Global Electronic Manufacturing Services (EMS) Market By Service (Electronics Manufacturing Services, Engineering Services, Test & Development Implementation, Logistics Services, and Others), By Industry (Consumer Electronics, Automotive, Heavy Industrial Manufacturing, Aerospace and Defense, Healthcare, IT and Telecom, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 21740

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

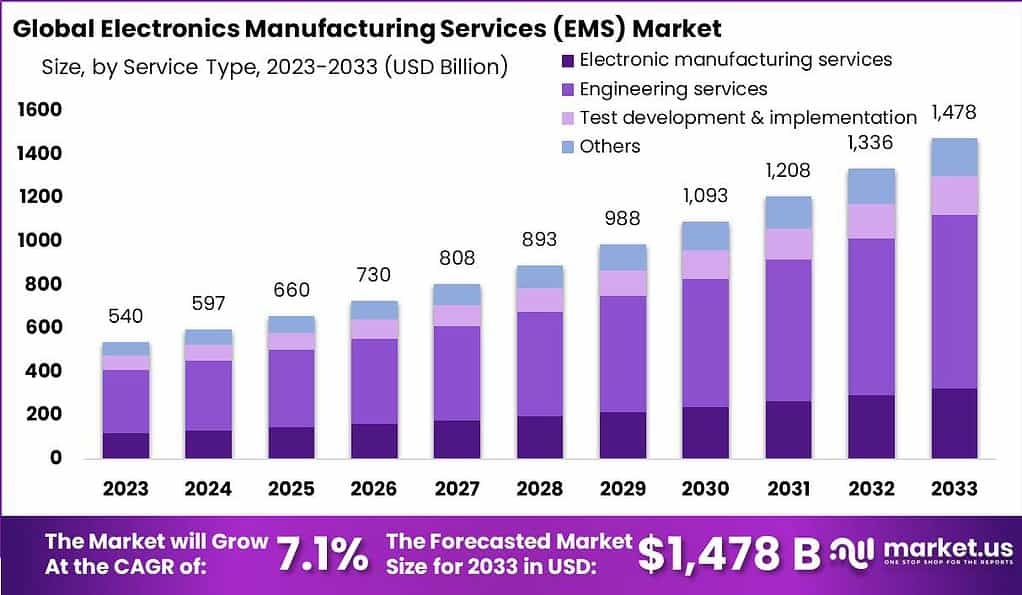

The Global Electronics Manufacturing Services (EMS) Market is anticipated to be USD 1,478 billion by 2033. It is estimated to record a steady CAGR of 7.1% in the Forecast period 2024 to 2033. It is likely to total USD 597 billion in 2024.

Electronics Manufacturing Services (EMS) refers to a broad range of services provided by companies that design, manufacture, test, distribute, and offer return/repair services for electronic components and assemblies. These services cater to original equipment manufacturers (OEMs), enabling them to outsource parts of their electronic manufacturing processes.

The primary driving forces behind the EMS market include the growing consumer demand for electronic products, the integration of advanced technologies like IoT and artificial intelligence in industrial applications, and the significant advancements in automotive electronics. Additionally, the increasing reliance on electronic devices in the healthcare sector adds to the market demand.

The demand within the EMS market is diversified across several sectors, including consumer electronics, automotive, aerospace and defense, healthcare, IT, and telecommunications. This widespread demand is primarily due to the continual advancements and the necessity for high precision and reliability in electronic components used across these industries.

Significant factors contributing to the heightened demand in the EMS sector include the miniaturization of electronic devices, the rising adoption of smart devices, and the robust growth of the semiconductor industry, which necessitates sophisticated manufacturing and testing services.

The EMS market is increasingly adopting new technologies such as 5G, IoT, and machine learning to enhance manufacturing processes, improve supply chain management, and increase product lifecycle through better predictive maintenance. These technologies are critical in driving efficiency and reducing costs, making them highly attractive to EMS providers.

For instance, In March 2024, Xiaomi, a prominent Chinese consumer electronics manufacturer, officially entered the electric vehicle (EV) sector with the launch of its first connected smart EV sedan. Known for its ecosystem of smart devices, Xiaomi has extended its technological strengths into automotive innovation, introducing a sporty, feature-rich EV equipped with advanced connectivity and intelligent systems.

The adoption of advanced technologies in the EMS sector is largely driven by the need to enhance operational efficiency, improve product quality, and meet the stringent regulatory requirements that vary across different regions and industries.

Key Takeaways

- Market Size and Growth: The EMS market is expected to reach a valuation of USD 1,478 billion by 2033, with a steady compound annual growth rate (CAGR) of 7.1%. In 2024, it is projected to be USD 597 billion.

- Service Type Analysis: In 2023, engineering services played a crucial role in the EMS market, offering design, prototyping, and product development support.

