Global Dynamic Wireless Charging Market Size, Share, Growth Analysis By Technology (Inductive Charging, Resonant Charging, Radio Frequency-Based Charging, Others), By Power Supply Range (Low Power, Medium Power, High Power), By End-User (Automotive, Consumer Electronics, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172784

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

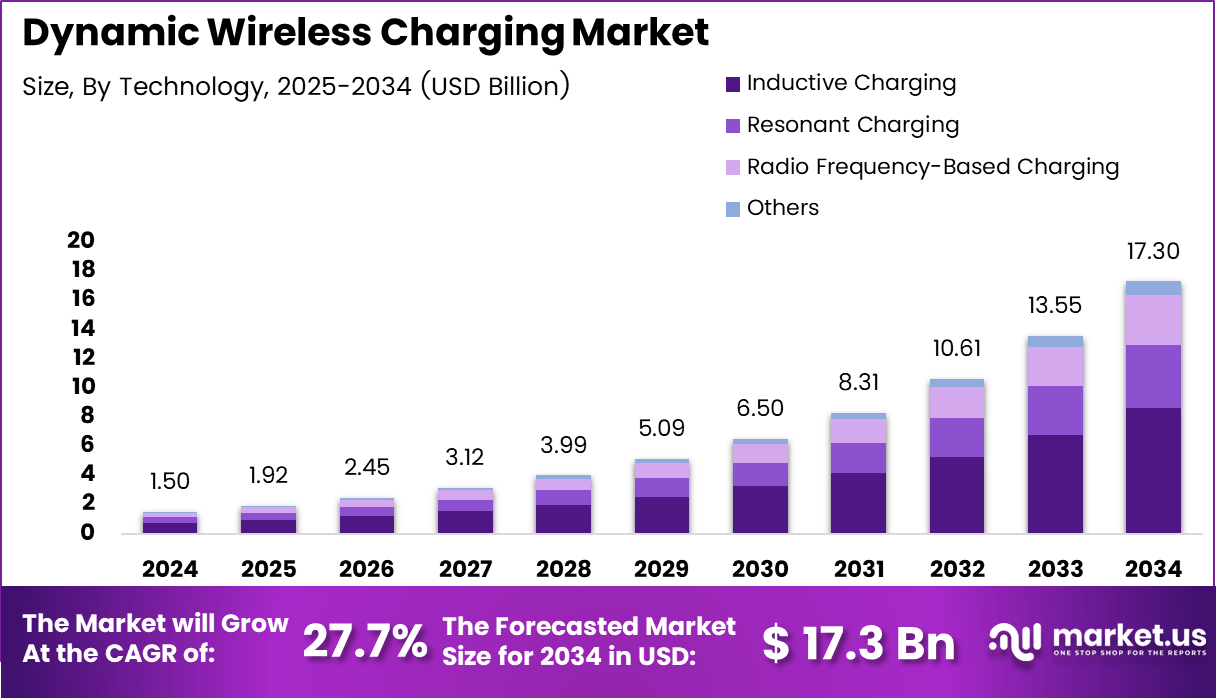

The Global Dynamic Wireless Charging Market size is expected to be worth around USD 17.3 billion by 2034, from USD 1.5 billion in 2024, growing at a CAGR of 27.7% during the forecast period from 2025 to 2034.

The Dynamic Wireless Charging Market refers to in-motion power transfer systems that charge electric vehicles while driving, using embedded roadway infrastructure. It enables continuous energy delivery without physical connectors, improving vehicle uptime. Consequently, this market aligns with electric mobility, smart roads, and wireless power transfer technologies, supporting scalable electrification strategies.

Dynamic Wireless Charging represents a structural shift in how energy integrates with transportation infrastructure. Instead of stationary charging dependence, power becomes embedded within mobility ecosystems. As a result, this model supports operational efficiency, range confidence, and fleet optimization, making it relevant for highways, logistics corridors, and autonomous transport systems.

