Global Energy Gels Market Size, Share Analysis Report By Product Type (Carbohydrate Gels, Isotonic/Electrolyte Gels, Caffeinated Gels, and Others), By Flavour Type (Unflavoured and Flavoured), By Distribution Channel (Offline Store and Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173212

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

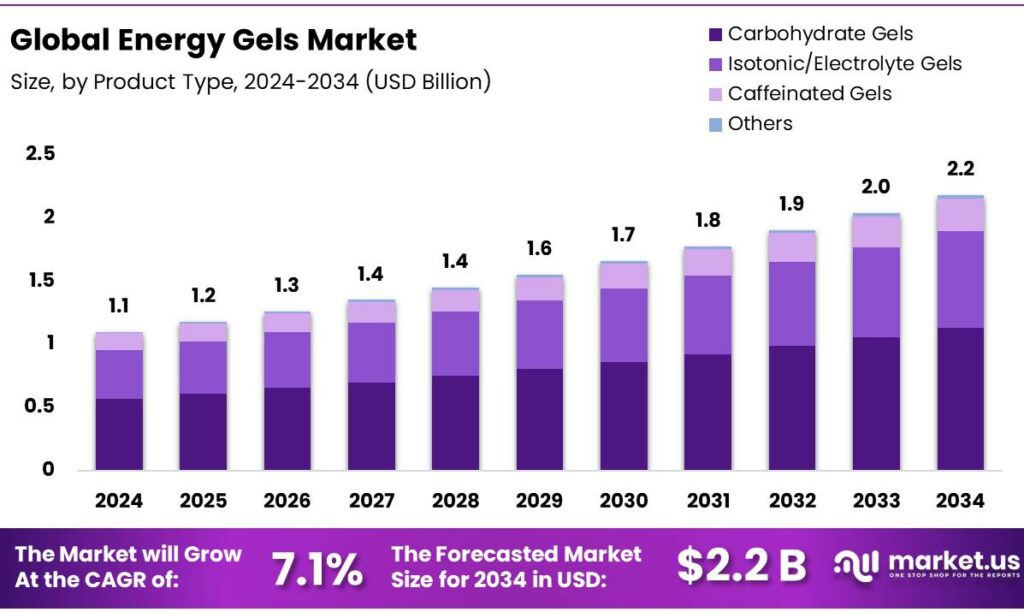

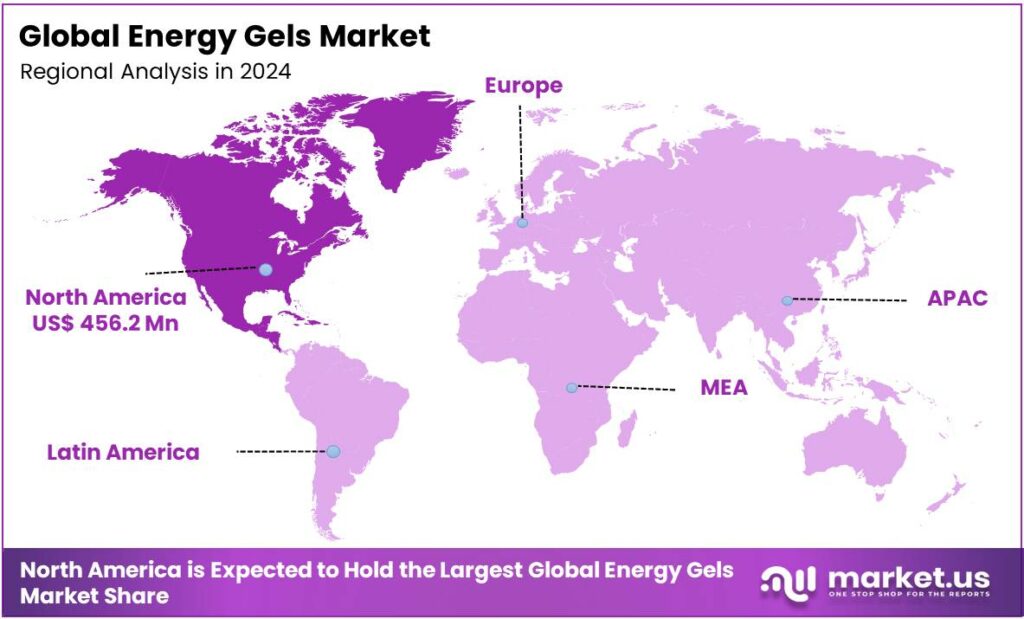

The Global Energy Gels Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 41.7% share, holding USD 0.4 Billion in revenue.

