Global Drip Coffee Maker Market By Type (Automatic, Manual), By Power (Below 500 Watt, 500 to 1000 Watt, Above 1000 Watt), By End Use (Residential, Commercial, Offices, Cafes, Restaurants, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158785

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

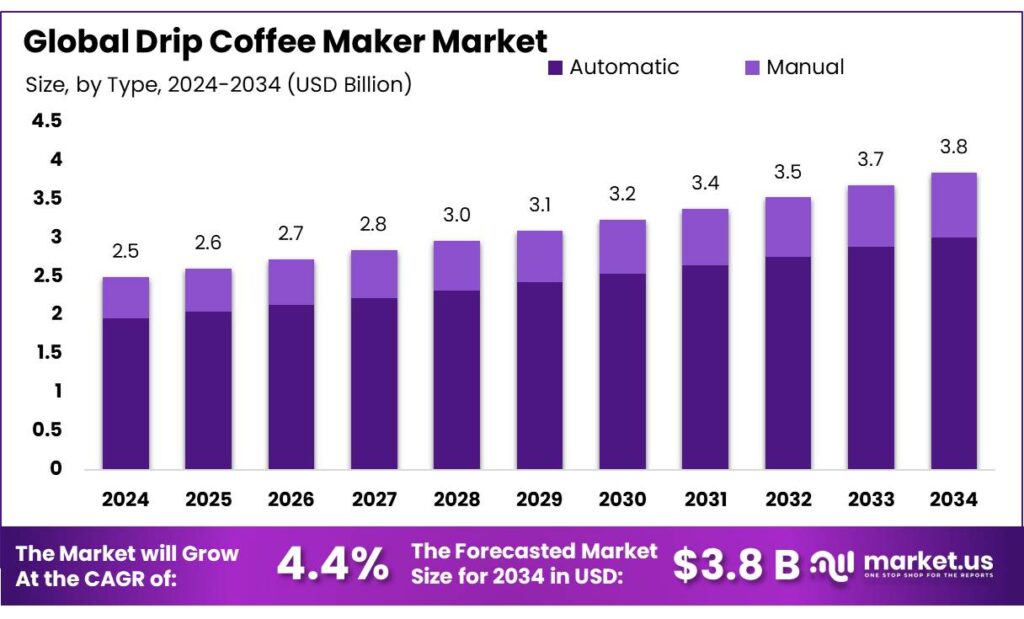

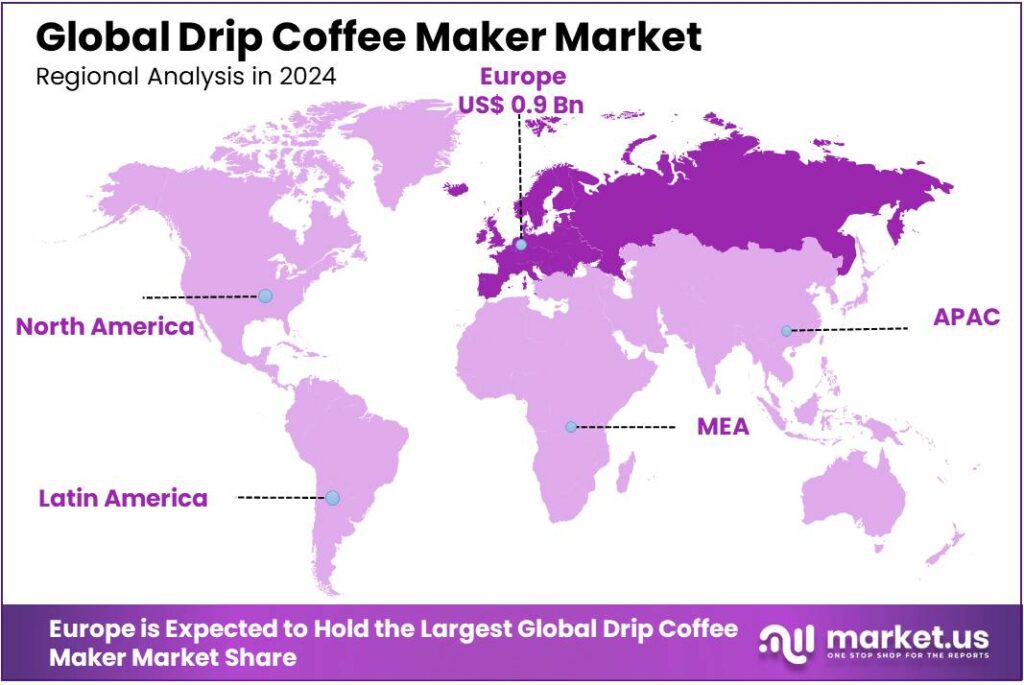

The Global Drip Coffee Maker Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 38.30% share, holding USD 0.9 Billion in revenue.

The drip coffee maker industry is an essential segment within the global home appliances market, driven by the growing demand for convenient, affordable, and quality coffee preparation. As coffee consumption continues to rise globally, especially in regions such as North America and Europe, drip coffee makers remain one of the most widely used brewing methods due to their affordability, ease of use, and consistent results.

According to data from the National Coffee Association (NCA), the U.S. coffee consumption has reached 66% of the population, indicating a strong and sustained demand for coffee-related products and equipment. With more consumers turning towards home-brewing, drip coffee makers account for a significant portion of the home brewing equipment market, with steady growth expected in the coming years.

