Global Electric Wheelchair Market By Product Type (Center Wheel Drive, Standing Electric Wheelchairs, Front Wheel Drive, and Rear Wheel Drive), By Age Group (60 years & above, 21-60 years, and 20 years or less), By End-user (Hospitals & Clinics, Home Care, Sports Conditioning, and Others), By Distribution Channel (Offline (Speciality Stores, Convenience Stores, and Others) and Online (Company Websites, E-commerce, and Others)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126114

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

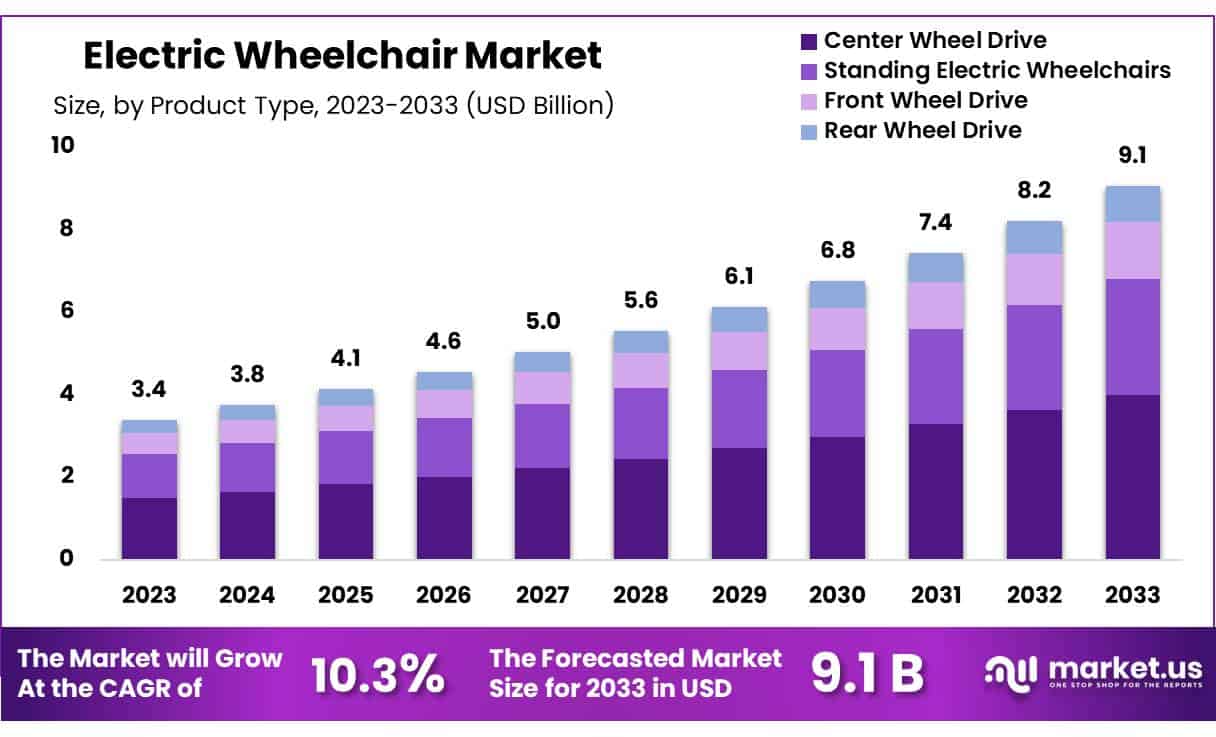

The Electric Wheelchair Market size is expected to be worth around USD 9.1 billion by 2033 from USD 3.4 billion in 2023, growing at a CAGR of 10.3% during the forecast period 2024 to 2033.

The rise in the global geriatric population is expected to boost the market during the forecast period. There has also been a surge in road accidents in recent years that is leading to a steep rise in the cases of physical disabilities. Furthermore, the growing prevalence of chronic diseases is projected to open new avenues of growth for the market. Consumer demand for improved mobility and independence is a driving force behind the growth of the electric wheelchair market.

Many modern electric wheelchairs come equipped with advanced control systems, allowing users to operate them effortlessly using joysticks or other interfaces. These features enhance mobility and navigation, contributing to market expansion.

Additionally, manufacturers are investing in technological advancements, focusing on comfort, affordability, and innovations such as programmable control systems, seat elevation for better accessibility, and robotic technologies to enhance navigation and obstacle avoidance. These efforts are expected to further elevate the value of the electric wheelchair market.

