Global Electronic Grade Nitric Acid Market Size, Share, And Business Benefits By Product Type (EL Grade, VL Grade, UL Grade, SL Grade), By Application (Semiconductor, Solar Energy, LCD Panel, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155346

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

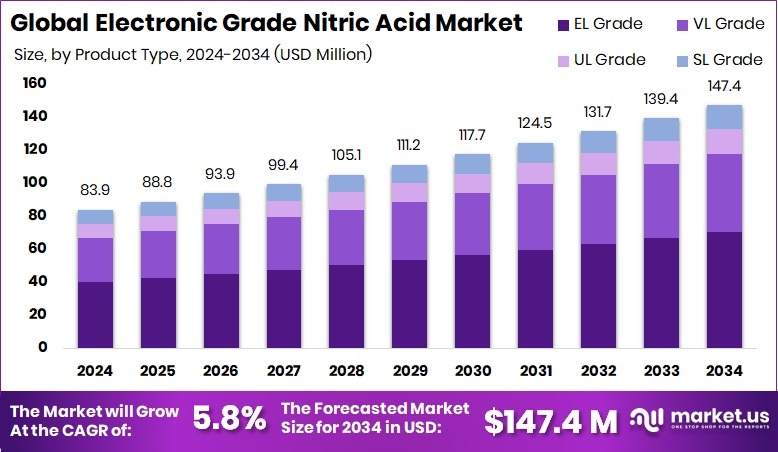

The Global Electronic Grade Nitric Acid Market is expected to be worth around USD 147.4 million by 2034, up from USD 83.9 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong semiconductor growth drives Asia Pacific’s 52.90% dominant market position.

Electronic Grade Nitric Acid (EGNA) is a high-purity form of nitric acid specifically refined for use in semiconductor manufacturing, photovoltaic cell production, and other advanced electronics applications. It is free from metallic and organic impurities that could interfere with delicate processes like wafer cleaning, etching, and surface preparation. Its ultra-clean properties help ensure higher yields and improved performance of microelectronic components, making it an essential chemical in the electronics supply chain.

The Electronic Grade Nitric Acid market refers to the global trade, production, and consumption of this high-purity acid within the electronics industry. Demand comes mainly from semiconductor fabrication plants, flat panel display manufacturers, and solar cell producers. The market’s growth is closely tied to the expansion of the electronics sector, advancements in chip technology, and stricter quality requirements in manufacturing processes.

Increasing semiconductor production, driven by the global demand for faster and more powerful devices, is a key driver. The shift toward smaller, more complex chip architectures requires cleaner processing chemicals, boosting EGNA consumption. The rapid expansion of solar energy projects also fuels the need for high-purity acids in photovoltaic manufacturing.

Rising electronics consumption, particularly in 5G, AI, and IoT applications, has led to higher wafer production volumes. In turn, this creates sustained demand for EGNA in precision cleaning and etching steps, where purity directly impacts device reliability and yield.

Key Takeaways

- The Global Electronic Grade Nitric Acid Market is expected to be worth around USD 147.4 million by 2034, up from USD 83.9 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, EL Grade dominated the Electronic Grade Nitric Acid Market, holding a 47.9% share.

- Semiconductor applications led the Electronic Grade Nitric Acid Market in 2024, capturing a 51.2% share.

- The market value in Asia Pacific reached USD 44.3 Mn.

By Product Type Analysis

EL Grade holds 47.9% in the Electronic Grade Nitric Acid Market.

In 2024, EL Grade held a dominant market position in the By Product Type segment of the Electronic Grade Nitric Acid Market, with a 47.9% share. This grade is highly sought after for its exceptional purity and reliability, making it the preferred choice in advanced semiconductor manufacturing and precision electronics applications. Its ultra-low metallic and particulate content ensures minimal contamination risk, which is critical in processes such as wafer cleaning, micro-pattern etching, and surface preparation for high-performance chips.

The strong demand is largely supported by the rising complexity of integrated circuits and the industry’s push toward smaller nanometer-scale nodes, where even trace impurities can affect yield and device functionality. The growth of 5G infrastructure, AI computing, and automotive electronics has further strengthened the need for EL Grade nitric acid, as these technologies demand flawless component performance.