As of 2023, India’s domestic coffee consumption has risen to 91,000 tonnes, up from 84,000 tonnes in 2012, reflecting a broader shift in drinking habits and a growing preference for coffee over traditional beverages like tea.

The surge in coffee consumption is also reflected in consumer behavior. A significant 41% of Indian coffee consumers prefer powder-to-brew coffee, while 31% opt for instant coffee. Packaging preferences indicate that 53% of consumers favor bottle/jar packaging, and 63% purchase coffee from traditional kirana or general stores.

Key Takeaways

- Drip Coffee Maker Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 4.4%.

- Automatic drip coffee makers held a dominant market position, capturing more than a 78.3% share of the global market.

- 500 to 1000 watts held a dominant market position, capturing more than a 49.2% share.

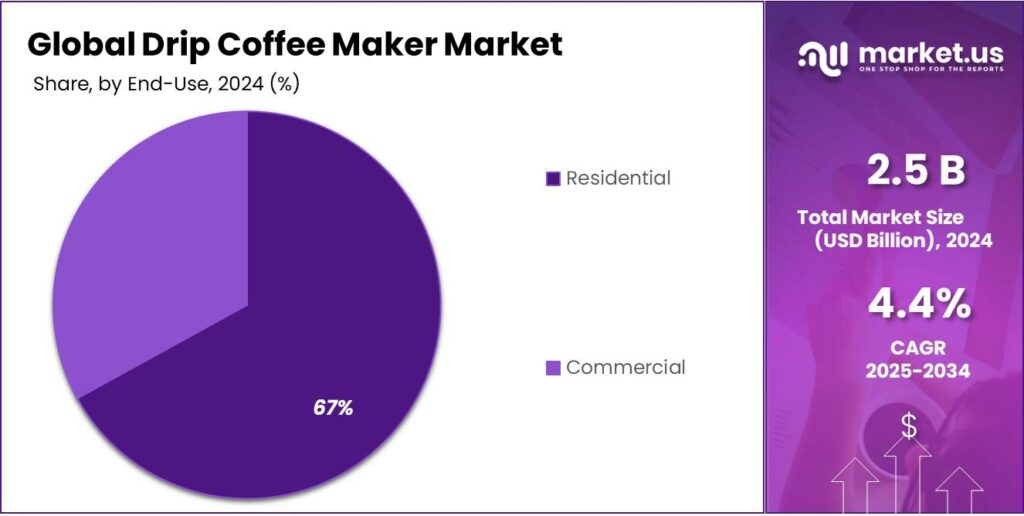

- Residential segment held a dominant market position in the drip coffee maker industry, capturing more than a 67.7% share.

