Global DMARC Software Market Size, Share Analysis Report By Deployment (Cloud-based, On-premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry (BFSI, Government, Healthcare, Manufacturing, Retail & consumer goods, Telecom & IT, Transportation & Logistics, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151165

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

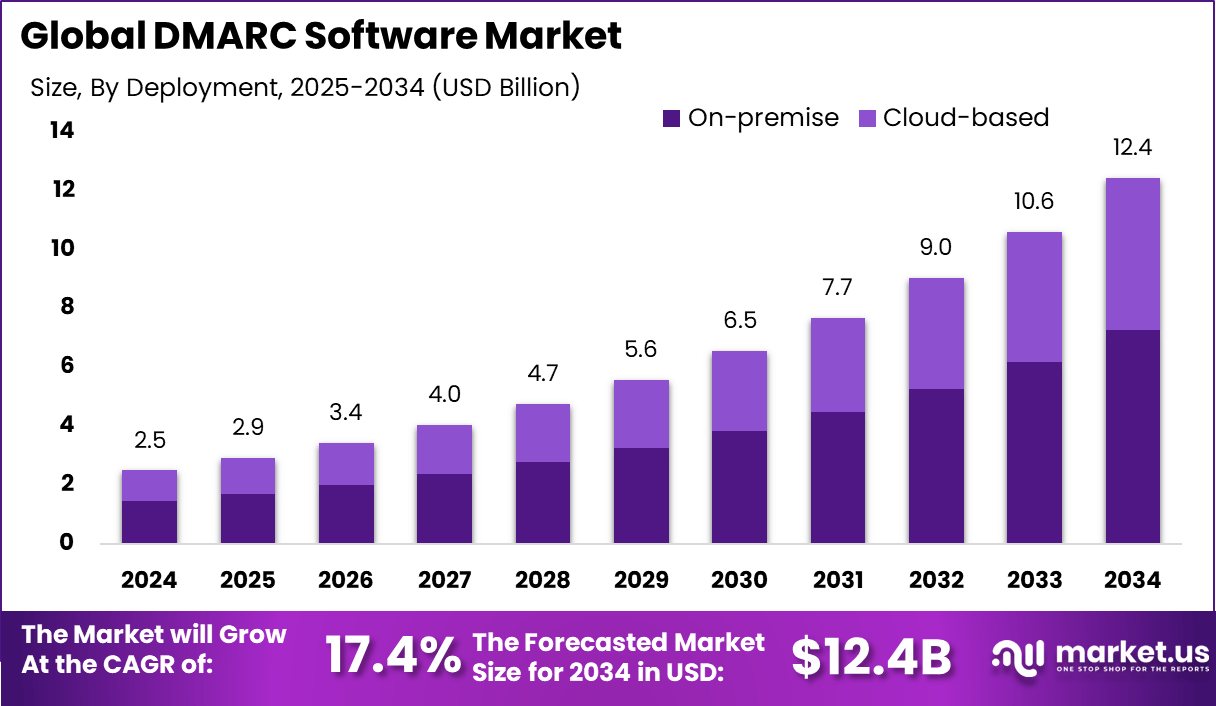

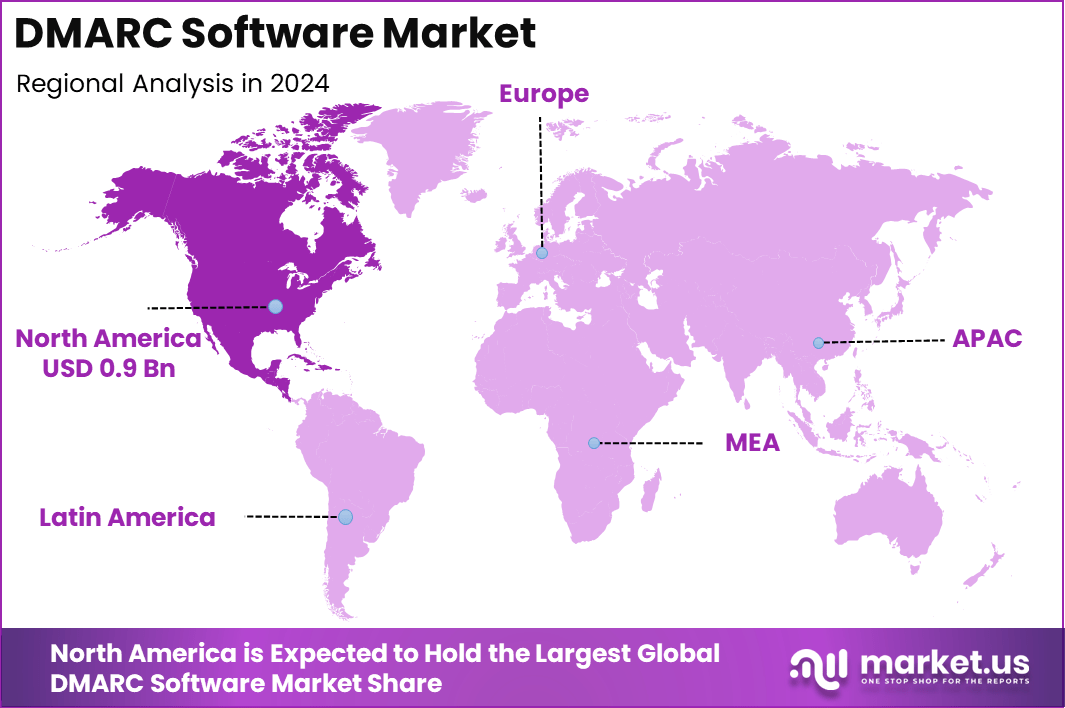

The Global DMARC Software Market size is expected to be worth around USD 12.4 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 17.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.2% share, holding USD 0.9 Billion revenue.

The DMARC (Domain-based Message Authentication, Reporting, and Conformance) software market is witnessing rapid expansion due to growing concerns over email security and brand protection. DMARC software enables domain owners to protect their email communications from spoofing, phishing, and unauthorized use by validating messages through SPF and DKIM mechanisms. This layer of authentication is increasingly seen as critical in the broader context of enterprise cybersecurity frameworks.

One of the top driving factors of this market is the continuous rise in email-based attacks. Phishing attempts and domain impersonation have escalated sharply in both frequency and sophistication. Enterprises are now prioritizing domain protection strategies not only to secure their internal communications but also to maintain customer trust. This has led to a consistent push for DMARC implementation across public and private sectors.

