Global Dyes And Pigments Market By Product (Dyes, Pigments), By Application (Textile, Paints And coatings, Plastics, Leather, Paper, Printing ink, Others) as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2024-2033

- Published date: Dec 2023

- Report ID: 39249

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global dyes and pigments market size is expected to be worth around USD 68.6 billion by 2033, from USD 41.7 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The dyes & pigments market size is expected to expand further due to increased demand from various industries such as construction, and the paints & coatings sectors. Major producers are actively looking to improve their products using advanced technologies that can efficiently remove hazardous pollutants from their manufacturing processes.

Variable prices for raw materials like benzene will cause manufacturers to have varied production costs. Both physical retail stores, as well as online retail, allow for wider market distribution.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global dyes and pigments market is set to reach approximately USD 68.6 billion by 2033, from its 2023 valuation of USD 41.7 billion, marking a steady growth at a CAGR of 5.1% during the forecast period.

- Product Type Trends: Reactive dyes dominated the market in 2023 with over 54.7% share, known for vibrant and long-lasting colors in textiles, and expected to grow at a 4.2% CAGR between 2023 and 2032. Organic pigments, despite a lower market share than inorganic pigments, are forecasted to grow at a 5.1% CAGR in terms of revenue share between 2023 and 2032.

- Application Insights: Textiles represented the largest market share in 2023, accounting for over 59.6%. Dyes and pigments play a crucial role in enhancing the appearance of fabrics used in clothing and home furnishings. Printing inks are expected to see increased demand, especially in the Asia Pacific region, attributed to digital printing growth and the presence of major producers like India and China.

- Market Drivers: Growing demand in the textile industry due to the preference for organic products and technological advancements. Increased production in the paints, coatings, and automotive sectors, leading to higher demand for dyes and pigments.

- Market Restraints: Stringent regulations concerning waste generation and its adverse effects on the environment pose challenges for industry growth, particularly regarding compliance and managing environmental impact.

- Opportunities: Rising demand across various industries like textiles, paints, coatings, plastics, and printing inks, driven by population growth, urbanization, and changing consumer preferences. Technological advancements improving efficiency and quality, along with the shift towards eco-friendly products, offer niche market segments for organic and natural dyes and pigments.

- Challenges: Compliance with environmental regulations and the adoption of sustainable practices. Health and safety concerns for employees due to chemicals used in manufacturing.