- Industry Outlook: The consumer electronics segment dominated the market in 2023 due to increasing demand for innovative electronic gadgets.

- Driving Factors: Increasing demand for consumer electronics, automotive technology, and industrial equipment.

- Restraining Factors: Handling sensitive data requires robust security measures.

- Growth Opportunities: Adoption of AI and automation enhances efficiency and quality control.

- Challenges: Attracting skilled professionals is a persistent challenge.

- Key Market Trends: Digital Twin Technology: EMS providers adopt digital twin technology for virtual prototyping.

- Regional Analysis: In 2023, Asia-Pacific (APAC) dominated the market due to its manufacturing hub status.

- Key Players: Major players in the EMS market include Sanmina Corporation, Foxconn, Benchmark Electronics Inc., Flex Ltd, Jabil Inc., and others.

Analysts’ Viewpoint

The EMS market presents significant investment opportunities, especially in regions like Asia-Pacific, which dominates the market due to its cost-effective manufacturing capabilities and substantial market demand, particularly in countries like China and India. Investments are also flowing into sectors like automotive and medical devices, where electronics are increasingly used.

Companies engaging in EMS can benefit from reduced production costs, access to specialized manufacturing expertise without the need for in-house facilities, and the ability to quickly scale operations to meet market demands. This flexibility is crucial for companies looking to adapt to rapid changes in technology and consumer preferences.

The regulatory landscape for EMS is complex, influenced by global standards and local regulations concerning electronic waste, labor practices, and environmental impact. Compliance with these regulations is not only essential for legal operations but also benefits companies by enhancing their reputation and product acceptance in environmentally conscious markets.

Service Type Analysis

In 2023, within the Electronics Manufacturing Services (EMS) market, the Engineering Services segment emerged as a dominant force, securing a significant share. This segment’s prominence can be attributed to its pivotal role in the electronic manufacturing process. Engineering services encompass a range of critical activities, including design, prototyping, and product development.

EMS providers offering engineering services enable clients to benefit from their specialized expertise, facilitating the creation of innovative and efficient electronic products. In 2023, this segment not only contributed significantly to the market but also showcased the importance of robust engineering support in electronic manufacturing.

The Electronics Manufacturing Services (EMS) segment, on the other hand, remains a fundamental component of the EMS market. It involves the actual manufacturing and assembly of electronic components and devices. EMS providers in this segment are responsible for the production of electronic products based on client specifications. With the growing demand for electronics across industries, this segment continues to play a crucial role in meeting the market’s manufacturing needs.

Test & Development Implementation is another vital segment within the EMS market. It focuses on ensuring the quality and functionality of electronic products through rigorous testing and development processes. This segment aids in identifying and rectifying any issues in the electronic devices before they reach the market, thus enhancing product reliability.

Logistics Services represent a critical part of the Electronics Manufacturing Services (EMS) Market as well. Effective logistics services are essential for the timely and efficient distribution of electronic products to global markets. These services encompass supply chain management, inventory control, and transportation, ensuring that electronic products reach their destinations promptly.

Industry Outlook

In 2023, the Electronics Manufacturing Services (EMS) market saw the Consumer Electronics segment rise to a dominant market position, capturing a substantial share. This prominence can be attributed to the ever-increasing demand for consumer electronics globally. With the rapid pace of technological advancements and the continuous introduction of innovative electronic gadgets, EMS providers catering to the consumer electronics sector have experienced robust growth. From smartphones and tablets to home appliances and wearable devices, the Consumer Electronics segment has been a driving force in the EMS market.

The Automotive industry also played a significant role in the EMS market in 2023. As vehicles become more technologically advanced, the need for electronic components and systems has surged. EMS providers serving the automotive sector have been integral in manufacturing critical electronic components, including control units, sensors, and infotainment systems, contributing to the overall growth of the market.

In Heavy Industrial Manufacturing, Electronics Manufacturing Services (EMS) providers have been essential partners in producing electronic solutions for various heavy machinery and equipment. This sector’s reliance on electronics for automation and control systems has led to the steady growth of the EMS market, with EMS companies contributing to the development of advanced industrial electronics.

Aerospace and Defense is another key industry that has driven the EMS market’s expansion. The stringent quality and reliability standards in this sector have necessitated the involvement of EMS providers to manufacture specialized electronic components and systems, including avionics and communication equipment.

Healthcare, IT, and Telecom have all seen notable growth in their electronic manufacturing requirements. In the healthcare sector, EMS companies have been instrumental in producing medical devices and equipment, contributing to advancements in healthcare technology. In the IT and Telecom sectors, EMS providers have played a crucial role in manufacturing components for networking, communication, and computing devices, supporting the digital revolution.

