Global E-Commerce Payment Gateway Market Size, Share Report By Type (Hosted, Non-hosted), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153871

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

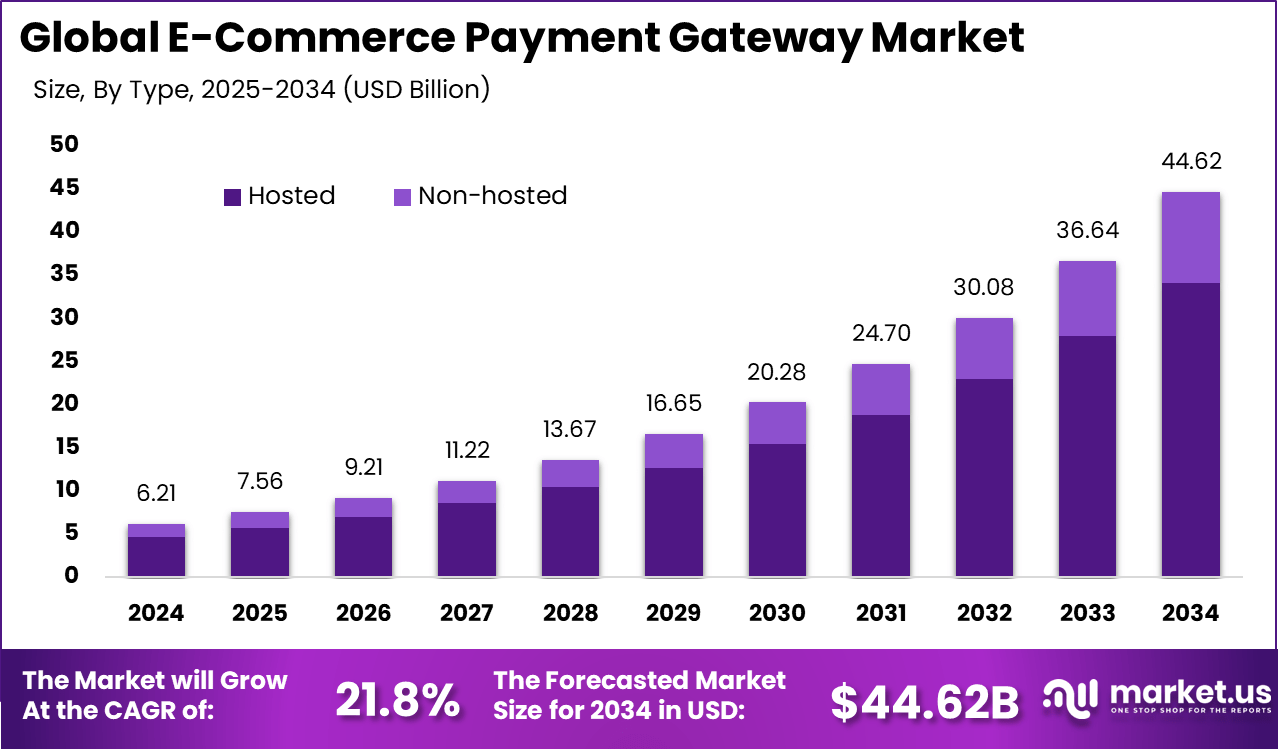

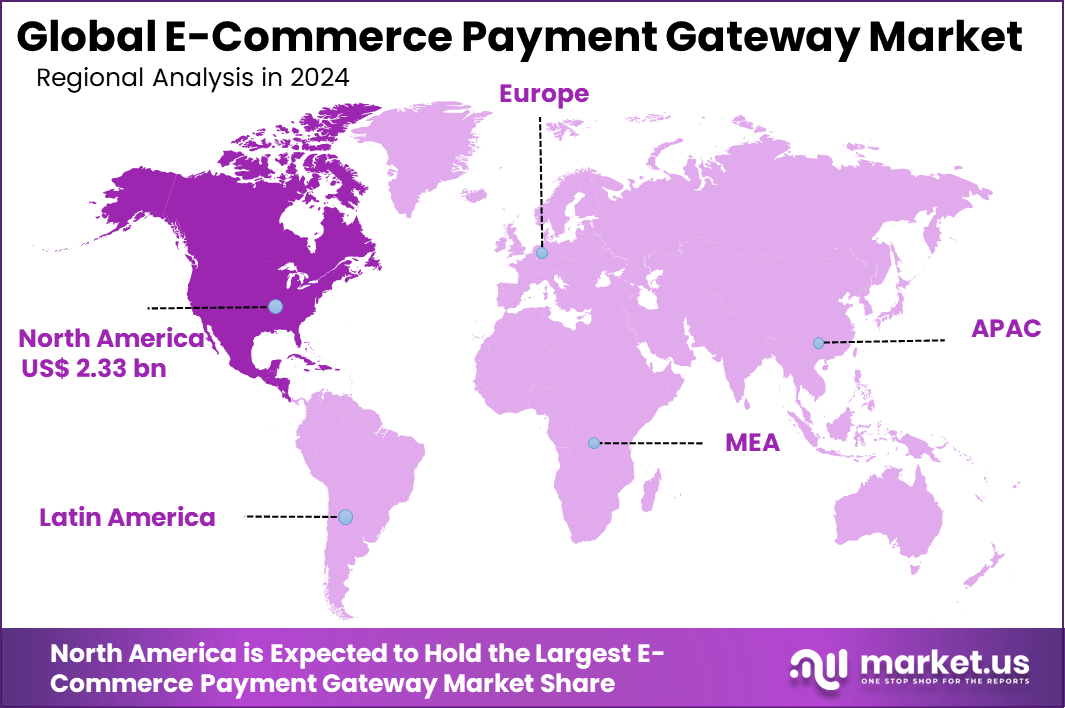

The Global E-Commerce Payment Gateway Market size is expected to be worth around USD 44.62 billion by 2034, from USD 6.21 billion in 2024, growing at a CAGR of 21.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.6% share, holding USD 2.33 billion in revenue.

The e‑commerce payment gateway market refers to the infrastructure and services that enable online merchants to accept payments securely. This sector mediates transactions between buyers and sellers by processing card, wallet, bank transfer and other digital payments in real time. Its significance has grown as online retail expanded, requiring secure, compliant gateways to manage payment flows efficiently.

The primary driver of this market is the rapid growth of online commerce and mobile shopping. Consumer preference for fast and contactless transactions compels merchants to implement seamless gateway solutions. In addition, regulatory requirements for secure digital payments and fraud prevention are pushing adoption of advanced gateway technologies. Governments promoting cashless economies also play a role in energizing demand.

