Global Earmuffs Market Size, Share, Growth Analysis By Type (Standard Headband Style Earmuffs, Wrap-around Earmuffs), By Function (Noise-Reduction, Stay Warm), By End User (Adults, Kids), By Distribution Channel (Hypermarket/Supermarket, Direct Sales, Wholesalers/Distributors, Specialty Stores, Online Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174324

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

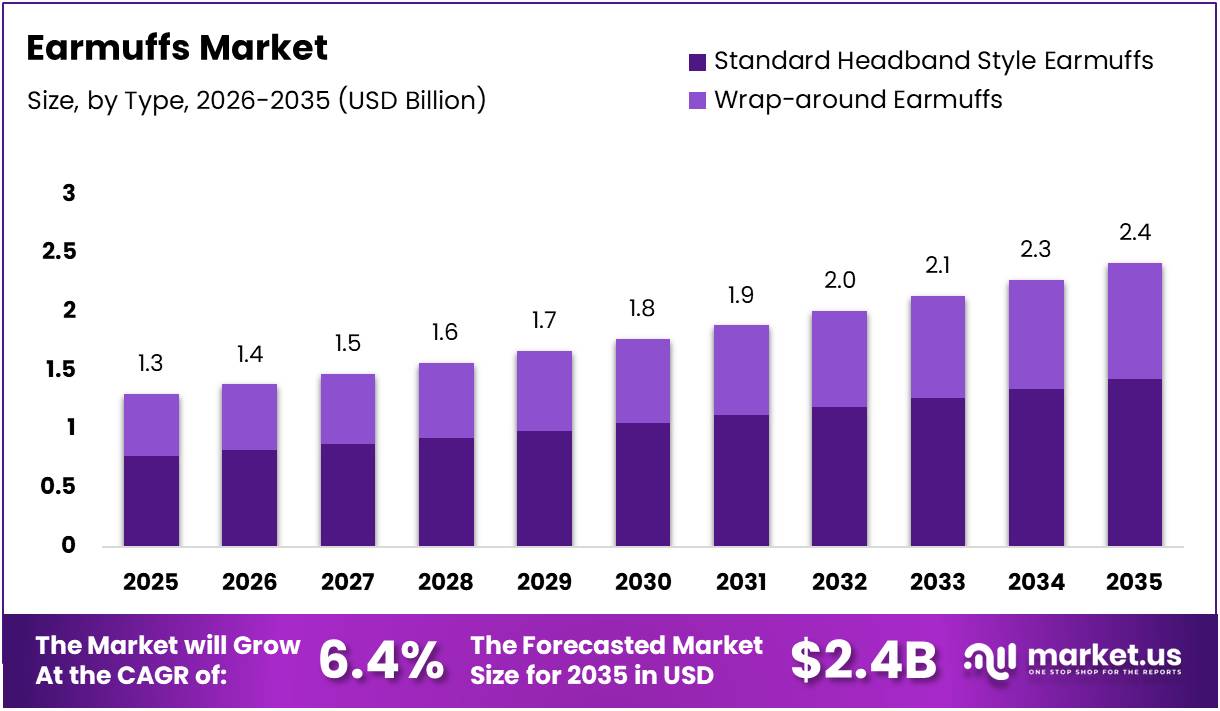

The Global Earmuffs Market size is expected to be worth around USD 2.4 Billion by 2035, from USD 1.3 Billion in 2025, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

The earmuffs market encompasses protective headwear designed to shield ears from extreme cold, loud noise, and hazardous sound environments. These devices serve dual purposes across industrial safety applications and winter weather protection. Manufacturers focus on developing comfortable, durable products that meet stringent safety standards while addressing diverse consumer needs globally.

Market growth accelerates as workplace safety regulations tighten worldwide, driving demand for reliable hearing protection equipment. Industries including construction, manufacturing, aviation, and mining increasingly mandate earmuff usage for employee safety. Furthermore, rising awareness about noise-induced hearing loss propels adoption rates across professional and recreational settings, creating substantial expansion opportunities.

