Global Dust Control Suppression Chemicals Market Size, Share Analysis Report By Type (Lignin Sulfonate, Calcium Chloride, Magnesium Chloride, Asphalt Emulsions, Oil Emulsions, Polymeric Emulsions, and Others), By End-Use (Mining, Food And Beverages, Construction, Pharmaceuticals, Oil And gas, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172260

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

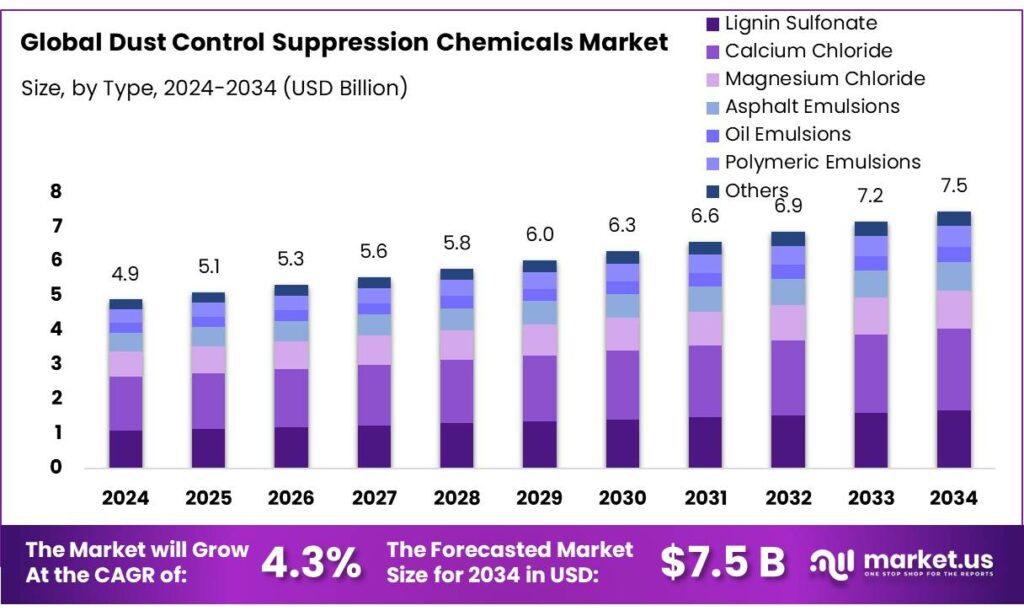

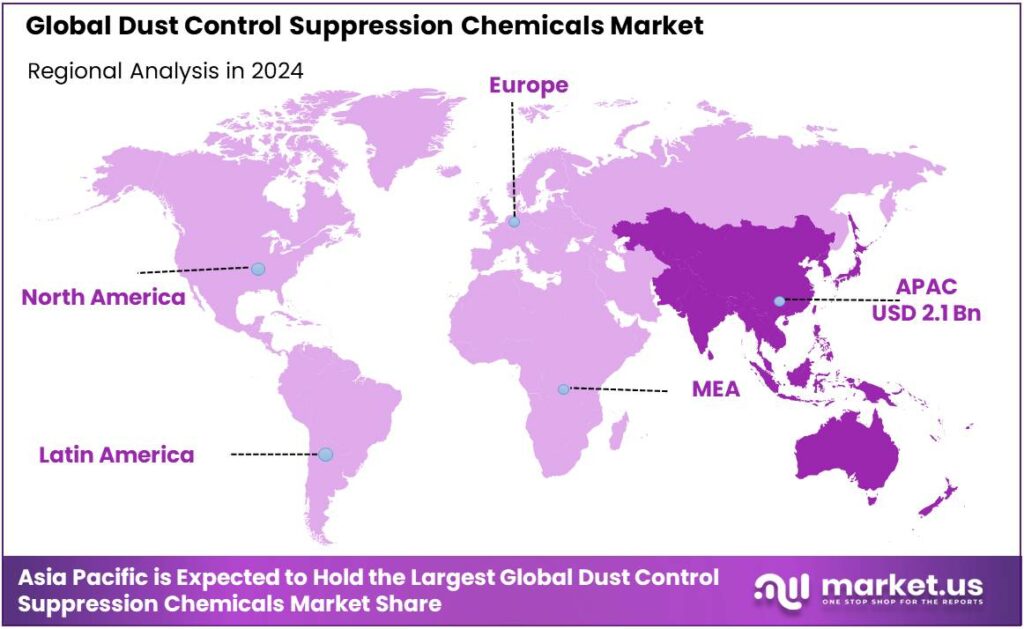

The Global Dust Control Suppression Chemicals Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.9 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.9% share, holding USD 0.4 Billion in revenue.

Dust control suppression chemicals are the chemicals implemented to reduce or eliminate dust emissions from the activities that generate airborne and fugitive dust and cause erosion. Its market is primarily driven by the need to mitigate airborne particulate matter in industrial environments, especially in sectors such as mining, construction, and agriculture. As industrial activities expand, particularly in regions such as the Asia Pacific, the demand for effective dust suppression solutions has increased due to stricter air quality regulations and heightened environmental awareness.

- In 2023, PM2.5 pollution contributed to 4.9 million deaths worldwide, contributing to 8% of the disease burden from air pollution. Globally, deaths from PM2.5 exposure increased by about 24% from 2013 to 2023.