For instance, in December 2024, Worldline announced its strategic move to empower global online businesses by enhancing its payment gateway solutions in the United Arab Emirates (UAE). By expanding its services in this key market, Worldline aims to help merchants navigate the growing e-commerce sector in the UAE, offering advanced, secure, and scalable payment processing solutions.

Demand for e-commerce payment gateways continues to rise sharply because businesses now recognize the necessity of offering efficient, reliable payment methods. The pandemic served as a catalyst for digitally reluctant enterprises to go online and invest in robust payment solutions. Whether it’s small retail stores or major e-commerce brands, everyone needs a payment gateway to manage growing volumes and ensure seamless international transactions.

Scope and Forecast

Report Features Description Market Value (2024) USD 6.21 Bn Forecast Revenue (2034) USD 44.62 Bn CAGR(2025-2034) 21.8% Leading Segment Hosted: 76.4% Largest Market North America [37.6% Market Share] Largest Country US: USD 2.10 Bn: CAGR: 19.4% According to Coinlaw, PayPal processed over $1.52 trillion in total payment volume, representing a 10.8% year-over-year increase. This upward trend was supported by rising demand for peer-to-peer transfers, the expansion of PayPal’s crypto offerings, and its strategic growth across international corridors. The scale of this volume confirms the platform’s enduring relevance in both consumer and merchant segments globally.

