Global eCommerce Payments Market By Component (Payment Gateway Solutions, Payment Processing Services, Security & Fraud Management, Others), By Payment Method (Card Payments, Digital Wallets, Bank Transfers, Buy Now Pay Later, Others), By End-User (Large Enterprises, Small & Medium Businesses, Individual Merchants),By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan.2026

- Report ID: 174914

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Global Adoption and Usage Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Payment Method Analysis

- End-User Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future outlook

- Recent Developments

- Report Scope

Report Overview

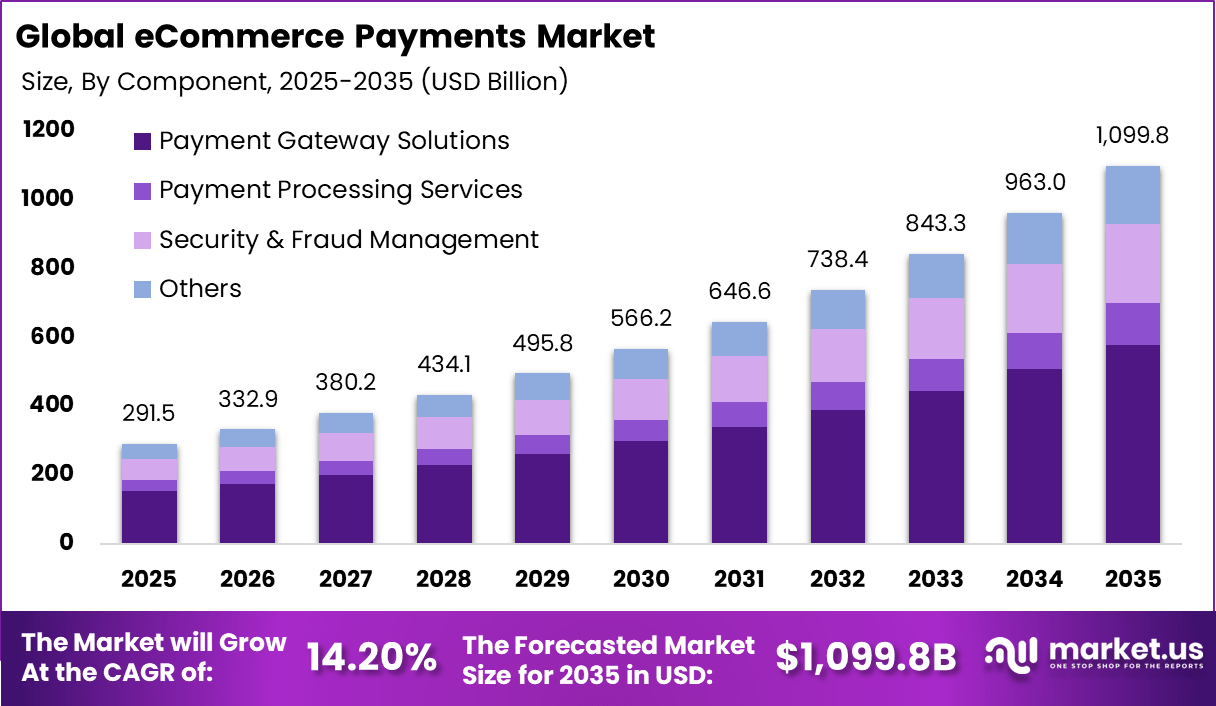

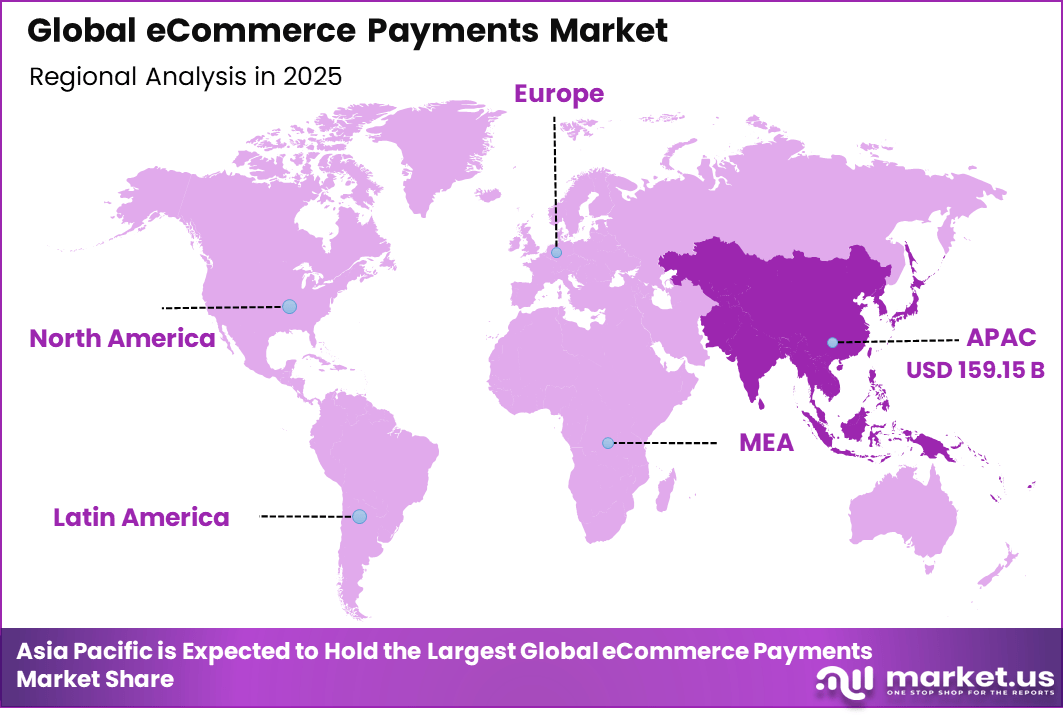

The Global eCommerce Payments Market generated USD 291.5 billion in 2025 and is predicted to register growth from USD 332.9 billion in 2026 to about USD 1,099.8 billion by 2035, recording a CAGR of 14.20% throughout the forecast span. In 2025, Asia Pacific held a dominan market position, capturing more than a 54.6% share, holding USD 159.15 Billion revenue.

The eCommerce payments market encompasses all digital systems and services that enable customers to pay for goods and services online using the internet. These systems include payment gateways, card processing, digital wallets, bank transfers, and other digital mechanisms that facilitate secure transactions between buyers and sellers in online settings.

This market underpins the entire online shopping experience by offering a way to move money and data electronically when a purchase is made through websites or mobile apps. It has become essential as eCommerce itself has grown to be a fundamental channel for global retail activity, transforming how consumers shop and how businesses transact.

The market is defined by diverse payment options that reflect changes in consumer behaviour, including increased use of mobile devices and digital tools for shopping and payments. In addition to traditional card payments, modern eCommerce payments include digital wallets, mobile initiated payments, and alternative methods that enhance convenience and reach.

One of the strongest drivers of the eCommerce payments market is the rising penetration of smartphones and internet connectivity across regions. Consumers increasingly prefer shopping from mobile devices, and mobile-optimized payment solutions make it easier to complete purchases seamlessly on smaller screens. This shift in behaviour requires payment systems to support mobile wallets and quick checkout experiences that reduce friction and improve conversion rates for merchants.

Demand in the eCommerce payments market is shaped by the need for speed, convenience, and security at checkout. Customers are less likely to complete a purchase if the payment process is slow, confusing, or perceived as insecure, which drives businesses to adopt streamlined and trustworthy payment solutions. Reliable transaction processing and real-time confirmations contribute to a smoother user experience that can increase customer satisfaction and loyalty.

Top Market Takeaways

- By component, payment processing services led the eCommerce payments market with 52.7% share, handling transactions securely with fraud detection and multi-currency support.

- By payment method, digital wallets captured 48.3%, popular for one-click checkouts, mobile convenience, and growing adoption in emerging markets.

