Global Drone Logistics and Transportation Market By Platform (Freight Drone, Passenger Drone, Ambulance Drone), By Range (Close range, Short range, Mid-range, Long-range), By Application (Logistics and Transportation), By End User (Commercial, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 113959

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

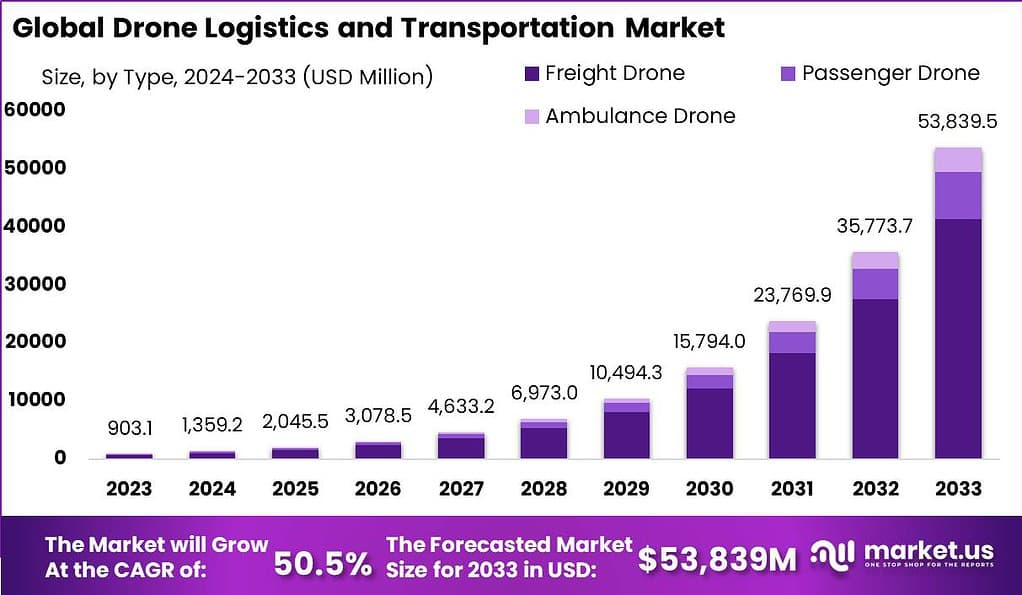

The Global Drone Logistics and Transportation Market size is expected to be worth around USD 53,839.5 Million by 2033, from USD 903.1 Million in 2023, growing at a CAGR of 50.5% during the forecast period from 2024 to 2033.

Drone Logistics and Transportation refers to the use of unmanned aerial vehicles (UAVs), commonly known as drones, for the transportation of goods and materials. This emerging field leverages drone technology to overcome traditional transportation challenges, such as traffic congestion, delivery delays, and limited accessibility. Drone logistics and transportation offer numerous benefits, including faster and more efficient delivery, reduced costs, increased safety, and the ability to reach remote or challenging locations.

The drone logistics and transportation market is witnessing remarkable growth as businesses and governments recognize the transformative potential of aerial drone technologies. In recent years, this market has experienced significant expansion due to the increasing demand for efficient, on-demand delivery services and the automation of logistics processes.

Analyst Viewpoint

The drone logistics and transportation sector exhibits a compelling landscape with several driving factors and abundant opportunities. Firstly, the growing need for faster and more efficient delivery solutions is a significant driver of this market. Consumers and businesses alike are seeking quicker ways to receive goods, and drones offer an agile response to this demand. Additionally, advancements in drone technology, including longer flight ranges, enhanced payload capacities, and improved navigation systems, are contributing to the expansion of drone logistics.

Furthermore, the opportunities within this market are extensive. One notable opportunity lies in the last-mile delivery segment, where drones can drastically reduce the time and cost associated with delivering packages to customers’ doorsteps. In the healthcare industry, drones hold the potential to revolutionize the transport of medical supplies, especially in remote or disaster-stricken areas. Moreover, the integration of drone logistics into urban settings presents a unique opportunity for businesses to streamline operations, reduce congestion, and minimize environmental impact.

