Global Ebb and Flow System Market Size, Share and Report Analysis By System Type (Flood Table Systems, Bucket Systems, Modular Systems), By Application (Commercial Greenhouses, Vertical Farms, Nurseries And Propagation, Research Facilities, Home/Hobby Growing), By Crop Type (Leafy Greens, Herbs, Fruiting Vegetables, Flowers and Ornamentals, Cannabis and Hemp, Microgreens and Sprouts) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178393

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

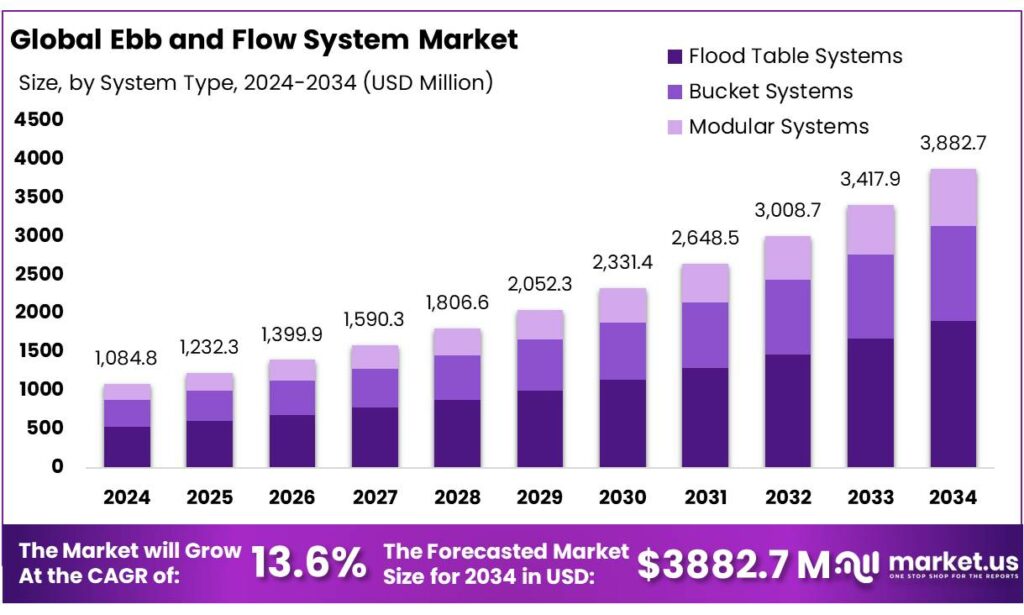

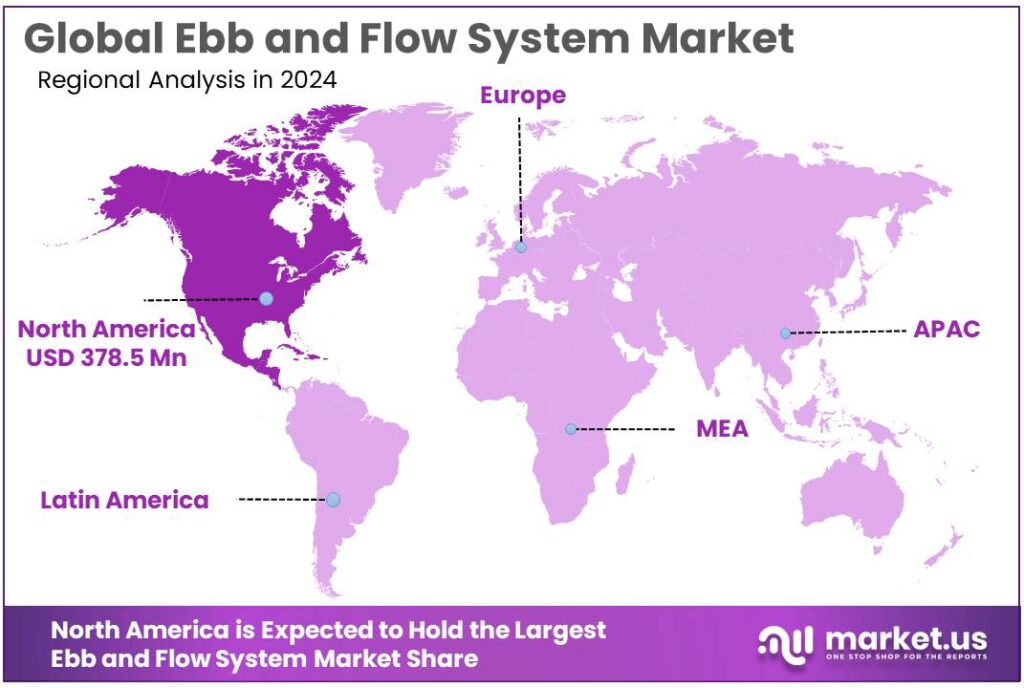

The Global Ebb and Flow System Market is expected to be worth around USD 3882.7 Million by 2034, up from USD 1048.8 Million in 2024, and is projected to grow at a CAGR of 13.6%, from 2025 to 2034. North America accounted for 34.9%, reaching USD 378.5 Mn.

Ebb and Flow is a recirculating hydroponic method where a grow bed is periodically flooded with nutrient solution and then drained back into a reservoir. In commercial settings, it is used for leafy greens, herbs, and nursery starts because it can support fast root oxygenation (during drain cycles), simple nutrient management, and modular scaling across racks or benches.

From an industrial standpoint, ebb and flow systems sit inside the broader controlled-environment and protected-cropping value chain, supplying consistent vegetables close to consumption centers. In the EU alone, fresh-vegetable harvested production reached 63.5 million tonnes in 2024, indicating the scale of downstream demand that protected cultivation and hydroponics increasingly serve. The sector’s economics are also supported by the high value of fresh produce: the EU fruit-and-vegetable sector accounted for 12.6% of total EU agricultural production in 2023.

Key demand drivers are closely tied to resource constraints and supply-chain expectations. Water stress is a structural catalyst: agriculture accounts for about 70% of freshwater withdrawals worldwide, putting a premium on production models that improve water productivity through recirculation and controlled dosing. A second driver is the push for shorter, more resilient local food channels and urban cultivation. In the United States, USDA support for urban and innovative production has included targeted grantmaking; for example, USDA reported $5.2 million invested in 17 Urban Agriculture and Innovative Production grants.