Calcium chloride is widely used as a dust suppressant due to its ability to absorb moisture and bind dust effectively, even in arid conditions. While traditional suppressants are employed, bio-based alternatives are gaining traction as industries move towards more eco-friendly solutions.

However, concerns over the environmental and health impacts of some chemical suppressants, along with the potential for supply chain disruptions caused by geopolitical tensions, pose challenges to market growth. Despite these challenges, the growing focus on worker safety, environmental regulations, and industrial expansion continues to fuel the demand for dust control chemicals across various sectors.

- According to the State of Global Air, 99% of individuals on Earth are exposed to levels of PM2.5 pollution above the annual WHO guideline level of 5 µg/m3; however, 83% of the world’s countries meet the Interim Target 1 of 35 µg/m3 for annual PM2.5.

Key Takeaways

- The global dust control suppression chemicals market was valued at USD 4.9 billion in 2024.

- The global dust control suppression chemicals market is projected to grow at a CAGR of 4.3% and is estimated to reach USD 7.5 billion by 2034.

- Based on the types of dust control suppression chemicals, calcium chloride dominated the market, with a market share of around 31.7%.

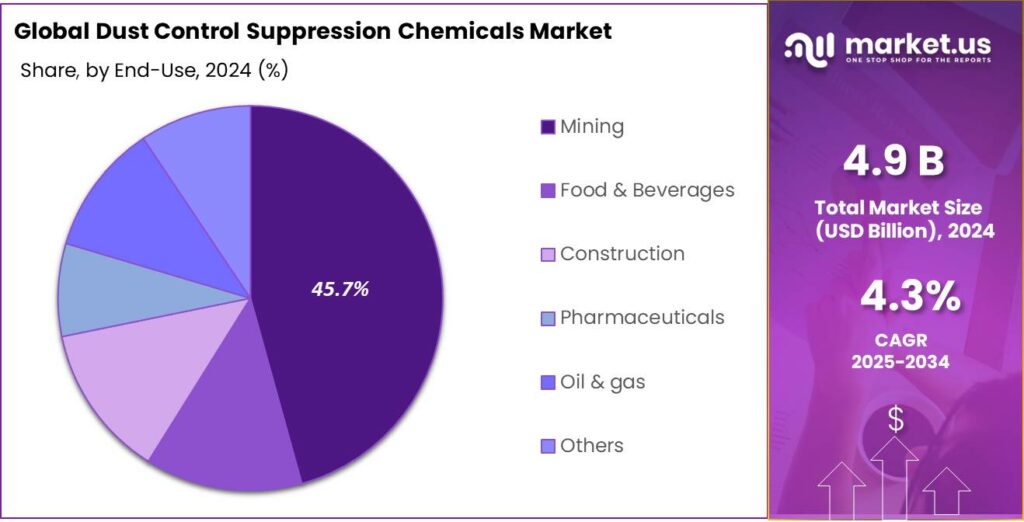

- Among the end-uses of dust control suppression chemicals, mining held a major share in the market, 45.7% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the dust control suppression chemicals market, accounting for around 43.7% of the total global consumption.

