforms rather than standalone tools or services. These platforms help collect, process, and visualize large volumes of structured and unstructured business data.

The dominance of this segment is supported by the need for centralized analytics and consistent reporting. Software platforms allow enterprises to integrate data from multiple departments, improve decision accuracy, and reduce dependence on manual analysis.

By Deployment Mode

Cloud-based deployment holds 70.5%, reflecting a clear shift toward flexible and scalable analytics environments. Cloud platforms allow enterprises to access analytics tools from any location while supporting growing data volumes. This model reduces dependency on physical infrastructure.

Growth in cloud deployment is supported by faster implementation and simplified system maintenance. Enterprises benefit from automatic updates and easier integration with cloud-native applications. These advantages support wider adoption across both large and distributed organizations.

By Application

Marketing and sales analytics represent 25.9%, making them the leading application area. Organizations use analytics software to study customer behavior, evaluate campaign performance, and track sales conversion trends. These insights help teams align marketing strategies with revenue goals.

Demand for this application is driven by increased competition and data-driven selling approaches. Analytics tools help identify high-performing channels and customer segments. This improves targeting accuracy and overall sales efficiency.

By Organization Size

Large enterprises account for 66.2%, highlighting their strong reliance on analytics platforms. These organizations operate complex structures with large data flows across departments and regions. Advanced analytics is essential to manage this complexity.

Adoption is supported by higher IT budgets and strategic planning requirements. Analytics software helps large enterprises improve forecasting, optimize operations, and support executive decision-making. Long-term digital transformation initiatives further increase demand.

By Technology

Descriptive analytics leads with 51.4%, confirming its role as the foundation of business analytics. This technology focuses on analyzing historical data to explain past business performance. It is widely used for dashboards, reports, and operational reviews.

Organizations rely on descriptive analytics to gain visibility into trends and outcomes. These insights help identify performance gaps and support routine monitoring. Descriptive analytics often serves as the starting point for more advanced analysis.

By End-User

The BFSI sector holds 26.4%, making it the largest end-user segment. Financial institutions use analytics software to manage customer data, monitor transactions, and assess operational risk. Accurate analytics is essential for compliance and reporting.

Analytics adoption in BFSI is driven by regulatory pressure and fraud prevention needs. Data-driven insights help institutions improve service quality and operational transparency. Strong data governance requirements further support software adoption.

Increasing Adoption Technologies

Key technologies supporting adoption include cloud computing, artificial intelligence, machine learning, and data integration platforms. Cloud based analytics enables elastic scaling of compute and storage, which supports enterprise demands for real-time and historical analysis. AI and machine learning embedded within analytics tools allow automated anomaly detection and predictive forecasting.

Integration with enterprise resource planning and customer relationship systems ensures unified data views. These technologies amplify the ability of analytics platforms to generate timely and contextual insights. Enterprises adopt analytics software to enable fact driven decision making, reduce operational inefficiencies, and personalize customer engagement.

Analytics support predictive planning and help reduce reliance on intuition. With greater visibility into data, organizations can optimize processes, allocate resources effectively, and anticipate market shifts. Internal enterprise studies indicate that firms using analytics platforms report measurable improvements in decision quality and operational predictability.

Investment and Business Benefits

Investment opportunities exist in scalable cloud analytics platforms, embedded artificial intelligence modules, and industry specific analytics solutions. Demand is growing for tools that support real time data streams and integrate seamlessly with existing enterprise systems. Services such as analytics consulting, data engineering, and managed analytics offerings also present investment value.

Expansion of analytics capabilities tailored to small and mid sized enterprises reflects increasing demand beyond large corporations. Enterprise analytics software delivers measurable business benefits such as improved efficiency, stronger competitive advantage, and enhanced customer insights.

By enabling continuous monitoring of performance metrics, organizations can identify bottlenecks and refine processes. Analytics also supports compliance monitoring and risk management by providing traceability and reporting clarity. These benefits help enterprises maintain operational resilience and support long term planning in dynamic markets.

Key Market Segments

- By Component

- Software/Platform

- Services

- Professional Services

- Managed Services

- By Deployment Mode

- On-Premise

- Cloud-Based

- By Application

- Financial Analytics

- Risk & Compliance Analytics

- Supply Chain & Operation Analytics

- Marketing & Sales Analytics

- Human Resource Analytics

- Others

- By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- By Technology

- Predictive Analytics

- Prescriptive Analytics

- Descriptive Analytics

- Diagnostic Analytics

- By End User

- BFSI

- Retail

- Healthcare

- Manufacturing

- IT and Telecom

- Others

Emerging Trends

Movement Toward Real-Time and Unified Analytics Platforms

A major trend in this market is the move toward platforms that offer real-time insights. Traditional reporting relied on monthly or quarterly updates, but businesses now prefer continuous data access to support faster decisions. Real-time dashboards help managers respond quickly when performance issues appear, reducing operational delays.

Another trend is the adoption of unified analytics environments that bring all organizational data into one place. Instead of using separate tools for finance, marketing, or logistics, companies are seeking platforms that combine all data sources. This helps reduce inconsistencies in reporting and makes it easier for teams to work with shared information.

Growth Factors

Increase in Digital Workflows and Data Volume

A key growth factor for the enterprise business analytics software market is the rapid expansion of digital workflows. As companies adopt online sales systems, automated supply chains, and digital finance tools, they produce large volumes of data every day. Analytics software helps convert this data into insights that support planning and improve overall performance.

