Global Electric Tractor Market Size, Share, Growth Analysis By Power Source (Battery Electric, Hybrid Electric, Plug-in Hybrid Electric), By Horsepower (Less than 50 HP, 50-100 HP, 100-150 HP, More than 150 HP), By Application (Agricultural, Construction, Logistics, Mining, Others), By End Use (Farm Use, Rental Services, Commercial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 173996

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

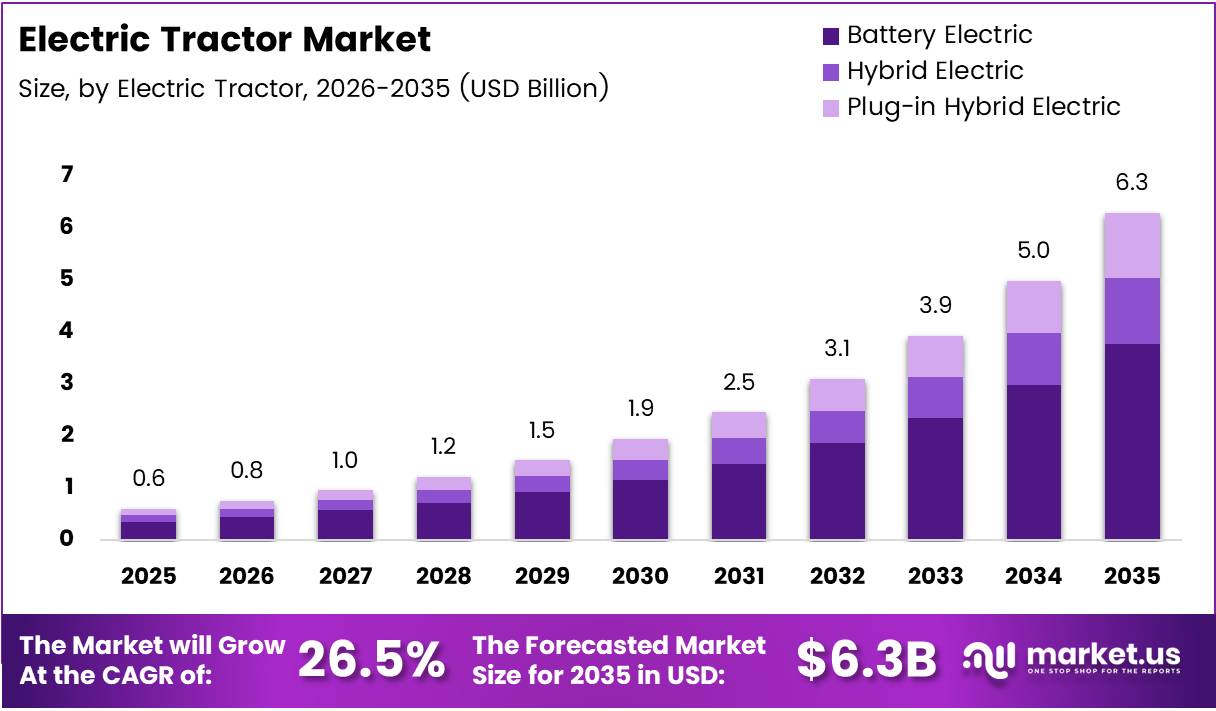

The Global Electric Tractor Market size is projected to reach approximately USD 6.7 Billion by 2035, expanding from USD 0.6 Billion in 2025. This represents a remarkable compound annual growth rate of 26.5% throughout the forecast period from 2026 to 2035.

Electric tractors represent battery-powered agricultural machinery designed to replace conventional diesel-powered farm equipment. These vehicles utilize electric motors and rechargeable battery systems to deliver mechanical power for farming operations while eliminating direct carbon emissions.

The market demonstrates substantial transformation driven by agricultural sustainability initiatives worldwide. Farmers increasingly recognize the operational cost advantages and environmental benefits associated with electric farm equipment adoption.

Government policies supporting zero-emission agricultural machinery accelerate market penetration across developed economies. Financial incentives, tax credits, and subsidies reduce the initial investment burden for early adopters seeking cleaner farming solutions.