Government agencies worldwide invest heavily in occupational health programs, strengthening regulatory frameworks governing workplace noise exposure limits. These initiatives compel employers to provide adequate hearing protection, subsequently boosting market demand. Additionally, evolving safety standards require manufacturers to innovate continuously, enhancing product performance while maintaining cost-effectiveness for widespread industrial deployment.

The market presents significant opportunities through technological advancements integrating smart features like Bluetooth connectivity and active noise cancellation. Meanwhile, growing outdoor recreation participation during winter months expands the consumer segment beyond industrial applications. Manufacturers leverage these trends by developing multifunctional designs that appeal to broader demographics seeking comfort and protection.

Consumer acceptance strengthens as product comfort levels improve significantly through ergonomic innovations and advanced materials. According research, earmuffs were rated comfortable by 50-90% of subjects in usability studies, demonstrating high satisfaction rates. Moreover, adoption statistics reveal that 66.8 percent of adults aged 20 to 69 years used hearing protection devices including earmuffs when exposed to loud sounds, highlighting widespread recognition of hearing conservation importance.

Key Takeaways

- Global Earmuffs Market size is projected to reach USD 2.4 Billion by 2035 from USD 1.3 Billion in 2025, growing at a CAGR of 6.4%.

- Standard Headband Style Earmuffs dominated the By Type segment with a 59.3% market share in 2025.

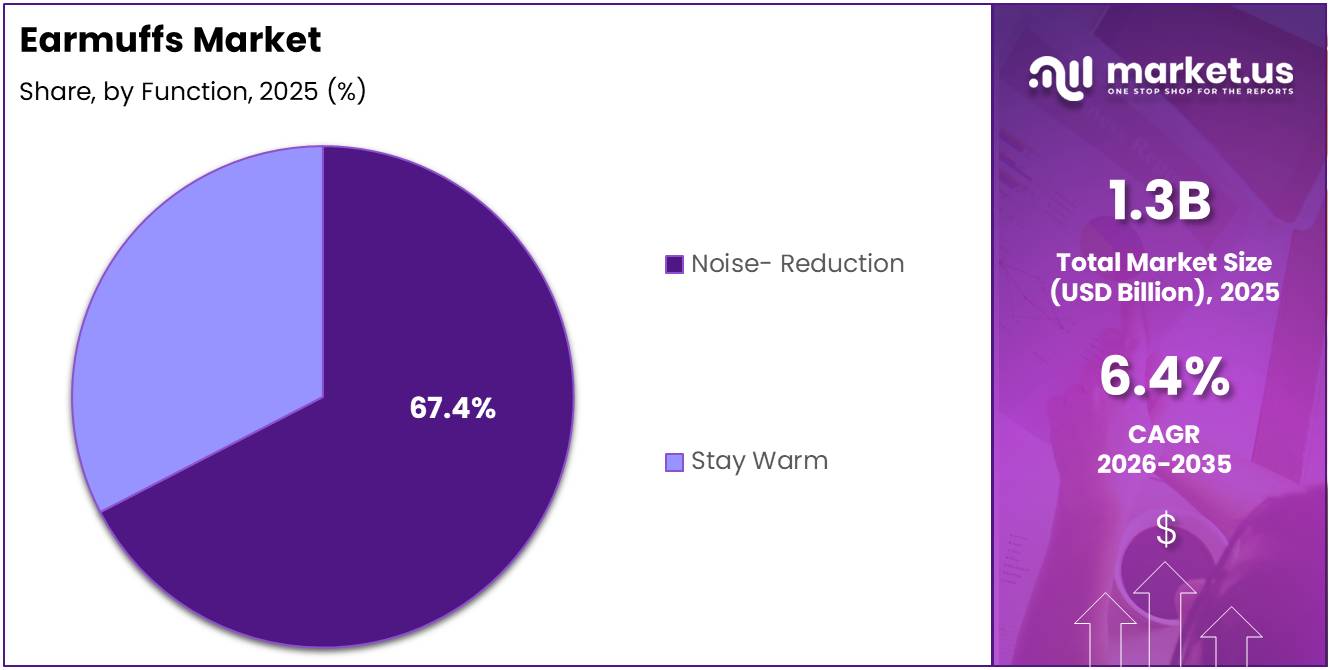

- Noise-Reduction earmuffs led the By Function segment with a 67.4% share, mainly used in industrial and construction sectors.

