Global Employer-Sponsored EWA Market Size, Share, Industry Analysis Report By Type (On-Demand Access, Scheduled/Partial Access, Hybrid Models), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Retail & E-commerce, Hospitality & Food Services, Healthcare, Manufacturing, Transportation & Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166064

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key EWS Statistics (Primarily for the U.S.)

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

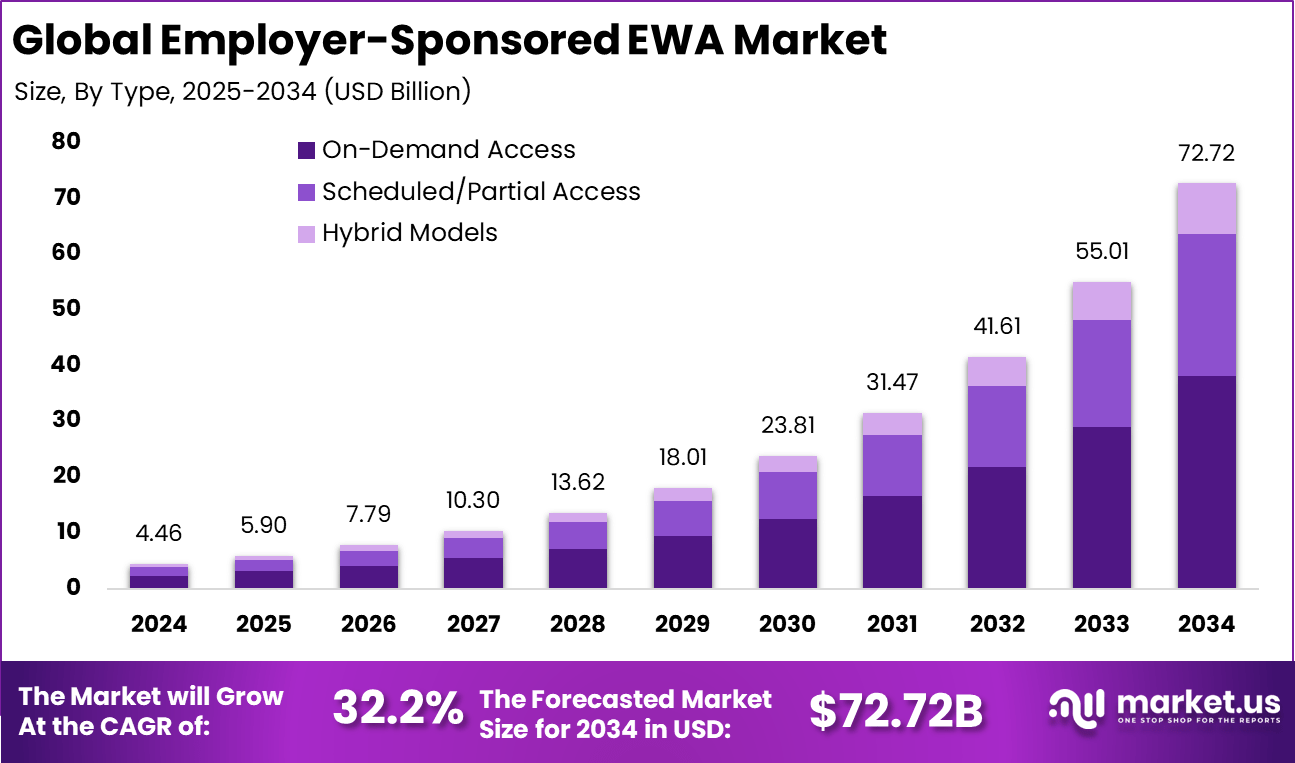

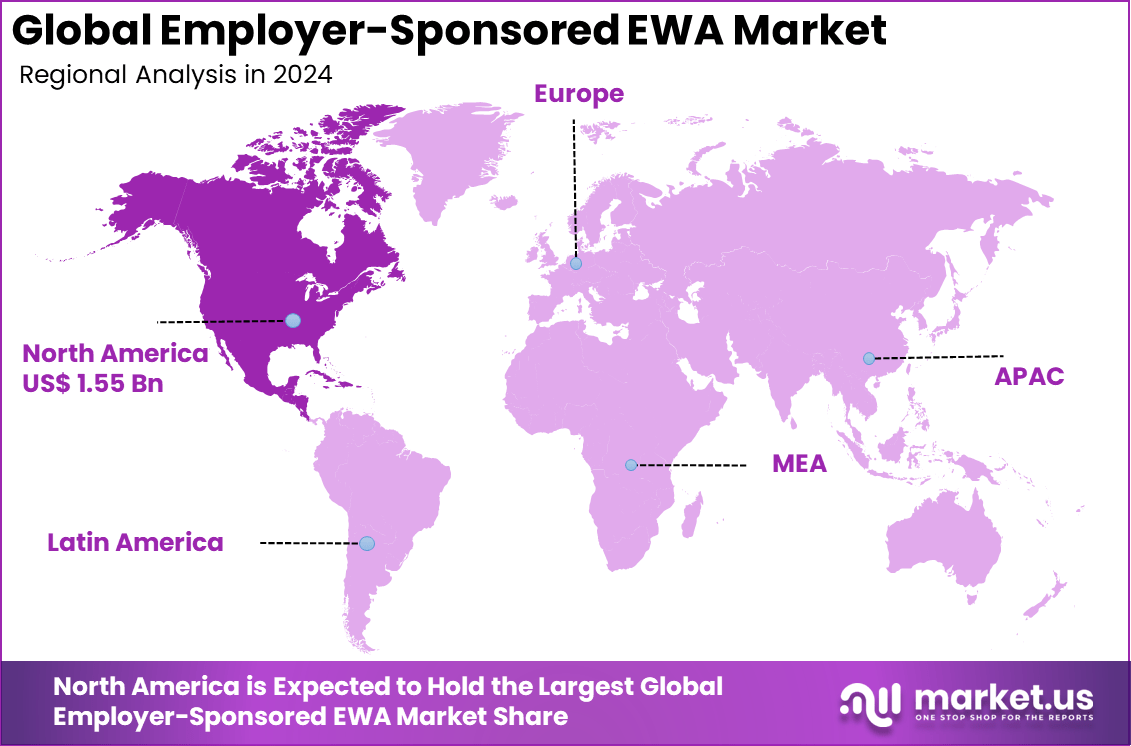

The Global Employer-Sponsored EWA Market size is expected to be worth around USD 72.72 billion by 2034, from USD 4.46 billion in 2024, growing at a CAGR of 32.2% during the forecast period from 2025 to 2034. iN 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 1.55 billion in revenue.

The employer sponsored EWA market has expanded as more organisations integrate flexible pay solutions into their employee benefit programs. Growth reflects increasing interest in financial wellness tools that allow workers to access a portion of their earned wages before the scheduled payday. The market has moved from an optional benefit to a mainstream workforce support tool across industries with hourly, shift based and high turnover roles.

The growth of the market can be attributed to rising financial pressure on workers, the shift toward flexible workforce models and the desire among employers to strengthen retention. Heightened focus on employee well being has prompted many organisations to adopt solutions that reduce stress linked to income timing. The wider availability of digital payroll systems and real time time-tracking tools also supports faster adoption of employer sponsored EWA programs.

The top driving factors for Employer-Sponsored EWA include rising employee financial stress and the challenges many workers face in managing living expenses between pay periods. Increasing costs of living and the growth of gig and hourly-waged workforces have boosted demand for more flexible income access. Technological progress in cloud payroll, mobile payment apps, and real-time payment systems has made it easier for employers to provide secure and seamless EWA services within existing HR platforms.

According to Market.us research, The global Earned Wage Access market is projected to reach USD 61.06 billion by 2034, rising from USD 6.2 billion in 2024 at a 25.7% CAGR from 2025 to 2034. In 2024, North America accounted for more than 42.4% of the market, generating about USD 2.62 million in revenue.