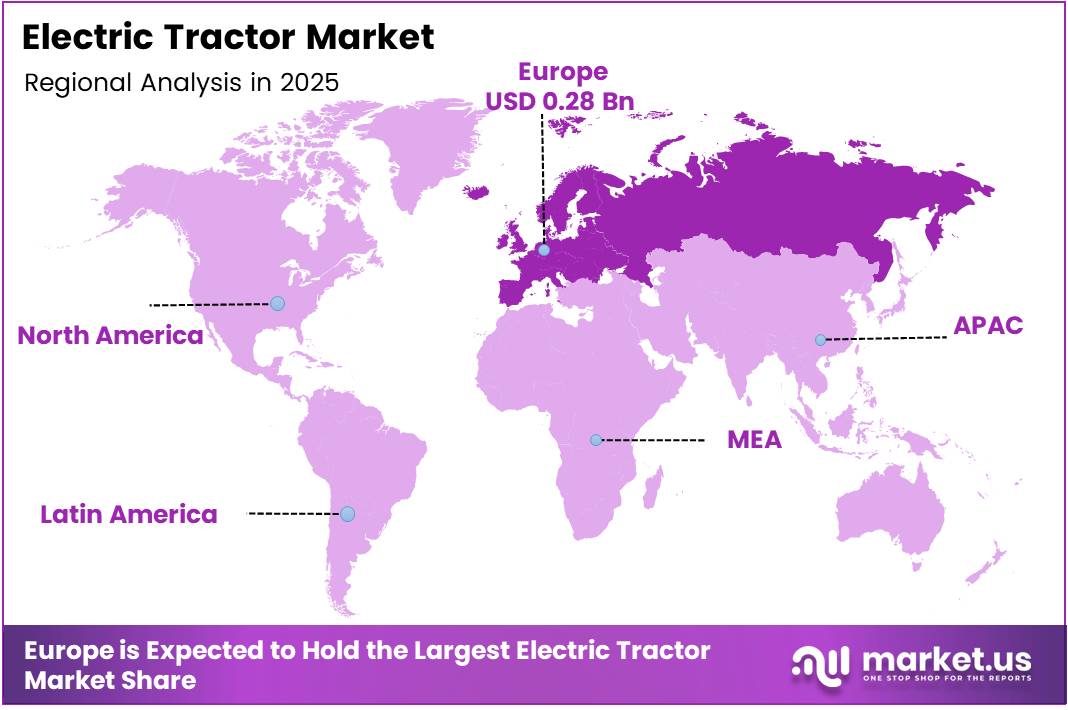

Europe currently dominates the global landscape, commanding 48.1% market share valued at USD 0.28 Billion. This regional leadership stems from stringent environmental regulations and progressive agricultural mechanization policies across European Union member states.

Battery electric configurations lead the power source segment with 67.3% market dominance. These fully electric systems offer superior efficiency and simplified maintenance compared to hybrid alternatives, attracting commercial farming operations.