Amazon Pay’s reach also expanded substantially, recording a 24% growth and reaching 62 million users globally. This was driven by deeper integration into Amazon’s voice commerce architecture and its use in IoT-powered shopping experiences. Its adoption in emerging markets contributed significantly to this user base growth, highlighting consumer preference for familiar, secure, and frictionless payment methods.

Square reported $54.2 billion in Q3 gross payment volume, supported by BNPL and its Cash App ecosystem. Adyen’s revenue rose 23% to $8.4 billion, thanks to more enterprise clients and embedded payments. Mobile payments now power 47% of global e-commerce, led by QR codes, smartphone checkouts, and biometrics.

Key Takeaway

- In 2024, the hosted segment led the market with a 76.4% share, favored for its ease of integration, enhanced security, and third-party management of payment operations.

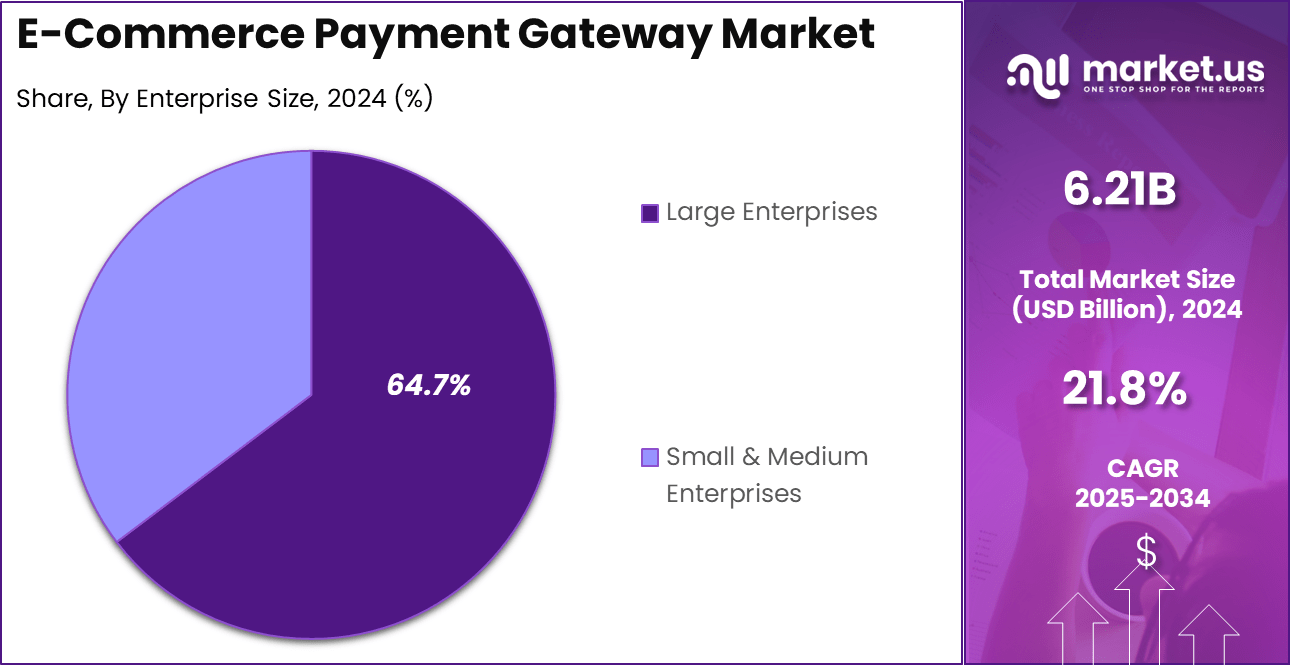

- The large enterprises segment accounted for 64.7% of the market, driven by their high transaction volumes, complex payment workflows, and demand for robust fraud prevention systems.