Market growth is driven by electrification mandates, urban congestion pressures, and charging downtime challenges. Governments increasingly support smart infrastructure investments to accelerate EV adoption. Moreover, dynamic charging enables vehicles to reduce onboard battery size and weight by 80%, improving efficiency and lowering material dependency, which strengthens long-term commercial and policy appeal.

Technologically, systems generate 20kHz electromagnetic fields through power inverters to transfer energy safely and continuously. Electric power strips are buried 30 cm beneath roads and connected to the power grid, enabling seamless charging. This infrastructure-based approach improves energy availability while vehicles remain operational, supporting high-utilization transport use cases.

Historically, wireless energy concepts trace back over a century. Nikola Tesla demonstrated long-range power transmission by lighting 200 lamps from 40 km away using a 187-foot tower, according to historical engineering records. However, tower operations stopped due to funding limitations, delaying large-scale wireless power development.

Despite progress, efficiency challenges persist. Studies from academic and pilot deployments indicate average energy loss exceeds 30%, highlighting optimization needs. Nevertheless, ongoing policy support, renewable grid integration, and smart road investments position the Dynamic Wireless Charging Market as a long-term enabler of sustainable, connected, and autonomous electric mobility ecosystems.

Key Takeaways

- The Global Dynamic Wireless Charging Market is projected to reach USD 17.3 billion by 2034, expanding from USD 1.5 billion in 2024 at a CAGR of 27.7%.

- Inductive Charging leads the technology landscape with a dominant market share of 49.7%, reflecting its maturity and infrastructure compatibility.

- Medium Power systems account for the largest share at 47.9%, supported by balanced efficiency and deployment feasibility.

