Duck Boots in Japan Market Size, Share, Growth Analysis By Material (Rubber, Canvas, Leather, Cotton), By End User (Women, Men, Kids), By Sales Channel (Specialty Stores, Multi-Brand Stores, Independent Small Retailers, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171569

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

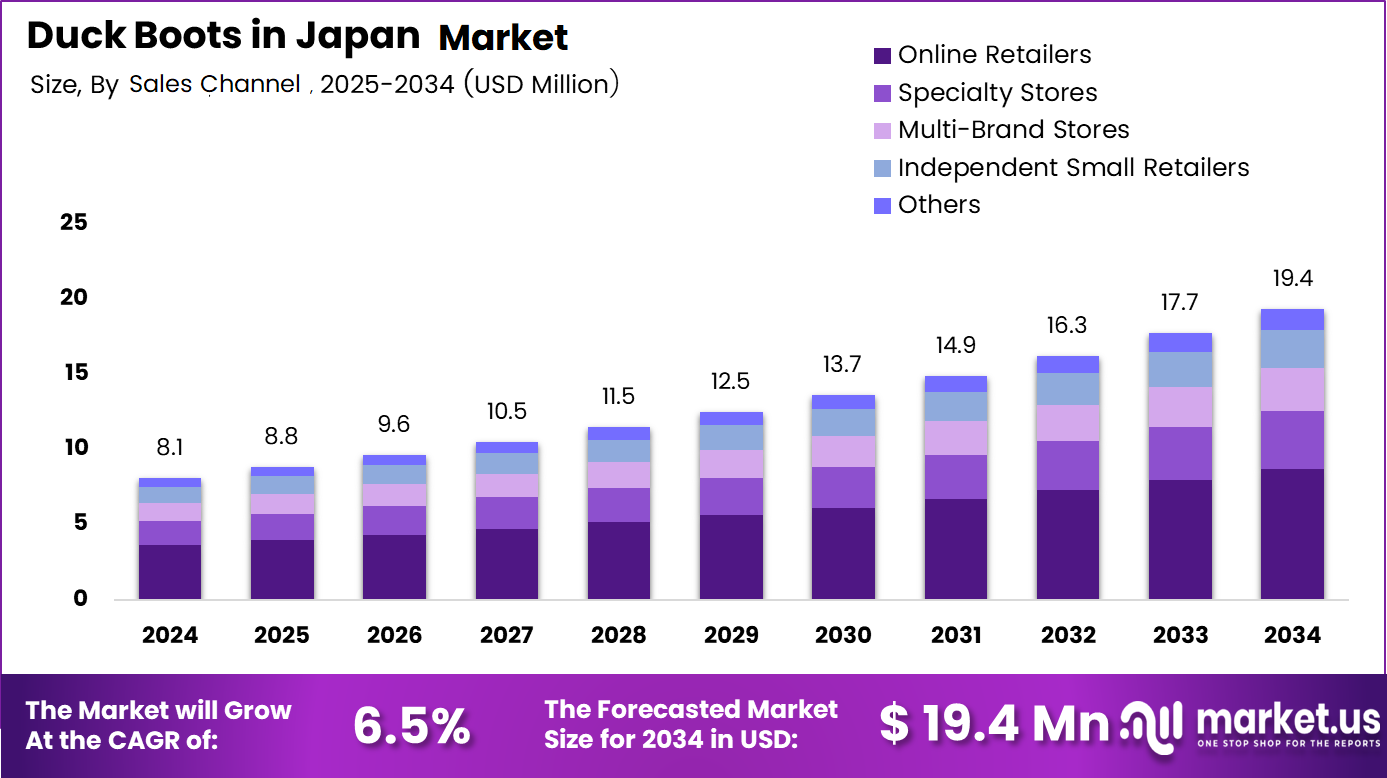

The Duck Boots in Japan Market size is expected to be worth around USD 19.4 million by 2034, from USD 8.1 Million in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The Duck Boots in Japan market refers to the demand, distribution, and usage of waterproof, insulated footwear designed for wet, cold, and slippery environments. In Japan, duck boots align well with seasonal rainfall, snowfall in northern regions, and urban winter commuting needs. These boots combine functionality, durability, and lifestyle appeal within the broader outdoor footwear market.

