Global Educational Toys Market By Product Type (Motor Skills Toys, STEM Toys, Role Play Toys, Arts & Crafts, Games & Puzzles, Other Product Types), By Age Group (Below 4 Years, 4 to 8 Years, Above 8 Years), By Distribution Channel (Online Platforms, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124342

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

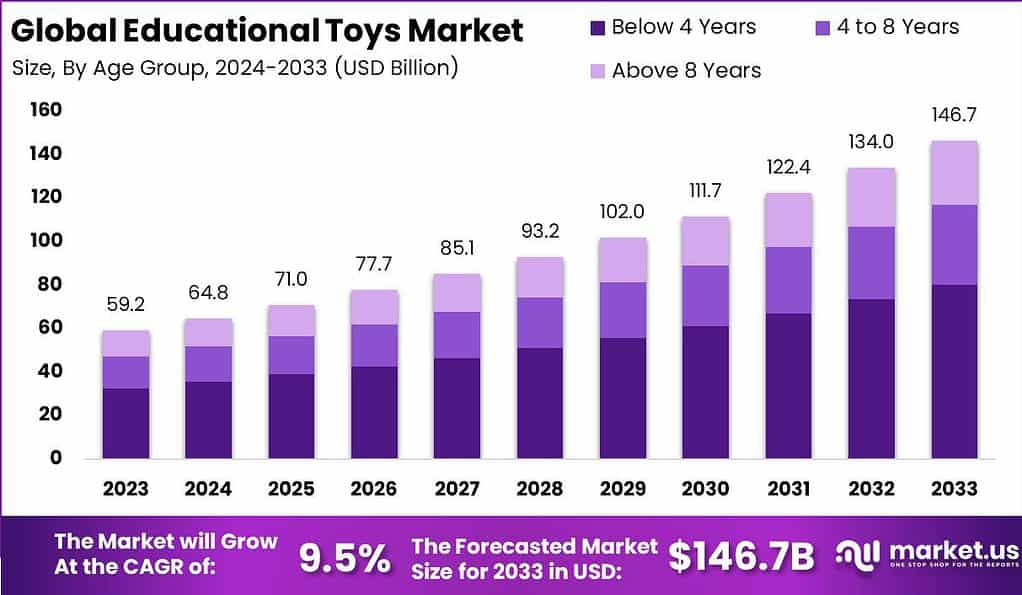

The Global Educational Toys Market size is expected to be worth around USD 146.7 Billion By 2033, from USD 59.2 Billion in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

Educational toys play a crucial role in a child’s development by promoting learning, creativity, and problem-solving skills in an engaging and interactive manner. These toys are specifically designed to stimulate cognitive, social, and physical development while providing an enjoyable play experience for children.

The educational toys market is experiencing significant growth due to increasing awareness among parents and educators about the benefits these toys offer in early childhood development. Educational toys, which include puzzles, building blocks, and interactive electronic devices, are designed to stimulate learning and cognitive development in children. This market’s expansion can be attributed to rising incomes and the growing emphasis on educational quality, allowing more families to invest in these developmental tools.

Additionally, the rise of online retail has opened up new opportunities for the educational toys market. Parents now have the convenience of exploring and purchasing toys from online platforms, expanding the market reach and allowing smaller toy manufacturers to gain visibility. This has resulted in a more competitive and diverse market landscape.

However, along with growth opportunities, the educational toys market also faces certain challenges. One of the challenges is the need for continuous innovation. Toy manufacturers must constantly develop new and engaging products to meet the evolving demands of children and parents. Additionally, there is a growing focus on incorporating sustainable materials and eco-friendly practices, presenting both a challenge and an opportunity for the industry.

Despite these challenges, the educational toys market holds immense potential. Advancements in technology have opened doors for interactive toys that integrate augmented reality, virtual reality, and artificial intelligence, providing children with immersive learning experiences. These technological advancements present exciting opportunities for further growth and innovation in the market.

