Global Dredging Equipment Market Size, Share, Growth Analysis By Dredging Type (Hydraulic Dredger[Cutter Suction Dredgers (CSD), Trailing Suction Hopper Dredgers (TSHD), Plain Suction Dredgers]; Mechanical Dredger[Bucket Dredgers, Grab Dredgers, Backhoe Dredgers]), By Application (Land Reclamation, Navigational Channel Maintenance, Port & Harbor Expansion, Environmental Remediation, Offshore Renewable Energy Construction, Others), By End User (Government Agencies, Private Port Operators, EPC Contractors, Mining & Energy Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176241

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

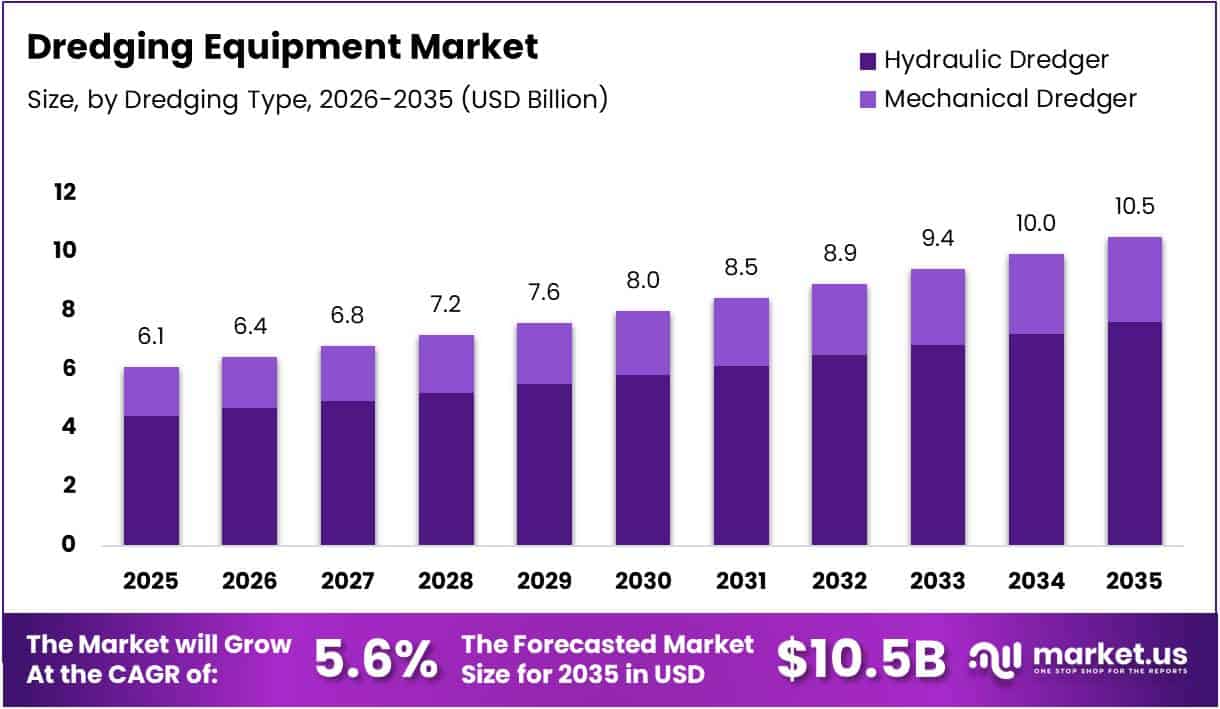

The Global Dredging Equipment Market size is expected to be worth around USD 10.5 Billion by 2035, from USD 6.10 Billion in 2025, growing at a CAGR of 5.6% during the forecast period from 2026 to 2035.

The dredging equipment market encompasses specialized machinery designed for underwater excavation and sediment removal. These systems facilitate critical maritime operations, including channel deepening, port maintenance, and coastal restoration. Modern equipment integrates advanced hydraulic mechanisms, offering enhanced operational efficiency. Subsequently, the market demonstrates robust technological evolution across global waterway infrastructure projects.

Market growth accelerates through expanding maritime trade volumes and urbanization pressures. Developing nations particularly invest in port modernization programs, driving substantial equipment demand. Furthermore, climate adaptation strategies necessitate coastal protection infrastructure, creating sustained opportunities. Industry participants consequently benefit from diversified revenue streams across multiple application segments.

