Global Direct-to-Consumer EWA Market Size, Share, Industry Analysis Report By Type of Service (Pay-as-you-go (On-demand), Subscription-based (Monthly/Annual), By Customer Type (SMB, Large Enterprises, Platform/Aggregators), By Vertical (Retail, Healthcare, Manufacturing, IT & Telecom, Travel & Transportation, Hospitality, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166081

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. D2C EWA Market Size

- Type of Service Analysis

- Customer Type Analysis

- Vertical Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

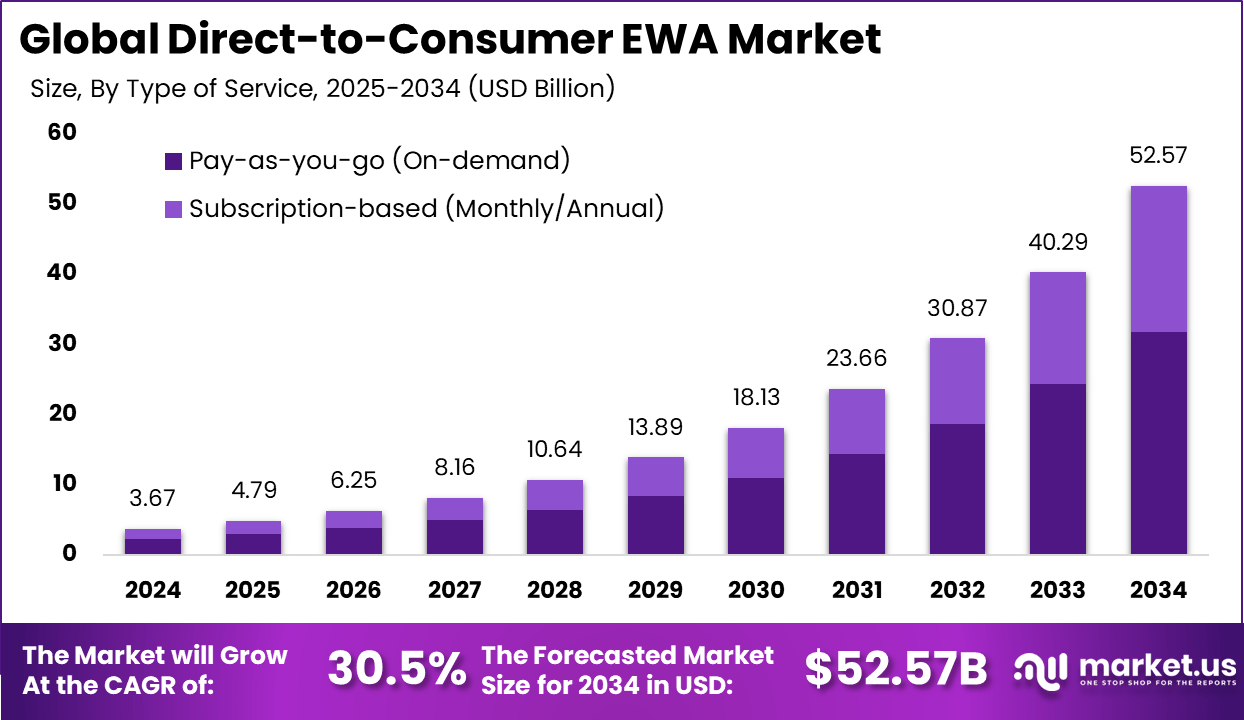

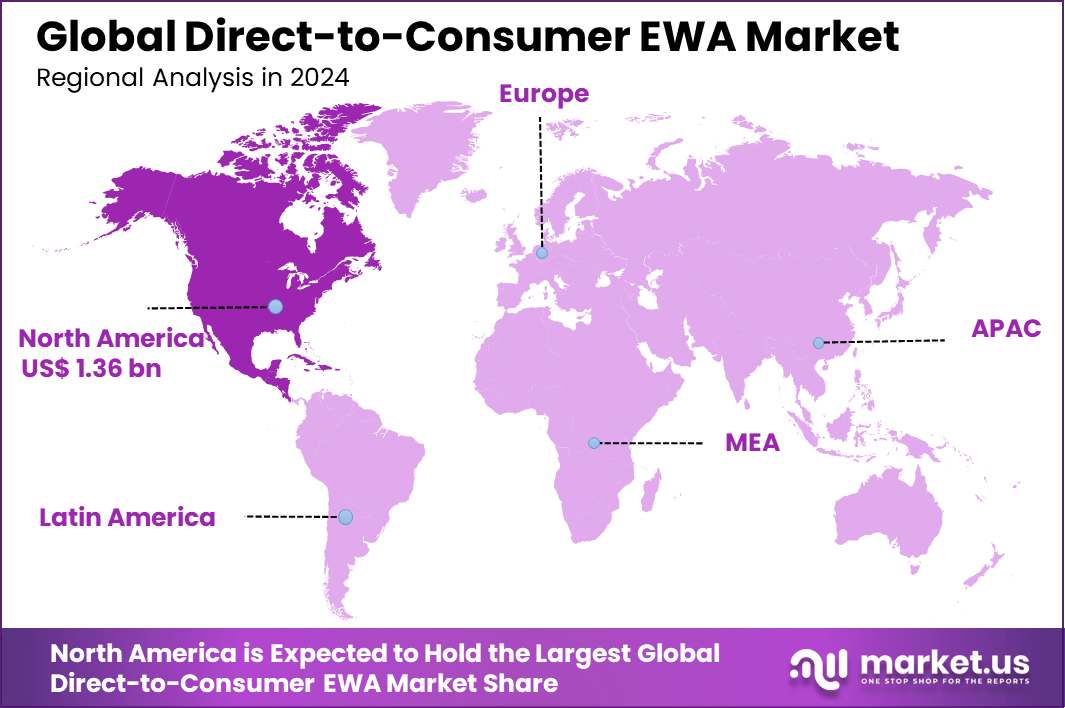

The Global Direct-to-Consumer EWA Market size is expected to be worth around USD 52.57 billion by 2034, from USD 3.67 billion in 2024, growing at a CAGR of 30.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.1% share, holding USD 1.36 billion in revenue.

The direct to consumer EWA market has expanded as workers increasingly seek independent access to earned wages without relying on employer sponsored programs. These platforms allow individuals to withdraw a portion of their accrued earnings directly, often by linking payroll deposits, time worked or bank account activity. Growth reflects wider acceptance of flexible wage access models and rising interest in financial tools that support short term cash flow needs.

The growth of the market can be attributed to financial stress among workers, increased reliance on hourly or gig based employment and broader adoption of digital financial services. Many individuals prefer independent EWA access when their employers do not offer on site solutions. Growth in mobile banking, real time payments and AI driven income verification systems also strengthens this segment. Rising awareness of financial wellness tools further supports the shift toward direct access models.