- Adults dominated the By End User segment with a 76.2% share, driven by occupational safety and lifestyle needs.

- Hypermarket/Supermarket was the leading distribution channel with a 31.7% share, offering convenience and wide accessibility.

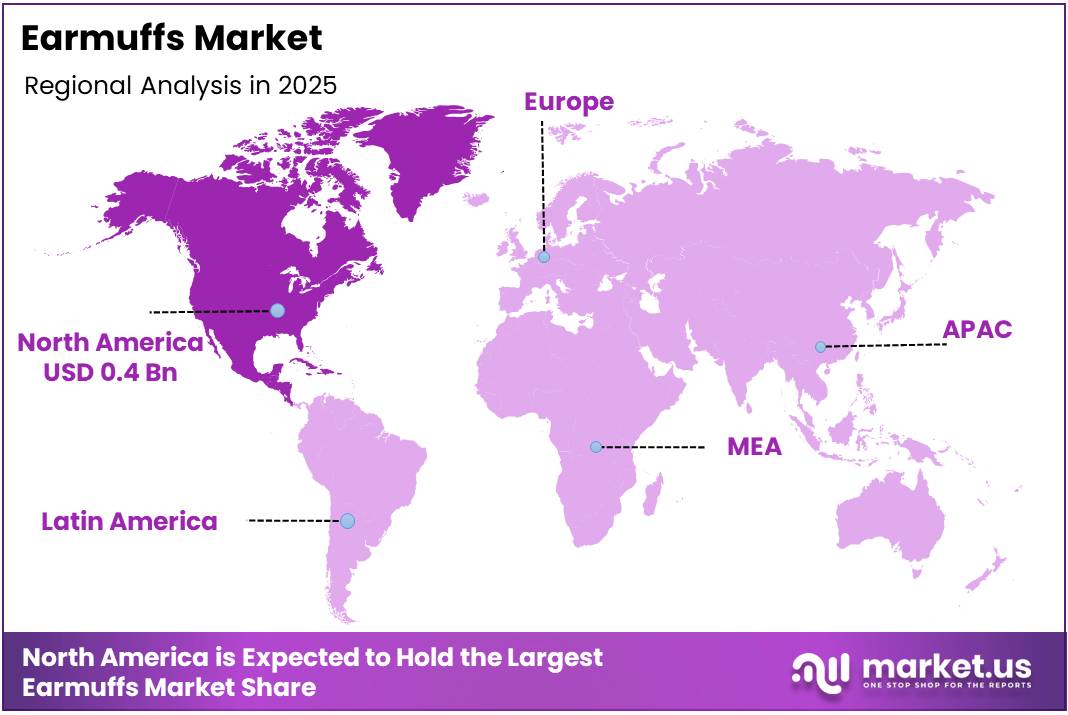

- North America led the regional market with 34.8% share valued at USD 0.4 Billion, driven by awareness and advanced safety standards.

By Type Analysis

Standard Headband Style Earmuffs held a dominant market position in the By Type Analysis segment of Earmuffs Market, with a 59.3% share.

In 2025, Standard Headband Style Earmuffs were widely preferred due to their lightweight design, comfort, and ease of use. They offered excellent noise isolation and could be worn for extended periods without discomfort. Their versatility made them suitable for both industrial workers and casual users, contributing to widespread adoption in global markets.

Wrap-around Earmuffs provided complete ear coverage and a more secure fit for active users. They were particularly valued in high-intensity industrial environments where movement and prolonged wear were common. While holding a smaller market share than standard headband styles, their durability and enhanced protection ensured steady demand among niche users needing extra stability and performance.