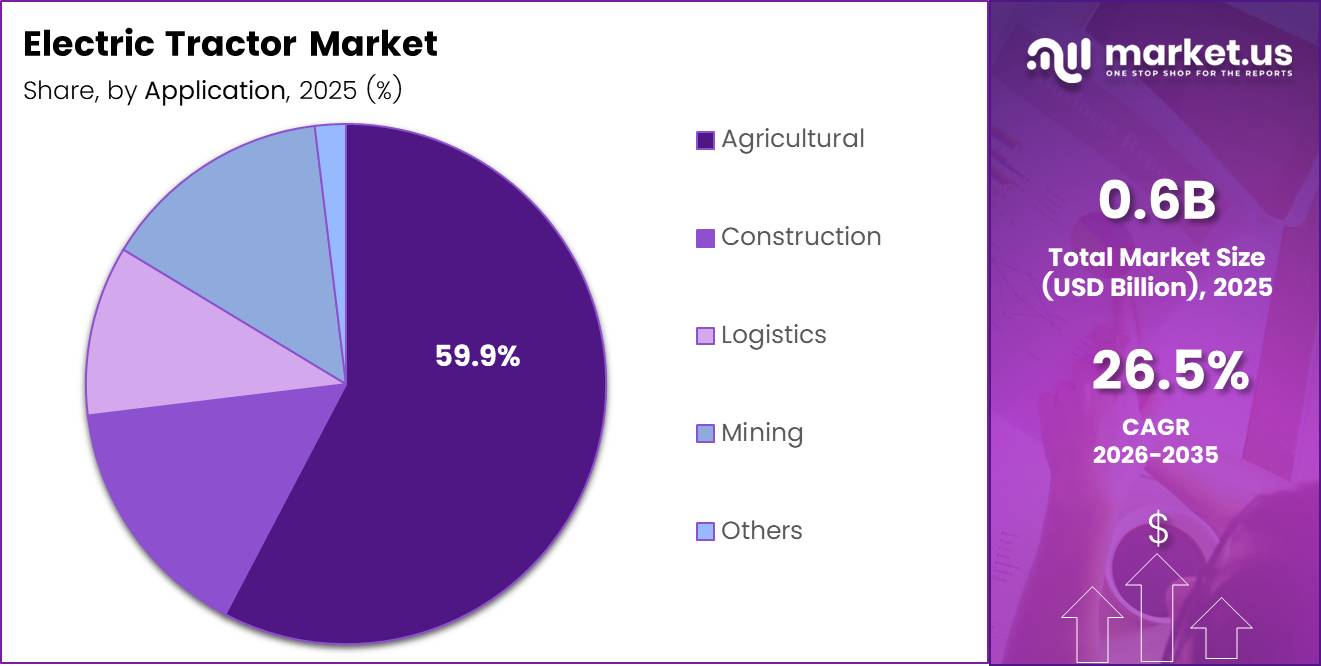

Agricultural applications represent the primary use case, capturing 59.9% of total market demand. Farm operations benefit significantly from the quiet operation, reduced vibration, and precision control capabilities inherent to electric propulsion systems.

Technological advancements in battery energy density and fast-charging infrastructure expand operational viability. Manufacturers develop swappable battery platforms enabling continuous field operations without extended downtime for recharging cycles.

The less than 50 HP segment holds 43.7% market share, reflecting strong demand for compact electric tractors. Small-scale farmers and specialty crop operations particularly favor these maneuverable units for vineyard, orchard, and greenhouse applications.

Farm use accounts for 52.8% of end-use applications as private agricultural landowners invest in electric equipment. Direct ownership models gradually gain traction alongside emerging rental and leasing service arrangements targeting cost-conscious operators.

Key Takeaways

- Global Electric Tractor Market projected to grow from USD 0.6 Billion in 2025 to USD 6.7 Billion by 2035 at 26.5% CAGR

- Europe dominates with 48.1% market share valued at USD 0.28 Billion

- Battery Electric power source leads with 67.3% market share

- Less than 50 HP segment captures 43.7% of horsepower category

- Agricultural application holds 59.9% market dominance

- Farm use represents 52.8% of end-use segment

By Power Source

Battery Electric dominates with 67.3% share due to superior efficiency and zero direct emissions.

In 2025, Battery Electric held a dominant market position in the By Power Source segment of Electric Tractor Market, with a 67.3% share. This configuration offers complete elimination of fossil fuel dependency while delivering consistent torque characteristics ideal for agricultural workloads.

Farmers appreciate the simplified maintenance requirements since battery electric systems contain fewer moving components compared to combustion engines. The absence of engine oil changes, filter replacements, and emission system servicing significantly reduces ongoing operational expenses. Additionally, overnight charging during off-peak electricity hours minimizes energy costs for farm operations with predictable daily usage patterns.

Hybrid Electric systems combine battery power with internal combustion engines to extend operational range. These configurations appeal to large-scale farming operations requiring extended field time without recharging interruptions. The dual power approach provides flexibility for diverse agricultural tasks across varying terrain conditions and workload intensities.

Plug-in Hybrid Electric tractors offer grid-charging capability alongside onboard power generation. This segment targets transitional buyers seeking electric benefits while maintaining conventional fuel backup options. Market adoption remains limited as infrastructure development and battery technology improvements favor fully electric solutions.

By Horsepower

Less than 50 HP dominates with 43.7% due to strong demand for compact tractors in specialty farming.

In 2025, Less than 50 HP held a dominant market position in the By Horsepower segment of Electric Tractor Market, with a 43.7% share. These compact units excel in vineyard operations, orchard management, and greenhouse applications where maneuverability matters significantly.

Small-scale farmers and organic producers particularly favor these tractors for sustainable farming practices requiring minimal soil compaction. The lower power category aligns perfectly with urban farming initiatives and community agricultural projects in densely populated regions. Battery capacity requirements remain manageable, enabling practical all-day operation without excessive charging infrastructure investment.

The 50-100 HP segment serves mid-sized farming operations requiring moderate pulling power for diverse implements. These tractors handle general tillage, planting, and harvesting tasks across mixed crop rotations. Commercial vegetable producers and dairy farms commonly select this horsepower range for versatile year-round utility.

100-150 HP electric tractors target larger agricultural enterprises managing extensive acreage. These machines demonstrate sufficient power for heavy tillage equipment and multiple implement operations. Adoption accelerates among progressive farmers prioritizing sustainability without compromising productivity levels.