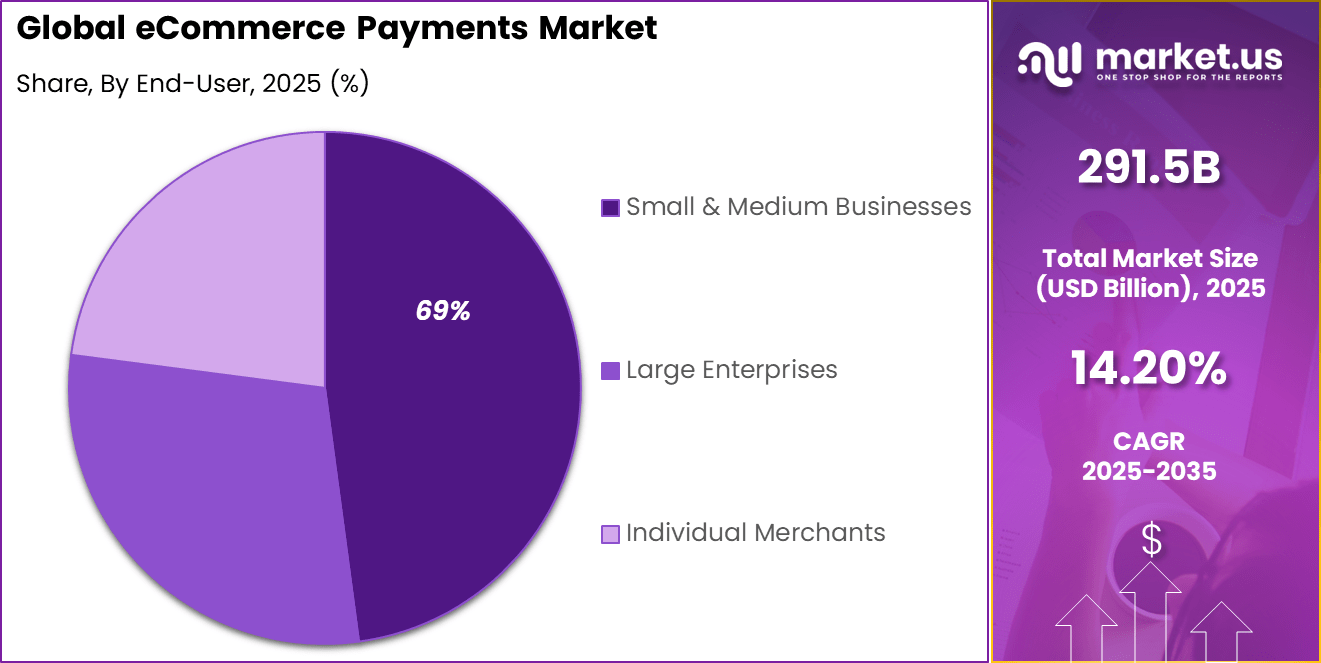

- By end-user, small and medium businesses dominated at 68.9%, benefiting from affordable gateways and easy integration with online stores.

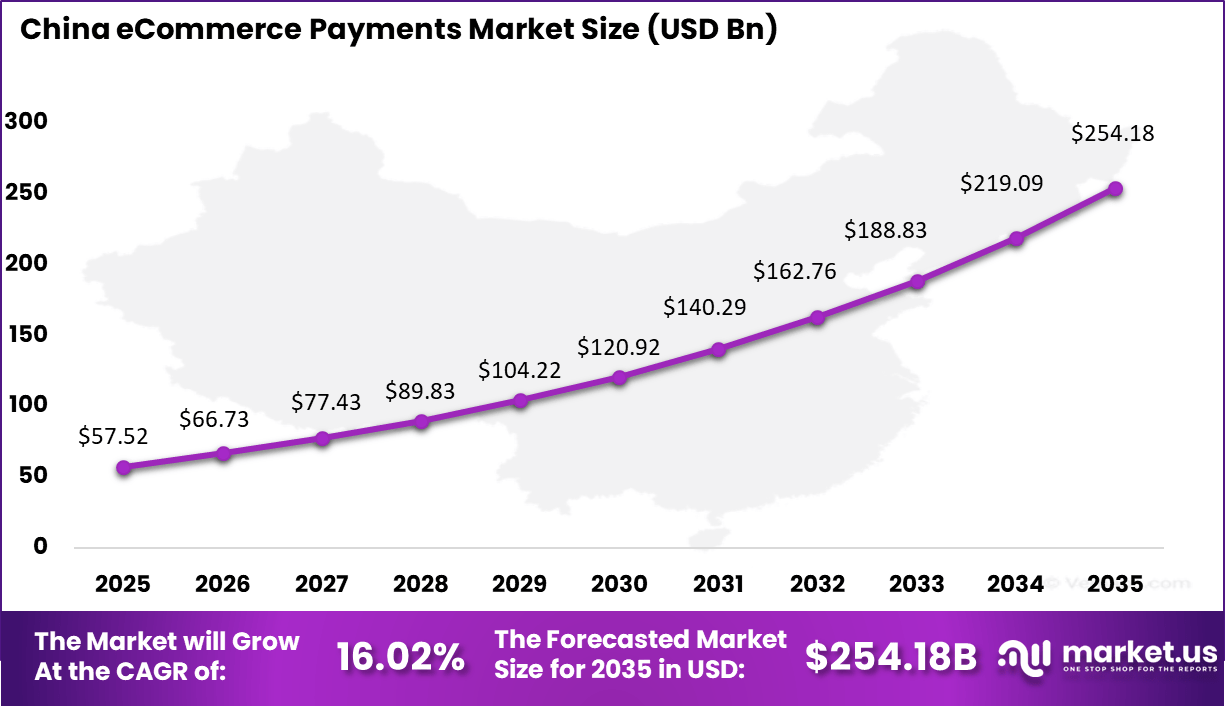

- Asia-Pacific held 54.6% of the global market, with China valued at USD 57.52 billion and growing at a CAGR of 16.02%.