Government investment substantially influences market trajectories through infrastructure development initiatives. Regulatory frameworks increasingly emphasize environmental compliance and sustainable dredging practices. Subsequently, equipment manufacturers innovate to meet stringent emission standards and ecological preservation requirements. These policy-driven transformations reshape competitive dynamics, favoring technologically advanced solutions.

Commercial opportunities expand as vessel specifications evolve to address project complexities. According to industry specifications, dredgers with 4,000–8,000 m³ hopper capacity predominantly serve commercial port and harbor maintenance operations. Meanwhile, vessels exceeding 8,000 m³ capacity are strategically deployed for large-scale land reclamation and deep-channel dredging projects, reflecting operational specialization trends.

Key Takeaways

- Global Dredging Equipment Market size is expected to reach USD 10.5 Billion by 2035 from USD 6.10 Billion in 2025.

- The market is projected to grow at a CAGR of 5.6% during 2026-2035.

- Hydraulic Dredgers dominate the market with a 72.64% share by dredging type.

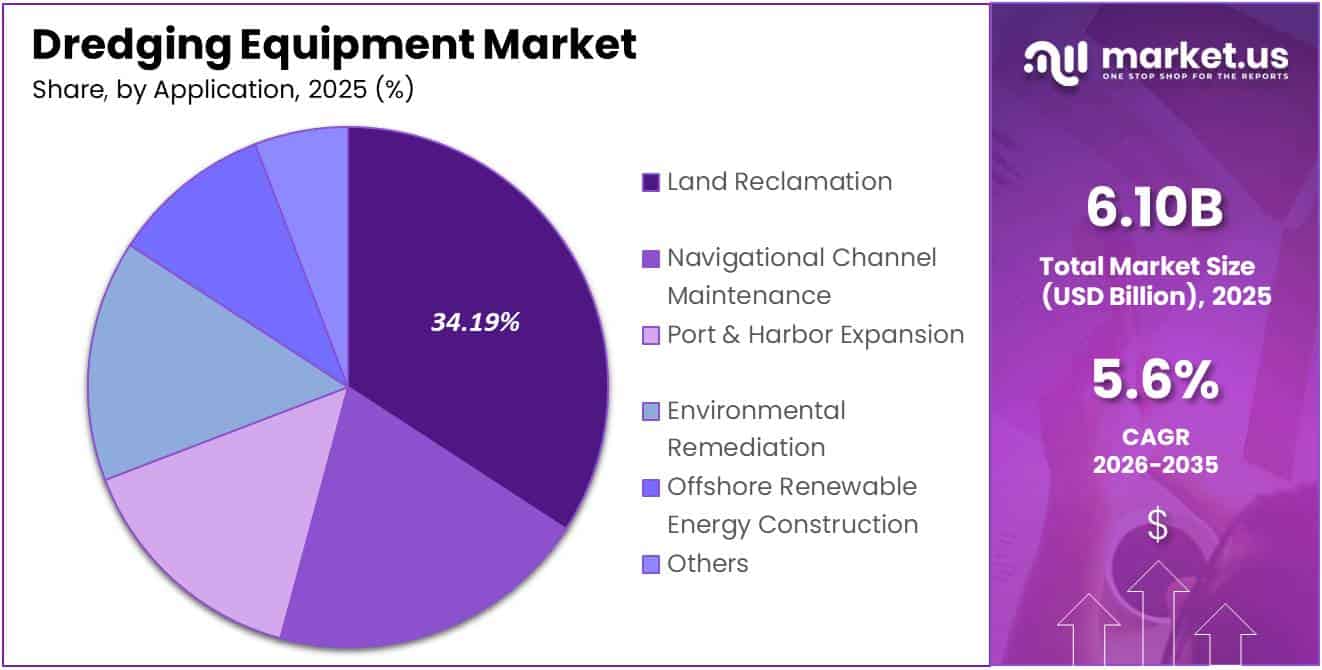

- Land Reclamation leads applications with a 34.19% share.

- Government Agencies are the largest end users, holding a 38.92% share.