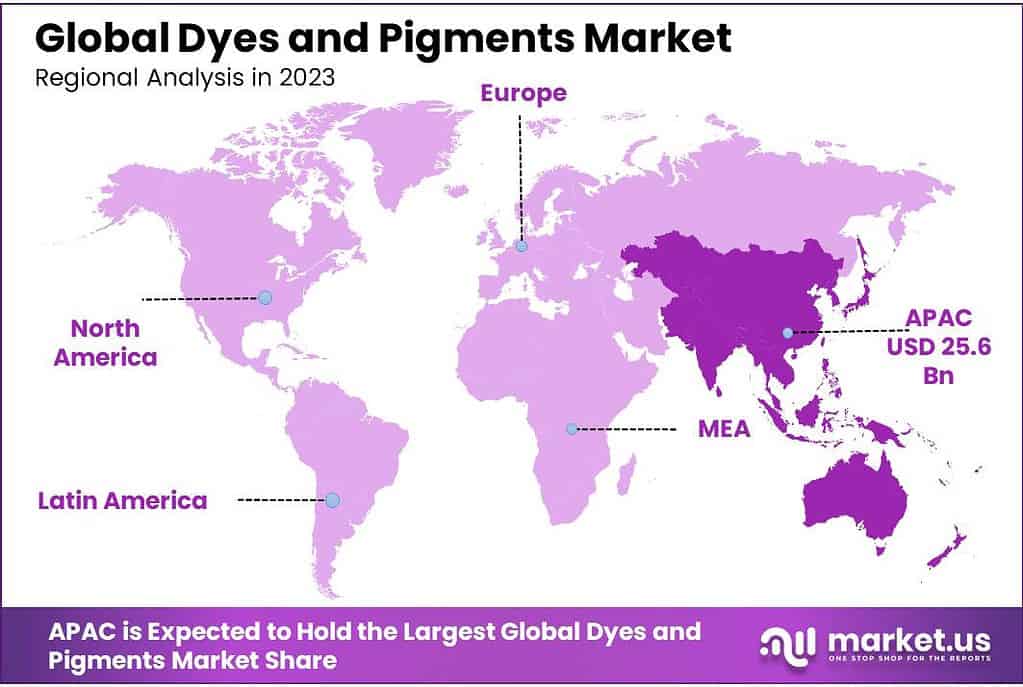

- Regional Analysis: The Asia Pacific region led the market in 2023, accounting for over 61.3% of global revenues, supported by favorable manufacturing conditions and lower regulations.

- Key Players: Major players in the market include BASF SE, Clariant AG, DIC Corporation, Sudarshan Chemical Industries Ltd., among others, focusing on R&D and expanding their operations.

Product type analysis

In 2023, Reactive Dyes were the big players, owning over 54.7% of the market. These dyes are known for sticking well to fibers, making vibrant and long-lasting colors in textiles.

These products are made of highly colored organic materials and have primary applications in the tinting of textiles. These products are resistant to fading and come in a variety of bright colors, making them ideal for coloring rayon and cotton.

They can also form a covalent link with fiber during the dyeing process. It includes a parent dye, linking groups, and an active group. They have characteristics that are better than other dyes in cellulose fibers. This segment is expected to grow at a faster CAGR of 4.2%, between 2023 and 2032.

Organic pigments had a lower market share than inorganic pigments. This is due to their characteristics, including better wetting, darker colors, and leanness. The segment of organic pigments is expected to grow at a 5.1% CAGR in terms of revenue share, between 2023 and 2032. The various stringent regulations that affect the demand for inorganic pigments are likely to make it possible to produce organic pigments by internal substitution.

Application Analysis

In 2023, the Textile sector was ruling the market, grabbing over 59.6% of the share. Dyes and pigments in this field add life and color to fabrics we use for clothes, home furnishings, and more.

Digital printing is expected to increase the demand for printing inks. India and China are two of the largest producers and have the largest markets for dyes. This will increase the potential for printing ink applications across the Asia Pacific region.

Inks can be dyed to achieve desired colors and density. Dyes can give users more density and color per unit of mass than pigments. Dye-based inks can react chemically with other substances. They provide a better image than pigment-based inks that have been enhanced with optical brighteners or color-enhancing agents. These factors are likely to increase the demand for printing inks in the application segment.

Different types of dyes exist, each with unique characteristics and affinities for textiles, including reactive dyes, sulfur dyes, direct dyes, vat dyes, acid dyes, dispersed dyes, and metal complex dyes. Organic compounds called vat dyes are used to color textile material, cotton fiber, leather, and viscose rayon.

Industrial coatings such as automobile refinish, interior paints, exterior paints, printing inks, and plastics are where inorganic pigments are primarily used.

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Dyes

- Reactive Dyes

- Vat Dyes

- Acid Dyes

- Direct Dyes

- Disperse Dyes

- Others

- Pigments

- Organic

- Inorganic

By Application

- Printing Inks

- Paper

- Leather

- Textiles

- Others

Drivers

The textile industry is growing because more people want organic products and because of new technology. Luxury brands are selling more in Asia because people there want these products.

China, Japan, India and the U.S. produce most of the world’s textiles; China being the main producer and exporter. Europe contributes a third to global textile exports from France to Italy and Germany alone while India and also a significant producer while America being amongst one of its primary buyers of textiles.

Making textiles colorful is important. There are two ways to do it: dyeing and substratum impression. Dyeing uses different types of dyes to color materials like linen and nylon. This coloring process helps the global textile industry grow.