From a demand perspective, there is a significant shift toward integrated security ecosystems that emphasize proactive threat prevention. Organizations are increasingly adopting DMARC software as part of their email security stack to align with zero-trust principles. As awareness of domain spoofing risks increases, more businesses are pursuing full DMARC enforcement policies with aggregate and forensic reporting functionalities.

A key trend in technology adoption involves the growing integration of DMARC tools with cloud-native security platforms and AI-driven monitoring systems. These technologies automate policy configurations, threat detection, and compliance reporting, thereby reducing the burden on internal IT teams. Additionally, the rise of managed security service providers (MSSPs) offering DMARC as a service has widened adoption among small and mid-sized enterprises.

As per the latest insights from llcbuddy, In 2021, the adoption of valid DMARC policies grew sharply by 84%, reaching nearly 5 million unique records, as organizations focused more on email security and customer trust. A key factor behind this surge is the finding that 88% of consumers are more likely to share personal information with brands they trust, pushing businesses to implement stronger authentication protocols.

Data from Farsight Security shows that in the first half of 2021 alone, valid DMARC records increased by 28%, totaling 3.46 million, nearly double the 17% growth seen in the same period of 2020. The financial sector, in particular, saw a 58% rise in attacks per quarter, making it the most targeted industry and driving faster DMARC adoption to protect sensitive communications.