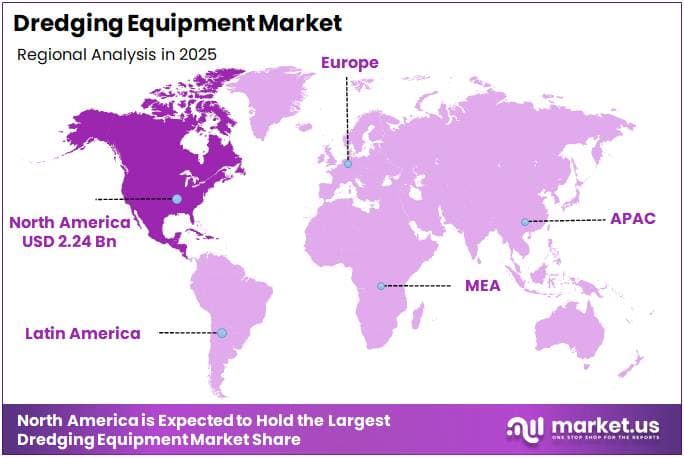

- North America dominates the regional market with a 36.83% share, valued at USD 2.24 Billion.

Dredging Type Analysis

Hydraulic Dredger held a dominant market position in the By Dredging Type Analysis segment of Dredging Equipment Market, with a 72.64% share.

In 2025, Hydraulic Dredgers dominate the market due to their exceptional efficiency in sediment removal through advanced pipeline systems. These dredgers utilize powerful centrifugal pumps creating suction to extract underwater materials, offering continuous operation capabilities that reduce project timelines. Their versatility across soil conditions makes them essential for large-scale projects. The technology enables precise control while minimizing environmental disturbance and demonstrates superior cost-effectiveness in handling high-volume material displacement.

Mechanical Dredgers maintain significant presence through specialized capabilities in handling consolidated materials and contaminated sediments. These systems employ physical excavation mechanisms to remove underwater materials with high precision. They excel in projects requiring selective excavation, particularly in rocky terrain where hydraulic systems face limitations. Environmental remediation projects particularly benefit from their controlled material handling capabilities.

Application Analysis

Land Reclamation held a dominant market position in the By Application Analysis segment of Dredging Equipment Market, with a 34.19% share.

In 2025, Land Reclamation drives the dredging equipment market as nations address land scarcity through coastal expansion initiatives. Rapid urbanization in coastal regions has intensified the need for creating new land masses to accommodate infrastructure. Countries across Asia, the Middle East, and Europe invest billions in reclamation projects to develop smart cities and economic zones. The process involves extracting seabed sediments and depositing them to form stable land areas suitable for construction and development.

Navigational Channel Maintenance ensures uninterrupted maritime commerce through regular dredging of shipping routes and harbor approaches. Sediment naturally accumulates in channels, reducing water depth and creating navigational hazards. Ports conduct systematic maintenance dredging to preserve design depths accommodating modern cargo ships, supporting international trade flows worth trillions annually.

Port & Harbor Expansion responds to the maritime industry’s evolution toward larger container ships and increased cargo demands. Modern ultra-large vessels require deeper berths and wider turning basins necessitating extensive capital dredging operations. Port authorities invest in deepening projects to remain competitive and attract major shipping lines handling next-generation vessels.

Environmental Remediation addresses legacy pollution through targeted sediment removal operations. Contaminated sediments from industrial discharge require careful extraction using specialized dredging techniques preventing contaminant resuspension. This application combines dredging with environmental engineering to restore aquatic ecosystems while protecting public health and meeting regulatory mandates.

Offshore Renewable Energy Construction supports the expanding wind energy sector through seabed preparation for turbine foundations and cable installation. Offshore wind farms require level seabed surfaces and cleared pathways for subsea electrical infrastructure. As countries accelerate renewable energy deployment, offshore wind capacity additions drive increasing dredging activity globally.

Others encompass diverse applications including beach nourishment, aggregate extraction, flood control infrastructure, and recreational waterway improvements. Beach restoration projects combat erosion and protect coastal communities. Mineral dredging extracts valuable resources like sand and gravel from underwater deposits supporting construction and technology industries with essential raw materials.

End User Analysis

Government Agencies held a dominant market position in the By End User Analysis segment of Dredging Equipment Market, with a 38.92% share.