Driving Factors

- Rising Demand for Electronics: The increasing demand for consumer electronics, automotive technology, and advanced industrial equipment is a major driving force in the EMS market. As these industries grow, the need for EMS providers to manufacture electronic components and assemblies has surged.

- Outsourcing Trends: Many companies are outsourcing their electronic manufacturing needs to EMS providers to reduce costs, improve efficiency, and focus on their core competencies. This trend has led to a steady flow of business for Electronics Manufacturing Services (EMS) companies.

- Technological Advancements: The rapid pace of technological advancements in electronics requires EMS providers to stay at the forefront of innovation. This drive for innovation and the adoption of cutting-edge technologies have contributed to market growth.

- Globalization: The globalization of markets and supply chains has expanded the reach of EMS providers. They can now serve clients in different regions, tapping into emerging markets and diversifying their customer base.

Restraining Factors

- Data Security Concerns: As EMS providers handle sensitive data related to product designs and intellectual property, data security and protection have become critical concerns. Data breaches can have significant consequences for both EMS companies and their clients.

- Supply Chain Disruptions: The EMS market is vulnerable to supply chain disruptions, such as component shortages or geopolitical issues. These disruptions can lead to production delays and increased costs.

- Intense Competition: The EMS market is highly competitive, with numerous players vying for contracts. This competition can put pressure on pricing and profit margins, making it essential for EMS companies to differentiate themselves.

Growth Opportunities

- AI and Automation Integration: Incorporating artificial intelligence (AI) and automation into manufacturing processes presents growth opportunities. EMS providers can enhance efficiency, quality control, and predictive maintenance by adopting these technologies.

- Customization for Industries: Tailoring EMS offerings to specific industries, such as healthcare or aerospace, allows providers to address industry-specific challenges. Customized solutions are in demand and can open new markets.

- Global Expansion: Expanding Electronic Manufacturing Services (EMS) into emerging markets offers growth potential. These regions often have growing electronic manufacturing needs and demand for advanced EMS solutions.

- Diversification: EMS providers can diversify their service offerings by expanding into related fields, such as IoT device manufacturing or providing end-to-end solutions, including design and logistics.

Challenges

- Talent Shortage: There is a shortage of skilled professionals with expertise in electronic manufacturing and emerging technologies. Attracting and retaining talent is a persistent challenge.

- Environmental Regulations: Compliance with environmental regulations and sustainability standards can be complex and costly. EMS providers must invest in eco-friendly practices and materials.

- Technological Evolution: Keeping up with rapid technological advancements and staying competitive in a dynamic market requires constant investment in research and development.

- Complex Supply Chains: Managing complex global supply chains with diverse components and materials can lead to logistical challenges and supply chain disruptions.

Key Market Trends

- Digital Twin Technology: EMS providers are increasingly adopting digital twin technology for virtual prototyping and testing, reducing development time and costs.

- IoT and Smart Devices: The growth of the Internet of Things (IoT) has driven EMS providers to manufacture components for smart devices, including sensors and connectivity solutions.

- Sustainability Focus: EMS providers are emphasizing sustainability by reducing energy consumption, optimizing data center operations, and promoting eco-friendly manufacturing practices.

- Additive Manufacturing: 3D printing and additive manufacturing are becoming integral in electronic component production, enabling complex and customized designs.

Key Market Segments

Service Type

- Electronic manufacturing services

- Engineering services

- Test development & implementation

- Others

Industry

- Consumer Electronics

- Automotive

- Heavy Industrial Manufacturing

- Aerospace and Defense

- Healthcare

- IT and Telecom

- Others

Regional Analysis

In 2023, the Electronic Manufacturing Services (EMS) market exhibited varying regional dynamics, with APAC emerging as a dominant force, capturing a significant share. Asia-Pacific (APAC) has solidified its position as a global manufacturing hub, attracting electronics production and assembly on a large scale.

The region’s robust manufacturing ecosystem, skilled workforce, and cost-effective labor have driven the growth of the EMS market. With countries such as China, Japan, South Korea and India leading the way in electronics manufacturing APAC is consistently meeting the ever-growing global demand for electronic goods. Furthermore, the emergence of cutting-edge technologies as well as the development of sectors like automotive and consumer electronics has further boosted APAC’s dominance on market share in the EMS market.

In Europe, the EMS market also witnessed substantial growth in 2023, primarily driven by countries like Germany, France, and the United Kingdom. European organizations recognized the significance of EMS providers in enhancing their electronic manufacturing capabilities while complying with stringent quality standards. The emphasis on data security, environmental sustainability, and adherence to regulatory requirements has contributed to the growth of the EMS market in Europe.

North America, particularly the United States and Canada, continued to play a crucial role in the EMS market, with a focus on technology advancement and digital innovation. The region’s well-established technology giants and entrepreneurial culture have bolstered EMS providers’ presence. The demand for electronic components in industries like aerospace, defense, and healthcare also contributed to the market’s growth in North America.