More than 150 HP represents the premium segment addressing industrial-scale farming operations. These high-capacity units compete directly with conventional diesel tractors in demanding field conditions. Limited battery technology currently restricts widespread adoption, though technological advances continue narrowing the performance gap.

By Application

Agricultural dominates with 59.9% driven by farm mechanization and sustainability initiatives.

In 2025, Agricultural held a dominant market position in the By Application segment of Electric Tractor Market, with a 59.9% share. Farming operations benefit tremendously from reduced noise pollution, enabling early morning and late evening field work without disturbing residential neighbors.

The precision control capabilities inherent to electric motors enhance implement performance across planting, spraying, and cultivation activities. Organic certification requirements increasingly favor zero-emission equipment, accelerating electric tractor adoption among certified organic producers. Government agricultural subsidies specifically targeting clean energy farm equipment further incentivize this transition across multiple geographic markets.

Construction applications utilize electric tractors for material handling and site preparation in noise-sensitive urban development projects. These machines operate effectively in enclosed spaces where diesel exhaust presents health and safety concerns. Municipal contractors increasingly specify electric equipment for compliance with local emission regulations.

Logistics operations deploy electric tractors for yard management and trailer spotting at distribution facilities. The constant start-stop duty cycle suits electric propulsion characteristics while minimizing fuel consumption. Indoor warehouse applications particularly benefit from zero direct emissions and reduced ventilation requirements.

Mining sector adoption focuses on underground operations where diesel exhaust management poses significant operational challenges. Electric tractors eliminate ventilation costs associated with combustion engine operation in confined spaces. Surface mining applications remain limited due to extended operational range requirements.

Other applications encompass landscaping, golf course maintenance, and municipal grounds management. These niche segments value quiet operation and environmental stewardship alignment with organizational sustainability commitments.

By End Use

Farm Use dominates with 52.8% reflecting direct ownership preference among agricultural operators.

In 2025, Farm Use held a dominant market position in the By End Use segment of Electric Tractor Market, with a 52.8% share. Private farm ownership enables operators to customize equipment specifications matching specific operational requirements and crop production systems.

Direct purchase arrangements provide long-term cost predictability through reduced fuel and maintenance expenditures over equipment lifecycles. Farmers investing in electric tractors often integrate solar charging infrastructure, creating energy-independent farm operations. Tax incentives and depreciation benefits further enhance the financial attractiveness of direct ownership for established agricultural businesses.

Rental Services cater to seasonal farmers and contractors requiring temporary equipment access without capital commitment. This model reduces adoption barriers for operators testing electric technology before permanent investment decisions. Equipment rental companies diversify fleets with electric options responding to growing customer demand for sustainable alternatives.

Commercial operations include agricultural service providers performing custom fieldwork across multiple client properties. These businesses leverage electric tractors to differentiate service offerings while managing operational costs. The predictable maintenance schedules and fuel cost stability improve business planning and pricing strategies.

Other end uses encompass educational institutions, research facilities, and demonstration farms showcasing agricultural innovation. These entities prioritize technology leadership and sustainability messaging over pure economic considerations in equipment selection decisions.

Key Market Segments

By Power Source

- Battery Electric

- Hybrid Electric

- Plug-in Hybrid Electric

By Horsepower

- Less than 50 HP

- 50-100 HP

- 100-150 HP

- More than 150 HP

By Application

- Agricultural

- Construction

- Logistics

- Mining

- Others

By End Use

- Farm Use

- Rental Services

- Commercial

- Others

Drivers

Rapid Global Electrification of Agricultural Machinery Reduces Farm-Level Carbon Emissions

The agricultural sector faces mounting pressure to decrease greenhouse gas contributions as climate change concerns intensify globally. Electric tractors eliminate direct tailpipe emissions, substantially reducing the carbon footprint associated with conventional diesel-powered farm equipment operations.

Escalating diesel fuel cost volatility creates significant financial uncertainty for farming operations dependent on traditional combustion-powered machinery. Electric tractors deliver predictable energy costs through stable electricity pricing, improving operational budgeting and long-term financial planning for agricultural businesses.

Government incentives substantially accelerate zero-emission farm equipment adoption across developed agricultural markets. Financial support mechanisms including purchase subsidies, tax credits, and low-interest financing programs reduce the initial capital investment barrier preventing widespread electric tractor deployment among cost-conscious farmers.