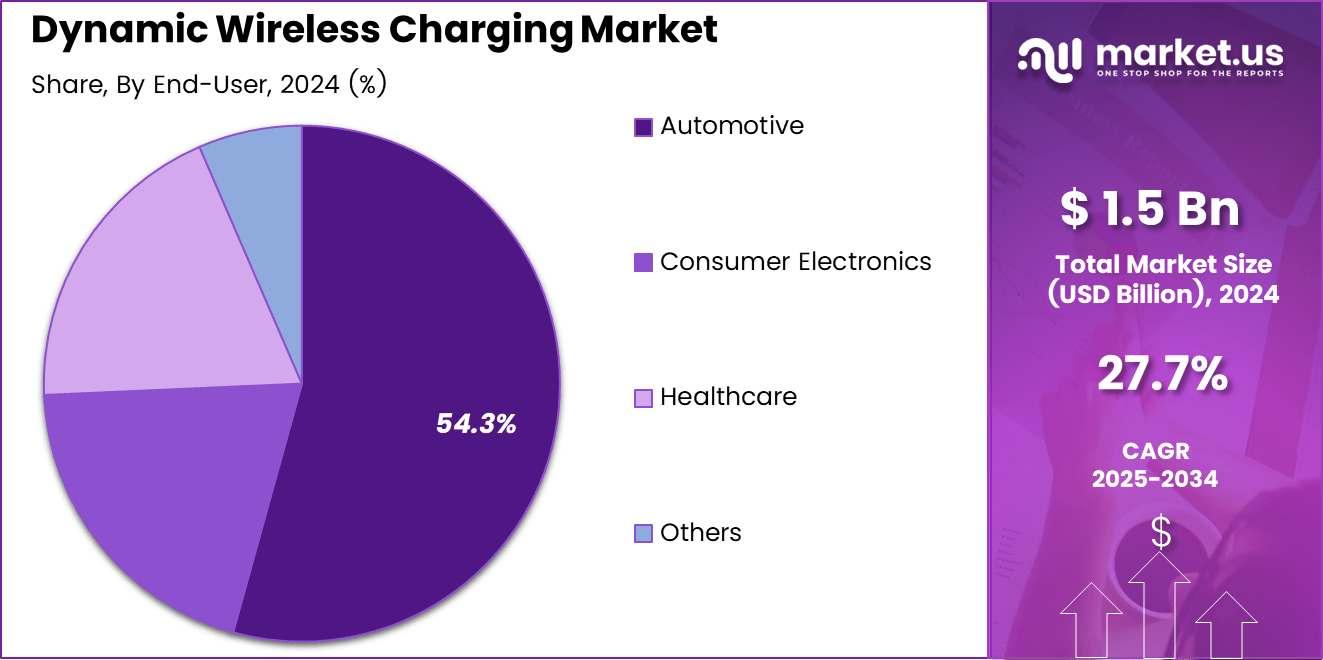

- The Automotive segment dominates end-user adoption with a market share of 54.3%, driven by electrification and reduced charging downtime.

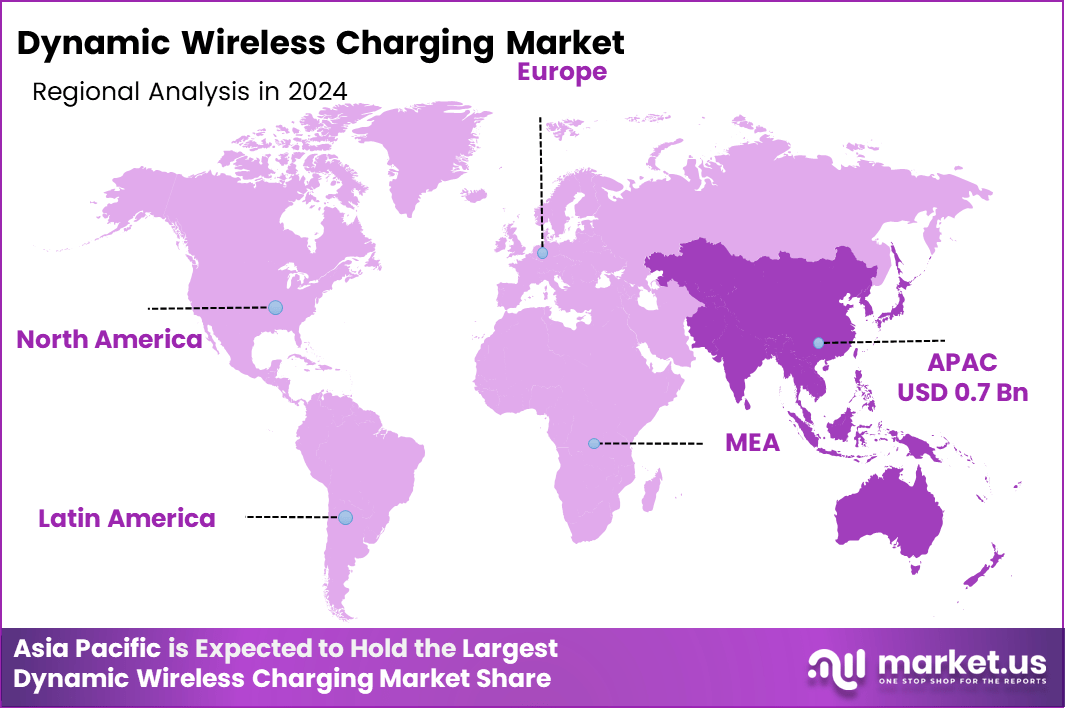

- Asia Pacific emerges as the leading region with a market share of 49.7%, representing a valuation of USD 0.7 billion.

By Technology Analysis

Inductive Charging dominates with 49.7% due to its proven reliability and compatibility with existing EV architectures.

In 2024, Inductive Charging held a dominant market position in the By Technology Analysis segment of Dynamic Wireless Charging Market, with a 49.7% share. This dominance is supported by mature coil designs, stable electromagnetic coupling, and ease of integration into road infrastructure. Consequently, it remains the preferred choice for pilot corridors and early commercial deployments.

Resonant Charging plays a supportive role by enabling greater tolerance to misalignment between vehicles and embedded coils. As a result, this technology attracts interest for applications involving variable vehicle speeds and lane positioning. Moreover, ongoing improvements in resonance tuning continue to enhance transfer stability across diverse driving conditions.

