Global Electron Beam Lithography System Market By Type (Gaussian beam EBL Systems, and Shaped beam EBL Systems), By Application (Academic Field, and Industrial Field), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 15417

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

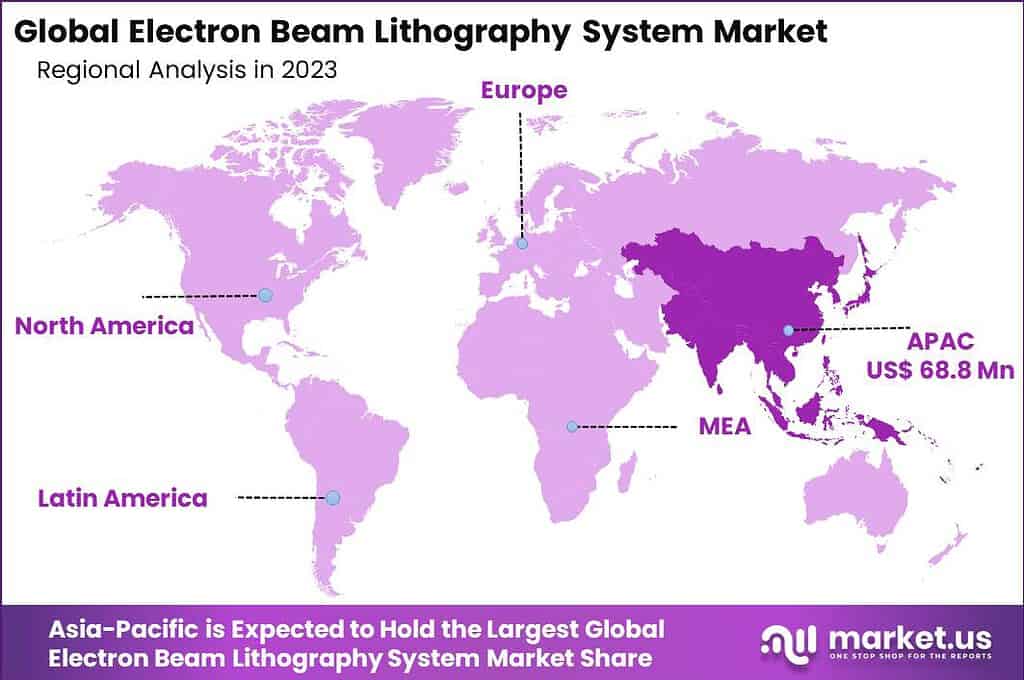

The projected value of the global Electron Beam Lithography System Market is anticipated to be USD 209.9 Million by 2024 and is expected to witness substantial growth, reaching USD 389.2 Million by 2033. The market is poised for a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 7.1% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 35.1% share, holding USD 68.8 Million revenue.

Electron Beam Lithography (EBL) System refers to a technology used in nanofabrication processes to create patterns with extremely high precision and resolution. It utilizes a focused beam of electrons to write patterns onto a substrate, enabling the production of intricate structures at the nanoscale level. EBL systems are widely used in various industries, including semiconductor manufacturing, research and development, photonics, and nanotechnology.

The Electron Beam Lithography System market is the market for these advanced systems and associated services. The market has been witnessing significant growth due to the increasing demand for nanofabrication techniques and the need for high-resolution patterning in various applications. The EBL systems offer several advantages, including the ability to achieve sub-10-nanometer resolution, high flexibility in pattern design, and the capability to work with a wide range of materials.

Several growth factors propel the electron beam lithography system market. The ongoing miniaturization of electronic devices necessitates advanced manufacturing technology that can produce extremely small and complex components. Additionally, the burgeoning field of nanotechnology, with its wide applications across medicine, energy, and materials science, further amplifies the need for precise and reliable nanofabrication tools. This demand translates into a robust growth trajectory for the electron beam lithography system market.