The primary reasons for adopting DMARC software include the prevention of fraudulent email activity, the protection of brand identity, and improved deliverability of legitimate emails. By deploying DMARC policies, businesses can gain visibility into who is using their domains and ensure that only authenticated messages reach recipients, enhancing sender reputation and engagement metrics.

Key Takeaways

- The DMARC Software Market is projected to expand from USD 2.5 billion in 2024 to around USD 12.4 billion by 2034, growing steadily at a CAGR of 17.4% over the forecast period.

- In 2024, North America led the global landscape, accounting for over 38.2% of the market share, with regional revenue touching USD 0.9 billion.

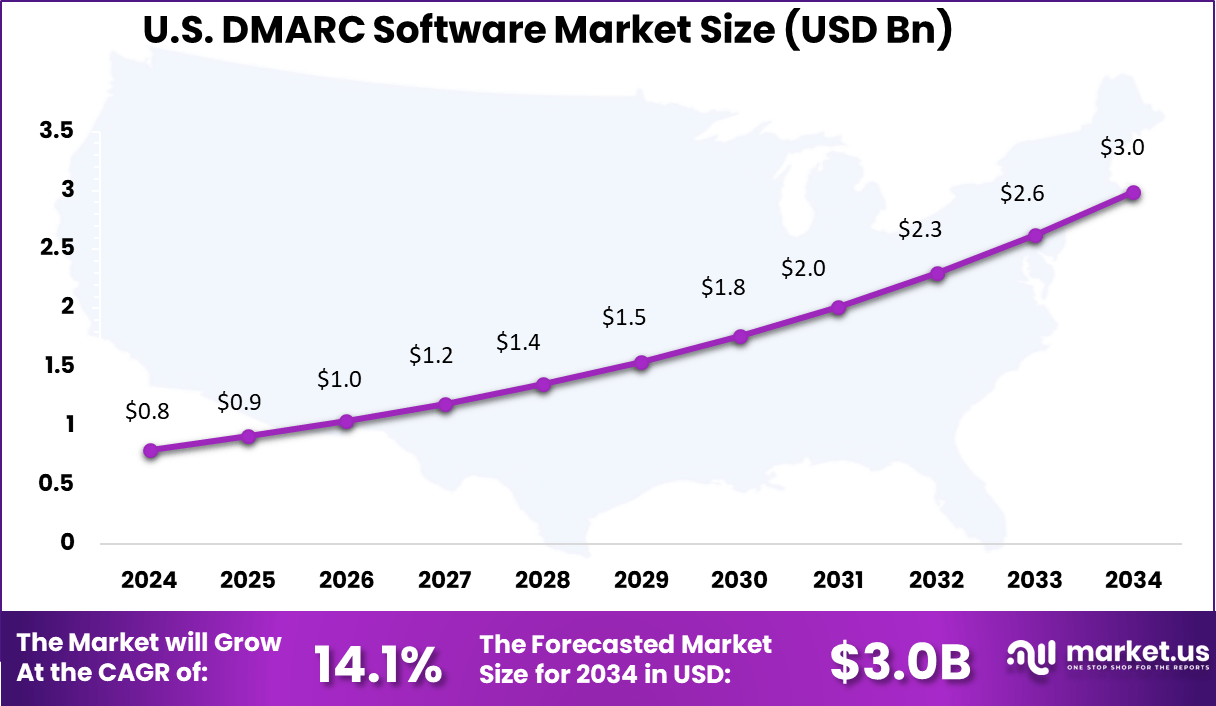

- The United States alone contributed approximately USD 0.80 billion in 2024 and is expected to grow at a healthy CAGR of 14.1% through 2034.

- By deployment, the On-premise segment held a clear lead, representing nearly 58.5% of the total market due to heightened control and data sovereignty concerns.