- Government initiatives and institutional support are also reinforcing adoption. In the U.S., USDA announced $14.4 million in grants and technical assistance for urban agriculture and innovative production, including $2.5 million for UAIP competitive grants, building on $53.7 million invested in UAIP grant projects since 2020; this funding environment helps de-risk start-up and community-scale controlled-environment builds where hydroponic benches and flood tables are common.

Key Takeaways

- Ebb and Flow System Market is expected to be worth around USD 3882.7 Million by 2034, up from USD 1048.8 Million in 2024, and is projected to grow at a CAGR of 13.6%.

- Flood Table Systems held a dominant market position, capturing more than a 49.6% share.

- Commercial Greenhouses held a dominant market position, capturing more than a 41.8% share.

- Energy Storage System held a dominant market position, capturing more than a 38.5% share.

- North America dominated the Ebb and Flow System market, holding 34.9% share and reaching USD 378.5 Mn.

By System Type Analysis

Flood Table Systems lead with 49.6% share driven by operational simplicity and scalable hydroponic adoption

In 2024, Flood Table Systems held a dominant market position, capturing more than a 49.6% share. This leadership reflects their practical design, cost efficiency, and ease of integration within commercial hydroponic setups. Flood tables are widely preferred by greenhouse operators and indoor growers because they allow uniform nutrient distribution across multiple plants at once, while supporting efficient drainage and reuse of solution. Their simple pump-and-timer mechanism reduces technical complexity, making them suitable for both mid-scale growers and expanding vertical farming units.

By Application Analysis

Commercial Greenhouses dominate with 41.8% share supported by rising controlled cultivation demand

In 2024, Commercial Greenhouses held a dominant market position, capturing more than a 41.8% share. This strong position is mainly linked to the growing shift toward protected cultivation and year-round crop production. Commercial greenhouse operators prefer ebb and flow systems because they offer uniform irrigation, better nutrient control, and efficient water reuse within structured growing environments. The flood-and-drain approach fits well into bench-based greenhouse layouts, allowing growers to manage large plant volumes with consistent moisture levels while minimizing manual labor.