The demand within the electron beam lithography system market is robust, fueled by the rapid expansion of the semiconductor industry and the increasing sophistication of electronic devices. As devices become smaller and more complex, the requirements for the tools that manufacture them become more stringent. Moreover, the growing interest in quantum computing and the need for constructing quantum devices, which require exacting standards of nanofabrication, also contribute significantly to the market demand.

There are substantial opportunities in the electron beam lithography system market, especially in emerging technologies and developing regions. As countries and companies invest more in technological infrastructure, the need for advanced lithography systems is expected to rise. There’s also potential for growth in applications outside traditional electronics, such as in creating biosensors and other nanoscale biological tools, which could open new paths for the adoption of electron beam lithography systems.

Technological advancements in electron beam lithography systems continue to enhance their appeal. Innovations in beam control, improved resists, and the development of more user-friendly software interfaces make these systems more efficient and accessible. Additionally, ongoing research into increasing throughput and reducing costs without compromising quality is likely to increase the adoption and utility of EBL systems in various fields, further fueling market growth.

Key Takeaways

- The Electron Beam Lithography System Market is expected to grow steadily with a projected Compound Annual Growth Rate (CAGR) of 7.1% from 2024 to 2033.

- In 2023, Shaped Beam EBL Systems captured more than a 67.4% share in the market due to their advantages in precision, resolution, and pattern fidelity.

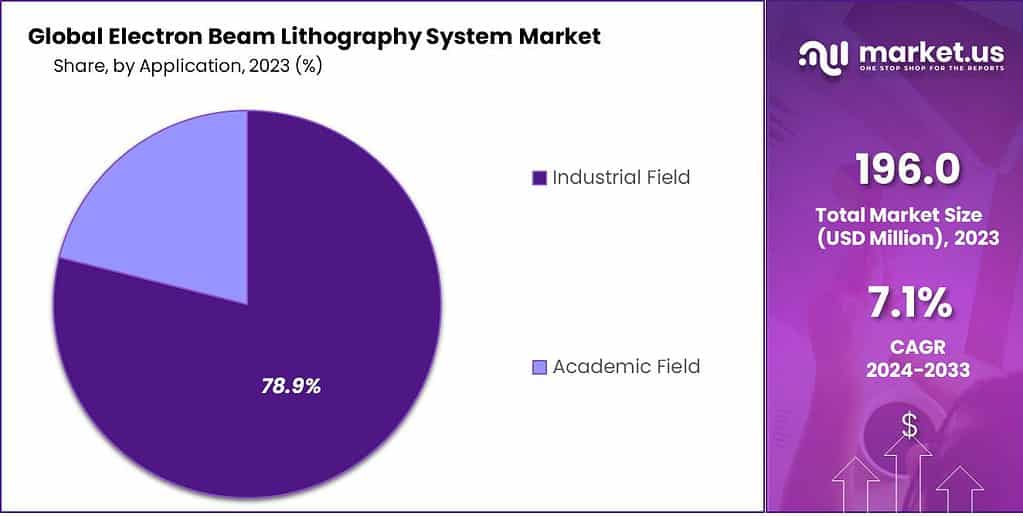

- The Industrial Field segment held a dominant market position in 2023, with over a 78.9% share, driven by the demand for advanced electronic components and ongoing research and development.

- In 2023, Asia-Pacific emerged as the dominant region, capturing over 35.1% of the market, driven by advancements in nanotechnology, strong electronics manufacturing, and government initiatives in countries like China, Japan, and South Korea.

- Key players in the EBL System market include Raith GmbH, STS-Elionix, JEOL Ltd., Vistec Electron Beam GmbH, CRESTEC Corporation, NanoBeam Ltd., Nanoscribe GmbH, NIL Technology ApS, JC Nabity Lithography Systems, and IMS Nanofabrication GmbH.

Type Analysis

In 2023, the Shaped Beam EBL Systems segment emerged as the dominant player in the Electron Beam Lithography (EBL) System market, capturing more than a 67.4% share. This segment’s remarkable performance can be attributed to several factors.