The market for Direct-to-Consumer Earned Wage Access (EWA) is driven by the growing financial stress among workers who need faster access to their earned wages. Many employees face unexpected expenses and living costs that make waiting for payday difficult. The direct-to-consumer model offers immediate cash access, especially benefiting gig workers and freelancers without employer programs.

A Consumer Financial Protection Bureau report indicated that more than 7 million U.S. workers used EWA services in 2022, supporting over USD 22 billion in transactions across both D2C and employer sponsored models. This reflects sharp growth from the 1.9 million users recorded in 2021.

Demand analysis shows increasing adoption of direct-to-consumer EWA, driven by the need for financial flexibility among those paid irregularly or working multiple jobs. The convenience of accessing wages in real-time helps reduce reliance on high-interest credit, payday loans, and overdrafts. The technology also appeals to younger workforce segments who prefer mobile-first financial services.

For instance, in June 2025, CloudPay highlighted its aggressive digital transformation in payroll through AI, automation, and API integration. Its CloudPay NOW platform advances pay-on-demand capabilities with a roadmap focused on automation and regulatory compliance, serving larger organizations with flexible payment methods.

Key Takeaway

- The Pay-as-you-go model led the market with a 60.6% share, supported by strong adoption among workers seeking flexible, low-commitment access to earned wages.

- Large enterprises dominated with 75.2%, reflecting their wider employee bases and greater willingness to adopt D2C EWA as a supplemental financial wellness tool.