Energy gels are portable, carbohydrate-rich packets providing quick fuel for endurance athletes during long workouts to prevent fatigue and maintain performance, often containing electrolytes and sometimes caffeine, designed for fast absorption with water. The energy gels market is driven by increasing consumer demand for convenient, portable nutrition that supports physical performance, particularly in endurance sports.

Carbohydrate-based gels dominate the market due to their ability to deliver quick, easily digestible energy, making them essential for athletes in events such as marathons and triathlons. Flavored energy gels, such as fruit and chocolate varieties, are more popular than unflavored options, as they enhance taste satisfaction and reduce the monotony of consuming gels during long-duration activities.

However, the market faces challenges, including consumer skepticism about ingredients and the rising cost of raw materials due to geopolitical tensions. Innovation in product formulations, including natural and organic options, is helping address these concerns and expand the appeal of energy gels to a broader, health-conscious audience.

Key Takeaways

- The global energy gels market was valued at USD 1.1 billion in 2024.

- The global energy gels market is projected to grow at a CAGR of 7.1% and is estimated to reach USD 2.2 billion by 2034.

- Based on the type of energy gels, carbohydrate gels dominated the energy gels market, with a substantial market share of around 51.8%.

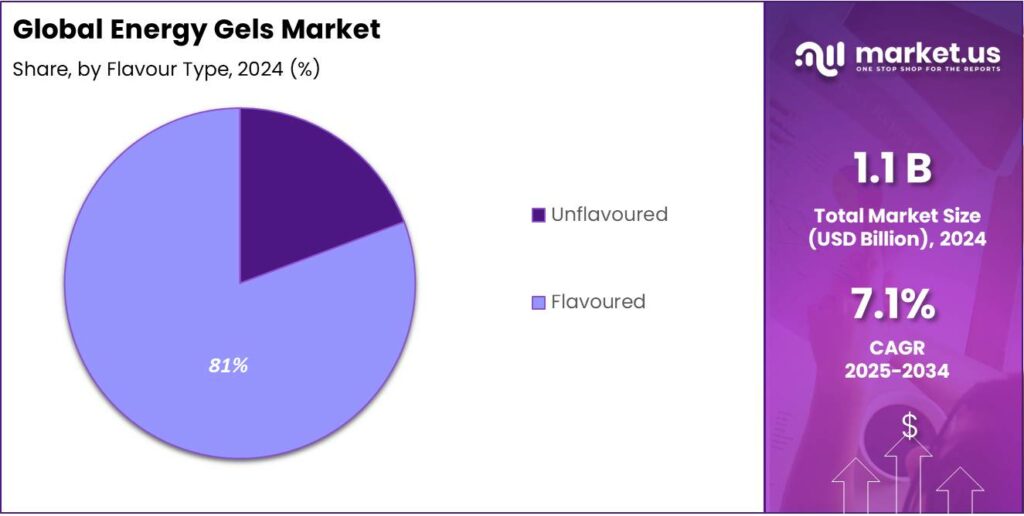

- Based on flavors, the energy gels market is dominated by flavored gels, comprising 80.7% share of the total market.

- Among the distribution channels, offline stores held a major share in the market, 72.6% of the market share.

- In 2024, North America was the most dominant region in the energy gels market, accounting for around 41.7% of the total global consumption.

Product Type Analysis

Carbohydrate Gels are a Prominent Segment in the Energy Gels Market.

The energy gels market is segmented based on product type as carbohydrate gels, isotonic/electrolyte gels, caffeinated gels, and others. The carbohydrate gels dominated the market, comprising around 51.8% of the market share, due to their ability to provide quick, efficient, and easily digestible energy during prolonged physical exertion.

Carbohydrates are the body’s primary source of fuel during endurance activities, making carbohydrate-based gels particularly effective for athletes engaged in long-distance running, cycling, or other endurance sports. These gels quickly replenish glycogen stores, helping maintain energy levels and prevent fatigue. Additionally, carbohydrate gels are often simpler to consume, as they focus on a single nutritional benefit, making them ideal for athletes seeking focused energy without unwanted side effects.

Flavour Type Analysis

Flavored Gels Dominated the Energy Gels Market.

On the basis of flavour type, the energy gels market is segmented into unflavored and flavored. The flavored gels dominated the market, comprising around 80.7% of the market share. Flavored energy gels, such as fruit or chocolate varieties, are more widely utilized than unflavored gels primarily because they enhance the overall consumption experience, making them more palatable during long-duration activities.

The intense physical exertion involved in endurance sports often leads to taste fatigue, where athletes may struggle to consume plain, unflavored gels over extended periods. Additionally, popular flavors such as berry, citrus, or chocolate are more appealing to athletes, aligning with their preference for familiar, enjoyable tastes. This appeal helps with the ease of consumption during events but promotes better hydration and performance in athletes.

Distribution Channel Analysis

Offline Stores Held a Major Share in the Energy Gels Market.