According to a survey conducted by the Toy Association in 2023, a substantial 94% of parents acknowledged the significant role of toys in their child’s development. Additionally, 91% emphasized the importance of educational toys in fostering their child’s learning and overall growth.

China plays a pivotal role in the global toy manufacturing landscape, hosting an astounding 90% of toy factories worldwide. This concentration highlights China’s integral position in the supply chain, influencing production capabilities and logistics for the global market.

Simultaneously, the United States emerges as a significant market player, heavily reliant on imports to satisfy its toy demand. Approximately 97% of toys sold in the U.S. are imported, underscoring the country’s dependence on international markets, particularly China, for meeting consumer needs.

Additionally, the U.S. game, doll, and toy manufacturing sector itself is valued at $2 billion, indicating a robust domestic industry despite the high volume of imports. This valuation reflects the industry’s capacity to generate revenue and sustain employment, contributing to economic activities within the specialty manufacturing sector.

Meanwhile, the U.S. market demonstrates significant demand, with imports accounting for approximately 97% of domestic toy consumption. The U.S. toy industry contributes around USD 98.2 billion annually to the national economy, with online sales businesses numbering over 21,200. In the U.K., the revenue for the Toys & Games market is expected to reach approximately USD 5.5 billion in 2024.

Key Takeaways

- The Global Educational Toys Market size is expected to be worth around USD 146.7 Billion by 2033, increasing from USD 59.2 Billion in 2023, with a CAGR of 9.5% during the forecast period from 2024 to 2033.

- In 2023, the Motor Skills Toys segment held a dominant position in the Educational Toys Market, capturing more than a 27.1% share.

- In 2023, the Below 4 Years segment held a dominant market position in the Educational Toys Market, capturing more than a 54.8% share.

- In 2023, the Offline Stores segment held a dominant position in the Educational Toys Market, capturing more than a 64.4% share.

- In 2023, North America held a dominant market position in the Educational Toys Market, capturing more than a 36.5% share, with revenues reaching USD 21.6 Billion.

Product Type Analysis

In 2023, the Motor Skills Toys segment held a dominant position in the Educational Toys Market, capturing more than a 27.1% share. This leading status can be attributed to the critical role these toys play in early childhood development. Motor Skills Toys, which include items like building blocks, puzzles, and threading beads, are essential for enhancing fine and gross motor skills in young children.

These toys help in the development of hand-eye coordination, dexterity, and even problem-solving abilities, making them a fundamental component of early education. Parents and educators prioritize these toys because they serve as foundational tools that support children’s physical and cognitive growth, preparing them for more complex tasks and learning. The demand for Motor Skills Toys has been further amplified by increasing awareness among parents about the importance of developmental milestones in their children’s growth trajectory.

Additionally, educational systems across the globe are emphasizing experiential learning, where Motor Skills Toys play a pivotal role, thereby bolstering their market dominance. The leadership of the Motor Skills Toys segment is also reinforced by innovations and product enhancements that make these toys more appealing and effective as educational tools.

Manufacturers are continuously integrating materials that are safer and more durable, alongside designs that are both educational and engaging. This focus on quality and educational value appeals to modern parents who are looking for toys that offer more than just entertainment, ensuring the segment’s continued growth and prominence in the educational toys market.

Age Group Analysis

In 2023, the Below 4 Years segment held a dominant market position in the Educational Toys Market, capturing more than a 54.8% share. This segment’s leadership is largely due to the critical developmental milestones that occur in early childhood.

Toys designed for children under four years old focus on basic motor skills, sensory experiences, and fundamental cognitive skills like color recognition, shape sorting, and basic problem-solving. These toys are essential tools that parents and educators use to stimulate early brain development and physical coordination.

The high demand in this age group is also driven by the heightened awareness among parents and caregivers about the importance of early childhood education. As research continues to underscore the long-term benefits of educational play in the formative years, more consumers are investing in quality educational toys that support this critical phase of development.