- Supermarkets and hypermarkets held a dominant market position in the drip coffee maker industry, capturing more than a 37.8% share.

- Europe held the largest market share in the drip coffee maker industry, capturing 38.30% of the global market, valued at approximately USD 0.9 billion.

By Type Analysis

Automatic Drip Coffee Makers Lead the Market with 78.3% Share in 2024

In 2024, automatic drip coffee makers held a dominant market position, capturing more than a 78.3% share of the global market. This type of coffee maker is favored for its ease of use and consistency, making it the preferred choice for both households and offices. The automatic coffee maker’s ability to brew coffee with minimal user input has made it a staple in many homes and businesses. The rise in demand for convenience, coupled with advancements in coffee-making technology, has further propelled the adoption of automatic machines.

By Power Analysis

500 to 1000 Watt Drip Coffee Makers Capture 49.2% Market Share in 2024

In 2024, drip coffee makers with a power range of 500 to 1000 watts held a dominant market position, capturing more than a 49.2% share. This power range is ideal for providing a balanced brewing experience, offering a quick brew time without consuming excessive energy. The 500 to 1000 watt range strikes the perfect balance between efficiency and performance, making it the preferred choice for most consumers looking for energy-efficient options without compromising on the quality of their coffee.

By End Use Analysis

Residential Segment Dominates with 67.7% Share in 2024

In 2024, the residential segment held a dominant market position in the drip coffee maker industry, capturing more than a 67.7% share. This sector’s strong growth can be attributed to the increasing number of coffee enthusiasts preferring to brew their coffee at home for convenience and cost-effectiveness. Residential consumers are opting for drip coffee makers that offer consistent quality and ease of use, and with many modern models featuring programmable settings and energy-efficient features, they have become a common household appliance.

By Distribution Channel Analysis

Supermarkets/Hypermarkets Lead the Market with 37.8% Share in 2024

In 2024, supermarkets and hypermarkets held a dominant market position in the drip coffee maker industry, capturing more than a 37.8% share. These retail channels remain popular for coffee maker purchases due to their wide product variety, competitive pricing, and the convenience of in-person shopping. Consumers often prefer to buy coffee makers from supermarkets and hypermarkets as they can compare different models and receive immediate customer support. With the added benefit of promotional offers and discounts, these stores continue to attract a large number of buyers.

Key Market Segments

By Type

- Automatic

- Manual

By Power

- Below 500 Watt

- 500 to 1000 Watt

- Above 1000 Watt

By End Use

- Residential

- Commercial

- Offices

- Cafes

- Restaurants

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

- Others

Emerging Trends

Smart Technology Integration in Drip Coffee Makers

The integration of smart technology into drip coffee makers is revolutionizing the way consumers experience coffee brewing at home. Manufacturers are increasingly incorporating features such as Wi-Fi connectivity, app control, and programmable brewing schedules to cater to the growing demand for convenience and customization. This trend aligns with the broader shift towards smart home appliances, where consumers seek seamless integration and enhanced user experiences.

For instance, the Breville Luxe Brewer, launched in May 2025, offers advanced features like PID temperature control, programmable algorithms, and a thermocoil heating system. These innovations ensure precise brewing temperatures and consistent extraction, resulting in high-quality coffee. Additionally, the Luxe Brewer includes a cold brew function that allows users to steep coffee grounds at room temperature for up to 24 hours, providing a convenient and automated solution for cold brew enthusiasts.

Similarly, the Ninja Luxe Café Premier Series Coffee & Espresso Machine, priced at $500, combines multiple brewing methods into a single appliance. It offers hot drip coffee, hot espresso, cold brew, and cold-pressed espresso capabilities. Equipped with a built-in scale, a conical burr grinder with 25 settings, and automatic grind size recommendations, this machine caters to the needs of coffee aficionados who appreciate precision and versatility in their brewing process.