From an analyst perspective, Duck Boots in Japan are expected to experience steady growth as consumers increasingly prioritize weather resilience and daily comfort. Moreover, urban consumers seek versatile footwear suitable for commuting, travel, and casual outdoor activities. As a result, duck boots are increasingly positioned as practical lifestyle products rather than purely seasonal utility footwear.

Additionally, changing climate patterns have intensified rainfall variability and winter precipitation across several Japanese prefectures. Consequently, demand for waterproof boots with reliable grip continues to strengthen. Retailers benefit from this shift, as duck boots meet both functional and aesthetic expectations. Furthermore, rising interest in domestic travel and outdoor leisure supports sustained category expansion.

Government focus on pedestrian safety and winter mobility indirectly supports market development. Japan’s emphasis on slip prevention in public infrastructure and footwear safety standards encourages adoption of slip-resistant Shoe. Moreover, regulations governing material safety and consumer product quality enhance buyer confidence, supporting long-term demand for compliant and durable winter footwear products.

Opportunities also emerge from innovation in lightweight materials and ergonomic sole construction. Manufacturers increasingly invest in comfort-focused engineering to support extended wear. As Japanese consumers value minimalism and comfort, boots that balance protection with reduced bulk gain stronger acceptance across age groups, especially among urban professionals and aging populations.

In terms of performance benchmarks, advanced duck boot models integrate waterproofing, insulation, and slip resistance while withstanding temperatures as low as -25°F, according to manufacturers study. Such specifications improve consumer trust, particularly in northern Japan, where winter exposure risks remain consistently high.

Recent product documentation further highlights lightweight sole engineering innovations. According to manufacturer technical documentation, some designs feature soles that are 50% thinner and 30% lighter, improving comfort without compromising stability. Consequently, these advancements enhance walkability, reduce fatigue, and expand duck boots’ relevance within Japan’s everyday footwear market.

Key Takeaways

- USD 8.1 million market size in 2024 projected to reach USD 19.4 million by 2034, expanding at a 6.5% CAGR.