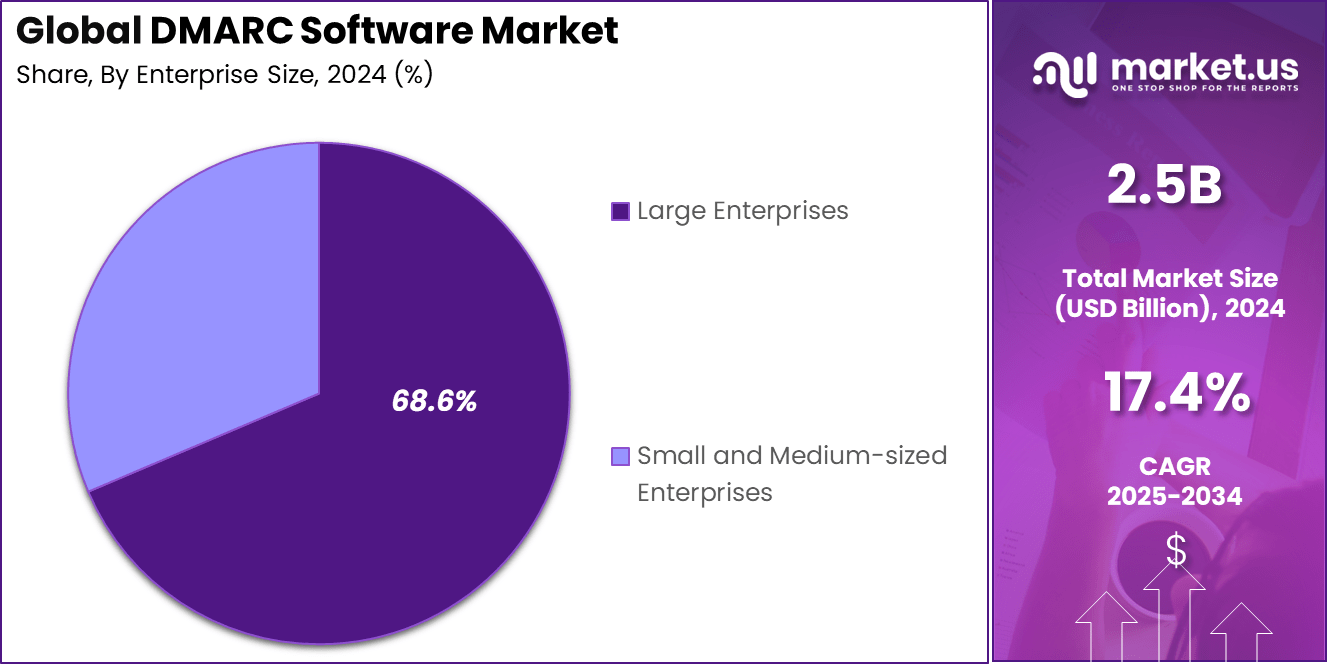

- Among enterprise sizes, Large Enterprises dominated the adoption landscape with a strong 68.6% share, driven by their higher cybersecurity budgets and compliance needs.

- Within industries, the BFSI sector emerged as the leading adopter, accounting for 30.2% of the market in 2024, owing to its strict data protection mandates and high risk of phishing attacks.

Analysts’ Viewpoint

In terms of investment opportunities, the market is poised for innovation in managed offerings and API-driven integrations with broader security platforms. Solutions that offer ease of configuration, real-time analytics, and compatibility with multi-domain infrastructures are expected to gain traction. Furthermore, expansion into untapped geographies with rising digital infrastructure presents an avenue for sustained growth.

Businesses benefit from DMARC in multiple ways, notably through enhanced security postures, improved trust among stakeholders, and greater operational efficiency. Preventing unauthorized email use can significantly reduce the financial and reputational damage associated with phishing attacks, while enabling regulatory compliance and protecting customer data.

The regulatory environment is increasingly favoring DMARC adoption. Data protection regulations and cybersecurity standards across financial, healthcare, and government sectors emphasize email authentication and data integrity. Regulatory bodies in several regions have recommended or mandated DMARC implementation for official communications, further solidifying its role in compliance frameworks.