The market for employer-sponsored Earned Wage Access (EWA) is driven by the rising financial stress faced by employees who increasingly live paycheck to paycheck and seek timely access to earned wages. This solution helps workers manage unexpected expenses, avoiding costly loans and reducing financial anxiety. Employers recognize the benefits of integrating EWA into payroll systems to improve employee satisfaction, reduce turnover, and boost productivity.

For instance, in June 2025, ZayZoon partnered with Group Management Services (GMS), enabling rapid activation of earned wage access for employees with no employer cost or risk, signaling its growth in the North American SMB market. Additionally, ZayZoon launched a Rewards & Recognition product to enhance employee engagement alongside its EWA offerings.

Key Takeaway

- The On-Demand Access segment led the market with a 52.6% share, reflecting strong employee preference for immediate access to earned wages.

- On-Premise deployment accounted for 60.6%, driven by employers prioritizing tighter control, security, and compliance within payroll ecosystems.

- Large Enterprises dominated adoption with 76.4%, as large workforces increasingly rely on EWA to improve retention and reduce financial stress.

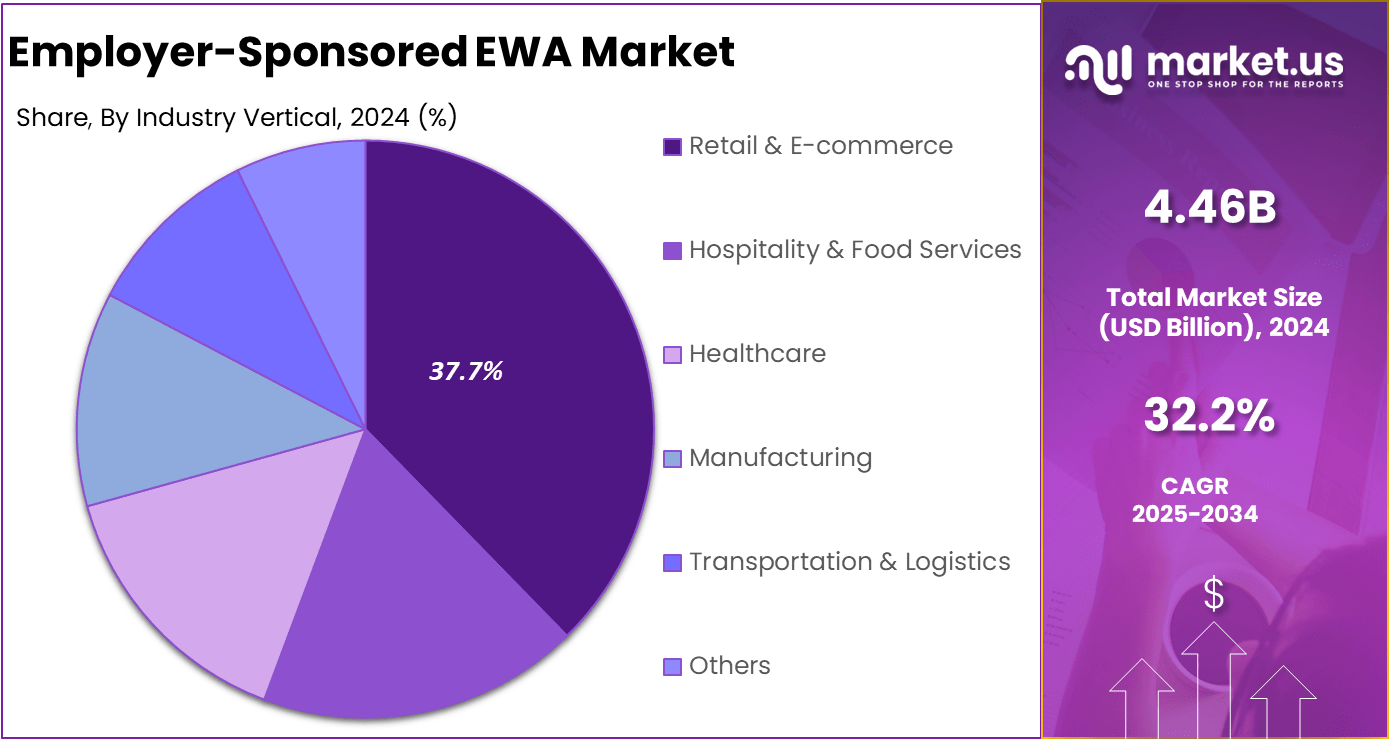

- The Retail and E-commerce sector held a 37.7% share, highlighting high use among hourly and shift-based employees.

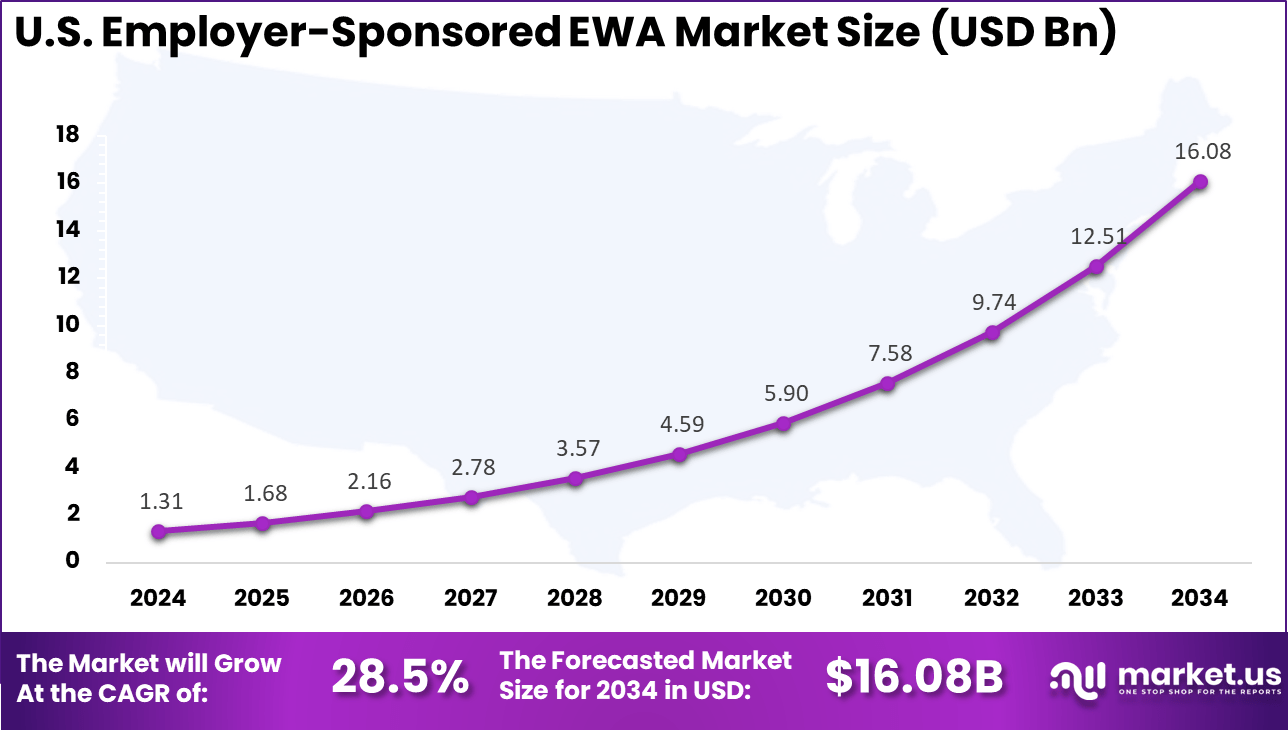

- The U.S. market reached USD 1.31 billion in 2024, expanding at a strong 28.5% CAGR, supported by growing employer integration and employee demand.