Additionally, the rapid expansion of photovoltaic production, particularly in Asia-Pacific, has reinforced its market dominance due to stringent purity standards in solar cell fabrication. With increasing investments in new semiconductor fabrication plants and the ongoing global shift toward electric and connected devices, EL Grade’s robust position is expected to remain steady, driving consistent consumption within the high-purity chemical supply chain.

By Application Analysis

Semiconductors lead with 51.2% in the Electronic Grade Nitric Acid Market.

In 2024, Semiconductor held a dominant market position in the By Application segment of the Electronic Grade Nitric Acid Market, with a 51.2% share. This dominance stems from the sector’s heavy reliance on ultra-high purity chemicals to achieve precise and defect-free manufacturing processes. Electronic Grade Nitric Acid plays a critical role in semiconductor fabrication, particularly in wafer cleaning, oxidation removal, and surface preparation before layering advanced circuit patterns.

The shift toward advanced chip designs, including sub-5nm nodes, has heightened purity requirements, making contamination control more crucial than ever. Rising demand for high-performance chips used in 5G networks, artificial intelligence, autonomous vehicles, and high-speed computing has significantly increased the volume of semiconductor production, directly boosting nitric acid consumption. Additionally, the expansion of fabrication plants in Asia-Pacific and North America, driven by both private investments and government incentives, has reinforced the sector’s leading position.

With the semiconductor industry expected to maintain strong growth momentum due to digitalization trends and the rapid adoption of connected devices, the need for consistent, high-purity chemical supplies like Electronic Grade Nitric Acid will remain a top priority, ensuring the segment’s continued dominance in the coming years.

Key Market Segments

By Product Type

- EL Grade

- VL Grade

- UL Grade

- SL Grade

By Application

- Semiconductor

- Solar Energy

- LCD Panel

- Others

Driving Factors

Rising Semiconductor Production Boosts High-Purity Acid Demand

The biggest driving factor for the Electronic Grade Nitric Acid Market in 2024 is the rapid growth of semiconductor production worldwide. As technology advances toward smaller and more powerful chips, the manufacturing process demands extremely pure chemicals to avoid contamination and defects. Electronic Grade Nitric Acid is essential for cleaning wafers, removing impurities, and preparing surfaces during chip fabrication.

With booming demand for 5G devices, artificial intelligence systems, electric vehicles, and IoT applications, semiconductor plants are increasing their production capacity. Many countries are also investing heavily in new fabrication facilities to secure their supply chains. This expansion is creating a steady and growing need for high-purity nitric acid, firmly positioning it as a critical material in electronics manufacturing.

Restraining Factors

High Production Costs Limit Wider Market Growth

One of the main restraining factors for the Electronic Grade Nitric Acid Market is the high cost of production. Achieving the ultra-high purity required for semiconductor and advanced electronics applications involves complex purification processes, specialized equipment, and strict quality control measures. These processes consume significant energy and resources, which drive up manufacturing costs.

Additionally, the need to comply with stringent environmental and safety regulations adds further expense to operations. As a result, the higher price of Electronic Grade Nitric Acid can limit its adoption, especially in cost-sensitive markets or among smaller manufacturers. This cost barrier may slow down market expansion, despite the growing demand from high-tech industries that rely on consistent and reliable purity standards.

Growth Opportunity

Expansion of Semiconductor Manufacturing in Emerging Regions

A major growth opportunity for the Electronic Grade Nitric Acid Market lies in the rapid expansion of semiconductor manufacturing in emerging regions. Countries in Asia, the Middle East, and parts of Eastern Europe are investing heavily in new fabrication plants to meet global chip demand and reduce dependency on traditional manufacturing hubs. These facilities require large volumes of ultra-pure chemicals, including Electronic Grade Nitric Acid, for wafer cleaning and precision etching.

Government incentives, foreign investments, and technological partnerships are further encouraging local production. As more semiconductor clusters develop in these regions, suppliers of high-purity nitric acid can secure long-term contracts and strengthen their global presence, tapping into fresh markets with rising high-tech manufacturing needs.