Latin America displayed steady growth in the EMS market, driven by economic development and the need for technology-driven solutions. The region’s businesses sought EMS providers to support their electronic manufacturing needs, particularly in sectors like telecommunications and industrial manufacturing. Similarly, the Middle East and Africa (MEA) region showed notable progress, with a growing demand for skilled labor and technology integration in various industries.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Electronic Manufacturing Services (EMS) market is highly competitive, with several key players operating globally. These companies provide contract manufacturing services for electronic components and products, offering a wide range of services to support the production and assembly of electronic devices

Key Market Players included in the report:

- Sanmina Corporation (U.S.)

- Hon Hai Precision Industry Co. Ltd (Foxconn) (Taiwan)

- Benchmark Electronics Inc. (U.S.)

- Flex Ltd (Singapore)

- Jabil Inc. (U.S.)

- Celestica Inc. (Canada)

- Wistron Corporation (Taiwan)

- Plexus Corporation (U.S.)

- Fabrinet (Thailand)

- COMPAL Inc. (Taiwan)

Recent Developments

- July 2023, Analog Devices, Inc. One of the global semiconductor companies and Hon Hai Technology Group (Foxconn) one of the world’s largest electronic manufacturing service providers have announced the signing of an Memorandum of Understanding (MoU) for the development of an advanced digital cockpit for cars, as well as an advanced battery management system (BMS).

- May 2023, Infineon Technologies AG, one of the top global players in automotive semiconductors along with Hon Hai Technology Group (Foxconn) one of the biggest global electronic manufacturing service providers are aiming to form an alliance in the electric vehicle (EV) area to develop advanced electromobility that is innovative and intelligent features. It is a Memorandum of Understanding (MoU) is aimed at the development of silicon carbide (SiC) creation and leverage Infineon’s automotive SiC advancements for automotive systems.

Report Scope

Report Features Description Market Value (2023) US$ 540 Bn Forecast Revenue (2033) US$ 1,478 Bn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Electronics Manufacturing Services, Engineering Services, Test & Development Implementation, Logistics Services, and Others), By Industry (Consumer Electronics, Automotive, Heavy Industrial Manufacturing, Aerospace and Defense, Healthcare, IT and Telecom, and Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sanmina Corporation (U.S.), Hon Hai Precision Industry Co. Ltd (Foxconn) (Taiwan), Benchmark Electronics Inc. (U.S.), Flex Ltd (Singapore), Jabil Inc. (U.S.), Celestica Inc. (Canada), Wistron Corporation (Taiwan), Plexus Corporation (U.S.), Fabrinet (Thailand), COMPAL Inc. (Taiwan) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Electronics Manufacturing Services (EMS)?Electronics Manufacturing Services (EMS) refers to companies that provide a wide range of services related to the design, manufacturing, testing, and distribution of electronic components and products.

What services do Electronics Manufacturing Services (EMS) companies offer?EMS companies offer a comprehensive suite of services, including product design, prototyping, printed circuit board (PCB) assembly, system assembly, testing, packaging, and logistics. They may also provide aftermarket services such as repair and maintenance.

Who are the top key players in Electronic Manufacturing Services (EMS) Market?Some of key players include Sanmina Corporation (U.S.), Hon Hai Precision Industry Co. Ltd (Foxconn) (Taiwan), Benchmark Electronics Inc. (U.S.), Flex Ltd (Singapore), Jabil Inc. (U.S.), Celestica Inc. (Canada), Wistron Corporation (Taiwan), Plexus Corporation (U.S.), Fabrinet (Thailand), COMPAL Inc. (Taiwan)

What industries commonly utilize Electronics Manufacturing Services (EMS)?EMS is widely used in various industries, including telecommunications, automotive, consumer electronics, healthcare, industrial, and aerospace. The flexibility of EMS providers makes them adaptable to different sectors with electronic component needs.

What factors drive the growth of the Electronics Manufacturing Services (EMS) market?The growth of the EMS market is driven by factors such as the increasing complexity of electronic products, rapid technological advancements, globalization of supply chains, cost efficiency, and the need for faster time-to-market for electronic devices.

Electronics Manufacturing Services (EMS) MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Electronics Manufacturing Services (EMS) MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sanmina Corporation (U.S.)

- Hon Hai Precision Industry Co. Ltd (Foxconn) (Taiwan)

- Benchmark Electronics Inc. (U.S.)

- Flex Ltd (Singapore)

- Jabil Inc. (U.S.)

- Celestica Inc. (Canada)

- Wistron Corporation (Taiwan)

- Plexus Corporation (U.S.)

- Fabrinet (Thailand)

- COMPAL Inc. (Taiwan)