The trend towards educational products that contribute positively to a child’s growth trajectory is particularly strong among new parents, who are often eager to provide the best start for their children’s educational journeys. Furthermore, manufacturers are increasingly focusing on this segment by creating safe, durable, and engaging toys that cater to the developmental needs of infants and toddlers.

These products often incorporate vibrant colors, varied textures, and sounds that capture the attention of young children while also encouraging exploration and learning. This strategic focus by toy manufacturers not only meets consumer demand but also reinforces the Below 4 Years segment’s leading position in the educational toys market.

Distribution Channel Analysis

In 2023, the Offline Stores segment held a dominant position in the Educational Toys Market, capturing more than a 64.4% share. This substantial market share can be attributed to several key factors that favor physical retail outlets over online platforms.

Primarily, consumers appreciate the tactile experience offered by offline stores, where they can physically interact with products before making a purchase. This is particularly significant in the educational toys sector, as parents and guardians prefer to assess the quality, educational value, and safety of toys firsthand.

Moreover, offline stores provide instant gratification, a crucial factor in purchasing decisions, especially during peak shopping seasons like holidays and back-to-school periods. The ability to immediately obtain a product without waiting for delivery appeals to many shoppers. Additionally, offline stores often have knowledgeable staff available to assist customers in selecting products that are age-appropriate and meet educational objectives, enhancing the consumer experience and building trust.

Despite the growing trend of digital shopping, the Offline Stores segment continues to lead due to these personalized shopping experiences. Consumers’ desire for a hands-on approach to selecting educational tools for children underscores the importance of offline channels in the distribution of educational toys. The segment’s success also reflects broader retail trends where consumer preferences for direct product engagement and expert advice remain strong.

Key Market Segment

Product Type

- Motor Skills Toys

- STEM Toys

- Role Play Toys

- Arts & Crafts

- Games & Puzzles

- Other Product Types

Age Group

- Below 4 Years

- 4 to 8 Years

- Above 8 Years

Distribution Channel

- Online Platforms

- Offline Stores

Driver

Increasing Focus on STEM Education

The demand for educational toys that emphasize STEM (Science, Technology, Engineering, and Mathematics) concepts is a significant driver in the market. This demand is propelled by a broader recognition of the importance of these skills for future educational and career success.

Parents and educators are increasingly selecting toys that facilitate the development of critical thinking, problem-solving, and technology skills from an early age. The growing emphasis on STEM education is reflected in the expanding variety of toys designed to introduce complex concepts in engaging and interactive ways. This trend is expected to continue driving the market as STEM skills remain a priority in educational curricula globally.

Restraint

Safety Concerns and Regulatory Challenges

Safety concerns and stringent regulations pose significant restraints to the educational toys market. Manufacturers face challenges related to compliance with safety standards, which can vary significantly between regions and are frequently updated to ensure child safety.

These regulations cover aspects such as the use of non-toxic materials, the absence of sharp edges, and the durability of toys to withstand regular use by children. The necessity to comply with these regulations increases production costs and complexity, potentially limiting the speed and flexibility with which new toys can be introduced to the market.

Opportunity

Advancements in Technology and Interactive Toys

Technological advancements present substantial opportunities within the educational toys market. The integration of technology in toys has led to the creation of more engaging and interactive learning experiences.

Smart toys, which often include features such as voice recognition, connectivity to apps, and interactive content, are increasingly popular. These toys not only entertain children but also provide educational value, such as language learning, math skills, and cognitive development. As technology continues to evolve, the potential for new and innovative educational toys grows, providing significant market opportunities.

Challenge

Competition from Digital Media and Electronic Devices

One of the major challenges facing the educational toys market is the competition from digital media and electronic devices, such as tablets and smartphones. With the increasing screen time among children, toys that do not incorporate digital elements may struggle to capture the attention of this young audience.