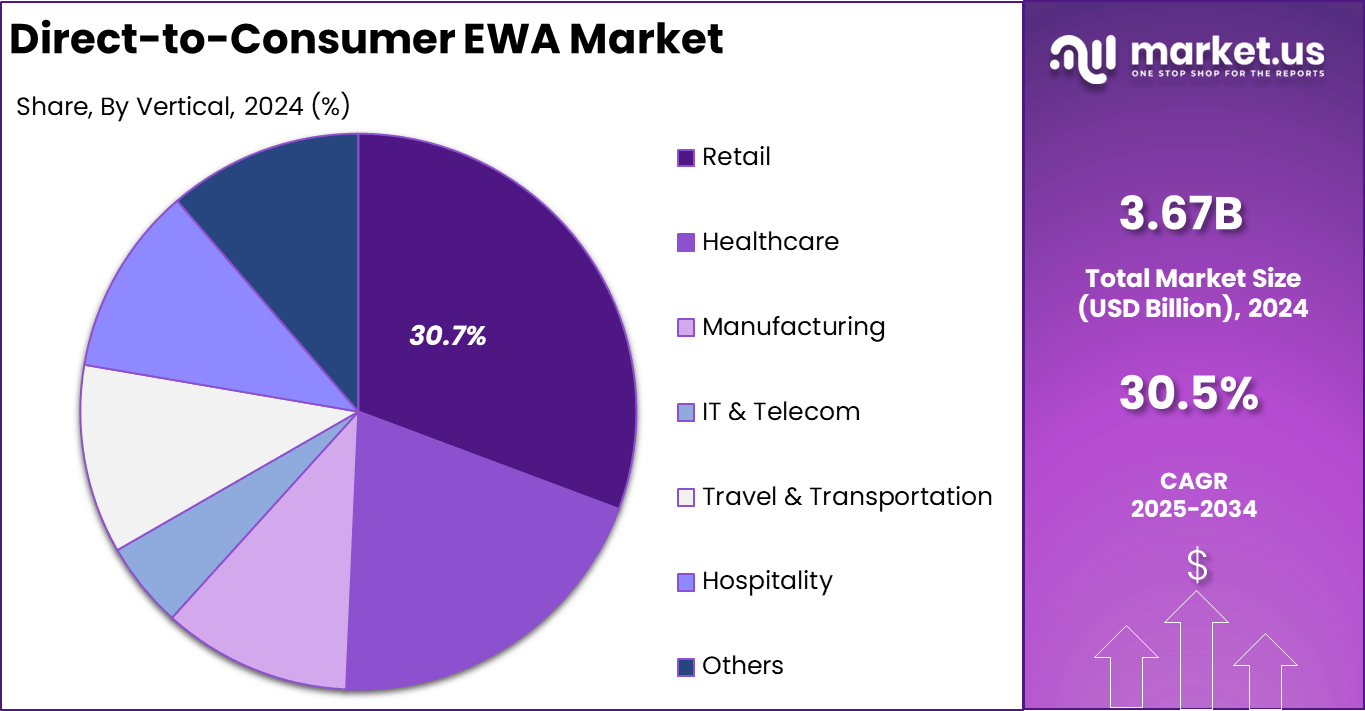

- The Retail sector held a 30.7% share, driven by high turnover, variable scheduling, and strong demand for instant wage access among hourly employees.