Another growth factor is the need for accurate and transparent reporting at all management levels. Executives, department heads, and operational teams rely on clear information to review progress and adjust strategies. Analytics software supports this need by offering consistent data views across the organization, improving clarity and reducing errors.

Driver Analysis

Growing Demand for Data-Driven Decision Support

A key driver of the market is the rising need for data-driven decisions. Organizations want to base their strategies on measurable information instead of informal judgment. Analytics tools provide this support by highlighting performance trends, forecasting future outcomes, and revealing areas that need attention.

Another driver is the desire to reduce the manual work involved in preparing reports. Many companies still spend considerable time collecting and organizing data for regular reviews. Analytics platforms automate this process, saving time and ensuring that reports remain consistent across departments.

Restraint Analysis

Complex Deployment and High Initial Costs

A major restraint is the difficulty of integrating analytics software into older systems. Enterprises often use multiple platforms built at different times, and connecting them to a central analytics system requires specialized configuration. This increases the cost and complexity of adoption, slowing down implementation for many organizations.

Another restraint is the relatively high cost of licensing advanced analytics platforms. While large companies may adopt these tools easily, smaller firms may struggle to afford long-term subscriptions, training, and technical support. This cost gap limits adoption among mid-sized businesses with tight budgets.

Opportunity Analysis

Growing Use of Analytics in New Industry Sectors

There is a strong opportunity in expanding analytics tools into fields such as healthcare, public services, education, and agriculture. As these sectors digitize operations, they require software that can interpret data and improve planning. Vendors offering simple, sector-specific tools can capture new customer groups and increase market reach.

Another opportunity arises from growing demand for predictive insights. Many organizations want to estimate future outcomes such as sales trends, inventory needs, or service demand. Analytics tools that offer clear forecasting models and automated alerts can attract businesses seeking to plan ahead without relying on complex manual analysis.

Challenge Analysis

Data Quality Issues and Lack of Skilled Staff

A major challenge in this market is poor data quality. Analytics software depends on accurate and well-organized data. If information is incomplete or inconsistent across departments, the insights produced may be unreliable. Many organizations must improve their data management practices before they can receive full value from analytics tools.

Another challenge is the shortage of employees trained to interpret analytical findings. Even when software is easy to use, companies still need staff who understand how to read dashboards and convert insights into action. Without proper training, the benefits of analytics may not fully reach operational teams, slowing long-term adoption.

Key Players Analysis

IBM, Microsoft, Oracle, SAP, and SAS Institute lead the enterprise business analytics software market with platforms that support large scale data analysis, reporting, and predictive insights. Their solutions help organizations improve decision making across finance, operations, sales, and risk management. These companies focus on scalability, data governance, and integration with enterprise systems. Growing reliance on data driven strategies continues to reinforce their leadership.

Information Builders, Tableau, MicroStrategy, Qlik, and TIBCO strengthen the market with advanced data visualization, self service analytics, and real time dashboards. Their tools enable business users to explore data without heavy technical dependency. These providers emphasize usability, interactive reporting, and fast insight generation. Rising demand for agile analytics across departments supports wider adoption.

Adobe, RapidMiner, and other players expand the landscape with AI driven analytics, customer intelligence, and machine learning based modeling tools. Their offerings support advanced analytics use cases such as personalization and forecasting. These companies focus on automation, flexibility, and cloud deployment. Increasing complexity of enterprise data environments continues to drive steady growth in the business analytics software market.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Information Builders

- Oracle

- SAP

- SAS Institute Inc.

- Tableau Software, LLC

- MicroStrategy Incorporated

- Adobe

- RapidMiner, Inc.

- Qlik

- TIBCO Software

- Others

Recent Developments

- February 2025 – Microsoft introduced major Microsoft Fabric and Power BI enhancements, including “Explore from Copilot visual answers” for ad‑hoc analysis and conversational queries, plus Copilot for Data Warehouse chat, which together make self‑service analytics more intuitive for business users and reduce report developer workload in large enterprises.

- March 2025 – Qlik delivered a new Qlik Cloud release with feature updates across analytics and data services, continuing the cadence of monthly improvements that focus on scalability, automation and AI‑assisted data preparation for enterprise deployments

Future Outlook and Opportunities

The future outlook for the enterprise business analytics software market remains positive as digital transformation continues across industries. Growth is expected in areas such as augmented analytics, real time decision support, and AI enabled insight generation.

Analytics platforms that support data governance, privacy compliance, and advanced automation will gain traction as enterprises balance innovation with regulatory needs. The ongoing focus on data literacy and analytics integration into core business processes suggests sustained demand for analytics solutions across global markets.

Report Scope

Report Features Description Market Value (2024) USD 159.9 Bn Forecast Revenue (2034) USD 364.9 Bn CAGR(2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform, Services: Professional Services, Managed Services), By Deployment Mode (On-Premise, Cloud-Based), By Application (Financial Analytics, Risk & Compliance Analytics, Supply Chain & Operation Analytics, Marketing & Sales Analytics, Human Resource Analytics, Others), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Technology (Predictive Analytics, Prescriptive Analytics, Descriptive Analytics, Diagnostic Analytics), By End User (BFSI, Retail, Healthcare, Manufacturing, IT and Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Information Builders, Oracle, SAP, SAS Institute Inc., Tableau Software LLC, MicroStrategy Incorporated, Adobe, RapidMiner Inc., Qlik, TIBCO Software, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Business Analytics Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Business Analytics Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Information Builders

- Oracle

- SAP

- SAS Institute Inc.

- Tableau Software, LLC

- MicroStrategy Incorporated

- Adobe

- RapidMiner, Inc.

- Qlik

- TIBCO Software

- Others