Type Analysis

Calcium Chloride is a Prominent Segment in the Dust Control Suppression Chemicals Market.

The dust control suppression chemicals market is segmented based on type into lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, and others. The calcium chloride dominated the market, comprising around 31.7% of the market share, due to its cost-effectiveness, ease of application, extended results, and highly effective hygroscopic properties, which allow it to absorb moisture from the air and bind dust particles more efficiently than other suppressants. It can absorb moisture above 42% RH (relative humidity), and can take more than 95% of its weight in water.

This ability to attract and retain moisture helps reduce dust in dry conditions, making it particularly valuable in regions with arid climates or seasonal droughts. Contrary to lignin sulfonates or magnesium chloride, which may require more frequent reapplication or are less effective in extreme conditions, calcium chloride maintains dust control for extended periods in high-traffic areas. While other suppressants, such as asphalt emulsions or oils, are useful for specific applications, they can be more expensive, less environmentally friendly, or unsuitable for certain climates, making calcium chloride an ideal and widely adopted option for dust suppression.

End-Use Analysis

The Dust Control Suppression Chemicals Were Mostly Utilized in the Mining Sector.

Based on the end-uses of dust control suppression chemicals, the market is divided into mining, food & beverages, construction, pharmaceuticals, oil & gas, and others. The mining sector dominated the market, with a market share of 45.7%. The mining sector is the largest consumer of dust suppressants due to the nature of its operations, which generate significant amounts of particulate matter. Mining activities, including extraction, processing, and transportation of materials, produce dust that poses serious health risks to workers and environmental concerns. Dust can affect air quality, damage equipment, and reduce productivity, making effective dust control essential.

Unlike other industries, such as food & beverages or pharmaceuticals, where dust is less of an operational concern, mining environments often involve large-scale, high-intensity activities in open-air conditions. In contrast, sectors such as construction or oil & gas use dust suppressants more selectively, often in specific applications such as road construction or drilling sites. The mining sector’s constant exposure to dust, coupled with stringent health and safety regulations, necessitates frequent and intensive use of dust suppression chemicals, making it the leading industry for such products.

Key Market Segments

By Type

- Lignin Sulfonate

- Calcium Chloride

- Magnesium Chloride

- Asphalt Emulsions

- Oil Emulsions

- Polymeric Emulsions

- Others

By End-Use

- Mining

- Food & Beverages

- Construction

- Pharmaceuticals

- Oil & gas

- Others

Drivers

Regulatory Frameworks to Reduce Particulate Matters Drive the Dust Control Suppression Chemicals Market.

Regulatory frameworks aimed at reducing particulate matter (PM) emissions are significantly influencing the dust control suppression chemicals market. Governments worldwide have implemented stringent air quality regulations, particularly in industrial sectors such as mining, construction, and agriculture, where particulate pollution is most prevalent. For instance, in the United States, the Environmental Protection Agency (EPA) has set regulations under the Clean Air Act to limit PM emissions, pushing industries to adopt dust control measures.

Similarly, the European Union’s directives on ambient air quality emphasize reducing dust and particulate pollution. These regulations encourage industries to use chemical suppressants such as surfactants, polymers, and lignosulfonates, which are highly effective in binding dust particles and preventing their release into the atmosphere. The demand for such chemicals is amplified by rising environmental awareness and growing penalties for non-compliance with air quality standards, driving greater adoption across global industries.

- In the United States, non-compliance with US air quality standards under the Clean Air Act (CAA) results in serious penalties, including substantial civil fines, often over US$100,000 per day, and criminal prosecution for knowing violations.