By Function Analysis

Noise-Reduction held a dominant market position in the By Function Analysis segment of Earmuffs Market, with a 67.4% share.

In 2025, Noise-Reduction earmuffs were the top choice in industrial, construction, and manufacturing sectors due to their effective sound attenuation. They helped comply with safety regulations and protect workers from long-term hearing damage. Growing awareness of occupational health and safety standards further fueled their strong market performance worldwide.

Stay Warm earmuffs, though smaller in market share, remained essential for outdoor and recreational use. They provided thermal comfort in cold weather while maintaining a lightweight and portable design. Seasonal demand, especially in winter months, supported steady sales and highlighted the importance of functional diversity within the earmuffs market.

By End User Analysis

Adults held a dominant market position in the By End User Analysis segment of Earmuffs Market, with a 76.2% share.

In 2025, Adults were the primary consumers, driven by occupational safety needs, outdoor activities, and lifestyle preferences. Earmuffs targeting this segment emphasized durability, ergonomic design, and effective noise or thermal protection. Their large population base and purchasing power ensured consistent market demand globally.

Kids earmuffs were gaining popularity for school use and outdoor recreation. These products were designed with smaller sizes, vibrant colors, and comfortable materials to appeal to younger audiences. Although holding a smaller share, the segment showed potential growth as parents increasingly prioritized hearing protection and winter warmth for their children.

By Distribution Channel Analysis

Hypermarket/Supermarket held a dominant market position in the By Distribution Channel Analysis segment of Earmuffs Market, with a 31.7% share.

Hypermarket/Supermarket dominated the By Distribution Channel segment with a 31.7% share. Their convenience, wide accessibility, and visibility attracted large consumer volumes. Seasonal promotions and bundled offers increased sales, making these outlets the primary choice for everyday earmuff purchases across urban markets, ensuring strong brand presence and consistent growth.

Direct Sales provided manufacturers with a way to sell directly to customers without intermediaries. This channel offered personalized attention, bulk purchasing options, and better margins. Although smaller than hypermarkets, it helped establish relationships with corporate clients and local industries, supporting niche demand and fostering brand loyalty among repeat buyers.

Wholesalers/Distributors acted as intermediaries connecting manufacturers to retailers and smaller stores. They enabled bulk orders and widespread distribution across multiple regions. While individually smaller in market share, they were vital for reaching semi-urban and rural areas, ensuring that products were available beyond major retail chains and improving overall market penetration.

Specialty Stores focused on niche consumer segments, offering targeted products like industrial or high-performance earmuffs. They provided expert guidance and specialized services. Though their share was limited, specialty stores strengthened brand positioning among discerning buyers, building trust and encouraging repeat purchases in specific market segments.

Online Store channels offered convenience, home delivery, and wider accessibility for urban and remote consumers. They supported targeted promotions, seasonal discounts, and easy product comparisons. Online sales helped manufacturers reach tech-savvy buyers and younger audiences, complementing traditional retail channels and gradually increasing their market presence.

Others included small local retailers, pop-up stores, and temporary outlets. While individually minor, they played a strategic role in serving specific locations, events, or seasonal demand. These channels enhanced overall market coverage, ensuring earmuffs were available even in underserved areas, contributing to the complete distribution landscape.

Key Market Segments

By Type

- Standard Headband Style Earmuffs

- Wrap-around Earmuffs

By Function

- Noise-Reduction

- Stay Warm

By End User

- Adults

- Kids

By Distribution Channel

- Hypermarket/Supermarket

- Direct Sales

- Wholesalers/Distributors

- Specialty Stores

- Online Store

- Others

Drivers

Rising Awareness About Hearing Protection Boosts Earmuffs Market

The global earmuffs market is growing steadily as more industries recognize the importance of hearing protection. Workers in construction, manufacturing, and other noisy environments are increasingly aware of the risks of prolonged exposure to loud sounds. This awareness is encouraging companies to adopt earmuffs as a standard safety measure, driving demand in industrial sectors.