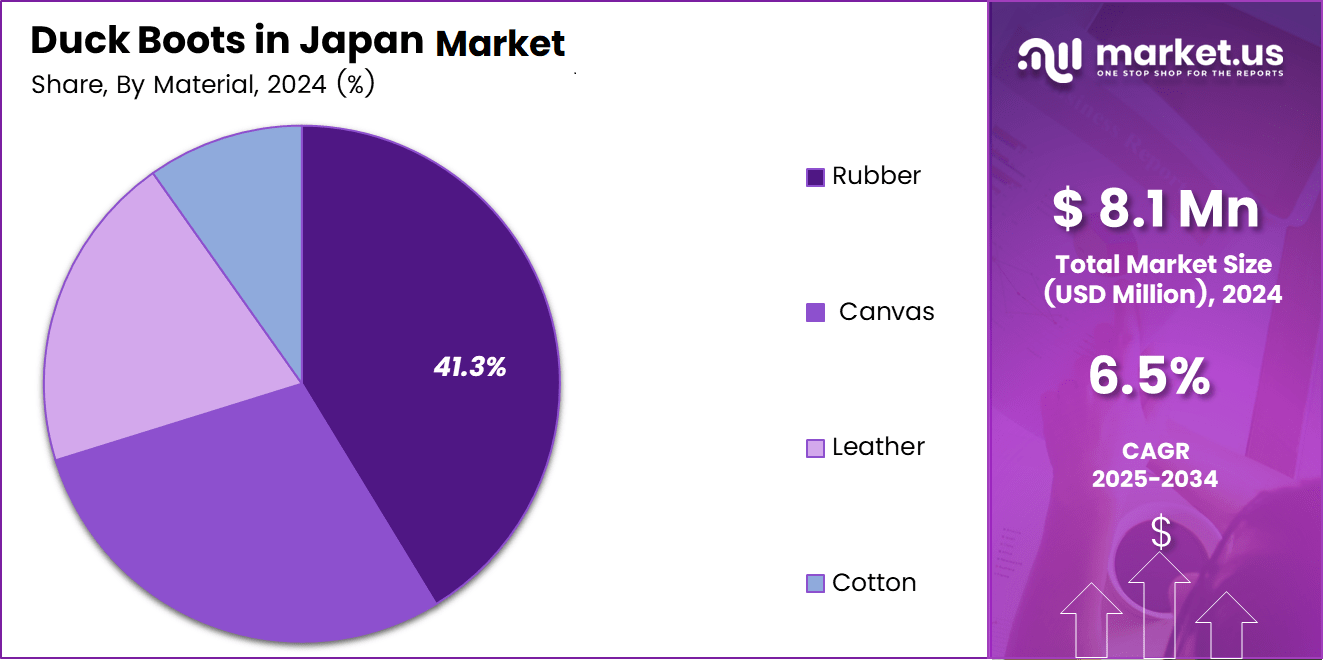

- Rubber emerged as the leading material segment with a market share of 41.3%, driven by waterproofing and durability needs.

- Women represented the dominant end-user segment, accounting for a 44.6% share due to higher seasonal footwear consumption.

- Online Retailers led sales channels with a contribution of 44.8%, supported by digital adoption and convenience.

- Japan remained the core regional market, supported by wet climate conditions, urban commuting demand, and winter safety requirements.

By Material Analysis

Rubber dominates with 41.3% due to its superior waterproofing and durability in wet and snowy Japanese conditions.

In 2024, Rubber held a dominant market position in the By Material Analysis segment of Duck Boots in Japan Market, with a 41.3% share. Moreover, consumers favor rubber for monsoon resilience, snow resistance, and easy maintenance. As a result, rubber-based duck boots remain preferred for outdoor commuting, rural travel, and seasonal weather protection.

Canvas duck boots are increasingly adopted due to their breathable structure and lighter weight. Additionally, these products appeal to urban users seeking casual styling with moderate water resistance. As fashion utility footwear grows, canvas-based designs are expected to gain traction in mild weather and lifestyle-driven purchasing decisions.

Leather duck boots continue to attract premium buyers because of durability and aesthetic appeal. Furthermore, leather offers insulation and longevity, making it suitable for colder regions. Consequently, this segment benefits from gifting demand and consumers prioritizing craftsmanship, despite higher price sensitivity in Japan.

Cotton-based duck boots serve niche demand emphasizing comfort and sustainability. Gradually, eco-conscious buyers support cotton variants for daily wear. Although limited in waterproof performance, cotton materials align with minimalist fashion preferences and indoor-outdoor transitional usage.

By End User Analysis

Women dominate with 44.6% driven by higher fashion adaptability and seasonal footwear consumption.

In 2024, Women held a dominant market position in the By End User Analysis segment of Duck Boots in Japan Market, with a 44.6% share. Moreover, women consumers actively seek weather-ready footwear blending fashion and function. Consequently, brands focus on color options, slim profiles, and lightweight designs.

Men represent a steady demand segment emphasizing durability and outdoor practicality. Additionally, male buyers prioritize grip, insulation, and long-term wear. As a result, classic and utility-focused duck boots remain popular among commuters, hikers, and rural workers.

Kids duck boots witness consistent adoption driven by school use and seasonal protection needs. Furthermore, parents value waterproof safety and slip resistance. As weather unpredictability rises, demand for child-friendly duck boots with easy fastening continues to expand.