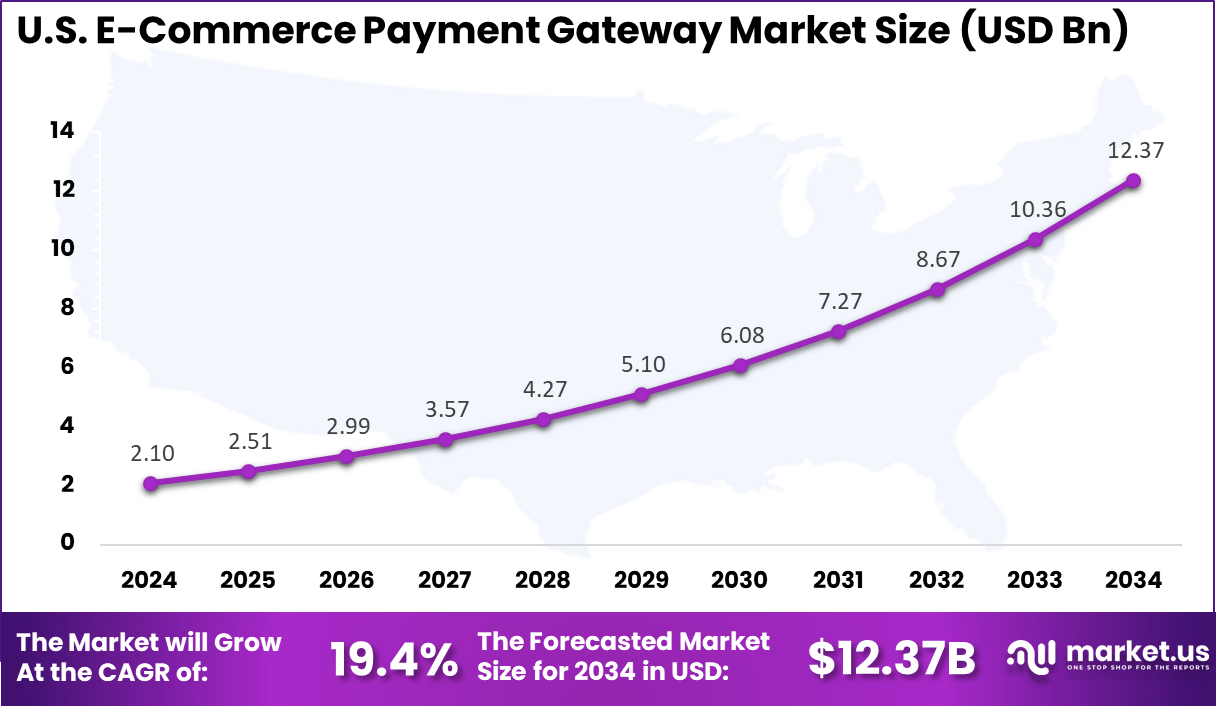

- The U.S. market reached a valuation of USD 2.10 Billion in 2024 and is advancing at a strong CAGR of 19.4%, supported by a surge in digital retail, mobile commerce, and secure checkout preferences.

- North America maintained its leadership position globally, holding 37.6% market share, reflecting the region’s mature digital infrastructure and high adoption of multi-channel payment technologies.

U.S. Market Size

The market for E-Commerce Payment Gateway within the U.S. is growing tremendously and is currently valued at USD 2.10 billion, the market has a projected CAGR of 19.4%. The market is experiencing rapid growth driven by the digital transformation of retail, increased mobile and online shopping, and a shift to contactless payments.

The rise of digital wallets like Apple Pay and Google Pay, along with flexible options such as BNPL, is boosting demand for secure and seamless payment solutions. Additionally, the growing preference for convenience, adoption of real-time payments, and the need for multi-currency support in cross-border e-commerce are fostering continued innovation and market expansion, leading to strong, sustained growth.

For instance, in August 2024, PayPal and Adyen strengthened their strategic partnership to enhance the U.S. checkout experience. This collaboration focuses on improving consumer and merchant interactions through Fastlane by PayPal, a seamless and optimized guest checkout solution. The partnership aims to streamline payment processes, reduce friction, and accelerate the growing demand for mobile payments and digital wallets.