- North America led globally with 34.8%, reflecting advanced fintech maturity and broad acceptance of flexible pay solutions.

Key EWS Statistics (Primarily for the U.S.)

Employee Assistance Programs (EAPs)

- More than 72 million U.S. workers had access to an EAP in 2021.

- 84% of large employers with 500 or more employees offer EAPs.

- 66% of medium employers (100 to 499 employees) provide EAP access.

- 32% of small employers (1 to 99 employees) offer EAPs.

- EAP utilization for personal counseling historically averaged 5%, rising to 9.7% in 2021 during the pandemic.

Earned Wage Access (EWA)

- EWA enables employees to access earned wages before their scheduled payday.

- Adoption among U.S. companies increased from 5% in 2021 to an estimated 20% in 2023.

- Employers offering EWA filled open positions 52% faster, according to one study.

- The U.S. EWA market is projected to reach USD 2.08 billion in 2025.

Employer-Sponsored Emergency Savings Accounts

- The global market for employer-sponsored emergency savings reached USD 2.7 billion in 2024, showing rapid growth.

- In the U.S., 30% of adults keep emergency savings in cash, while 33% use a high-yield savings account.

Other Financial Wellness Programs

- 52% of U.S. employers offered general wellness programs in 2020, often including financial education.

- 8% of employers provided student loan repayment assistance.

- 11% offered payroll deductions into tax-advantaged savings plans.

Role of Generative AI

Employer-Sponsored Earned Wage Access (EWA) is increasingly integrating generative AI to improve efficiency and user experience in managing employee finances. Generative AI automates routine payroll tasks and supports around 0.5% to 3.5% of total work hours in the U.S., boosting workforce productivity by about 15%.

This technology streamlines transaction approvals and enhances cash flow predictions, making wage access faster and more accurate while personalizing financial wellness support. It plays a critical role in ensuring secure and timely payout processes, improving employer-employee interactions, and system scalability.

Adoption of generative AI in EWA platforms also drives better communication and customer support, which helps employers implement these solutions more effectively. With growing regulatory focus, generative AI helps maintain compliance while empowering employees with smarter, faster access to their earnings.

Investment and Business Benefits

Investment opportunities in employer-sponsored EWA are expanding, particularly in fintech solutions that enhance the user experience and offer scalable integration across industries. The sector’s youthful nature allows for innovation such as zero-interest usage models and expanding features like real-time wage tracking and comprehensive financial wellness support.

Business benefits of offering employer-sponsored EWA include enhanced employee well-being and retention, reduced financial anxiety, improved attendance, and stronger engagement. Employers also enjoy an improved brand image, which aids recruitment and positions them competitively in labor markets. Financial stability delivered through EWA translates into measurable productivity gains and cost savings associated with reduced reliance on high-cost short-term loans by employees.

U.S. Market Size

The market for Employer-Sponsored EWA within the U.S. is growing tremendously and is currently valued at USD 1.31 billion, the market has a projected CAGR of 28.5%. This growth is driven by increasing financial stress among workers, with a large share living paycheck to paycheck. Employers are adopting EWA solutions to provide employees with on-demand access to earned wages, which helps reduce financial anxiety and improve retention.

The rise of gig and hourly workers seeking financial flexibility and the integration of digital payroll and mobile platforms also fuel the market’s expansion. Additionally, employers see EWA as a strategic tool to boost productivity and workforce stability in today’s competitive labor market.

For instance, in October 2025, Refyne expanded its employer-sponsored Earned Wage Access (EWA) offerings by partnering with several large U.S.-based corporations to provide faster, flexible wage access, enhancing employee financial wellness and reducing turnover.

In 2024, North America held a dominant market position in the Global Employer-Sponsored EWA Market, capturing more than a 34.8% share, holding USD 1.55 billion in revenue. This dominance is primarily due to the region’s early adoption of digital payroll systems and the strong presence of leading EWA providers such as DailyPay and Payactiv.