Radio Frequency-Based Charging remains limited to niche applications due to lower power transfer capability. However, it supports experimentation in lightweight mobility platforms and sensor-driven environments. Therefore, its role remains exploratory rather than commercially dominant within large-scale dynamic charging infrastructure.

Other technologies include hybrid and experimental wireless transfer methods under early-stage development. These approaches focus on improving efficiency, reducing interference, and lowering deployment complexity. Nevertheless, adoption remains constrained as validation and standardization efforts are still underway.

By Power Supply Range Analysis

Medium Power dominates with 47.9% due to balanced efficiency, safety, and infrastructure feasibility.

In 2024, Medium Power held a dominant market position in the By Power Supply Range Analysis segment of Dynamic Wireless Charging Market, with a 47.9% share. This range effectively supports passenger vehicles and commercial fleets without excessive grid stress. Consequently, it aligns well with urban and highway deployment models.

Low Power systems primarily serve auxiliary charging needs and early-stage testing environments. As a result, their adoption remains limited to pilot projects and low-speed mobility solutions. However, they continue to play a role in validating wireless transfer safety and control mechanisms.

High Power solutions target heavy-duty vehicles and long-haul transport applications. Nevertheless, infrastructure cost, thermal management, and efficiency losses constrain widespread deployment. Therefore, adoption remains selective and focused on controlled industrial or freight corridors.

By End-User Analysis

Automotive dominates with 54.3% driven by electrification targets and charging downtime reduction.

In 2024, Automotive held a dominant market position in the By End-User Analysis segment of Dynamic Wireless Charging Market, with a 54.3% share. This leadership reflects strong demand from passenger cars, buses, and commercial fleets seeking continuous charging. As a result, automotive use cases anchor infrastructure investment decisions.

Consumer Electronics adoption remains limited due to lower power requirements and mobility constraints. However, research applications and concept demonstrations continue to explore dynamic charging for connected devices. Therefore, this segment supports innovation rather than volume deployment.

Healthcare applications focus on specialized mobility platforms and hospital logistics systems. Consequently, dynamic wireless charging enables uninterrupted operation of autonomous carts and medical transport devices. Still, adoption remains selective due to regulatory and cost considerations.

Other end users include industrial campuses and smart city pilot environments. These deployments emphasize controlled conditions and integrated energy management. As a result, they contribute to long-term ecosystem validation rather than immediate market scale.

Key Market Segments

By Technology

- Inductive Charging

- Resonant Charging

- Radio Frequency-Based Charging

- Others

By Power Supply Range

- Low Power

- Medium Power

- High Power

By End-User

- Automotive

- Consumer Electronics

- Healthcare

- Others

Drivers

Accelerated Electrification of Public and Commercial Vehicle Fleets Drives Market Growth

The accelerated electrification of public and commercial vehicle fleets acts as a primary driver for the dynamic wireless charging market. City buses, municipal vehicles, delivery vans, and fleet taxis increasingly shift toward electric models to meet emission targets and operating cost goals. Dynamic wireless charging supports this transition by allowing vehicles to receive power while moving, reducing dependence on large onboard batteries.

Another key driver is the rising demand for continuous power supply without vehicle downtime. Fleet operators value high vehicle availability, especially in logistics, public transport, and shared mobility. In-motion charging minimizes charging stops, improves route efficiency, and supports round-the-clock operations, making it highly attractive for commercial users.

Government-backed pilot corridors for in-motion EV charging infrastructure further accelerate market development. Many national and local authorities support test roads, smart highways, and electrified bus lanes to validate performance and economic viability. These pilots reduce technology risk and encourage private investment.

Additionally, the growing focus on reducing battery size and total vehicle weight strengthens demand. Smaller batteries lower vehicle cost, improve energy efficiency, and reduce raw material usage. Dynamic wireless charging enables this design shift by supplying energy continuously during operation.