In 2024, North America held a dominant market position in the Global E-Commerce Payment Gateway Market, capturing more than a 37.6% share, holding USD 2.33 billion in revenue. The market is in a dominant position due to its advanced digital infrastructure, widespread internet access, and a tech-savvy population driving rapid adoption of digital commerce.

The region’s strong embrace of mobile payments, digital wallets, and BNPL options has increased demand for secure, seamless payment solutions. Furthermore, North America’s solid regulatory environment, extensive use of real-time payments, and expansion of cross-border e-commerce continue to reinforce its market leadership, ensuring sustained growth in the years ahead.

For instance, in July 2025, Checkout.com expanded its presence in Canada with the appointment of new leadership, further solidifying its position in North America’s dominant e-commerce payment gateway market. This strategic expansion allows Checkout.com to enhance its service offerings, including seamless payment processing, fraud protection, and multi-currency support, catering to both local and global merchants.

Type Analysis

In 2024, the Hosted segment held a dominant market position, capturing a 76.4% share of the Global E-Commerce Payment Gateway Market. This dominance is driven by its ease of integration, security features, and scalability, which make it a preferred choice for businesses of all sizes.

Hosted payment gateways offer robust fraud protection, seamless transaction processing, and simplified compliance with regulatory standards, making them ideal for merchants looking to reduce operational complexity. As e-commerce continues to grow, the Hosted segment is expected to maintain its leading position due to these advantages.

Segment Sub-Segment Share (%) By Type Hosted 76.4% For Instance, In November 2024, MyFatoorah partnered with Mastercard to enhance e-commerce payments in the Middle East through advanced hosted payment gateway solutions. This collaboration integrates Mastercard’s global network with MyFatoorah’s platform to deliver secure, scalable, and seamless transactions. It aims to improve checkout experiences, strengthen fraud detection, and broaden available payment options for consumers.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 64.7% share of the Global E-Commerce Payment Gateway Market. This demand stems from the need for secure, scalable payment solutions capable of handling high transaction volumes and complex global operations. Large enterprises require advanced features like multi-currency support, customizable payment options, and enhanced fraud protection.

Their capacity to invest in innovative payment technologies and compliance ensures their preference for comprehensive, enterprise-level solutions. With vast client bases and diverse industry needs, they further drive the demand for tailored, secure payment gateways that optimize operations and streamline transaction processes worldwide.

Segment Sub-Segment Share (%) By Enterprise Size Large Enterprises 64.7% For instance, In November 2024, City Bank partnered with Compass Plus Technologies to deploy the TranzAxis Payment Gateway for its e-commerce acquiring services. This integration enables the bank to deliver secure, scalable, and efficient payment solutions tailored for large enterprises. TranzAxis supports various payment methods, including mobile wallets and cards, allowing City Bank to handle high transaction volumes and meet diverse customer demands.

Key Features and Trends

Feature/Trend Details Omnichannel Integration Unified payments across desktop, mobile, in-app, point-of-sale (POS), and more. Multiple Payment Methods Support for cards, digital wallets (Apple Pay, Google Pay), UPI, BNPL, cryptocurrencies, etc. Contactless & Mobile Payments Growth in NFC/contactless and QR-code driven payments, especially in Asia-Pacific. AI & ML Security AI-driven fraud detection, risk scoring, voice/biometric authentication for transaction safety. Open Banking & API Connectivity Streamlined banking integration and data sharing for instant payments and financial services. Subscription/Recurring Billing Automated recurring payment capabilities for SaaS, memberships, and digital subscriptions. Real-time Analytics Enhanced reporting tools to track, analyze, and optimize payment flows and customer trends. Key Market Segments

By Type

- Hosted

- Non-hosted

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Mobile and Digital Payments Demand

As people use mobile devices and the internet more frequently, their payment preferences for goods and services have been on the rise. Online shopping is becoming more popular among shoppers who use digital wallets, credit or debit cards, and other options like buy-now-pay-later plans.