Global Adoption and Usage Statistics

Digital Wallets

- Digital wallets are the leading payment method for online purchases, driven by speed and ease of use.

- More than 4.3 billion people used digital payments in 2024, representing over half of the global population, with usage expected to exceed 5.3 billion by 2026.

- Digital wallets accounted for around 50% of global e commerce transaction value in 2023–2024.

- In physical stores, digital wallets represented about 32% of point of sale transactions in 2024.

- Adoption is highest among Gen Z (around 79%) and Millennials (around 67%).

Credit and Debit Cards

- Credit and debit cards remain widely used, though their direct share is declining as they are increasingly stored within digital wallets.

- In 2023, credit cards captured around 22% of global e commerce value, while debit cards accounted for about 12%.

- In markets such as India, debit card usage has declined as consumers shift to real time payment systems for low value transactions.

- Credit cards continue to be preferred for higher value purchases.

Real Time Payments (RTPs)

- Real time payment systems are reshaping digital payments by enabling instant settlement and continuous availability.

- Global real time transaction volumes increased by 42.2% in 2023.

- In India, UPI accounts for around 83% of total digital payment volume.

- In Brazil, the Pix system is projected to represent 51% of e commerce transactions by 2027.

Buy Now, Pay Later (BNPL)

- BNPL is gaining popularity as an entry level credit option, particularly among younger consumers.

- BNPL accounted for about 5% of global e commerce transactions in 2023.

- Global BNPL payment value is projected to exceed USD 560 billion by the end of 2025.

Key Consumer Trends

- Mobile devices generate nearly 78% of retail website traffic, and mobile commerce is expected to account for almost 60% of online sales by 2026.

- Consumers are 165% more likely to use digital wallets than other online payment methods due to speed and convenience, which also reduces friction in spending decisions.

- Increased digital payment usage has raised focus on security, with wider adoption of AI based fraud detection and biometric authentication to address nearly USD 48 billion in annual e commerce fraud losses.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rapid growth of online retail and mobile commerce +5.7% Asia Pacific, North America Short to medium term Expansion of digital wallets and real time payment methods +5.1% Asia Pacific, Europe Medium term Increasing cross border eCommerce transactions +4.6% Asia Pacific, Europe, North America Medium to long term Rising smartphone penetration and internet access +4.0% Asia Pacific, Latin America, Africa Short term Growth of subscription based and digital services commerce +3.4% Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Payment fraud and cybersecurity risks -3.2% Global Short to medium term Regulatory complexity across countries and payment systems -2.7% Europe, Asia Pacific Medium term High transaction fees for merchants -2.3% Emerging markets Medium term Limited interoperability among payment platforms -1.9% Global Medium to long term Dependence on consumer spending cycles -1.5% Global Long term Component Analysis

Payment processing services account for 52.7%, highlighting their central role in eCommerce transactions. These services handle authorization, settlement, and transaction routing. Reliable processing ensures smooth checkout experiences for customers. Speed and accuracy reduce payment failures and disputes. Security remains a critical requirement for merchants.

The dominance of payment processing services is driven by rising online transaction volumes. Merchants depend on stable infrastructure to manage peak demand. Integrated processing simplifies reconciliation and reporting. Automation reduces operational overhead. This sustains strong demand for payment processing services.

Payment Method Analysis

Digital wallets represent 48.3%, making them the leading payment method. Wallets enable fast and convenient payments without repeated data entry. Consumers prefer mobile-friendly options for online purchases. Tokenization improves transaction security. Ease of use supports higher conversion rates.

Growth in digital wallets is driven by smartphone penetration. Consumers adopt contactless and app-based payments widely. Wallets support multiple funding sources. Cross-border usability improves reach. This keeps digital wallets widely adopted.

End-User Analysis

Small and medium businesses account for 68.9%, making them the largest end-user group. These businesses rely on eCommerce to expand market access. Payment platforms simplify acceptance of multiple methods. Affordable pricing supports adoption. Reliability remains essential for daily operations.