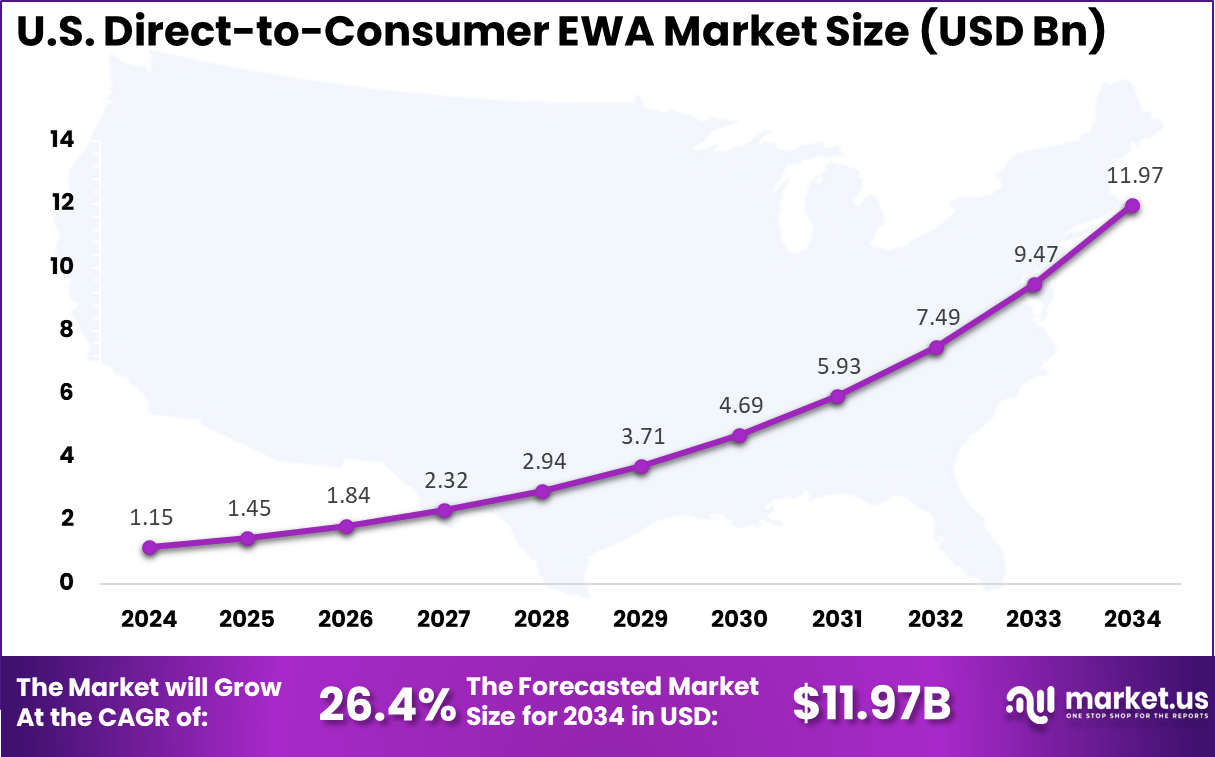

- The U.S. market reached USD 1.15 billion in 2024, expanding at a 26.4% CAGR, underscoring rapid acceptance of direct-to-consumer EWA apps.

- North America maintained leadership with 37.1% of global share, supported by mature fintech ecosystems and strong consumer preference for real-time financial tools.

Role of Generative AI

Generative AI contributes significantly to improving direct-to-consumer EWA services by automating and speeding up various processes critical to user experience. It streamlines wage calculation, risk assessment, and transaction approvals, reducing delays and lowering operational costs.

Around 68% of service professionals report using generative AI tools for enhancing communication and customizing customer interactions, which translates to better service quality and faster response times in EWA platforms. AI’s predictive capabilities also help providers better anticipate cash flow needs, reducing errors in wage advance estimations and improving overall trust in the system.

Generative AI also strengthens financial wellness tools within EWA applications by analyzing spending and income patterns to provide personalized guidance. These insights help users manage their money responsibly and reduce excessive reliance on wage advances. AI driven analytics further enhance the scalability of D2C EWA platforms while supporting user financial health and encouraging steady, responsible usage instead of impulsive withdrawals.

Investment and Business Benefits

Investment opportunities in direct-to-consumer EWA lie in expanding digital financial inclusion for underserved workers and leveraging advancements in fintech infrastructure. The segment is growing at a rapid rate due to unmet needs among non-traditional workers.

Investors can focus on enhancing AI-driven financial management tools, expanding partnerships with banks for seamless fund transfers, and improving user verification methods to minimize risk. Growth potential is also tied to evolving regulatory clarity that will either facilitate or constrain market expansion.

Business benefits of offering direct-to-consumer EWA include improved employee retention, enhanced financial health of workers, and a competitive edge in talent acquisition. By reducing financial emergencies and dependency on costly loans, companies can foster happier, more productive employees.

The flexibility and convenience of direct-to-consumer EWA also support workforce resilience, particularly in unstable economic environments. For providers, this model opens new revenue streams through subscription or transaction fees while addressing a large untapped market segment.

U.S. D2C EWA Market Size

The market for Direct-to-Consumer EWA within the U.S. is growing tremendously and is currently valued at USD 1.15 billion, the market has a projected CAGR of 26.4%. This growth is primarily driven by increasing financial stress among workers, many of whom live paycheck to paycheck.

As living costs rise, employees seek flexible access to earned wages to cover unexpected expenses and reduce dependence on costly payday loans. Additionally, advances in digital payroll technologies and mobile access have made it easier for workers and employers to adopt these solutions.