In January 2022, Permobil AB launched the Progeo Noir 2.0 carbon fiber wheelchair in the United Kingdom. In August 2021, Pride Mobility Products Limited introduced the Jazzy EVO 613Li, an electric chair powered by a lithium-ion battery. It boasts a maximum speed of 5.1 miles per hour and offers impressive maneuverability with a narrow base width of only 22 inches and a turning radius of 22 inches.

Key Takeaways

- Market Size: Electric Wheelchair Market size is expected to be worth around USD 9.1 billion by 2033 from USD 3.4 billion in 2023,

- Market Growth: The market growing at a CAGR of 10.3% during the forecast period 2024 to 2033.

- Product Type Analysis: Center wheel drive taking the lead in 2023 with a market share of 44.1%.

- Age Group Analysis: The 60 years and above held a significant share of 54.2%. in 2023.

- End-Use Analysis: The home care sector stands out as the dominant player, holding the largest revenue share of 66.8% in the Electric Wheelchair market.

- Distribution Channel Analysis: The distribution channel segment is segregated into offline and online, with the offline segment leading the market, holding a revenue share of 66.2%.

- Regional Analysis: North America dominated the market with the highest revenue share of 39.4% in 2023

By Product Type Analysis

The center wheel drive segment led in 2023, claiming a market share of 44.1% owing to the growing elderly population and surge in cases of physical disabilities. The center wheel drive is preferred by elderly people as well as people with disabilities because it has various benefits over other types, such as tighter turning radius, better stability, and improved traction, helping it stably maneuver through tight spaces, minimizing any risk of injury. These factors are also projected to maintain its market dominance in the coming years.

By Age Group Analysis

The 60 years and above held a significant share of 54.2% as elderly people often struggle with walking and carrying out basic day-to-day activities. There is a high prevalence of chronic ailments such as arthritis, osteoporosis, and diminished muscle strength in such people. Consequently, there is a high demand for electric wheelchairs among such people as it aids in improving the overall quality of life and helps them move freely.

Furthermore, old people often require long-term mobility assistance, leading to prolonged use of electric wheelchairs. Several key players carry product development keeping in mind the needs of the geriatric population.

By End-user Analysis

The home care segment had a tremendous growth rate, with a revenue share of 66.8%. Many elderly individuals prefer to stay at home, maintaining their independence within familiar surroundings. Electric wheelchairs play a crucial role in enabling this lifestyle choice. By providing mobility assistance indoors, these wheelchairs allow elderly people to perform daily tasks, move freely, and access different areas of their homes. Whether it’s navigating narrow hallways, reaching kitchen counters, or moving from room to room, powered wheelchairs enhance the quality of life for aging individuals.

Moreover, people with chronic conditions or disabilities often require long-term mobility solutions, and homecare settings are ideal for utilizing these devices effectively.

By Distribution Channel Analysis

The offline segment grew at a substantial rate, generating a revenue portion of 66.2% as brick-and-mortar stores offer unique advantages, especially for powered wheelchair users. These physical stores provide personalized services that go beyond mere transactions. Customers can benefit from in-person consultations, fittings, and adjustments. Trained staff, including experts in mobility solutions, can guide users through the selection process.

They consider individual needs, lifestyle, and medical conditions to recommend the most suitable powered wheelchair. Additionally, the hands-on experience allows users to test different models, ensuring comfort, safety, and optimal functionality.

Key Market Segments:

By Product Type

- Center Wheel Drive

- Standing Electric Wheelchairs

- Front Wheel Drive

- Rear Wheel Drive

By Age Group

- 60 years & above

- 21-60 years

- 20 years or less

By End-user

- Hospitals & Clinics

- Home Care

- Sports Conditioning

- Others

By Distribution Channel

- Offline

- Speciality Stores

- Convenience Stores

- Others

- Online

- Company Websites

- E-commerce

- Others

Drivers

Rise in Accident Cases

The rise in accidents is anticipated to boost the market as it leads to a large number of individuals with mobility impairment. Accidents can cause spinal cord injuries, amputations, and other conditions that require the use of electric wheelchairs. According to the World Health Organization (WHO), approximately 50 million people worldwide suffer injuries due to road accidents. Electric wheelchairs provide a safe and comfortable solution for transferring patients between locations. As accident rates rise, the demand for electric wheelchairs is expected to grow.