Additionally, North America benefits from a mature fintech ecosystem and advanced payment infrastructures like FedNow and Real-Time Payments, which facilitate seamless wage disbursements. The widespread demand for flexible wage solutions by U.S. employees, particularly hourly, gig, and paycheck-to-paycheck workers, drives this substantial market leadership.

For instance, in September 2025, DailyPay launched new AI-powered predictive payroll features that enable employers to better manage wage advances and optimize cash flow, strengthening its position as a leading EWA provider in North America.

Type Analysis

In 2024, The On-Demand Access segment held a dominant market position, capturing a 52.6% share of the Global Employer-Sponsored EWA Market. This type allows employees to access their earned wages whenever they need, without waiting for the usual payday. The flexibility helps workers manage unexpected expenses and reduce financial stress, which employers recognize as improving job satisfaction and retention.

Employers appreciate how on-demand access integrates smoothly with payroll systems, making the process efficient and accurate. This approach tends to appeal especially to hourly, gig, and paycheck-to-paycheck workers who value immediate access to their earned income. Increasing adoption in various sectors reflects the growing demand for workplace financial wellness programs that prioritize employee needs and promote a more stable workforce.

For Instance, in June 2025, Refyne, an earned wage access platform, made significant senior appointments in engineering, finance, and people management as part of its strategic growth efforts focused on on-demand wage access solutions. The company also secured fresh funding to support its working capital and expand its customer base, illustrating its active role in the on-demand access segment of the EWA market.

Deployment Mode Analysis

In 2024, the On-Premise segment held a dominant market position, capturing a 60.6% share of the Global Employer-Sponsored EWA Market. These enterprises prefer to host EWA solutions on their internal servers to ensure compliance with privacy and regulatory requirements. On-premise options allow customization to fit complex payroll and HR infrastructures, making them particularly suitable for industries with strict governance standards.

Though cloud-based solutions grow in popularity for scalability and ease of deployment, on-premise remains essential for organizations seeking a higher level of control over their financial systems. This deployment helps enterprises safeguard sensitive employee financial data while seamlessly integrating with existing IT frameworks.

For instance, in May 2025, Stream Platforms Ltd continued expanding its offerings amidst broader market shifts, though specific EWA-focused deployments are more indirect through its broader payment and platform services. Stream Platforms plays a supportive role for employers implementing on-premise financial solutions.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 76.4% share of the Global Employer-Sponsored EWA Market. Their sizeable, often hourly or shift-based workforces benefit significantly from offering early wage access as a financial wellness tool. These companies invest in EWA to reduce turnover, improve productivity, and enhance employee engagement. The ability to integrate EWA with expansive payroll systems enables them to implement scalable and compliant solutions efficiently.

Their adoption is also supported by the financial and infrastructural capabilities needed to partner with leading EWA providers, ensuring smooth implementation and ongoing management. Large organizations see EWA as a strategic benefit that supports broader workforce retention and satisfaction goals.

For Instance, in April 2025, Earnin announced its international expansion plans, extending its earned wage services to markets including the UK, Canada, and Australia. This expansion highlights Earnin’s robust presence in the large enterprise segment, as it partners with multinational employers to offer early wage access worldwide.

Industry Vertical Analysis

In 2024, the Retail & E-commerce segment held a dominant market position, capturing a 37.7% share of the Global Employer-Sponsored EWA Market. This industry’s high turnover and reliance on hourly workers create strong demand for EWA solutions. Providing employees with quick access to earned wages helps reduce financial stress, making these jobs more attractive and improving retention rates. The sector adopts EWA to maintain staffing levels and boost operational productivity.

EWA’s flexibility fits well with the dynamic and shift-based nature of retail and e-commerce labor, addressing fluctuating work hours and seasonal spikes. It also supports companies’ efforts to enhance worker satisfaction and reduce absenteeism, which are critical to maintaining customer service standards.