Additionally, the market includes various supporting technologies and services, such as drone delivery platforms, route optimization software, and maintenance and repair services. In March 2023, Zipline introduced its latest aircraft model, the P2 Zip, aiming to normalize fast aerial deliveries for customers across the U.S., including densely populated urban regions. The P2 Zip drone boasts the ability to transport up to eight pounds of cargo over a ten-mile range, facilitating deliveries to areas as small as a table or doorstep.

Key Takeaways

- The Global Drone Logistics and Transportation market size is poised to cross USD 1,074.9 million in 2024 and is likely to attain a valuation of USD 1,336.20 million by 2033.

- In 2023, the Freight segment emerged as the dominant market segment in the Drone Logistics and Transportation Market, capturing more than a 77% share.

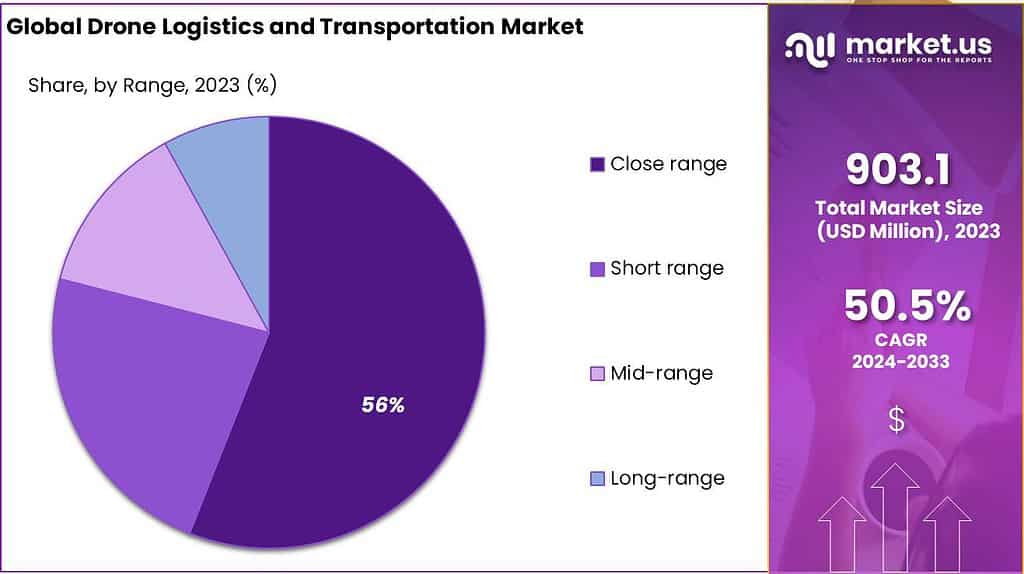

- In 2023, the Close range segment emerged as the dominant player in the drone logistics and transportation market, capturing a significant market share of over 56%.

- In 2023, the Logistics segment held a dominant market position in the drone logistics and transportation industry, capturing a significant share.

- In 2023, the Commercial segment emerged as the dominant force in the drone logistics and transportation market, capturing a significant market share of over 70%.

Platform Analysis

In 2023, the Freight segment emerged as the dominant market segment in the Drone Logistics and Transportation Market, capturing more than a 77% share. This segment’s significant market position can be attributed to several key factors. First and foremost, the use of drones in freight transportation offers numerous advantages, including faster delivery times, reduced costs, and improved efficiency. Drones are capable of bypassing traditional transportation infrastructure, such as roads and traffic, to deliver goods directly from point to point, making them particularly well-suited for last-mile delivery in urban areas or remote locations.

Furthermore, the increasing demand for e-commerce and same-day delivery services has created a need for efficient and timely freight transportation solutions. Drones provide a cost-effective alternative to traditional delivery methods, enabling companies to enhance their logistics operations and meet customer expectations for faster and more convenient deliveries.

The freight segment encompasses a wide range of applications, including the transportation of packages, parcels, and even heavy cargo. Drones designed for freight are equipped with advanced navigation systems, payload capacities, and safety features to ensure secure and reliable transportation. Additionally, advancements in drone technology, such as longer flight times, improved battery life, and enhanced payload capabilities, have further fueled the growth of the freight segment.