Employers are also playing a key role by integrating EWA programs into their financial wellness offerings to improve employee satisfaction and reduce turnover. The expanding gig economy and the rise of freelancers and hourly workers, who often lack traditional credit access, further accelerate demand.

For instance, in August 2025, Earnin launched “Live Pay,” a technology enabling workers to stream their paychecks in real time, marking a significant innovation in direct-to-consumer earned wage access. Earlier in 2025, Earnin introduced a $2.99 expedited transfer option, making fast wage access affordable and accessible to a wider range of US workers.

In 2024, North America held a dominant market position in the Global Direct-to-Consumer EWA Market, capturing more than a 37.1% share, holding USD 1.36 billion in revenue. This leadership stems from the early adoption of advanced digital payroll technologies and a well-established fintech ecosystem that supports real-time wage payments.

The presence of leading EWA providers and strong regulatory frameworks has also encouraged widespread acceptance of wage access solutions. Additionally, the high financial stress among North American workers, with many living paycheck to paycheck, fuels demand for flexible and immediate wage access.

Employers across various sectors, especially large enterprises, are adopting EWA programs to enhance employee satisfaction and retention. The growth of gig and hourly workforces further accelerates this trend, solidifying North America’s market dominance.

For instance, in September 2025, PayActiv launched “Access-as-a-Service℠,” an API-driven infrastructure allowing employers and platforms to embed earned wage access and financial wellness features under their own brands, representing a shift towards scalable and unified EWA solutions.

Type of Service Analysis

In 2024, The Pay-as-you-go (On-demand) segment held a dominant market position, capturing a 60.6% share of the Global Direct-to-Consumer EWA Market. This type of service appeals especially to workers who require flexibility, such as gig workers and part-time employees, allowing them to withdraw wages instantly when needed.

The simplicity and immediacy of this model make it a preferred choice for those who need urgent access to their earned income without waiting for scheduled paydays. The adoption of pay-as-you-go models benefits both employees and service providers. Employees gain financial stability by managing cash flow in real time, while providers benefit from a scalable transaction-based revenue model.

For Instance, in September 2025, DailyPay enhanced its position in the pay-as-you-go (on-demand) EWA segment by launching a new Frontline Communications solution aimed at improving employee engagement and real-time wage access for hourly workers. This development highlights DailyPay’s focus on delivering flexible, on-demand financial services to meet the needs of the workforce that prefers immediate access to earned wages.

Customer Type Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 75.2% share of the Global Direct-to-Consumer EWA Market. These organizations typically have large hourly or shift-based workforces, making EWA an effective tool to improve employee satisfaction and reduce turnover. Large enterprises integrate EWA programs into their payroll systems to offer seamless, real-time wage access and support worker financial well-being.

The ability of large enterprises to invest in robust EWA partnerships and infrastructure gives them an advantage in deploying comprehensive wage access solutions. Their scale allows them to customize offerings across multiple jurisdictions, enhancing compliance and workforce engagement. This makes large enterprises the primary drivers behind the growing adoption of EWA programs.

For instance, in January 2025, PayActiv partnered with U.S. Bank to deliver an earned wage access solution that integrates real-time payments, targeting large organizations using prepaid payroll cards. This move underscores PayActiv’s strategy to serve enterprise-scale customers by providing scalable and instantaneous wage access solutions, enhancing financial wellness across sizable workforces.

Vertical Analysis

In 2024, The Retail segment held a dominant market position, capturing a 30.7% share of the Global Direct-to-Consumer EWA Market. Retailers find EWA particularly valuable to help workers bridge pay gaps during periods of financial stress. By enabling immediate access to earned wages, these solutions reduce absenteeism and improve staff retention, especially during peak shopping seasons.

Retail’s embrace of EWA is supported by technological advancements that facilitate smooth payroll integrations and faster payments. This creates a more stable and satisfied workforce, which in turn enhances service quality and operational efficiency in retail businesses. The ongoing focus on employee financial health drives continued demand in this vertical.

For Instance, in May 2025, Wagestream secured a €352 million debt facility to expand its financial wellbeing products, including earned wage access tailored for sectors like retail with high hourly labor reliance. Wagestream’s solution addresses retail workers’ needs through flexible loan products with clear, manageable terms, supporting retention and financial stability in this industry.