Drivers

Government Support and Export Growth Driving India’s Drip Coffee Maker Market

The surge in India’s coffee exports is a pivotal factor propelling the demand for drip coffee makers, both domestically and internationally. In the fiscal year 2023–24, India achieved a remarkable 125% increase in coffee export value, reaching USD 1.8 billion, up from USD 800 million in 2014–15. This growth underscores the global recognition of Indian coffee and the expanding market opportunities for related products, including coffee makers.

Government initiatives have played a crucial role in this export expansion. The Coffee Board of India has implemented several programs to enhance coffee quality and promote exports. These include financial incentives for value-added coffee products, such as a ₹3 per kilogram subsidy for value-added coffee and ₹2 per kilogram for green coffee. Additionally, subsidies of up to 40% (up to ₹15 lakh) are provided for coffee machinery, encouraging the adoption of advanced equipment in coffee production.

The growing demand for Indian coffee in international markets has spurred interest in coffee-related appliances, including drip coffee makers. As Indian coffee gains popularity, consumers are increasingly seeking quality brewing equipment to replicate café-style experiences at home. This trend is particularly evident in urban areas, where the café culture is thriving, and consumers are willing to invest in premium coffee machines.

Restraints

Regulatory Compliance Challenges Impacting Drip Coffee Maker Market

A significant restraint affecting the growth of the drip coffee maker market is the stringent regulatory compliance requirements, particularly concerning environmental sustainability and ethical sourcing. These regulations, while essential for promoting responsible practices, impose substantial burdens on manufacturers and exporters, especially in developing countries like India.

In India, the European Union’s Deforestation Regulation (EUDR), effective from December 30, 2025, mandates that coffee exports to the EU must be certified as deforestation-free. This regulation requires precise geolocation and polygon mapping of coffee plantations, posing challenges for India’s smallholder farmers who often lack the technical expertise and resources to comply. With over 30,000 farmers in Wayanad, Kerala, still unregistered, the Coffee Board of India is intensifying efforts to onboard them through the India Coffee app, aiming to register 40,000 farmers across the state by year-end

Non-compliance with such regulations can result in exclusion from high-value EU markets, potentially leading to significant financial losses for exporters. For instance, Karnataka’s coffee exports experienced remarkable growth, with shipment values soaring over 60% in the fiscal year 2024–25, surpassing $1.1 billion. However, stringent compliance requirements could hinder future growth if not adequately addressed.

Opportunity

Government Initiatives Fueling Growth in India’s Drip Coffee Maker Market

A significant growth opportunity for the drip coffee maker market in India arises from the country’s expanding coffee exports, driven by supportive government initiatives and increasing global demand.

In the fiscal year 2024–25, India’s coffee exports reached a record USD 1.81 billion, marking a 40.37% increase from USD 1.29 billion in the previous year. This surge was propelled by rising global demand for Indian coffee, particularly Robusta varieties, and enhanced export capabilities. Karnataka’s coffee shipments alone soared over 60%, surpassing USD 1.1 billion, highlighting the state’s pivotal role in the national coffee export landscape.

The Coffee Board of India has been instrumental in this growth through initiatives like the Integrated Coffee Development Project (ICDP), which focuses on improving yields and expanding cultivation. Additionally, the board has launched programs to promote shade-grown coffee and assist entrepreneurs, thereby enhancing the quality and sustainability of coffee production.

These developments present a unique opportunity for the drip coffee maker market. As India’s coffee exports increase, there is a growing demand for quality brewing equipment both domestically and internationally. Consumers are seeking to replicate café-style experiences at home, driving the need for advanced coffee-making appliances. This trend is further supported by the government’s efforts to promote coffee culture within the country.