Latest Trends

Shift Toward Sustainable and Low-Emission Production

One of the latest trends in the Electronic Grade Nitric Acid Market is the growing shift toward sustainable and low-emission production methods. Manufacturers are focusing on reducing the environmental impact of nitric acid production by adopting cleaner technologies, improving energy efficiency, and minimizing waste. This includes using advanced filtration systems, closed-loop processes, and eco-friendly raw material sourcing to meet stricter environmental regulations.

The push for greener manufacturing is also driven by the sustainability commitments of semiconductor and electronics companies, which expect their suppliers to follow similar standards. As global awareness of carbon emissions and chemical waste increases, the sustainable production of Electronic Grade Nitric Acid is becoming both a competitive advantage and a key market differentiator.

Regional Analysis

In Asia Pacific, Electronic Grade Nitric Acid holds 52.90%.

In 2024, Asia Pacific emerged as the leading region in the Electronic Grade Nitric Acid Market, holding a dominant 52.90% share valued at USD 44.3 million. The region’s strong position is driven by its status as a global hub for semiconductor manufacturing, with countries like China, Japan, South Korea, and Taiwan hosting some of the largest fabrication facilities.

Rapid advancements in electronics, 5G infrastructure, and electric vehicle production have significantly increased the demand for high-purity chemicals used in wafer cleaning and microfabrication processes. Government-backed investments in chip manufacturing, coupled with rising photovoltaic production, further reinforce the market’s expansion in the region.

North America and Europe continue to show steady demand, supported by technological innovations and localized manufacturing strategies, while the Middle East & Africa and Latin America are gradually developing their high-tech manufacturing capabilities. However, the scale and pace of growth in Asia Pacific region remain unmatched, as the region benefits from a well-established supply chain, skilled workforce, and proximity to major electronics markets.

With ongoing capacity expansions and increasing demand for ultra-clean materials, Asia Pacific is expected to maintain its leadership position, driving the bulk of global Electronic Grade Nitric Acid consumption in the foreseeable future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to leverage its extensive chemical expertise and global distribution network to meet the stringent purity standards demanded by semiconductor and electronics manufacturers. Its focus on advanced purification technologies ensures a consistent supply for high-end applications.

Columbus Chemicals, known for its specialization in high-purity chemicals, plays a crucial role in supplying ultra-clean nitric acid for precision cleaning and etching processes, particularly to semiconductor fabrication plants.

UBE Corporation, with its diversified chemical portfolio and manufacturing capabilities across Asia, remains a key contributor to meeting the surging demand in the region’s rapidly expanding electronics sector.

T. N. C. Industrial stands out for its regional presence and adaptability, catering to niche electronics manufacturing hubs with tailored production capabilities. Collectively, these companies are responding to industry trends such as the push for smaller, more complex chips and the growing emphasis on sustainable production. Their ability to maintain high quality, meet volume requirements, and adapt to evolving technological demands positions them as essential enablers of semiconductor and photovoltaic advancements, ensuring the market’s continued growth trajectory.

Top Key Players in the Market

- BASF SE

- Columbus Chemicals

- UBE Corporation

- T. N. C. Industrial

- KMG Electronic Chemicals

- EuroChem

- Asia Union Electronic Chemicals

Recent Developments

- In June 2024, EuroChem installations are improving emission controls at nitric acid facilities, such as installing an automatic emission control system that tracks pollutants in real-time, but this is environmental compliance rather than a new product or service

- In October 2023, Fujifilm completed the acquisition of the “electronic chemicals” business formerly known as CMC Materials KMG Corporation (this is the same business as KMG Electronic Chemicals) for US$700 million and rebranded it as FUJIFILM Electronic Materials Process Chemicals.

Report Scope

Report Features Description Market Value (2024) USD 83.9 Million Forecast Revenue (2034) USD 147.4 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (EL Grade, VL Grade, UL Grade, SL Grade), By Application (Semiconductor, Solar Energy, LCD Panel, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Columbus Chemicals, UBE Corporation, T. N. C. Industrial, KMG Electronic Chemicals, EuroChem, Asia Union Electronic Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Grade Nitric Acid MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Grade Nitric Acid MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Columbus Chemicals

- UBE Corporation

- T. N. C. Industrial

- KMG Electronic Chemicals

- EuroChem

- Asia Union Electronic Chemicals