Due to this, businesses are now utilizing increasingly flexible payment methods that operate across multiple channels. New markets that are thriving in the mobile device shopping experience show a marked change. Companies that offer payment services are profiting from this shift in behavior, which enhances digital systems and simplifies payment transactions for consumers globally.

For instance, In May 2025, PYMNTS’ Money Mobility Tracker® reported a surge in mobile and digital payment demand, driven by consumer expectations for speed, security, and convenience. Rising smartphone use and mobile wallet adoption are accelerating the shift toward real-time, secure transactions.

Restraint

Regulatory Compliance

Changing financial regulations pose a challenge for payment services. Compliance with regulations such as PCI-DSS, money laundering laws, and local licenses leads to increased costs and complexity. Additionally, traditional banking systems hinder efficiency in transactions and obstruct innovative ideas.

Due to the increasing regulations on digital payments by governments, businesses are finding themselves unable to expand and may face difficulties in entering the market, as new and smaller businesses depend on legal support, risk management, or secure systems.

For instance, In March 2025, PCI Compliance was identified as a key challenge for e-commerce merchants, according to recent card processing FAQs. As data security regulations evolve, meeting PCI-DSS standards remains costly and complex, requiring continuous investments in security, staff training, and audits to guard against fraud and breaches.

Opportunities and Challenges

Category Highlights Opportunities – Rapid growth in emerging markets (mobile internet, digital wallets)

– Fintech innovation (AI, blockchain, BNPL, voice)

– Expanding global trade and cross-border services

– SMEs adopting digital payment acceptance platformsChallenges – Cybersecurity risks; need for constant upgrades

– Regulatory complexity across jurisdictions

– Global payment system fragmentation (currency, standards)

– High integration/setup costs for small businesses

– Competition and fee pressure in commoditized marketsKey Players Analysis

In the E-Commerce Payment Gateway Market, Adyen, Amazon Payments Inc., and Authorize.Net continue to maintain strong market influence due to their vast global integrations and stable transaction systems. Adyen’s omnichannel capabilities support both online and in-store payments, strengthening its partner ecosystem. Amazon Payments leverages its strong consumer base to deliver seamless checkout experiences.

Bitpay, Braintree, and PayPal Holdings, Inc. are fostering greater payment flexibility by focusing on digital currencies and mobile commerce. Bitpay is advancing cryptocurrency acceptance across global merchants, attracting tech-savvy buyers. Braintree, a PayPal service, supports scalable payments for mobile-first platforms. PayPal continues to lead with its massive user base and buyer protection policies.

PayU Group, Stripe, Verifone Holdings, Inc., and WePay, Inc. are driving innovation through region-specific strategies and enterprise partnerships. Stripe leads in developer adoption, offering custom checkout tools and strong fraud protection. PayU focuses on high-growth emerging markets with tailored financial services. Verifone emphasizes secure hardware-software combinations for omnichannel payments. WePay, backed by a leading financial institution, integrates with crowdfunding and SaaS platforms.

Top Key Players in the Market

- Adyen

- Amazon Payments Inc.

- Net

- Bitpay, Inc.

- Braintree

- PayPal Holdings, Inc.

- PayU Group

- Stripe

- Verifone Holdings, Inc.

- Wepay, Inc.

- Others

Recent Developments

- In January 2025, PayU became the first payment gateway in Colombia to integrate Google Pay, allowing Android users to make fast and secure online transactions. This integration enhances the user experience by offering a seamless checkout process and boosting PayU’s reach in the Latin American market.

- In October 2024, Mastercard announced the acquisition of Minna Technologies, a provider of subscription management solutions. This acquisition enhances Mastercard’s ability to support recurring payments, streamlining the management of subscriptions for both merchants and consumers

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Hosted, Non-hosted), By Enterprise Size (Large Enterprises, Small & Medium Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adyen, Amazon Payments Inc., Authorize.Net, Bitpay, Inc., Braintree, PayPal Holdings, Inc., PayU Group, Stripe, Verifone Holdings, Inc., Wepay, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Commerce Payment Gateway MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

E-Commerce Payment Gateway MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-