Regional Insights

Europe Leads the Drip Coffee Maker Market with 38.30% Share, Valued at 0.9 Billion USD in 2024

In 2024, Europe held the largest market share in the drip coffee maker industry, capturing 38.30% of the global market, valued at approximately USD 0.9 billion. The European market has consistently been a significant contributor to the global growth of drip coffee makers, driven by the region’s strong coffee culture and high consumer demand for quality home-brewing appliances. Coffee consumption in Europe remains one of the highest globally, with countries like Germany, France, and Italy having long-established coffee traditions.

- According to the European Coffee Federation, Europeans consume over 200 million cups of coffee daily, reinforcing the demand for efficient, user-friendly coffee makers like drip coffee machines.

The region’s market growth is supported by a robust retail infrastructure, particularly supermarkets and hypermarkets, where drip coffee makers are widely available. With strong distribution channels and extensive retail networks, Europe’s supermarkets/hypermarkets play a critical role in driving sales in the residential sector. Additionally, as consumers become increasingly focused on energy efficiency and sustainability, European manufacturers are responding with eco-friendly, energy-saving models that align with the EU’s strict environmental standards.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BSH Hausgeräte GmbH, operating under the Bosch brand, is a leading global manufacturer of home appliances. With a turnover of €15.3 billion in 2024 and approximately 57,000 employees, BSH produces a wide range of coffee machines, including drip coffee makers. Their products are known for their durability, efficiency, and integration with smart home ecosystems, aligning with the increasing consumer preference for connected appliances.

BLACK+DECKER offers a diverse range of drip coffee makers, including the 12-Cup Thermal Programmable Coffeemaker, priced at $76.99. These models feature QuickTouch programming, auto shutoff, and thermal carafes to maintain coffee temperature. The brand emphasizes affordability and user-friendly designs, catering to a broad consumer base. Their products are widely available through major retailers, ensuring accessibility for customers seeking reliable and budget-friendly coffee brewing solutions.

Breville is renowned for its high-end coffee machines, such as the Luxe Brewer™ and the Precision Brewer™. These models feature advanced technology, including PID temperature control and programmable brewing algorithms, allowing users to customize their coffee brewing experience. Breville’s commitment to innovation has led to the introduction of features like cold brew capabilities and app connectivity, catering to the growing demand for smart home appliances.

Top Key Players Outlook

- Black & Decker

- Breville

- BSH Hausgeräte GmbH

- Budan

- Capresso

- Cuisinart

- De’Longhi

- Electrolux AB

- Espresso Supply, Inc.

- Glen Appliances

- GROUPE SEB UK, Ltd.

- Cimbali S.p.A.

Recent Industry Developments

In 2024, Cuisinart’s coffee makers were featured in major retail promotions, such as Amazon’s Cyber Monday deals, where the 14-Cup model was available at a 30% discount, reflecting a growing consumer interest in high-quality, cost-effective brewing solutions.

In 2024, BLACK+DECKER continued to solidify its position in the drip coffee maker market by offering a range of affordable and user-friendly models. Their 12-Cup Programmable Coffeemaker, priced at approximately $40.99, features QuickTouch™ programming, an auto-brew function, and a removable filter basket, catering to budget-conscious consumers seeking reliable brewing solutions.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automatic, Manual), By Power (Below 500 Watt, 500 to 1000 Watt, Above 1000 Watt), By End Use (Residential, Commercial, Offices, Cafes, Restaurants, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Black & Decker, Breville, BSH Hausgeräte GmbH, Budan, Capresso, Cuisinart, De’Longhi, Electrolux AB, Espresso Supply, Inc., Glen Appliances, GROUPE SEB UK, Ltd., Cimbali S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Black & Decker

- Breville

- BSH Hausgeräte GmbH

- Budan

- Capresso

- Cuisinart

- De'Longhi

- Electrolux AB

- Espresso Supply, Inc.

- Glen Appliances

- GROUPE SEB UK, Ltd.

- Cimbali S.p.A.