Based on the distribution channel, the energy gels market is divided into offline stores and online retail. The offline stores held a major share in the market, with a market share of 72.6%, as they cater to immediate consumer needs. Physical retail outlets, such as sports goods stores or convenience shops, provide the benefit of instant availability, allowing customers to purchase energy gels on demand, particularly before or during sporting activities.

Additionally, the ability to physically examine products and quickly compare options adds to the appeal of offline purchases. Similarly, the opportunity to receive advice and recommendations appeals to consumers who are new to endurance sports. While online sales have grown over the years, the convenience and immediacy of offline stores continue to dominate the energy gels market.

Key Market Segments

By Product Type

- Carbohydrate Gels

- Isotonic/Electrolyte Gels

- Caffeinated Gels

- Others

By Flavour Type

- Unflavored

- Flavored

- Fruit flavors

- Citrus Fruits

- Berries

- Tropical Fruits

- Others

- Chocolate flavors

- Others

- Fruit flavors

By Distribution Channel

- Offline Store

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacy & Drugstores

- Others

- Online Retail

Drivers

Demand for Convenient Nutrition Drives the Energy Gels Market.

The growing demand for convenient and on-the-go nutrition has significantly contributed to the expansion of the energy gels market. As lifestyles become increasingly fast-paced, consumers are seeking easy-to-consume products that support energy needs during physical activity or busy routines. The product appeals to consumers due to its portability, ease of consumption, and fast-acting energy release. For instance, professional athletes during marathons or endurance events often rely on energy gels to maintain performance levels without the need for bulky snacks.

The increasing trend of health-conscious consumers, coupled with the rise of fitness culture globally, has driven the widespread adoption of such products. Additionally, energy gels cater to various dietary preferences, with options available that are vegan, gluten-free, and low in sugar, broadening their market appeal. For instance, in January 2025, UK-based natural sports nutrition provider Protein Rebel launched vegan Maple Coffee gel designed with runners and triathletes in mind.

Restraints

Consumer Skepticism Might Pose a Significant Challenge to the Energy Gels Market.

Consumer skepticism remains a significant challenge to the growth of the energy gels market, as many individuals question the long-term health effects and efficacy of these products. Despite their convenience, some consumers remain wary of the high sugar content, artificial additives, and preservatives commonly found in many energy gels. For instance, a 2020 study review in the International Journal of Sport Nutrition and Exercise Metabolism found no clear performance or GI benefits for CHO hydrogels over traditional fluids, with similar CHO oxidation rates.

Furthermore, the rise of clean eating and a shift towards more natural nutrition has led to a growing demand for products free from synthetic ingredients. Some consumers, particularly in health-conscious markets, hesitate to incorporate energy gels into routines, preferring alternatives such as energy bars, smoothies, or homemade gels. Manufacturers are increasingly responding to this skepticism by introducing options with cleaner labels, reduced sugar, and organic ingredients, in an attempt to address these concerns and gain consumer trust.

Opportunity

Rising Participation in Endurance Sports Creates Opportunities in the Energy Gels Market.

The increasing participation in endurance sports has created significant opportunities for the energy gels market, as athletes require efficient and convenient sources of energy during long-duration activities. Events such as marathons, triathlons, and ultra-endurance races have seen a surge in entrants in recent years, particularly among amateur athletes. For instance, in 2023, major marathons saw huge participation, with the NYC Marathon becoming the world’s largest with over 51,000 finishers, while the Boston Marathon had a 98.3% finish rate, and races such as the Tokyo, Chicago, and others showed strong numbers, with overall running continuing to grow, featuring diverse finishers across age groups and non-binary categories, with more individuals seeking ways to optimize their performance.

As these athletes engage in physically demanding activities, energy gels offer a practical solution by providing a rapid source of carbohydrates, electrolytes, and hydration without interrupting the flow of the activity. Moreover, with the rise of digital fitness platforms and apps, there is a growing awareness of the benefits of proper nutrition in endurance training, further encouraging the use of energy gels.

Trends

Innovation in Flavors.

Innovation in flavors has become a key trend in the energy gels market, driven by the need to cater to a wider range of consumer preferences. With increasing competition and a growing consumer base, manufacturers are diversifying their flavor offerings to enhance the appeal of energy gels beyond traditional options such as orange, berry, or lemon. The flavors such as tropical fruit, salted caramel, and coffee have gained popularity, providing consumers with more choices while meeting the demand for unique and enjoyable taste experiences.