Shaped Beam EBL Systems offer distinct advantages over Gaussian Beam EBL Systems, making them the preferred choice for many applications. These systems utilize a shaped electron beam, allowing for greater control and flexibility in pattern formation. The ability to shape the beam enables the creation of complex and intricate structures with high precision, making it ideal for demanding nanofabrication processes.

The dominance of Shaped Beam EBL Systems can also be attributed to their superior resolution capabilities. These systems excel in achieving ultra-high resolution, enabling the fabrication of features at the sub-10-nanometer scale. This level of resolution is crucial in industries such as semiconductor manufacturing, photonics, and nanotechnology, where precise and intricate patterns are required.

Furthermore, Shaped Beam EBL Systems exhibit excellent proximity effect correction capabilities. The proximity effect refers to the phenomenon where electrons scattered during exposure can affect adjacent features, leading to distortion or blurring. Shaped Beam EBL Systems employ sophisticated correction techniques to minimize the proximity effect, resulting in improved pattern fidelity and accuracy.

The dominance of Shaped Beam EBL Systems can also be attributed to their widespread adoption in research and development activities. These systems are favored by academic institutions, research laboratories, and advanced technology companies for their ability to push the boundaries of scientific understanding and technological innovation. The flexibility and versatility of Shaped Beam EBL Systems make them invaluable tools for exploring new materials, developing novel devices, and advancing various fields of study.

As a result of these advantages, the Shaped Beam EBL Systems segment has witnessed significant growth and continues to dominate the Electron Beam Lithography System market. With their superior resolution, precise patterning capabilities, proximity effect correction, and extensive use in research and development, Shaped Beam EBL Systems are expected to maintain their market dominance in the coming years.

Application Analysis

In 2023, the Industrial Field segment held a dominant market position, capturing more than a 78.9% share of the Electron Beam Lithography System market. This segment’s strong performance can be attributed to several key factors.

Firstly, the Industrial Field segment encompasses various industries such as semiconductor manufacturing, nanotechnology, and optoelectronics, which have a high demand for advanced lithography systems. These industries require precise and intricate patterns to be created on a nanoscale level, making electron beam lithography systems an essential tool in their manufacturing processes.

Secondly, the Industrial Field segment benefits from the increasing adoption of advanced technologies, such as Internet of Things (IoT), artificial intelligence (AI), and virtual reality (VR), which have driven the need for smaller and more powerful electronic components. Electron beam lithography systems play a crucial role in the fabrication of these miniaturized components, enabling manufacturers to meet the growing demand for high-performance devices.

Furthermore, the Industrial Field segment also benefits from significant investments in research and development (R&D) activities. Companies operating in this segment constantly strive to innovate and improve their products to stay competitive in the market. The academic community and research institutions collaborate closely with industrial players to develop cutting-edge lithography systems that can meet the evolving demands of various industries.

Moreover, the Industrial Field segment enjoys economies of scale, as large-scale production and bulk purchases allow manufacturers to achieve cost efficiencies. This makes the adoption of electron beam lithography systems more feasible for industrial applications, contributing to the segment’s dominance in the market.

Overall, the Industrial Field segment’s dominance in the Electron Beam Lithography System market can be attributed to its strong presence in key industries, the increasing demand for advanced electronic components, ongoing R&D investments, and economies of scale. With the continuous advancements in technology and the ever-growing need for miniaturization, it is expected that the Industrial Field segment will continue to hold a significant market share in the coming years.

Key Market Segments

Type

- Gaussian beam EBL Systems

- Shaped beam EBL Systems

Application

- Academic Field

- Industrial Field

Driver

“Advancements in Nanotechnology Fueling Demand for Precision Electron Beam Lithography Systems”

The driver behind the growth of the global Electron Beam Lithography (EBL) System market is the increasing demand for high-resolution and precision manufacturing in the field of nanotechnology. Nanotechnology has witnessed significant advancements in recent years, enabling the development of smaller, more powerful electronic components. To fabricate these intricate structures, manufacturers require lithography systems capable of achieving the highest levels of precision and resolution.