In 2025, Government Agencies lead dredging equipment utilization through extensive public infrastructure mandates and waterway management responsibilities. National governments and regional authorities invest heavily in strategic maritime infrastructure projects underpinning economic growth. Public sector initiatives encompass port development, navigational safety improvements, flood protection systems, and environmental restoration programs funded through government budgets supporting long-term infrastructure planning and development.

Private Port Operators drive substantial dredging activity through competitive facility optimization and capacity expansion. Privatized port terminals invest in maintaining adequate channel depths to accommodate vessels and maximize throughput efficiency. These commercial entities operate under performance pressures requiring optimal draft conditions and frequently contract dredging services for routine maintenance and capital improvement projects.

EPC Contractors execute comprehensive dredging projects providing integrated engineering, procurement, and construction services for complex marine infrastructure developments. These specialized firms combine technical expertise with equipment resources to deliver turnkey solutions. They serve both public and private clients, managing large-scale reclamation and port construction projects worldwide.

Mining & Energy Companies utilize dredging for offshore resource extraction and facility development. Oil and gas companies require seabed preparation for platform installations and pipeline trenching. Mining firms employ dredging to extract valuable minerals from seabeds, while the renewable energy sector’s expansion into offshore wind creates new requirements for turbine foundation preparation.

Key Market Segments

By Dredging Type

- Hydraulic Dredger

- Cutter Suction Dredgers (CSD)

- Trailing Suction Hopper Dredgers (TSHD)

- Plain Suction Dredgers

- Mechanical Dredger

- Bucket Dredgers

- Grab Dredgers

- Backhoe Dredgers

By Application

- Land Reclamation

- Navigational Channel Maintenance

- Port & Harbor Expansion

- Environmental Remediation

- Offshore Renewable Energy Construction

- Others

By End User

- Government Agencies

- Private Port Operators

- EPC Contractors

- Mining & Energy Companies

Drivers

Expansion of Port Modernization and Capacity Enhancement Projects Drives Market Growth

Global trade volumes continue to rise, pushing port authorities to modernize and expand their infrastructure. Many ports are upgrading their facilities to accommodate larger vessels, which require deeper channels and wider berths. This modernization wave is creating substantial demand for advanced dredging equipment capable of handling large-scale excavation projects efficiently.

Inland waterways are receiving renewed attention as cost-effective transportation alternatives to road and rail networks. Governments are investing heavily in deepening rivers and canals to enable year-round navigation for commercial vessels. Regular maintenance dredging has become essential to prevent sediment buildup that can disrupt shipping routes. This ongoing need for waterway maintenance ensures steady demand for dredging equipment across multiple regions.

Climate change and rising sea levels are accelerating coastal erosion in many areas worldwide. Communities and governments are implementing shoreline stabilization projects to protect infrastructure and residential areas from storm surges and flooding. Beach nourishment programs require specialized dredging equipment to move sand and sediment.

Restraints

Stringent Environmental Regulations and Lengthy Approval Processes Restrain Market Growth

Dredging operations face increasingly strict environmental oversight from regulatory authorities worldwide. Projects must undergo extensive environmental impact assessments before approval, often taking months or years to complete. These regulations aim to protect marine ecosystems, water quality, and aquatic life from disturbance during dredging activities. Companies must invest significant resources in compliance documentation and mitigation measures, which increases project costs and delays timelines.

The permitting process involves multiple stakeholder consultations and public hearings, further extending project initiation periods. Operators must demonstrate minimal environmental harm and develop comprehensive monitoring plans. Non-compliance can result in substantial fines and project shutdowns, making regulatory navigation a critical business challenge.

Weather patterns significantly impact dredging operations, particularly in regions with harsh seasonal conditions. High waves, strong currents, and storms can halt work for extended periods, affecting project schedules and profitability. Many coastal areas have limited operational windows during specific months when sea conditions are favorable. Winter months in temperate regions often see reduced dredging activity due to ice formation and rough seas.

Growth Factors

Deployment of Dredging Equipment in Offshore Wind and Marine Energy Projects Creates Growth Opportunities

The global transition toward renewable energy is driving massive investments in offshore wind farms. These projects require extensive seabed preparation, including foundation installation and cable laying, which creates substantial opportunities for specialized dredging equipment. Developers need precise excavation services to prepare sites for turbine foundations in challenging marine environments.