Precision farming operations increasingly demand quiet, low-vibration equipment enabling enhanced operator comfort and improved implement control accuracy. Electric tractors inherently deliver smooth power delivery characteristics ideal for GPS-guided autonomous systems and variable-rate application technologies transforming modern agricultural production methods.

Restraints

Limited Battery Range and Charging Infrastructure Restricts Remote Agricultural Applications

Battery capacity limitations constrain operational duration for electric tractors compared to diesel alternatives that refuel rapidly in minutes. Extended charging times interrupt field operations during critical planting and harvesting windows when continuous equipment availability determines seasonal productivity outcomes.

Charging infrastructure remains underdeveloped across rural agricultural regions where farms operate far from electrical grid access points. The capital investment required for dedicated high-capacity charging stations presents a significant financial burden particularly for small and medium-sized farming operations.

High upfront capital costs position electric tractors at substantial price premiums compared to conventional diesel equivalents with similar horsepower ratings. This initial investment differential deters adoption among price-sensitive farmers despite lower long-term operational expenses, particularly impacting developing agricultural markets.

Battery replacement costs introduce long-term financial uncertainty as lithium-ion battery packs degrade over operational lifecycles. Farmers hesitate committing to electric technology without clear understanding of battery longevity and replacement expense implications affecting total ownership economics.

Growth Factors

Expanding Adoption in Specialty Crop Farming Creates New Market Opportunities

Vineyard, orchard, and specialty crop operations increasingly favor electric tractors for their compact dimensions and superior maneuverability in confined growing spaces. These agricultural segments prioritize environmental stewardship aligning perfectly with zero-emission equipment capabilities attracting premium-price conscious consumers.

Swappable battery platform development enables continuous field operations by eliminating charging downtime through rapid battery exchange systems. This technological innovation addresses the primary operational limitation preventing electric tractor adoption among large-scale farming operations requiring extended daily equipment utilization.

Organic and regenerative farming communities demonstrate strong preference for electric tractors supporting their sustainability-focused production philosophies. These farmer segments willingly invest premium pricing for equipment aligning with environmental values that differentiate their agricultural products in competitive marketplaces.

Smart farming system integration connects electric tractors with autonomous guidance technologies and precision agriculture platforms. This convergence creates comprehensive digital farming ecosystems where electric propulsion enables advanced telematics, energy management optimization, and data-driven operational efficiency improvements impossible with conventional machinery.

Emerging Trends

Battery-as-a-Service Models Transform Electric Tractor Ownership Economics

Original equipment manufacturers increasingly partner with battery suppliers offering leasing-based tractor models separating battery ownership from vehicle purchase. This arrangement reduces upfront capital requirements while transferring battery degradation risk from farmers to specialized service providers with replacement management expertise.

Compact electric tractor launches specifically target small-scale and urban farming applications expanding market accessibility beyond traditional agricultural operations. These purpose-built designs address emerging food production models including rooftop farms, community gardens, and vertical farming facilities in metropolitan areas.

Telematics-enabled energy management systems optimize electric tractor operation through real-time performance monitoring and predictive maintenance capabilities. These connected technologies maximize battery efficiency while minimizing operational costs through data-driven insights informing equipment utilization and charging strategies.

Solar-powered on-farm charging stations proliferate as farmers seek energy independence and further operational cost reductions. This infrastructure trend creates completely renewable energy farming systems where solar generation powers electric tractors, eliminating fossil fuel dependency across entire agricultural production operations.

Regional Analysis

Europe Dominates the Electric Tractor Market with 48.1% Market Share, Valued at USD 0.28 Billion

Europe commands the global electric tractor landscape with a 48.1% market share valued at USD 0.28 Billion, driven by stringent environmental regulations and substantial government subsidies supporting agricultural electrification. The European Union’s aggressive carbon neutrality targets accelerate zero-emission farm equipment adoption across member states. Progressive agricultural policies in Germany, France, and the Netherlands particularly drive electric tractor deployment through comprehensive financial incentive programs.

North America Electric Tractor Market Trends

North America demonstrates strong growth potential supported by large-scale farming operations seeking operational cost reductions and sustainability improvements. United States federal and state-level incentive programs increasingly support electric agricultural equipment purchases. Canadian provinces implement complementary policies encouraging clean technology adoption across the agricultural sector.

Asia Pacific Electric Tractor Market Trends

Asia Pacific emerges as a high-growth region with expanding mechanization across developing agricultural economies. Government initiatives in China, India, and Japan promote electric farm equipment reducing air pollution in rural areas. Small landholding patterns throughout the region favor compact electric tractor configurations suited to intensive farming operations.