Restraints

High Cost of Electric Wheelchairs

The high cost of electric wheelchairs substantially impedes the market as it limits access to such wheelchairs for low- to mid-income households, making them unaffordable for many individuals, particularly in developing countries. This reduces the adoption rate, as many potential users opt for manual wheelchairs or alternative mobility aids. Furthermore, insufficient government funding and insurance coverage limitations also contribute to the affordability issue, significantly hampering the market growth.

Opportunities

Global Rise in Geriatric Population and Disabilities

The increasing elderly population and the prevalence of chronic diseases contribute to a rise in disabilities. Consequently, hospitals, healthcare facilities, and homecare settings rely on electric wheelchairs to enhance patient welfare. As the geriatric population continues to expand, the demand for electric wheelchairs is expected to rise.

According to the World Health Organization, by 2050, the proportion of people aged 65 and over will double, creating significant opportunities for wheelchair adoption globally. In 2021, the World Health Organization also stated that as of that year, approximately one billion people worldwide were living with some form of disability, constituting 15% of the global population.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the Electric Wheelchair market, shaping its growth trajectory and dynamics. Macroeconomic factors such as economic growth, inflation, and government policies can impact the market, with growth leading to increased demand and inflation affecting affordability.

Geopolitical factors such as trade wars and tariffs can dispute supply chains and increase costs. However, government initiatives and funding for healthcare are projected to positively impact the market in the years to come.

Latest Trends

Integration of AI with Electric Wheelchairs

One of the latest trends in the electric wheelchair market is the integration of artificial intelligence (AI) into wheelchair systems. This advancement has significantly increased demand. These wheelchairs can be controlled using facial expressions, making them accessible even for individuals with severe disabilities. Additionally, AI-enhanced electric wheelchairs offer personalized features such as adaptive navigation, obstacle avoidance, and predictive movement patterns.

These intelligent systems learn from user behavior and adjust their responses accordingly. For instance, an AI-powered wheelchair might anticipate a user’s preferred routes or adapt to changes in the environment, ensuring smoother and safer mobility.

Regional Analysis

North America is leading the Electric Wheelchair Market

North America dominated the market with the highest revenue share of 39.4% owing to the rising awareness regarding the advancements in mobility technology and the benefits of electric wheelchairs. Growing awareness about the benefits of powered wheelchairs and advancements in mobility technology increases acceptance and adoption among potential users.

In addition, there is a high prevalence of mobility impairments in this region due to road accidents and other physical injuries. For instance, as per the Centers for Disease Control and Prevention (CDC), around 26% of total adults in the US have some type of physical disability, with the problem of mobility impairment being one of the most common. The financial support from Medicaid, Medicare, and private insurance also plays a crucial role in making powered wheelchairs more accessible.

Moreover, the substantial healthcare spending in the US contributes to improved access to advanced medical devices, including powered wheelchairs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to factors such as increased healthcare spending, technological advancements in healthcare, and the rise in target population. With the rapid increment in the population of this region, the incidences of road accidents and physical disabilities have also risen.

Furthermore, there is a significant growth in the elderly population of this region. As a result, the governments are launching various initiatives to enhance healthcare accessibility and provide subsidies to people with disabilities. These factors are likely to propel the market during the forecast period.

According to the Office of the Commissioner for Persons with Disabilities, India, The Delhi Social Welfare Department in India implements a disability pension scheme known as the Subsistence Allowance/Financial Allowance for persons with special needs. This grant amounts to INR 2500 (US$ 29.8) per month.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Electric Wheelchair market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning.

In May 2022, Sunrise Medical introduced two new offerings: the ZIPPIE Q300 M Mini, a pediatric power wheelchair, and the QUICKIE Q200 R, a rear-wheel-drive power wheelchair. In January 2022, Invacare Corporation launched the Invacare AVIVA STORM RX Narrow Base Power Wheelchair, featuring several new enhancements compared to the standard version.