Rapid urbanization in coastal cities worldwide is creating land scarcity issues that many governments address through land reclamation projects. Countries with limited terrestrial space are increasingly turning to ocean reclamation to create new urban areas, industrial zones, and commercial developments. These large-scale projects require sophisticated dredging equipment capable of moving millions of cubic meters of material.

Technological advancement is transforming traditional dredging operations through automation and digitalization. Modern equipment now incorporates GPS positioning, automated depth control, and sensor-based sediment monitoring systems. These smart technologies improve operational efficiency, reduce fuel consumption, and minimize environmental impact.

Emerging Trends

Integration of Real-Time Data Analytics and Digital Control Systems Shapes Market Trends

Digital transformation is revolutionizing how dredging operations are planned and executed. Advanced equipment now features integrated sensors that collect real-time data on sediment composition, water depth, and equipment performance. Operators use this information to optimize dredging patterns and adjust operational parameters instantly. Cloud-based platforms enable remote monitoring, allowing experts to oversee multiple projects from central locations.

Environmental consciousness is reshaping industry standards across the dredging sector. Companies are adopting eco-friendly methods that minimize turbidity, protect marine habitats, and reduce carbon emissions. Equipment manufacturers are developing cleaner propulsion systems and sediment handling technologies that limit environmental disruption.

Ecologically sensitive projects near coral reefs, seagrass beds, and protected marine areas require exceptional precision. Specialized dredging equipment with advanced positioning systems and controlled sediment dispersion capabilities is increasingly necessary for these applications. Environmental monitoring regulations demand minimal impact on surrounding ecosystems, driving adoption of precision dredging technologies in sensitive marine zones.

Regional Analysis

North America Dominates the Dredging Equipment Market with a Market Share of 36.83%, Valued at USD 2.24 Billion

North America commands the leading position in the global dredging equipment market, accounting for 36.83% of the market share with a valuation of USD 2.24 billion. The region’s dominance is driven by extensive coastal infrastructure development, ongoing maintenance of major ports and waterways, and substantial investments in navigational channel deepening projects. The United States plays a pivotal role with federal funding for harbor maintenance and the need to accommodate larger vessels for enhanced maritime trade capabilities.

Asia Pacific Dredging Equipment Market Trends

Asia Pacific represents a rapidly growing market for dredging equipment, propelled by aggressive port expansion initiatives and land reclamation projects across emerging economies. Countries such as China, India, and Southeast Asian nations are investing heavily in maritime infrastructure to support international trade and urbanization. Government-led initiatives focused on developing smart ports and enhancing waterway connectivity are expected to sustain market growth in the coming years.

Europe Dredging Equipment Market Trends

Europe maintains a significant presence in the dredging equipment market, characterized by advanced technological adoption and stringent environmental regulations. The region’s mature maritime industry, combined with the necessity to maintain and deepen existing ports to accommodate ultra-large container vessels, drives consistent demand. Additionally, focus on sustainable dredging practices and coastal protection projects supports steady market development.

Middle East and Africa Dredging Equipment Market Trends

The Middle East and Africa region exhibits growing demand for dredging equipment, driven by ambitious port development projects and coastal infrastructure expansion. The Gulf countries are investing in mega port facilities and artificial islands, while African nations are upgrading their maritime infrastructure to boost trade connectivity and economic growth.

Latin America Dredging Equipment Market Trends

Latin America demonstrates moderate growth in the dredging equipment market, supported by port modernization efforts and river navigation improvements. Brazil, Mexico, and other coastal nations are focusing on enhancing their maritime logistics capabilities to facilitate exports and improve regional trade efficiency through strategic dredging operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dredging Equipment Company Insights

The global dredging equipment market in 2025 is characterized by intense competition among established players who continue to drive technological innovation and operational efficiency. The market landscape is dominated by companies with extensive experience in maritime construction and specialized dredging solutions, each bringing unique capabilities to meet the growing demand for coastal protection, port expansion, and infrastructure development worldwide.

Royal IHC (IHC Merwede Holding B.V.) maintains its position as a leading innovator in the dredging equipment sector, offering comprehensive solutions ranging from cutter suction dredgers to specialized mining equipment. The company’s focus on sustainable dredging technologies and digitalization positions it favorably for future market opportunities.