For Instance, in April 2025, PayActiv introduced Visa+, a real-time payout service enabling users to transfer earned wages securely to Venmo and PayPal accounts. This development strengthens PayActiv’s offerings to the retail and e-commerce sector by improving payment flexibility and financial control for employees.

Emerging trends

Emerging trends in Employer-Sponsored EWA reflect a move beyond traditional hourly and gig workers, reaching industries like healthcare, construction, and caregiving. About 74% of job seekers show a preference for employers offering financial wellness benefits, reinforcing EWA’s role in attracting talent.

Additionally, the integration of cloud-based and mobile-enabled platforms allows seamless, scalable deployment, which supports instant access to earned wages. Regulatory clarity has increased, with more than 20 U.S. states enacting laws to govern EWA offerings, which increases market trust and sustainability.

Employers are embedding EWA into broader financial wellness programs as a key tool to reduce absenteeism and turnover. These trends indicate the transition of EWA from a niche fintech product to a mainstream benefit prioritized in employee financial health strategies.

Growth Factors

Growth in EWA is driven by high levels of financial stress among employees, with around 97% of workers experiencing money-related stress that impacts their work. On-demand wage access offers a safer alternative to payday loans and reduces reliance on credit cards with high fees. The growing gig and hourly workforce, along with advances in payroll technology, further boost the adoption of EWA solutions.

Employers benefit from EWA through improved employee morale and retention. Access to wages as they are earned lets workers manage immediate expenses smarter, leading to healthier financial habits and reduced absenteeism. These factors combine to make EWA an important part of employee benefits portfolios amid changing work patterns.

Key Market Segments

By Type

- On-Demand Access

- Scheduled/Partial Access

- Hybrid Models

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- Retail & E-commerce

- Hospitality & Food Services

- Healthcare

- Manufacturing

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Drivers

Rising Focus on Employee Financial Wellness

The growing recognition of employee financial wellness is a key driver for employer-sponsored EWA adoption. Many workers face financial stress due to irregular expenses and living paycheck to paycheck. Employer-sponsored EWA allows employees to access wages they have already earned before payday, providing immediate relief from cash flow issues. This helps reduce dependence on expensive credit options and eases day-to-day financial pressures.

Companies are adopting EWA programs as part of their workforce financial wellness initiatives. They see it as a benefit that improves employee satisfaction, loyalty, and retention. Integration with payroll systems facilitates seamless, real-time wage access without operational friction, making it easier for large enterprises to implement this solution for hourly and shift workers. This driver reflects broader trends in workplace support and improving employee stability.

For instance, in December 2023, Refyne emphasized its role as Asia’s largest financial wellness suite, offering employees access to funds coupled with educational tools to improve personal finance and long-term financial security. This supports workforce productivity and satisfaction by addressing financial stress points like mid-month cash crunches.

Restraint

Regulatory Complexity and Uncertainty

A major restraint limiting the full potential of employer-sponsored EWA is the unclear regulatory environment. Laws differ by jurisdiction on whether EWA constitutes credit or advance wages, creating confusion for businesses about licensing, disclosures, and compliance. This ambiguity causes some providers and employers to hesitate in offering or scaling these services due to legal risks and investment uncertainty.

Without consistent regulations, the market faces barriers to broader adoption and expansion, especially in states or countries with ambiguous or evolving policies. This restraint also limits innovation as stakeholders await clearer guidelines from regulatory bodies. Clarity and uniform regulation are essential to build confidence and enable smoother market growth.

For instance, in September 2025, DailyPay faced complex regulatory challenges expanding into jurisdictions like Canada, requiring robust compliance tools involving AML and transaction monitoring to meet varying legal standards. This illustrated the navigating burden that EWA providers face due to evolving and fragmented regulatory landscapes.