In paints and coatings, dyes and pigments add color and protect surfaces. They’re used in architecture, cars, and other stuff. More people building homes and making cars means more demand for paint and coatings. The global automotive industry growing in places with more money is also boosting the need for these products. This higher demand for paints and coatings is helping the market grow.

Restraints

Stringent Regulations Regarding Waste Generation:

The Environmental Protection Agency (EPA) has set strict rules concerning waste generated by a specific industry. They’ve classified the leftovers from producing dyes and pigments as hazardous waste under the EPA hazardous waste code K181. This waste is a byproduct of the preparation and processing of dyes and pigments within manufacturing facilities.

These products have widespread use across various sectors, including clothing, paper, inks, and cosmetics, among others. Across the nation, about 36 facilities contribute to the production of this waste, totaling approximately 36,000 metric tons annually. Unfortunately, this industry’s waste has adverse effects on water bodies, human health, and aquatic life.

Impact on Market Growth:

These stringent regulations regarding waste generation pose a significant challenge to the industry’s growth. The designation of these residues as hazardous waste and the volume produced annually could potentially impact nearly 36 facilities nationally.

Moreover, the adverse effects of this waste on water, humans, and aquatic ecosystems underline the potential hindrance it presents to the industry’s growth trajectory. Compliance with these strict regulations and managing the environmental impact of waste generation emerges as a critical factor that might impede the market’s expansion.

Opportunity

The dyes and pigments market holds promising opportunities driven by various factors. With increasing demand across industries like textiles, paints, coatings, plastics, and printing inks, the market has ample room for growth. Growing populations, urbanization, and changing consumer preferences towards vibrant and aesthetically pleasing products contribute significantly to the market’s expansion.

Moreover, technological advancements in dyeing and pigment manufacturing processes have improved efficiency and quality, enhancing the market’s potential. The shift towards eco-friendly and sustainable products has also spurred innovation in developing organic and natural dyes and pigments, presenting a niche but growing market segment.

The expanding automotive sector, particularly in developing economies, fuels the need for specialized pigments and coatings, further boosting market prospects. Additionally, advancements in healthcare and pharmaceuticals have driven the demand for specialized dyes used in medical diagnostics and imaging.

As industries worldwide continue to prioritize quality, durability, and environmental sustainability, the dyes and pigments market stands poised for growth, offering diverse opportunities for innovation, development, and market expansion.

Challenges

Environmental Regulations and Sustainability: Stricter environmental regulations concerning waste disposal and emissions pose a significant challenge. The classification of certain residues as hazardous waste by regulatory bodies requires adherence to stringent disposal protocols, impacting manufacturing processes and costs.

Additionally, the industry faces increased pressure to adopt sustainable practices due to increased awareness of environmental issues, with customers demanding eco-friendly and non-toxic alternatives.

Health and Safety Issues: Some chemicals found in dyes and pigments pose health and safety threats to employees in manufacturing facilities. Ensuring the safety of employees and complying with health regulations requires substantial investments in safety measures and continuous monitoring, adding to operational costs.

Rapid Technological Changes: While technological advancements drive innovation, they also present challenges. The industry must adapt swiftly to new technologies, such as digital printing, which can disrupt traditional dyeing and printing methods. Staying updated with evolving technologies while ensuring cost-effectiveness and maintaining product quality can be demanding.

Market Competition and Price Volatility: Intense competition within the market, coupled with price fluctuations of raw materials, impacts profit margins for manufacturers. The market’s sensitivity to economic changes and the global supply chain’s volatility further exacerbate challenges related to price stability and competitiveness.

Consumer Preferences and Product Innovation: Meeting ever-changing consumer preferences for novel and sustainable products requires continuous innovation. Developing new formulations that balance performance, cost-effectiveness, and environmental sustainability poses a challenge for manufacturers striving to stay ahead in the market.

Navigating these challenges demands a delicate balance between innovation, compliance, sustainability, and cost-effectiveness, necessitating strategic planning and continuous adaptation within the dyes and pigments industry.