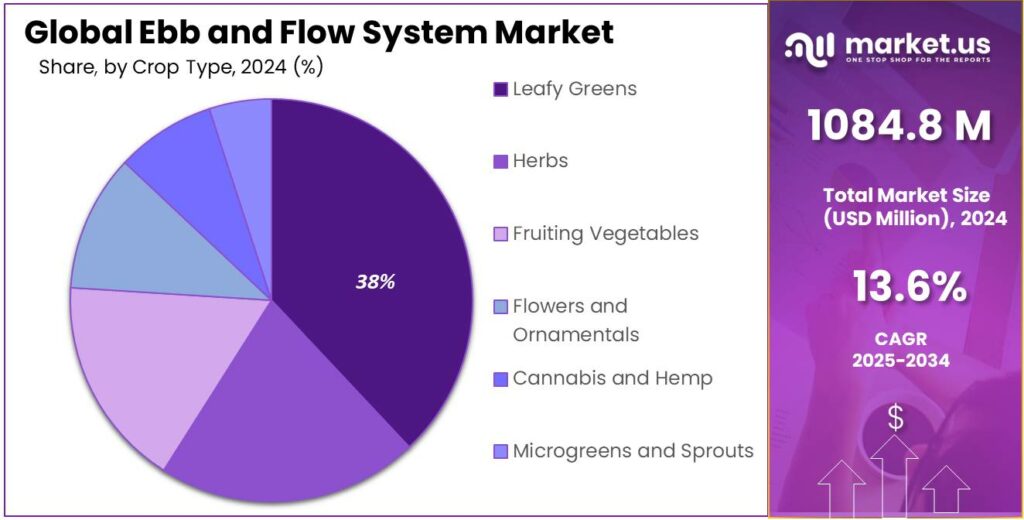

By Crop Type Analysis

Leafy Greens lead with 38.5% share driven by fast growth cycles and steady demand

In 2024, Energy Storage System held a dominant market position, capturing more than a 38.5% share. Within the Ebb and Flow System market by crop type, leafy greens represent the leading cultivation category due to their short growth cycles, high turnover rates, and consistent year-round consumption. Crops such as lettuce, spinach, and arugula respond well to controlled irrigation patterns, making flood-and-drain systems highly suitable. The periodic flooding ensures even nutrient absorption, while proper drainage prevents root diseases, which is critical for delicate leafy varieties.

Key Market Segments

By System Type

- Flood Table Systems

- Bucket Systems

- Modular Systems

By Application

- Commercial Greenhouses

- Vertical Farms

- Nurseries & Propagation

- Research Facilities

- Home/Hobby Growing

By Crop Type

- Leafy Greens

- Herbs

- Fruiting Vegetables

- Flowers and Ornamentals

- Cannabis and Hemp

- Microgreens and Sprouts

Emerging Trends

Automation And Data-Driven Irrigation Control Is Becoming The New Standard

A clear latest trend around the Ebb and Flow System is the move from “timer-only” flooding to automation with routine data checks—especially in controlled environment agriculture (CEA) sites that want repeatable quality with fewer labor surprises. In practical terms, operators are pairing flood-and-drain tables with simple digital practices: scheduled irrigation cycles, consistent reservoir management, and frequent tracking of nutrient solution stability.

Industry-scale CEA growth is one of the strongest signals supporting this shift. USDA’s Economic Research Service reports that the number of individual CEA operations more than doubled to nearly 3,000 between 2009 and 2019, and that the quantity of crop production increased by 56%, from 502 million pounds to 786 million pounds over the same period.

Water pressure is also nudging the trend toward better measurement and reuse, which naturally fits recirculating ebb-and-flow setups. The UN World Water Development Report’s statistics page notes that agriculture accounts for roughly 70% of freshwater withdrawals worldwide. FAO repeats the same scale, stating agriculture accounts for 70% of freshwater withdrawals worldwide.

Government support is another reason this trend is sticking. USDA announced $14.4 million (January 8, 2025) in grants and technical assistance to support urban agriculture and innovative production, including $2.5 million for UAIP competitive grants, building on $53.7 million invested in UAIP grant projects since 2020.

Drivers

Water efficiency is the biggest growth driver as agriculture faces rising water stress

Water scarcity and the push to use water more efficiently is one major driving factor for the Ebb and Flow System. In day-to-day farming and greenhouse operations, irrigation is where water losses happen fastest, so growers are steadily moving toward systems that reuse water instead of letting it run off.

Ebb and flow works on a simple loop—nutrient solution floods the root zone, then drains back into a reservoir—so the same water can be used again with better control. That matters because agriculture is still the largest user of freshwater: FAO notes that agriculture accounts for 70% of freshwater withdrawals worldwide, which puts constant pressure on producers to reduce water waste while keeping yields stable.