Damen Shipyards Group continues to expand its dredging portfolio through standardized, modular designs that offer cost-effective solutions for diverse applications. Their emphasis on rapid delivery times and customizable equipment has strengthened their market presence across multiple geographic regions.

Jan De Nul Group distinguishes itself through vertical integration, combining dredging operations with equipment manufacturing capabilities. This strategic approach enables the company to optimize equipment design based on real-world operational feedback, enhancing both efficiency and reliability.

DEME Group leverages its dual expertise in dredging operations and environmental engineering to develop cutting-edge equipment solutions. Their commitment to sustainable practices and innovation in offshore wind farm installation has opened new revenue streams beyond traditional dredging applications.

The market’s competitive dynamics are further intensified by regional players and specialized manufacturers who cater to niche segments, ensuring continued technological advancement and competitive pricing across the global dredging equipment industry.

Top Key Players in the Market

- Royal IHC (IHC Merwede Holding B.V.)

- Damen Shipyards Group

- Jan De Nul Group

- DEME Group

- Boskalis Westminster

- Ellicott Dredges LLC

- DSC Dredge LLC

- American Marine Corporation

- Holland Dredge Design B.V.

- Liebherr-International AG

- Shandong Haohai Dredging Equipment Co., Ltd.

- Hyundai Heavy Industries Co. Ltd.

- SANY Group

- VOSTA LMG

- Caterpillar Inc.

- HJ Shipbuilding & Construction

- Keppel Offshore & Marine

- US Aqua Services

- GeoForm International Inc.

- Others

Recent Developments

- In June 2025, Paragon ISG has acquired HK Dredging LLC, marking a strategic expansion into new regional markets and enhancing its dredging capabilities.

- In October 2025, Bird Construction Inc. successfully completed its previously announced acquisition of Fraser River Pile & Dredge (“FRPD”), strengthening its presence in marine construction services.

- In September 2025, Bird announced the acquisition of Canada’s largest marine infrastructure, land foundation, and dredging company for $82.3 Million, positioning itself for accelerated future growth.

- In August 2025, Straatman acquired Kraaijeveld Winches to bolster the Dutch maritime industry, enhancing its product portfolio and operational capabilities in marine solutions.

Report Scope

Report Features Description Market Value (2025) USD 6.10 Billion Forecast Revenue (2035) USD 10.5 Billion CAGR (2026-2035) 5.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Dredging Type (Hydraulic Dredger[Cutter Suction Dredgers (CSD), Trailing Suction Hopper Dredgers (TSHD), Plain Suction Dredgers]; Mechanical Dredger [Bucket Dredgers, Grab Dredgers, Backhoe Dredgers]), By Application (Land Reclamation, Navigational Channel Maintenance, Port & Harbor Expansion, Environmental Remediation, Offshore Renewable Energy Construction, Others), By End User (Government Agencies, Private Port Operators, EPC Contractors, Mining & Energy Companies) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Royal IHC (IHC Merwede Holding B.V.), Damen Shipyards Group, Jan De Nul Group, DEME Group, Boskalis Westminster, Ellicott Dredges LLC, DSC Dredge LLC, American Marine Corporation, Holland Dredge Design B.V., Liebherr-International AG, Shandong Haohai Dredging Equipment Co., Ltd., Hyundai Heavy Industries Co. Ltd., SANY Group, VOSTA LMG, Caterpillar Inc., HJ Shipbuilding & Construction, Keppel Offshore & Marine, US Aqua Services, GeoForm International Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal IHC (IHC Merwede Holding B.V.)

- Damen Shipyards Group

- Jan De Nul Group

- DEME Group

- Boskalis Westminster

- Ellicott Dredges LLC

- DSC Dredge LLC

- American Marine Corporation

- Holland Dredge Design B.V.

- Liebherr-International AG

- Shandong Haohai Dredging Equipment Co., Ltd.

- Hyundai Heavy Industries Co. Ltd.

- SANY Group

- VOSTA LMG

- Caterpillar Inc.

- HJ Shipbuilding & Construction

- Keppel Offshore & Marine

- US Aqua Services

- GeoForm International Inc.

- Others