US Market Expansion

The US DMARC Software Market is valued at USD 0.8 Billion in 2024 and is predicted to increase from USD 1.5 Billion in 2029 to approximately USD 3.0 Billion by 2034, projected at a CAGR of 14.1% from 2025 to 2034.

The market’s growth in the U.S. is being supported by growing awareness of phishing threats, email spoofing, and domain-based fraud – ssues that have become increasingly common across sectors such as finance, healthcare, and government. Organizations are under growing pressure to adopt robust domain authentication mechanisms, and DMARC has become a trusted tool to ensure that only legitimate senders can use an organization’s domain.

Additionally, U.S. federal agencies and large corporations have been early adopters of DMARC policies due to mandates and industry frameworks, which encourage the adoption of advanced threat detection and prevention technologies. The widespread integration of cloud-based communication systems, along with the rising focus on Zero Trust security models, is further accelerating implementation.

In 2024, North America held a dominant market position, capturing more than a 38.2% share, holding USD 0.9 Billion revenue in the DMARC software market. This leadership can be directly attributed to the region’s early and aggressive stance on email security, combined with its high exposure to targeted phishing and brand impersonation attacks.

Large enterprises and federal agencies across the U.S. and Canada have implemented domain-based authentication protocols like DMARC to safeguard their digital communication infrastructure. The enforcement of strict cybersecurity regulations, such as the U.S. Federal Risk and Authorization Management Program (FedRAMP) and other data protection laws, has further compelled organizations to adopt verified sender identity solutions.

Another key factor behind North America’s lead is the maturity of its cybersecurity ecosystem and the strong presence of security-first digital transformation initiatives. Companies in sectors like BFSI, healthcare, and e-commerce are prioritizing email-based threat detection, driving the demand for DMARC solutions.

Top 5 DMARC Providers

- PowerDMARC: PowerDMARC stands out for its full‑suite email authentication solutions, covering DMARC, SPF, DKIM, BIMI and TLS‑RPT generation with simple DNS updates. It offers unique capabilities such as encrypted forensic reports, SPF flattening, real‑time threat intelligence, alerts, and domain grouping.

- dmarcian: With a mission rooted in managing the “email identity crisis,” dmarcian focuses on transforming raw XML DMARC data into actionable insights. It provides strong visualization, DNS validation, alerting, and multi‑account reporting features suited to MSPs. The platform, operating since the inception of DMARC, offers clarity and confidence to domain teams.

- DMARC Report: DMARC Report is designed for MSPs and service‑oriented environments offering GDPR‑compliant tracking and domain monitoring. The platform processes both aggregate and forensic reports to detect spoofing and phishing activities efficiently, with robust reporting tools that support ongoing domain protection.

- Fraudmarc: Fraudmarc delivers both open‑source and commercial DMARC report analysis, targeting government and enterprises with high control needs. Its self‑hosted community edition supports aggregate report parsing at scale. With mail deliverability assistance and SPF record checks, it appeals to teams with limited resources.

- Valimail: Valimail leads in automated email authentication, enabling DMARC enforcement speeds up to four times faster, according to customer reviews. Reviews highlight its dashboard clarity, streamlined DKIM/SPF alignment, and exceptional customer support. Valimail Enforce eliminates DNS manual errors with its automated policy deployment.

By Deployment Analysis

In 2024, On-premise segment held a dominant market position, capturing more than a 58.5% share in the global DMARC software market. The dominance of on-premise deployment is largely due to the high demand for complete control over data security, especially among large enterprises, government bodies, and regulated industries such as banking and healthcare.

Organizations in these sectors often deal with sensitive internal communications and customer data, making it critical to manage and monitor security systems within their own IT environment rather than relying on third-party cloud infrastructure. Moreover, many institutions in regions with strict data residency laws prefer on-premise solutions to meet local compliance requirements.

The ability to customize deployment, integrate with legacy infrastructure, and avoid latency issues also strengthens the case for on-premise adoption. While cloud-based DMARC solutions are growing in popularity due to ease of deployment and scalability, the continued preference for on-premise models among security-conscious organizations underscores the importance of data sovereignty, internal governance, and long-term infrastructure investments.