Emerging trends

One big trend in direct-to-consumer EWA is the increasing mobile-first approach, fueled by higher smartphone penetration among hourly workers and gig economy participants. This trend allows users to instantly request wage advances via apps with seamless payment integrations such as digital wallets and real-time payments, making wage access faster and more convenient.

Mobile EWA platforms are now expanding beyond retail and hospitality into healthcare, construction, and caregiving sectors, reflecting broadening adoption across industries. Another emerging trend is regulatory clarity, which helps establish fair use policies and sustainable growth frameworks for direct-to-consumer EWA.

Increased regulatory oversight reduces risks and builds trust among consumers and enterprises alike. This enables market participants to innovate with subscription pricing models that promote recurring revenue and deeper customer engagement. Subscription models now typically replace per-transaction fees, fostering usage without deterring workers who need frequent advances.

Growth Factors

The main growth driver for direct-to-consumer EWA is the rising financial stress among workers caused by increasing living costs. With many employees living paycheck to paycheck, demand for flexible wage access surges. The expanding gig and hourly economy fuels this demand further, as freelancers and part-time workers seek on-demand wage options outside traditional payroll systems.

Cloud payroll adoption and smartphone penetration also help growth by allowing seamless EWA integration and easy user access anywhere. Employers’ growing focus on workforce wellness is another key growth factor. Integrating EWA into employee benefit programs improves satisfaction, reduces turnover, and enhances retention.

As a result, many enterprises now support or partner with D2C EWA providers to boost employee financial wellness, especially during peak demand seasons. This emphasis on financial health at work creates a stable base for ongoing adoption and innovation in direct-to-consumer earned wage solutions.

Key Market Segments

By Type of Service

- Pay-as-you-go (On-demand)

- Subscription-based (Monthly/Annual)

By Customer Type

- SMB

- Large Enterprises

- Platform/Aggregators

By Vertical

- Retail

- Healthcare

- Manufacturing

- IT & Telecom

- Travel & Transportation

- Hospitality

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Drivers

Rising Financial Stress Among Workers

The main driver for the direct-to-consumer EWA market is the growing financial pressure on workers who live paycheck to paycheck. Many employees face rising living costs and unexpected expenses, which create a need for faster access to earned wages. Direct-to-consumer EWA fills this gap by offering immediate cash access without waiting for the usual payday. This flexibility attracts gig workers, freelancers, and those without employer-sponsored programs, making the model increasingly popular.

Such financial stress encourages workers to use EWA services as a practical short-term solution to manage bills and emergencies. Employers and service providers see this demand growing, which fuels product innovation and expansion in the market. This evolving need for financial wellness tools directly supports the growth of the direct-to-consumer EWA segment.

For instance, in November 2025, DailyPay was recognized as a Power Partner Award winner for supporting employee financial wellness, emphasizing its role in addressing financial stress by enabling workers to access earned wages before payday, thereby reducing financial anxiety and improving workplace satisfaction.

Restraint

Regulatory Uncertainty and Compliance Risks

One significant restraint faced by direct-to-consumer EWA providers is the complex and uncertain regulatory environment around wage advances. Different regions impose varying laws that classify EWA either as a form of credit or a payroll service, causing confusion about licensing and fee disclosure requirements. Without clear regulatory guidance, companies face higher compliance costs and risks, which limit their ability to scale operations broadly.

This uncertainty creates barriers for providers who must navigate a patchwork of rules that may change frequently or conflict across jurisdictions. Additionally, direct-to-consumer models often lack employer integration, which means they have to rely on users’ self-reported income, raising concerns about repayment risks and legal liabilities. These regulatory challenges slow market growth and restrain provider innovation.

For instance, in April 2025, Rain Technologies showcased its fog mitigation technology but faced broader industry challenges, including regulatory uncertainties about weather modification and atmospheric control, which mirror compliance uncertainties faced by EWA providers in navigating evolving financial regulations.

Opportunities

Expanding Financial Inclusion for Underserved Workers

Direct-to-consumer EWA presents a strong opportunity to improve financial inclusion, particularly for gig workers, freelancers, and part-time employees who typically lack access to employer-sponsored benefits. By offering immediate access to earned wages, these platforms can help workers avoid costly payday loans or credit card debt, promoting healthier financial habits and reducing stress. This broadening of access addresses an important gap in the current financial services landscape.