This pressure is not just a “farm problem”; it is now a supply-chain risk for food production. The UN World Water Development Report 2024 (Statistics) also highlights that worldwide, agriculture accounts for roughly 70% of freshwater withdrawals, reinforcing that irrigation efficiency is one of the most direct levers available to protect food output under tightening water conditions.

Government programs are also reinforcing this water-efficiency shift by supporting controlled and innovative production models where recirculating irrigation is common. For example, USDA announced it would provide $14.4 million in grants and technical assistance to support urban agriculture and innovative production, including $2.5 million made available for UAIP competitive grants, building on $53.7 million invested in UAIP grant projects since 2020.

Restraints

High initial infrastructure and compliance costs limit wider adoption

One major restraining factor for the Ebb and Flow System is the high initial infrastructure and compliance cost required to set up a reliable, commercial-scale operation. While the system is efficient once installed, growers must invest in flood tables, pumps, reservoirs, timers, plumbing lines, growing benches, and often greenhouse structures or indoor controlled facilities. For small and medium-sized growers, this upfront cost can be a significant barrier, especially when compared to traditional soil-based cultivation that may require lower initial equipment spending.

The broader cost environment in agriculture adds further pressure. According to the United States Department of Agriculture (USDA) Economic Research Service, total farm production expenses in the United States reached $455.1 billion in 2023, reflecting sustained high input costs across labor, energy, fertilizer, and equipment categories. Elevated operational expenses make growers more cautious about taking on new capital investments such as hydroponic irrigation infrastructure.

Energy cost exposure is another component. Ebb and flow systems depend on electric pumps and, in many cases, climate-controlled greenhouses. The U.S. Energy Information Administration (EIA) reported that the average retail electricity price for the commercial sector in 2023 was 12.83 cents per kilowatt-hour, with rates higher in certain regions. For growers operating multiple irrigation cycles daily, energy consumption becomes an ongoing operational cost layered on top of initial installation expenses.

Water quality compliance can also add cost. Recirculating systems require careful nutrient monitoring and sanitation to prevent pathogen spread across crops. The Food and Agriculture Organization (FAO) has highlighted that agriculture accounts for 70% of global freshwater withdrawals, and water management regulations are tightening in several regions due to sustainability concerns.

Opportunity

Urban controlled farming is a clear growth opportunity for ebb-and-flow systems, backed by public support and rising production

A major growth opportunity for the Ebb and Flow System is the steady expansion of controlled environment agriculture (CEA)—especially urban agriculture, greenhouses, and indoor farms that need repeatable irrigation with strong water control. Ebb-and-flow benches and flood tables fit this model because they are easy to scale in modules, work well with standardized grow trays, and support consistent watering cycles without constant hand irrigation.

The opportunity is getting stronger as water and land pressure push more production into protected spaces. Globally, agriculture still accounts for roughly 70% of freshwater withdrawals, so systems that can recirculate and tightly manage irrigation become more attractive to commercial operators trying to stabilize costs and reduce waste.

On the industry side, the U.S. offers a clear signal that CEA is moving from niche to mainstream production. USDA’s Economic Research Service reported that the number of individual CEA operations more than doubled to nearly 3,000 between 2009 and 2019, and that crop output in those systems rose 56%, from 502 million pounds to 786 million pounds over the same period.

This is important for ebb-and-flow adoption because many of these operations focus on standardized, repeatable crop cycles where flood-and-drain systems reduce labor variability. USDA also notes that about 60% to 70% of crops grown in CEA systems in 2009 and 2019 were tomatoes, lettuce, and cucumbers, crops that often rely on consistent moisture delivery and uniform root-zone management—conditions that ebb-and-flow layouts can support well in bench-based production.

Government initiatives are adding fuel to this opportunity by lowering barriers for new urban and innovative growers. USDA announced it would provide $14.4 million (January 8, 2025) in grants and technical assistance to support urban agriculture and innovative production, including $2.5 million made available for UAIP competitive grants, building on $53.7 million invested in UAIP grant projects since 2020.

Longer-term food demand also supports the opportunity for controlled systems that can produce consistently near consumers. FAO has projected that feeding the world in 2050 would require raising overall food production by some 70% between 2005/07 and 2050.