Regional Analysis

The Asia Pacific was the dominant market, accounting for over 61.3% of global revenues in 2023

. Strict regulations governing the markets in North America and Europe could hinder product consumption as well as production.

Because of favorable manufacturing conditions and more relaxed regulations, production facilities are steadily being moved to the Asia Pacific. This is possible due to easy access to raw materials and low-cost, skilled labor.

In 2021, Europe was responsible for 17.0% of total revenues. Growing demand is evident in the increasing production capacities of European dyes. Cathay Industries, for instance, announced in June 2020 that it would expand its South-East Asia manufacturing footprint to meet the increasing demand for iron oxide pigments in the plastics, construction, and coatings industries.

Between April and December 2023, India’s exports of textiles and apparel, including handicrafts, were USD 30.1 billion, up from USD 20.9 billion during the same period the year before.

The growth of the market in Canada will be aided by the increasing usage of titanium dioxide as a pigment in the production of plastics.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

- Latin America

Key Players Analysis

This market’s major players are involved in research and development activities to produce superior-quality colors with better features. To increase their R&D efforts, companies also collaborate with various technological partners.

Although a majority of products are distributed via company-owned channels, certain third-party channels are also being used. To increase their respective market share, companies place significant emphasis on expanding their given operations. Due to the large number of companies operating around the world, the global dyes & pigments market is highly fragmented.

Маrkеt Кеу Рlауеrѕ

- BASF SE

- Clariant AG

- DIC Corporation

- Sudarshan Chemical Industries Ltd.

- Atul Ltd.

- Huntsman Corp.

- Kronos Worldwide, Inc.

- Lanxess AG

- Kiri Industries Ltd.

- Archroma

- Nippon Kayaku

- Kyung-In

Recent developments

In January 2022, Clariant completed the sale of its Pigments business to a consortium of Heubach Group (‘Heubach’) and SK Capital Partners (‘SK Capital’). However, the company retains a 20 % stake in the newly formed Group

In March 2023, BTC Europe, a big name in specialty chemicals, teamed up with Sudarshan Chemical Industries. Sudarshan makes top-notch pigments, both organic and inorganic. This agreement lets BTC Europe offer a wider range of these pigments all across Europe, expanding what they can provide to their customers.

Report Scope

Report Features Description Market Value (2023) USD 41.7 Billion Forecast Revenue (2033) USD 68.6 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dyes, Pigments), By Application (Textile, Paints & coatings, Plastics, Leather, Paper, Printing ink, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Clariant AG, DIC Corporation, Sudarshan Chemical Industries Ltd., Atul Ltd., Huntsman Corp., Kronos Worldwide, Inc., Lanxess AG, Kiri Industries Ltd., Archroma, Nippon Kayaku, Kyung-In Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are dyes and pigments?Dyes and pigments are substances used to impart color to various materials. Dyes are soluble colorants that penetrate and chemically bond with the material, while pigments are insoluble particles suspended in a medium, providing color through dispersion.

What are the main differences between dyes and pigments?Dyes are typically used for coloring textiles, paper, and other materials by chemically bonding with the substrate. Pigments, on the other hand, are particles that provide color by being dispersed in a medium, often requiring a binder to adhere to surfaces.

What industries use dyes and pigments?Dyes and pigments find applications in textiles, paints and coatings, plastics, printing inks, cosmetics, and construction materials like concrete and ceramics.

How do dyes and pigments contribute to product differentiation in various industries?Dyes and pigments play a significant role in product differentiation by providing unique and attractive colors and finishes, allowing brands to distinguish their products in competitive markets.

-

-

- BASF SE

- Clariant AG

- DIC Corporation

- Sudarshan Chemical Industries Ltd.

- Atul Ltd.

- Huntsman Corp.

- Cabot Corp.

- I. DuPont De Nemours & Co.

- Kronos Worldwide, Inc.

- Tronox Ltd.

- Flint Group

- Heubach GmbH

- Other Key Players