As regulations surrounding drone operations continue to evolve and become more favorable for commercial use, the freight segment is expected to witness continued growth. However, it is important to note that the passenger and ambulance segments also hold significant potential in the drone logistics and transportation market. Passenger drones have the potential to revolutionize personal transportation, offering a convenient and efficient mode of travel in urban areas. Ambulance drones can provide rapid medical assistance in emergency situations, reducing response times and potentially saving lives. These segments are expected to gain traction as technology advances, regulations mature, and public acceptance grows.

Range Analysis

In 2023, the Close range segment emerged as the dominant player in the drone logistics and transportation market, capturing a significant market share of over 56%. This segment refers to drones that operate within a limited range, typically within a few kilometers from their base. Close range drones have gained popularity due to their ability to efficiently handle last-mile deliveries and provide speedy transportation services within urban areas.

The rise of e-commerce and the increasing demand for quick and convenient deliveries have fueled the adoption of close range drones. These drones offer several advantages over traditional delivery methods, such as reduced delivery time, enhanced efficiency, and cost-effectiveness. With their ability to navigate through congested urban areas and bypass traffic, close range drones enable companies to meet the growing expectations of customers for same-day or even one-hour deliveries.

Additionally, close range drones are equipped with advanced technologies such as collision avoidance systems and GPS navigation, ensuring safe and accurate deliveries. They can carry small packages, groceries, medicines, and other essential items, making them ideal for fulfilling the immediate needs of customers. Moreover, the compact size and maneuverability of close range drones allow them to access hard-to-reach locations, including densely populated areas or places with limited infrastructure.

The market growth of close range drones is further supported by the regulatory environment, with many countries implementing favorable regulations for their commercial use. Governments are recognizing the potential of drone technology to revolutionize logistics and transportation, leading to the relaxation of restrictions and the establishment of guidelines for safe drone operations.

Application Analysis

In 2023, the Logistics segment held a dominant market position in the drone logistics and transportation industry, capturing a significant share. This segment primarily focuses on the use of drones for various logistics applications, including inventory management, warehouse operations, and supply chain optimization. The adoption of drone technology in the logistics sector has gained traction due to its potential to streamline operations, enhance efficiency, and reduce costs.

Logistics companies face numerous challenges in managing their operations, such as inventory tracking, order fulfillment, and last-mile deliveries. Drones offer a compelling solution to address these challenges by providing real-time monitoring, rapid data collection, and efficient transportation capabilities. With drones, logistics companies can automate inventory management, track stock levels, and gather data on warehouse operations, enabling them to make informed decisions and streamline their processes.

One of the key advantages of using drones in logistics is their ability to optimize supply chain operations. Drones can be deployed to collect data on transportation routes, monitor traffic conditions, and assess road congestion. This information can be used to identify bottlenecks, optimize delivery routes, and improve overall supply chain efficiency. By leveraging drone technology, logistics companies can reduce delivery times, minimize fuel consumption, and ultimately enhance customer satisfaction.

Moreover, drones can play a crucial role in last-mile deliveries, which is often the most challenging and expensive part of the logistics process. With their ability to navigate through congested urban areas and deliver packages to specific locations, drones offer a faster and more cost-effective alternative to traditional delivery methods. This is particularly beneficial for e-commerce companies that strive to meet the growing demand for same-day or next-day deliveries.

End User Analysis

In 2023, the Commercial segment emerged as the dominant force in the drone logistics and transportation market, capturing a significant market share of over 70%. This segment primarily focuses on the use of drones for commercial purposes, including logistics and transportation services. The rapid growth of e-commerce, coupled with the need for efficient and timely deliveries, has propelled the commercial use of drones in the logistics industry.

Commercial drones offer numerous advantages, making them an attractive option for logistics and transportation companies. These drones are equipped with advanced technologies such as GPS navigation, real-time tracking systems, and high-resolution cameras, enabling companies to monitor and manage their operations effectively. By leveraging drone technology, businesses can optimize their delivery routes, reduce costs, and enhance overall operational efficiency.

The use of drones in the commercial sector enables faster and more flexible deliveries, particularly in congested urban areas. Drones can navigate through traffic and reach destinations more quickly, reducing delivery times and improving customer satisfaction. Moreover, commercial drones have the capacity to carry small to medium-sized packages, making them suitable for various logistics applications, including last-mile deliveries and inter-warehouse transportation.