The integration of mobile technologies and real-time payment systems further enhances this opportunity, enabling scalable, user-friendly solutions tailored to diverse worker needs. Providers can also expand services by tailoring pricing, limits, and support to meet the unique circumstances of these underserved groups, making the direct-to-consumer EWA model a valuable addition to employee financial health options.

For instance, in September 2025, Payactiv launched its ‘Access-as-a-Service’ API infrastructure, enabling scalable, branded EWA solutions that facilitate financial inclusion for workers previously excluded from traditional banking systems, thereby expanding financial access.

Challenges

Preventing Over-Reliance and Financial Dependency

A major challenge in the direct-to-consumer EWA market is avoiding the risk that users become financially dependent on early wage access. While EWA provides short-term cash flow relief, it is not a substitute for sustainable income or savings. Frequent use can lead to cash shortages in subsequent pay periods, increasing financial instability for users rather than resolving it. This cyclical dependency risks undermining the benefits of the service.

Providers must implement responsible lending practices, clear user education, and usage limits to encourage healthy habits. Balancing between providing needed liquidity and preventing overuse is delicate, especially without employer oversight in the direct-to-consumer model. Successfully navigating this challenge is vital for the long-term credibility and acceptance of direct-to-consumer EWA solutions.

For instance, in August 2025, ZayZoon expanded employer partnerships and introduced a model encouraging responsible wage access, emphasizing the ongoing challenge of balancing flexibility with safeguards to prevent workers from becoming overly reliant on frequent wage withdrawals.

Key Players Analysis

DailyPay, EarnIn, and PayActiv hold a strong position in the direct-to-consumer EWA market. Their platforms focus on providing fast access to earned income without relying on employer integration. User-friendly mobile apps, transparent fee structures, and real-time payout options strengthen adoption among workers facing short-term cash gaps. Their emphasis on financial wellness tools, spending insights, and safe access models supports responsible usage.

Rain Technologies, FlexWage, Wagestream, Refyne, and CloudPay NOW expand the market through flexible disbursement models and wider geographic reach. Their solutions are used by workers across gig, retail, logistics, and hospitality sectors who seek independent access to wages. Strong focus on compliance, affordability, and automated repayment processes supports reliability. These platforms integrate budgeting features and savings options to improve long-term financial stability.

Instant Financial, Hastee, Branch, ZayZoon, Earnipay, Strovia, and other providers enhance the competitive structure with cost-efficient payout systems and simplified onboarding. Their products are designed for high-frequency use, enabling instant wage access for varied income patterns. Many platforms introduce cashless spending, prepaid cards, and spending controls to improve user convenience. Rising demand for accessible liquidity continues to support their growth, as workers prioritize faster access to earnings in both developed and emerging markets.

Top Key Players in the Market

- DailyPay

- Earnin

- PayActiv

- Rain Technologies, Inc.

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- ZayZoon

- Earnipay

- Strovia

- Others

Recent Developments

- In June 2025, PayActiv registered officially as an EWA services provider in Utah following the state’s new regulatory framework recognizing EWA as an innovative financial product. They also partnered with U.S. Bank to provide immediate direct deposit EWA solutions integrated with prepaid payroll cards and real-time payments.

- In March 2025, FlexWage emphasized its seamless integration with payroll systems for earned wage access while ensuring compliance and transparency. The company highlighted its employer-controlled program design to avoid predatory lending risks and support employee financial wellness.

Report Scope

Report Features Description Market Value (2024) USD 3.67 Bn Forecast Revenue (2034) USD 52.57 Bn CAGR (2025-2034) 30.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Service (Pay-as-you-go (On-demand), Subscription-based (Monthly/Annual), By Customer Type (SMB, Large Enterprises, Platform/Aggregators), By Vertical (Retail, Healthcare, Manufacturing, IT & Telecom, Travel & Transportation, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DailyPay, Earnin, PayActiv, Rain Technologies, Inc., FlexWage, Wagestream, Refyne, CloudPay NOW, Instant Financial, Hastee, Branch, ZayZoon, Earnipay, Strovia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct-to-Consumer EWA MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Direct-to-Consumer EWA MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DailyPay

- Earnin

- PayActiv

- Rain Technologies, Inc.

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- ZayZoon

- Earnipay

- Strovia

- Others