Regional Insights

North America leads at 34.9% share, valued at USD 378.5 Mn, supported by strong CEA scale-up

In 2024, North America dominated the Ebb and Flow System market, holding 34.9% share and reaching USD 378.5 Mn, helped by the region’s mature commercial greenhouse base and fast adoption of controlled growing methods that favor repeatable flood-and-drain irrigation.

The U.S. market benefits from the steady expansion of controlled environment agriculture (CEA): USDA’s Economic Research Service reports that the number of individual CEA operations more than doubled to nearly 3,000 between 2009 and 2019, while the quantity of crop production rose 56%, increasing from 502 million pounds to 786 million pounds—a scale shift that naturally increases demand for standardized irrigation systems used on benches and trays.

In parallel, USDA highlights that about 60% to 70% of crops produced in CEA systems in 2009 and 2019 were tomatoes, lettuce, and cucumbers, and notes that hydroponic systems were the most common method of cultivation, supporting strong underlying demand for recirculating irrigation hardware across high-volume crops.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Growing Innovations is commonly associated with greenhouse control hardware used alongside ebb-and-flow benches, especially where growers want stable CO₂ and repeatable day/night control. One widely listed GI CO₂ monitor/controller is adjustable from 0 to 2,000 ppm, uses a light sensor to switch modes automatically, and comes with an external sensor on a 3-meter cable—practical numbers for commercial rooms where the controller can’t sit next to the crop. These “small” specs matter because they reduce manual checks and keep crop zones consistent.

Netafim operates as Orbia’s Precision Agriculture business (brand: Netafim). In 2024, Orbia reported net revenues of $7,506 million, and stated that Precision Agriculture represented 13% of sales that year—showing how meaningful irrigation and fertigation-related hardware remains inside a diversified industrial group. Netafim’s positioning is also tied to its “systems + services + digital” approach, which aligns well with ebb-and-flow projects that demand repeatable irrigation cycles and nutrient consistency at facility scale.

Autogrow is known for nutrient and pH automation that complements ebb-and-flow operations by keeping recipes steady between flood cycles. Bluelab (which acquired Autogrow) highlighted experience built over 30 years, and Autogrow’s IntelliDose documentation lists concrete control limits: dosing up to 9 outputs, nutrient measurement range up to 9.99 EC, 0–7000 ppm, pH range 2–12 pH, and dosing times from 1 second to 30 minutes—the kind of quantified control that reduces drift in commercial grow rooms.

Top Key Players Outlook

- Growing Innovations, Inc.

- Netafim Ltd.

- Rivulis Irrigation Ltd.

- Priva Holding B.V.

- Autogrow Systems Ltd.

- Argus Control Systems Ltd.

- Certhon Group

- GGS Structures Inc

- Prospiant Inc.

- Growlink Inc.

Recent Industry Developments

In 2024, Rivulis reported significant measurable impact through its sustainability reporting, with products helping growers save 1.48 billion cubic meters of water, conserve 162 million kWh of energy, avoid 1.23 million tons of CO₂ emissions, and reduce 740,000 tons of fertilizer use, demonstrating the real value of its irrigation solutions in practical production contexts.

In 2025, Netafim Ltd launched sustainability initiatives like the carbon credit program in Turkey covering over 1,000 hectares, aimed at reducing at least 3.5 tons of CO₂e per hectare per year by combining precision irrigation with regenerative practices.

Report Scope

Report Features Description Market Value (2024) USD 1084.8 Mn Forecast Revenue (2034) USD 3882.7 Mn CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Flood Table Systems, Bucket Systems, Modular Systems), By Application (Commercial Greenhouses, Vertical Farms, Nurseries And Propagation, Research Facilities, Home/Hobby Growing), By Crop Type (Leafy Greens, Herbs, Fruiting Vegetables, Flowers and Ornamentals, Cannabis and Hemp, Microgreens and Sprouts) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Growing Innovations, Inc., Netafim Ltd., Rivulis Irrigation Ltd., Priva Holding B.V., Autogrow Systems Ltd., Argus Control Systems Ltd., Certhon Group, GGS Structures Inc, Prospiant Inc., Growlink Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Growing Innovations, Inc.

- Netafim Ltd.

- Rivulis Irrigation Ltd.

- Priva Holding B.V.

- Autogrow Systems Ltd.

- Argus Control Systems Ltd.

- Certhon Group

- GGS Structures Inc

- Prospiant Inc.

- Growlink Inc.