The commercial segment has also benefited from favorable regulatory frameworks that support the integration of drones into existing logistics and transportation systems. Governments and regulatory bodies have recognized the potential of drones to revolutionize the logistics industry, leading to the establishment of guidelines and regulations for their safe and responsible use. This has provided businesses with the necessary confidence to invest in commercial drone operations and leverage their benefits.

Key Market Segments

By Platform

- Freight Drone

- Passenger Drone

- Ambulance Drone

By Range

- Close range

- Short range

- Mid-range

- Long-range

By Application

- Logistics

- Transportation

By End User

- Commercial

- Defense

Driving Factor

Demand for Autonomous Last Mile Deliveries

The surge in demand for autonomous last-mile deliveries is propelled by the increasing consumer expectation for faster and more efficient delivery services. This trend is further accelerated by the growth of e-commerce platforms and the need for businesses to enhance operational efficiencies while reducing delivery times and costs.

The integration of drone technology into logistics and transportation systems offers a viable solution to these demands, enabling companies to leverage unmanned aerial vehicles (UAVs) for the rapid, flexible, and cost-effective delivery of goods directly to consumers’ doorsteps. The proliferation of autonomous drones for last-mile deliveries can be attributed to their ability to circumvent traditional ground transportation challenges, such as traffic congestion and infrastructure limitations, thereby facilitating quicker delivery times and improved customer satisfaction.

Restraining Factor

Uncertainty in Regulatory Frameworks to Ensure Safe Aircraft Operations

The advancement of the Drone Logistics and Transportation Market is significantly hampered by the uncertainty in regulatory frameworks across different jurisdictions. This uncertainty poses a major restraint as it affects the deployment and scalability of drone operations for logistics and transportation purposes. Regulatory bodies are tasked with the complex challenge of ensuring safe aircraft operations within crowded airspaces and near sensitive areas, without stifling innovation.

The lack of clear, harmonized regulations regarding drone flights, airspace management, and privacy concerns leads to a cautious approach towards the widespread adoption of drone logistics. As a result, companies face difficulties in planning and implementing drone delivery services on a larger scale, thus impeding market growth and the potential benefits of drone technology in transforming last-mile deliveries.

Opportunities

Use for Cargo Delivery in Military and Commercial Applications

The Drone Logistics and Transportation Market is presented with substantial opportunities, particularly in the use of drones for cargo delivery within military and commercial sectors. In military applications, drones offer a strategic advantage by enabling the safe and efficient transport of supplies, equipment, and materials to remote or conflict-affected regions without risking human lives.

In the commercial realm, drones are revolutionizing traditional logistics and supply chain models by facilitating swift cargo deliveries, especially in areas difficult to access via conventional transportation methods. This capability is critical for sectors such as healthcare, where timely delivery of medical supplies and specimens is essential. The versatility and adaptability of drones to various cargo delivery needs underscore their potential to significantly enhance operational efficiencies, reduce costs, and open new avenues for service expansion in both military and commercial contexts.

Challenges

Limited Implementation of Ground Infrastructure

One of the significant challenges facing the Drone Logistics and Transportation Market is the limited implementation of ground infrastructure designed to support drone operations. The development and deployment of drones for logistics purposes require a robust network of ground support systems, including takeoff and landing zones, charging stations, and maintenance facilities. The absence or inadequacy of such infrastructure complicates the operational viability of drone logistics on a large scale.

Moreover, the establishment of this infrastructure necessitates substantial investments and collaborative efforts among stakeholders to ensure compatibility and safety standards. This challenge not only affects the scalability of drone logistics services but also delays the realization of their full potential in enhancing the efficiency of transportation and delivery systems.