By Sales Channel Analysis

Online Retailers dominate with 44.8% supported by convenience, product variety, and digital promotions.

In 2024, Online Retailers held a dominant market position in the By Sales Channel Analysis segment of Duck Boots in Japan Market, with a 44.8% share. Moreover, consumers increasingly prefer online platforms for size comparison, reviews, and seasonal discounts. Consequently, digital-first brands strengthen direct-to-consumer strategies.

Specialty Stores maintain relevance through expert guidance and curated collections. Additionally, customers value in-store trials and material verification. Therefore, specialty outlets remain important for premium and first-time buyers.

Multi-Brand Stores attract shoppers seeking brand comparison under one roof. Furthermore, these stores support impulse purchases during seasonal promotions. As a result, they sustain moderate but stable sales contributions.

Independent Small Retailers cater to localized demand and community loyalty. Gradually, personalized service supports repeat purchases, although limited inventory restricts scale growth.

Other channels, including pop-up stores and exhibitions, contribute marginally by supporting brand visibility. These formats enhance experiential engagement and seasonal marketing reach.

Key Market Segments

By Material

- Rubber

- Canvas

- Leather

- Cotton

By End User

- Women

- Men

- Kids

By Sales Channel

- Specialty Stores

- Multi-Brand Stores

- Independent Small Retailers

- Online Retailers

- Others

Drivers

Rising Demand for Waterproof Winter Footwear Drives Duck Boots in Japan Market Growth

Rising demand for waterproof winter footwear strongly supports the duck boots market in Japan, driven by snowy northern regions and prolonged rainy seasons. Consumers actively seek boots that protect feet from slush, rain, and wet streets, making duck boots a practical solution for daily winter use. This climate alignment strengthens their functional relevance across multiple regions.

Strong consumer preference for durable outdoor lifestyle footwear further drives market demand. Japanese buyers value long-lasting products with extended replacement cycles, especially for seasonal footwear. Duck boots meet this expectation through sturdy rubber soles and reinforced uppers, reducing the need for frequent repurchases and improving long-term value perception.

Growing influence of urban outdoor fashion also accelerates adoption. Utility-inspired boots increasingly blend with casual streetwear, appealing to younger consumers and city professionals. Duck boots fit this trend by combining rugged looks with clean silhouettes suitable for everyday outfits.

Increased participation in light hiking, camping, and nature tourism among domestic travelers supports usage beyond winter commuting. Duck boots offer sufficient grip and weather resistance for casual outdoor activities, making them a versatile option for short trips and recreational travel within Japan.

Restraints

High Price Sensitivity Limits Wider Adoption in Duck Boots in Japan Market

High price sensitivity among mid-income consumers restrains market expansion, particularly for premium duck boots. Many buyers compare prices closely and may shift toward lower-cost winter footwear alternatives, limiting penetration of higher-margin products in mass retail channels.

Seasonal demand concentration also challenges consistent sales. Duck boots are primarily purchased during colder and wetter months, resulting in uneven revenue flows for retailers. This seasonality complicates inventory planning and reduces year-round shelf visibility.

Limited product differentiation across brands adds to substitution risks. Similar designs, materials, and performance features make it easier for consumers to switch to other winter boots offering comparable protection. This reduces brand loyalty and intensifies price-based competition.

Preference for lightweight footwear in dense urban commuting environments further restricts adoption. Heavy boots may feel inconvenient for long train commutes and daily walking, leading some consumers to choose lighter shoes even during wet conditions.

Growth Factors

Expansion of Eco-Friendly Product Lines Creates New Growth Opportunities

Expansion of eco-friendly and recycled-material duck boots presents a strong growth opportunity. Sustainability-conscious Japanese consumers increasingly favor products made from recycled rubber, organic textiles, and low-impact materials, encouraging brands to innovate responsibly.

Product localization tailored to Japanese foot sizing and comfort standards offers another opportunity. Adjusting fit, cushioning, and flexibility to local preferences can improve comfort and reduce fatigue, enhancing acceptance among everyday urban users.