Restraints

Environmental Harm and Health Concerns Related to Various Suppressants Might Hamper the Growth of the Dust Control Suppression Chemicals Market.

The potential environmental and health risks associated with certain dust control suppression chemicals may hinder the growth of the market. Many dust suppressants, particularly those containing harmful chemical compounds, pose risks to ecosystems and human health. For instance, some surfactants and synthetic polymers used in dust control have been found to leach into the soil and water, negatively impacting vegetation and aquatic life.

In addition, some studies have shown that prolonged exposure to these chemicals can lead to respiratory issues, skin irritation, and other health concerns for workers in industries such as mining and construction. Similarly, the toxicity of some chemicals raises concerns about long-term environmental contamination. The regulatory bodies are increasingly scrutinizing the use of these chemicals, pushing for the development and adoption of safer, eco-friendly alternatives. This regulatory pressure, combined with heightened environmental awareness, may limit the widespread use of traditional dust suppression chemicals, restraining market growth.

Opportunity

Rapid Industrial Expansion Creates Opportunities in the Dust Control Suppression Chemicals Market.

According to the International Yearbook of Industrial Statistics by the United Nations, industrial sectors, comprising mining, manufacturing, and utilities, experienced a global growth rate of 2.4% in 2023, and the world’s manufacturing value added (MVA) share in the GDP was 16.7%. Rapid industrial expansion, particularly in emerging economies, is generating significant opportunities for the dust control suppression chemicals market. As industries such as mining, construction, and manufacturing grow, the demand for effective dust suppression solutions becomes more critical. In regions such as Asia-Pacific, where infrastructure development is experiencing exponential growth, the construction sector alone contributes to increased particulate emissions.

For instance, large-scale projects in countries such as India and China are creating environments with elevated dust levels, prompting stricter air quality regulations and the adoption of dust control chemicals. Similarly, in mining operations, where dust can severely impact both worker health and productivity, the demand for suppression products is rising. As industrial activities expand and environmental regulations tighten, companies are increasingly utilizing chemical solutions to manage dust, creating a substantial market opportunity.

- According to the Organization for Economic Co-operation and Development, across 11 countries of Canada, Denmark, France, Germany, Ireland, Israel, Italy, Netherlands, Slovenia, Sweden, and the United Kingdom, the industrial policy expenditures through grants, tax incentives, and financial instruments, such as loans, loan guarantees and government venture capital, grew from an average of 2.13% of GDP in 2019 to 2.35% of GDP in 2022, approximately an increase of US$ 6.1 billion.

Trends

Shift Towards Bio-Based Suppressants.

The shift towards bio-based suppressants in the dust control suppression chemicals market is gaining momentum as industries and regulatory bodies prioritize sustainability and environmental safety. Bio-based dust suppressants, derived from natural sources such as plant extracts, lignin, and polysaccharides, offer a more eco-friendly alternative to traditional chemical formulations.

These products are biodegradable, non-toxic, and typically have a lower environmental footprint, making them increasingly attractive to industries that are facing stricter environmental regulations. The bio-based solutions are being adopted in road construction and agricultural sectors, where chemical runoff can lead to soil and water contamination.

This growing trend is driven by consumer demand for greener solutions and an overall shift toward corporate sustainability practices, pushing manufacturers to invest in more eco-conscious alternatives to traditional dust control chemicals. For instance, in December 2025, Ergo Eco Solutions announced the launch of a new bio-based dust suppressant made from recycled organic food waste.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Dust Control Suppression Chemicals Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions are influencing the dust control suppression chemicals market in multiple ways, creating challenges and opportunities for the industry. The trade disruptions resulting from geopolitical instability, such as the ongoing trade tensions between major economies, can lead to supply chain challenges, affecting the availability and cost of raw materials used in dust control products. For instance, China is the largest exporter of chemicals in the world, and the US tariffs on certain Chinese imports have driven up the prices of several chemicals in the region.