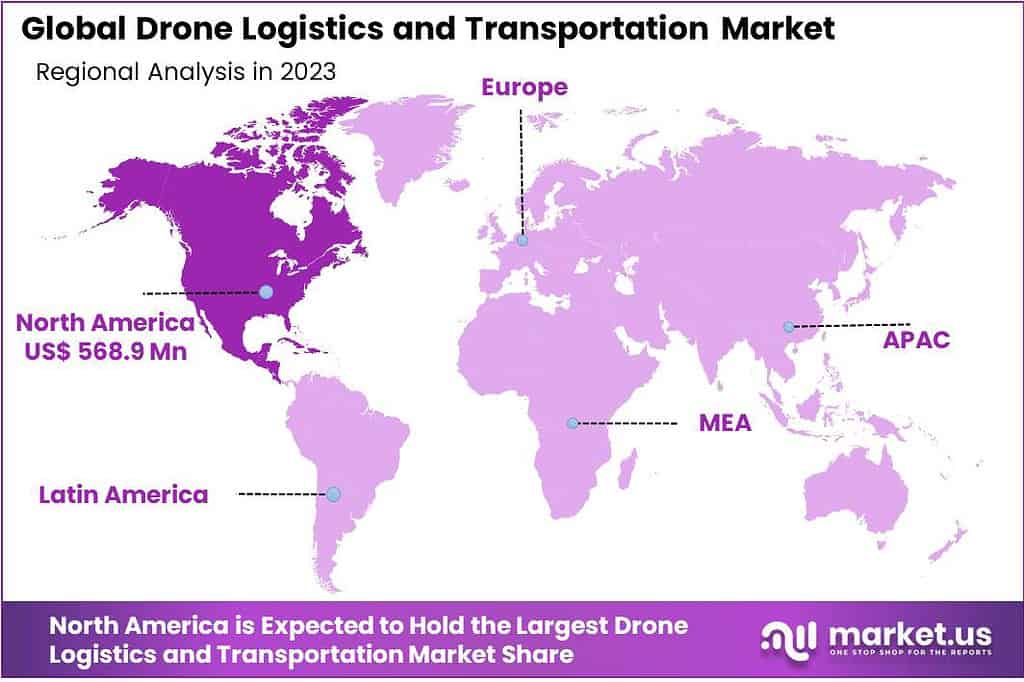

Regional Analysis

In 2023, North America emerged as the frontrunner in the drone logistics and transportation market, holding a dominant market position with a share of over 63%. The demand for Drone Logistics and Transportation in North America reached US$ 568.9 Million in 2023, and there are optimistic projections for significant growth in the foreseeable future.

The region’s strong market presence can be attributed to several factors that have accelerated the adoption of drones for logistics and transportation purposes. North America, particularly the United States, has been at the forefront of technological advancements and innovation. The region is home to major players in the drone industry, including manufacturers, service providers, and technology developers. The presence of these industry leaders has fostered a conducive environment for the growth of the drone logistics and transportation market in North America.

Additionally, North America boasts a robust e-commerce ecosystem, with a high penetration rate of online shopping and a strong customer demand for fast and efficient deliveries. This has propelled logistics companies to explore innovative solutions to meet customer expectations, leading to the adoption of drones as a viable option for last-mile deliveries and optimizing supply chain operations.

Moreover, the regulatory landscape in North America has been relatively favorable for commercial drone operations. The Federal Aviation Administration (FAA) in the United States has taken proactive steps to establish rules and regulations, allowing for the safe and responsible integration of drones into the national airspace. These regulations have provided clarity and guidance to businesses, encouraging them to invest in drone logistics and transportation services.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The drone logistics and transportation market is characterized by a dynamic and competitive landscape, with several key players contributing to its growth and evolution. These entities are pivotal in driving innovation, enhancing technological capabilities, and expanding the market reach of drone logistics solutions. A detailed analysis of these key players reveals their strategic positions, product offerings, and market influence.

Top Key Players

- Airbus SE

- Amazon.com Inc.

- CANA Advisors

- Deutsche Post DHL Group

- DroneScan

- Drone Delivery Canada

- FedEx Corporation

- Flytrex Inc.

- Hardis Group

- Infinium Robotics

- Maternity Inc.

- PINC Solutions

- SZ DJI Technology Co. Ltd.

- United Parcel Service of America Inc.

- Wing Aviation LLC

- Workhorse Group and Zipline International Inc.