Adoption among small and medium businesses is driven by digital storefront growth. Easy onboarding reduces technical barriers. Integrated payments improve cash flow visibility. Automation supports scalability. This sustains strong usage by smaller merchants.

Key Reasons for Adoption

- Online shopping activity is increasing across consumer and business segments

- Customers expect fast, secure, and convenient payment options at checkout

- Merchants need payment systems that support multiple digital channels

- Cashless transaction preferences are growing across global markets

- Cross-border commerce requires reliable and scalable payment solutions

Benefits

- Checkout experience is improved through smooth and quick payment processing

- Transaction security is strengthened with fraud prevention measures

- Payment acceptance flexibility is increased across methods and regions

- Revenue collection efficiency is improved for online merchants

- Customer trust is enhanced through reliable payment performance

Usage

- Used by online retailers to process customer payments

- Applied in marketplaces to manage multi-seller transactions

- Deployed in subscription-based platforms for recurring payments

- Utilized in digital services for instant payment confirmation

- Integrated with eCommerce platforms for end-to-end transaction management

Emerging Trends

Key Trend Description Buy Now Pay Later integration Interest-free installments at checkout boost conversions. Embedded wallet solutions One-click payments across merchant platforms. Real-time payment networks Instant settlements reduce fraud exposure. Biometric authentication Fingerprint and facial recognition for seamless security. Crypto payment gateways Stablecoins enable borderless transactions. Growth Factors

Key Factors Description Global eCommerce expansion Emerging markets drive payment infrastructure needs. Mobile commerce dominance Smartphone shopping demands optimized methods. Cart abandonment reduction Frictionless options lift completion rates. Cross-border trade growth Localized methods support international sales. Regulatory fintech support Open banking accelerates innovation. Key Market Segments

By Component

- Payment Gateway Solutions

- Payment Processing Services

- Security & Fraud Management

- Others

By Payment Method

- Card Payments

- Digital Wallets

- Bank Transfers

- Buy Now Pay Later

- Others

By End-User

- Large Enterprises

- Small & Medium Businesses

- Individual Merchants

Regional Analysis

Asia Pacific accounted for 54.6% share, supported by rapid growth of online retail, widespread smartphone usage, and strong adoption of digital payment methods across the region. Consumers have increasingly relied on mobile wallets, QR based payments, and real time bank transfers for eCommerce transactions.

Demand has been driven by high transaction volumes, expanding middle class populations, and strong participation of small and medium online merchants. The region’s diverse payment ecosystem has enabled flexible checkout options, improving conversion rates and customer convenience.

China reached a market value of USD 57.52 Bn and is projected to grow at a 16.02% CAGR, reflecting the country’s highly developed digital commerce and payment environment. Online shopping platforms and super apps have driven high frequency digital transactions, with consumers showing strong preference for cashless payments. The scale of China’s eCommerce ecosystem has created continuous demand for fast, reliable, and low cost payment processing solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Expansion of Online Shopping and Diverse Payment Options

The rapid expansion of online shopping has driven growth in the eCommerce payments market. As consumers increasingly prefer to purchase products and services through digital platforms, merchants have responded by integrating more payment options such as digital wallets, real-time bank transfers, and open banking solutions. These advancements have improved convenience and trust in online payments, making it easier for customers to complete purchases without friction.

Growth in mobile commerce has also contributed to this trend. Buyers are using smartphones and apps to shop and pay, which encourages payment providers to innovate and offer secure and seamless transaction methods. The focus on reducing checkout friction has led to broader acceptance of newer payment technologies that support global retail and cross-border transactions.

Restraint Analysis

Regulatory Compliance and Security Complexities

Regulatory compliance remains a restraint on the development of the eCommerce payments market. Payment service providers must adhere to a complex set of data protection and financial rules that vary by region and country. These regulations require extensive investment in systems and procedures to monitor transactions, protect consumer data, and prevent fraud. Compliance efforts often slow down product launches and raise operational costs for businesses.

Security expectations from both businesses and consumers add further complexity. Merchants and payment platforms must deploy advanced fraud detection tools and verification protocols, which can be costly and technically demanding. Maintaining compliance and robust security can strain resources, particularly for smaller enterprises seeking to expand their online payment capabilities.

Opportunity Analysis

Adoption of Real-Time and Account-to-Account Payments

The rise of real-time settlement systems and account-to-account payments presents a significant opportunity for eCommerce payment growth. These payment methods offer faster transaction processing, improved transparency, and reduced costs compared to traditional card-based systems. Merchants benefit from near-instant order confirmation and settlement, which enhances the shopping experience and strengthens customer trust.