Moreover, many educational apps and online platforms offer interactive and engaging learning experiences without the need for physical toys. This shift poses a challenge for traditional toy manufacturers to innovate and remain relevant in a rapidly changing market landscape where digital engagement is highly valued.

Growth Factors

- Emphasis on Early Childhood Education: There is an increasing global emphasis on the importance of early childhood education. Parents and educators are investing in educational toys that contribute to cognitive development, literacy, and numeracy skills from a young age. This shift towards educational priorities over pure entertainment is driving the market.

- Technological Integration: The integration of technology into educational toys is becoming more prevalent. Toys that include interactive elements such as electronic features, connectivity to apps, and augmented reality are becoming increasingly popular, offering dynamic learning experiences that engage children more effectively than traditional toys.

- Rise in Disposable Income: Economic growth and the rise in disposable incomes, especially in developing countries, allow more families to invest in educational toys. As parents seek the best resources for their children’s development, the demand for quality educational toys increases, contributing to market growth.

- Parental Awareness about Developmental Benefits: Increasing awareness among parents about the developmental benefits of educational toys is driving demand. Parents are more informed about how certain types of toys contribute to the development of specific skills such as problem-solving, creativity, and social interaction.

- Customization and Personalization: The trend towards customized and personalized toys is growing. Educational toys that can be tailored to the individual learning pace and style of a child are particularly appealing, as they offer a more personal learning experience that can adapt to the child’s developmental stages.

Emerging Trends

- Eco-friendly Toys: There is a growing trend towards sustainable and eco-friendly toys, driven by consumer demand for products made from non-toxic, recyclable, or biodegradable materials. This trend is not only seen as better for the environment but also safer for children.

- Inclusive and Diverse Toys: The market is seeing a rise in toys that promote inclusivity and diversity, such as toys that include different cultures, languages, and abilities. This helps children learn acceptance and understanding of diversity at a young age.

- Focus on STEM and Coding Toys: STEM (Science, Technology, Engineering, and Mathematics) toys continue to be a strong trend, with an added emphasis on coding toys. These toys are designed to foster interest in technology and engineering from an early age, preparing children for the digital age.

- Subscription and Rental Services: Subscription-based models and toy rental services are becoming more popular. These services allow parents to provide their children with a variety of educational toys without a significant upfront investment and contribute to a more sustainable approach by reducing waste.

- Integration of AI and Machine Learning: Advanced technologies like AI and machine learning are being integrated into educational toys to make them more interactive. These toys can adapt to a child’s learning level and provide customized educational experiences, making learning more effective and engaging.

Regional Analysis

In 2023, North America held a dominant market position in the Educational Toys Market, capturing more than a 36.5% share, with revenues reaching USD 21.6 billion. This leadership is primarily due to the high consumer spending on educational development tools combined with a strong awareness of the benefits of educational toys in child development.

The region’s robust economic status allows for significant discretionary spending on educational products, which supports the high sales volumes seen in this market segment. Additionally, North America benefits from a well-established retail infrastructure, both online and offline, which ensures wide accessibility and availability of a diverse range of educational toys.

This is complemented by aggressive marketing and extensive distribution channels that cover vast geographic and demographic segments. The presence of major market players in the U.S. and Canada, who are continually innovating and expanding their product offerings, also significantly contributes to the market’s growth.

Moreover, the emphasis on STEM (Science, Technology, Engineering, and Mathematics) education in the North American school curricula has propelled the demand for educational toys that support these subjects. This educational policy shift has led to a growing market for toys that promote problem-solving and cognitive skills, further solidifying North America’s leading position in the global educational toys market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Educational Toys Market is dominated by several key players, each of whom has contributed significantly through strategic mergers, acquisitions, and new product launches. LEGO Group, a leading figure in this sector, has continually expanded its educational portfolio with innovative products that encourage creative building and learning. Mattel, Inc., renowned for its iconic brands, recently launched a new line of STEM toys under its Fisher-Price label, aiming to merge play with educational development from an early age.