EBL systems have emerged as a critical tool in nanotechnology, offering unparalleled resolution at the nanoscale level. With their ability to create intricate patterns and structures, EBL systems are essential for various industries, including semiconductor manufacturing, optoelectronics, and nanofabrication. The demand for these systems has been driven by the need to manufacture advanced electronic devices, such as microprocessors, memory chips, sensors, and photonic devices.

The continuous miniaturization of electronic components, driven by advancements in nanotechnology, has created a strong market demand for EBL systems. These systems enable manufacturers to achieve submicron and nanoscale resolutions, allowing for the precise fabrication of complex structures. The ability to create smaller and more efficient devices is crucial for industries ranging from consumer electronics to healthcare and energy storage.

As nanotechnology continues to advance, the demand for precision manufacturing is expected to grow further. New applications and emerging technologies, such as quantum computing, nanosensors, and nanophotonics, are driving the need for even higher levels of precision and control. EBL systems are poised to play a critical role in enabling these technological advancements, making them a key driver for the global EBL System market.

Restraint

“High Cost and Complexity of EBL Systems Limiting Market Penetration”

While Electron Beam Lithography (EBL) systems offer exceptional resolution and precision, their high cost and complexity act as significant restraints on their market penetration. EBL systems are complex pieces of equipment that require sophisticated technology, specialized expertise, and extensive maintenance. These factors contribute to the high upfront costs associated with acquiring and operating EBL systems, making them a considerable investment for companies, particularly for small and medium-sized enterprises (SMEs).

The high cost of EBL systems stems from various factors. Firstly, the advanced technology used in these systems, including electron beam sources, beam deflectors, and sophisticated control software, adds to their manufacturing costs. Additionally, the stringent quality control measures and calibration requirements further increase the overall cost. Moreover, the specialized expertise required to operate and maintain these systems adds to the operational expenses.

The high cost of EBL systems creates a barrier to adoption, particularly for SMEs and organizations with limited financial resources. The substantial upfront investment required can be prohibitive for many potential customers, deterring them from considering EBL systems as a viable solution for their manufacturing needs. Instead, these companies may opt for alternative lithography technologies that offer lower initial costs and simpler operation.

Another challenge associated with the complexity of EBL systems is the need for skilled operators. Operating an EBL system requires specialized training and expertise, as it involves intricate processes and precise control of the electron beam. The scarcity of skilled operators can further limit the market penetration of EBL systems, as companies may face difficulties in finding qualified personnel or incur additional costs for training.

Nevertheless, efforts are being made to address these restraints. Some manufacturers are working on developing more cost-effective EBL systems, exploring alternative materials and components that can reduce manufacturing costs without compromising performance. Additionally, advancements in automation and user-friendly interfaces are aimed at simplifying the operation and reducing the dependency on highly skilled operators.

Opportunity

“Emerging Applications in Integrated Circuit Miniaturization Offering Growth Avenues for EBL Systems”

The Electron Beam Lithography (EBL) System market presents significant growth opportunities due to emerging applications in integrated circuit miniaturization. Integrated circuits (ICs) are the fundamental building blocks of modern electronic devices and are continuously evolving to meet the demand for smaller, more powerful, and energy-efficient devices. EBL systems play a crucial role in the fabrication of these advanced ICs, offering the precision and resolution required for miniaturization.

One of the key growth avenues for EBLsystems lies in the development of nanoscale ICs. As the demand for smaller and more efficient electronic devices continues to rise, manufacturers are pushing the boundaries of miniaturization. EBL systems provide the necessary capabilities to create intricate patterns and structures at the nanoscale level, enabling the fabrication of nanoscale ICs with enhanced performance and functionality.

The emerging field of nanoelectronics offers promising opportunities for EBL systems. Nanoelectronics focuses on the development of electronic devices and components at the nanoscale, where quantum effects become prominent. EBL systems are essential tools for researchers and manufacturers in this field, enabling them to create nanoscale structures, such as nanowires, nanotubes, and quantum dots, with precise control over their dimensions and properties.