Technological advancements are also contributing to market growth. Modern earmuffs now come with wireless connectivity, Bluetooth integration, and smart features that allow users to control sound levels and monitor exposure. These innovations make earmuffs more appealing, not just for safety but also for convenience, increasing their adoption among professionals and casual users alike.

Urban populations are embracing noise-canceling earmuffs to protect against everyday noise pollution. People living in cities with high traffic, construction, and industrial noise prefer earmuffs to maintain comfort and reduce stress. This trend is expanding the market beyond traditional industrial users, creating opportunities in consumer segments.

Restraints

Bulky Design Limiting Portability and Everyday Wearability

One major restraint in the earmuffs market is their bulky design, which limits portability and everyday wearability. Compared to smaller hearing protection options, earmuffs are harder to carry and store. Many users find them inconvenient for regular use, especially in workplaces where workers move frequently or need to switch tasks.

Another challenge linked to bulkiness is limited acceptance in lifestyle and casual use. Consumers looking for compact and lightweight solutions often avoid earmuffs, even when noise protection is required. This affects demand beyond industrial and extreme weather use cases, narrowing the overall market reach. Design limitations also make earmuffs less compatible with helmets, glasses, or other safety gear, further restricting adoption in certain industries.

Strong competition from alternative hearing protection solutions, especially earplugs, also restrains market growth. Earplugs are low-cost, easy to carry, and widely available, making them a preferred choice for many users. They offer sufficient noise reduction for short-term or moderate exposure, which reduces the need for earmuffs.

Growth Factors

Expansion in Emerging Markets and Technological Advancements Driving Earmuffs Market Growth

The earmuffs market is witnessing significant growth opportunities due to rapid industrialization in emerging markets. Countries in Asia-Pacific and Latin America are expanding their manufacturing and construction sectors, which increases the demand for personal protective equipment, including earmuffs. This trend offers manufacturers a chance to tap into new, high-potential markets.

Another key growth area is the integration of health monitoring features into earmuffs. Smart earmuffs equipped with sensors can track noise exposure levels, heart rate, and other health parameters. This innovation appeals to industrial workers and tech-savvy consumers who prioritize both safety and health, creating a niche segment in the market.

Rising e-commerce penetration is also transforming how earmuffs are sold. Online platforms enable manufacturers to reach consumers directly, reducing reliance on traditional retail channels. This trend not only improves product accessibility but also allows brands to showcase advanced features and customized solutions to a wider audience.

Emerging Trends

Rising Demand for Stylish and Functional Earmuffs Drives Market Trends

The earmuffs market is witnessing a shift as customizable and fashion-forward designs gain popularity among consumers. People are increasingly looking for products that not only protect their ears but also match their personal style, allowing them to make a fashion statement while staying comfortable and warm in different weather conditions, creating opportunities for brands to offer vibrant colors, patterns, and adjustable features.

Another significant trend is the adoption of eco-friendly and sustainable materials in earmuff manufacturing. Consumers are becoming more environmentally conscious and prefer products made from recycled or biodegradable components. This shift encourages companies to innovate while promoting sustainability, which also enhances brand reputation.

The growing popularity of gaming and music-oriented noise-canceling earmuffs is influencing market growth. Gamers and music enthusiasts seek high-quality sound experiences, and earmuffs with advanced noise reduction technology cater to these needs. This trend is particularly strong among younger demographics who value both entertainment and comfort.

Regional Analysis

North America Dominates the Earmuffs Market with a Market Share of 34.8%, Valued at USD 0.4 Billion

North America is the leading region in the earmuffs market, holding a strong market share of 34.8% and valued at USD 0.4 Billion. The region’s growth is driven by rising awareness of hearing protection, advanced manufacturing standards, and growing adoption of noise-canceling earmuffs for industrial and recreational purposes. Increasing consumer preference for high-quality and branded products also supports the market expansion.