Restraints

High Upfront Infrastructure Deployment Costs Limit Market Expansion

High upfront infrastructure deployment and roadway integration costs remain a major restraint for the dynamic wireless charging market. Installing embedded charging coils, power electronics, and control systems into roads requires significant capital investment. These costs often exceed those of conventional charging stations, slowing adoption in cost-sensitive regions.

Complex standardization requirements across vehicles and grid systems also restrict market growth. Dynamic charging needs precise alignment between vehicle receivers, road infrastructure, and grid management systems. Differences in vehicle designs, charging frequencies, and power ratings create compatibility challenges that delay large-scale deployment.

Limited scalability due to road modification and maintenance challenges further constrains adoption. Retrofitting existing roads disrupts traffic and increases maintenance complexity. Any damage to embedded systems can lead to costly repairs and service interruptions, raising concerns among road authorities.

Efficiency losses at higher vehicle speeds and varying alignment conditions present additional technical barriers. Power transfer efficiency can decline when vehicles move faster or deviate from optimal alignment. These performance limitations affect energy reliability and reduce confidence among fleet operators evaluating long-term operational benefits.

Growth Factors

Expansion of Dynamic Charging Lanes Creates New Growth Opportunities

The expansion of dynamic charging lanes on highways and urban transit routes presents a strong growth opportunity for the market. Dedicated electrified lanes for buses, trucks, and high-usage vehicles improve utilization rates and strengthen the business case for infrastructure investment.

Integration with smart grids network and renewable energy management systems also unlocks future potential. Dynamic wireless charging can align power delivery with grid conditions, renewable availability, and real-time demand. This integration supports energy efficiency, grid stability, and lower operational emissions.

Adoption in logistics, autonomous shuttles, and last-mile delivery vehicles further expands addressable demand. These vehicles operate on fixed routes and predictable schedules, making them ideal candidates for in-motion charging solutions. Continuous charging improves reliability and reduces fleet size requirements.

Urban mobility planners increasingly view dynamic charging as a long-term solution for congestion and emissions challenges. As cities invest in smart transport infrastructure, dynamic wireless charging gains relevance as a scalable and future-ready energy delivery method.

Emerging Trends

Modular Road-Based Charging Systems Shape Emerging Market Trends

A key trending factor is the shift toward modular and prefabricated charging coil road segments. These designs simplify installation, reduce construction time, and lower maintenance complexity. Modular systems also support phased deployment, making projects more financially manageable.

Increasing collaboration between automakers, utilities, and infrastructure providers shapes market evolution. Joint development efforts improve system compatibility, accelerate pilot programs, and align vehicle designs with infrastructure capabilities. This ecosystem approach reduces deployment risk.

The development of interoperable charging standards for multi-brand vehicles represents another important trend. Standardization supports wider adoption by ensuring that different vehicle models can use the same charging infrastructure, improving utilization and investment returns.

Growing use of AI-based power control and vehicle-to-infrastructure communication enhances system efficiency. AI optimizes power transfer, manages load balancing, and adapts charging based on vehicle speed and position. These advancements improve reliability and strengthen the commercial viability of dynamic wireless charging systems.

Regional Analysis

Asia Pacific Dominates the Dynamic Wireless Charging Market with a Market Share of 49.7%, Valued at USD 0.7 Billion

Asia Pacific holds the dominant position in the Dynamic Wireless Charging Market due to strong government-led electrification programs and rapid urban mobility expansion. The region accounted for 49.7% of the global market, with a valuation of USD 0.7 billion, supported by large-scale pilot roads and smart highway initiatives. High adoption of electric buses, logistics fleets, and urban transit systems strengthens demand for in-motion charging solutions. Additionally, dense traffic corridors and long daily vehicle utilization cycles improve the economic feasibility of dynamic charging infrastructure across major economies in the region.

North America Dynamic Wireless Charging Market Trends

North America represents a technologically advanced and innovation-driven market for dynamic wireless charging. The region benefits from strong research funding, smart transportation policies, and early-stage deployment of electrified road pilots. Public transit electrification and growing interest in reducing charging downtime for commercial fleets continue to support market expansion. Regulatory focus on emission reduction and energy efficiency further enhances long-term adoption potential.