Open banking and direct bank transfer solutions have gained traction in key markets, enabling retailers to diversify checkout options. Real-time and bank-integrated payments allow businesses to reduce dependence on card rails and lower transaction fees. This shift also supports global expansion by allowing merchants to tailor payment options for local markets and consumer preferences.

Challenge Analysis

Integration and Technology Adaptation Across Platforms

One of the main challenges for the eCommerce payments market is the technical integration of multiple payment systems and platforms. Merchants often operate across regions with differing payment expectations and infrastructure standards. Aligning these varied systems while maintaining a seamless and secure checkout experience demands substantial development effort and coordination with payment service providers.

Another challenge is consumer adaptation to newer payment technologies. While digital wallets and alternative payment methods are gaining popularity, many consumers remain accustomed to traditional card payments. Encouraging adoption of innovative payment options requires education, incentives, and trust-building, particularly in markets where legacy systems and consumer habits are deeply entrenched.

Competitive Analysis

Global payment platforms such as PayPal, Stripe, and Adyen hold strong positions in the eCommerce payments market. Their solutions support multi-currency transactions, fraud detection, and seamless checkout experiences. Advanced APIs and developer-friendly tools enable fast integration for online merchants. These players benefit from global merchant reach and strong compliance frameworks. Demand is driven by rising cross-border eCommerce transactions and the need for secure digital payments.

Digital wallet and platform-based providers such as Amazon Pay, Apple Pay, and Google Pay focus on convenience and faster checkout. Their strength lies in large consumer ecosystems and tokenized payment security. Square supports small and mid-sized businesses with omnichannel payment tools. These solutions improve conversion rates and reduce cart abandonment. Adoption is supported by increasing mobile commerce and contactless payment usage.

Card networks and payment infrastructure providers such as Visa, Mastercard, and Fiserv form the backbone of eCommerce transactions. Worldpay, Authorize.Net, Braintree, and Razorpay expand regional and merchant-specific coverage. Other players increase competition and innovation. This landscape supports scalable, secure, and flexible eCommerce payment ecosystems worldwide.

Top Key Players in the Market

- PayPal

- Stripe

- Square

- Adyen

- Amazon Pay

- Apple Pay

- Google Pay

- Visa

- Mastercard

- Fiserv

- Worldpay

- Authorize.Net

- 2Checkout

- Braintree

- Razorpay

- Others

Future outlook

Growth in the eCommerce Payments market is expected to remain strong as online shopping continues to expand across regions and categories. Consumers are using digital wallets, cards, and alternative payment methods for faster and more secure transactions.

Rising mobile commerce and cross border online sales are supporting steady demand for flexible payment solutions. Over time, better fraud detection, smoother checkout experiences, and local payment options are likely to improve conversion rates and customer trust.

Recent Developments

- In 2026, PayPal grabbed headlines by agreeing to acquire Cymbio in January, aiming to supercharge AI-driven shopping experiences through agentic commerce. This move positions them deeper into platforms like Microsoft Copilot, with the deal expected to close by mid-year. It builds on their push for smarter, personalized checkouts in eCommerce.

- In 2026, Square, now under Block, rolled out native Bitcoin payments using the Lightning Network, announced at Bitcoin 2025 with full rollout planned this year. This targets crypto-savvy merchants expanding online sales. Small businesses get a seamless way to accept digital currencies alongside traditional payments.

Report Scope

Report Features Description Market Value (2025) USD 291.5 Bn Forecast Revenue (2035) USD 1,099.8 Bn CAGR(2025-2035) 14.20% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Payment Gateway Solutions, Payment Processing Services, Security & Fraud Management, Others), By Payment Method (Card Payments, Digital Wallets, Bank Transfers, Buy Now Pay Later, Others), By End-User (Large Enterprises, Small & Medium Businesses, Individual Merchants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PayPal, Stripe, Square, Adyen, Amazon Pay, Apple Pay, Google Pay, Visa, Mastercard, Fiserv, Worldpay, Authorize.Net, 2Checkout, Braintree, Razorpay, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PayPal

- Stripe

- Square

- Adyen

- Amazon Pay

- Apple Pay

- Google Pay

- Visa

- Mastercard

- Fiserv

- Worldpay

- Authorize.Net

- 2Checkout

- Braintree

- Razorpay

- Others