Additionally, the conflicts involving major maritime routes, such as the South China Sea, have resulted in delays in deliveries of goods. Furthermore, the chemical industry relies heavily on raw materials such as crude oil. Due to the conflicts, such as the Russia-Ukraine conflict and conflicts in the Middle East, the production costs of petrochemicals have increased, making the dust control suppression chemicals expensive. In contrast, these tensions, which have limited access to certain chemical components, are encouraging the development of alternative solutions, including bio-based or locally sourced suppressants.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Dust Control Suppression Chemicals Market.

In 2024, the Asia Pacific dominated the global dust control suppression chemicals market, holding about 43.7% of the total global consumption. The region holds the largest share of the global dust control suppression chemicals market, primarily driven by rapid industrialization, infrastructure development, and stringent air quality regulations. The region’s booming construction, mining, and manufacturing sectors are significant contributors to elevated particulate emissions, prompting a high demand for dust suppression solutions.

- According to the United Nations Industrial Development Organization, manufacturing employment in the Asia Pacific increased by 1.7%, as the region accounted for 56.7% of the world’s manufacturing value added (MVA) in 2023.

For instance, according to the National Bureau of Statistics of China, infrastructure investment reached approximately US$2.4 trillion in 2023, marking a 6% increase from 2022. These infrastructure developments generate significant dust levels, leading to increased adoption of dust control chemicals. Furthermore, air quality standards in countries such as India, Japan, and South Korea have become stricter, further spurring the demand for effective dust suppressants.

For instance, in India, polluters failing to inform authorities about emission breaches now face penalties from INR10,000 to INR15 lakh, plus INR10,000 daily for continued non-compliance. This combination of industrial growth and regulatory pressures has cemented Asia Pacific’s dominance in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies invest in research and development to create innovative, eco-friendly, and more efficient dust suppression solutions, responding to growing demand for sustainable products. In addition, companies form strategic collaborations and alliances with key industries such as mining, construction, and agriculture to ensure widespread adoption of their products. Similarly, the companies focus on partnerships with distributors to expand their geographical presence through distribution networks to tap into regions experiencing rapid industrialization.

The Major Players in The Industry

- Borregaard AS

- Cargill, Incorporated

- Midwest Industrial Supply Inc.

- Green Vision Life Sciences

- Alumichem

- Cloud Tech Private Limited

- Chemtex

- Soilworks, LLC

- Ecolab Inc.

- Benetech, Inc.

- Hexion

- Evonik Industries AG

- Other Key Players

Key Development

- In November 2025, Alumichem A/S announced to have signed an agreement to sell its calcium magnesium acetate de-icing and dust suppression line for a consideration in the low single-digit million DKK range, with full IP and commercial rights to Photocat.

- In October 2024, Borregaard announced NOK 490 million to expand its Sarpsborg lignin-biopolymer capacity by up to 10% by 2027. The investment specifically targeted increasing the capacity for the biopolymers used in their Dustex dust suppression product.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Bn Forecast Revenue (2034) USD 7.5 Bn CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lignin Sulfonate, Calcium Chloride, Magnesium Chloride, Asphalt Emulsions, Oil Emulsions, Polymeric Emulsions, and Others), By End-Use (Mining, Food & Beverages, Construction, Pharmaceuticals, Oil & gas, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Borregaard AS, Cargill, Incorporated, Midwest Industrial Supply Inc., Green Vision Life Sciences, Alumichem, Cloud Tech Private Limited, Chemtex, Soilworks, LLC, Ecolab Inc., Benetech, Inc., Hexion, Evonik Industries AG, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Dust Control Suppression Chemicals MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Dust Control Suppression Chemicals MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample- Borregaard AS

- Cargill, Incorporated

- Midwest Industrial Supply Inc.

- Green Vision Life Sciences

- Alumichem

- Cloud Tech Private Limited

- Chemtex

- Soilworks, LLC

- Ecolab Inc.

- Benetech, Inc.

- Hexion

- Evonik Industries AG

- Other Key Players