Europe Earmuffs Market Trends

Europe demonstrates steady growth in the earmuffs market, supported by strict occupational safety regulations and growing demand for personal protective equipment. Rising adoption of eco-friendly materials and fashion-oriented designs are also contributing to market development. Industrial and recreational sectors continue to fuel demand in this region.

Asia Pacific Earmuffs Market Trends

Asia Pacific is witnessing increasing demand due to rapid industrialization, urbanization, and rising awareness about hearing protection. The growth is further boosted by expanding e-commerce penetration and availability of affordable earmuff options. Countries like China, India, and Japan are emerging as key contributors to regional market growth.

Middle East and Africa Earmuffs Market Trends

The Middle East and Africa region is gradually expanding its earmuffs market, driven by growing industrial safety initiatives and government support for worker protection. Increased investments in construction and manufacturing sectors are creating opportunities for market adoption, although growth remains moderate compared to North America and Europe.

Latin America Earmuffs Market Trends

Latin America shows potential for earmuffs market growth, supported by rising industrial activities and increasing consumer awareness of noise-related health risks. Market expansion is being aided by improving distribution networks and growing urban population, though adoption rates are lower than in North America and Europe.

U.S Earmuffs Market Insights

The U.S. market continues to be a significant contributor within North America, with high demand for noise-canceling and protective earmuffs. Consumer preference for premium and technologically advanced products drives growth, alongside government regulations promoting workplace safety. Rising popularity of outdoor and recreational activities further supports the market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Earmuffs Company Insights

Honeywell continues to maintain a strong presence through its diversified product portfolio, including advanced noise-reduction and comfort-focused earmuffs. The company’s emphasis on workplace safety and strict compliance with international standards has reinforced its position among industrial and consumer segments worldwide.

Moldex-Metric stands out for its specialized hearing protection solutions, combining ergonomic designs with high-performance noise attenuation. The brand has been actively leveraging research and development to introduce innovative materials, improved fit, and enhanced user comfort, appealing to industries where long-duration usage is critical for worker safety and productivity.

Delta Plus has focused on expanding its global footprint, particularly in emerging markets, through strategic distribution partnerships, localized manufacturing, and tailored product offerings. Its products are recognized for durability and reliability, effectively addressing the specific safety and comfort needs of workers in construction, manufacturing, and other industrial sectors.

Centurion Safety continues to gain recognition for its balance of affordability and quality. The company’s earmuffs cater to a wide range of users, from industrial workers to outdoor enthusiasts, and its consistent focus on stringent product safety standards and certifications enhances consumer confidence and broadens adoption across different markets.

Collectively, these four players exemplify the market’s dual focus on safety, user experience, and product reliability. Their strategies ranging from product innovation to geographic expansion underline the competitive intensity of the global earmuffs market. In 2025, market growth is expected to be influenced by ongoing technological improvements, rising industrial safety regulations, and the increasing consumer preference for high-quality, ergonomically designed hearing protection solutions.

Top Key Players in the Market

Recent Developments

- In June 2025, Vendis Capital announced it signed an agreement to sell Alpine, a leading international consumer brand specializing in passive hearing protection solutions, to Gimv, strengthening Alpine’s strategic positioning and future growth potential.

- In December 2025, AXIL Brands, Inc. announced the launch of its next-generation MX II Series Earmuffs, featuring advanced SonicShieldX™ Technology designed to enhance noise reduction performance and user comforta

Report Scope

Report Features Description Market Value (2025) USD 1.3 Billion Forecast Revenue (2035) USD 2.4 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Headband Style Earmuffs, Wrap-around Earmuffs), By Function (Noise-Reduction, Stay Warm), By End User (Adults, Kids), By Distribution Channel (Hypermarket/Supermarket, Direct Sales, Wholesalers/Distributors, Specialty Stores, Online Store, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Honeywell, Moldex-Metric, Delta Plus, Centurion Safety, Silenta Group Oy, ADCO, 3M, MSA, JSP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honeywell

- Moldex-Metric

- Delta Plus

- Centurion Safety

- Silenta Group Oy

- ADCO

- 3M

- MSA

- JSP