By Enterprise Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more than a 68.6% share in the DMARC software market. This dominance is closely linked to the fact that large organizations manage high volumes of daily email traffic and often operate across multiple domains, increasing their risk exposure to phishing, spoofing, and business email compromise (BEC) attacks.

To protect their brand reputation and customer trust, large enterprises are prioritizing the implementation of DMARC protocols as part of their broader email authentication and cybersecurity strategy. Furthermore, large enterprises typically possess greater financial and technical resources to adopt advanced security frameworks and manage complex IT ecosystems.

These organizations are also more likely to be subject to regulatory compliance and industry standards that mandate domain-based email protection, prompting faster and more widespread deployment of DMARC solutions. With stronger internal policies, dedicated security teams, and a growing focus on digital resilience, large enterprises continue to drive the highest adoption of DMARC tools, setting the pace for other segments in the global market.

By Industry Analysis

In 2024, BFSI segment held a dominant market position, capturing more than a 30.2% share in the global DMARC software market. This leadership is primarily due to the highly sensitive nature of financial communications and the constant threat of phishing attacks targeting banks, insurance companies, and financial service providers.

With billions of transactions and confidential client data being exchanged over email every day, the BFSI sector remains a prime target for cybercriminals aiming to exploit domain vulnerabilities. As a result, financial institutions are aggressively deploying DMARC solutions to prevent unauthorized parties from sending fraudulent emails on their behalf.

Additionally, regulatory bodies across several regions have introduced strict mandates around data security and email authentication, placing added pressure on BFSI firms to comply with security protocols like DMARC. The sector’s proactive attitude toward adopting layered security mechanisms – integrating DMARC with SPF, DKIM, and threat intelligence tools – has made it a frontrunner in the adoption curve.

Key Market Segments

By Deployment

- Cloud-based

- On-premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail & consumer goods

- Telecom & IT

- Transportation & Logistics

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging Trend: AI‑Driven Policy Enforcement and Analytics

Software vendors are increasingly integrating artificial intelligence and machine learning into DMARC solutions. These features automate the enforcement of email authentication policies, reducing manual intervention.

Systems can now detect anomalies in real time, adjust DMARC policies based on behavior, and generate actionable insights through advanced analytics interfaces. This trend boosts operational efficiency and strengthens email security across organizations.

Leading vendors in North America, for example, are embedding AI to streamline deployment and monitoring, allowing improved detection of spoofing and phishing campaigns with minimal human oversight. This evolution aligns with broader zero-trust strategies and real-time threat management practices.

Driver

Escalating Cyber Threats and Regulatory Compliance

Phishing, business email compromise, and spoofing attacks continue to grow in sophistication and impact. This escalating threat landscape has prompted organizations to adopt DMARC solutions to protect brand reputation and maintain trust. Additionally, stringent data privacy laws such as GDPR and CCPA are reinforcing the need for robust email authentication measures.

Regulators and large cloud providers (e.g., Microsoft, Google, Yahoo) are mandating strong DMARC compliance for high-volume senders. For instance, as of May 2025, Microsoft enforces strict DMARC alignment for Outlook domains, rejecting non-compliant emails entirely, forcing organizations to implement full authentication systems.

Restraint

Implementation Complexity and Legacy System Integration

Implementing DMARC can be technically complex – especially for organizations with multiple email domains and legacy email infrastructures. Tasks such as DNS configuration, policy alignment, and continuous monitoring require specialized skill sets that many IT teams lack.

These challenges often slow DMARC adoption. Small and mid-sized enterprises may neglect proper enforcement due to limited technical resources, while larger organizations delay full rollout to avoid operational disruption. Misconfigurations also risk email delivery failures, undermining confidence.