Minimalist design preferences also support localized development. Clean lines, subtle branding, and neutral tones align well with Japanese aesthetics, helping duck boots transition from outdoor use to daily wear.

Growth of private-label offerings by domestic retailers and department stores further expands market reach. These products typically balance quality and affordability, attracting price-sensitive consumers while increasing category visibility through trusted retail brands.

Emerging Trends

Integration of Comfort and Style Shapes Key Trends in Duck Boots in Japan Market

Integration of thermal insulation with breathable linings is a major trend. Consumers seek warmth without overheating, especially for all-day urban wear. Advanced linings improve comfort during long commutes and indoor transitions.

Popularity of neutral colors and minimalist silhouettes continues to rise. Shades such as black, beige, and olive suit Japanese fashion trends and make duck boots easier to pair with work and casual clothing.

Increasing use of duck boots in casual office and hybrid work settings reflects changing dress norms. As workplaces adopt relaxed dress codes, functional boots gain acceptance beyond outdoor use.

Collaboration launches between footwear brands and Japanese outdoor or fashion labels also trend upward. These partnerships add cultural relevance, limited-edition appeal, and localized design elements that attract style-conscious buyers.

Key Duck Boots in Japan Company Insights

In the competitive landscape of the Duck Boots in Japan Market in 2024, consumer preferences are shifting toward functional yet fashion-forward outdoor footwear.

Rockport continues to strengthen its position by blending comfort technology with classic duck boot design, appealing to both urban commuters and outdoor enthusiasts. Its focus on ergonomic fit and durable materials has resonated with Japanese consumers who value quality and versatility in seasonal footwear.

Market dynamics in Japan show a growing niche for heritage and rugged outdoor brands, where Milwaukee Boots has carved out a distinct identity. Known for its robust build and workwear aesthetic, the brand’s duck boot offerings have attracted a segment of male and female buyers seeking durability without sacrificing everyday comfort. Strategic collaborations with local retailers have further enhanced its visibility in key urban centers like Tokyo and Osaka.

Heritage fashion influences are evident in the performance of Frye within this segment, as consumers increasingly gravitate toward premium craftsmanship. Frye’s duck boots leverage its storied reputation in leather goods, positioning its products as a blend of rugged functionality and high-end style. This dual appeal has supported steady growth among fashion-conscious yet practical shoppers who are willing to invest in long-lasting footwear solutions.

Finally, Clarks has utilized its brand equity to gain traction in Japan’s duck boot category, emphasizing comfort technologies and seasonal relevance. By integrating moisture-resistant materials with the brand’s signature cushioning systems, Clarks has attracted a broad demographic, from outdoor adventurers to everyday urban users. Its extensive retail network and targeted marketing campaigns have been instrumental in driving consumer awareness and adoption throughout 2024.

Top Key Players in the Market

- Rockport

- Milwaukee Boots

- Frye

- Clarks

- Others

Recent Developments

- In March 2024, L.L.Bean’s Japanese operations did not reach a total of 25 stores; rather, the company reported that it already had a total of 25 stores in Japan as part of its existing global operations. This reflects its established physical retail presence, which complements its e-commerce business in the region.

- In March 2024, the FCTRY LAb company launched unique duck boot collaborations with several athletes and artists, demonstrating a trend towards lifestyle and celebrity endorsements.

Report Scope

Report Features Description Market Value (2024) USD 8.1 Million Forecast Revenue (2034) USD 19.4 million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Rubber, Canvas, Leather, Cotton), By End User (Women, Men, Kids), By Sales Channel (Specialty Stores, Multi-Brand Stores, Independent Small Retailers, Online Retailers, Others) Competitive Landscape Rockport, Milwaukee Boots, Frye, Clarks, Others Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rockport

- Milwaukee Boots

- Frye

- Clarks

- Others