Opportunities

Integration with Broader Fintech Ecosystems

Employer-sponsored EWA has strong potential to integrate with wider fintech ecosystems, which is a major opportunity. By embedding wage access into real-time payment and payroll platforms, employers can enhance financial wellness programs and provide instant liquidity to workers. This integration can extend to mobile apps, benefits platforms, and financial education tools, offering personalized support beyond mere wage access.

Such integration could help underserved groups like gig and part-time workers and expand flexible wage access across diverse employee types. Fintech partnerships may also enable customizable, scalable solutions that improve worker empowerment, reduce financial stress, and increase productivity. This opportunity aligns with the ongoing digital transformation in payroll and employee services.

For instance, in April 2025, fintech trends emphasize expanding open banking and decentralized finance (DeFi), which EWA providers can leverage to enhance offerings and innovation. This creates opportunities for firms like EarnIn to integrate more deeply into fintech ecosystems and provide more flexible financial products.

Challenges

Preventing Financial Dependency on Early Wage Access

A key challenge in the employer-sponsored EWA market is avoiding financial dependency among users. While EWA provides much-needed cash flow relief, some employees may overuse it, repeatedly withdrawing wages early and creating a cycle of financial shortfalls. This pattern can lead to instability in future pay periods and worsen financial stress rather than alleviate it.

Employers and providers must balance access with responsible use, incorporating education and limits to prevent dependency. Designing sustainable programs that support long-term financial health rather than short-term fixes is crucial. Without addressing this challenge, EWA risks negative outcomes that could undermine employee well-being and employer trust.

For instance, in February 2025, Payactiv highlighted its EWA program’s positive impact on reducing reliance on high-interest payday loans and overdrafts by enabling budgeting and savings through early access, thus helping workers avoid financial dependency.

Key Players Analysis

Refyne, DailyPay, and EarnIn remain central to the employer-sponsored EWA market. Their platforms focus on real-time wage access, simple integration with payroll systems, and stronger financial wellness tools. These providers improve employee liquidity while helping employers lower absenteeism. Their emphasis on fast disbursement, transparent fees, and mobile accessibility strengthens adoption among organizations seeking to reduce financial stress across the workforce.

Payactiv, Stream Platforms, Flexwage Solutions, and Hastee Technologies contribute to market expansion with flexible payout models and compliance-aligned frameworks. Their systems are built to reduce operational friction for HR teams while improving employee engagement. Enhanced budgeting tools and responsible access features support healthier financial behavior.

ZayZoon, Instant Financial, Branch, and other participants expand the market with cost-efficient solutions for small and mid-sized employers. Their platforms emphasize rapid setup, low administrative effort, and user-friendly payout experiences. Growth is supported by rising demand for earned wage flexibility in retail, logistics, and service industries. Improved analytics, usage insights, and real-time transaction monitoring are strengthening performance.

Top Key Players in the Market

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- In June 2025, Refyne secured INR 35 crore (around $4 million) debt funding from Stride Ventures to support its on-demand salary platform, expanding its financial wellness offerings quickly to employers and employees across Asia. This funding reinforces Refyne’s role as a significant player in the EWA space.

- In September 2025, Payactiv launched “Access-as-a-Service℠,” an API-driven infrastructure allowing large enterprises and HCM platforms to embed EWA features under their own brand for scalable, customizable financial wellness solutions. Additionally, Payactiv rolled out Visa+, enabling real-time wage disbursements to digital wallets like Venmo and PayPal without requiring bank info, improving access convenience.

Report Scope

Report Features Description Market Value (2024) USD 4.46 Bn Forecast Revenue (2034) USD 72.7 Bn CAGR (2025-2034) 32.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (On-Demand Access, Scheduled/Partial Access, Hybrid Models), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Retail & E-commerce, Hospitality & Food Services, Healthcare, Manufacturing, Transportation & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Refyne, DailyPay, EarnIn, Payactiv, Inc., Stream Platforms Ltd., Flexwage Solutions, Hastee Technologies Ltd., ZayZoon, Instant Financial, Branch, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Employer-Sponsored EWA MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Employer-Sponsored EWA MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others