For instance, GU Energy Labs offers a popular salted caramel energy gel, which is known for its balance of sweet and salty, and Lecka offers tropical-inspired energy gels with real fruit flavors such as mango coconut, pineapple banana, cacao banana, and passion fruit A significant portion of athletes prefer a variety of flavors during long-duration events to avoid taste fatigue, particularly during endurance races where gels are consumed at regular intervals. These advancements also align with broader dietary trends, such as the rise in demand for organic and natural ingredients.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Energy Gels Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions, particularly those involving major economies and supply chain disruptions, have had a notable impact on the energy gel market. Trade restrictions, fluctuating commodity prices, and logistical challenges have affected the availability and cost of key raw materials used in energy gels, such as sugars, electrolytes, and packaging materials. For instance, the global shortage of key agricultural products, exacerbated by conflicts in major grain-producing regions, such as Russia and the United States, has led to price volatility in ingredients such as corn syrup and fructose, which are commonly used in energy gels.

Moreover, supply chain disruptions, particularly in the transportation sector, have slowed the distribution of products to retail outlets and online platforms, particularly in regions heavily impacted by geopolitical tensions. For instance, the ongoing disruptions in shipping routes between Asia and North America have affected the timely delivery of energy gel supplies, leading to stock shortages in certain markets. Additionally, consumer sentiment may shift, with some focusing more on local or domestically produced options to avoid international trade complexities.

Regional Analysis

North America Held the Largest Share of the Global Energy Gels Market.

In 2024, North America dominated the global energy gels market, holding about 41.7% of the total global consumption. North America has maintained the largest share of the global energy gel market, driven by a strong culture of fitness, endurance sports, and increasing health awareness. The United States, in particular, has seen consistent growth in the participation in endurance events such as marathons and triathlons, which has contributed to the high demand for energy gels.

The number of finishers in the top 100 races across the 5K, 10K, half-marathon, and marathon categories grew by an average of 15% in the second half of 2024. Similarly, in 2020, over 1 million individuals participated in marathons across the U.S., further reinforcing the market’s potential. Additionally, with the rise of fitness trends, such as CrossFit and ultra-marathon running, the popularity of energy gels has expanded beyond professional athletes to include recreational fitness enthusiasts. Furthermore, North American consumers are increasingly inclined to adopt products that align with dietary preferences such as vegan, gluten-free, or organic, prompting manufacturers to offer specialized energy gels catering to these needs.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies innovate with diverse product offerings, introducing new flavors, organic or natural ingredients, and catering to specific dietary preferences such as vegan, gluten-free, or low-sugar options. Additionally, the companies put emphasis on partnerships with athletes, fitness influencers, and sponsorships of sporting events as they help boost brand visibility and credibility within the target consumer base. Similarly, several players focus on distribution channels expansion, with companies increasingly leveraging e-commerce platforms to reach a broader audience while maintaining a strong presence in physical retail outlets. Furthermore, the manufacturers are expanding their product lines to meet the diverse needs of their expanding consumer base.

The Major Players in The Industry

- Nestle

- PepsiCo, Inc.

- GU Energy Labs

- Mellifera JSC

- Boom Nutrition Inc.

- Hammer Nutrition

- Powerbar

- Science In Sport

- Amacx B.V.

- Bare Performance Nutrition, LLC

- Veloforte

- Tā Energy

- Styrkr

- Carbs Fuel

- Huma Gel

- Myprotein

- Pure Sport Oil Ltd.

- Other Key Players

Key Development:

- In July 2024, Myprotein, the leading online sports nutrition brand, announced the expansion of its exclusive, multi-year partnership with HYROX, the sport of fitness racing, as the official global nutrition partner.

- In October 2025, Puresport, in collaboration with Dr. Sam Impey, the performance nutritionist, launched its energy gel, which is designed to deliver 30g of carbohydrate every 30 minutes.

Report Scope

Report Features Description Market Value (2024) US$1.1 Bn Forecast Revenue (2034) US$2.2 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Carbohydrate Gels, Isotonic/Electrolyte Gels, Caffeinated Gels, and Others), By Flavour Type (Unflavoured and Flavoured), By Distribution Channel (Offline Store and Online Retail) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nestle, PepsiCo, Inc., GU Energy Labs, Mellifera JSC, Boom Nutrition Inc., Hammer Nutrition, Powerbar, Science In Sport, Amacx B.V., Bare Performance Nutrition, LLC, Veloforte, Tā Energy, Styrkr, Carbs Fuel, Huma Gel, Myprotein, PureSport, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nestle

- PepsiCo, Inc.

- GU Energy Labs

- Mellifera JSC

- Boom Nutrition Inc.

- Hammer Nutrition

- Powerbar

- Science In Sport

- Amacx B.V.

- Bare Performance Nutrition, LLC

- Veloforte

- Tā Energy

- Styrkr

- Carbs Fuel

- Huma Gel

- Myprotein

- Pure Sport Oil Ltd.

- Other Key Players