Another area of opportunity for EBL systems is in the production of advanced memory devices. With the increasing demand for high-capacity and faster memory solutions, manufacturers are exploring novel memory technologies, such as resistive random-access memory (RRAM) and phase-change memory (PCM). These emerging memory technologies often require complex patterns and nanoscale features, which can be achieved using EBL systems.

Moreover, the growing field of photonics offers potential growth opportunities for EBL systems. Photonics involves the use of light for various applications, including data communication, sensing, and imaging. EBL systems can be used to fabricate intricate photonic structures, such as waveguides, gratings, and photonic crystals, which are crucial for the development of advanced photonic devices and systems.

Challenge

“Technical Limitations in Throughput and Resolution Posing Challenges for EBL Market Expansion”

One of the primary challenges is the throughput limitation. The writing speed of EBL systems is relatively slow compared to other lithography techniques. The serial nature of the electron beam writing process, where each point is individually exposed, leads to extensive fabrication times for large-scale patterns or high-volume manufacturing. This limitation makes EBL systems less suitable for industries that require quick turnaround times and high production volumes.

Researchers and manufacturers are exploring innovative approaches to enhance the writing speed, such as utilizing multiple electron beams simultaneously or implementing parallel writing strategies. These advancements aim to increase the number of points exposed simultaneously, thereby reducing the overall fabrication time. However, achieving high throughput without compromising resolution and accuracy remains a complex task that requires further research and development.

Resolution is another critical aspect posing challenges for the EBL market expansion. While EBL systems excel at achieving high-resolution patterns at the nanoscale level, maintaining the same level of resolution over larger areas can be difficult. This limitation becomes more pronounced when fabricating patterns on substrates with non-uniform topography or dealing with complex three-dimensional structures. The degradation of resolution can lead to reduced pattern fidelity and accuracy, ultimately affecting the quality of the fabricated devices.

Efforts are underway to address the resolution challenges in EBL systems. Advanced proximity effect correction techniques, such as dose modulation and shape modification, are being employed to compensate for the proximity effects and improve resolution. Additionally, advancements in electron beam column design and optimization aim to enhance beam focus and minimize aberrations, ultimately improving the resolution capabilities of EBL systems.

Furthermore, the trade-off between resolution and writing speed presents a challenge for EBL systems. Systems with higher resolutions often have slower writing speeds, while those with faster writing speeds may sacrifice resolution. Striking the right balance between resolution and throughput is crucial for meeting the diverse requirements of different applications and industries.

Regional Analysis

In 2023, Asia-Pacific emerged as the dominant region in the Electron Beam Lithography (EBL) System market, capturing a significant market share of over 35.1%. This strong market position can be attributed to several factors that contribute to the region’s leadership in this industry. The demand for Electron Beam Lithography System in Asia-Pacific was valued at USD 68.8 Million in 2023 and is anticipated to grow significantly in the forecast period.

Firstly, Asia-Pacific is home to several technologically advanced economies such as China, Japan, and South Korea, which have been investing heavily in research and development activities. These countries have made substantial advancements in nanotechnology and semiconductor manufacturing, driving the demand for high-resolution lithography systems like EBL. The strong presence of major semiconductor manufacturers and research institutions in this region further fuels the adoption of EBL systems.

Additionally, Asia-Pacific benefits from a robust electronics manufacturing sector, with several key players situated in countries like China, Taiwan, and South Korea. The demand for miniaturized electronic components and devices, particularly in sectors such as consumer electronics and telecommunications, drives the need for high-resolution lithography systems to achieve intricate patterns at the nanoscale level. EBL systems provide the necessary capabilities to meet these requirements, further bolstering their adoption in the region.

Furthermore, the supportive government initiatives and favorable investment policies in Asia-Pacific play a crucial role in driving the growth of the EBL market. Governments in countries like China, Japan, and South Korea have implemented strategic plans and funding programs to promote nanotechnology research and development, which includes the adoption of advanced lithography systems. These initiatives create a conducive environment for the expansion of the EBL market in the region.