Opportunity

Increasing Adoption and Growth in Managed Services

Impressive adoption growth has been observed globally: only around 9.7% of sampled domains have implemented DMARC as of early 2025, indicating significant room for growth. Additionally, growth in regions like North America, Europe, and Asia-Pacific is driven by rising cybersecurity awareness.

This opens opportunities for managed security service providers (MSSPs) offering DMARC-as-a-service. SMEs, lacking internal expertise, can benefit from outsourced deployment, compliance monitoring, email flow optimization, and reporting. Cloud-native DMARC solutions offer rapid deployment and scalability—appealing to cost- and efficiency-sensitive clients.

Challenge

Market Fragmentation and Talent Shortage

The DMARC software market is highly fragmented, with numerous small vendors offering overlapping solutions – leading to inconsistent quality and minimal brand recognition. This fragmentation makes it difficult for buyers to choose reliable providers and prevents vendors from investing deeply in R&D or scaling globally.

A further constraint is the scarcity of skilled professionals trained in email authentication protocols and security management. The limited workforce available for DNS configuration, policy tuning, and security monitoring slows deployment and forces providers to invest heavily in training or staffing.

Key Player Analysis

ValiMail has firmly maintained its leading position in the DMARC software market throughout 2025, as evidenced by its consistent top ranking in G2’s quarterly reports, including both Winter and Spring editions.The company’s focus on trust, ease‑of‑use, and rapid return on investment resonates strongly across enterprise, mid‑market, and SMB segments.

PowerDMARC has emerged as the fastest‑growing DMARC solution in 2025, earning recognition in G2’s Top 100 fastest‑growing software list. The platform offering stands out for its comprehensive suite – including real‑time threat intelligence, forensic reporting, and full support for SPF, DKIM, MTA‑STS, TLS‑RPT, and BIMI – combined with a user‑friendly dashboard.

dmarcian continues to be a core player, particularly among organizations seeking expert‑guided DMARC deployment. Founded by one of the original architects of the DMARC specification, the platform remains valued for its simplicity, instructional approach, and real‑time domain monitoring. While PowerDMARC and ValiMail have surged in market visibility, dmarcian’s steady presence and enduring reputation reflect its continued relevance in the ecosystem

Top Key Players Covered

- Dmarcian

- EasyDMARC Inc.

- Redshift Limited

- Barracuda Networks Inc.

- GoDMARC

- MXToolBox Inc.

- ValiMail Inc.

- DuoCircle LLC

- PowerDMARC

- ValiMail Inc.

- Kratikal Tech Pvt Ltd

- Mimecast Services Limited.

- Others

Recent Developments

- In March 2025, Dmarcian became one of the preferred alternatives for public sector organizations in the UK after the National Cyber Security Centre (NCSC) announced the retirement of its Mail Check DMARC reporting tool. This development positioned Dmarcian to support a wave of government and enterprise migrations looking for user-friendly, privacy-focused DMARC analytics tools.

- In October 2024, EasyDMARC raised funding and appointed Allan Richards to lead its global Managed Service Provider (MSP) strategy, aiming to scale operations in response to stricter email security regulations by Google and Yahoo. The company later released its 2025 DMARC Adoption Report in June, which reviewed over 1.8 million domains to identify enforcement trends and adoption patterns.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 12.4 Bn CAGR (2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (Cloud-based, On-premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry (BFSI, Government, Healthcare, Manufacturing, Retail & consumer goods, Telecom & IT, Transportation & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dmarcian, EasyDMARC Inc., Redshift Limited, Barracuda Networks Inc., GoDMARC, MXToolBox Inc., ValiMail Inc., DuoCircle LLC, PowerDMARC, Kratikal Tech Pvt Ltd, Mimecast Services Limited., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dmarcian

- EasyDMARC Inc.

- Redshift Limited

- Barracuda Networks Inc.

- GoDMARC

- MXToolBox Inc.

- ValiMail Inc.

- DuoCircle LLC

- PowerDMARC

- ValiMail Inc.

- Kratikal Tech Pvt Ltd

- Mimecast Services Limited.

- Others