- Other key players

Recent Developments

1. Airbus SE:

- February 2023: Launched the “Skyways” urban air mobility platform, partnering with various stakeholders to develop and implement drone delivery solutions in urban environments.

- November 2023: Signed a collaboration agreement with Deutsche Post DHL Group to explore and develop use cases for autonomous drones in logistics operations.

2. Amazon.com Inc.:

- March 2023: Received approval from the Federal Aviation Administration (FAA) to operate its Prime Air drone delivery service in limited areas within the United States.

- August 2023: Partnered with CANA Advisors to expand drone delivery trials in rural areas of Texas, focusing on delivering medical supplies and other essential goods.

3. Deutsche Post DHL Group:

- January 2023: Completed a successful pilot project using drones to deliver medical supplies to a remote island in Scotland, showcasing the potential for healthcare applications.

- October 2023: Signed a partnership with Drone Delivery Canada to explore and implement drone delivery solutions in remote and challenging terrains, particularly in North America.

4. DroneScan:

- May 2023: Launched the “SkyGuard” drone security platform, offering advanced drone detection and tracking solutions for critical infrastructure protection.

- December 2023: Expanded its operations to Europe, establishing partnerships with security companies and airports to address growing drone security concerns.

Report Scope

Report Features Description Market Value (2023) US$ 903.1 Mn Forecast Revenue (2033) US$ 53,839.5 Mn CAGR (2024-2033) 50.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (Freight Drone, Passenger Drone, Ambulance Drone), By Range (Close range, Short range, Mid-range, Long-range), By Application (Logistics and Transportation), By End User (Commercial, Defense) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Airbus SE, Amazon.com, Inc., CANA Advisors, Deutsche Post DHL Group, DroneScan, Drone Delivery Canada, FedEx Corporation, Flytrex Inc., Hardis Group, Infinium Robotics, Maternity Inc., PINC Solutions, SZ DJI Technology Co., Ltd., United Parcel Service of America, Inc., Wing Aviation LLC, Workhorse Group, and Zipline International Inc., Other key players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

what is drone logistics and transportation?Drone logistics and transportation refer to the use of unmanned aerial vehicles, commonly known as drones, for the movement of goods and materials in various industries. This innovative application of drone technology is transforming traditional logistics and transportation systems by offering efficient and often more cost-effective solutions.

How big is Drone Logistics and Transportation Industry?The Global Drone Logistics and Transportation Market size is expected to be worth around USD 53,839.5 Million by 2033, from USD 903.1 Million in 2023, growing at a CAGR of 50.5% during the forecast period from 2024 to 2033.

Who are the key players in Drone Logistics and Transportation Market?Airbus SE, Amazon.com, Inc., CANA Advisors, Deutsche Post DHL Group, DroneScan, Drone Delivery Canada, FedEx Corporation, Flytrex Inc., Hardis Group, Infinium Robotics, Maternity Inc., PINC Solutions, SZ DJI Technology Co., Ltd., United Parcel Service of America, Inc., Wing Aviation LLC, Workhorse Group, and Zipline International Inc., Other key players are the major companies operating in the Drone Logistics and Transportation Market.

Which is the fastest growing region in Drone Logistics and Transportation Market?In 2023, North America emerged as the frontrunner in the drone logistics and transportation market, holding a dominant market position with a share of over 63%.

Which sectors contribute the most to the growth of the drone logistics and transportation market?The drone logistics and transportation market experiences significant contributions from various sectors, including e-commerce, healthcare, and military, each leveraging drone technology for different purposes.

What challenges does the drone logistics and transportation market face?Challenges include regulatory hurdles, technological limitations, security concerns, and public acceptance. Addressing these challenges is crucial for the widespread adoption of drone technology in logistics.

Drone Logistics and Transportation MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Drone Logistics and Transportation MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus SE

- Amazon.com Inc.

- CANA Advisors

- Deutsche Post DHL Group

- DroneScan

- Drone Delivery Canada

- FedEx Corporation

- Flytrex Inc.

- Hardis Group

- Infinium Robotics

- Maternity Inc.

- PINC Solutions

- SZ DJI Technology Co. Ltd.

- United Parcel Service of America Inc.

- Wing Aviation LLC

- Workhorse Group and Zipline International Inc.

- Other key players