Hasbro, Inc. has also been active, acquiring smaller companies to broaden its educational toy offerings, emphasizing interactive and tech-driven solutions for engaging learning experiences. VTech Holdings Limited remains a significant player with its consistent introduction of electronic learning products that combine play with educational content, particularly in early childhood development.

Melissa & Doug, LLC, known for its wooden toys and craft items, continues to focus on products that foster creativity and cognitive skills. In a recent move, Spin Master Corp. expanded its portfolio by acquiring a company specializing in educational games, which complements its existing product lines and enhances its market reach.

Top Key Players in the Market

- LEGO Group

- Mattel, Inc.

- Hasbro, Inc.

- VTech Holdings Limited

- Melissa & Doug, LLC

- Spin Master Corp.

- Sphero, Inc.

- Ravensburger AG

- MindWare, Inc.

- LeapFrog Enterprises, Inc.

- Other Key Players

Recent Developments

- April 2023: Mattel announced the release of new interactive educational toys under their Fisher-Price brand, focusing on STEM learning for toddlers.

- November 2023: Mattel launched a range of Barbie dolls featuring new professions and STEM-related accessories to promote educational play.

- January 2023: Melissa & Doug introduced a new series of puzzles and educational games aimed at preschoolers, enhancing fine motor skills and cognitive development.

- March 2023: Spin Master released the Rubik’s Perplexus Fusion, combining the classic Rubik’s Cube with the Perplexus maze game to challenge problem-solving skills.

- February 2023: MindWare launched a new line of brain teaser games designed to improve cognitive skills and critical thinking in children.

Report Scope

Report Features Description Market Value (2023) USD 59.2 Bn Forecast Revenue (2033) USD 146.7 Bn CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Motor Skills Toys, STEM Toys, Role Play Toys, Arts & Crafts, Games & Puzzles, Other Product Types), By Age Group (Below 4 Years, 4 to 8 Years, Above 8 Years), By Distribution Channel (Online Platforms, Offline Stores) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape LEGO Group, Mattel Inc., Hasbro Inc., VTech Holdings Limited, Melissa & Doug LLC, Spin Master Corp., Sphero Inc., Ravensburger AG, MindWare Inc., LeapFrog Enterprises Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are educational toys?Educational toys are products designed to stimulate learning through play. They aim to develop various skills such as cognitive, motor, social, and emotional abilities in children. These toys range from puzzles, building blocks, and board games to electronic gadgets and interactive tools.

How big is Educational Toys Market?The Global Educational Toys Market size is expected to be worth around USD 146.7 Billion By 2033, from USD 59.2 Billion in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Educational Toys Market?The growth is driven by increasing awareness of the benefits of early childhood education, the rising demand for STEM (science, technology, engineering, and mathematics) toys, the influence of educational policies, and growing parental emphasis on skill development through play.

What are the current trends and advancements in the Educational Toys Market?Current trends include the integration of technology in toys, such as AI and augmented reality, the popularity of eco-friendly and sustainable toys, the rise of subscription-based toy services, and the increasing focus on personalized learning experiences through educational toys.

What are the major challenges and opportunities in the Educational Toys Market?Challenges include high competition, safety concerns, and regulatory compliance. Opportunities lie in developing innovative and interactive toys, expanding into emerging markets, and leveraging digital platforms to enhance the educational value of toys.

Who are the leading players in the Educational Toys Market?Leading players include companies like LEGO Group, Mattel Inc., Hasbro Inc., VTech Holdings Limited, Melissa & Doug LLC, Spin Master Corp., Sphero Inc., Ravensburger AG, MindWare Inc., LeapFrog Enterprises Inc., Other Key Players

-

-

- LEGO Group

- Mattel, Inc.

- Hasbro, Inc.

- VTech Holdings Limited

- Melissa & Doug, LLC

- Spin Master Corp.

- Sphero, Inc.

- Ravensburger AG

- MindWare, Inc.

- LeapFrog Enterprises, Inc.

- Other Key Players