Europe Dynamic Wireless Charging Market Trends

Europe demonstrates steady growth driven by stringent emission regulations and integrated mobility planning. Governments across the region actively support sustainable transport corridors, smart roads, and cross-border EV infrastructure projects. Dynamic wireless charging aligns well with Europe’s focus on reducing battery size, vehicle weight, and lifecycle emissions. Strong collaboration between transport authorities and energy networks supports gradual commercialization.

Middle East and Africa Dynamic Wireless Charging Market Trends

The Middle East and Africa region shows emerging potential, primarily led by smart city developments and sustainable transport investments. High urbanization rates in selected economies create opportunities for electric buses and autonomous transit systems. While large-scale deployment remains limited, pilot projects and government-backed innovation zones are laying the groundwork for future adoption of dynamic charging technologies.

Latin America Dynamic Wireless Charging Market Trends

Latin America remains at a nascent stage but shows growing interest in dynamic wireless charging as cities modernize public transport networks. Electrification of bus fleets and urban mobility reforms support gradual market development. Infrastructure funding constraints slow near-term deployment; however, increasing focus on energy efficiency and emission reduction supports long-term growth prospects across key metropolitan areas.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dynamic Wireless Charging Company Insights

Cruise America strengthened its position in rental led mobility by keeping fleet utilization high and aligning inventory with peak season travel corridors. The company emphasized standardized vehicle classes and a predictable customer experience, supporting repeat bookings and improved operational efficiency across major US leisure routes.

El Monte RV focused on premium rental readiness through well maintained fleets, flexible trip planning support, and value added packages that simplified longer itineraries. The brand’s strategy leaned on serving travelers seeking reliable RV access without ownership costs, supporting stronger conversion during high demand travel periods.

RVshare advanced the peer to peer model by scaling host supply, improving booking confidence, and expanding consumer choice across vehicle types and price points. Its focus on trust mechanisms, insurance enablement, and smoother pickup workflows supported higher transaction volumes and broader adoption among first time renters.

Outdoorsy competed by positioning itself as a marketplace for experiential travel, connecting renters with curated listings and trip friendly services that reduced friction. The platform leaned into mobile first discovery, host enablement tools, and flexible booking structures, supporting sustained growth and category expansion beyond traditional RV rentals.

Top Key Players in the Market

- Qualcomm Incorporated

- WiTricity Corporation

- Electreon Wireless Ltd.

- Plugless Power Inc.

- HEVO Inc.

- DAIHEN Corporation

- Toshiba Corporation

- Continental AG

- Robert Bosch GmbH

- Renault Group

Recent Developments

- In November 2025, Electreon signed a memorandum of understanding to acquire the core assets of InductEV, marking a strategic consolidation move within the wireless EV charging ecosystem. This development positioned the combined entity to accelerate global deployment of dynamic and stationary wireless charging infrastructure across public transit and commercial fleet applications.

Report Scope

Report Features Description Market Value (2024) USD 1.5 billion Forecast Revenue (2034) USD 17.3 billion CAGR (2025-2034) 27.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Inductive Charging, Resonant Charging, Radio Frequency-Based Charging, Others), By Power Supply Range (Low Power, Medium Power, High Power), By End-User (Automotive, Consumer Electronics, Healthcare, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Qualcomm Incorporated, WiTricity Corporation, Electreon Wireless Ltd., Plugless Power Inc., HEVO Inc., DAIHEN Corporation, Toshiba Corporation, Continental AG, Robert Bosch GmbH, Renault Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dynamic Wireless Charging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Dynamic Wireless Charging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Qualcomm Incorporated

- WiTricity Corporation

- Electreon Wireless Ltd.

- Plugless Power Inc.

- HEVO Inc.

- DAIHEN Corporation

- Toshiba Corporation

- Continental AG

- Robert Bosch GmbH

- Renault Group