Top Key Players

- Sunrise Medical (U.S.) LLC

- Pride Mobility Products Corp

- Permobil AB

- OttoBock Healthcare GmbH

- Nissin Medical Industries Co., Ltd

- Miki Kogyosho Co., Ltd

- MEYRA GmbH

- Matsunaga Manufactory Co., Ltd

- Karma Medical Products Co., Ltd

- Invacare Corporation

Recent Developments

- Sunrise Medical (U.S.) LLC: In June 2023, Sunrise Medical (U.S.) LLC launched the Quickie Q700-UP M, an advanced electric wheelchair with standing functionality. This innovative model features enhanced power positioning and customizable seating options, catering to users requiring mobility and standing capabilities. The launch reinforces Sunrise Medical’s commitment to offering cutting-edge mobility solutions.

- Pride Mobility Products Corp: In April 2023, Pride Mobility Products Corp introduced the Jazzy Air 3, an electric wheelchair that offers superior elevation technology, allowing users to rise to 12 inches while driving. This feature promotes social engagement and accessibility, reflecting Pride Mobility’s dedication to enhancing user experience through innovation in the electric wheelchair market.

- Permobil AB: In May 2023, Permobil AB acquired LUCI, a company known for its smart wheelchair technology that enhances safety and independence. This acquisition aims to integrate LUCI’s advanced sensors and software into Permobil’s existing electric wheelchair lineup, solidifying Permobil’s position as a leader in smart mobility solutions.

- OttoBock Healthcare GmbH: In July 2023, OttoBock Healthcare GmbH launched the Juvo B6, a highly customizable electric wheelchair designed for both indoor and outdoor use. The Juvo B6 offers advanced features such as programmable seating positions and robust all-terrain capabilities, catering to users with diverse mobility needs. This launch emphasizes OttoBock’s focus on innovative, user-centric designs.

Report Scope

Report Features Description Market Value (2023) USD 3.4 billion Forecast Revenue (2033) USD 9.1 billion CAGR (2024-2033) 10.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Center Wheel Drive, Standing Electric Wheelchairs, Front Wheel Drive, and Rear Wheel Drive), By Age Group (60 years & above, 21-60 years, and 20 years or less), By End-user (Hospitals & Clinics, Home Care, Sports Conditioning, and Others), By Distribution Channel (Offline (Speciality Stores, Convenience Stores, and Others) and Online (Company Websites, E-commerce, and Others)) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Sunrise Medical (U.S.) LLC, Pride Mobility Products Corp, Permobil AB, OttoBock Healthcare GmbH, Nissin Medical Industries Co., Ltd, Miki Kogyosho Co., Ltd, MEYRA GmbH, Matsunaga Manufactory Co., Ltd, Karma Medical Products Co., Ltd, and Invacare Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Electric Wheelchair Market?The Electric Wheelchair Market refers to the global industry focused on the design, manufacturing, and sales of powered wheelchairs that offer mobility solutions for individuals with physical disabilities or limited mobility.

How big is the Electric Wheelchair Market?The global Electric Wheelchair Market size was estimated at USD 3.4 Billion in 2023 and is expected to reach USD 9.1 Billion in 2033.

What is the Electric Wheelchair Market growth?The global Electric Wheelchair Market is expected to grow at a compound annual growth rate of 10.3%. From 2024 To 2033

Who are the key companies/players in the Electric Wheelchair Market?Some of the key players in the Electric Wheelchair Markets are Sunrise Medical (U.S.) LLC, Pride Mobility Products Corp, Permobil AB, OttoBock Healthcare GmbH, Nissin Medical Industries Co., Ltd, Miki Kogyosho Co., Ltd, MEYRA GmbH, Matsunaga Manufactory Co., Ltd, Karma Medical Products Co., Ltd, and Invacare Corporation.

Which regions are leading in the Electric Wheelchair market?North America dominated the market with the highest revenue share of 39.4% in 2023.

What are the main growth drivers for the Electric Wheelchair Market?Growth drivers include the increasing elderly population, rising prevalence of physical disabilities, technological advancements, and greater awareness and acceptance of electric wheelchairs.

What is the future outlook for the Electric Wheelchair Market?The market is expected to grow due to increasing demand for advanced mobility solutions, technological innovations, and expanding healthcare infrastructure globally.

-

-

- Sunrise Medical (U.S.) LLC

- Pride Mobility Products Corp

- Permobil AB

- OttoBock Healthcare GmbH

- Nissin Medical Industries Co., Ltd

- Miki Kogyosho Co., Ltd

- MEYRA GmbH

- Matsunaga Manufactory Co., Ltd

- Karma Medical Products Co., Ltd

- Invacare Corporation