Latin America Electric Tractor Market Trends

Latin America shows gradual adoption driven by export-oriented agricultural sectors emphasizing sustainability credentials for international markets. Brazilian and Argentine farming operations explore electric technology for specialty crop production. Infrastructure development remains a primary challenge limiting widespread market penetration across the region.

Middle East and Africa Electric Tractor Market Trends

Middle East and Africa represents an emerging market with limited current penetration but significant long-term potential. Government agricultural modernization programs in Gulf states explore electric equipment for controlled environment agriculture. South African commercial farms pilot electric tractors within sustainable farming initiatives targeting European export markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric Tractor Company Insights

Deere & Company maintains significant market influence through its comprehensive agricultural equipment portfolio and extensive dealer network infrastructure. The company invests substantially in electric and autonomous tractor development, leveraging decades of engineering expertise and customer relationships built serving farming communities worldwide. Their strategic approach combines battery-electric technology with precision agriculture platforms, creating integrated solutions addressing modern farming operational requirements.

Kubota Corporation expands its electric tractor offerings targeting compact and utility segments where the Japanese manufacturer holds established market positions. Their development strategy focuses on small-to-medium horsepower ranges serving specialty crop operations, vineyards, and residential agricultural applications. Kubota leverages its reputation for reliability and dealer service quality to build customer confidence in emerging electric technology adoption.

Monarch Tractor represents a specialized electric tractor manufacturer focused exclusively on sustainable agricultural equipment innovation. The company develops purpose-built electric platforms incorporating autonomous capabilities and smart farming integration from initial design stages. Their technology-forward approach attracts venture capital investment and partnerships with progressive farming operations seeking cutting-edge sustainable equipment solutions.

Fendt brings premium agricultural equipment manufacturing expertise to electric tractor development within the AGCO Corporation portfolio. The German brand emphasizes performance characteristics matching conventional diesel tractors while delivering zero-emission operation. Their engineering focus addresses range anxiety concerns through advanced battery management and optional hybrid configurations serving large-scale commercial farming operations.

Key Market Players

- Alke

- Deere & Company

- Cummins Inc.

- Escorts Limited

- Fendt

- Motivo Engineering

- Kubota Corporation

- Solectrac Inc.

- Sonalika

- Yanmar Holdings Co. Ltd.

- Monarch Tractor

- AutoNxt Automation Pvt. Ltd.

- Celestial

- EcoFactor

- Ztractor

Recent Developments

- In July 2024, Monarch Tractor announced a USD 133 million Series C funding round supporting continued product development and market expansion efforts. This substantial investment demonstrates strong venture capital confidence in electric agricultural equipment market growth potential and the company’s technological leadership position within the emerging sector.

- In April 2024, Seederal reported raising EUR 7.1 million to advance its electric tractor development initiatives and accelerate commercialization timelines. The funding enables enhanced battery technology research and expanded production capacity serving European agricultural markets seeking sustainable farming equipment solutions.

- In December 2025, Electric Tractor Maker Moonrider Raises USD 6 Million in Series A Round financing to scale manufacturing operations and strengthen distribution channels. This investment supports the company’s mission delivering affordable electric tractors targeting small and medium-sized farming operations across developing agricultural markets.

Report Scope

Report Features Description Market Value (2025) USD 0.6 Billion Forecast Revenue (2035) USD 6.7 Billion CAGR (2026-2035) 26.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Source (Battery Electric, Hybrid Electric, Plug-in Hybrid Electric), By Horsepower (Less than 50 HP, 50-100 HP, 100-150 HP, More than 150 HP), By Application (Agricultural, Construction, Logistics, Mining, Others), By End Use (Farm Use, Rental Services, Commercial, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alke, Deere & Company, Cummins Inc., Escorts Limited, Fendt, Motivo Engineering, Kubota Corporation, Solectrac Inc., Sonalika, Yanmar Holdings Co. Ltd., Monarch Tractor, AutoNxt Automation Pvt. Ltd., Celestial, EcoFactor, Ztractor Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alke

- Deere & Company

- Cummins Inc.

- Escorts Limited

- Fendt

- Motivo Engineering

- Kubota Corporation

- Solectrac Inc.

- Sonalika

- Yanmar Holdings Co. Ltd.

- Monarch Tractor

- AutoNxt Automation Pvt. Ltd.

- Celestial

- EcoFactor

- Ztractor