Moreover, Asia-Pacific has witnessed a rapid increase in the demand for various emerging technologies, including augmented reality, virtual reality, Internet of Things (IoT), and 5G. These technologies require highly precise and complex micro- and nano-structures, driving the demand for high-resolution lithography systems like EBL. The region’s proactive approach towards adopting and implementing these advanced technologies further contributes to its leadership in the EBL market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Electron Beam Lithography System market, the landscape is defined by several key players, each contributing significantly to technological advancements and market dynamics. These companies are known for their innovation, quality, and extensive research and development efforts.

Top Electron Beam Lithography System Market Key Players

- Raith GmbH

- STS-Elionix

- JEOL, Ltd.

- Vistec Electron Beam GmbH

- CRESTEC Corporation

- NanoBeam Ltd.

- Nanoscribe GmbH

- NIL Technology ApS

- JC Nabity Lithography Systems

- IMS Nanofabrication GmbH

- Other Key Players

Recent Developments

- In 2023, Raith GmbH: Introducing the VOYAGER system, a cutting-edge platform equipped with the world’s premier variable-shaped beam technology, making it the first commercially accessible option. This technology facilitates high-resolution patterning on diverse substrates.

- In 2023, STS-Elionix: Presenting the ELS-G Xtreme, a cutting-edge system incorporating a gallium liquid metal ion source. This technology delivers exceptional resolution and pattern fidelity, catering to the demands of advanced micro and nanoelectronics applications.

- In 2023, JEOL Ltd., Released the JIBL-6300FS: This versatile system offers high resolution and throughput for a wide range of applications, from microfluidics to quantum devices.

Report Scope

Report Features Description Market Value (2023) USD 196.0 Mn Forecast Revenue (2033) USD 389.2 Mn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Gaussian beam EBL Systems, and Shaped beam EBL Systems), By Application (Academic Field, and Industrial Field) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Raith GmbH, STS-Elionix, JEOL Ltd., Vistec Electron Beam GmbH, CRESTEC Corporation, NanoBeam Ltd., Nanoscribe GmbH, NIL Technology ApS, JC Nabity Lithography Systems, IMS Nanofabrication GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Electron Beam Lithography and its significance in the semiconductor industry?Electron Beam Lithography is a nanolithography technique using a focused electron beam to pattern a substrate. Its significance lies in its ability to achieve high-resolution and precise patterning, crucial for semiconductor manufacturing.

How big is Electron Beam Lithography System Market?The projected value of the global Electron Beam Lithography System Market is anticipated to be USD 209.9 Million by 2024 and is expected to witness substantial growth, reaching USD 389.2 billion by 2033.

What are the key drivers influencing the growth of the Electron Beam Lithography System Market?The market is primarily driven by increasing demand for advanced semiconductor devices, where high precision and miniaturization are essential. Additionally, the rising need for efficient patterning techniques in research and development contributes to market growth.

What challenges are faced by the Electron Beam Lithography System industry, and how are they being addressed?Challenges include high initial costs and complexity. Industry players are addressing these by continuous technological advancements, cost-effective solutions, and collaborations to enhance accessibility and affordability.

Who are the top key players in Electron Beam Lithography System Market?Raith GmbH, STS-Elionix, JEOL Ltd., Vistec Electron Beam GmbH, CRESTEC Corporation, NanoBeam Ltd., Nanoscribe GmbH, NIL Technology ApS, JC Nabity Lithography Systems, IMS Nanofabrication GmbH, Other Key Players

Electron Beam Lithography System MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Electron Beam Lithography System MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Raith GmbH

- STS-Elionix

- JEOL, Ltd.

- Vistec Electron Beam GmbH

- CRESTEC Corporation

- NanoBeam Ltd.

- Nanoscribe GmbH

- NIL Technology ApS

- JC Nabity Lithography Systems

- IMS Nanofabrication GmbH

- Other Key Players